Decentralized Identity Market by Identity Type, End User, Organization Size, Vertical (BFSI, Government, Healthcare and Life Sciences, Retail and eCommerce, Telecom and IT, Transport and Logistics, Real Estate) and Region - Global Forecast to 2027

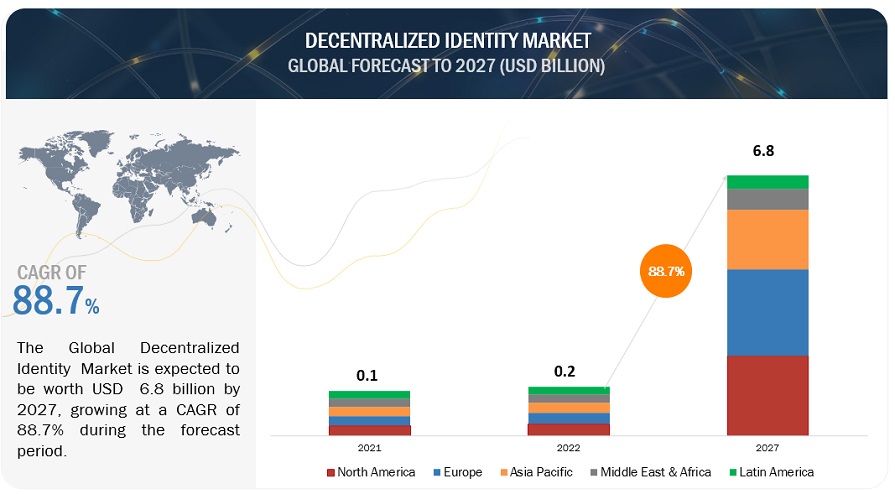

[146 Pages Report] The decentralized identity market size is projected to grow from USD 0.2 billion in 2022 to USD 6.8 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 88.7% during the forecast period. The major driving factors contributing to the growth of the decentralized identity market include the Inefficiency of existing identity management practices, rising instances of security breaches and identity-related fraud, and the end-user advantage of retaining complete control over the use of identities.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact Analysis on Decentralized Identity Market

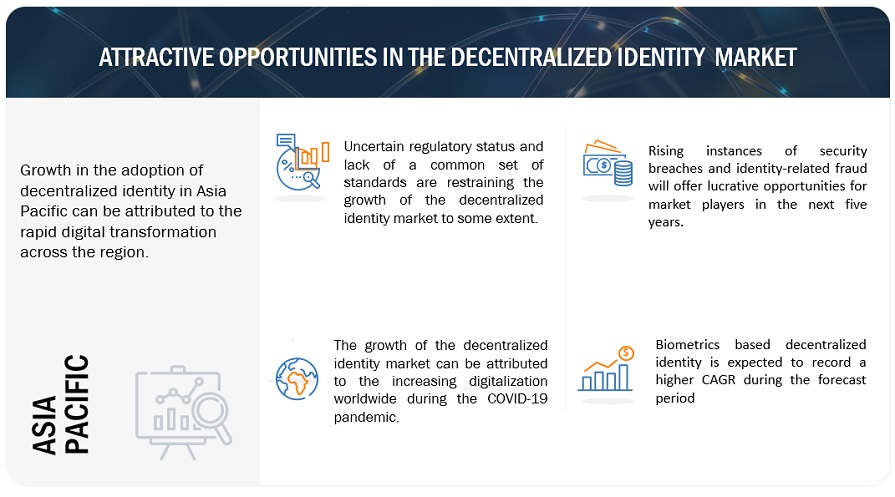

The COVID-19 pandemic has affected everyone, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Decentralized identity technology has experienced remarkable gains due to the confluence of COVID-19. Since the outbreak of COVID-19, many businesses started providing online services, which has increased the concerns about the identity security of online users. Decentralized identity plays a significant role in verifying user identities and storing it securely. In addition, organizations worldwide have stepped up measures to adopt decentralized identity technologies. This is anticipated to boost the demand for decentralized identity technologies worldwide.

