Cloud Data Warehouse Market by Application (Customer Analytics, Business Intelligence, Operational Analytics, Predictive Analytics), Vertical, Deployment Model, Type (EDWaaS & ODS) & Organization Size - Global Forecast to 2026

Updated on : March 21, 2024

Cloud Data Warehouse Market Overview, Industry Share and Forecast

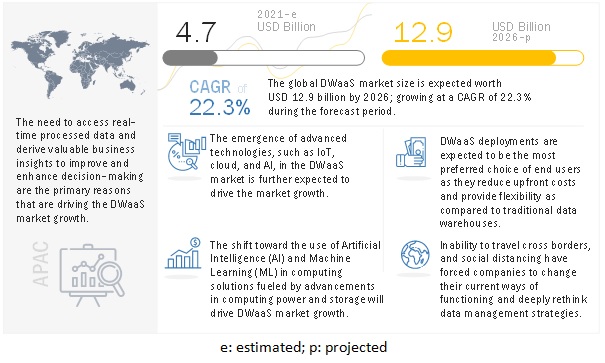

The global cloud data warehouse market size was worth approximately $4.7 billion in 2021 and is expected to generate revenue around $12.9 billion by the end of 2026 growing at a CAGR of around 22.3% between 2021 to 2026. Key factors that are expected to drive the growth of the market are the increasing role of business intelligence and data analytics in the enterprise management, growing dependence on data-driven decision-making to improve business performance, and requirement of regulatory governance and security.

The cloud data warehouse market is growing due to the presence of large number of global vendors in the market. The major factors that are driving the adoption of Cloud Data Warehouse model among the enterprises as well as SMEs across various verticals including BFSI, energy and utilities, government and public sector, healthcare and life sciences, IT and ITeS, manufacturing, media and entertainment, retail and consumer goods, telecommunications, and others due to significant adoption of cloud services and digital transformation. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market. The recent economic slowdown with the impact of COVID-19 emphasizes the need for alternate business systems. It has become important for businesses to embrace cloud computing and migrate to cloud data warehouses. This will help organizations to have a stable business condition in the short term while targeting continued growth and expansion in the long run. Organizations across different verticals are leveraging data warehouse services due to various advantages including higher availability, low latency, scalability, and enterprise-grade security.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increasing role of business intelligence and data analytics in enterprise management

Business intelligence and analytics are not possible without a data warehouse system in place. Business intelligence is the ability to answer complex questions and these insights can be used for informed decision making. In business intelligence, a data warehouse serves as a backbone for storage. Business intelligence includes three activities including data wrangling, data analysis, and data storage. The emergence of cloud services has led to increasing BI adoption. The major functionalities in a BI solution are dashboard, data visualization, BI/OLAP tools, and analytics. The exponential growth of data demands excellent data analytics to derive meaningful insights. To assist organizations with improved data categories and reporting, BI tools are heavily utilized. Thus, the increasing utilization of BI tools is driving the demand for data warehouse services in the market.

Restraint: Lack of resources and expertise

Several companies are heavily investing in emerging technologies including cloud computing and big data analytics to modernize the enterprise data structure, which is driving the demand for a skilled workforce. The World Economic Forum estimates that about 54% of employees will require reskilling by 2022. The study suggests that countries should increase public and private investments in the three major areas including people reskilling; rules and regulations related to work and sectors such as education, digital, and transport infrastructure; thus, more specialized skills companies will successfully adopt digital technologies.

Hiring and training employees are critical activities in the adoption of data warehouse services. Several organizations find it difficult to hire new employees due to budget constraints and the training of existing employees also incurs costs. A data warehouse is one of the most complex systems to implement on the cloud, which is not possible without the availability of the right knowledge and skills. To run a successful cloud data warehouse, companies require people with knowledge of cloud architecture, technical understanding of integrating data systems, and understanding of cloud security and governance. Thus, the lack of skilled resources is likely to affect the demand for data warehouse services in the market.

