Data Center Virtualization Market by Type (Advisory & Implementation Services, Optimization Services, Managed Services, Technical Support Services), Organization Size (Large Enterprises, SMEs), Vertical, and Region - Global Forecast to 2022

According to the information, the data center virtualization market was estimated at $3.75 billion in 2017 and was projected to reach $8.06 billion by 2022. The compound annual growth rate (CAGR) during this period is stated as 16.5%. It's worth noting that these figures are specific to the time period mentioned (2017 to 2022) and the projected growth rate. Market conditions may have changed since then, so the actual market size and growth rate may vary. Key factors propelling the growth of the market include the need to reduce operational costs and enhance business agility of enterprises and demand for unified and centralized management of data centers.

Objectives of the study:

- To determine and forecast the global data center virtualization market based on type, organization size, vertical, and region from 2017 to 2022, and analyze various macro and micro-economic factors that affect market growth

- To forecast the size of market segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze each submarket with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the data center virtualization market

- To profile key market players, provide comparative analysis based on business overviews, product offerings, regional presence, business strategies, and key financials with the help of in-house statistical tools to understand the competitive landscape

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, agreements, partnerships & collaborations, and Research & Development (R&D) activities in the market

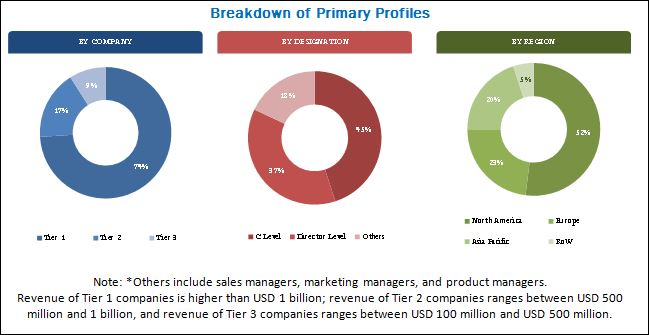

The research methodology used to estimate and forecast the data center virtualization market size begins with capturing data of key vendor revenues through secondary research, such as annual reports, white papers, certified publications, databases, such as Factiva and Hoovers, press releases, and investor presentations of Data Center Virtualization vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. Vendor offerings are also taken into consideration to determine market segmentations. The bottom-up procedure has been employed to arrive at the overall global market size from the revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of the profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The Data Center Virtualization market ecosystem includes key players, such as the VMware (US), Microsoft (US), Citrix Systems (US), Adobe Systems (US), Amazon Web Services (AWS) (US), Cisco Systems (US), Fujitsu (Japan), Radiant Communications (Canada), HPE (US), AT&T (US), Huawei (China), HCL (India), and IBM (US).

Key Target Audience

- Providers of Data Center Virtualization Services

- Suppliers of IT Hardware/Software/Services

- Software and System Integrators

- Technology Investors

- Research/Consultancy Firms

- Technology Providers

- Network Operators

- Data Center Operators

- IT Infrastructure Providers

- Managed Service Providers

- Cloud Service Providers

- Associations and Technology Groups

- Corporate and Institutional Investors

Scope of the Data Center Virtualization Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Organization Size, Vertical and Region |

|

Geographies covered |

North America, Europe, MEA, APAC and Latin America |

|

Companies covered |

VMware (US), Microsoft (US), Citrix Systems (US), Adobe Systems (US), Amazon Web Services (AWS) (US), Cisco Systems (US), Fujitsu (Japan), Radiant Communications (Canada), HPE (US), AT&T (US), Huawei (China), HCL (India), and IBM (US). |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- Advisory & Implementation Services

- Optimization Services

- Managed Services

- Technical Support Services

By Organization size

- Large Enterprises

- SMEs

By Vertical

- IT & Telecommunication

- Banking Financial Services & Insurance (BFSI)

- Education

- Healthcare

- Government

- Retail & SCM

- Media & Entertainment

- Manufacturing & Automotive

- Others( Energy & Utility and Travel & Hospitality)

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Available Customizations

Along with the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North America Data Center Virtualization market

- Further country-level breakdown of the Europe market

- Further country-level breakdown of the Asia Pacific market

- Further country-level breakdown of the Middle East & Africa market

- Further country-level breakdown of the Latin America market

Company Information

- Detailed analysis and profiles of additional market players

The data center virtualization market has been segmented on the basis of type, organization size, vertical, and region. Based on type, the market has been segmented into advisory & implementation services, optimization services, managed services, and technical support services. The optimization services segment of the market is expected to grow at the highest CAGR. Optimization services assist organizations to plan, build, and manage data center facilities. These services also help organizations improve operational efficiency and performance as well as enhance network security. Thus, benefits associated with the adoption of optimization services are projected to drive the growth of the optimization services segment of this market.

