Cryo-electron Microscopy Market by Product & Service (Instruments, Software, Services), Technology (Electron Crystallography, Cryo-ET), Voltage (300 kV), Application (Cancer, Omics, Gene Therapy, Nanotechnology, Vaccine) & Region - Global Forecasts to 2028

Updated on : March 03, 2023

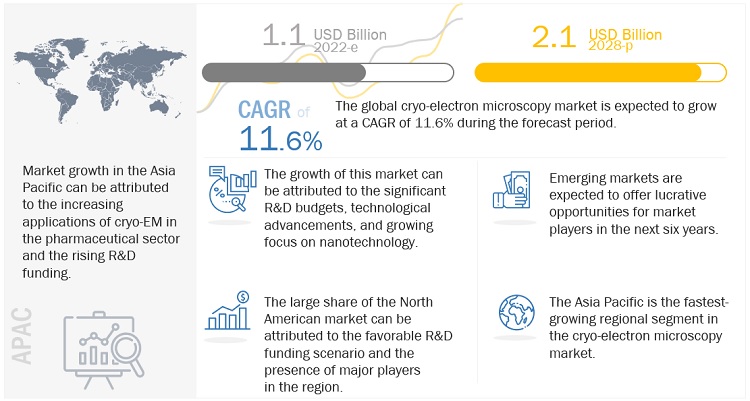

The global cryo-electron microscopy market in terms of revenue was estimated to be worth $1.1 billion in 2022 and is poised to reach $2.1 billion by 2028, growing at a CAGR of 11.6% from 2022 to 2028. The increasing focus on nanotechnology has risen the use of cryo-electron microscopes globally. Different academic and research institutes has increased the adoption of technologically advanced cryo-electron microscopes.

Global Cryo-Electron Microscopy Market

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Cryo-electron Microscopy Market Dynamics

Drivers: Technological advancements in cryo-electron microscopes

Recent years have seen significant advancements in cryo-electron microscopes, such as developments in direct electron detectors (DEDs) and data analysis software such as cryoSPARC, SerialEM, and CryoDiscovery. These technologically advanced detectors have improved sensors and detect electrons at increased frame rates with higher detector quantum efficiency (DQE). Recent advancements have also eliminated the challenges associated with sample preparation. These advancements has increased the popularity of the instruments in different sectors such as pharmaceutical & biotech industries and research institutes.

- Restraints: High equipment costs

Recent technological advancements, newly added features, and high resolution have increased the popularity of cryo-electron microscopes. There is a consistent rise in the cost of these systems with the addition of sample preparation & transfer systems and customized software for analyzing the generated images. The basic software solution is priced low but the software with advanced features and specific applications is often costly. In addition, there are recurrent expenses in the form of maintenance costs, which ultimately drive up the overall cost of ownership. This high cost has left users reliant on government and private research funding, which restricts market growth to a certain extent.

Opportunities: Growing opportunities in emerging markets

Developing countries, including China, India, Russia, and Brazil, offer significant growth opportunities for players in the microscopy market. Government funding for R&D in advanced microscopes has increased considerably in these countries. In addition to government funding, original equipment manufacturers (OEMs) in emerging markets provide opportunities for key players to outsource their microscopy products as a cost-saving strategy. Increasing use of cryo-electron microscopy technique for structural analysis of proteins and other biomolecules at an atomic scale for various applications in life science research is driving the growth of the market.

Challenges: Shortage of skilled professionals

Skilled personnel are required to use advanced cryo-electron microscopes. High-end microscopes are required to be maintained properly. This requires qualified service engineers to ensure optimal performance. The individual operating the high end microscopes requires to have a interdisciplinary knowledge to study the characterization of biological molecules at a nanoscale. The complexity of cryo-electron microscopes makes the shortage of skilled professionals a key challenge to their use and adoption.

By Technology, single particle analysis segment of cryo-electron microscopy market, accounted for the largest share in 2021.