Market Dynamics

Driver: Rising instances of security breaches and identity-related fraud

With the world continuing its journey towards digitalization, the data being uploaded to the web is increasingly getting exposed to threats. Each consumer's personal information resides on hundreds of servers across the globe, resulting in increasing instances of identity theft. The Federal Trade Commission (FTC) estimates that identity fraud incidents increased worldwide by around 45% in 2020, resulting in substantial financial losses. The increase in cyberattacks is attributed to technologies such as ML, which helps attackers create several different versions of malicious codes daily. The constant emergence of such new cyberattacks is damaging the reputation of companies, harming their assets, and resulting in financial losses. Hence, safeguarding against cyber threats has become essential for business growth. This has prompted enterprises to adopt decentralized identity for protection against security breaches and cyberattacks, a catalyst for developing and adopting decentralized identity technology. Airlines and airports worldwide have implemented decentralized identity technology that enables travelers to check in with face recognition - enabling contactless passage through multiple touchpoints. This technology allows passengers to check bags, enter security, and board the airplane with a secure, quick, and accurate face scan.

Restraint: Uncertain regulatory status and lack of a common set of standards

Regulatory entities always find it challenging to cope with advances in technology. With technology advancements, regulatory bodies need to understand what the current regulations lack and how they can impact the overall technology applications. Uncertainties in regulations remain a concern in the blockchain identity management market. The lack of rules and the resulting uncertainties are among the significant restraining factors for adopting blockchain technology across verticals. Financial institutions across the globe are working closely to find a common set of standards for the blockchain technology. However, regulatory acceptance by financial institutions is one of the biggest challenges in transforming transactional systems. The distributed ledger technology is still nascent; many questions are being raised relating to its wide range of applications, security, ease of transaction level, and authenticity for regulators and policymakers, both at the national and international levels. Regulators are still skeptical about the potential of blockchain technology, as the overall technology cannot be regulated; only the use cases related to this technology, such as payments, smart contracts, documentation, and digital identity, can be regulated. Due to such problems as lack of standardization and interoperability, the regulatory status of blockchain technology remains uncertain.

Opportunity: Extensive applications of blockchain identity solutions in banking

Blockchain identity management technology has great potential in various application areas, such as banking, cybersecurity, and IoT. This technology can revolutionize the world by addressing the multiple challenges in traditional banking processes providing uninterrupted banking services. Advantages such as low transaction fees and reduced transaction time would increase the efficiency and security of business transactions. Since blockchain technology is based on distributed ledger technology and the blocks are encrypted using advanced cryptography, the data is less prone to being hacked or changed without authorization. Several pioneers are implementing this technology to create a decentralized network of IoT devices, eliminating the need for a central location to handle the communication between devices. Blockchain technology is expected to enable devices to communicate directly, thereby reducing the need for additional monitoring systems.

Challenge: Lack of technical knowledge and understanding of blockchain concept

Undoubtedly, blockchain is one of the most intriguing technologies in the market. However, since it is in the nascent stage, end-users are still facing some challenges related to their technical understanding of the concept. Despite the enormous benefits this technology provides and the number of vendors entering this market space in the last few years, adopting blockchain identity management solutions is still relatively slow. As the adoption and use cases of distributed ledger technology increase in the next few years, there will be a corresponding need to understand blockchain technology better and for the development of platforms. Since blockchain technology uses cryptographic algorithms running across a vast network of independent computers, technical knowledge about the related techniques is required to explore the benefits of blockchain applications. Challenges related to the legacy infrastructure will be another major obstacle, as the practicality of implementing decentralized cryptosystems falls outside the traditional IT development skill sets.

Based on Verticals, BFSI segment to hold the largest market share during the forecast period

Identity plays a significant role in the financial services industry. To verify the identity of customers and ensure they are not entangled in illegal activity such as bribery or money laundering, banks and other financial institutions are required to carry out KYC checks. According to Forbes, major banks spend up to USD 500 million on cybersecurity annually, with USD 25 billion being spent in the US on AML compliance. Outdated KYC processes can be reshaped with a decentralized identity by allowing for the effective outsourcing and decentralization of personal data while allowing the owners to maintain complete control over their data. The way insurance agencies interact with their customers and provide them greater convenience, personalization, and security when shopping for insurance products can be securely transformed with the help of decentralized or self-sovereign identity. Banks can also offer a digital credit card version compatible with decentralized identity protocols. Some commercial banks and research institutions are experimenting with DLT–based solutions for trade finance and cross-border remittance solutions. However, it is necessary to expand the scope of decentralized identity solutions to ensure interoperability and standardization in customer-facing processes and risk management practices to reap further benefits.

