Defense Integrated Antenna Market by Type (Aperture Antenna, Wire Antenna, Array Antenna, Microstrip Antenna), Platform (Ground, Airborne, Marine), Application, Frequency and Region -Global Forecast to 2026

Updated on : Nov 25, 2024

Defense Integrated Antenna Market Size & Share

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Defense integrated antenna Market

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of defense integrated antenna and components has also been impacted. Disruptions in the supply chain have led to halts in manufacturing processes. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

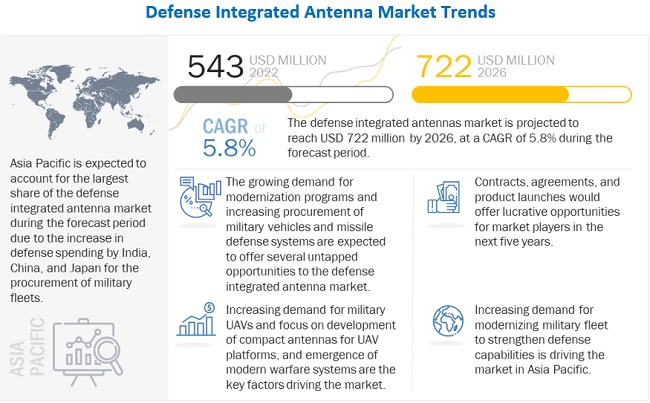

Defense Integrated Antenna Market Trends

Driver: Rise in airspace modernization programs

Modernizing and overhauling the airspace is a prime focus area in North American and European countries to enhance safety and minimize flight delays. Better routing decisions, improved pilot communications, and enhanced efficiency are some benefits of airspace modernization, which involve the installation of new technologies and components to communicate effectively with air traffic managers, perform multidimensional aircraft tracking, and improve navigation by generating an image of forward external scene topography. These airspace modernization programs, when implemented successfully, help save fuel, enhance the quality of air, and reduce carbon emissions.

Aircraft modernization programs drive the demand for advanced and integrated antennas in new aircraft. These antennas are also likely to be installed in existing fleets as part of retrofitting activities. For instance, the Single European Sky ATM Research (SESAR), an airspace modernization program adopted by European nations, focuses on improving air traffic management (ATM) and installing innovative solutions to eliminate inefficiencies such as undesired route extensions of up to 50 km and unnecessary delays of around 10 minutes per flight in European air traffic. Advanced and integrated antennas will be installed in aircraft to reduce such inefficiencies.

Airspace modernization programs include designing new antennas to increase the connectivity of aircraft. For instance, in March 2021, a new antenna was designed by ThinKom Solutions, which offers flexible installation options for special-purpose aircraft. The company has developed a new variant of its Variable Inclination Continuous Transverse Stub (VICTS) antenna for the government and military Beyond-Line-of-Sight (BLoS) applications. Initial units of the product are currently going through integration, with formal qualification scheduled to start soon. In November 2021, Leidos Special Mission Aircraft decided to feature ThinKom phased array antenna. A modified Bombardier Challenger 650 will embark on its first test flight equipped with the ThinAir Ka2517 phased-array antenna in early 2022. The Leidos Special Mission Aircraft (LMSA) will be equipped with the ThinAir Ka2517 phased-array antenna from ThinKom Solutions. The low-profile Ka-band aero satellite antenna system, which is being integrated with a US military-compliant modem, provides real-time, reliable, and resilient broadband transmission to and from the aircraft in flight. The agile antenna system is based on VICTS phased-array technology, which can interoperate seamlessly with satellites in geostationary and non-geostationary orbits for worldwide connectivity.

Restraints: High costs associated with development and maintenance of infrastructure

The high cost incurred in the development and maintenance of earth station infrastructure is one of the major factors hindering the market growth. Most of the required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors, which is expensive. Besides, the design, development, and construction of antennas and their components require several hours of work by trained personnel. The level of skill required itself poses a significant barrier to entry. Significant investments are required in the R&D, manufacturing, system integration, and assembly stages of the value chains of these systems.

Satellite communication services are used for highly sophisticated defense systems, due to which any incident of system failure is unfavorable. These services should be accurate, reliable, durable, energy-efficient, and have a wide detection range. Companies in this market should develop highly functional and efficient ground facilities to maintain market leadership and stay competitive.

Opportunities: Development of low-cost and miniaturized antenna

The cost of electronic components has reduced significantly due to large-scale manufacturing and integration of circuits into single PCBs. This has made it possible to produce integrated antennas at low-cost rates. These antennas are increasingly used in the fishing industry, small aircraft, and UAVs due to their reliability, efficiency, and low costs. Large-scale miniaturization of electronic components is also helping in the reduction of the overall size of integrated antennas, as they can be easily accommodated in small spaces, which further results in limited consumption of power and fuel. They also help manufacturers to reduce the size of satellites and UAVs. Therefore, the development of small-sized antennas at low costs offers lucrative growth opportunities for players operating in the defense integrated antenna market.