Based on technology, the global market is segmented into electron crystallography, single particle analysis, cryo-electron tomography, and other technologies. In 2021, single particle analysis segment accounted for the largest share of market. Rising use of technogical advanced instruments neurodegenerative research, rapid freezing of the samples, and requirement of small amount of purified sample is driving the growth of this segment.

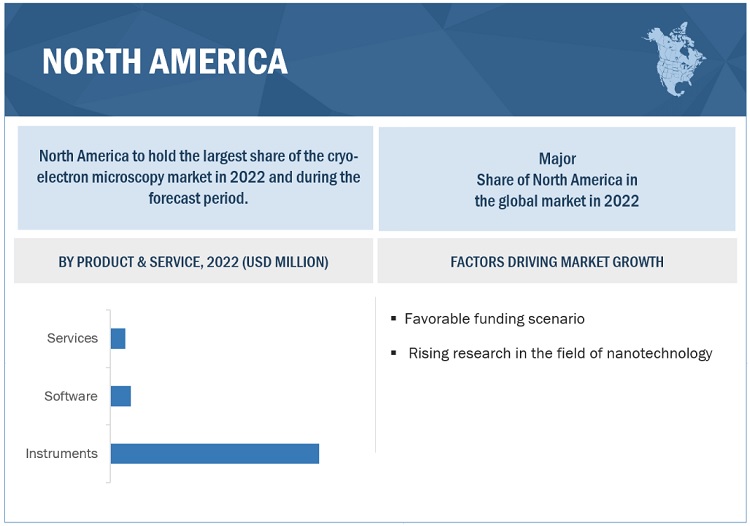

By product & service, instruments segment of cryo-electron microscopy market, accounted for the largest share in 2021

Based on product & services, the global market is segmented into instruments, software, and services. The instruments segment is further segmented into fully automated instruments and semi-automated instruments. In 2021, fully automated instruments accounted for the largest share of market. The highest share of this segment is attributed to the technological advancements and new product launches in the segment.

By application, life science research & academia segment of cryo-electron microscopy market, to register significant growth in near future

Based on application, the global market is segmented into life science research & academia, pharma & biotech manufacturing, healthcare/medical applications, material analysis, and nanotechnology. Life science research & academia to register the highest growth rate during the forecast period. The major factors responsible for the highest growth rate of this segment are numerous fundings to promote research and development in structural biology and rising assistance by the major players in the market by providing different grants for cryo-EM installation.

By Region, North America is expected to be the largest region of cryo-electron microscopy market, during the forecast period

North America, comprising the US and Canada, accounted for the largest share of market market in 2021. Factors such as increase in the funding to support research activities, rise in the number of clinical trials, and growing applications in healthcare/medical sector are driving the growth of the of market in North America.

To know about the assumptions considered for the study, download the pdf brochure

As of 2021, prominent players in the market are Thermo Fisher Scientific (US), Danaher (US), JEOL Ltd. (Japan), Intertek Group Plc (UK), Charles River Laboratories (US).

Cryo-electron Microscopy Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product & Service, Technology, Voltage, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Thermo Fisher Scientific (US), Danaher (US), JEOL (Japan), Intertek Group Plc (UK), Charles River Laboratories (US), Hitachi High-Technologies Corporation (Japan), Carl Zeiss (Germany), Gatan, Inc. (US), Oxford Instruments (UK) among others. |

This report has segmented the global cryo-electron microscopy market into following segments & sub-segments:

By Product & Service

- Instruments

- Fully Automated Instruments

- Semi-automated Instruments

- Software

- Services

By Technology

- Electron Crystallography

- Single Particle Analysis

- Cryo-electron Tomography

- Other Technologies

By Voltage

- 300 kV

- 200 kV

- 120 kV

By Application

- Life Science Research & Academia

- Cancer Research

- Omics Research

- Pharma & Biotech Manufacturing

- Cell & Gene Therapy

- Vaccines

- Preclinical & Clinical Research

- Healthcare/Medical Applications

- Disease Diagnosis & Pathology

- Toxicology Studies

- Material Analysis

- Nanotechnology

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In 2022, Thermo Fisher Scientific (US) launched the Glacios 2 Cryo-Transmission Electron Microscope (Cryo-TEM). The product features high-resolution capabilities and helps in drug discovery research.