North America is expected to hold the largest market size during the forecast period.

The rapidly evolving digital world requires efforts and advancements to keep up with subsequent increases in fraud and privacy concerns. A different, simplified approach is needed, one that understands the security model to keep data safe. Increasing identity thefts in government and public sectors may boost the adoption of protection services. The US Federal Government has invested tens of millions of dollars to help companies standardize and build solutions for decentralized identity and related technologies. Dozens of solution providers are emerging in the private sector; several Fortune 100 companies are also launching solutions in the decentralized identity market. These players are now driving the decentralized identity market in North America. For example, IBM and Evernym have introduced a new joint offering limited to North America. This offering will bring together the Evernym Accelerator and IBM Blockchain Lab Services to accelerate the country's decentralized identity adoption.

Key players

The study includes an in-depth competitive analysis of these key players in the decentralized identity market with their company profiles, recent developments, and key market strategies.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the decentralized identity market include Microsoft (US), Accenture (Ireland), Persistent (India), Wipro (India), SecureKey Technologies (Canada), R3 (US), Avast (Czech Republic), Validated ID (Spain), Serto (US), Ping Identity (US), NuID (US), Dragonchain (US), Nuggets (UK), Finema (Thailand), Datarella (Germany), Civic Technologies

Scope of the Report

Report Metrics |

Details |

Market size available for years |

2018–2027 |

Base year considered |

2021 |

Forecast period |

2022–2027 |

Forecast units |

Value (USD Million) |

Segments Covered |

Identity type, end user, organization size, verticals, and regions |

Geographies covered |

North America, Europe, APAC, Middle East and Africa (MEA), and Latin America. |

Major companies covered |

Microsoft (US), Accenture (Ireland), Persistent (India), Wipro (India), SecureKey Technologies (Canada), R3 (US), Avast (Czech Republic), Validated ID (Spain), Serto (US), Ping Identity (US), NuID (US), Dragonchain (US), Nuggets (UK), Finema (Thailand), Datarella (Germany), Civic Technologies (US), 1Kosmos (US), Affinity (Singapore), Hu-manity (US), SelfKey (Mauritius) Gataca (Spain) |

This research report categorizes the decentralized identity to forecast revenues and analyze trends in each of the following submarkets:

Based on Identity type:

- Non- biometrics

- Biometrics

Based on End-user:

- Enterprises

- Individual

Based on Organization size:

- Large Enterprises

- SMEs

Based on Verticals:

- BFSI

- Government

- Healthcare and life sciences

- Telecom and IT

- Retail & E-Commerce

- Transport and Logistics

- Real Estate

- Media and Entertainment

- Travel and Hospitality

- Other Verticals

Based on the region:

- North America

- Europe

- APAC

- Middle East and Africa (MEA)

- Latin America

Recent Developments:

- In March 2022, Avast acquired SecureKey. Acquiring SecureKey Technologies will give Avast access to its decentralized identity expertise and large customer base. It will also help Avast with geographic expansion.

- In October 2021, Interac acquired exclusive rights to SecureKey digital ID services for Canada. Interac will leverage SecureKey Technologies' existing digital ID services to accelerate secure online service delivery.

- In April 2021, Microsoft collaborated with Onfido for fast and secure identity verification and onboarding for its Azure Active Directory (Azure AD) verifiable credentials.

- In February 2021, Accenture partnered with Nuggets, a self-sovereign digital ID and payments platform. Through this partnership, Accenture will help Nuggets to improve and develop its decentralized identity technologies and business models.

- In March 2020, Wipro partnered with Hedera, which offers decentralized identity services. Wipro joined Hedera's Governing Council, providing decentralized governance to its hashgraph distributed ledger technology.

Frequently Asked Questions (FAQ):

What is the projected market value of the decentralized identity market?

The decentralized identity market size is projected to grow from USD 0.2 billion in 2022 to USD 6.8 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 88.7% during the forecast period.

