Data Center Transformation Market by Service Type (Consolidation Services, Optimization Services, Automation Services, and Infrastructure Management Services), Tier Type, Data Center Type, Data Center Size and Region - Global Forecast to 2028

Data Center Transformation Market Size

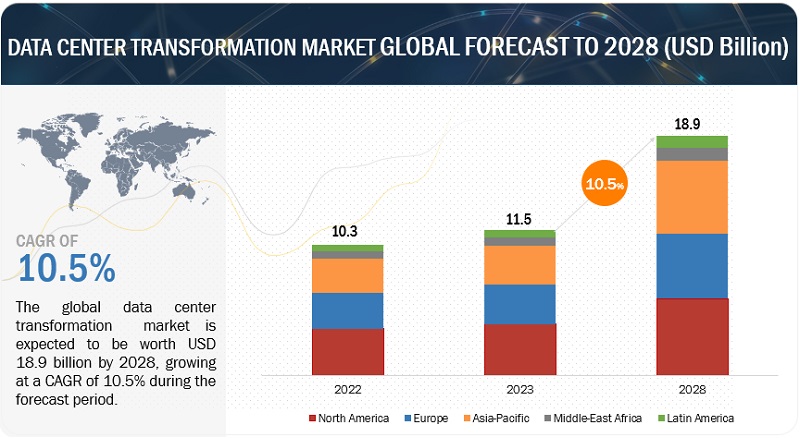

The Data Center Transformation Market is estimated at USD 11.5 billion in 2023 to USD 18.9 billion by 2028 at a compound annual growth rate (CAGR) of 10.5%. Some important factors that boost the growth of the data center transformation market include the necessity to tackle significant network congestion within data centers, the proliferation of edge devices, and legacy modernization.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Data Center Transformation Market

The recession impact has a medium-term impact on the market. The market vendors offering data center transformation services are impacted mildly. For example, in connection with the Russian invasion of Ukraine, Cisco has stopped its business operations in Russia and Belarus for the foreseeable future; those operations in Russia and Belarus included sales, services, and related support functions. However, despite inflation, the ongoing Russia-Ukraine conflict, and the looming threat of recession, private investors throughout 2022’s H1 poured billions of dollars into the data centers that power cloud computing.

Data Center Transformation Market Dynamics

Driver: Indispensable requirements to improve data center uptime and energy efficiency

Outages or downtimes have been the biggest culprit behind immediate hefty losses, brand damages, reduced productivity, and potential data loss among major data center customers. According to the 2019 Uptime Institute global data center survey, 50% of respondents had an outage or severe IT service degradation in the past three years. As per the 2020 report by Uptime Institute, power failure was a critical cause of outages by over 37% of respondents. Power supply issues have long been the most common factor behind network or data center outages. The growing demand for energy across data centers and falling Power Usage Effectiveness (PUE) have compelled various governments to introduce PUE caps to curb the environmental impact of the growing data center power usage. Therefore, multiple organizations adopt modern data center infrastructure approaches to improve power efficiency, availability, agility, and resiliency. DCIM helps monitor nodes, gain information about assets, manage workflows, and track network and power connectivity to improve data center performance and prevent downtimes. The proactive maintenance and in-time troubleshooting help improve data center availability and energy efficiency while complying with the new energy regulations, improving overall performance.

Restraint: Data security and privacy concerns

As organizations modernize their infrastructures and migrate data to cloud environments, it becomes paramount to ensure the confidentiality, integrity, and availability of sensitive information: data breaches, unauthorized access, and regulatory non-compliance risks are at their peak during these transitions. Striking a delicate balance between seamless transformation and robust security measures demands meticulous planning, stringent encryption, access controls, and adherence to evolving data protection regulations. Failing to address these concerns adequately could lead to reputational damage, legal repercussions, and compromised customer trust, significantly impeding the progression of data center transformation initiatives. Organizations often work with third-party vendors for various aspects of data center transformation. Ensuring these vendors comply with data privacy regulations and security standards is essential to mitigate third-party risk. Also, when moving data between on-premises and cloud environments, organizations must maintain consistent data handling practices to protect personal and sensitive data. Some regulations require that certain data remain within specific geographic boundaries. Datacenter transformations involving cloud services must consider data residency and sovereignty requirements. Many regions and industries have strict data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe or the US Health Insurance Portability and Accountability Act (HIPAA). Datacenter transformations must ensure compliance with these regulations, which can be complex and demanding. While cloud providers offer robust security measures, organizations must protect their data. Misconfigured cloud settings, weak access controls, and inadequate encryption can lead to security incidents.

Opportunity: Data center consolidation and optimization to drive the demand for data center transformation services

Data center consolidation plays a significant role in driving the demand for data center transformation services. Data center consolidation refers to optimizing and centralizing IT resources by reducing an organization’s number of data centers. This strategy helps businesses streamline operations, improve resource utilization, enhance efficiency, and reduce costs. However, data center consolidation is a complex undertaking requiring comprehensive transformation efforts.

Businesses are continuously acquiring and being acquired all over the globe. Such acquisitions may force the companies to consolidate and relocate their data centers to drive better business outcomes. Relocation helps in reducing costs while providing increased operational flexibility and improved efficiency. Data center relocation involves financial and operational challenges and requires a process-driven approach. Data center transformation services can benefit from this opportunity, aid in the consolidation and relocation process, and provide a holistic data center strategy that includes application dependency mapping, program management, virtual server migration services, and online data migration services between data centers. Therefore, data center consolidation necessitates a holistic IT infrastructure and operations transformation. The complexities of migrating, optimizing, integrating, and securing resources drive the demand for specialized data center transformation services. These services help organizations successfully navigate the intricacies of consolidation, ultimately achieving more efficient, cost-effective, and streamlined data center environments.

The US federal government owns many data centers and has long struggled to reduce its footprints and eliminate inefficiencies. The US Office of Management and Budget (OMB) established the Data Center Optimization Initiative (DCOI) to address challenges. DCOI requires federal agencies to develop and report on data center strategies for consolidating and modernizing their infrastructure. With this, the adoption of data center transformation solutions is increasing among federal agencies. Data center infrastructure providers, such as Sunbird Software and Nlyte Software, provide dashboards with their DCIM software that enlists DCOI KPIs and delivers insights into DCOI optimization efforts. As per the US Government Accountability Office (GAO), in FY 2021, federal agencies closed 58 data centers with savings of USD 612 million.