Challenges: System requirements and design constraints

Manufacturers of defense integrated antennas have to adhere to military standard requirements of size, weight, efficiency, bandwidth, and cost. The weight of an integrated antenna must be within the permissible limit, as the integrated antenna adds to the weight of the platform, such as aircraft, UAVs, or manpacks. It must be of the desired diameter, length, and length-to-power ratio. However, integrated antenna designers are finding it challenging to reduce the size and weight of antennas as different frequency ranges require specific antenna lengths. Incorporating new technologies as well as addressing end-user requirements is also a time-consuming process. These requirements increase the cost of the system, restraining the growth of the defense integrated antenna market.

Emergence of modern warfare systems

One of the most significant factors contributing to the increasing demand for defense integrated antenna systems is the emergence of modern warfare. With rapid development of computer and network technology, traditional combat systems are being replaced with new combat technologies. Countries worldwide are diversifying their investment patterns, from buying conventional weapons to adopting newer ways of obtaining and integrating essential information related to the battlefield for better decision-making and coordination. The new modern warfare military technologies include the use of network-centric warfare systems and electronic warfare systems. Integrated antenna serves to be an important component of these warfare systems. It improves the efficiency of such systems by tracking and identifying objects accurately as well as improving surveillance capabilities and situational awareness. Therefore, the paradigm shift from traditional warfare systems to modern systems is expected to fuel the growth of the defense integrated antenna market.

Defense Integrated Antenna Market Segmentation

Based on type, array antenna segment is estimated to witness the largest share of the defense integrated antenna market from 2022 to 2026.

Based on type, array antenna is estimated to witness the largest share of the defense integrated antenna market in 2022. There is a growing demand for array antennas due to the increasing need for throughput satellite communication. Thus, companies are introducing new passed array antennas for effective satellite communication.

For instance, in May 2021, Viasat demonstrated phased array antennas on business jets. The first demonstration flight took place in April 2021 during a flight from Rotterdam, Netherlands, to Payerne, Switzerland. This was part of Project AIDAN, which is led by Viasat Antenna Systems (Switzerland) and involves a consortium of partners that include Viasat Netherlands, NLR, and Lionix International.

Based on platform, marine segment of the defense integrated antenna market is projected to witness the largest share in 2022.

Based on platform, marine segment is projected to lead the defense integrated antenna market during the forecast period. The growing need of advanced antennas for reliable and high quality communication for underwater operations, large scale search and rescue mission, and for better communication between ships and drone/UAVs will drive the market.

Based on application, communication segment is estimated to account for the fastest growth of the defense integrated antenna market from 2022 to 2026.

Based on application, communication segment of the defense integrated antenna market is projected to grow at the highest CAGR during the forecast period. This growth is driven due to the need for uninterrupted long-range communication through integrated antennas. Military operations are highly dependent on communication antennas to ensure effective decision-making, which is crucial to the success of military missions. Increased bandwidth and use of high frequencies have made it possible to establish uninterrupted communication between control rooms and defense personnel over long distances. For instance, in 2021, L3Harris Technologies received a contract to provide long-range communications to the US military through mosaic antennas composed of spatially distributed low size, weight, power, and cost (SWaP-C) transceiver elements.

Based on frequency, X-band is estimated to account for the largest share of the defense integrated antenna market from 2022 to 2026.

Based on frequency, X-band segment is estimated to account for the largest share of the defense integrated antenna market during the forecast period. This growth is driven because x-band facilitates high-throughput communication from satellites to ground stations. X bands operate within a range of 8–12 GHz. X-band antennas have recently become a reality for satellites owing to the advent of commercially available monolithic microwave integrated circuits (MMICs). X-band antenna is crucial for naval operations, including searching and tracking of surface targets.

Defense Integrated Antenna Market Regional Analysis

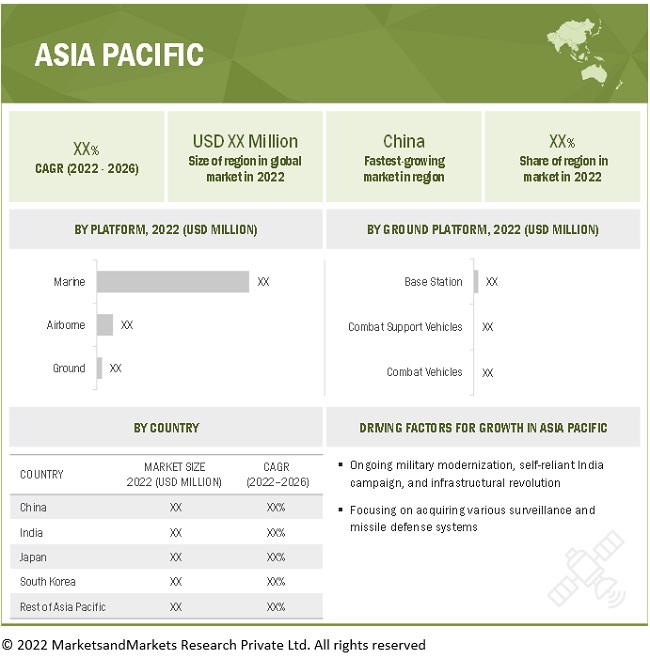

The Asia Pacific market is estimated to account for the fastest growth from 2022 to 2026 in the Defense integrated antenna market