Opportunity: Rapid deployment of large-scale cloud data warehouses

With the ever-increasing data volumes and complexity levels in the present IT infrastructure, organizations are looking for ways to focus on business functioning rather than the IT infrastructure. Advancements in cloud-based infrastructure are encouraging companies to shift their critical business activities to the cloud, including the adoption of cloud-based data marts and data warehouses. Currently, cloud data storage accounts for 45% of organization data, and by Q2 2021, the number could grow by 53%. Cloud data warehouses can be a game-changer as they support business intelligence tools to correctly structure the data and provide accurate business insights. The recent economic slowdown with the impact of COVID-19 emphasizes the need for alternate business systems. It has become important for businesses to embrace cloud computing and migrate to cloud data warehouses. This will help organizations to have a stable business condition in the short term while targeting continued growth and expansion in the long run.

Challenge: Lack of proper structure of access control

Defining the structure of access control is extremely important while dealing with data warehouses. In most cases, businesses are unable to decide which department and users must have access to the data warehouse. Not balancing users and granting permissions result in an extensive load on the system, which creates bottlenecks that cannot be avoided. The lack of proper access control can open up sensitive information, which can be accessed by unauthorized users, thereby resulting in a major loss to the business growth. Thus, a defined system for access control is necessary for the deployment of data warehouses.

Operational data storage segment to grow at a higher CAGR during the forecast period.

The market for operational data storage is expected to grow at a higher CAGR during the forecast period. The growth is mainly attributed to the increasing demand for real-time data analytics and reporting. The implementation of ODS in an enterprise complements the existing data infrastructure and supports the current and future needs of the enterprise. In addition, the growing use of AI in data warehouses is likely to provide future growth opportunities for the ODS segment. Companies operating in the Cloud Data Warehouse Market provide advanced solutions to meet the rapid growth of data volumes and to adhere to regulatory compliance mandates.

The public cloud segment to hold the largest market share in 2021.

The Market is segmented by deployment type into public and private cloud. The public cloud segment account for a higher share of the Cloud Data Warehouse Market during the forecast period due to increasing investments in mobility, collaboration and other remote working technology and infrastructure.

Healthcare and life sciences vertical to grow at a higher CAGR during the forecast period.

Healthcare and life sciences is one of the fastest-growing verticals as the industry is undergoing extensive development, with advancements in technologies, thereby enhancing the overall industry vertical. The quality of information and the interest toward quality medicinal administrations have turned out to be progressively imperative. Initially, owing to data complexities and a variety of medical cum clinical data, the adoption of Cloud Data Warehouse solutions in the healthcare sector was comparatively slow. However, over the past years, the increase in the usage of Cloud Data Warehouse solutions has proved to be handy in administrative and clinical areas. The vast amounts of data generated over the years have been used in a variety of areas, right from enhancing patient health to pharmaceuticals testing.

To know about the assumptions considered for the study, download the pdf brochure