Challenge: Downtime and disruption challenge

Downtime refers to when services, applications, and critical business functions are unavailable to users, while disruption encompasses any disturbance or interruption to normal operations. Both challenges can have far-reaching consequences for organizations undergoing data center transformation. Downtime and disruptions can halt business operations, resulting in financial losses, missed opportunities, and customer dissatisfaction. Even brief downtime can have severe consequences in industries where 24/7 availability is crucial, such as e-commerce, finance, and healthcare. Every minute of downtime can be costly, particularly for high-transaction-volume businesses. Extended or frequent downtime can erode customer trust and damage a company’s reputation. Customer loyalty and brand perception can suffer if users experience frequent disruptions or perceive the organization as unreliable. Industries subject to regulatory requirements must ensure that data remains secure and compliant even during transformations. Downtime or disruption can potentially violate compliance standards and lead to legal consequences. Addressing downtime and disruption challenges requires careful planning and execution. Organizations should prioritize risk assessment, adopt phased approaches to transformation, implement robust testing and validation, and have contingency plans to manage unexpected issues. To overcome the challenges of downtime and disruption, organizations must approach data center transformation with comprehensive strategies that prioritize minimizing disruptions, ensuring business continuity, and maintaining a seamless user experience throughout the transformation process.

Data Center Transformation Market Ecosystem

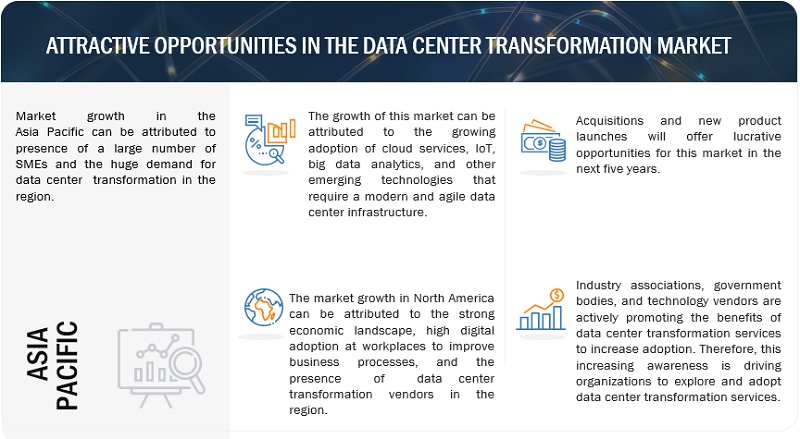

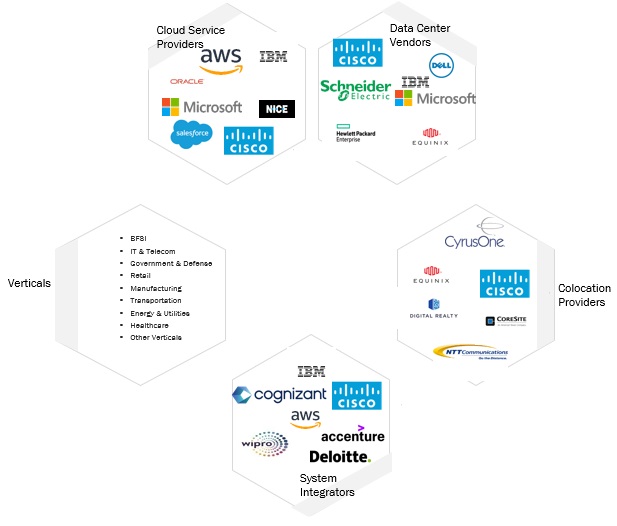

This section highlights the data center transformation ecosystem comprising the colocation providers, cloud service providers, data center vendors, system integrators, and verticals. The data center transformation ecosystem varies based on the various vendors in the market. The data center transformation ecosystem represents a relationship between all the elements—vendors, solutions/services, and end users/verticals. System integrator design, build, synthesize, and implement applications that are customized as per the requirements of customers/users. SI players test and authenticate the data center transformation solution to determine suitability before integration. SI players own integration capabilities among software, hardware, services, or other related devices to develop a comprehensive data center transformation system.

The optimization segment will witness the second-highest CAGR during the forecast period based on service type.

Data center optimization maximizes an existing infrastructure’s efficiency, performance, and cost-effectiveness. The primary goal is to use resources best within the current setup. Data center optimization ensures that a data center operates at its highest capacity while minimizing operational costs and energy consumption. Optimization involves reconfiguring or changing data centers to reduce required resources without hampering the functionalities. Data center optimization services help organizations determine how to optimize performance and evolve their data centers to realize more value from the current infrastructure. Data center optimization services provide advantages such as improved performance of business-critical applications, reduced operational overhead, rapid adoption of technology innovations with fewer risks, reduced costs through efficient equipment and data center operations, better productivity, enhanced business processes, and increased revenue. Data center consolidation is about reducing the number of physical data center facilities, often with a strong focus on cost reduction, while data center optimization is about maximizing the efficiency and performance of the existing infrastructure, regardless of the number of facilities. End users often pursue either or both strategies, depending on their specific goals and circumstances.

Based on data center size, the mid-sized data center segment will witness the second-highest growth during the forecast period.

Midsized data centers have an area ranging from 10,000 to 25,000 square feet. Enterprises and cloud service providers use mid-sized data centers. These data centers are characterized by the high use of computing power to fulfill the data center needs of large companies. Tight constraints in operational costs and a greater need for energy efficiency also characterize them. Moreover, mid-sized data centers experience the high use of the virtualized environment for the optimal utilization of servers, and they require the optimal allocation of various data center resources. Mid-sized data centers are increasingly adopting data center transformation services to facilitate high performance, efficient design, and easy deployment. Organizations that have outgrown small data centers but do not require the extensive capacity of large data centers often opt for mid-sized facilities to meet their specific scaling requirements.

