Crop Monitoring Market by Offering (Hardware, Software, Services), Technology (Sensing & Imagery, VRT), Application (Field Mapping, Soil Monitoring, Crop Scouting), Farm Size, Region - Global Forecast to 2025

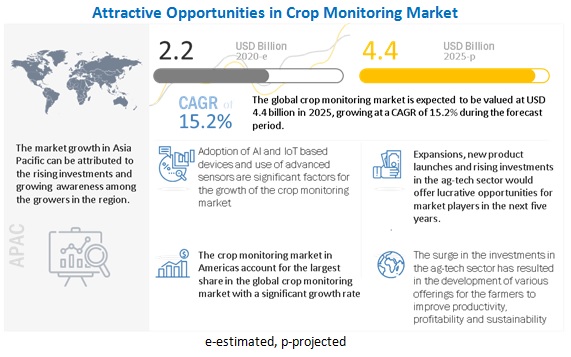

The crop monitoring market is estimated to be USD 2.2 billion in 2020 and projected to reach USD 4.4 billion by 2025, growing at a CAGR of 15.2% during the forecast period.

The surging investments in the agriculture technology segment, rising adoption of IoT and AI based devices for crop monitoring, rising concerns for the improvement of farm productivity and profitability as well as the increasing awareness among the farmers towards the use of remote sensing technology are some of the driving factors for the crop monitoring market.

Impact of AI in Crop Monitoring Market

The integration of artificial intelligence (AI) in the crop monitoring market is transforming modern agriculture by enabling precise, data-driven decision-making to optimize yield, reduce resource usage, and improve overall farm productivity. AI-powered systems analyze real-time data from drones, satellites, and ground sensors to monitor crop health, detect diseases or pest infestations early, and forecast weather-related risks with high accuracy. This allows farmers to implement timely interventions and adopt precision farming practices that minimize waste and maximize output. As a result, AI is driving significant advancements in sustainable agriculture, reducing operational costs, and boosting the global adoption of smart crop monitoring solutions.

Crop Monitoring Market Dynamics

Driver: Rising adoption of AI and IoT-based crop monitoring devices

The emergence of the IoT and AI based devices for the crop monitoring has been one of the driving factor for the growth of the crop monitoring market. Moreover the connected environment along with the remote monitoring capabilities has resulted in higher adoption of these devices. The use of smart sensors is becoming mainstream in the agriculture sector owing to the developments in the field of sensors and their affordability. Companies such as Prospera Technologies (Israel), Blue River Technology (US), Bosch (Germany), CropIn Technology (India), and Sigfox (France) are a few companies that have created a major impact in the market by offering advance technologies such as AI and IoT for better crop monitoring and management.

Low penetration of advance agriculture technologies in developing countries

The digital divide in the developing countries between the rural and urban areas has been a huge restraining factor for the growth of crop monitoring market in developing countries. Several barriers to the adoption of technologies in developing countries such as unskilled farmers, a less techno-savvy and family-owned farming model have led to a poor adoption of advanced technology in the developing countries. Moreover, the low awareness among farmers in the rural areas of developing economies towards the technology has resulted in the lower adoption of sensing & imagery technology for crop monitoring.

Opportunity: Further boost of digitization plan in agriculture sector due to COVID-19

The COVID-19 pandemic could be an opportunity for the companies operating in the crop monitoring market. The disruptions caused by the pandemic at the global level leading to troubled supply chain, sortage of labor due to lockdowns and temporariry shutting of the manufacturing facilities. This could result in the automation and digitization of agriculture sector in the post COVID-19 world. Digital agriculture has become an attractive segment for the players in the ariculture technology as the farmers have identified income-generation opportunities through enterprises that deliver digitally empowered services to farmers. A majority of players in the market have already invested extensively to cater to this group.

Challenge: Small and fragmented land holdings in large parts of world

One of the major challenge faced by the companies in the crop monitoring market is catering to the farmers with the small and fragmeneted land holding. The implementation of the remote sensing, VRT, and automation and robotics is based on the economies of scale where a small holding will not provide a significant return. The countires like China and India have huge potential in the market, however the land holdings in these countries are quite small and fragmented. This could be a significant challenge in the development of market across the world.

