DDI Market by Component (Solutions and Services), Application (Network Automation, Virtualization and Cloud, Data Center Transformation, Network Security), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2026

Updated on : March 19, 2024

DDI Market Size

The DDI market size is anticipated to increase at a CAGR of 15.9% over the forecast period, rising from an estimated USD 400 million in 2021 to USD 836 million by 2026.

DDI Market Growth

Analysis of DDI market trends is part of the new research report. The new research report includes market buying patterns, pricing analysis, patent analysis, conference and webinar materials, and information on important stakeholders. The major factors fueling the DDI market include the rise of IoT platforms, increasing BYOD trend at workplaces, expansion of existing DDI solutions and adjacent network services, and significant adoption of virtualization by organizations. Moreover, increasing need for IPAM and advent of IPv6 would provide lucrative opportunities for DDI vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 IMPACT

The ecosystem of connected devices witnessed a surge due to the COVID-19 pandemic, and DDI demonstrated its added value in this increasingly connected market. Almost all entities are working from home needed networks to be more resilient for functioning properly, fueling the need for efficient DDI solutions and services. Hence, the rise of IoT platforms acted as a driver for the DDI market. WFH made almost everyone work and operate from home, including large organizations, educational institutes, and lawmakers. Organizations are especially accelerating their digital transformation initiatives for fulfilling the needs of their employees, such as connecting to an enterprise network, accessing resources and apps from anywhere, etc. Hence, in order to provide secure access to every remote enterprise user as well as maintaining the security of accessed resources, the adoption of DDI witnessed an increase. With the second wave of COVID-19 in countries such as the UK, Brazil, and India, WFH is expected to continue, which would further necessitate the demand for DDI solutions and services. The outbreak of COVID-19 fueled the trend of online digital education. This trend resulted in an increased number of laptops, tablets, and mobile devices connected to a network, making DDI a necessity for them. Even though the COVID-19 outbreak slowed down the process of 5G rollout, 5G was still on track to roll out extensively in 2020 and 2021. In fact, the pandemic has grown the importance of 5G, especially with most people of a country that are working remotely, necessitating data speeds and increased network support for people to do their jobs.

MARKET DYNAMICS

Driver: Rise of IoT Platforms

Internet of Things (IoT) enables the communication between physical devices embedded with electronics and software to collect data. The framework on which this is done is called the IoT platform. Today, a majority of companies are adopting IoT to facilitate their operations and process. The implementation of IoT platforms requires a large number of devices, frameworks, and IP services at a large scale. IoT platforms at this scale and degree require a dynamic and robust DDI solution. Thus, the increasing need for IoT platforms is likely to propel the demand for commercial DDI solutions. Clients undertaking IoT initiatives with a central framework require DDI to manage large-scale IP addresses. Using DDI based on IoT platforms provides efficient operational benefits for vendors that are deploying internally managed IoT platforms, automated DNS, or diversified IPv6. Furthermore, vendors such as EfficientIP, Nixu Software, and Men & Mice provide cost-effective DDI options in the market and serve small-scale IoT environments.

Restraint: Limited mainstream adoption of SDN

Software-Defined Networking (SDN) is a method to manage and monitor computer networks via open interfaces and software tools. SDN infrastructure is the mechanism or platform by which network application services achieve their objective. SDN gives a new perspective to plan, design, build, and execute networks that support abstraction, virtualization, and authenticity to the server infrastructure. SDN also provides new ways to implement mobile devices and manage DDI services on them. However, a few of the DDI vendors are not adopting SDN architectures to deploy their commercial DDI software. Some of the reasons why organizations do not implement SDN include the improper definition of SDN use cases and the requirement for an environment with OpenFlow support in the switches for the adoption of real-time SDN infrastructure. However, many companies are currently developing network applications for SDN, giving network virtualization a new value by influencing the infrastructure dynamically on behalf of the hosted application or their users. Hybrid network services automation, rapid time-to-service, and cloud integration are some of the reasons that would propel the implementation of SDN in the coming years.