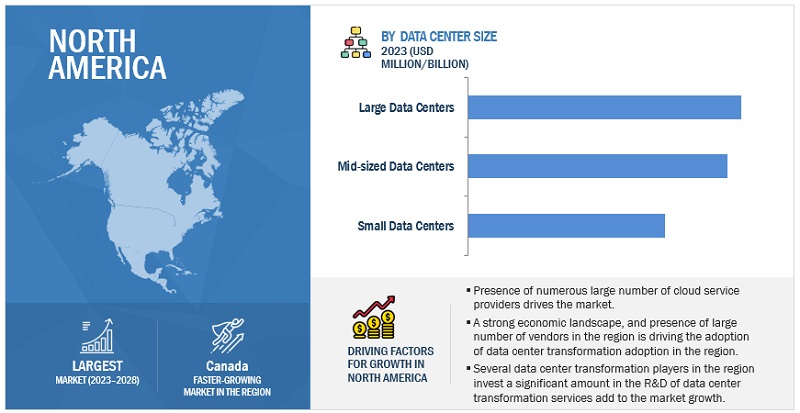

The US market contributes the largest share of North America’s data center transformation market during the forecast period.

The US is estimated to account for North America’s most significant share of the data center transformation market in 2023, and the trend will continue until 2028. Due to several factors, including advanced IT infrastructure, the existence of numerous businesses, and the availability of technical skills, it is the most developed market for adopting data center transformation. The US has the highest readiness for the adoption of cloud, and companies in the US will spend more on AI, ML, and data contact center solutions. The United States data center transformation market is a dynamic and rapidly evolving sector within the broader IT industry. It encompasses a wide range of services and solutions to modernize, optimize, and adapt data center infrastructure to meet the evolving needs of businesses in the digital age. The US has one of the world’s largest data center transformation markets. The market has experienced consistent growth due to the increasing demand for data center modernization and digital transformation. Businesses across various industries undergo digital transformation initiatives, often requiring updated and agile data center infrastructures. Some data center transformation providers are IBM, Deloitte, Accenture, and Cognizant.

Key Market Players

The key technology vendors in the data center transformation market include Dell (US), Microsoft (US), IBM (US), Schneider Electric (France), Cisco (US), NTT (Japan), HCLTech (India), Accenture (Ireland), Cognizant (India), Google (US), Wipro (India), Atos (France), TCS (India), Hitachi (Japan), NetApp (US), Mindteck (India), Bytes Technology Group (UK), General Datatech (US), Insight Enterprises (US), Tech Mahindra (India), NETSCOUT (US), Dyntek (US), Softchoice (Canada), InKnowTech (India), Rahi Systems (US), Blue Mantis (UK), GreenField Software (India), Hyperview (Canada), FlexiScale (UK), LiquidStack (US), RackBank Datacenters (India), and Vapor IO (US). Most key players have adopted partnerships and product developments to cater to the demand for data center transformation.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments Covered |

Service Type, Tier Type, Data Center Type, Data Center Size, Verticals |

|

Geographies Covered |

North America, Latin America, Europe, Middle East & Africa, and Asia Pacific |

|

Companies Covered |

The key technology vendors in the market include Dell (US), Microsoft (US), IBM (US), Schneider Electric (France), Cisco (US), NTT (Japan), HCLTech (India), and more. |

This research report categorizes the data center transformation market based on service type, tier type, data center type, data center size, verticals, and regions.

Based on the Service Type:

- Consolidation Services

- Optimization Services

- Automation Services

- Infrastructure Management Services

Based on the Tier Type:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Based on the Data Center Type:

- Cloud Data Center

- Colocation Data Center

- Enterprise Data Center

Based on the Data Center Size:

- Small Data Centers

- Mid-Sized Data Centers

- Large Data Centers

Based on the Vertical:

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Transportation

- Manufacturing

- Government & Defense

- Energy & Utilities

- Other Verticals (Education and Media & Entertainment)

Based on Regions:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2023, IBM unveiled the introduction of its new Turbonomic Reporting Dashboards, currently accessible to Turbonomic SaaS clients, with the release of IBM Turbonomic version 8.9.6. These upgraded reporting dashboards within IBM Turbonomic offer in-depth observations into both application performance and the utilization of the supply chain.

- In August 2023, Cisco and Nutanix, inc., a leader in hybrid multi-cloud computing, announced a global strategic partnership to accelerate hybrid multi-cloud deployments by offering the industry’s most complete hyper-converged solution for IT modernization and business transformation. This partnership will deliver an expanded market opportunity for both organizations as they tackle the challenges of standardizing, simplifying, and securing environments across the data center, the public cloud, and the edge.

- In July 2023, Schneider introduced the easy ups 3-phase modular, a sturdy, uninterruptible power supply (ups) engineered to safeguard vital loads, and it comes with third-party validated live swap capabilities. The easy ups 3-phase modular is offered in a 50-250 kW capacity range, featuring n+1 scalability and compatibility with the EcoStruxure architecture, enabling remote monitoring services. Its modular design and live swap feature make it ideal for small and medium-sized data centers and business-critical applications.

- In July 2023, HCLTech announced its collaboration with Schneider Electric, one of the leaders in digital transformation of energy management and industrial automation, to develop carbon-efficient solutions for data centers in the Asia Pacific (APAC) region.

- In June 2023, IBM announced plans to open its first Europe-based quantum data center to facilitate access to cutting-edge quantum computing for companies, research institutions, and government agencies.

- In June 2023, NTT unveiled its most recent hyperscale data center campus, Chennai 2. Additionally, they have introduced their subsea cable system, MIST, to the city. The Chennai 2 campus, situated in Ambattur and spanning 6 acres, represents a cutting-edge project with a planned total capacity of 34.8 MW for critical IT load across two data center buildings.

- In June 2023, Microsoft announced the upcoming availability of its first cloud region in Italy, providing Italian organizations access to scalable, available, and resilient cloud services and confirming its commitment to promoting digital transformation and sustainable innovation in the country.

- In June 2023, Dell has recently expanded its Dell Private wireless program, aiming to offer secure enterprise connectivity for edge locations. The program now supports Airspan and Druid wireless solutions, providing businesses with enhanced options for safe and reliable wireless connectivity at the edge.

- In May 2023, Wipro announced that its FullStride Cloud Studio has partnered with Google Cloud’s Rapid Migration Program (RaMP) to help clients accelerate their journey to the cloud and pursue a migration strategy anchored in business outcomes.

- In March 2023, Cisco unveiled a data center in India in Chennai, which will further expand to Mumbai. The aim is to ensure hybrid and multi-cloud environments in India.

- In February 2023, Microsoft and SAP partnered to launch RISE with SAP on Microsoft’s hyperscale cloud data center region in Qatar. SAP customers in Qatar can now host RISE with SAP on Microsoft Azure, expanding the opportunities for building a cloud-first economy in Qatar, the GCC, and the MENA region.