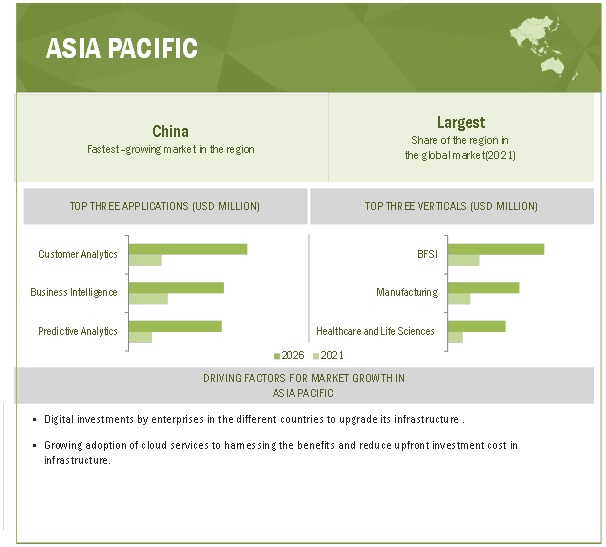

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

There is an increasing demand for Cloud Data Warehouse, which is cloud-driven and cloud-supported, in the APAC region, thereby resulting in increasing investments and technological advancements across various industries. BFSI is one of the biggest industry verticals in the APAC region, followed by manufacturing, and retail, and e-commerce. Due to the global competition, lower operational costs and higher productivity have become major concerns for local manufacturers, which need to be addressed immediately to stay competitive in the market. Companies in this region continue to focus on improving their customer service to drive competitive differentiation and revenue growth. This is pushing companies to explore hosted and cloud alternatives for on-premises-based Cloud Data Warehouse solutions. China, Japan, and Australia and New Zealand (ANZ) are the leading countries in terms of the adoption of the data warehouse services in the region.

Key Players

The Cloud Data Warehouse vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The Cloud Data Warehouse Market comprises major providers, such as AWS(US), IBM(US), Microsoft(US), Google(US), Oracle(US), SAP(Germany), Snowflake(US), Micro Focus(UK), Teradata(US), 1010Data(US), Cloudera(US), Pivotal(US), Yellowbrick(US), Veeva Systems(US), Actian(US), Marklogic(US), Netavis Software(Austria), Solver(US), Accur8 Software(US), AtScale(US), Panoply(US), SingleStore(US), and Transwarp(China).

Scope of the report

|

Report Metric |

Details |

|

Market value in 2021 |

USD 4.7 Billion |

|

Market value in 2026 |

USD 12.9 Billion |

|

Market growth rate |

22.3% CAGR |

|

Largest market |

Asia Pacific |

|

Cloud Data Warehouse Market Drivers |

|

|

Cloud Data Warehouse Market Opportunities |

|

|

Market size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Segments covered |

By Application (Customer Analytics, Business Intelligence, Operational Analytics, Predictive Analytics), Vertical, Deployment Model, Type (EDWaaS & ODS) & Organization Size |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

AWS(US), IBM(US), Microsoft(US), Google(US), Oracle(US), SAP(Germany), Snowflake(US), Micro Focus(UK), Teradata(US), 1010Data(US), Cloudera(US), Pivotal(US), Yellowbrick(US), Veeva Systems(US), Actian(US), Marklogic(US), Netavis Software(Austria), Solver(US), Accur8 Software(US), AtScale(US), Panoply(US), SingleStore(US), and Transwarp(China). |

This research report of Cloud Data Warehouse Market based on application, vertical, deployment model, type, and organization size.

Based on the application:

- Business Intelligence

- Customer Analytics

- Data Modernization

- Operational Analytics

- Predictive Analytics

Based on the type:

- Enterprise DWaaS

- Operational data storage

Based on the deployment model:

- Public cloud

- Private cloud

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- Energy and utilities

- Government and public sector

- Healthcare and life sciences

- IT and ITeS

- Manufacturing

- Media and Entertainment

- Retail and consumer goods

- Telecommunications

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2021, AWS introduced the Amazon redshift query editor that supports clusters with enhanced VPC routing. The query editor supports all node types and the query time-out limit increased from 10 minutes to 24 hours to queries with longer run times.

- In May 2021, WPP announced a partnership with Microsoft to creatively transform content production with the launch of cloud studio.

- In March 2020, Google launched the Google AI cloud platform to provide a way to deploy robust machine learning pipelines.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Cloud Data Warehouse Market?

The global Cloud Data Warehouse Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 22.3% during the forecast period, to reach USD 12.9 billion by 2026 from USD 4.7 billion in 2021.

Which region has the highest market share in the Cloud Data Warehouse Market?

North America and Europe hold the highest market share of the global Cloud Data Warehouse Market in 2021.

Who are the major vendors in the Cloud Data Warehouse Market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as AWS(US), IBM(US), Microsoft(US), Google(US), Oracle(US), SAP(Germany), Snowflake(US), Micro Focus(UK), Teradata(US), 1010Data(US), Cloudera(US), Pivotal(US), Yellowbrick(US), Veeva Systems(US), Actian(US), Marklogic(US), Netavis Software(Austria), Solver(US), Accur8 Software(US), AtScale(US), Panoply(US), SingleStore(US), and Transwarp(China).