Opportunity: Increasing need for IPAM

IP addresses are a significant part of a network, and dealing with them becomes complex as they increase in number. Most of the enterprise applications require internet protocol for communication, and more IPs are used for databases, services, and more. Managing all of the necessary IP addresses becomes very important as it gives devices the ability to communicate. IP Address Management (IPAM) is the way in which enterprises track and manage the IP address on the network. Usually, IPAM integrates DHCP and DNS, which allows real-time automatic updating of changes. With all of the new mobile devices and services in need of IP addresses today, maintaining and monitoring all of them on the network without an organized plan is difficult, which is why organizations must have an IPAM strategy in place. IPAM also provides enterprises with security as its data includes information such as the IP addresses in use, what and which devices each IP is assigned to, and the timestamps. IPAM helps in compliance with internal policies, which can be enforced using NAC systems and IPAM data.

Challenge: Integration of DDI in complex networks is time consuming

The network of any organization is completely dependent upon IP addresses and forms an important part of a network. The number of IP addresses used on the network increases as the company starts to expand its operations. Most of the network applications require IPs to be allocated as the enterprise grows. In the growing stage, an organization needs to abandon the manual administration of IP, DHCP, DNS and needs to properly manage IP. The organization’s network becomes complex and cluttered by implementing BYOD, other mobile devices, and network endpoints. Most of the businesses also use virtualization to diversify resources for their business strategy execution but end up doubling their IP in doing so. Integrating DDI solutions in an existing complex network becomes a time-consuming task as the implementation counts in migrating and managing the current network infrastructure to a new optimized and organized network structure.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of DDI. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the DDI market in SMEs. Also, factors such as the need for efficient customer data protection, cost-cutting, getting a competitive advantage, and quick response and timely decisions are projected to drive the growth of the DDI market in SMEs.

Telecom and IT vertical to hold the largest market size during the forecast period

Telecom and IT companies deal with complex networks that need to be upgraded on a regular basis to meet the fast-changing technological demands of the industry, necessitating the deployment of efficient DDI solutions and services. Protecting DNS servers from malicious attacks, high resiliency, and centralized management and monitoring of networks are major aspects of the telecom and IT industry that contribute to the major share of the DDI market. The proliferation of mobile devices and the advent of IPv6 are putting growing pressure on telecom and IT companies to effectively create provision and manage vast numbers of IP addresses, thus aiding the adoption of DDI solutions and services in the telecom and IT vertical.

To know about the assumptions considered for the study, download the pdf brochure

