Curing Agents Market by Type (Epoxy, Polyurethane, Silicone Rubber, and Others), Application (Coatings, Electrical & Electronics, Composites, Adhesives, Construction, Wind Energy, and Others), and Region - Global Forecast to 2023

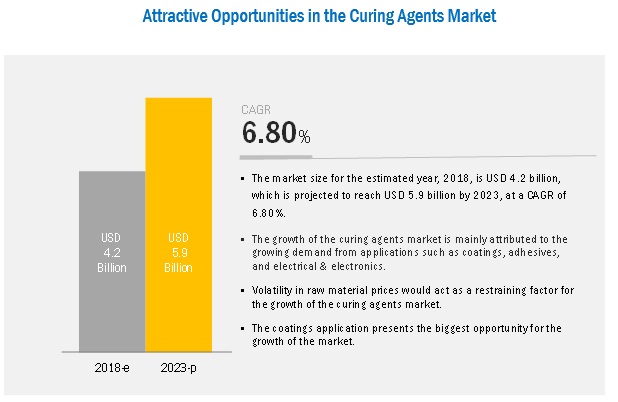

[138 Pages Report] The market for curing agents is projected to grow from USD 4.2 billion in 2018 to USD 5.9 billion by 2023, at a compound annual growth rate (CAGR) of 6.80% during the forecast period. The growth of applications such as coatings, wind energy, electrical & electronics, construction, composites, and adhesives is majorly driving the curing agents market.

The epoxy segment is estimated to account for the largest share of the curing agents market during the forecast period.

Epoxy resins are used for manufacturing coatings, adhesives, composites, and other products. They act as additives that are used to cure or harden various materials in different surroundings. The increase in the use of epoxy curing agents in applications such as coatings, wind energy, electrical & electronics, construction, composites, adhesives, and others is expected to boost its demand. The rising need for high performance, durable, and easy-to-use products is the key factor contributing to the growth of the epoxy-based curing agents market.

Coatings is estimated to be the largest application of curing agents during the forecast period.

Curing agents are used in marine, can & coil, decorative, protective, and general industrial coatings. Curing agents are used in primers to enhance the adhesion quality of coated parts in marine and other applications, especially on metal surfaces where corrosion and chemical resistance are important to protect them from damage or wear.

Drivers for the growth of the coatings sector are growing economy, growth in the end-use industrial activity, and an increase in its demand in the APAC region, especially from emerging economies such as China, India, Thailand, Indonesia, and Malaysia. For instance, in March 2017, Huntsman Corporation launched a new portfolio of low-temperature curing agents for heavy-duty industrial coating applications in sectors including oil & gas, marine, transportation, and industrial maintenance. Such developments are expected to propel the demand for curing agents in the coatings application.

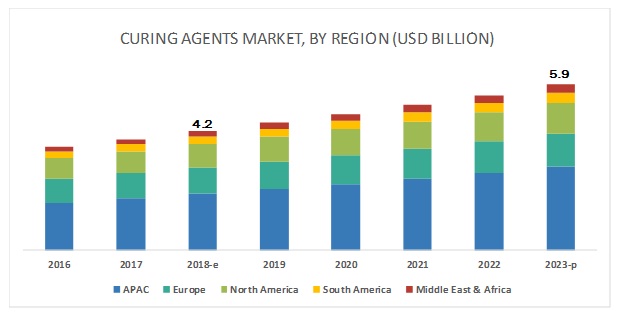

The curing agents market in APAC to register the highest CAGR during the forecast period.

APAC is the most promising end-use market and is expected to remain the same in the near future. The continuous rise in the manufacturing of products for use within the region and for exports drives the demand for curing agents. Rising population and growing end-use industries have led to innovation and developments in the end-use industries, making it a strong application industry hub globally.

Key Market Players

The major players operating in the curing agents market are Evonik Industries (Germany), Hexion Inc. (US), Huntsman Corporation (US), Cardolite Corporation (US), and BASF (Germany).