- In January 2023, NTT introduced pioneering implementations of Liquid Immersion Cooling (LIC) and Direct Contact Liquid Cooling (DCLC) technologies. NTT has recently achieved a significant milestone by deploying these technologies for the first time in the Asia-Pacific (APAC) region at its Navi Mumbai Data Center. This facility, situated within its Mahape campus, spans 13,740 square feet and boasts a capacity of 4.8 MW.

- In January 2023, Google entered into a long-term lease agreement for a data center spanning approximately 381,000 square feet in Navi Mumbai. This strategic move is part of Google’s expansion of its cloud infrastructure in India, addressing the increasing demand in one of its key growth markets.

- In November 2022, Atos & AWS jointly announced a Global Strategic Transformation Agreement. This agreement empowers Atos customers with substantial infrastructure outsourcing contracts to expedite their workload migrations to the cloud and achieve digital transformation. AWS and Atos will collaborate on developing and delivering innovative industry solutions for global IT outsourcing and data center transformation. Additionally, the partnership will focus on enhancing Atos’ workforce skills and optimizing its data center, cloud, and security operations, including targeted migration of legacy data centers and IT hardware assets.

- In March 2022, Microsoft and Fortum collaborated in which Fortum will harness surplus heat produced by a forthcoming Microsoft data center in the Helsinki metropolitan area of Finland. These data centers will operate on 100% clean energy. Fortum channeled the eco-friendly heat generated during the server cooling process to residences, businesses, and service providers linked to its district heating network. This waste heat recovery initiative from the data center region is poised to become the largest of its kind globally.

Frequently Asked Questions (FAQ):

What is data center transformation?

Data center transformation services provide capabilities for consolidation, optimization, automation, and management of IT infrastructure for modernizing data centers to facilitate optimum space utilization, reduced energy consumption, cost savings, scalability, business continuity and disaster recovery, hybrid/multi-cloud integration, and other such benefits.

Which country is an early adopter of data center transformation?

The US is at the initial stage of adopting data center transformation.

What are the driving factors in the data center transformation market?

Factors include the leveraging digital transformation to drive data center evolution, indispensable requirements to improve data center uptime and energy efficiency, the proliferation of data center colocation facilities globally, the rising necessity to tackle significant network congestion within data centers, increasing cloud adoption and hybridization, and rapid data explosion drives the market growth to drive market growth.

Which are significant verticals adopting the data center transformation market?

Key verticals adopting the data center transformation market include: -

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare

- Transportation

- Retail

- Energy & Utilities

- Manufacturing

- Other Verticals (Education and Media & Entertainment)

Which are the key vendors exploring the data center transformation market?

The key technology vendors in the market include Dell (US), Microsoft (US), IBM (US), Schneider Electric (France), Cisco (US), NTT (Japan), HCLTech (India), Accenture (Ireland), Cognizant (India), Google (US), Wipro (India), Atos (France), TCS (India), Hitachi (Japan), NetApp (US), Mindteck (India), Bytes Technology Group (UK), General Datatech (US), Insight Enterprises (US), Tech Mahindra (India), NETSCOUT (US), Dyntek (US), Softchoice (Canada), InKnowTech (India), Rahi Systems (US), Blue Mantis (UK), GreenField Software (India), Hyperview (Canada), FlexiScale (UK), LiquidStack (US), RackBank Datacenters (India), and Vapor IO (US). Most key players have adopted partnerships and product developments to cater to the demand for data center transformation.

What is the total CAGR for the data center transformation market during the forecast years (2023-2028)?

The data center transformation market would record a CAGR of 10.5% during 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Leveraging digital transformation to drive data center evolution- Expansion of cloud services in fresh territories while maintaining cloud sovereignty- Increase in IT spending impacts data center transformation growth- Proliferation of data center colocation facilities globallyRESTRAINTS- Data security and privacy concerns- Complexity related to transformation process- Energy efficiency in data center facilitiesOPPORTUNITIES- Data center expansion in developing regions- Growing investments in data centers- Growing demand for AI and generative AI- Growth in 5G and edge computing boosts data center transformation services adoption- Green initiativesCHALLENGES- Skill shortage- Downtime and disruption challenge

-

5.3 CASE STUDY ANALYSISCARHARTT DELIVERED CLOUD-FIRST STRATEGY WITH IBM TURBONOMICTHAI GOVERNMENT USED SCHNEIDER TO REDUCE CARBON EMISSION FOOTPRINTS AND POWER USAGE FOR BETTER ENERGY EFFICIENCYANIMAL LOGIC SELECTED SCHNEIDER’S PREFABRICATED SYSTEM FOR ENHANCING ITS PLANNING AND OPERATIONAL PERFORMANCESEAMLESS CLOUD MIGRATION INCREASED SCALABILITY AND LOWERED RISK FOR GLOBAL TECH PROVIDER GDTPRODUCTIVITY AND CUSTOMER EXPERIENCE ENHANCED WITH GDT’S DATA CENTER SOLUTIONS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 TECHNOLOGICAL ANALYSISVIRTUALIZATIONCLOUD COMPUTINGAI & MACHINE LEARNINGSOFTWARE-DEFINED INFRASTRUCTURE (SDI)

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY LANDSCAPE- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaGLOBAL STANDARDS

-

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 BUSINESS MODEL ANALYSISON-PREMISES BUSINESS MODELCLOUD-BASED BUSINESS MODELHYBRID BUSINESS MODEL

- 5.14 KEY CONFERENCES AND EVENTS

- 6.1 INTRODUCTION

-

6.2 CONSOLIDATION SERVICESCONSOLIDATING MULTIPLE DATA CENTERS INTO FEWER DATA CENTERS TO AID IN COST REDUCTION AND IMPROVED EFFICIENCYCONSOLIDATION SERVICES: MARKET DRIVERSCASE STUDYMIGRATIONVIRTUALIZATIONSTORAGE AND MANAGEMENTENERGY EFFICIENCY

-

6.3 OPTIMIZATION SERVICESDATA CENTER OPTIMIZATION TO MAXIMIZE EFFICIENCY AND PERFORMANCE OF EXISTING DATA CENTER INFRASTRUCTURE, REGARDLESS OF NUMBER OF FACILITIESOPTIMIZATION SERVICES: DATA CENTER TRANSFORMATION MARKET DRIVERSCASE STUDYENERGY EFFICIENCY OPTIMIZATIONDISASTER RECOVERY AND BUSINESS CONTINUITY OPTIMIZATIONSCALABILITY AND FLEXIBILITY