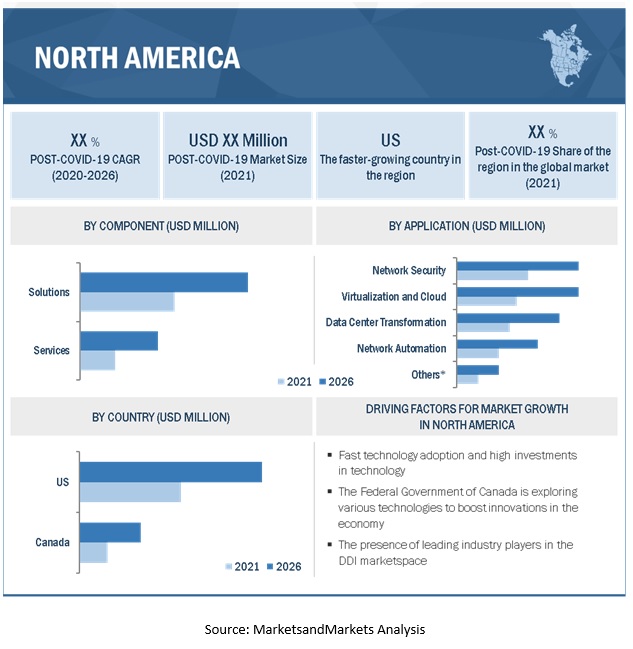

North America to hold the largest market size during the forecast period

DDI has demonstrated its capabilities to maintain network dynamics securely and smoothly, which has helped organizations to reduce their maintenance and operational expenses. North America accounts for the major chunk of the global DDI solutions and services market, and it is considered as one of the most advanced regions in technology adoption and infrastructure. Furthermore, the various verticals operating in the region, such as IT & Telecom, have been increasingly adopting new ways to monitor network security and IPAM. In the past, verticals relied on traditional methods such as maintaining documents and spreadsheets to record IP address allocations. North America held the largest share in terms of revenue generated from DDI due to the presence of large telecom and IT, government and defense, and education organizations in the region. The presence of leading industry players in the DDI space such as Infoblox, BlueCat Networks, and in the region as well as potential untapped opportunities in countries such as Canada, are also expected to fuel the adoption of DDI in the region. The growing technological adoption and high investments in technology are key factors contributing to the DDI market in the region.

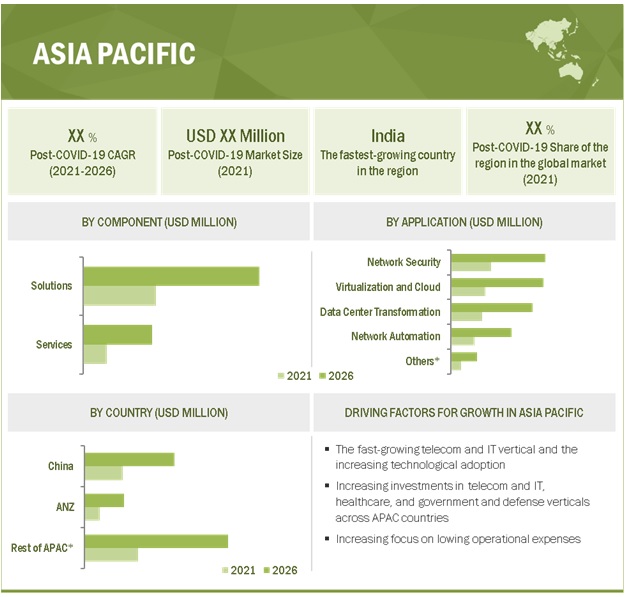

Asia Pacific to grow at the highest CAGR during the forecast period

The Asia-Pacific (APAC) region is emerging as the world’s growing economy, due to the increasing spending on improving performance, security, and economic stability. The APAC region comprises major economies, such as China, India, Japan, Singapore, Malaysia, and Australia. The APAC region is witnessing a surge in the deployment of DDI solutions. China, the world’s top manufacturing country, is leveraging real-time machine monitoring systems to increase manufacturing companies’ operational efficiency and production. The manufacturers are considering network management as a strategic business function and plan to lower their OPEX. DDI solutions enable the companies to streamline their security and maintenance by efficient DHCP, DNS, and IPAM implementation. Furthermore, the DDI solutions will allow vendors operating on the APAC region to achieve high efficiency. APAC is an emerging market with significant growth in the telecom and IT vertical in the emerging economies. Similarly, the demand for DDI solutions and services is expected to increase in the APAC region due to the advent of IPv6 and the increasing number of mobile devices.

Key Market Players

Major vendors in the global DDI market include Nokia Corporation (France), BlueCat Networks (Canada), Infoblox(US), Men and Mice(Iceland), and EfficientIP(US).

Founded in 1990 and headquartered in Kopavogur, Iceland, Men&Mice is a renowned provider of various solutions, including cloud solutions, virtualization, network security, APIs, replace excel spreadsheets, advance from homegrown solutions, and migration from alternative DDI vendors. Moreover, the company has a comprehensive DDI product portfolio consisting of Men & Mice DDI suite, DHCP management, DNS management, and IP address management. Men & Mice caters to a diverse set of clients spread across the globe through its extensive reseller network. The company has implemented its business functions as a software overlay solution that can support Microsoft DNS, Azure DNS, and Amazon Web Services. This allows the company to integrate and serve the customers requiring overlay DDI solutions easily. Men & Mice provides support for DNS (Microsoft and Unbound) and DHCP (Microsoft and Cisco routers). The company’s solutions are scalable and provide tools for efficient administration and control. Its simplified deployment is the key advantage to its solution and allows easy integration with Microsoft Active Directory simplifying network management. Men & Mice might face challenges serving enterprises and service providers, as it is a small company with specific and limited resources. The company offers solutions for various industry verticals including IT, manufacturing and production, education, and healthcare. Men & Mice has business operations in the US and Europe and caters to a diverse client base through its extensive reseller network spread across the globe.