What are some of the latest trends that will shape the Cloud Data Warehouse Market in the future?

Emergence of BI and analytics, AI and cloud enabled offerings which significantly improve the Cloud Data Warehouse Market is expected to shape the market in the coming years..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 6 Cloud Data Warehouse Market: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

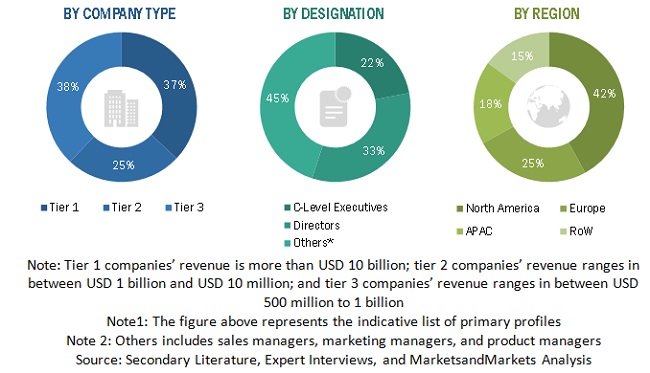

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 Cloud Data Warehouse Market: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 15 Cloud Data Warehouse Market: GLOBAL SNAPSHOT

FIGURE 16 MARKET: TOP GROWING SEGMENTS

FIGURE 17 CUSTOMER ANALYTICS SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 18 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 19 TOP VERTICALS IN MARKET

FIGURE 20 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN Market

FIGURE 21 FOCUS ON IMPROVING CUSTOMER EXPERIENCE AND SIMPLIFYING INFORMATION TECHNOLOGY OPERATIONS WORKFLOW TO DRIVE ADOPTION OF CLOUD DATA WAREHOUSE

4.2 MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 22 CUSTOMER ANALYTICS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 23 PUBLIC CLOUD SEGMENT TO HOLD LARGER MARKET SHARE IN 2021

4.4 MARKET, BY ORGANIZATION SIZE, 2021

FIGURE 24 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2021

4.5 MARKET, BY VERTICAL, 2021 VS. 2026

FIGURE 25 BFSI VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 Cloud Data Warehouse Market: REGIONAL SCENARIO, 2021–2026

FIGURE 26 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing role of business intelligence and data analytics in enterprise management

5.2.1.2 Growing dependence on data-driven decision making to improve business performance

5.2.1.3 Requirement for regulatory governance and security

5.2.2 RESTRAINTS

5.2.2.1 Lack of resources and expertise

FIGURE 28 PROJECTED SPENDING ON TECHNOLOGIES BY PROPORTION OF COMPANY REVENUE BY 2022

5.2.2.2 High cost of implementation and complexity in utilizing data warehouse services

FIGURE 29 CHALLENGES IN ADOPTION OF CLOUD SERVICES

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid deployment of large-scale cloud data warehouses

FIGURE 30 TOP CLOUD INITIATIVES IN 2020

5.2.3.2 Rise in adoption of virtual data warehousing to speed up data access process

5.2.4 CHALLENGES

5.2.4.1 Lack of proper structure for access control

5.2.4.2 Ensuring acceptable data quality

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 2: REAL-TIME ANALYTICS TO IMPROVE DATA GOVERNANCE

5.3.2 CASE STUDY: 3 ACCELERATED BUSINESS INSIGHTS

5.4 TECHNOLOGICAL ANALYSIS

5.4.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.4.2 CLOUD COMPUTING

5.4.3 BIG DATA AND ANALYTICS

5.5 PATENT ANALYSIS

FIGURE 31 NUMBER OF PATENTS PUBLISHED

FIGURE 32 TOP FIVE PATENT OWNERS

TABLE 3 TOP TEN PATENT OWNERS (US)