-

6.4 AUTOMATION SERVICESDATA CENTER TRANSFORMATION POWERED BY AI TO ENSURE OPTIMIZED RESOURCE ALLOCATION AND IMPROVED ENERGY EFFICIENCYAUTOMATION SERVICES: MARKET DRIVERSCASE STUDYMONITORING AND ALERTSREPORTING AND DOCUMENTATIONCAPACITY PLANNING

-

6.5 INFRASTRUCTURE MANAGEMENT SERVICESINFRASTRUCTURE MANAGEMENT SERVICES TO HELP ORGANIZATIONS MONITOR AND MANAGE ALL DATA CENTER RESOURCESINFRASTRUCTURE MANAGEMENT SERVICES: MARKET DRIVERSCASE STUDY 1CASE STUDY 2ASSET MANAGEMENTCAPACITY PLANNINGPOWER MONITORINGENVIRONMENTAL MONITORING

- 7.1 INTRODUCTION

-

7.2 TIER 1AFFORDABILITY OF TIER 1 TO DRIVE GROWTHTIER 1: MARKET DRIVERS

-

7.3 TIER 2TIER 2 DATA CENTERS TO BE ATTRACTIVE OPTION FOR MID-SIZED ORGANIZATIONSTIER 2: DATA CENTER TRANSFORMATION MARKET DRIVERS

-

7.4 TIER 3TIER 3 DATA CENTERS TO BE SUITABLE FOR BUSINESSES THAT REQUIRE HIGH LEVEL OF RELIABILITY BUT CAN TOLERATE LIMITED DOWNTIMETIER 3: MARKET DRIVERS

-

7.5 TIER 4TIER 4 DATA CENTERS TO BE FAULT-TOLERANT AND CAPABLE OF WITHSTANDING WIDE RANGE OF POTENTIAL DISRUPTIONSTIER 4: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 CLOUD DATA CENTERCLOUD SERVICE PROVIDERS TO HOST DATA AND APPLICATIONSCLOUD DATA CENTER: MARKET DRIVERS

-

8.3 COLOCATION DATA CENTERCOLOCATION FACILITIES TO RENT SPACE TO MULTIPLE ORGANIZATIONS TO HOST THEIR DATA CENTERSCOLOCATION DATA CENTER: DATA CENTER TRANSFORMATION MARKET DRIVERS

-

8.4 ENTERPRISE DATA CENTERBUILDING AND MAINTAINING ENTERPRISE DATA CENTER TO INVOLVE SIGNIFICANT CAPITAL EXPENDITUREENTERPRISE DATA CENTER: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 SMALL DATA CENTERSNEED FOR EDGE COMPUTING, COST-EFFICIENCY, SCALABILITY, RAPID DEPLOYMENT, AND COMPLIANCE CONSIDERATIONS TO DRIVE SMALL DATA CENTERS GROWTHSMALL DATA CENTERS: MARKET DRIVERS

-

9.3 MID-SIZED DATA CENTERSMID-SIZED DATA CENTERS TO HELP MEET DIVERSE NEEDS OF ORGANIZATIONSMID-SIZED DATA CENTERS: DATA CENTER TRANSFORMATION MARKET DRIVERS

-

9.4 LARGE DATA CENTERSNEED FOR MASSIVE DATA PROCESSING, CLOUD COMPUTING DEMANDS, SCALABILITY, HIGH AVAILABILITY, AND COST EFFICIENCY TO DRIVE MARKETLARGE DATA CENTERS: MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 IT & TELECOMIT & TELECOM TO EMBRACE MODERNIZATION AND DATA CENTER INFRASTRUCTURE AND TECHNOLOGIES TO MEET EVOLVING DEMANDIT & TELECOM: MARKET DRIVERS

-

10.3 BFSINEED FOR REAL-TIME PROCESSING, DATA SECURITY, DATA ANALYTICS, COMPLIANCE, AND IMPROVED CUSTOMER EXPERIENCES TO BOOST DEMANDBFSI: DATA CENTER TRANSFORMATION MARKET DRIVERS

-

10.4 HEALTHCARENEED TO EMBRACE DIGITAL HEALTH TECHNOLOGIES, SAFEGUARD PATIENT DATA, COMPLY WITH REGULATIONS, AND ADVANCE MEDICAL RESEARCH TO DRIVE MARKETHEALTHCARE: MARKET DRIVERS

-

10.5 MANUFACTURINGNEED FOR REAL-TIME DATA PROCESSING, OPERATIONAL OPTIMIZATION, AND LEVERAGING BENEFITS OF IIOT FOR SMARTER, MORE EFFICIENT PRODUCTION PROCESSES TO PROPEL MARKETMANUFACTURING: MARKET DRIVERS

-

10.6 GOVERNMENT & DEFENSENEED FOR REAL-TIME PROCESSING, DATA SECURITY, AND IMPROVED PUBLIC SERVICE DELIVERY TO FUEL DEMAND FOR DATA CENTER TRANSFORMATIONGOVERNMENT & DEFENSE: MARKET DRIVERS

-

10.7 TRANSPORTATIONNEED TO ADOPT SMART TRANSPORTATION SYSTEMS, INTEGRATE IOT DEVICES, IMPROVE EFFICIENCY, ENHANCE PASSENGER EXPERIENCE, AND SUPPORT GROWTH OF ELECTRIC VEHICLES TO DRIVE MARKETTRANSPORTATION: DATA CENTER TRANSFORMATION MARKET DRIVERS

-

10.8 RETAILNEED FOR FASTER, MORE PERSONALIZED ONLINE EXPERIENCES AND DATA-DRIVEN DECISION-MAKING TO DRIVE MARKETRETAIL: MARKET DRIVERS

-

10.9 ENERGY & UTILITIESNEED TO ADOPT SMART GRID TECHNOLOGIES, INTEGRATE RENEWABLE ENERGY SOURCES, AND ENHANCE GRID RESILIENCE TO DRIVE MARKETENERGY & UTILITIES: MARKET DRIVERS

-

10.10 OTHER VERTICALSOTHER VERTICALS: MARKET DRIVERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: DATA CENTER TRANSFORMATION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPE- US Securities and Exchange Commission- International Organization for Standardization 27001- California Consumer Privacy Act- Health Insurance Portability and Accountability Act of 1996- Sarbanes-Oxley Act of 2002US- Presence of several data center transformation providers to drive marketCANADA- Growing innovations and IT infrastructure to drive market

