Crude Sulfate Turpentine Market by Type (Alpha Pinene, Beta Pinene, Delta 3 Carene, Camphene, Limonene), Application (Aromatic Chemicals, Adhesives, Paints and printing inks, Camphor), and Region - Global Forecast to 2022

The crude sulfate turpentine market is projected to grow at a CAGR of 4.10% from 2016 to 2022, to reach USD 279.5 Million by 2022. The base year considered for the study is 2015, and the forecast period is from 2016 to 2022. The basic objective of the report is to define, segment, and project the global market size for crude sulfate turpentine on the basis of type, application, and region. It also helps to understand the structure of the global market by identifying its various subsegments. The other objectives include analyzing the opportunities in the market for stakeholders and provide a competitive landscape of market trends, analyzing the macro and micro indicators of this market to provide factor analysis and to project the size of the global market and its submarkets, in terms of value.

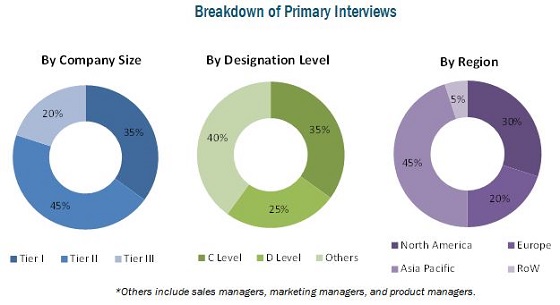

This report includes estimations of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global crude sulfate turpentine market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the supply chain of the crude sulfate turpentine market are crude sulfate turpentine manufacturers. The key players that are profiled in the report include Renessenz LLC (U.S.), International Flavors & Fragrances Inc. (U.S.), Privi Organics Limited (India), Dujodwala Paper Chemicals Ltd. (India), Arizona Chemical Company LLC (U.S.), Derives Resiniques et Terpeniqes (France), Lawter Inc. (U.S.), Harting S.A. (Chile), and Pine Chemical Group (Finland).

This report is targeted at the existing players in the industry, which include the following:

- Manufacturers, importers & exporters, traders, distributors, and suppliers of crude sulfate turpentine

- Raw material suppliers

- Government authorities

“The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments.”

Scope of the Report:

On the basis of type, the market has been segmented into:

- Alpha-pinene

- Beta-pinene

- Delta-3-Carene

- Camphene

- Limonene

- Others (terpenes and p-cymene)

On the basis of application, the market has been segmented into:

- Aromatic Chemicals

- Adhesives

- Paints and printing inks

- Camphor

- Others (metallurgy and textile)

On the basis of region, the market has been segmented into:

- North America

- Europe

- Asia-Pacific

- ROW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- Further country specific data and its market analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Crude sulfate turpentine has become prominent in recent years due to the increasing demand for fragrance ingredients that require crude sulfate turpentine derivatives; increasing preference of consumers towards eco-friendly products that include crude sulfate turpentine as a substitute to petrochemicals; and increasing demand for personal care products such as perfumes, detergents, and soaps.

On the basis of type, the global market was led by alpha-pinene and was followed by beta-pinene and delta-3-carene in 2015. Alpha-pinene is the leading segment owing to the lower cost of production involved when compared with the other types of turpentine derivatives. The others type segment, which includes p-cymene, dipentene, and terpenes, is expected to register the highest growth rate due to the high application of p-cymene for manufacturing essential oils and also the increasing usage of dipentene as a solvent in cleaning products, paints, and perfumes among others.

The crude sulfate turpentine market, on the basis of application, is segmented into aromatic chemicals, adhesives, paints and printing inks, camphor, and others. Aromatic chemicals accounted for the largest market share in 2015. They are used to a large extent for personal care products across the globe. Aromatic chemicals is extensively used in fast-moving consumable goods in countries with a high population such as India and China.