Based on organization size, the market has been segmented into large enterprises and SMEs. High initial capital requirements associated with on-premises data centers have propelled SMEs to focus on off-premises/cloud data centers, thereby propelling the demand for off-premises/cloud data center virtualization services. This, in turn, is projected to drive the growth of the SMEs segment of the data center virtualization market.

Based on vertical, the healthcare segment of the data center virtualization market is expected to witness the highest growth in the coming years. Healthcare organizations have moved to data centers and cloud services to manage and process the ever-growing amount of data, which provides huge growth opportunities for data center virtualization vendors.

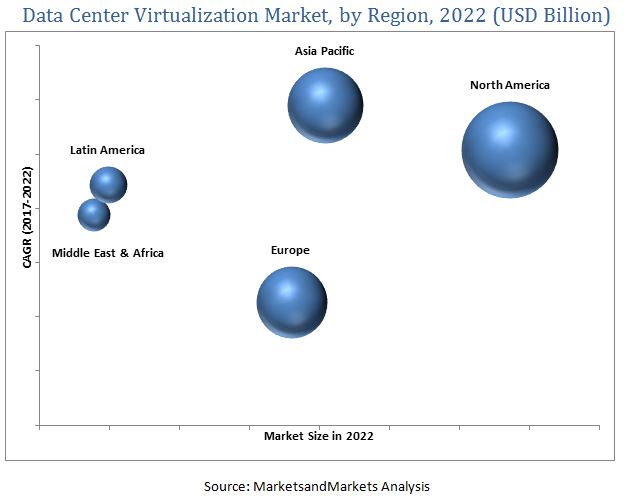

North America is estimated to be the largest market for data center virtualization in 2017, as organizations in this region are early adopters of the data center virtualization technology. Additionally, the presence of key market players in this region, such as VMware (US), Microsoft (US), Amazon Web Services (US), and Citrix Systems (US) is also driving the adoption of the data center virtualization. This region is also experiencing very high cloud adoption, and cloud service providers are expanding and improving their infrastructure by adopting virtualization services. Many other organizations are opting for data center virtualization to increase agility, scalability, and flexibility of their private data centers, which, in turn, is expected to drive the growth of the data center virtualization market in this region.

A key restraining factor that affects the growth of the data center virtualization market is data center localization. Thus, stringent laws related to data center localization acts as a restraint to the growth of the market, as data center virtualization service providers consistently need to keep up with changing regulatory compliances and upgrade their solutions and services. The primary challenges for this market include limited awareness regarding the collective benefits of virtualization and limitations associated with the virtualization of legacy IT infrastructure.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Market

4.2 Europe: Market, By Type

4.3 Asia Pacific: Market, By Organization Size

4.4 North America: Market, By Vertical

4.5 Data Center Virtualization Market, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need to Reduce Enterprise Operational Costs and Enhance Business Agility