Scope of the Report

|

Report Metric |

Details |

|

Market value in 2026 |

USD 836 Million |

|

Market value in 2021 |

USD 400 Million |

|

Market Growth Rate |

15.9% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2015–2026 |

|

DDI Market Drivers |

|

|

DDI Market Opportunities |

|

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Segments covered |

Component (Solutions and Services), application, deployment mode, organization size, vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Nokia Corporation (France), BlueCat Networks (Canada), Microsoft Corporation (US), Infoblox (US), Cisco Systems (US), Men & Mice (Iceland), EfficientIP (US), BT Diamond IP (US), FusionLayer (Finland), PC Network (US), TCPwave (US), Apteriks (Netherlands), ApplianSys (UK), NCC Group (UK), Solarwinds Network (US), NS1 (US), Empowered Networks (Canada), Datacomm (Indonesia), INVETICO (Australia). |

This research report categorizes the DDI market to forecast revenues and analyze trends in each of the following subsegments:

Market based on Component:

- Solutions

- Services

Market based on Application:

- Network Automation

- Virtualization and Cloud

- Data Center Transformation

- Network Security

- Others (Transition to IPv6)

Market based on Deployment Mode:

- Cloud

- On-Premises

Market based on Organization Size:

- SMEs

- Large enterprises

Market based on Verticals:

- Telecom and IT

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Education

- Retail

- Manufacturing

- Others (Media and Entertainment, Energy, and Hospitality)

Market based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- ANZ

- Rest of APAC

-

MEA

- UAE

- KSA

- Rest of MEA

-

Latin America

- Mexico

- Rest of Latin America

Recent Developments in DDI Market:

- In January 2020, Men&Mice Suite 9.3 was released with support for Akamai Fast DNS, strengthened enterprise features, improved High Availability, and various user experience enhancements

- In July 2018, new Men&Mice Suite version 9.1 for cloud-ready DDI was introduced viz a powerful and simplified web-based management application that optimized cloud support and virtual appliance upgrades, reinforcing commitment to visibility and functionality across hybrid and multi-cloud DNS networks.

Frequently Asked Questions (FAQ):

What is DDI ?

DDI is shorthand for the integration of DNS, DHCP, and IPAM (IP Address Management) into a unified service or solution. DDI comprises the foundation of core network services that enables all communications over an IP-based network.

What are the top trends that are impacting DDI market?

Trends that are impacting DDI market includes:

- Rise of IoT platforms

- Increasing BYOD trend at workplaces

- Significant adoption of virtualization by organizations

- Increasing need for IPAM

- Advent of IPv6

Who are the prominent players in the DDI market?

Nokia Corporation (France), BlueCat Networks (Canada), Microsoft Corporation (US), Infoblox (US), Cisco Systems (US), Men & Mice (Iceland), EfficientIP (US), BT Diamond IP (US), FusionLayer (Finland), PC Network (US), TCPwave (US), Apteriks (Netherlands), ApplianSys (UK), NCC Group (UK), Solarwinds Network (US), NS1 (US), Empowered Networks (Canada), Datacomm (Indonesia), INVETICO (Australia).

What are the major applications of DDI?

The various applications of DDI are as follows:

- Network Automation

- Virtualization and Cloud

- Data Center Transformation

- Network Security

- Others (Transition to IPv6)

What is the DDI market share?