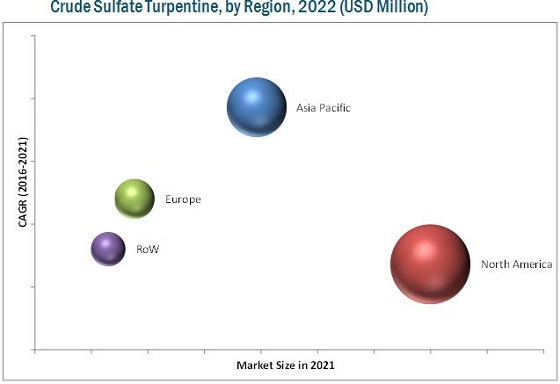

North America accounted for the largest market share for crude sulfate turpentine in 2015. Asia-Pacific is projected to be the fastest-growing market during the forecast period considered, due to the high consumption of crude sulfate turpentine in countries such as India and China. This is attributed to the high population in countries and also increasing demand for personal care products in the Asia-Pacific region.

The major restraining factor for the market is that distillation requires high investments that restricts manufacturers from efficient utilization of the raw material. Moreover, low recovery of black liquor through the kraft process is expected to hamper the market growth of the crude sulfate turpentine globally over the forecast period

Derives Resiniques eT Terpeniqes (France), one of the prominent players in the crude sulfate turpentine market, focuses on strengthening its crude sulfate turpentine portfolio through expanding its production unit for terpene derivatives in the North American region. Its core competencies are an extensive product portfolio that includes alpha-pinene and beta-pinene and also caters to varied industries such as adhesives and perfumes. In March 2015, the company signed an agreement with Safic-Alcan (France), a specialty chemical distributor in order to expand business in Czech Republic, Hungary, and Slovakia.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Market Scope

1.4.1 Markets Covered

1.4.2 Geographic Scope

1.4.3 Years Considered for the Study

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Per Capita Global GDP Over the Years

2.2.2.2 Rate of Urbanization

2.2.3 Supply-Side Analysis

2.2.3.1 High Levels of Marketing and Advertising

2.2.3.2 Increasing Trends in the Extent of Planted Forests

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitation

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in this Market

4.2 Crude Sulfate Turpentine Market, By Application

4.3 Crude Sulfate Turpentine Market in the North American Region

4.4 Rest of Asia-Pacific is Projected to Be the Fastest-Growing Market

4.5 Market, By Application

4.6 Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Demand for Fragrance Ingredients Requiring Crude Sulfate Turpentine

5.3.1.2 High Percentage of Forests Designated for Production in Nordic Countries

5.3.1.3 Rising Production of Paper, Ensuring Cheap Raw Materials

5.3.2 Restraints

5.3.2.1 Dependence on the Wood and Paper Industry for Raw Material

5.3.2.2 High Cost of Further Processing After Fractional Distillation

5.3.2.3 Low Recovery Rate Through Kraft Process

5.3.3 Opportunities

5.3.3.1 Rising Demand for High-Value Personal Care Products in Middle Income Countries

5.3.3.2 Adoption of Crude Sulfate Turpentine as A Substitute to Petrochemicals Due to Its Eco-Friendly Nature

5.3.4 Challenges

5.3.4.1 Cost Difference in Producing Different Types of Crude Sulfate Turpentine

5.3.4.2 Hazardous Nature of the Organic Solvent

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis: Distillation Stage Adds Maximum Value