Based on region, Asia Pacific is estimated to account for the fastest growth rate in defense integrated antenna market from 2022 to 2026. Instability across all border areas and neighboring countries, improving domestic capabilities of aerospace industry, focus on strengthening combat capabilities of UAVs by integration of antenna will drive the market. For instance, in November 2021, South Korea developed a new homegrown antenna designed for stealth aircraft, which will help reduce the possibility of detection by enemy radar systems. This antenna was developed by Agency for Defense Development (ADD) along with Hanwha Systems Co.

To know about the assumptions considered for the study, download the pdf brochure

Top Defense Integrated Antenna Companies - Key Market Players

Defense integrated antenna market is dominated by a few globally established players such as L3Harris Technologies (US), Airbus (Netherlands), General Dynamics (US), Maxar Technologies (US), and Honeywell International Inc. (US), among others, are the key manufacturers that secured Defense integrated antenna contracts in the last few years. Major focus was given to the contracts and new product development due to increase in the demand for integration of advanced antenna products and the growth of emerging markets have encouraged companies to adopt this strategy to enter new markets.

Defense Integrated Antenna Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 543 million in 2022 |

|

Projected Market Size |

USD 722 million by 2026 |

|

Growth Rate (CAGR) |

5.8% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By application, by platform, by type, by frequency and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

L3Harris Technologies (US), Airbus (Netherlands), General Dynamics (US), Maxar Technologies (US), and Honeywell International Inc. (US) are some of the major players of Defense integrated antenna market. (25 Companies) |

The study categorizes the Defense integrated antenna market based on frequency, type, platform, application, and region.

By Type

- Aperture Antenna

- Array Antenna

- Microstrip Antenna

- Wire Antenna

By Platform

- Ground

- Combat Vehicles

- Base station

- Unmanned ground vehicle (UGV)

- Airborne

- Fighter Aircraft

- Unmanned Aerial Vehicle (UAV)

- Military Transport Aircraft

- Military Helicopters

- Marine

- Destroyers

- Frigates

- Corvettes

- Amphibious Ships

- Offshore Patrol Vessels

- Submarine

- Aircraft carriers

By Application

- Navigation & Surveillance

- Communication

- Telemetry

By Frequency

- HF/VHF/UHF-Band

- L-Band

- S-Band

- C-Band

- X-Band

- Ka-Band

- Ku-Band

- Multi-Band

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In January 2022, L3Harris Technologies was awarded an IDIQ contract by the US Marine Corps worth USD 750 million for multi-channel handheld and vehicular radio systems.

- In November 2021, L3Harris Technologies received a multi-year contract worth USD 125 million to produce space electronic warfare systems, including antennas that safeguard the US military operations and warfighters.

- In November 2021, General Dynamics Mission Systems, a business unit of General Dynamics Corporation, provided initial production antennas aboard GA-ASI’s Sky Guardian and Sea Guardian unmanned aerial vehicles with follow-on orders for up to 52 additional antennas by the end of December 2021 to General Atomics Aeronautical Systems.

- In October 2021, NASA selected L3Harris Technologies to conduct a second, advanced study to significantly improve the accuracy and timeliness of the US weather. This includes antenna and other avionics parts production.

- In October 2021, AJW Group and Honeywell entered into a distribution agreement for Boeing 787. The distribution agreement covers parts ranging from global navigation satellite systems antenna to dual-axis modal suppression accelerometers and inertial reference units to flight control modules, applicable to the Boeing 787.

- In October 2021, L3Harris Technologies was awarded a contract worth USD 5.7 million by the US Air Force Research Laboratory to integrate a low-Earth orbit terminal (antenna) into rotary-wing aircraft to further enhance aerial communications capability.

- In August 2021, Terma was awarded a contract by the Indonesian Navy to supply a third-party Electronic Support Measure (ESM) system integrated with C-Flex Patrol for six vessels.

- In March 2021, Airbus was awarded a contract by Eutelsat to build EUTELSAT 36D equipped with 70 Ku-band transponders, over five downlink beams, and a steerable antenna. EUTELSAT 36D provides flexibility and performance optimization to deliver service in Africa, Russia, and Europe.