The global DDI market share is projected to reach USD 836 million by 2026 from USD 400 million in 2021, at a Compound Annual Growth Rate (CAGR) of 15.9%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONAL SCOPE

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL DDI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SERVICES IN THE MARKET

FIGURE 9 DDI MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 EVOLUTION OF THE DDI MARKET

TABLE 3 MARKET SIZE AND GROWTH, 2015–2020 (USD MILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH, 2020–2026 (USD MILLION, Y-O-Y %)

FIGURE 10 NORTH AMERICA TO HOLD THE LARGEST SHARE IN THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE DDI MARKET

FIGURE 11 USE OF IOT PLATFORMS AND BYOD TREND AT WORKPLACES, EXPANSION OF EXISTING DDI SOLUTIONS AND ADJACENT NETWORK SERVICES, AND INCREASED ADOPTION OF VIRTUALIZATION TO FUEL MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2020

FIGURE 12 SOLUTIONS SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY APPLICATION, 2020

FIGURE 13 VIRTUALIZATION AND CLOUD SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE, 2020

FIGURE 14 ON-PREMISES SEGMENT TO HAVE A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.5 DDI MARKET, MARKET SHARE OF TOP THREE APPLICATIONS AND REGIONS, 2021

FIGURE 15 NETWORK SECURITY MANAGEMENT AND NORTH AMERICA TO HOLD THE LARGEST MARKET SHARES IN 2021

4.6 MARKET INVESTMENT SCENARIO

FIGURE 16 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DDI MARKET

5.2.1 DRIVERS

5.2.1.1 Rise of IoT platforms

5.2.1.2 Increasing BYOD trend at workplaces

5.2.1.3 Expansion of existing DDI solutions and adjacent network services

5.2.1.4 Significant adoption of virtualization by organizations

5.2.2 RESTRAINTS

5.2.2.1 Limited mainstream adoption of SDN

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need for IPAM

5.2.3.2 Advent of IPv6

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness

5.2.4.2 Integration of DDI in complex networks is time-consuming

5.3 COVID-19 DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 REGULATORY IMPLICATIONS

5.4.1 GENERAL DATA PROTECTION REGULATION

5.4.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

5.4.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.4.4 GRAMM-LEACH-BLILEY ACT

5.4.5 SARBANES-OXLEY ACT

5.4.6 SOC2

5.5 USE CASES

5.5.1 USE CASE: SCENARIO 1

5.5.2 USE CASE: SCENARIO 2

5.5.3 USE CASE: SCENARIO 3

6 INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 INNOVATION SPOTLIGHT

6.3 STRATEGIC BENCHMARKING

6.3.1 STRATEGIC BENCHMARKING: NEW PRODUCT LAUNCHES AND PARTNERSHIPS OF TOP VENDORS

FIGURE 18 STRATEGIC BENCHMARKING: NEW PRODUCT LAUNCHES AND PARTNERSHIPS OF TOP VENDORS

7 DDI MARKET ANALYSIS, BY COMPONENT (Page No. - 61)

7.1 INTRODUCTION

7.1.1 COMPONENT: MARKET DRIVERS

7.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 19 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 6 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

7.2 SOLUTIONS

TABLE 7 SOLUTIONS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SERVICES

FIGURE 20 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 SERVICES: DDI MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 11 COMPONENT: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 12 COMPONENT: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

7.3.1 MANAGED SERVICES

TABLE 13 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 14 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3.2 PROFESSIONAL SERVICES

TABLE 15 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 16 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 DDI MARKET ANALYSIS, BY APPLICATION (Page No. - 68)

8.1 INTRODUCTION

8.1.1 APPLICATION: MARKET DRIVERS

8.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 21 VIRTUALIZATION AND CLOUD TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 18 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

8.2 NETWORK AUTOMATION

TABLE 19 NETWORK AUTOMATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 20 NETWORK AUTOMATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 VIRTUALIZATION AND CLOUD

TABLE 21 VIRTUALIZATION AND CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 22 VIRTUALIZATION AND CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.4 DATA CENTER TRANSFORMATION

TABLE 23 DATA CENTER TRANSFORMATION: DDI MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 24 DATA CENTER TRANSFORMATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.5 NETWORK SECURITY

TABLE 25 NETWORK SECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 26 NETWORK SECURITY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.6 OTHERS

TABLE 27 OTHERS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 DDI MARKET ANALYSIS, BY DEPLOYMENT MODE (Page No. - 76)