6.4 Trade Analysis

6.4.1 Gum and Sulfate Turpentine Oils

6.4.2 Terpenic Oils, Crude Dipentene, Crude Para-Cymene and Others

6.4.3 Pine Oil

6.5 Porter’s Five Forces Analysis

6.5.1 Intensity of Competitive Rivalry

6.5.2 Bargaining Power of Suppliers

6.5.3 Bargaining Power of Buyers

6.5.4 Threat of New Entrants

6.5.5 Threat of Substitutes

7 Crude Sulfate Turpentine Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Alpha-Pinene

7.3 Beta-Pinene

7.4 Delta-3-Carene

7.5 Camphene

7.6 Limonene

7.7 Other Types

8 Crude Sulfate Turpentine Market, By Application (Page No. - 67)

8.1 Introduction

8.2 Aromatic Chemicals

8.3 Adhesives

8.4 Paints and Printing Inks

8.5 Camphor

8.6 Other Applications

9 Crude Sulfate Turpentine Market, By Region (Page No. - 75)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 Spain

9.3.3 Russia

9.3.4 U.K.

9.3.5 Finland

9.3.6 Germany

9.3.7 Rest of Europe

9.4 Asia-Pacific

9.4.1 India

9.4.2 China

9.4.3 Japan

9.4.4 New Zealand

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Others in RoW

10 Competitive Landscape (Page No. - 133)

10.1 Overview

10.2 Competitive Situation & Trends

10.2.1 Acquisitions

10.2.2 Expansions

10.2.3 Agreements

11 Company Profiles (Page No. - 137)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

11.1 Introduction

11.2 International Flavors & Fragrances Inc. (IFF)

11.3 Lawter Inc.

11.4 DRT (Derives Resiniques ET Terpeniqes)

11.5 Privi Organics Limited

11.6 Renessenz LLC (Symrise Ag)

11.7 Dujodwala Paper Chemicals Ltd. (DPCL)

11.8 Arizona Chemical Company LLC

11.9 Harting S.A.

11.10 Pine Chemical Group

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 149)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (131 Tables)

Table 1 Crude Sulfate Turpentine Market Size, By Type, 2014–2022 ( USD Million)

Table 2 Market Size, By Type, 2014–2022 (Tons)

Table 3 Alpha-Pinene Market Size, By Region, 2014–2022 (USD Million)

Table 4 Alpha-Pinene Market Size, By Region, 2014–2022 (Tons)

Table 5 Beta-Pinene Market Size, By Region, 2014–2022 (USD Million)

Table 6 Beta-Pinene Market Size, By Region, 2014–2022 (Tons)

Table 7 Delta-3-Carene Market Size, By Region, 2014–2022 (USD Million)

Table 8 Delta-3-Carene Market Size, By Region, 2014–2022 (Tons)

Table 9 Camphene Market Size, By Region, 2014–2022 (USD Million)

Table 10 Camphene Market Size, By Region, 2014–2022 (Tons)

Table 11 Limonene Market Size, By Region, 2014–2022 (USD Million)

Table 12 Limonene Market Size, By Region, 2014–2022 (Tons)

Table 13 Other Types Market Size, By Region, 2014–2022 (USD Million)

Table 14 Other Types Market Size, By Region, 2014–2022 (Tons)

Table 15 Crude Sulfate Turpentine Market Size, By Application, 2014–2022 (USD Million)

Table 16 Aromatic Chemicals Market Size, By Region, 2014–2022 (USD Million)

Table 17 Adhesives Market Size, By Region, 2014–2022 (USD Million)

Table 18 Paints and Printing Inks Market Size, By Region, 2014–2022 (USD Million)

Table 19 Camphor Market Size, By Region, 2014–2022 (USD Million)

Table 20 Other Applications Market Size, By Region, 2014–2022 (USD Million)

Table 21 Market Size for Crude Sulfate Turpentine, By Region, 2014-2022 (USD Million)

Table 22 Market Size, By Region, 2014-2022 (Tons)

Table 23 North America: Crude Sulfate Turpentine Market Size, By Country, 2014-2022 (USD Million)

Table 24 North America: Market Size, By Country, 2014-2022 (Tons)

Table 25 North America: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 26 North America: Market Size, By Type, 2014-2022 (Tons)

Table 27 North America: Alpha-Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 28 North America: Alpha-Pinene Market Size, By Country, 2014-2022 (Tons)

Table 29 North America: Beta-Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 30 North America: Beta-Pinene Market Size, By Country, 2014-2022 (Tons)

Table 31 North America: Delta-3-Carene Market Size, By Country, 2014-2022 (USD Million)

Table 32 North America: Delta-3-Carene Market Size, By Country, 2014-2022 (Tons)