-

11.3 EUROPEEUROPE: DATA CENTER TRANSFORMATION MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPE- General Data Protection Regulation- European Cybersecurity ActUK- Increasing demand for digital services, sustainability initiatives, data privacy regulations, and advancements in technology to drive market in UKGERMANY- Increasing digitalization to fuel growth of data center transformation servicesFRANCE- Government initiatives to support adoption of cloud technologiesREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPE- Personal Data Protection Act- Singapore Standard SS 564- Internet Data Center in ChinaCHINA- Rapid digitalization, economic growth, and increasing data consumption to fuel market growthJAPAN- Rising demand for data center transformation to drive marketINDIA- Need for modernization and innovation in data center infrastructure to drive market growthREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPE- Personal Data Protection Law- Cloud Computing Regulatory FrameworkSAUDI ARABIA- Increasing government initiatives, data demands, and evolving digital landscape to drive marketUNITED ARAB EMIRATES (UAE)- UAE data center transformation market to thrive due to government initiatives, economic diversification, and the increasing digital demands of businessesSOUTH AFRICA- Dynamic technology landscape in South Africa to foster innovation in data center design, management, and energy efficiencyREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: DATA CENTER TRANSFORMATION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEFEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALSBRAZIL- Presence of several data center transformation players to accelerate market growthMEXICO- Increasing government support, digitalization efforts, economic growth, and increasing data requirements drive marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- 12.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT FOR KEY PLAYERS

-

12.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 12.9 VALUATION AND FINANCIAL METRICS OF DATA CENTER TRANSFORMATION VENDORS

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDELL TECHNOLOGIES- Business overview- Product/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE- Business Overview- Products/Solutions/Services offered- Recent DevelopmentsNTT- Business overview- Products/Solutions/Services offered- Recent developmentsHCLTECH- Business overview- Products/Solutions/Services offered- Recent developmentsACCENTURE- Business overview- Products/Solutions/Services offered- Recent developmentsATOS- Business overview- Products/Solutions/Services offered- Recent developmentsGOOGLE- Business overview- Products/Solutions/Services offered- Recent developmentsWIPRO- Business overview- Products/Solutions/Services offered- Recent developmentsTCS- Business overview- Products/Solutions/Services offered- Recent developments

-

13.3 OTHER PLAYERSCOGNIZANTHITACHINETAPPMINDTECKBYTES TECHNOLOGY GROUPGENERAL DATATECH (GDT)INSIGHT ENTERPRISESINKNOWTECHTECH MAHINDRANETSCOUTRAHI SYSTEMSBLUE MANTISDYNTEKSOFTCHOICE

-

13.4 SMES/STARTUP PLAYERSGREENFIELD SOFTWAREHYPERVIEWVAPOR IOFLEXISCALELIQUIDSTACKRACKBANK DATACENTERS

-

14.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 14.2 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET

- 14.3 DATA CENTER COLOCATION MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DATA CENTER TRANSFORMATION MARKET SIZE AND GROWTH, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 DATA CENTER ESTABLISHMENTS BY CLOUD PROVIDERS

- TABLE 6 PRICING ANALYSIS OF DATA CENTER RACK VENDORS

- TABLE 7 INDICATIVE PRICING ANALYSIS OF DATA CENTER TRANSFORMATION VENDORS

- TABLE 8 TOP 10 PATENT APPLICANTS (US)

- TABLE 9 IMPACT OF PORTER’S FIVE FORCES

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS (%)

- TABLE 15 KEY BUYING CRITERIA FOR VERTICALS

- TABLE 16 DATA CENTER TRANSFORMATION MARKET: KEY CONFERENCES AND EVENTS, 2023 & 2024

- TABLE 17 MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 19 CONSOLIDATION SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 CONSOLIDATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 OPTIMIZATION SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 OPTIMIZATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 AUTOMATION SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 AUTOMATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 INFRASTRUCTURE MANAGEMENT SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 INFRASTRUCTURE MANAGEMENT SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET: TYPES OF DATA CENTER TIERS

- TABLE 28 MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 29 MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 30 TIER 1: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 TIER 1: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 TIER 2: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 TIER 2: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 TIER 3: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 TIER 3: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 TIER 4: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 TIER 4: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 39 MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 40 CLOUD DATA CENTER: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 CLOUD DATA CENTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 COLOCATION DATA CENTER: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 COLOCATION DATA CENTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 ENTERPRISE DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 ENTERPRISE DATA CENTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 47 MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 48 SMALL DATA CENTERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 SMALL DATA CENTERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 MID-SIZED DATA CENTERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 MID-SIZED DATA CENTERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 LARGE DATA CENTERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 LARGE DATA CENTERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 55 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 56 IT & TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 IT & TELECOM: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 TRANSPORTATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 TRANSPORTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 RETAIL: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ENERGY & UTILITIES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 US: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 89 US: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 90 US: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 91 US: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 93 CANADA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 94 CANADA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 95 CANADA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 UK: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 109 UK: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 110 UK: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 111 UK: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 113 GERMANY: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 115 GERMANY: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 116 FRANCE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 117 FRANCE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 118 FRANCE: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 119 FRANCE: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 137 CHINA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 139 CHINA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 141 JAPAN: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 142 JAPAN: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 143 JAPAN: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 144 INDIA: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 145 INDIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 146 INDIA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 147 INDIA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 SAUDI ARABIA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 165 SAUDI ARABIA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 166 SAUDI ARABIA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 167 SAUDI ARABIA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 168 UAE: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 169 UAE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 170 UAE: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 171 UAE: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 172 SOUTH AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 173 SOUTH AFRICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 174 SOUTH AFRICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 175 SOUTH AFRICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY TIER TYPE, 2017–2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY TIER TYPE, 2023–2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY DATA CENTER TYPE, 2017–2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY DATA CENTER TYPE, 2023–2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 192 BRAZIL: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 193 BRAZIL: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 194 BRAZIL: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 195 BRAZIL: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 196 MEXICO: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 197 MEXICO: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 198 MEXICO: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 199 MEXICO: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: MARKET, BY DATA CENTER SIZE, 2017–2022 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: MARKET, BY DATA CENTER SIZE, 2023–2028 (USD MILLION)

