Data Fusion Market by Business Function (IT, Sales and Marketing, Operations, Finance, and HR), Component (Tools and Services), Deployment Model (On-Premises and On-Demand), Organization Size, Industry, and Region - Global Forecast to 2022

[142 Pages Report] The data fusion market size is expected to grow from USD 6.75 Billion in 2016 to USD 15.92 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period. The year 2016 is considered as the base year, while the forecast period is considered from 2017 to 2022. Data fusion is the process of integrating data from multiple, disparate data sources to produce accurate, consistent, and more useful information than provided by an individual data source. It seamlessly detects and combines the data to generate improved information and extract new knowledge that could be shared with the authorized users for better decision-making. Data fusion is a collection of multiple big data sources, which delivers a comprehensive view of customer and business data across an organization. .

The objective of the report is to define, describe, and forecast the data fusion market trends based on component, business function, deployment model, organization size, industry, and region. The objective is to provide detailed information related to the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges.

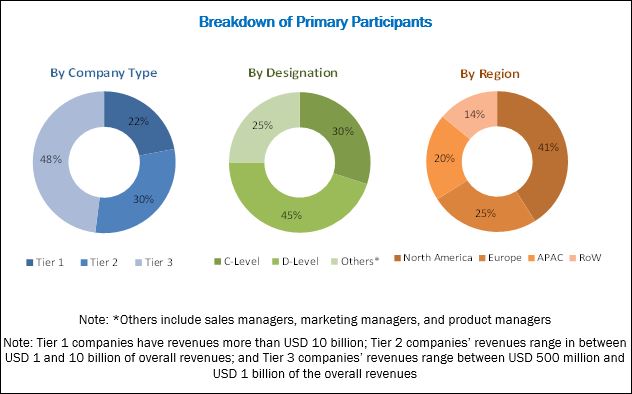

The research methodology used to estimate and forecast the data fusion market begins with capturing data through key vendor revenues by secondary research sources, such as company websites, Factiva, and Hoovers. The other secondary sources include annual reports, press releases, and investor presentations of companies; white papers and certified publications; and articles from recognized authors, directories, and databases. In addition, vendor offerings are taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. Post-arrival at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The data fusion ecosystem comprises vendors, such as AGT International(Switzerland), Esri (US), LexisNexis (US), Palantir Technologies (US), Thomson Reuters (Canada), InvenSense (US), Clarivate Analytics (US), Cogint (US), Merrick & Company (US), and INRIX (US). The other stakeholders of the data fusion market include data fusion tools providers, analytics service providers, consulting service providers, IT service providers, resellers, enterprise users, and technology providers.

The target audiences of the data fusion market report are:

- Data fusion tools vendors

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- System integrators

- Networking companies

- Third-party providers

- Value-added Resellers (VARs)

- Government agencies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Technology providers

The study answers several questions for the stakeholders; primarily, which market segments to focus in the next 2 to 5 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the data fusion market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Tool

- Service

By Service

- Managed services

-

Professional services

- Consulting

- Deployment and integration

- Support and maintenance

By Business Function

- Information Technology (IT)

- Sales and Marketing

- Finance

- Operations

- Human Resources (HR)

By Deployment Model

- On-premises

- On-demand

By Organization Size

- Large enterprises

- Small and Medium Enterprises (SMEs)

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Retail and consumer goods

- Healthcare and life sciences

- Manufacturing

- Government and defense

- Energy and utilities

- Transportation and logistics

- Media and entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American data fusion market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The data fusion market size is expected to grow from USD 7.62 Billion in 2017 to USD 15.92 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period. The major growth drivers of the market include rapid adoption of data-driven decision-making and introduction of Industrial Internet of Things (IIoT).

The Banking, Financial Services, and Insurance (BFSI) industry vertical is expected to account for the largest share of the data fusion market in 2017. The growth is fueled by the growth in need of people to simplify their workload related to security and increase in dependence on data generated from various IT systems used for financial transactions. The media and entertainment industry vertical is projected to grow at the highest CAGR during the forecast period due to the increase in need to manage data extracted from various sources and other IT systems, such as operations management.

The major business functions, which the data fusion caters to are Information Technology (IT), sales and marketing, finance, operations, and Human Resources (HR). The adoption of data fusion for HR business function is expected to increase significantly in the forthcoming years, owing to the surge in need to resolve HR process-related issues in real time and rise in requirement to streamline operations across industries.

Several organizations have rapidly deployed data fusion tools either on- premises or on-demand. The demand for on-demand or cloud-based data fusion tools has increased due to its cost-effective and time-efficient features. On-demand data fusion tools’ growth is specifically high in Small and Medium-sized Enterprises (SMEs), where low-cost solutions are much required.