5.6 COVID-19-DRIVEN MARKET DYNAMICS

5.6.1 DRIVERS AND OPPORTUNITIES

5.6.2 RESTRAINTS AND CHALLENGES

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 Cloud Data Warehouse Market: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 PRICING ANALYSIS

TABLE 5 PRICING ANALYSIS OF DATA WAREHOUSE SERVICE PROVIDERS

5.9 ECOSYSTEM

TABLE 6 MARKET: ECOSYSTEM

FIGURE 34 MARKET: ECOSYSTEM

5.10 VALUE CHAIN ANALYSIS

FIGURE 35 MARKET: VALUE CHAIN

6 Cloud Data Warehouse Market, BY APPLICATION (Page No. - 85)

6.1 INTRODUCTION

FIGURE 36 CUSTOMER ANALYTICS SEGMENT EXPECTED TO REGISTER LARGEST MARKET SIZE IN 2026

6.1.1 APPLICATIONS: MARKET DRIVERS

6.1.2 APPLICATIONS: COVID-19 IMPACT

TABLE 7 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 8 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2 BUSINESS INTELLIGENCE

TABLE 9 BUSINESS INTELLIGENCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 BUSINESS INTELLIGENCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 CUSTOMER ANALYTICS

TABLE 11 CUSTOMER ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 CUSTOMER ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 DATA MODERNIZATION

TABLE 13 DATA MODERNIZATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 DATA MODERNIZATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 OPERATIONAL ANALYTICS

TABLE 15 OPERATIONAL ANALYTICS: Market SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 OPERATIONAL ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 PREDICTIVE ANALYTICS

TABLE 17 PREDICTIVE ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 PREDICTIVE ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 Cloud Data Warehouse Market, BY TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 37 MARKET FOR OPERATIONAL DATA STORAGE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

7.1.1 TYPE: MARKET DRIVERS

7.1.2 TYPE: COVID-19 IMPACT

TABLE 19 MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.2 ENTERPRISE CLOUD DATAWAREHOUSE

TABLE 21 ENTERPRISE CLOUD DATAWAREHOUSE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 ENTERPRISE CLOUD DATAWAREHOUSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 OPERATIONAL DATA STORAGE

TABLE 23 OPERATIONAL DATA STORAGE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 OPERATIONAL DATA STORAGE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 Cloud Data Warehouse Market, BY DEPLOYMENT MODEL (Page No. - 99)

8.1 INTRODUCTION

FIGURE 38 PUBLIC CLOUD DEPLOYMENT MODEL TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

8.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

8.1.2 DEPLOYMENT MODEL: COVID-19 IMPACT

TABLE 25 MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 26 MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

8.2 PUBLIC CLOUD

TABLE 27 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 PRIVATE CLOUD

TABLE 29 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 Cloud Data Warehouse Market, BY ORGANIZATION SIZE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 39 LARGE ENTERPRISES ARE EXPECTED TO RECORD LARGER MARKET SIZE DURING FORECAST PERIOD

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.2 LARGE ENTERPRISES

TABLE 33 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 Cloud Data Warehouse Market, BY VERTICAL (Page No. - 109)

10.1 INTRODUCTION

FIGURE 40 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

TABLE 37 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 39 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 ENERGY AND UTILITIES

TABLE 41 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 GOVERNMENT AND PUBLIC SECTOR

TABLE 43 GOVERNMENT AND PUBLIC SECTOR: Cloud Data Warehouse Market SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

TABLE 45 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 IT AND ITES

TABLE 47 IT AND ITES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 IT AND ITES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 MANUFACTURING

TABLE 49 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 MEDIA AND ENTERTAINMENT

TABLE 51 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.9 RETAIL AND CONSUMER GOODS

TABLE 53 RETAIL AND CONSUMER GOODS: Cloud Data Warehouse Market SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.10 TELECOMMUNICATIONS

TABLE 55 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.11 OTHERS

TABLE 57 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 Cloud Data Warehouse Market, BY REGION (Page No. - 123)

11.1 INTRODUCTION

FIGURE 41 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 59 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Health Information Technology for Economic and Clinical Health Act