- TABLE 204 DATA CENTER TRANSFORMATION MARKET: DEGREE OF COMPETITION

- TABLE 205 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 206 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 207 COMPANY FOOTPRINT FOR KEY PLAYERS, BY SERVICE TYPE

- TABLE 208 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 209 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 210 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 211 INITIATIVES TAKEN BY MAJOR PLAYERS IN THE MARKET SPACE

- TABLE 212 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 213 MARKET: DEALS, 2020–2023

- TABLE 214 MARKET: OTHERS

- TABLE 215 IBM: BUSINESS OVERVIEW

- TABLE 216 IBM: PRODUCTS/SERVICES OFFERED

- TABLE 217 IBM: PRODUCT LAUNCHES

- TABLE 218 IBM: DEALS

- TABLE 219 IBM: OTHERS

- TABLE 220 MICROSOFT: BUSINESS OVERVIEW

- TABLE 221 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 MICROSOFT: PRODUCT LAUNCHES

- TABLE 223 MICROSOFT: DEALS

- TABLE 224 MICROSOFT: OTHERS

- TABLE 225 DELL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 226 DELL TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

- TABLE 227 DELL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 228 DELL TECHNOLOGIES: DEALS

- TABLE 229 CISCO: BUSINESS OVERVIEW

- TABLE 230 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 CISCO: DEALS

- TABLE 233 CISCO: OTHERS

- TABLE 234 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 235 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES OFFERED

- TABLE 236 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 237 SCHNEIDER ELECTRIC: DEALS

- TABLE 238 AWS: BUSINESS OVERVIEW

- TABLE 239 AWS: PRODUCTS/SERVICES OFFERED

- TABLE 240 AWS: DEALS

- TABLE 241 AWS: OTHERS

- TABLE 242 ORACLE: COMPANY OVERVIEW

- TABLE 243 ORACLE: PRODUCTS/SERVICES OFFERED

- TABLE 244 ORACLE: PRODUCT LAUNCHES

- TABLE 245 ORACLE: DEALS

- TABLE 246 NTT: BUSINESS OVERVIEW

- TABLE 247 NTT: PRODUCTS/SERVICES OFFERED

- TABLE 248 NTT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 249 NTT: DEALS

- TABLE 250 NTT: OTHERS

- TABLE 251 HCLTECH: BUSINESS OVERVIEW

- TABLE 252 HCLTECH: PRODUCTS/SERVICES OFFERED

- TABLE 253 HCLTECH: DEALS

- TABLE 254 ACCENTURE: BUSINESS OVERVIEW

- TABLE 255 ACCENTURE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 256 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 ATOS: BUSINESS OVERVIEW

- TABLE 258 ATOS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 259 ATOS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 ATOS: DEALS

- TABLE 261 GOOGLE: BUSINESS OVERVIEW

- TABLE 262 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 GOOGLE: DEALS

- TABLE 264 GOOGLE: OTHERS

- TABLE 265 WIPRO: BUSINESS OVERVIEW

- TABLE 266 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 268 WIPRO: DEALS

- TABLE 269 TCS: BUSINESS OVERVIEW

- TABLE 270 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 TCS: DEALS

- TABLE 272 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

- TABLE 273 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 274 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 275 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 276 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

- TABLE 277 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

- TABLE 278 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

- TABLE 279 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

- TABLE 280 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

- TABLE 281 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 282 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 283 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 284 DATA CENTER COLOCATION MARKET, BY TYPE, 2015–2022 (USD BILLION)

- TABLE 285 DATA CENTER COLOCATION MARKET, BY END USER, 2015–2022 (USD BILLION)

- TABLE 286 DATA CENTER COLOCATION MARKET, BY INDUSTRY, 2015–2022 (USD MILLION)

- TABLE 287 DATA CENTER COLOCATION MARKET, BY REGION, 2015–2022 (USD BILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA CENTER TRANSFORMATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: RESEARCH FLOW

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 ILLUSTRATIVE EXAMPLE: IBM

- FIGURE 10 DEMAND-SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- FIGURE 11 DEMAND-SIDE APPROACH: MARKET

- FIGURE 12 MARKET: DATA TRIANGULATION

- FIGURE 13 GLOBAL MARKET KEY POINTS

- FIGURE 14 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 16 FASTEST-GROWING SEGMENTS OF DATA CENTER TRANSFORMATION MARKET

- FIGURE 17 DIGITAL TRANSFORMATION, CLOUD ADOPTION, NEED FOR COST/ENERGY EFFICIENCY, AND LEGACY MODERNIZATION TO BOOST DATA CENTER TRANSFORMATION MARKET GROWTH

- FIGURE 18 CONSOLIDATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 19 TIER 4 SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 20 ENTERPRISE DATA CENTER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 21 LARGE DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 22 BFSI IS TOP RANKED VERTICAL IN 2023

- FIGURE 23 ASIA PACIFIC EXPECTED TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 24 MARKET DYNAMICS: MARKET

- FIGURE 25 DIGITAL TRANSFORMATION MARKET SIZE WORLDWIDE, 2018–2030 (USD BILLION)

- FIGURE 26 WORLDWIDE IT SPENDING

- FIGURE 27 GLOBAL DATA CENTER MERGERS & ACQUISITIONS

- FIGURE 28 GLOBAL GENERATIVE AI MARKET

- FIGURE 29 DATA CENTER TRANSFORMATION MARKET: SUPPLY CHAIN

- FIGURE 30 MARKET: ECOSYSTEM

- FIGURE 31 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 32 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 33 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 34 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- FIGURE 36 KEY BUYING CRITERIA FOR VERTICALS

- FIGURE 37 DATA CENTER TRANSFORMATION MARKET: BUSINESS MODELS

- FIGURE 38 AUTOMATION SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 TIER 3 SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 CLOUD DATA CENTER TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 SMALL DATA CENTERS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 43 PRIORITIZING INDUSTRIES AND USE CASES

- FIGURE 44 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 47 OVERVIEW OF STRATEGIES BY KEY DATA CENTER TRANSFORMATION VENDORS

- FIGURE 48 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY DATA CENTER TRANSFORMATION PROVIDERS, 2018–2022 (USD MILLION)

- FIGURE 49 MARKET SHARE ANALYSIS, 2022

- FIGURE 50 DATA CENTER TRANSFORMATION MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 51 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 52 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 53 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 54 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 55 VALUATION AND FINANCIAL METRICS OF DATA CENTER TRANSFORMATION VENDORS