Sensing and imagery were the most extensively used technology in the global crop monitoring market in2019

Sensing and imagery accounted for the largest share in the crop monitoring market in the year 2019. The higher adoption of remote sensing technology by the farmers enabling them to monitor their farms remotely has resulted in the such large adoption. The sensing and imagery technology is expected to get a further boost during the forecast period. The market for automation and robotics is expected to grow at the highest rate during the period 2020-2025. The rising labor crisis in most of the countries could lead to a demand for the automation and robotics in the market.

Medium type of farms to hold larger market share during forecast period

The medium sized farms are expected to hold the largest market share in the crop monitoring market during the forecast period. This is due to the presence of large number of medium sized farms across the world and the significant returns earned by the implementation of various technologies such as remote sensing, automation and robotics, and variable rate technology. The small sized farms are expected to grow at the highest rate in the market during the period 2020-2025. The small farms are more common in the countries like India, China and several Southeast Asian countries, which are investing significant amount of money to digitize the agriculture sector. Moreover the presence of various companies in these countries has led to a demand for the advanced agriculture technology in the small farms.

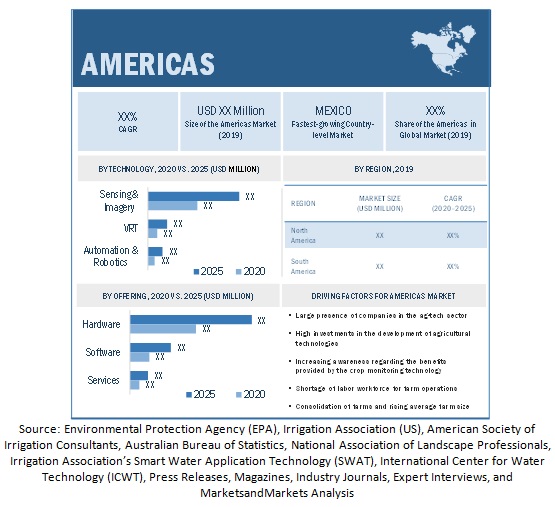

Americas held the largest market for the crop monitoring in 2019 and is expected to dominate during the forecast period

Americas held the largest share in the crop monitoring market in 2019 and could dominate the market during the forecast period. The presence of agri-tech giants such as Trimble, John Deere, AGCO, etc. is the prominent reason for the large market share in the market. However the APAC region is expected to witness a high growth during the forecast period owing to the high degree of adoption of agriculture technology in the countries like India, China, Australia and Japan. Further the major reforms to boost and digitize the agriculture sector, undertaken by the government in the APAC region could propel the growth of market in APAC.

Crop Monitoring Market Key Players

The major players in the crop monitoring market are Topcon Corporation (Japan), Trimble (US), The Climate Corporation (US), Yara International (Norway) and CropX Technologies (Israel).

Crop Monitroing Market Report Scope

|

Report Metric |

Scope |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million), and Volume (Million Units) |

|

Segments covered |

By Offering, By Technology, By Farm Size, and By Application |

|

Geographies covered |

Americas (North America & South America), Europe, Asia Pacific, and Rest of World |

|

Companies covered |

A few of the major players in the crop monitoring market are Trimble (US), Topcon Corporation (Japan), Yara International (Norway), The Climate Corporation (US), CropX Technologies (Israel), Cropio (US), Earth Observing System (US), PrecisionHawk (US), AgLeader (US), and Taranis (Israel). |

The study categorizes the crop monitoring market based on offering, technology, farm type, application at the regional and global level.

By Offering

- Hardware

- Software

- Services

By Technology

- Sensing and Imagery

- Variable Rate Technology

- Automation and Robotics

By Farm Type

- Small

- Medium

- Large

By Application

- Field mapping

- Crop scouting and monitoring

- Soil monitoring

- Yield mappping and monitoring

- Variable rate application

- Weather tracking and forecasting

- Others

By Region

- Americas

- Europe

- Asia Pacific

- Rest of World

Recent Developments in Crop Monitoring Industry

- Topcon Agriculture, a subsidiary of Topcon Corporation, partnered with CropZilla (US) for data sharing. This partnership will allow Topcon Agriculture Platform, an API, to be used in the CropZilla Web Mobile Analytics platform. It will further help the two companies to provide additional value to the end users, dealers, and OEMs.