Table 33 North America: Camphene Market Size, By Country, 2014-2022 (USD Million)

Table 34 North America: Camphene Market Size, By Country, 2014-2022 (Tons)

Table 35 North America: Limonene Market Size, By Country, 2014-2022 (USD Million)

Table 36 North America: Limonene Market Size, By Country, 2014-2022 (Tons)

Table 37 North America: Crude Sulfate Turpentine Market Size for Other Types, By Country, 2014-2022 (USD Million)

Table 38 North America: Market Size for Other Types, By Country, 2014-2022 (Tons)

Table 39 North America: Market Size for Crude Sulfate Turpentine, By Application, 2014-2022 (USD Million)

Table 40 North America: Market Size, By Application, 2014-2022 (Tons)

Table 41 U.S.: Market Size, By Type, 2014-2022 (USD Million)

Table 42 U.S.: Market Size, By Type, 2014-2022 (Tons)

Table 43 Canada: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 44 Canada: Market Size, By Type, 2014-2022 (Tons)

Table 45 Mexico: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 46 Mexico: Market Size, By Type, 2014-2022 (Tons)

Table 47 Europe: Market Size for Crude Sulfate Turpentine, By Country, 2014-2022 (USD Million)

Table 48 Europe: Market Size, By Country, 2014-2022 (Tons)

Table 49 Europe: Crude Sulfate Turpentine Market Size, By Type, 2014-2022 (USD Million)

Table 50 Europe: Market Size, By Type, 2014-2022 (Tons)

Table 51 Europe: Alpha-Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 52 Europe: Alpha-Pinene Market Size, By Country, 2014-2022 (Tons)

Table 53 Europe: Beta-Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 54 Europe: Beta-Pinene Market Size, By Country, 2014-2022 (Tons)

Table 55 Europe: Delta-3-Carene Market Size, By Country, 2014-2022 (USD Million)

Table 56 Europe: Delta-3-Carene Market Size, By Country, 2014-2022 (Tons)

Table 57 Europe: Camphene Market Size, By Country, 2014-2022 (USD Million)

Table 58 Europe: Camphene Market Size, By Country, 2014-2022 (Tons)

Table 59 Europe: Limonene Market Size, By Country, 2014-2022 (USD Million)

Table 60 Europe: Limonene Market Size, By Country, 2014-2022 (Tons)

Table 61 Europe: Market Size for Other Types, By Country, 2014-2022 (USD Million)

Table 62 Europe: Market Size for Other Types, By Country, 2014-2022 (Tons)

Table 63 Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 64 Europe: Market Size, By Application, 2014-2022 (Tons)

Table 65 France: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 66 France: Market Size, By Type, 2014-2022 (Tons)

Table 67 Spain: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 68 Spain: Market Size, By Type, 2014-2022 (Tons)

Table 69 Russia: Market Size, By Type, 2014-2022 (USD Million)

Table 70 Russia: Market Size, By Type, 2014-2022 (Tons)

Table 71 U.K.: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 72 U.K.: Market Size, By Type, 2014-2022 (Tons)

Table 73 Finland: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 74 Finland: Market Size, By Type, 2014-2022 (Tons)

Table 75 Germany: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 76 Germany: Market Size, By Type, 2014-2022 (Tons)

Table 77 Rest of Europe: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 78 Rest of Europe: Market Size, By Type, 2014-2022 (Tons)

Table 79 Asia-Pacific: Market Size for Crude Sulfate Turpentine, By Country, 2014-2022 (USD Million)

Table 80 Asia-Pacific: Market Size, By Country, 2016-2022 (Tons)

Table 81 Asia Pacific: Crude Sulfate Turpentine Market Size, By Type, 2014-2022 (USD Million)

Table 82 Asia Pacific: Market Size, By Type, 2014-2022 (Tons)

Table 83 Asia Pacific: Alpha Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 84 Asia Pacific: Alpha Pinene Market Size, By Country, 2014-2022 (Tons)