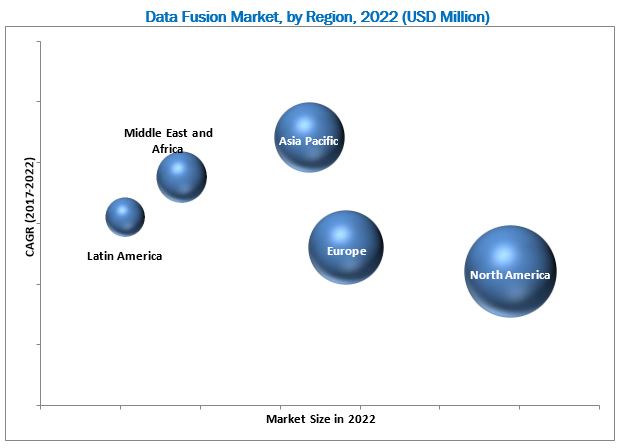

The global data fusion market is segmented based on regions into North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. Further, followed by Europe, North America is expected to continue being the largest revenue generating region for data fusion vendors in the next 5 years. This is mainly because in the developed economies of the US and Canada, there is a high focus on innovations obtained from Research and Development (R&D) and technology. The APAC region is expected to be the fastest-growing region in the data fusion market, owing to the increase in adoption of Internet of Things (IoT) and smart technologies, and various government initiatives, such as smart cities across APAC countries, including China and India.

The data fusion market faces challenges, such as management and maintenance of the data quality and dearth of skilled workforce. Furthermore, high-investment costs and varying structure of regulatory policies are expected to limit the market growth.

The major vendors that offer data fusion tools and services globally are AGT International (Switzerland), Esri (US), LexisNexis (US), Palantir Technologies (US), Thomson Reuters (Canada), InvenSense (US), Clarivate Analytics (US), Cogint (US), Merrick & Company (US), and INRIX (US). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the data fusion market.

Frequently Asked Questions (FAQ):

How big is the Data Fusion Market?

What is growth rate of the Data Fusion Market?

What are the top trends in Data Fusion Market?

Who are the key players in Data Fusion Market?

Who will be the leading hub for Data Fusion Market?

Who are the key target audience in Data Fusion Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Data Fusion Market

4.2 Market By Region

4.3 Market By Industry and Region

4.4 Market Professional Services, By Region

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Market Overview

5.1.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Adoption of Data-Driven Decision-Making

5.2.1.2 Introduction of IIoT

5.2.2 Restraints

5.2.2.1 High Investment Costs

5.2.2.2 Varying Structure of Regulation Policies

5.2.3 Opportunities

5.2.3.1 Higher Adoption of Data Fusions Tools and Services Among SMEs

5.2.3.2 The Need to Create Insights From Unused Data

5.2.4 Challenges

5.2.4.1 Managing and Maintaining Data Quality

5.2.4.2 Lack of Skilled Workforce

5.3 Industry Trends

5.3.1 Pillars of Data Fusion

5.3.1.1 Analysis and Fusion

5.3.1.2 Security and Privacy

5.3.1.3 Collaboration and Information Sharing

5.3.2 Data Fusion Market: Use Cases

5.3.2.1 Introduction

5.3.2.2 Use Case 1: Disaster Response

5.3.2.3 Use Case 2: Cybersecurity

5.3.2.4 Use Case 3: Predictive Maintenance

6 Data Fusion Market, By Business Function (Page No. - 43)

6.1 Introduction

6.2 Information Technology

6.3 Sales and Marketing

6.4 Operations

6.5 Finance

6.6 Human Resources

7 Data Fusion Market, By Component (Page No. - 49)

7.1 Introduction

7.2 Tools

7.3 Services

7.3.1 Professional Services

7.3.1.1 Consulting

7.3.1.2 Support and Maintenance

7.3.1.3 Deployment and Integration

7.3.2 Managed Services

8 Market By Deployment Model (Page No. - 58)

8.1 Introduction

8.2 On-Premises

8.3 On-Demand

9 Market By Organization Size (Page No. - 62)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Data Fusion Market, By Industry (Page No. - 66)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Telecom and IT