9.1 INTRODUCTION

FIGURE 22 CLOUD DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 29 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 30 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

9.2 CLOUD

9.2.1 CLOUD: MARKET DRIVERS

9.2.2 CLOUD: COVID-19 IMPACT

TABLE 31 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 ON-PREMISES

9.3.1 ON-PREMISES: MARKET DRIVERS

9.3.2 ON-PREMISES: COVID-19 IMPACT

TABLE 33 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 DDI MARKET ANALYSIS, BY ORGANIZATION SIZE (Page No. - 81)

10.1 INTRODUCTION

FIGURE 23 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 35 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

10.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

10.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: DDI MARKET DRIVERS

10.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 39 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11 DDI MARKET ANALYSIS, BY VERTICAL (Page No. - 86)

11.1 INTRODUCTION

FIGURE 24 HEALTHCARE VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 42 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2 TELECOM AND IT

11.2.1 TELECOM AND IT: MARKET DRIVERS

11.2.2 TELECOM AND IT: COVID-19 IMPACT

TABLE 43 TELECOM AND IT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 TELECOM AND IT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.3 BANKING, FINANCIAL SERVICES AND INSURANCE

11.3.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

11.3.2 BANKING, FINANCIAL SERVICES AND INSURANCE: COVID-19 IMPACT

TABLE 45 BANKING, FINANCIAL SERVICES AND INSURANCE: DDI MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.4 GOVERNMENT AND DEFENSE

11.4.1 GOVERNMENT AND DEFENSE: MARKET DRIVERS

11.4.2 GOVERNMENT AND DEFENSE: COVID-19 IMPACT

TABLE 47 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

11.5.1 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

11.5.2 HEALTHCARE AND LIFE SCIENCES: COVID-19 IMPACT

TABLE 49 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 50 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.6 EDUCATION

11.6.1 EDUCATION: DDI MARKET DRIVERS

11.6.2 EDUCATION: COVID-19 IMPACT

TABLE 51 EDUCATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 52 EDUCATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.7 RETAIL

11.7.1 RETAIL: MARKET DRIVERS

11.7.2 RETAIL: COVID-19 IMPACT

TABLE 53 RETAIL: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 54 RETAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.8 MANUFACTURING

11.8.1 MANUFACTURING: MARKET DRIVERS

11.8.2 MANUFACTURING: COVID-19 IMPACT

TABLE 55 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 56 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.9 OTHER VERTICALS

TABLE 57 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 58 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12 DDI MARKET ANALYSIS, BY REGION (Page No. - 100)

12.1 INTRODUCTION

FIGURE 25 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE GLOBAL MARKET

TABLE 59 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.2.3 UNITED STATES

TABLE 75 UNITED STATES: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 77 UNITED STATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 78 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 79 UNITED STATES: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 80 UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 81 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 82 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 83 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 84 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 85 UNITED STATES: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 86 UNITED STATES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.2.4 CANADA

TABLE 87 CANADA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 89 CANADA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 91 CANADA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: DDI MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

TABLE 99 EUROPE: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.3.3 UNITED KINGDOM

TABLE 113 UNITED KINGDOM: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 114 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 115 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 116 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 120 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 121 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3.4 GERMANY

TABLE 125 GERMANY: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 127 GERMANY: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 129 GERMANY: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 130 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 131 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 132 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3.5 REST OF EUROPE

TABLE 137 REST OF EUROPE: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.4 ASIA-PACIFIC

12.4.1 ASIA PACIFIC: DDI MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.4.3 CHINA

TABLE 163 CHINA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 172 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 173 CHINA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 175 AUSTRALIA AND NEW ZEALAND: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 176 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 177 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 178 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 179 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 180 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 181 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 182 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 183 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 184 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 185 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 186 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

TABLE 187 REST OF ASIA PACIFIC: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 189 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 190 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 191 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 196 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 197 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: DDI MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 199 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.5.3 UNITED ARAB EMIRATES