11.2.3.5 Sarbanes Oxley Act

11.2.3.6 Federal Information Security Management Act

11.2.3.7 Payment Card Industry Data Security Standard

11.2.3.8 Federal Information Processing Standards

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: Cloud Data Warehouse Market SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 73 UNITED STATES: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 77 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 81 EUROPE: Cloud Data Warehouse Market SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 93 UNITED KINGDOM: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 97 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.6 FRANCE

TABLE 101 FRANCE: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 105 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 International Organization for Standardization 27001

11.4.3.2 Personal Data Protection Act

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: Cloud Data Warehouse Market SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 121 CHINA: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 125 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 126 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 127 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 128 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 129 AUSTRALIA AND NEW ZEALAND: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 130 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 131 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 132 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 133 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 ISRAELI Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in KSA

11.5.3.4 Protection of Personal Information Act

11.5.3.5 TRA’s IoT Regulatory Policy

TABLE 137 MIDDLE EAST AND AFRICA: Cloud Data Warehouse Market SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 SAUDI ARABIA

TABLE 149 SAUDI ARABIA: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 151 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 152 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

TABLE 153 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 154 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 155 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 156 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.6 SOUTH AFRICA

TABLE 157 SOUTH AFRICA: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 158 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 159 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 160 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.7 REST OF MIDDLE EAST AND AFRICA

TABLE 161 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 162 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 163 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 165 LATIN AMERICA: Cloud Data Warehouse Market SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 177 BRAZIL: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 178 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 179 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 180 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 181 MEXICO: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 182 MEXICO: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 183 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 184 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 185 REST OF LATIN AMERICA: Cloud Data Warehouse Market SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 186 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 187 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 188 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 184)

12.1 INTRODUCTION

12.2 MARKET SHARE OF TOP VENDORS

TABLE 189 CLOUD DATAWAREHOUSE: DEGREE OF COMPETITION

FIGURE 44 MARKET: VENDOR SHARE ANALYSIS

12.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 45 HISTORICAL REVENUE ANALYSIS

12.4 COMPANY EVALUATION QUADRANT

12.4.1 DEFINITIONS AND METHODOLOGY

TABLE 190 COMPANY EVALUATION QUADRANT: CRITERIA

12.4.2 STAR

12.4.3 EMERGING LEADER

12.4.4 PERVASIVE

12.4.5 PARTICIPANT

FIGURE 46 Cloud Data Warehouse Market (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 191 COMPANY PRODUCT FOOTPRINT

TABLE 192 COMPANY INDUSTRY FOOTPRINT (1/2)

TABLE 193 COMPANY INDUSTRY FOOTPRINT (2/2)