- In 2022, Leica Microsystems (US), a subsidiary of Danaher launched a new Coral Cryo-electron workflow solution to support researchers with high-precision confocal 3D targeting

- In 2021, JEOL Ltd. (Japan) launched CRYO ARM 300 II. It is a cold emission cryo-electron microscope. It aims to enable the observation of biological specimens under high resolution

Frequently Asked Questions (FAQ):

What is the projected market value of the global cryo-electron microscopy market?

The global market of cryo-electron microscopy is projected to reach USD 2.1 billion.

What is the estimated growth rate (CAGR) of the global cryo-electron microscopy market for the next five years?

The global cryo-electron microscopy market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.6% from 2022 to 2028.

What are the major revenue pockets in the cryo-electron microscopy market currently?

North America, comprising the US and Canada, accounted for the largest share of market market in 2021. Factors such as increase in the funding to support research activities, rise in the number of clinical trials, and growing applications in healthcare/medical sector are driving the growth of the of cryo-electron microscopy market in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements in cryo-electron microscopes- Growing focus on nanotechnology- Increasing use of cryo-electron microscopy in drug discovery- Rising funding and grants for cryo-EM installationsRESTRAINTS- High equipment costsOPPORTUNITIES- Growing opportunities in emerging marketsCHALLENGES- Shortage of skilled professionals- Ambiguous regulatory network

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 TRADE ANALYSIS FOR ELECTRON MICROSCOPES

-

5.5 PATENT ANALYSIS

-

5.6 ECOSYSTEM COVERAGE: PARENT MARKET

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.9 PRICING TREND ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 CASE STUDYCASE–1: TO BETTER UNDERSTAND CRYO-EM STUDY OF KCC2 DIMER FOR DRUG DESIGN

- 5.12 KEY CONFERENCES & EVENTS (2023–2024)

- 6.1 INTRODUCTION

-

6.2 SINGLE PARTICLE ANALYSISRECENT ADVANCEMENTS IN SINGLE PARTICLE ANALYSIS TO FUEL MARKET GROWTH

-

6.3 CRYO-ELECTRON TOMOGRAPHYAPPLICATION OF CRYO-ELECTRON TOMOGRAPHY FOR DISEASE DIAGNOSIS TO DRIVE MARKET

-

6.4 ELECTRON CRYSTALLOGRAPHYINCREASING APPLICATION OF NANOCRYSTALLOGRAPHY TO CONTRIBUTE TO MARKET GROWTH

- 6.5 OTHER TECHNOLOGIES

- 7.1 INTRODUCTION

-

7.2 INSTRUMENTSFULLY AUTOMATED INSTRUMENTS- Rapid collection of data and high image quality to boost end-user demandSEMI-AUTOMATED INSTRUMENTS- Low cost of instruments to drive market

-

7.3 SOFTWAREINTRODUCTION OF NOVEL IMAGE ACQUISITION SOFTWARE AND TECHNOLOGICAL DEVELOPMENTS TO SUPPORT MARKET GROWTH

-

7.4 SERVICESGROWING DEMAND FOR IMAGE ANALYSIS AND DATA PROCESSING SERVICES TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 300 KV300 KV INSTRUMENTS TO DOMINATE MARKET OVER FORECAST PERIOD