TABLE 213 UNITED ARAB EMIRATES: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 214 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 215 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 216 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 217 UNITED ARAB EMIRATES: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 218 UNITED ARAB EMIRATES: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 219 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 220 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 221 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 222 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 223 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 224 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.5.4 KINGDOM OF SAUDI ARABIA

TABLE 225 KINGDOM OF SAUDI ARABIA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 226 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 227 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 228 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 229 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 230 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 231 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 232 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 233 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 234 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 235 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 236 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.5.5 REST OF MIDDLE EAST AND AFRICA AND AFRICA

TABLE 237 REST OF MIDDLE EAST AND AFRICA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 238 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 239 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 240 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 241 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 242 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 243 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 244 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: DDI MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 249 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 251 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 252 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 253 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 254 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 255 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 256 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 257 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 258 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 259 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 260 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 261 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 262 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.6.3 MEXICO

TABLE 263 MEXICO: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 264 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 265 MEXICO: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 266 MEXICO: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 267 MEXICO: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 268 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 269 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 270 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 271 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 272 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 273 MEXICO: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 274 MEXICO: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.6.4 REST OF LATIN AMERICA

TABLE 275 REST OF LATIN AMERICA: DDI MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 276 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 277 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 278 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 279 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 280 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 281 REST OF LATIN AMERICA:MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 282 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 283 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 284 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 285 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 286 REST OF LATIN AMERICA: DDI MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 182)

13.1 OVERVIEW

13.2 COMPANY EVALUATION MATRIX

13.2.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 287 EVALUATION CRITERIA

13.2.2 STAR

13.2.3 PERVASIVE

13.2.4 EMERGING LEADERS

13.2.5 PARTICIPANTS

FIGURE 28 DDI MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2021

13.3 COMPETITIVE BENCHMARKING

13.3.1 PRODUCT OFFERINGS (FOR 15 PLAYERS)

FIGURE 29 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.3.2 BUSINESS STRATEGY (FOR 15 PLAYERS)

FIGURE 30 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE DDI MARKET

14 COMPANY PROFILES (Page No. - 186)

(Business Overview, Solutions & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View)*