TABLE 194 COMPANY REGION FOOTPRINT

12.5 SME EVALUATION QUADRANT

12.5.1 DEFINITIONS AND METHODOLOGY

TABLE 195 SME EVALUATION QUADRANT: CRITERIA

12.5.2 PROGRESSIVE COMPANIES

12.5.3 RESPONSIVE COMPANIES

12.5.4 DYNAMIC COMPANIES

12.5.5 STARTING BLOCKS

FIGURE 47 Cloud Data Warehouse Market (GLOBAL): SME EVALUATION QUADRANT, 2021

12.6 COMPETITIVE SCENARIO

TABLE 196 CLOUD DATAWAREHOUSE: NEW PRODUCT LAUNCHES, NOVEMBER 2019–JULY 2021

TABLE 197 CLOUD DATAWAREHOUSE: DEALS, OCTOBER 2020–JULY 2021

13 COMPANY PROFILES (Page No. - 197)

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 AWS

TABLE 198 AWS: BUSINESS OVERVIEW

FIGURE 48 AWS: COMPANY SNAPSHOT

TABLE 199 AWS: PRODUCTS OFFERED

TABLE 200 AWS: MARKET: PRODUCT LAUNCHES

TABLE 201 AWS: MARKET: DEALS

13.2.2 IBM

TABLE 202 IBM: BUSINESS OVERVIEW

FIGURE 49 IBM: COMPANY SNAPSHOT

TABLE 203 IBM: PRODUCTS OFFERED

TABLE 204 IBM: Cloud Data Warehouse Market: PRODUCT LAUNCHES

TABLE 205 IBM: MARKET: DEALS

13.2.3 MICROSOFT

TABLE 206 MICROSOFT: BUSINESS OVERVIEW

FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

TABLE 207 MICROSOFT: PRODUCTS OFFERED

TABLE 208 MICROSOFT: MARKET: PRODUCT LAUNCHES

TABLE 209 MICROSOFT: MARKET: DEALS

13.2.4 GOOGLE

TABLE 210 GOOGLE: BUSINESS OVERVIEW

FIGURE 51 GOOGLE: COMPANY SNAPSHOT

TABLE 211 GOOGLE: PRODUCTS OFFERED

TABLE 212 GOOGLE: MARKET: PRODUCT LAUNCHES

TABLE 213 GOOGLE: MARKET: DEALS

13.2.5 ORACLE

TABLE 214 ORACLE: BUSINESS OVERVIEW

FIGURE 52 ORACLE: COMPANY SNAPSHOT

TABLE 215 ORACLE: PRODUCTS OFFERED

TABLE 216 ORACLE: Cloud Data Warehouse Market: PRODUCT LAUNCHES

TABLE 217 ORACLE: MARKET: DEALS

13.2.6 SAP

TABLE 218 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: COMPANY SNAPSHOT