Which region has the highest market share in the decentralized identity market?

North America is estimated to hold the highest market share in the decentralized identity market owing to the rising instances of criminal activities expected to increase the demand for decentralized identity in the United States.

What is decentralized identity?

Decentralized identity is a technology that allows individuals to manage their own identities. In a decentralized framework, the user receives credentials from a number of issuers (e.g., government, education, employer) and stores them in a digital wallet. The user presents those credentials to the relevant issuing authority, who then verifies their identity through a blockchain-based ledger that does not store the user's data.

What are the trends impacting the decentralized identity market?

The major trends impacting the decentralized identity market include:

- Rising instances of security breaches and identity-related fraud

- End-user advantage of retaining complete control over the use of identities

- Uncertain regulatory status and lack of a common set of standards

- Emergence and increasing adoption of SSIs

- Extensive applications of blockchain identity solutions in banking

- Lack of technical knowledge and understanding of the blockchain concept

Who are the major vendors in the Decentralized identity market?

Key and innovative vendors in decentralized identity market include Microsoft (US), Accenture (Ireland), Persistent (India), Wipro (India), SecureKey Technologies (Canada), R3 (US), Avast (Czech Republic), Validated ID (Spain), Serto (US), Ping Identity (US), NuID (US), Dragonchain (US), Nuggets (UK), Finema (Thailand), Datarella (Germany), Civic Technologies (US), 1Kosmos (US), Affinity (Singapore), Hu-manity (US), SelfKey (Mauritius), Gataca (Spain). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015–2022

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 1 DECENTRALIZED IDENTITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

TABLE 3 DECENTRALIZED IDENTITY MARKET SIZE AND GROWTH, 2019–2026 (USD MILLION, Y-O-Y %)

FIGURE 2 MARKET TO GROW EXPONENTIALLY FROM 2019 TO 2027

FIGURE 3 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 BRIEF OVERVIEW OF MARKET

FIGURE 4 INCREASING IDENTITY RELATED THREATS TO DRIVE MARKET GROWTH

4.2 MARKET, BY IDENTITY TYPE, 2022–2027

FIGURE 5 NON-BIOMETRICS IDENTITY TO HOLD LARGER MARKET SHARE IN 2022

4.3 MARKET, BY END USER, 2022–2027

FIGURE 6 ENTERPRISE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

4.4 MARKET INVESTMENT SCENARIO, BY REGION

FIGURE 7 EUROPE TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 33)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 8 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DECENTRALIZED IDENTITY MARKET

5.2.1 DRIVERS

5.2.1.1 Rising instances of security breaches and identity related fraud

5.2.1.2 End-user advantage of retaining full control over use of identities

5.2.1.3 Inefficiency of existing identity management practices

5.2.2 RESTRAINTS

5.2.2.1 Uncertain regulatory status and lack of common set of standards

5.2.3 OPPORTUNITIES

5.2.3.1 Extensive applications of blockchain identity solutions in banking, cybersecurity and IoT

5.2.3.2 Emergence and increasing adoption of SSIs

5.2.4 CHALLENGES

5.2.4.1 Lack of technical knowledge and understanding of blockchain concept

5.3 VALUE CHAIN

FIGURE 9 DECENTRALIZED IDENTITY MARKET VALUE CHAIN

5.4 ECOSYSTEM: DECENTRALIZED IDENTITY

5.5 TECHNOLOGY ANALYSIS

5.5.1 ARTIFICIAL INTELLIGENCE

5.5.2 BLOCKCHAIN

5.5.3 TYPES OF BLOCKCHAIN TECHNOLOGY

5.5.3.1 Private blockchain

5.5.3.2 Public blockchain

5.6 PATENT ANALYSIS

FIGURE 10 MARKET: PATENT ANALYSIS

5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 11 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 12 PORTERS FIVE FORCES MODEL FOR DECENTRALIZED IDENTITY MARKET

TABLE 4 PORTERS FIVE FORCES IMPACT ON MARKET

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 DEGREE OF COMPETITION

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

5.9.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)