Founded in 2007 and headquartered in Essen (Germany), Evonik Industries is a leading global chemical manufacturer and service provider with a technologically advanced product portfolio serving its customers. The company is specialized in high-performance curing agents, catering to a variety of industries across the globe. The company is highly focused on the European market for sales of its products. However, it has ample opportunities in the emerging markets of APAC and the Middle East & Africa for the purpose of investments & expansions, as these high-growth markets offer lucrative growth opportunities.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) and Volume (KILOTON) |

|

Segments covered |

Type, Application, and Region |

|

Geographies Covered |

North America, Europe, APAC, South America, Middle East & Africa |

|

Companies Covered |

Evonik Industries (Germany), Hexion Inc. (US), Huntsman Corporation (US), Cardolite Corporation (US), and BASF S.E. (Germany) |

This research report categorizes the curing agents market based on types, applications, and region.

On the basis of type, the curing agents market has been segmented as follows:

- Epoxy

- Polyurethane

- Silicone Rubber

- Others (Acrylic, Natural Rubber, and Vinyl Ester)

On the basis of application, the curing agents market has been segmented as follows:

- Coatings

- Wind Energy

- Construction

- Adhesives

- Composites

- Electrical & Electronics

- Others (Elastomers, Additives, and Accelerators)

Recent Developments

- In January 2017, Evonik Industries acquired the specialty additive division of Air Products and Chemicals (US) for USD 3.8 billion. This acquisition helped Evonik increase its share in the global curing agents market.

- In December 2017, Cardolite introduced a new waterborne, emulsion-type curing agent for epoxy coatings, NX-8401. The product is completely free of solvent, has low viscosity, and is easily reducible with water.

- In March 2017, Huntsman Corporation, launched a new portfolio of low-temperature curing agents, Ara, for heavy-duty industrial coating applications in sectors including oil & gas, marine, transportation, and industrial maintenance.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming applications of curing agents?

- What are the key trends in the applications of curing agents?

- What are the trends in the technologies of curing agents?

- Who are the major players in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities in the Curing Agents Market

4.2 Curing Agents Market, By Type

4.3 Curing Agents Market in APAC, By Application and Country

4.4 Curing Agents Market Attractiveness

4.5 Curing Agents Market, Developed vs Developing Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Growth in Construction and Wind Energy Industries

5.2.1.2 Infrastructural Developments in Emerging Economies

5.2.1.3 Technological Innovation in Manufacturing Process

5.2.2 Restraints

5.2.2.1 Environmental and Health Regulatory Concerns

5.2.3 Opportunities

5.2.3.1 Potential High Growth in APAC

5.2.3.2 Emerging Economies Creating Ample Opportunities for the Manufacturers

5.2.4 Challenges

5.2.4.1 Increasing Competition From the Chinese Chemical Manufacturers

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Trends and Forecast of GDP

5.4.2 Growth Projection in Global Wind Capacity, 20172022

6 Curing Agents Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Epoxy Curing Agent

6.2.1 Amine-Based Curing Agents

6.2.1.1 Growth in the Coatings Application is Expected to Drive the Amine-Based Curing Agents Market

6.2.2 Anhydride Curing Agents

6.2.2.1 Growth in the Electronics Industry is Expected to Drive the Anhydrides Curing Agents Market

6.2.3 Other Epoxy Curing Agents

6.3 Polyurethane-Based Curing Agents

6.3.1 APAC Accounted for the Largest Share of the Polyurethane-Based Curing Agents Market

6.4 Silicone Rubber

6.4.1 Retention of Initial Shape in Heavy Thermal Stress Or Sub-Zero Temperatures is Driving the Demand for Silicone Rubber Curing Agents

6.5 Others

7 Curing Agents Market, By Application (Page No. - 53)

7.1 Introduction

7.2 Coatings

7.2.1 Coatings is Expected to Be the Largest Application of Curing Agents

7.3 Electrical & Electronics

7.3.1 The Use of Epoxy Resin in Electronics Circuits is Driving the Market

7.4 Wind Energy

7.4.1 Growing Wind Energy Sector in APAC is Driving the Market

7.5 Construction

7.5.1 Construction Activities in Emerging Economies are Expected to Drive the Curing Agents Market

7.6 Composites

7.6.1 The Demand for Composites is Increasing Significantly in Aerospace and Wind Energy Industries

7.7 Adhesives

7.7.1 Growing Demand for Adhesives in Industries Such as Construction, Automotive, Pharmaceutical, and Consumer Durables Packaging is Expected to Drive the Market

7.8 Others

8 Curing Agents Market, By Region (Page No. - 64)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Emergence of Key Players is Driving the Market