- Trimble (US) launched a new platform, Farmer Core, to connect the entire farm operation. This product will enable growers to control various operations of their farms.

- The Climate Corporation announced its partnership with CLASS (Germany) to provide seamless connectivity solutions to farmers. This partnership will enable farmers to store the agronomic data into their FieldView account using CLAS TELEMATICS and cloud-to-cloud access to machine-generated data.

- Yara International collaborated with IBM (US) to launch an open collaboration for farm and field data. This collaboration will invite farmer associations, industry players, academia, and NGOs to join a movement to develop an open data exchange that facilitates collaboration around farm and field data, to improve efficiency and sustainability in the global food production.

- Cropx Technologies acquired cropmetrics (us), a company that specializes in cloud-based precision agriculture tools. This acquisition will enable cropx to increase its geographical footprint and to provide affordable and scalable solutions to farmers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 CROP MONITORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Major List of Primary Participants

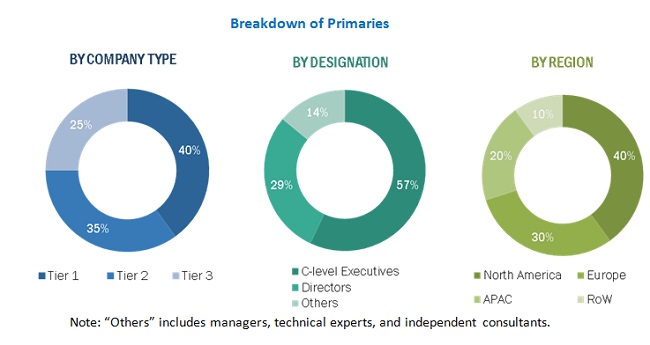

2.1.2.3 Breakdown of primaries

2.1.2.4 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: DEMAND SIDE APPROACH

TABLE 1 REMOTE SENSING TECHNOLOGY PENETRATION IN MAJOR COUNTRIES

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

3.1 REALISTIC (POST-COVID-19) SCENARIO

3.2 OPTIMISTIC (POST-COVID-19) SCENARIO

3.3 PESSIMISTIC (POST-COVID-19) SCENARIO

FIGURE 7 CROP MONITORING MARKET, 2017–2025 (USD MILLION)

FIGURE 8 MARKET FOR SOFTWARE TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 9 MARKET FOR AUTOMATION & ROBOTICS POISED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 10 CROP SCOUTING AND MONITORING APPLICATION TO HOLD LARGEST SIZE OF MARKET IN 2020

FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2020

FIGURE 12 MEDIUM-SIZED FARMS TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN CROP MONITORING MARKET

FIGURE 13 INCREASING ADOPTION OF HYPERSPECTRAL IMAGING CAMERAS AND IOT-BASED DEVICES IN AGRICULTURE FOR CROP MONITORING

4.2 MARKET IN APAC, BY TECHNOLOGY AND COUNTRY

FIGURE 14 AUSTRALIA AND SENSING & IMAGERY TECHNOLOGY WERE LARGEST SHAREHOLDERS OF MARKET IN ASIA PACIFIC IN 2019

4.3 MARKET, BY OFFERING

FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2020 AND 2025

4.4 MARKET, BY APPLICATION

FIGURE 16 CROP SCOUTING AND MONITORING TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2020

4.5 GEOGRAPHIC ANALYSIS OF MARKET

FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 CROP MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising adoption of AI and IoT-based crop monitoring devices

5.2.1.2 Increasing concerns for high yield, farmers’ profitability, food safety, and traceability

FIGURE 19 AGRICULTURAL CROP OUTPUT PER HECTARE (2018)

5.2.1.3 Growing literacy among growers regarding digital and remote sensing technologies worldwide

5.2.1.4 Surging investments in ag-tech and venture capital deals in terms of volume and size

FIGURE 20 GLOBAL ANNUAL FUNDING IN AGRICULTURE TECHNOLOGY, 2012-2020 (USD BILLION)

FIGURE 21 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Low penetration of advance agriculture technologies in developing countries

5.2.2.2 Barriers created by limited internet connectivity in developing countries

FIGURE 22 INTERNET PENETRATION IN DEVELOPING COUNTRIES (2019)

FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Further boost of digitization plan in agriculture sector due to COVID-19