5.3.1.2 Demand for Unified and Centralized Management of Data Centers

5.3.1.3 Increase in Data Center Complexities

5.3.2 Restraints

5.3.2.1 Data Center Localization

5.3.3 Opportunities

5.3.3.1 Increased Adoption of Private Cloud

5.3.3.2 Increased Spending on Data Center Technology

5.3.3.3 Exponential Growth in Data Center Traffic

5.3.4 Challenges

5.3.4.1 Lack of Awareness Regarding Virtualization Technology

5.3.4.2 Limitations Associated With the Virtualization of Legacy IT Infrastructure

5.4 Case Studies

5.4.1 Case Study 1: Outsourcing Service Providers Transform Their Business Models With Virtualized Data Centers

5.4.2 Case Study 2: Mining Company Implements Virtual Data Centers and Standardizes Applications Globally

5.5 Technological Standards

5.5.1 Distributed Management Task Force (DMTF) Standards

5.5.2 Cloud Infrastructure Management Interface (CIMI)

5.5.3 Open Virtualization Format (OVF)

5.5.4 Oasis Standards

5.5.5 SNIA-Cloud Data Management Interface (CDMI)

5.5.6 ETSI/ISG-Network Functions Virtualization (NFV)

5.5.7 ANSI/TIA-942-A 2014

5.5.8 ANSI/BICSI 002-2014

5.5.9 Uptime Institute Tier Standard

5.6 Regulatory Standards and Compliance

5.6.1 Payment Card Industry Data Security Standard (PCI DSS)

5.6.2 Health Insurance Portability and Accountability Act (HIPAA)

6 Data Center Virtualization Market By Type (Page No. - 39)

6.1 Introduction

6.2 Advisory & Implementation Services

6.3 Optimization Services

6.4 Managed Services

6.5 Technical Support Services

7 Market By Organization Size (Page No. - 44)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises (SMES)

7.3 Large Enterprises

8 Market By Vertical (Page No. - 48)

8.1 Introduction

8.2 IT & Telecommunication

8.3 BFSI

8.4 Government

8.5 Healthcare

8.6 Education

8.7 Retail & SCM

8.8 Media & Entertainment

8.9 Manufacturing & Automotive

8.10 Others

9 Data Center Virtualization Market By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Latin America

9.6 Middle East & Africa

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Launches & Product Enhancements

10.2.2 Agreements, Collaborations & Partnerships

10.2.3 Acquisitions

10.2.4 Expansions

10.3 Market Ranking of Key Players

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 VMware

11.2 Microsoft

11.3 Citrix Systems

11.4 Amazon Web Services

11.5 Cisco Systems

11.6 AT&T

11.7 Fujitsu

11.8 Radiant Communications

11.9 HPE

11.10 Huawei

11.11 HCL

11.12 IBM

11.13 Key Innovators

11.13.1 Openstack

11.13.2 Mindsight

11.13.3 Nutanix

11.13.4 Tso Logic

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 132)

12.1 Industry Excerpts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (69 Tables)

Table 1 USD Exchange Rate, 2015-2017

Table 2 Data Center Virtualization Market Size, By Type, 2017-2022 (USD Million)

Table 3 Advisory & Implementation Services: Market Size, By Region, 2017-2022 (USD Million)

Table 4 Optimization Services: Market Size, By Region, 2017-2022 (USD Million)

Table 5 Managed Services: Market Size, By Region, 2017-2022 (USD Million)

Table 6 Technical Support Services: Market Size, By Region, 2017-2022 (USD Million)

Table 7 Market Size, By Organization Size, 2015-2022 (USD Million)

Table 8 SMES: Market Size, By Region, 2015-2022 (USD Million)

Table 9 Large Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 10 Data Center Virtualization Market Size, By Vertical, 2015–2022 (USD Million)

Table 11 IT & Telecommunication: Market Size, By Region, 2015–2022 (USD Million)

Table 12 IT & Telecommunication: Market Size, By Type, 2015–2022 (USD Million)

Table 13 BFSI: Market, By Region, 2015–2022 (USD Million)

Table 14 BFSI: Market Size, By Type, 2015–2022 (USD Million)

Table 15 Government: Market Size, By Region, 2015–2022 (USD Million)

Table 16 Government: Market Size, By Type, 2015–2022 (USD Million)

Table 17 Healthcare: Market Size, By Region, 2015–2022 (USD Million)

Table 18 Healthcare: Market Size, By Type, 2015–2022 (USD Million)

Table 19 Education: Market Size, By Region, 2015–2022 (USD Million)

Table 20 Education: Data Center Virtualization Market Size, By Type, 2015–2022 (USD Million)

Table 21 Retail & SCM: Market Size, By Region, 2015–2022 (USD Million)

Table 22 Retail & SCM: Market Size, By Type, 2015–2022 (USD Million)

Table 23 Media & Entertainment: Market Size, By Region, 2015–2022 (USD Million)

Table 24 Media & Entertainment: Market Size, By Type, 2015–2022 (USD Million)

Table 25 Manufacturing & Automotive: Market Size, By Region, 2015–2022 (USD Million)

Table 26 Manufacturing & Automotive: Market Size, By Type, 2015–2022 (USD Million)

Table 27 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 28 Others: Market Size, By Type, 2015–2022 (USD Million)

Table 29 Data Center Virtualization Market Size, By Region, 2015-2022 (USD Million)

Table 30 North America Data Center Virtualization Market Size, By Type, 2015-2022 (USD Million)

Table 31 North America Market Size, By Organization Size, 2015-2022 (USD Million)