8.2.2 Japan

8.2.2.1 Japan's Adhesive Industry is Declining Due to the Maturity of the Market

8.2.3 South Korea

8.2.3.1 The Growth in the Electrical & Electronics Industry Will Positively Influence the Demand for Curing Agents in South Korea

8.2.4 India

8.2.4.1 India to Register the Highest CAGR in the Curing Agents Market During the Forecast Period

8.2.5 Indonesia

8.2.5.1 Easy Availability of Raw Materials and Low Import Taxes are the Major Factors Driving the Indonesian Economy

8.2.6 Taiwan

8.2.6.1 Domestic Demand and Improved Infrastructural Investments are Driving the Market in Taiwan

8.2.7 Malaysia

8.2.7.1 Growing Demand From the Construction Industry is Expected to Drive the Curing Agents Market

8.2.8 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 The US Dominates the North American Market Due to the High Demand for Coatings in the Country

8.3.2 Canada

8.3.2.1 The Coatings and Construction Applications are the Major Consumers of Curing Agents in Canada

8.3.3 Mexico

8.3.3.1 Construction is Expected to Be the Fastest-Growing Application Segment in the Mexican Curing Agents Market

8.4 Europe

8.4.1 Germany

8.4.1.1 Technological Leadership and Outstanding R&D are Leading to High Demand for Curing Agents

8.4.2 France

8.4.2.1 The Wind Energy Application is Expected to Drive the French Curing Agents Market

8.4.3 UK

8.4.3.1 The Developed Construction Industry is Expected to Drive the Curing Agents Market in the Uk

8.4.4 Italy

8.4.4.1 Construction, Automobile, and Wind Energy Applications are Expected to Drive the Curing Agents Market

8.4.5 Russia

8.4.5.1 The Financial Sanctions Imposed By the West Owing to Its Involvement in the Ukraine Crisis and Falling Oil Prices to Negatively Affect the Russian Economy

8.4.6 Turkey

8.4.6.1 Turkey is Rapidly Emerging as One of the Fastest-Growing Markets in Europe Due to the Undergoing Economic Revolution

8.4.7 Spain

8.4.7.1 Recovery in the Construction Industry is Expected to Drive the Market

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 The Growing Construction Sector is Expected to Propel the Demand for Curing Agents

8.5.2 UAE

8.5.2.1 The Growing Demand From the Buildings & Construction and Electrical & Electronics Applications is Expected to Spur the Demand for Curing Agents

8.5.3 South Africa

8.5.3.1 The Growing Industrialization and Urbanization is Primarily Driving the Demand for Curing Agents

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Brazil is Expected to Account for the Largest Share of the South American Curing Agents Market

8.6.2 Argentina

8.6.2.1 Strategic Industrial Plan 2020 By the Government Will Boost the Demand for Curing Agents

8.6.3 Colombia

8.6.3.1 The Automotive Industry Will Drive the Demand for Curing Agents

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 95)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 New Product Launch

9.2.2 Merger & Acquisition

10 Company Profiles (Page No. - 97)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Evonik Industries

10.2 Hexion Inc.

10.3 BASF SE

10.4 Huntsman Corporation

10.5 Olin Corporation

10.6 Cardolite Corporation

10.7 Kukdo Chemical Co., Ltd.

10.8 Aditya Birla Chemicals (Thailand) Ltd.

10.9 Mitsubishi Chemical Corporation

10.10 Atul Limited

10.11 Albemarle Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.12 Other Players

10.12.1 Royce International

10.12.2 Gabriel Performance Products

10.12.3 Campbell Plastics Limited

10.12.4 Cargill Inc.

10.12.5 Arnette Polymers

10.12.6 Epochemie International Pte Ltd

10.12.7 Kumiai Chemical Industry Co., Ltd.

10.12.8 Leuna-Harze GmbH

10.12.9 Nan Ya Plastics Corporation

10.12.10 Shandong Deyuan Epoxy Resin Co., Ltd

10.12.11 Spolchemie

10.12.12 Trans Oceanic Chemicals Pvt. Ltd.

11 Appendix (Page No. - 133)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (80 Tables)

Table 1 Curing Agents Market Snapshot, 2018 vs 2023

Table 2 Trends and Forecast of GDP, Percent Change

Table 3 Curing Agents Market Size, By Type, 20162023 (USD Million)