10.4 Retail and Consumer Goods

10.5 Healthcare and Life Sciences

10.6 Manufacturing

10.7 Government and Defense

10.8 Energy and Utilities

10.9 Transportation and Logistics

10.10 Media and Entertainment

10.11 Others

11 Data Fusion Market, By Region (Page No. - 76)

11.1 Introduction

11.2 North America

11.2.1 By Business Function

11.2.2 By Component

11.2.3 By Deployment Model

11.2.4 By Organization Size

11.2.5 By Industry

11.3 Europe

11.3.1 By Business Function

11.3.2 By Component

11.3.3 By Deployment Model

11.3.4 By Organization Size

11.3.5 By Industry

11.4 Asia Pacific

11.4.1 By Business Function

11.4.2 By Component

11.4.3 By Deployment Model

11.4.4 By Organization Size

11.4.5 By Industry

11.5 Latin America

11.5.1 By Business Function

11.5.2 By Component

11.5.3 By Deployment Model

11.5.4 By Organization Size

11.5.5 By Industry

11.6 Middle East and Africa

11.6.1 By Business Function

11.6.2 By Component

11.6.3 By Deployment Model

11.6.4 By Organization Size

11.6.5 By Industry

12 Competitive Landscape (Page No. - 100)

12.1 Overview

12.2 Competitive Scenario

12.2.1 New Product Launches and Product Upgradations

12.2.2 Partnerships and Collaborations

12.2.3 Acquisitions

12.2.4 Business Expansions

12.3 Data Fusion Market: Prominent Players

13 Company Profiles (Page No. - 105)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Thomson Reuters

13.2 AGT International

13.3 ESRI

13.4 Lexisnexis

13.5 Palantir Technologies

13.6 Cogint

13.7 Invensense

13.8 Clarivate Analytics

13.9 Merrick & Company

13.10 Inrix

13.11 Key Innovators

13.11.1 Konux

13.11.2 Signafire

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 132)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (74 Tables)

Table 1 Data Fusion Market, By Business Function, 2015–2022 (USD Million)

Table 2 Information Technology: Market Size By Region, 2015–2022 (USD Million)

Table 3 Sales and Marketing: Market Size By Region, 2015–2022 (USD Million)

Table 4 Operations: Market Size By Region, 2015–2022 (USD Million)

Table 5 Finance: Market Size By Region, 2015–2022 (USD Million)

Table 6 Human Resources: Market Size By Region, 2015–2022 (USD Million)

Table 7 Data Fusion Market Size, By Component, 2015–2022 (USD Million)

Table 8 Tools: Market Size By Region, 2015–2022(USD Million)

Table 9 Services: Market Size By Type, 2015–2022 (USD Million)

Table 10 Services: Market Size By Region, 2015–2022 (USD Million)

Table 11 Professional Services Market Size, By Type, 2015–2022 (USD Million)

Table 12 Professional Services Market Size, By Region, 2015–2022 (USD Million)

Table 13 Consulting Market Size, By Region, 2015–2022 (USD Million)

Table 14 Support and Maintenance Market Size, By Region, 2015–2022 (USD Million)

Table 15 Deployment and Integration Market Size, By Region, 2015–2022 (USD Million)

Table 16 Managed Services Market Size, By Region, 2015–2022 (USD Million)

Table 17 Data Fusion Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 18 On-Premises: Market Size By Region, 2015–2022 (USD Million)

Table 19 On-Demand: Market Size By Region, 2015–2022 (USD Million)

Table 20 Market Size By Organization Size, 2015–2022 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 23 Market Size By Industry, 2015–2022 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size By Region, 2015–2022 (USD Million)

Table 25 Telecom and IT: Market Size By Region, 2015–2022 (USD Million)

Table 26 Retail and Consumer Goods: Market Size By Region, 2015–2022 (USD Million)

Table 27 Healthcare and Life Sciences: Market Size By Region, 2015–2022 (USD Million)

Table 28 Manufacturing: Market Size By Region, 2015–2022 (USD Million)

Table 29 Government and Defense: Market Size, By Region, 2015–2022 (USD Million)

Table 30 Energy and Utilities: Market Size By Region, 2015–2022 (USD Million)

Table 31 Transportation and Logistics: Market Size By Region, 2015–2022 (USD Million)

Table 32 Media and Entertainment: Market Size By Region, 2015–2022 (USD Million)

Table 33 Others: Market Size By Region, 2015–2022 (USD Million)

Table 34 Data Fusion Market Size, By Region, 2015–2022 (USD Million)

Table 35 North America: Market Size By Business Function, 2015–2022 (USD Million)

Table 36 North America: Market Size By Component, 2015–2022 (USD Million)

Table 37 North America: Market Size By Service, 2015–2022 (USD Million)

Table 38 North America: Market Size By Professional Service, 2015–2022 (USD Million)

Table 39 North America: Market Size By Deployment Model, 2015–2022 (USD Million)

Table 40 North America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 41 North America: Market Size By Industry, 2015–2022 (USD Million)

Table 42 Europe: Data Fusion Market Size, By Business Function, 2015–2022 (USD Million)