14.1 NOKIA CORPORATION (ALCATEL-LUCENT ENTERPRISE)

TABLE 288 NOKIA CORPORATION: BUSINESS OVERVIEW

FIGURE 31 NOKIA CORPORATION (ALCATEL-LUCENT ENTERPRISE): COMPANY SNAPSHOT

TABLE 289 NOKIA CORPORATION: SOLUTIONS AND PRODUCTS OFFERED

TABLE 290 NOKIA CORPORATION: DEALS

14.2 BLUECAT NETWORKS

TABLE 291 BLUECAT NETWORKS: SOLUTIONS AND SERVICES OFFERED

TABLE 292 BLUECAT NETWORKS: PRODUCT LAUNCHES

TABLE 293 BLUECAT NETWORKS: DEALS

14.3 MICROSOFT CORPORATION

TABLE 294 MICROSOFT: BUSINESS OVERVIEW

FIGURE 32 MICROSOFT CORPORATION: COMPANY SNAPSHOT

TABLE 295 MICROSOFT: SOLUTIONS AND SERVICES OFFERED

TABLE 296 MICROSOFT: DEALS

14.4 INFOBLOX INC.

TABLE 297 INFOBLOX INC: SOLUTIONS AND SERVICES OFFERED

TABLE 298 INFOBLOX INC: PRODUCT LAUNCHES

TABLE 299 INFOBLOX INC: DEALS

14.5 CISCO SYSTEMS

FIGURE 33 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 300 CISCO SYSTEMS, INC.: SOLUTIONS AND SERVICES OFFERED

TABLE 301 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

TABLE 302 CISCO SYSTEMS, INC.: DEALS

14.6 MEN & MICE

TABLE 303 MEN & MICE: SOLUTIONS AND SERVICES OFFERED

TABLE 304 MEN & MICE: PRODUCT LAUNCHES

14.7 EFFICIENTIP

TABLE 305 EFFICIENTIP: SOLUTIONS AND SERVICES OFFERED

TABLE 306 EFFICIENTIP: PRODUCT LAUNCHES

TABLE 307 EFFICIENTIP: DEALS

14.8 BT DIAMOND IP

TABLE 308 BT DIAMOND IP: SOLUTIONS AND SERVICES OFFERED

TABLE 309 BT DIAMOND IP: OTHERS

14.9 FUSIONLAYER INC.

TABLE 310 FUSIONLAYER: SOLUTIONS AND SERVICES OFFERED

TABLE 311 FUSIONLAYER: PRODUCT LAUNCHES

14.10 PC NETWORK INC.

TABLE 312 PCN: SOLUTIONS AND SERVICES OFFERED

TABLE 313 PCN: DEALS

TABLE 314 PCN: OTHERS

14.11 TCPWAVE INC.

TABLE 315 TCPWAVE: SOLUTIONS AND SERVICES OFFERED

TABLE 316 TCPWAVE: PRODUCT LAUNCHES

TABLE 317 TCPWAVE: DEALS

14.12 APTERIKS

14.13 APPLIANSYS

14.14 NCC GROUP

14.15 SOLARWINDS

14.16 NS1

14.17 EMPOWERED NETWORKS

14.18 DATACOMM

14.19 INVETICO

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS (Page No. - 219)

15.1 INTRODUCTION

15.2 MANAGED DOMAIN NAME SYSTEM SERVICES MARKET

15.2.1 MARKET DEFINITION

TABLE 318 MANAGED DNS SERVICES MARKET SIZE, BY DNS SERVER, 2014–2019 (USD MILLION)

TABLE 319 MANAGED DNS SERVICES MARKET SIZE, BY DNS SERVER, 2020–2025 (USD MILLION)

TABLE 320 MANAGED DNS SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 321 MANAGED DNS SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 322 MANAGED DNS SERVICES MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 323 MANAGED DNS SERVICES MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 324 MANAGED DNS SERVICES MARKET SIZE, BY ENTERPRISE, 2014–2019 (USD MILLION)

TABLE 325 MANAGED DNS SERVICES MARKET SIZE, BY ENTERPRISE, 2020–2025 (USD MILLION)

15.3 DNS FIREWALL MARKET

15.3.1 MARKET DEFINITION

TABLE 326 DNS FIREWALL MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 327 DNS FIREWALL MARKET SIZE, BY END-USER, 2016–2023 (USD MILLION)

TABLE 328 DNS FIREWALL MARKET SIZE, BY END-USE VERTICAL, 2016–2023 (USD MILLION)

16 APPENDIX (Page No. - 224)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the DDI market. Exhaustive secondary research was done to collect information on the DDI market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for companies offering DDI offerings was arrived at based on the secondary data available through paid and unpaid sources, by analyzing product portfolios of the major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, journals, and certified publications. Secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study on the global DDI market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from DDI vendors, DDI solution providers, industry associations, independent blockchain consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using DDI solutions, were interviewed to understand the buyer’s perspective on the suppliers, and solution and service providers, and their current use of solutions.

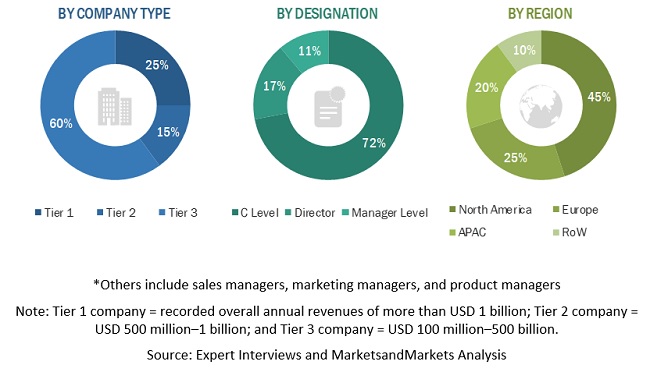

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the DDI market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the DDI market by component (solutions and services), application, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of APAC into countries in DDI market size

- Further breakup of Latin America into countries in market size

- Further breakup of MEA into countries in market size

- Further breakup of Europe into countries in market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DDI Market