Table 4 Curing Agents Market Size, By Type, 20162023 (Kiloton)

Table 5 Epoxy Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 6 Epoxy Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 7 Epoxy Curing Agents Market Size, By Epoxy Type, 20162023 (USD Million)

Table 8 Epoxy Curing Agents Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 9 Amine-Based Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 10 Amine-Based Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 11 Anhydrides Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 12 Anhydrides Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 13 Other Epoxy Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 14 Other Epoxy Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 15 Polyurethane Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 16 Polyurethane Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 17 Silicone Rubber Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 18 Silicone Rubber Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 19 Other Curing Agents Market Size, By Region, 20162023 (USD Million)

Table 20 Other Curing Agents Market Size, By Region, 20162023 (Kiloton)

Table 21 By Market Size, By Application, 20162023 (Kiloton)

Table 22 By Market Size, By Application, 20162023 (USD Million)

Table 23 By Market Size in Coatings Application, By Region, 20162023 (Kiloton)

Table 24 By Market Size in Coatings Application, By Region, 20162023 (USD Million)

Table 25 By Market Size in Electrical & Electronics Application, By Region, 20162023 (Kiloton)

Table 26 By Market Size in Electrical & Electronics Application, By Region, 20162023 (USD Million)

Table 27 By Market Size in Wind Energy Application, By Region, 20162023 (Kiloton)

Table 28 By Market Size in Wind Energy Application, By Region, 20162023 (USD Million)

Table 29 By Market Size in Construction Application, By Region, 20162023 (Kiloton)

Table 30 By Market Size in Construction Application, By Region, 20162023 (USD Million)

Table 31 By Market Size in Composites Application, By Region, 20162023 (Kiloton)

Table 32 By Market Size in Composites Application, By Region, 20162023 (USD Million)

Table 33 By Market Size in Adhesives Application, By Region, 20162023 (Kiloton)

Table 34 By Market Size in Adhesives Application, By Region, 20162023 (USD Million)

Table 35 By Market Size in Others, By Region, 20162023 (Kiloton)

Table 36 By Market Size in Others, By Region, 20162023 (USD Million)

Table 37 By Market Size, By Region, 20162023 (Kiloton)

Table 38 By Market Size, By Region, 20162023 (USD Million)

Table 39 APAC: By Market Size, By Type, 20162023 (Kiloton)

Table 40 APAC: By Market Size, By Type, 20162023 (USD Million)

Table 41 APAC: By Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 42 APAC: By Market Size, By Epoxy Type, 20162023 (USD Million)

Table 43 APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 44 APAC: By Market Size, By Application, 20162023 (USD Million)

Table 45 APAC: By Market Size, By Country, 20162023 (Kiloton)

Table 46 APAC: By Market Size, By Country, 20162023 (USD Million)

Table 47 North America: By Market Size, By Type, 20162023 (Kiloton)

Table 48 North America: By Market Size, By Type, 20162023 (USD Million)

Table 49 North America: By Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 50 North America: By Market Size, By Epoxy Type, 20162023 (USD Million)

Table 51 North America: By Market Size, By Application, 20162023 (Kiloton)

Table 52 North America: By Market Size, By Application, 20162023 (USD Million)

Table 53 North America: By Market Size, By Country, 20162023 (Kiloton)

Table 54 North America: By Market Size, By Country, 20162023 (USD Million)

Table 55 Europe: By Market Size, By Type, 20162023 (Kiloton)

Table 56 Europe: By Market Size, By Type, 20162023 (USD Million)

Table 57 Europe: By Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 58 Europe: By Market Size, By Epoxy Type, 20162023 (USD Million)

Table 59 Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 60 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 61 Europe: By Market Size, By Country, 20162023 (Kiloton)

Table 62 Europe: By Market Size, By Country, 20162023 (USD Million)

Table 63 Middle East & Africa: By Market Size, By Type, 20162023 (Kiloton)

Table 64 Middle East & Africa: By Market Size, By Type, 20162023 (USD Million)

Table 65 Middle East & Africa: By Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 66 Middle East & Africa: By Market Size, By Epoxy Type, 20162023 (USD Million)

Table 67 Middle East & Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 68 Middle East & Africa: By Market Size, By Application, 20162023 (USD Million)

Table 69 Middle East & Africa: By Market Size, By Country, 20162023 (Kiloton)

Table 70 Middle East & Africa: By Market Size, By Country, 20162023 (USD Million)