- In March 2021, Airbus was selected by the European Commission to study spacecraft manufacturing in space through the Horizon 2020 Program. The “orbital factory” envisioned by the PERIOD (PERASPERA In-Orbit Demonstration) Project will pioneer the construction of major components such as antenna reflectors, assembly of spacecraft components, and satellite payload replacements.

- In December 2020, Airbus was selected by Thales Alenia Space to build the advanced radar instrument for the ‘Radar Observatory System for Europe in L-band’ (ROSE-L) mission. ROSE-L will be equipped with the largest planar space radar antenna.

Frequently Asked Questions (FAQ):

Which are the major companies in the defense integrated antenna market? What are their major strategies to strengthen their market presence?

The Defense integrated antenna market is dominated by a few globally established players such as L3Harris Technologies (US), Airbus (Netherlands), General Dynamics (US), Maxar Technologies (US), and Honeywell International Inc. (US), among others, are the key manufacturers that secured Defense integrated antenna contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their defense integrated antenna market presence.

What are the drivers and opportunities for the defense integrated antenna market?

The market for defense integrated antenna has grown substantially across the globe, and especially in Asia Pacific, where increase in integration of advanced antennas in such as China, India, and South Korea, will offer several opportunities for integrated antenna manufacturing companies. The rising adoption of UAVs for various applications and due to the ongoing R&D to land UAVs on aircraft carriers are also expected to boost the growth of the market around the world.

North America and Europe are key developer of defense integrated antenna as most key manufacturers and leading players in this market are based in these regions. Some of these manufacturers are L3Harris Technologies (US), General Dynamics (US), Maxar Technologies (US), Cobham Advanced Electronic Solutions (US) and Honeywell International Inc. (US).

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2022 to 2026, showcasing strong demand from defense integrated antenna in the region. An increase in the instances of dispute with neighboring countries in the Asia Pacific region has led countries of the region to enhance their surveillance and anti-terrorism capabilities. In addition, the increase in defense expenditures of India and China, among others, and the expansion of military commands in emerging economies have accelerated the demand for defense integrated antenna in the Asia Pacific region.

Which are the key technology trends prevailing in the defense integrated antenna market?

Multi-material 3D printing of antennas and RF components, miniaturization of antenna, development of antennas using metamaterial, lightweight circuit chip antennas, and development of active electronically scanned array (aesa). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

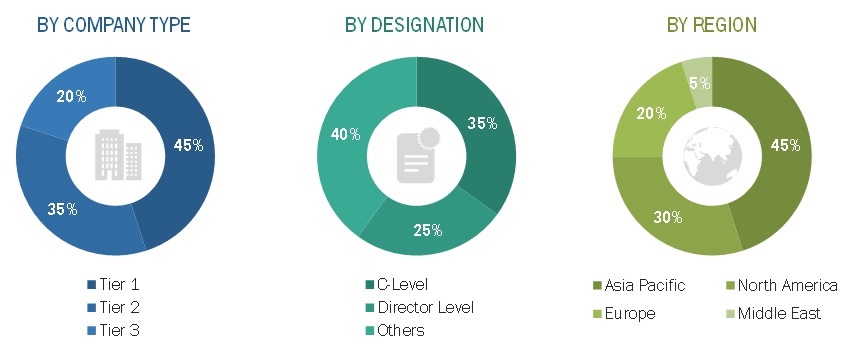

This research study conducted on the defense integrated antenna market involved extensive use of secondary sources, directories, and databases such as D&B Hoovers, FlightGlobal, SIPRI, and Factiva to identify and collect information relevant to the defense integrated antenna market. Primary sources considered included industry experts from the concerned market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry.

Secondary Research

The market share of companies in the defense integrated antenna market was determined using secondary data made available through paid and unpaid sources and by analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred for this research study on the defense integrated antenna market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the defense integrated antenna market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the defense integrated antenna market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW). This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

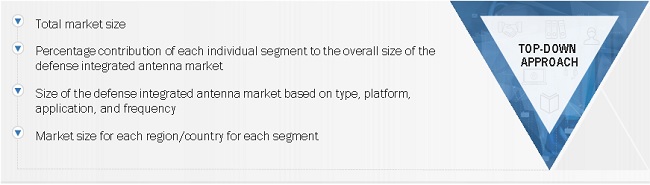

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the defense integrated antenna market. The research methodology used to estimate the market size included the following details:

Key players in the defense integrated antenna market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the defense integrated antenna market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the defense integrated antenna market.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Defense integrated antenna Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the defense integrated antenna market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the defense integrated antenna market based on type, platform, frequency band, application, and region from 2022 to 2026

- To forecast the size of various segments of the defense integrated antenna market with respect to five regions, such as North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions, and new product launches & developments in the market

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the defense integrated antenna market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the defense integrated antenna market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Defense Integrated Antenna Market