5.9.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

5.9.4 KNOW YOUR CUSTOMER (KYC)

5.9.5 ANTI-MONEY LAUNDERING

5.10 USE CASES

5.10.1 USE CASE: BLOKSEC

5.10.2 USE CASE: DIGITAL PERMANENT RESIDENT CARD

5.10.3 USE CASE: PUBLIC AUTHORITY IDENTITY CREDENTIALS

5.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 MARKET: CONFERENCES & EVENTS

6 DECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE (Page No. - 48)

6.1 INTRODUCTION

FIGURE 13 NON-BIOMETRICS TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 9 TY MARKET, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

6.2 NON-BIOMETRICS

6.2.1 NON-BIOMETRICS: MARKET DRIVERS

TABLE 10 NON-BIOMETRICS DECENTRALIZED IDENTITY MARKEYT SIZE, BY REGION, 2019–2027 (USD MILLION)

6.3 BIOMETRICS

6.3.1 BIOMETRICS: MARKET DRIVERS

TABLE 11 BIOMETRICS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

7 DECENTRALIZED IDENTITY MARKET, BY END USER (Page No. - 52)

7.1 INTRODUCTION

FIGURE 14 ENTERPRISE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY END USER, 2019–2027 (USD MILLION)

7.2 INDIVIDUAL

7.2.1 INDIVIDUAL: MARKET DRIVERS

TABLE 13 MARKET: INDIVIDUAL, BY REGION, 2019–2027 (USD MILLION)

7.3 ENTERPRISE

7.3.1 ENTERPRISE: MARKET DRIVERS

TABLE 14 MARKET: ENTERPRISE, BY REGION, 2019–2027 (USD MILLION)

8 DECENTRALIZED IDENTITY MARKET, BY ORGANIZATION SIZE (Page No. - 56)

8.1 INTRODUCTION

FIGURE 15 SMES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 16 LARGE ENTERPRISES MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

8.3 SMES

8.3.1 SMES: MARKET DRIVERS

TABLE 17 SMES MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9 DECENTRALIZED IDENTITY MARKET, BY VERTICAL (Page No. - 60)

9.1 INTRODUCTION

FIGURE 16 REAL ESTATE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 MARKET SIZE, BY VERTICALS, 2019–2027 (USD MILLION)

9.2 BFSI

9.2.1 BFSI: MARKET DRIVERS

TABLE 19 BFSI MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.3 GOVERNMENT

9.3.1 GOVERNMENT: MARKET DRIVERS

TABLE 20 GOVERNMENT MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.4 HEALTHCARE AND LIFE SCIENCES

9.4.1 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

TABLE 21 HEALTHCARE AND LIFE SCIENCES MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.5 TELECOM AND IT

9.5.1 TELECOM AND IT: MARKET DRIVERS

TABLE 22 TELECOM AND IT MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.6 RETAIL AND E-COMMERCE

9.6.1 RETAIL AND E-COMMERCE: DECENTRALIZED IDENTITY MARKET DRIVERS

TABLE 23 RETAIL AND E-COMMERCE MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.7 TRANSPORT AND LOGISTICS

9.7.1 TRANSPORT AND LOGISTICS: MARKET DRIVERS

TABLE 24 TRANSPORT AND LOGISTICS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.8 REAL ESTATE

9.8.1 REAL ESTATE: MARKET DRIVERS

TABLE 25 REAL ESTATE MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.9 MEDIA AND ENTERTAINMENT

9.9.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

TABLE 26 MEDIA AND ENTERTAINMENT MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.10 OTHERS

TABLE 27 OTHERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

10 DECENTRALIZED IDENTITY MARKET BY REGION (Page No. - 71)

10.1 INTRODUCTION

FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 18 NORTH AMERICA: MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MARKET SIZE, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: DECENTRALIZED IDENTITY MARKET DRIVERS

10.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 33 EUROPE: MARKET SIZE, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

TABLE 34 EUROPE: MARKET SIZE, BY END USER, 2019–2027 (USD MILLION)

TABLE 35 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

TABLE 36 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: DECENTRALIZED IDENTITY MARKET DRIVERS

10.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 19 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 37 ASIA PACIFIC: MARKET SIZE, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2027 (USD MILLION)