Table 85 Asia Pacific: Beta Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 86 Asia Pacific: Beta Pinene Market Size, By Country, 2014-2022 (Tons)

Table 87 Asia Pacific: Delta-3-Carene Market Size, By Country, 2014-2022 (USD Million)

Table 88 Asia Pacific: Delta-3-Carene Market Size, By Country, 2014-2022 (Tons)

Table 89 Asia Pacific: Camphene Market Size, By Country, 2014-2022 (USD Million)

Table 90 Asia Pacific: Camphene Market Size, By Country, 2014-2022 (Tons)

Table 91 Asia Pacific: Limonene Market Size, By Country, 2014-2022 (USD Million)

Table 92 Asia Pacific: Limonene Market Size, By Country, 2014-2022 (Tons)

Table 93 Asia Pacific: Market Size for Other Types, By Country, 2014-2022 (USD Million)

Table 94 Asia Pacific: Market Size for Other Types, By Country, 2014-2022 (Tons)

Table 95 Asia Pacific: Market Size for Crude Sulfate Turpentine, By Application, 2014-2022 (USD Million)

Table 96 India: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 97 India: Market Size, By Type, 2014-2022 (Tons)

Table 98 China: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 99 China: Market Size, By Type, 2014-2022 (Tons)

Table 100 Japan: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 101 Japan: Market Size, By Type, 2014-2022 (Tons)

Table 102 New Zealand: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 103 New Zealand: Market Size, By Type, 2014-2022 (Tons)

Table 104 Rest of Asia Pacific: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 105 Rest of Asia Pacific: Market Size, By Type, 2014-2022 (Tons)

Table 106 ROW: Crude Sulfate Turpentine Market Size, By Country, 2014-2022 (USD Million)

Table 107 ROW: Market Size, By Country, 2016-2022 (Tons)

Table 108 ROW: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 109 ROW: Market Size, By Type, 2014-2022 (Tons)

Table 110 ROW: Alpha Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 111 ROW: Alpha Pinene Market Size, By Country, 2014-2022 (Tons)

Table 112 ROW: Beta Pinene Market Size, By Country, 2014-2022 (USD Million)

Table 113 ROW: Beta Pinene Market Size, By Country, 2014-2022 (Tons)

Table 114 ROW: Delta-3-Carene Market Size, By Country, 2014-2022 (USD Million)

Table 115 ROW: Delta-3-Carene Market Size, By Country, 2014-2022 (Tons)

Table 116 ROW: Camphene Market Size, By Country, 2014-2022 (USD Million)

Table 117 ROW: Camphene Market Size, By Country, 2014-2022 (Tons)

Table 118 ROW: Limonene Market Size, By Country, 2014-2022 (USD Million)

Table 119 ROW: Limonene Market Size, By Country, 2014-2022 (Tons)

Table 120 ROW: Crude Sulfate Turpentine Market Size for Other Types, By Country, 2014-2022 (USD Million)

Table 121 ROW: Market Size for Other Types, By Country, 2014-2022 (Tons)

Table 122 ROW: Market Size for Crude Sulfate Turpentine, By Application, 2014-2022 (USD Million)

Table 123 Brazil: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 124 Brazil: Market Size, By Type, 2014-2022 (Tons)

Table 125 Argentina: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 126 Argentina: Market Size, By Type, 2014-2022 (Tons)

Table 127 Others in ROW: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (USD Million)

Table 128 Rest of ROW: Market Size for Crude Sulfate Turpentine, By Type, 2014-2022 (Tons)

Table 129 Acquisitions, 2010-2015

Table 130 Expansions, 2012-2015

Table 131 Agreements, 2012-2015

List of Figures (51 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design: Crude Sulfate Turpentine Market

Figure 3 Breakdown of Primary Interviews Share

Figure 4 Global Per Capita GDP, 2008-2014 (Current USD)

Figure 5 Average Annual Rate of Urbanization (2010-2015)

Figure 6 Planted Forest Trends By Country (1990-2010)