-

8.3 200 KVRISING USE OF 200 KV CRYO-ELECTRON MICROSCOPES IN STUDYING MEMBRANE PROTEINS TO BOOST MARKET

-

8.4 120 KVLOW EQUIPMENT PRICES TO ENSURE SUSTAINED DEMAND

- 9.1 INTRODUCTION

-

9.2 PHARMA & BIOTECH MANUFACTURINGVACCINES- Increasing application of cryo-electron microscopy for structural determination of viruses to boost marketCELL & GENE THERAPY- Rising funding opportunities for cell & gene therapy research to support market growthCLINICAL & PRECLINICAL RESEARCH- Rising number of clinical trials to drive segment

-

9.3 LIFE SCIENCE RESEARCH & ACADEMIACANCER RESEARCH- High incidence of cancer and focus on oncology research to boost adoptionOMICS RESEARCH- Rising use of cryo-electron microscopy in disease pathogenesis to propel market

-

9.4 HEALTHCARE/MEDICAL APPLICATIONSDISEASE DIAGNOSIS & PATHOLOGY- Growing applications of cryo-electron microscopy in infectious disease research to boost growthTOXICOLOGY STUDIES- Rising clinical trial activity to contribute to segment growth

-

9.5 MATERIAL ANALYSISGROWING FOCUS ON RESEARCH IN MATERIAL SCIENCE TO DRIVE ADOPTION OF CRYO-ELECTRON MICROSCOPES

-

9.6 NANOTECHNOLOGYRISING FOCUS ON NANOTECHNOLOGY IN LIFE SCIENCE TO DRIVE MARKET

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- US to hold largest share of North American marketCANADA- Rising R&D funding and efforts to boost nanotechnology sector to drive market

-

10.3 EUROPEGERMANY- Germany to dominate European market over forecast periodUK- Continuous growth in life science research to drive microscopy marketFRANCE- Growing biotechnology industry to propel marketITALY- Well-established medical device industry to support marketSPAIN- High government expenditure on R&D in life sciences and nanotechnology to increase demand for cryo-electron microscopyREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- China to dominate APAC cryo-electron microscopy marketJAPAN- Significant use of cryo-electron microscopes in pharmaceutical industry and rising number of cryo-EM labs to drive marketINDIA- Significant growth in biotechnology industry and increasing installations of microscopes to propel marketAUSTRALIA- Tax credits and incentives in Australia to encourage R&DSOUTH KOREA- High spending on research activities and rising developments in pharmaceutical drug discovery to influence marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICARISING NANOTECHNOLOGY RESEARCH AND R&D ACTIVITIES TO PROPEL MARKET

-

10.6 MIDDLE EAST & AFRICAGROWING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

- 11.1 OVERVIEW

- 11.2 RIGHT TO WIN

- 11.3 KEY PLAYER STRATEGIES

- 11.4 REVENUE SHARE ANALYSIS

- 11.5 MARKET SHARE ANALYSIS

-

11.6 COMPANY EVALUATION QUADRANT (2021)VENDOR INCLUSION CRITERIASTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.7 COMPANY EVALUATION QUADRANT FOR EMERGING COMPANIES/SMES/ START-UPS (2021)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developments- MnM viewDANAHER- Business overview- Products offered- Recent developments- MnM viewJEOL LTD.- Business overview- Products offered- Recent developments- MnM viewINTERTEK GROUP PLC- Business overview- Services offered- Recent developmentsCHARLES RIVER LABORATORIES- Business overview- Services offered- Recent developmentsCARL ZEISS AG (ZEISS GROUP)- Business overview- Products offered- Recent developmentsHITACHI HIGH-TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developmentsOXFORD INSTRUMENTS- Business overview- Products offered- Recent developmentsGATAN, INC.- Business overview- Products offered- Recent developmentsSTRUCTURA BIOTECHNOLOGY- Business overview- Products offered- Recent developmentsCREATIVE BIOSTRUCTURE- Business overview- Services offeredDIRECT ELECTRON- Business overview- Products offered- Recent developmentsNANOIMAGING SERVICES- Business overview- Services offered- Recent developments