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 58 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 59 CISCO: COMPANY SNAPSHOT

- FIGURE 60 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 61 AWS: COMPANY SNAPSHOT

- FIGURE 62 ORACLE: COMPANY SNAPSHOT

- FIGURE 63 NTT: COMPANY SNAPSHOT

- FIGURE 64 HCLTECH: COMPANY SNAPSHOT

- FIGURE 65 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 66 ATOS: COMPANY SNAPSHOT

- FIGURE 67 GOOGLE: COMPANY SNAPSHOT

- FIGURE 68 WIPRO: COMPANY SNAPSHOT

- FIGURE 69 TCS: COMPANY SNAPSHOT

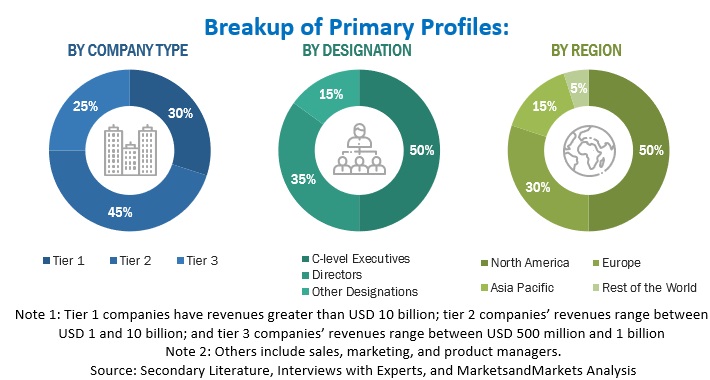

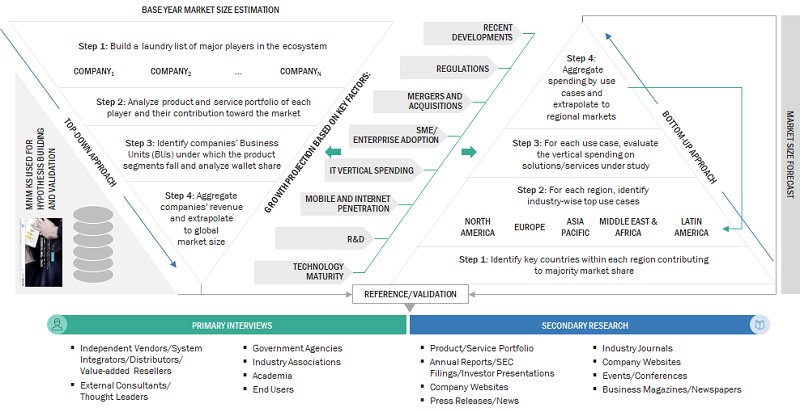

The study involved key activities in estimating the data center transformation market’s size. We conducted exhaustive secondary research to collect information on the current, adjacent, and parent market reports. The next step was to validate these assumptions, findings, and sizing with subject matter experts via primary research. We used the bottom-up approach to estimate the total market size. After that, we employed the market breakup and data triangulation procedures to estimate and forecast the market size of the segments/sub-segments of the data center transformation market.

Secondary Research

We analyzed the market size of companies offering data center transformation services based on the secondary data available through reliable unpaid/paid sources. We then examined the product portfolios of major companies based on their product capabilities, strategic initiatives, and market shares.

We referred to various sources for identifying and collecting study information in the secondary research process. The secondary sources included press releases, investor presentations of companies, annual reports, SEC filings, product data sheets, white papers, journals, certified publications, articles, government websites, and credible databases.

We used secondary research to obtain critical information about the industry’s supply chain, the total list of key/ startup players, market segmentation based on industry trends to the bottom level, and key developments from both markets - and technology-based perspectives, all validated by primary sources.

Primary Research

In the primary research process, we interviewed participants from the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from data center transformation vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, service types, end users, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall data center transformation market.

To know about the assumptions considered for the study, download the pdf brochure

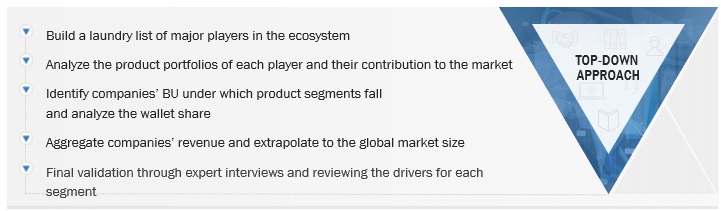

Market Size Estimation

We used the top-down and bottom-up approaches to calculate the data center transformation market and subsegments. We finalized the vendors in the market via secondary research and their segment shares in regions/ countries through extensive market research. This procedure included studying major market players’ annual reports and extensive interviews with industry leaders.

Top Down and Bottom Up Approach of Data Center Transformation Market

To know about the assumptions considered for the study, Request for Free Sample Report

Top Down Approach of Data Center Transformation Market

Data Triangulation

In the market estimation process, we split the market into segments and subsegments after arriving at the total market size. We followed data triangulation and market breakdown procedures to determine each market segment’s and subsegment’s size. The data was triangulated by studying factors and trends from the demand and supply in IT & telecom, BFSI, healthcare, manufacturing, government & defense, transportation, retail, energy & utilities, and others.

Market Definition

Data center transformation services provide capabilities for consolidation, optimization, automation, and management of IT infrastructure for modernizing data centers to facilitate optimum space utilization, reduced energy consumption, cost savings, scalability, business continuity and disaster recovery, hybrid/multi-cloud integration, and other such benefits. Data center transformation refers to the strategic process of modernizing and optimizing a data center’s infrastructure, operations, and technology to meet evolving business needs and technological advancements. The primary goals of data center transformation are to improve efficiency, agility, scalability, and cost-effectiveness.

Key Stakeholders

The data center transformation market consists of the following stakeholders:

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Software providers

- System integrators

- Network service providers

- Consulting service providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Colocation providers

- Enterprises

- Government and standardization bodies

- Telecom operators

- Healthcare organizations

- Financial organizations

- Datacenter vendors

Report Objectives

- To define, describe, and forecast the data center transformation market based on service type, tier type, data center size, data center type, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments concerning five regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments in the global data center transformation market, such as product enhancements, new product launches, acquisitions, and partnerships and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Data Center Transformation Market