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Asia-Pacific is Projected to Be the Fastest-Growing Region for the Global Market From 2016 to 2022

Figure 11 Market Size for Crude Sulfate Turpentine, By Region, 2016 vs 2022 (USD Million)

Figure 12 Comparative Analysis of the Crude Sulfate Turpentine Market By Application

Figure 13 Alpha-Pinene Segment is Estimated to Hold the Largest Market Share in 2016

Figure 14 Key Players Adopted Acquisitions and Agreements as Their Key Strategies From 2012 to 2016

Figure 15 Emerging Economies Offer Attractive Opportunities in this Market

Figure 16 North America Was the Largest Market for Crude Sulfate Turpentine in 2016

Figure 17 Rest of Asia-Pacifc is Projected to Be the Fastest-Growing Country-Level Market for Crude Sulfate Turpentine From 2016 to 2022

Figure 18 Aromatic Chemicals Dominated the Global Market in 2015

Figure 19 The Crude Sulfate Turpentine Market in Asia-Pacific is Experiencing High Growth

Figure 20 Market Segmentation, By Type

Figure 21 Market, By Application

Figure 22 High Percentage of Forests Designated for Production Use Drives the Global Market

Figure 23 Increase in Capacity Per Paper Producing Mill (1980-2013)

Figure 24 Personal Care Products Market Share, By Region, 2010

Figure 25 Supply Chain: Procuring Raw Material From Paper Industry is an Important Stage

Figure 26 Import-Export Value: Gum and Sulfate Turpentine Oils (2015)

Figure 27 Import-Export Value: Terpenic Oils, Crude Dipentene, Crude Para-Cymene and Others (2015)

Figure 28 Import Value: Pine Oil (2014 & 2015)

Figure 29 Porter’s Five Forces Analysis: Crude Sulfate Turpentine Market

Figure 30 Alpha-Pinene is Projected to Dominate the Crude Sulfate Turpentine Market Through 2022 (USD Million)

Figure 31 Asia Pacific Region is Expected to Be the Fastest Growing Market for Alpha-Pinene From 2016 to 2022 (USD Million)

Figure 32 Asia-Pacific Region is Expected to Be the Fastest Growing Market for Beta-Pinene From 2016 to 2022 (USD Million)

Figure 33 Asia Pacific Region is Projected to Grow at the Highest Rate for the Delta-3-Carene Market Between 2016 and 2022 (USD Million)

Figure 34 North American Region is Projected to Dominate the Camphene Market Through 2022 (USD Million)

Figure 35 Asia-Pacific is Projected to Register the Highest Growth Rate for the Limonene Market From 2016 to 2022 (USD Million)

Figure 36 Asia Pacific Region is Projected to Grow at the Highest Rate for the Other Types Market From 2016 to 2022 (USD Million)

Figure 37 Aromatic Chemicals is Projected to Be the Largest Segment Through 2022 (USD Million)

Figure 38 Aromatic Chemicals Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 39 Adhesives Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 40 Paints and Printing Inks Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 41 Camphor Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 42 Other Applications Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 43 Regional Snapshot (2015): the Markets in Mexico and Germany are Emerging as New Hot Spots

Figure 44 North American Crude Sulfate Turpentine Market Snapshot: Mexico is Projected to Grow at A High Rate Between 2016 & 2022

Figure 45 Asia-Pacific Crude Sulfate Turpentine Market Snapshot

Figure 46 Key Companies Preferred Acquisitions & Expansions Over the Last Five Years

Figure 47 Key Companies Preferred Strategies Such as Agreements & Acquisitions From 2012 to 2015

Figure 48 Annual Developments in the Global Crude Sulfate Turpentine Market, 2012-2015

Figure 49 Geographic Revenue Mix of Top Market Players

Figure 50 International Flavors & Fragrances Inc.: Company Snapshot

Figure 51 Dujodwala Paper Chemicals Ltd. (DPCL): Company Snapshot

Growth opportunities and latent adjacency in Crude Sulfate Turpentine Market