-

12.2 OTHER COMPANIESNEXPERIONATEM STRUCTURAL DISCOVERYIMAGE SCIENCE SOFTWARE GMBHEYEN SELINKAM SCIENTIFIC INSTRUMENTSEMBLCREATIVE BIOARRAYVIRONOVAFRED HUTCHINSON CANCER CENTERPROTEROS BIOSTRUCTURES GMBHHEALTH TECHNOLOGY INNOVATIONSCREATIVE BIOLABSDIAMOND LIGHT SOURCENOVALIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 FUNDING AND GRANTS FOR CRYO-ELECTRON MICROSCOPY

- TABLE 2 RECENT FUNDING FOR R&D IN CRYO-ELECTRON MICROSCOPY

- TABLE 3 CRYO-ELECTRON MICROSCOPY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 IMPORT DATA FOR ELECTRON MICROSCOPES, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 5 EXPORT DATA FOR ELECTRON MICROSCOPES, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 6 PRICE COMPARISON OF VARIOUS CRYO-ELECTRON MICROSCOPES

- TABLE 7 IMPORTANT PRODUCT LAUNCHES IN CRYO-ELECTRON MICROSCOPY MARKET (2018–2022)

- TABLE 8 CRYO-ELECTRON MICROSCOPY MARKET: DETAILED LIST OF MAJOR CONFERENCES & EVENTS (2023–2024)

- TABLE 9 CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 10 SINGLE PARTICLE ANALYSIS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 11 CRYO-ELECTRON TOMOGRAPHY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 12 ELECTRON CRYSTALLOGRAPHY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 13 CRYO-ELECTRON MICROSCOPY MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 14 CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 15 CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 16 CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 17 FULLY AUTOMATED INSTRUMENTS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 18 SEMI-AUTOMATED INSTRUMENTS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 19 CRYO-ELECTRON MICROSCOPY SOFTWARE MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 20 CRYO-ELECTRON MICROSCOPY SERVICES MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 21 CRYO-ELECTRON MICROSCOPY MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 22 CRYO-ELECTRON MICROSCOPY MARKET FOR 300 KV INSTRUMENTS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 23 CRYO-ELECTRON MICROSCOPY MARKET FOR 200 KV INSTRUMENTS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 24 CRYO-ELECTRON MICROSCOPY MARKET FOR 120 KV INSTRUMENTS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 25 CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 26 CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY REGION, 2020–2028 (USD MILLION)

- TABLE 27 CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 28 CRYO-ELECTRON MICROSCOPY MARKET FOR VACCINES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 29 CRYO-ELECTRON MICROSCOPY MARKET FOR CELL & GENE THERAPY, BY REGION, 2020–2028 (USD MILLION)

- TABLE 30 CRYO-ELECTRON MICROSCOPY MARKET FOR CLINICAL & PRECLINICAL RESEARCH, BY REGION, 2020–2028 (USD MILLION)

- TABLE 31 CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY REGION, 2020–2028 (USD MILLION)

- TABLE 32 CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 33 CRYO-ELECTRON MICROSCOPY MARKET FOR CANCER RESEARCH, BY REGION, 2020–2028 (USD MILLION)

- TABLE 34 CRYO-ELECTRON MICROSCOPY MARKET FOR OMICS RESEARCH, BY REGION, 2020–2028 (USD MILLION)

- TABLE 35 CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 36 CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 37 CRYO-ELECTRON MICROSCOPY MARKET FOR DISEASE DIAGNOSIS & PATHOLOGY, BY REGION, 2020–2028 (USD MILLION)

- TABLE 38 CRYO-ELECTRON MICROSCOPY MARKET FOR TOXICOLOGY STUDIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 39 CRYO-ELECTRON MICROSCOPY MARKET FOR MATERIAL ANALYSIS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 40 CRYO-ELECTRON MICROSCOPY MARKET FOR NANOTECHNOLOGY, BY REGION, 2020–2028 (USD MILLION)