Table 71 South America: By Market Size, By Type, 20162023 (Kiloton)

Table 72 South America: By Market Size, By Type, 20162023 (USD Million)

Table 73 South America: By Market Size, By Epoxy Type, 20162023 (Kiloton)

Table 74 South America: By Market Size, By Epoxy Type, 20162023 (USD Million)

Table 75 South America By Market Size, By Application, 20162023 (Kiloton)

Table 76 South America: By Market Size, By Application, 20162023 (USD Million)

Table 77 South America: By Market Size, By Country, 20162023 (Kiloton)

Table 78 South America: By Market Size, By Country, 20162023 (USD Million)

Table 79 New Product Launch, 20162018

Table 80 Merger & Acquisition, 20162018

List of Figures (40 Figures)

Figure 1 Curing Agents Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Curing Agents Market: Data Triangulation

Figure 5 APAC to Be the Leading Curing Agents Market

Figure 6 Epoxy Segment to Dominate the Curing Agents Market

Figure 7 Coatings to Be the Largest Application Segment of the Curing Agents Market

Figure 8 APAC Accounted for the Largest Market Share in 2017

Figure 9 Curing Agents Market to Register High Growth Between 2018 and 2023

Figure 10 Epoxy to Be the Largest Type Segment of the Curing Agents Market

Figure 11 Coatings Was the Largest Application for Curing Agents in APAC

Figure 12 India Emerging as A Lucrative Market for Curing Agents

Figure 13 Market in Developing Countries to Grow Faster Than Developed Countries

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Curing Agents Market

Figure 15 Curing Agents Market: Porters Five Forces Analysis

Figure 16 Cumulative Growth in Global Wind Capacity, 20172022

Figure 17 Epoxy Curing Agents to Be the Largest Type

Figure 18 Wind Energy to Be the Fastest-Growing Application

Figure 19 Coatings and Electrical & Electronics Industries to Drive the Market

Figure 20 India to Register the Highest CAGR During Forecast Period

Figure 21 APAC: Curing Agents Market Snapshot

Figure 22 North America: Curing Agents Market Snapshot

Figure 23 Rise in Demand for Coatings to Drive the Market in Europe

Figure 24 Increasing Investments in Building & Construction Industry is Driving the Market in the Middle East & Africa

Figure 25 Growth in the Construction Industry to Drive the Curing Agents Market in South America

Figure 26 New Product Launch Was the Key Growth Strategy Adopted By Players Between 2016 and 2018

Figure 27 Evonik Industries: Company Snapshot

Figure 28 Evonik Industries: SWOT Analysis

Figure 29 Hexion Inc.: Company Snapshot

Figure 30 Hexion Inc.: SWOT Analysis

Figure 31 BASF SE: Company Snapshot

Figure 32 BASF SE: SWOT Analysis

Figure 33 Huntsman Corporation: Company Snapshot

Figure 34 Huntsman Corporation: SWOT Analysis

Figure 35 Olin Corporation: Company Snapshot

Figure 36 Olin Corporation: SWOT Analysis

Figure 37 Aditya Birla Chemicals (Thailand) Ltd.: Company Snapshot

Figure 38 Mitsubishi Chemical Corporation: Company Snapshot

Figure 39 Atul Limited: Company Snapshot

Figure 40 Albemarle Corporation: Company Snapshot

The study involved four major activities in estimating the current market size for curing agents. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

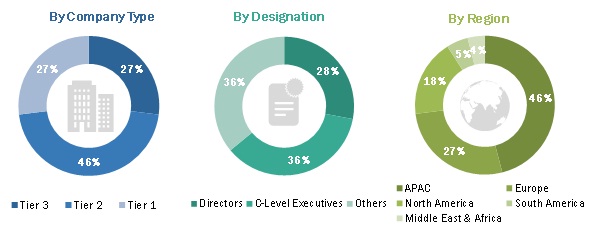

The curing agents market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of coating, adhesive, wind energy, and automotive & transportation industries. The supply side is characterized by advancements in technology and end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the curing agents market. These methods were also extensively used to estimate the size of various subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for curing agents

- To understand the structure of the curing agents market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across the key regions

- To analyze the competitive developments such as expansions & investments, new product launches, and mergers & acquisitions in the curing agents market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the curing agents market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Curing Agents Market