TABLE 219 SAP: PRODUCTS OFFERED

TABLE 220 SAP: MARKET: PRODUCT LAUNCHES

TABLE 221 SAP: MARKET: DEALS

13.2.7 SNOWFLAKE

TABLE 222 SNOWFLAKE: BUSINESS OVERVIEW

FIGURE 54 SNOWFLAKE: COMPANY SNAPSHOT

TABLE 223 SNOWFLAKE: PRODUCTS OFFERED

TABLE 224 SNOWFLAKE: MARKET: PRODUCT LAUNCHES

TABLE 225 SNOWFLAKE: MARKET: DEALS

13.2.8 MICRO FOCUS

TABLE 226 MICRO FOCUS: BUSINESS OVERVIEW

FIGURE 55 MICRO FOCUS: COMPANY SNAPSHOT

TABLE 227 MICRO FOCUS: PRODUCTS OFFERED

TABLE 228 MICRO FOCUS: Cloud Data Warehouse Market: PRODUCT LAUNCHES

TABLE 229 MICRO FOCUS: MARKET: DEALS

13.2.9 TERADATA

TABLE 230 TERADATA: BUSINESS OVERVIEW

FIGURE 56 TERADATA: COMPANY SNAPSHOT

TABLE 231 TERADATA: PRODUCTS OFFERED

TABLE 232 TERADATA: MARKET: PRODUCT LAUNCHES

TABLE 233 TERADATA: MARKET: DEALS

13.2.10 1010DATA

TABLE 234 1010 DATA: BUSINESS OVERVIEW

TABLE 235 1010 DATA: PRODUCTS OFFERED

TABLE 236 1010 DATA: MARKET: DEALS

13.2.11 CLOUDERA

TABLE 237 CLOUDERA: BUSINESS OVERVIEW

FIGURE 57 CLOUDERA: COMPANY SNAPSHOT

TABLE 238 CLOUDERA: PRODUCTS OFFERED

TABLE 239 CLOUDERA: Cloud Data Warehouse Market: PRODUCT LAUNCHES

TABLE 240 CLOUDERA: MARKET: DEALS

13.2.12 PIVOTAL

TABLE 241 PIVOTAL: BUSINESS OVERVIEW

TABLE 242 PIVOTAL: PRODUCTS OFFERED

13.2.13 YELLOWBRICK

TABLE 243 YELLOWBRICK: BUSINESS OVERVIEW

TABLE 244 YELLOWBRICK: PRODUCTS OFFERED

TABLE 245 YELLOWBRICK: MARKET: PRODUCT LAUNCHES

TABLE 246 YELLOWBRICK: MARKET: DEALS

13.2.14 VEEVA SYSTEMS

TABLE 247 VEEVA SYSTEMS: BUSINESS OVERVIEW

FIGURE 58 VEEVA SYSTEMS: COMPANY SNAPSHOT

TABLE 248 VEEVA SYSTEMS: PRODUCTS OFFERED

13.2.15 ACTIAN

TABLE 249 ACTIAN: BUSINESS OVERVIEW

TABLE 250 ACTIAN: PRODUCTS OFFERED

TABLE 251 ACTIAN: Cloud Data Warehouse Market: PRODUCT LAUNCHES

13.2.16 MARKLOGIC

TABLE 252 MARKLOGIC: BUSINESS OVERVIEW

TABLE 253 MARKLOGIC: PRODUCTS OFFERED

TABLE 254 MARKLOGIC: MARKET: PRODUCT LAUNCHES

13.2.17 NETAVIS SOFTWARE

TABLE 255 NETAVIS SOFTWARE: BUSINESS OVERVIEW

TABLE 256 NETAVIS SOFTWARE: PRODUCTS OFFERED

13.2.18 SOLVER

TABLE 257 SOLVER: BUSINESS OVERVIEW

TABLE 258 SOLVER: PRODUCTS OFFERED

TABLE 259 SOLVER: MARKET: DEALS

13.3 OTHER PLAYERS

13.3.1 ACCUR8 SOFTWARE

TABLE 260 ACCUR8 SOFTWARE: BUSINESS OVERVIEW

TABLE 261 ACCUR8 SOFTWARE: PRODUCTS OFFERED

TABLE 262 ACCUR8 SOFTWARE: Cloud Data Warehouse Market: PRODUCT LAUNCHES

13.3.2 ATSCALE

TABLE 263 ATSCALE: BUSINESS OVERVIEW

TABLE 264 ATSCALE: PRODUCTS OFFERED

TABLE 265 ATSCALE: MARKET: PRODUCT LAUNCHES

TABLE 266 ATSCALE: MARKET: DEALS

13.3.3 PANOPLY

TABLE 267 PANOPLY: BUSINESS OVERVIEW

TABLE 268 PANOPLY: PRODUCTS OFFERED

TABLE 269 PANOPLY: MARKET: PRODUCT LAUNCHES

TABLE 270 PANOPLY: MARKET: DEALS

13.3.4 SINGLESTORE

TABLE 271 SINGLE STORE: BUSINESS OVERVIEW

TABLE 272 SINGLESTORE: PRODUCTS OFFERED

TABLE 273 SINGLESTORE: Cloud Data Warehouse Market: PRODUCT LAUNCHES

13.3.5 TRANSWARP

TABLE 274 TRANSWARP: BUSINESS OVERVIEW

TABLE 275 TRANSWRAP: PRODUCTS OFFERED

*Details on Business Overview, Products, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 247)

14.1 INTRODUCTION

14.1.1 RELATED MARKET

14.2 BUSINESS INTELLIGENCE MARKET

TABLE 276 BUSINESS INTELLIGENCE MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 277 BUSINESS INTELLIGENCE MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 278 BUSINESS INTELLIGENCE MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 279 BUSINESS INTELLIGENCE MARKET SIZE, BY SERVICE, 2020–2025(USD MILLION)

TABLE 280 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 281 BUSINESS INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 282 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 283 BUSINESS INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 284 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 285 BUSINESS INTELLIGENCE MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2025 (USD MILLION)

TABLE 286 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 287 BUSINESS INTELLIGENCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 252)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global Cloud Data Warehouse Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Cloud Data Warehouse vendors, industry associations, and independent consultants; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Cloud Data Warehouse Market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Cloud Data Warehouse Market based on application, vertical, deployment model, type and organization size.

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the impact of COVID-19 on components, business functions, verticals, organization size, deployment types, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the Cloud Data Warehouse Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Data Warehouse Market