- TABLE 41 CRYO-ELECTRON MICROSCOPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 42 CRYO-ELECTRON MICROSCOPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 52 US: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 53 US: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 54 CANADA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 55 CANADA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 56 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 57 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 58 EUROPE: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 59 EUROPE: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 60 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 61 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 62 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 63 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 64 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 65 GERMANY: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 66 GERMANY: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 67 UK: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 68 UK: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 69 FRANCE: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 70 FRANCE: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 71 ITALY: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 72 ITALY: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 73 SPAIN: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 74 SPAIN: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 75 ROE: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 76 ROE: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 86 CHINA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 87 CHINA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 88 JAPAN: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 89 JAPAN: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 90 INDIA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 91 INDIA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 92 AUSTRALIA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 93 AUSTRALIA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 94 SOUTH KOREA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 95 SOUTH KOREA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 96 ROAPAC: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 97 ROAPAC: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 99 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 101 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 103 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2020–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2020–2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2020–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET FOR LIFE SCIENCE RESEARCH & ACADEMIA, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET FOR PHARMA & BIOTECH MANUFACTURING, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: CRYO-ELECTRON MICROSCOPY MARKET FOR HEALTHCARE/MEDICAL APPLICATIONS, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 114 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS IN CRYO-ELECTRON MICROSCOPY MARKET

- TABLE 115 CRYO-ELECTRON MICROSCOPY MARKET: PRODUCT LAUNCHES, JANUARY 2020–DECEMBER 2022

- TABLE 116 CRYO-ELECTRON MICROSCOPY MARKET: DEALS, JANUARY 2020–JANUARY 2023

- TABLE 117 CRYO-ELECTRON MICROSCOPY MARKET: OTHER DEVELOPMENTS, JANUARY 2020–DECEMBER 2022

- TABLE 118 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 119 DANAHER.: COMPANY OVERVIEW

- TABLE 120 JEOL LTD.: COMPANY OVERVIEW

- TABLE 121 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 122 CHARLES RIVER LABORATORIES: COMPANY OVERVIEW

- TABLE 123 CARL ZEISS AG: COMPANY OVERVIEW

- TABLE 124 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 125 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- TABLE 126 GATAN, INC.: COMPANY OVERVIEW

- TABLE 127 STRUCTURA BIOTECHNOLOGY: COMPANY OVERVIEW

- TABLE 128 CREATIVE BIOSTRUCTURE: COMPANY OVERVIEW

- TABLE 129 DIRECT ELECTRON: COMPANY OVERVIEW

- TABLE 130 NANOIMAGING SERVICES: COMPANY OVERVIEW

- FIGURE 1 CRYO-ELECTRON MICROSCOPY MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

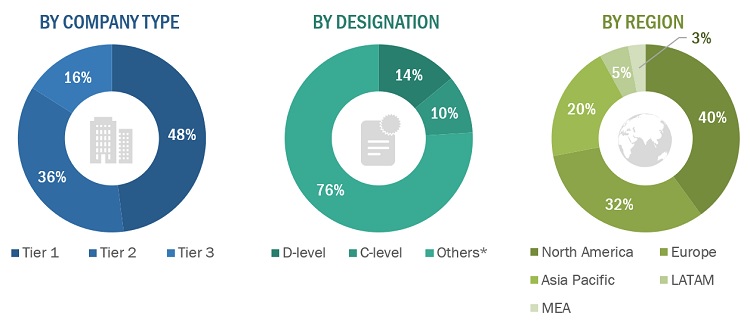

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION: CRYO-ELECTRON MICROSCOPY MARKET

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 CRYO-ELECTRON MICROSCOPY MARKET, BY PRODUCT & SERVICE, 2022 VS. 2028 (USD MILLION)

- FIGURE 9 CRYO-ELECTRON MICROSCOPY INSTRUMENTS MARKET, BY VOLTAGE, 2022 VS. 2028 (USD MILLION)