TABLE 39 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: DECENTRALIZED IDENTITY MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 41 MIDDLE EAST & AFRICA: MARKET SIZE, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2019–2027 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2019–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: DECENTRALIZED IDENTITY MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 45 LATIN AMERICA: MARKET SIZE, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

TABLE 46 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2027 (USD MILLION)

TABLE 47 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

TABLE 48 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 86)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 20 DECENTRALIZED IDENTITY MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 21 MARKET: REVENUE ANALYSIS

11.4 COMPANY EVALUATION MATRIX

11.4.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 49 EVALUATION CRITERIA

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 22 DECENTRALIZED IDENTITY MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING OF KEY PLAYERS, 2021

11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 50 COMPANY PRODUCT FOOTPRINT

TABLE 51 COMPANY COMPONENT FOOTPRINT

TABLE 52 COMPANY VERTICAL FOOTPRINT

TABLE 53 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 23 DECENTRALIZED IDENTITY MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2021

11.8 COMPETITIVE BENCHMARKING FOR START-UPS

11.8.1 DECENTRALIZED IDENTITY: START-UPS/SMES

11.8.2 DECENTRALIZED IDENTITY: COMPETITIVE BENCHMARKING OF START-UPS/SMES

12 COMPANY PROFILES (Page No. - 97)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

12.2.1 MICROSOFT

TABLE 54 MICROSOFT: BUSINESS OVERVIEW

FIGURE 24 MICROSOFT: COMPANY SNAPSHOT

TABLE 55 MICROSOFT: SOLUTIONS OFFERED

TABLE 56 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 57 IBM: DEALS

12.2.2 ACCENTURE

TABLE 58 ACCENTURE: BUSINESS OVERVIEW

FIGURE 25 ACCENTURE: COMPANY SNAPSHOT

TABLE 59 ACCENTURE: SOLUTIONS OFFERED

TABLE 60 ACCENTURE: DEALS

12.2.3 PERSISTENT

TABLE 61 PERSISTENT: BUSINESS OVERVIEW

FIGURE 26 PERSISTENT: COMPANY SNAPSHOT

TABLE 62 PERSISTENT: SOLUTIONS OFFERED

TABLE 63 PERSISTENT: DEALS

12.2.4 WIPRO

TABLE 64 WIPRO: BUSINESS OVERVIEW

FIGURE 27 WIPRO: COMPANY SNAPSHOT

TABLE 65 WIPRO: SOLUTIONS OFFERED

TABLE 66 WIPRO: DEALS

12.2.5 SECUREKEY TECHNOLOGIES

TABLE 67 SECUREKEY TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 68 SECUREKEY TECHNOLOGIES: SOLUTIONS OFFERED

TABLE 69 SECUREKEY TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 70 SECUREKEY TECHNOLOGIES: DEALS

12.2.6 R3

TABLE 71 R3: BUSINESS OVERVIEW

TABLE 72 R3: SOLUTIONS OFFERED

TABLE 73 R3: PRODUCT LAUNCHES

TABLE 74 R3: DEALS

12.2.7 AVAST

TABLE 75 AVAST: BUSINESS OVERVIEW

FIGURE 28 AVAST: COMPANY SNAPSHOT

TABLE 76 AVAST: SOLUTIONS OFFERED

TABLE 77 AVAST: DEALS

12.2.8 VALIDATED ID

TABLE 78 VALIDATED ID: BUSINESS OVERVIEW

TABLE 79 VALIDATED ID: SOLUTIONS OFFERED

12.2.9 SERTO

TABLE 80 SERTO: BUSINESS OVERVIEW

TABLE 81 SERTO: SOLUTIONS OFFERED

TABLE 82 SERTO: PRODUCT LAUNCHES

TABLE 83 SERTO: DEALS

12.2.10 PING IDENTITY

TABLE 84 PING IDENTITY: BUSINESS OVERVIEW

FIGURE 29 PING IDENTITY: COMPANY SNAPSHOT

TABLE 85 PING IDENTITY: SOLUTIONS OFFERED

TABLE 86 PING IDENTITY: PRODUCT LAUNCHES

TABLE 87 PING IDENTITY: DEALS

12.2.11 NUID

12.2.12 DRAGONCHAIN

12.2.13 NUGGETS

12.2.14 FINEMA

12.2.15 DATARELLA

12.2.16 CIVIC TECHNOLOGIES

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.3 STARTUP/SME

12.3.1 1KOSMOS

12.3.2 AFFINIDI

12.3.3 HU-MANITY

12.3.4 SELFKEY

13 ADJACENT/RELATED MARKETS (Page No. - 129)

13.1 INTRODUCTION

13.2 DIGITAL IDENTITY SOLUTIONS MARKET

13.2.1 MARKET DEFINITION