Table 43 Europe: Market Size By Component, 2015–2022 (USD Million)

Table 44 Europe: Market Size By Service, 2015–2022 (USD Million)

Table 45 Europe: Market Size By Professional Service, 2015–2022 (USD Million)

Table 46 Europe: Market Size By Deployment Model, 2015–2022 (USD Million)

Table 47 Europe: Market Size By Organization Size, 2015–2022 (USD Million)

Table 48 Europe: Market Size By Industry, 2015–2022 (USD Million)

Table 49 Asia Pacific: Market Size By Business Function, 2015–2022 (USD Million)

Table 50 Asia Pacific: Market Size By Component, 2015–2022 (USD Million)

Table 51 Asia Pacific: Market Size By Service, 2015–2022 (USD Million)

Table 52 Asia Pacific: Market Size By Professional Service, 2015–2022 (USD Million)

Table 53 Asia Pacific: Market Size By Deployment Model, 2015–2022 (USD Million)

Table 54 Asia Pacific: Market Size By Organization Size, 2015–2022 (USD Million)

Table 55 Asia Pacific: Market Size By Industry, 2015–2022 (USD Million)

Table 56 Latin America: Data Fusion Market Size, By Business Function, 2015–2022 (USD Million)

Table 57 Latin America: Market Size By Component, 2015–2022 (USD Million)

Table 58 Latin America: Market Size By Service, 2015–2022 (USD Million)

Table 59 Latin America: Market Size By Professional Service, 2015–2022 (USD Million)

Table 60 Latin America: Market Size By Deployment Model, 2015–2022 (USD Million)

Table 61 Latin America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 62 Latin America: Market Size By Industry, 2015–2022 (USD Million)

Table 63 Middle East and Africa: Market Size By Business Function, 2015–2022 (USD Million)

Table 64 Middle East and Africa: Market Size By Component, 2015–2022 (USD Million)

Table 65 Middle East and Africa: Data Fusion Market Size By Service, 2015–2022 (USD Million)

Table 66 Middle East and Africa: Market Size By Professional Service, 2015–2022 (USD Million)

Table 67 Middle East and Africa: Market Size By Deployment Model, 2015–2022 (USD Million)

Table 68 Middle East and Africa: Market Size By Organization Size, 2015–2022 (USD Million)

Table 69 Middle East and Africa: Market Size By Industry, 2015–2022 (USD Million)

Table 70 New Product Launches and Product Upgradations, 2016–2018

Table 71 Partnerships and Collaborations, 2017–2018

Table 72 Acquisitions, 2016

Table 73 Business Expansions, 2018

Table 74 Key Players in the Data Fusion Market

List of Figures (40 Figures)

Figure 1 Data Fusion Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 The Market is Expected to Witness High Growth During the Forecast Period

Figure 8 Data Fusion Market By Component (2017 vs 2022)

Figure 9 Market By Service (2017–2022)

Figure 10 Market By Professional Service (2017–2022)

Figure 11 Market By Business Function (2017–2022)

Figure 12 MarketBy Deployment Model (2017–2022)

Figure 13 Market By Organization Size (2017–2022)

Figure 14 Market By Industry (2017 vs 2022)

Figure 15 Increasing Need for Data Fusion Tools and Services Across Industries is Expected Drive the Growth of the Data Fusion Market

Figure 16 North America is Estimated to Have the Largest Market Share in 2017

Figure 17 Banking, Financial Services, and Insurance Industry, and North America are Estimated to Have the Largest Market Shares in 2017

Figure 18 Support and Maintenance Segment is Estimated to Hold the Largest Market Share Across the Globe, Except in Asia Pacific, in 2017

Figure 19 Data Fusion Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Global Industrial Internet of Things Market

Figure 21 Pillars of Data Fusion

Figure 22 Information Technology Business Function is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 Tools Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 24 Professional Services Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 25 Support and Maintenance Segment is Estimated to Have the Largest Market Size in 2017

Figure 26 On-Demand Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 28 Banking, Financial Services, and Insurance Industry is Expected to Have the Largest Market Size During the Forecast Period

Figure 29 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 31 North America: Market Snapshot

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Key Developments By the Leading Players in the Data Fusion Market, 2014–2018

Figure 34 Thomson Reuters: Company Snapshot

Figure 35 Thomson Reuters: SWOT Analysis

Figure 36 AGT International: SWOT Analysis

Figure 37 ESRI: SWOT Analysis

Figure 38 Lexisnexis: SWOT Analysis

Figure 39 Palantir Technologies: SWOT Analysis

Figure 40 Cogint: Company Snapshot

Growth opportunities and latent adjacency in Data Fusion Market