- FIGURE 10 CRYO-ELECTRON MICROSCOPY MARKET, BY APPLICATION, 2022 VS. 2028 (USD MILLION)

- FIGURE 11 CRYO-ELECTRON MICROSCOPY MARKET, BY TECHNOLOGY, 2022 VS. 2028 (USD MILLION)

- FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR

- FIGURE 13 RISING FOCUS ON NANOTECHNOLOGY TO DRIVE MARKET GROWTH

- FIGURE 14 CRYO-ELECTRON MICROSCOPY INSTRUMENTS TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 15 CRYO-ELECTRON TOMOGRAPHY TO REGISTER SIGNIFICANT GROWTH IN ASIA PACIFIC

- FIGURE 16 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 CRYO-ELECTRON MICROSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 TOP 10 PATENT APPLICANTS FOR CRYO-ELECTRON MICROSCOPY (JANUARY 2012–JUNE 2022)

- FIGURE 19 CRYO-ELECTRON MICROSCOPY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 NORTH AMERICA: CRYO-ELECTRON MICROSCOPY MARKET SNAPSHOT

- FIGURE 21 ASIA PACIFIC: CRYO-ELECTRON MICROSCOPY MARKET SNAPSHOT

- FIGURE 22 REVENUE SHARE ANALYSIS OF TOP THREE PLAYERS IN CRYO-ELECTRON MICROSCOPY MARKET (2019–2021)

- FIGURE 23 THERMO FISHER SCIENTIFIC HELD LEADING POSITION IN CRYO-ELECTRON MICROSCOPY MARKET IN 2021

- FIGURE 24 CRYO-ELECTRON MICROSCOPY MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 25 CRYO-ELECTRON MICROSCOPY MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- FIGURE 26 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

- FIGURE 27 DANAHER: COMPANY SNAPSHOT (2021)

- FIGURE 28 JEOL LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 29 INTERTEK GROUP PLC: COMPANY SNAPSHOT (2021)

- FIGURE 30 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 31 CARL ZEISS AG: COMPANY SNAPSHOT (2021)

- FIGURE 32 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 33 OXFORD INSTRUMENTS: COMPANY SNAPSHOT (2021)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the cryo-electron microscopy market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in cryo-electron microscopy market. The primary sources from the demand side include medical OEMs, Oncologists, CDMOs and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

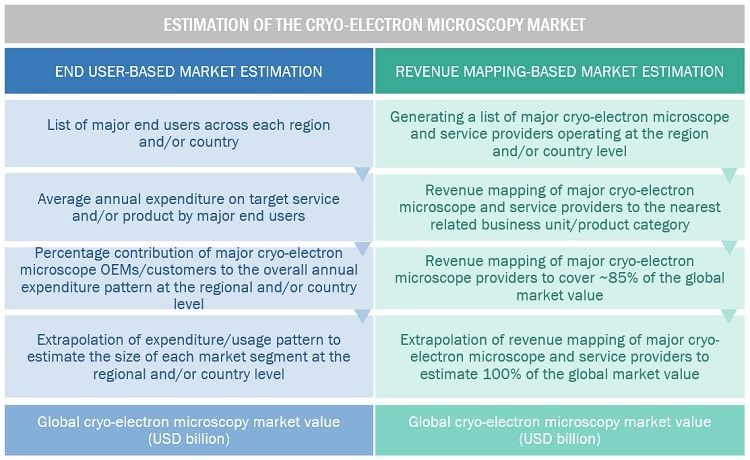

Market Estimation Methodology

In this report, the cryo-electron microscopy market's size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover major share of the global market share, as of 2021

- Extrapolating the global value of the market industry

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast cryo-electron microscopy market on the basis of product & service, technology, application, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global market.

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea and the RoAPAC), Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global cryo-electron microscopy market, such as product launches; agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global cryo-electron microscopy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American market into Brazil, Mexico, Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryo-electron Microscopy Market