Table 32 North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 33 Advisory & Implementation Services: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 34 Optimization Services: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 35 Managed Services: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 36 Technical Support Services: North America Market Size, By Vertical, 2015-2022 (USD Million)

Table 37 Europe Data Center Virtualization Market Size, By Type, 2015-2022 (USD Million)

Table 38 Europe Market Size, By Organization Size, 2015-2022 (USD Million)

Table 39 Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 40 Advisory & Implementation Services: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 41 Optimization Services: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 42 Managed Services: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 43 Technical Support Services: Europe Market Size, By Vertical, 2015-2022 (USD Million)

Table 44 Asia Pacific Data Center Virtualization Market Size, By Type, 2015-2022 (USD Million)

Table 45 Asia Pacific Market Size, By Organization Size, 2015-2022 (USD Million)

Table 46 Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 47 Advisory & Implementation Services: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 48 Optimization Services: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 49 Managed Services: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 50 Technical Support Services: Asia Pacific Market Size, By Vertical, 2015-2022 (USD Million)

Table 51 Latin America Data Center Virtualization Market Size, By Type, 2015-2022 (USD Million)

Table 52 Latin America Market Size, By Organization Size, 2015-2022 (USD Million)

Table 53 Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 54 Advisory & Implementation Services: Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 55 Optimization Services: Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 56 Managed Services: Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 57 By Technical Support Services: Latin America Market Size, By Vertical, 2015-2022 (USD Million)

Table 58 Middle East & Africa Data Center Virtualization Market Size, By Type, 2015-2022 (USD Million)

Table 59 Middle East & Africa Market Size, By Organization Size, 2015-2022 (USD Million)

Table 60 Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 61 Advisory & Implementation Services: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 62 Optimization Services: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 63 Managed Services: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 64 Technical Support Services: Middle East & Africa Market Size, By Vertical, 2015-2022 (USD Million)

Table 65 Market Evaluation Framework

Table 66 New Product Launches & Product Enhancements, July 2017-November 2017

Table 67 Agreements, Collaborations & Partnerships, August 2017-November 2017

Table 68 Acquisitions, January 2015-November 2017

Table 69 Expansions, November 2016-November 2017

List of Figures (38 Figures)

Figure 1 Data Center Virtualization Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Assumptions

Figure 7 Data Center Virtualization Market, By Type (2017 & 2022)

Figure 8 Market, By Organization Size (2017 & 2022)

Figure 9 Top 4 Verticals of the Market in 2017, in Terms of Market Share

Figure 10 Data Center Virtualization Market, By Vertical (2017 & 2022)

Figure 11 Market, By Region

Figure 12 The Demand for Unified and Centralized Management of Data Centers is Expected to Drive the Growth of the Data Center Virtualization Market

Figure 13 The Optimization Services Segment of the Europe Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 14 The Large Enterprises Segment is Projected to Lead the Asia Pacific Market During the Forecast Period

Figure 15 The Healthcare Segment of the North America Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 16 The Data Center Virtualization Market in the North America Region is Projected to Account for the Largest Market Share in 2017

Figure 17 Evolution of Data Center Virtualization

Figure 18 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Optimization Services Segment Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 20 Based on Organization Size, Large Enterprises Segment Estimated to Account for Larger Share of the Data Center Virtualization Market in 2017

Figure 21 Healthcare Vertical Segment is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 22 North America Projected to Lead the Market From 2017 to 2022

Figure 23 Regional Snapshot: Data Center Virtualization Market in Asia Pacific Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 North America Market Snapshot

Figure 25 Asia Pacific Market Snapshot

Figure 26 Companies Adopted Agreements, Collaborations & Partnerships as Key Growth Strategies Between 2015 and 2017

Figure 27 Market Ranking of Key Players in the Data Center Virtualization Market, 2017

Figure 28 VMware: Company Snapshot

Figure 29 Microsoft: Company Snapshot

Figure 30 Citrix Systems: Company Snapshot

Figure 31 Amazon Web Services: Company Snapshot

Figure 32 Cisco Systems: Company Snapshot

Figure 33 AT&T: Company Snapshot

Figure 34 Fujitsu: Company Snapshot

Figure 35 HPE: Company Snapshot

Figure 36 Huawei: Company Snapshot

Figure 37 HCL: Company Snapshot

Figure 38 IBM: Company Snapshot

Growth opportunities and latent adjacency in Data Center Virtualization Market