TABLE 88 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 89 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 90 DIGITAL IDENTITY SOLUTIONS SUBSEGMENT MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 91 DIGITAL IDENTITY SOLUTIONS SUBSEGMENT MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 92 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY SOLUTION TYPE, 2016–2020 (USD MILLION)

TABLE 93 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY SOLUTION TYPE, 2021–2026 (USD MILLION)

TABLE 94 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY AUTHENTICATION TYPE, 2016–2020 (USD MILLION)

TABLE 95 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY AUTHENTICATION TYPE, 2021–2026 (USD MILLION)

TABLE 96 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 97 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 98 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 99 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.3 BLOCKCHAIN IDENTITY MANAGEMENT MARKET

13.3.1 MARKET DEFINITION

TABLE 100 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY PROVIDER, 2016–2023 (USD MILLION)

TABLE 101 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 102 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 103 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4 IDENTITY VERIFICATION MARKET

13.4.1 MARKET DEFINITION

TABLE 104 IDENTITY VERIFICATION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 105 IDENTITY VERIFICATION MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 106 IDENTITY VERIFICATION MARKET SIZE, BY TYPE, 2015–2020 (USD MILLION)

TABLE 107 IDENTITY VERIFICATION MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 108 IDENTITY VERIFICATION MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 109 IDENTITY VERIFICATION MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 110 IDENTITY VERIFICATION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 111 IDENTITY VERIFICATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 139)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

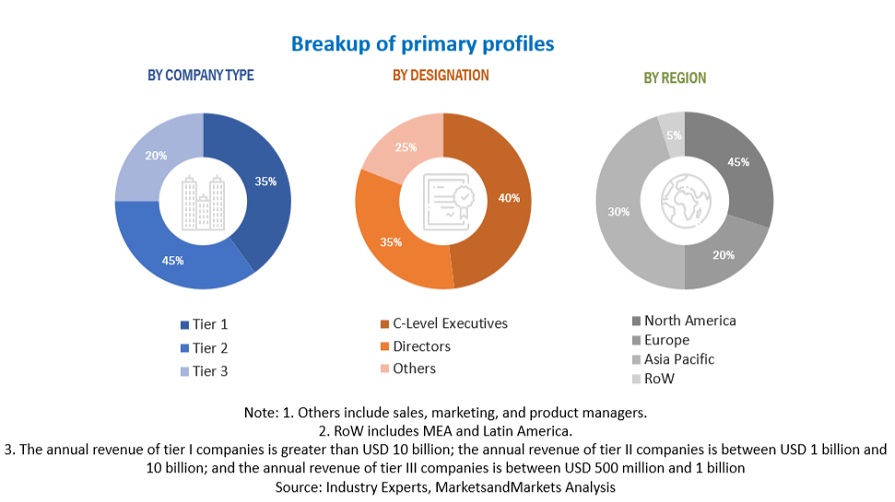

The study involved four major activities in estimating the current size of the decentralized identity market. Exhaustive secondary research was done to collect information related to the decentralized identity market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Secondary Research

The market share and revenue of the companies offering decentralized identity services for various end users were identified from the secondary data available through paid and unpaid sources by analyzing the product portfolio of major companies in the ecosystem and rating them based on performance and quality. In the secondary research process, various sources were used to identify and collect relevant information. The secondary sources included annual reports, press releases, and company investor presentations. Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspective – all of which were further validated by primary sources.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the decentralized identity market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the decentralized identity market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offerings. The aggregate of the revenues of all companies was extrapolated to reach the overall market size. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry's supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the decentralized identity market by identity type, end user type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments in the market, such as mergers and acquisitions, product developments, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company's needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Decentralized Identity Market