5.2.3.2 Increasing focus on sustainable agriculture and profitability for farmers

5.2.3.3 Surging adoption of remote sensing technology and variable rate technology

FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Temporary supply chain disruptions due to COVID-19 pandemic

5.2.4.2 Analyzing big data gathered from farms and interoperability of different standards

5.2.4.3 Small and fragmented land holdings in large parts of world

FIGURE 25 CROP HARVESTED AREA FOR DIFFERENT REGIONS (MILLION HECTARES)

FIGURE 26 IMPACT ANALYSIS: CHALLENGES

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INTRODUCTION

6.2 MAJOR TECHNOLOGY TRENDS IN MARKET

6.2.1 ADVANCEMENTS IN HYPERSPECTRAL AND MULTISPECTRAL IMAGING TECHNOLOGIES

6.2.2 EVOLVING IOT SOLUTIONS FOR CONNECTED FARMING

6.3 MAJOR PLAYERS AT DIFFERENT STAGES OF VALUE CHAIN IN MARKET

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN: CROP MONITORING MARKET

6.5 TECHNOLOGY ROADMAP

6.5.1 TECHNOLOGY ROADMAP (2010–2025)

FIGURE 28 PRESENT AND UPCOMING TECHNOLOGIES IN MARKET

6.6 IMPACT OF COVID-19 ON MARKET

7 CROP MONITORING MARKET, BY OFFERING (Page No. - 70)

7.1 INTRODUCTION

FIGURE 29 MARKET FOR SOFTWARE IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 2 MARKET, BY OFFERING, 2017–2025 (USD MILLION)

7.2 HARDWARE

TABLE 3 CROP MONITORING HARDWARE MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 4 MARKET FOR HARDWARE, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 5 MARKET FOR HARDWARE, BY APPLICATION, 2017–2025 (USD MILLION)

FIGURE 30 PENETRATION OF CROP MONITORING TECHNOLOGY IN SMALL FARMS IS EXPECTED TO GROW AT HIGHEST RATE DURING 2020–2025

TABLE 6 MARKET FOR HARDWARE, BY FARM TYPE, 2017–2025 (USD MILLION)

TABLE 7 MARKET FOR HARDWARE, BY REGION, 2017–2025 (USD MILLION)

7.2.1 SENSING & MONITORING DEVICES

FIGURE 31 CAMERA SYSTEMS EXPECTED TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 8 MARKET FOR SENSING AND MONITORING DEVICES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 9 MARKET FOR SENSING AND MONITORING DEVICES, BY FARM TYPE, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR SENSING AND MONITORING DEVICES, BY REGION, 2017–2025 (USD MILLION)

7.2.1.1 Sensors

FIGURE 32 MOISTURE SENSORS TO HOLD LARGEST SHARE OF CROP MONITORING MARKET IN 2025

TABLE 11 MARKET FOR SENSORS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 12 MARKET FOR SENSORS, BY FARM TYPE,2017–2025 (USD MILLION)

TABLE 13 MARKET FOR SENSORS, BY REGION, 2017–2025 (THOUSAND UNITS)

7.2.1.1.1 Nutrient sensors

7.2.1.1.1.1 Nutrient sensors to witness significant growth during forecast period owing to developments in precision agriculture practices

7.2.1.1.2 Moisture sensors

7.2.1.1.2.1 Moisture sensors to witness higher adoption for efficient management of irrigation

7.2.1.1.3 Temperature sensors

7.2.1.1.3.1 Increasing adoption of temperature sensors for sowing and checking suitability of soil for planting

7.2.1.1.4 Water sensors

7.2.1.1.4.1 Need to focus on effective control on irrigation to drive use of water sensors

7.2.1.1.5 Climate sensors

7.2.1.1.5.1 Uncertainties related to weather and climate to propel demand for climate sensors

7.2.1.1.6 Others

7.2.1.2 Camera systems

7.2.1.2.1 Surging adoption of hyperspectral imaging cameras for crop monitoring and NDVI measurement

7.2.1.3 Yield monitors

7.2.1.3.1 Market for yield monitor application to grow at significant rate during forecast period

TABLE 14 MARKET FOR YIELD MONITORS, BY FARM SIZE, 2017–2025 (USD MILLION)

7.2.1.4 Others

7.2.2 AUTOMATION & CONTROL

FIGURE 33 SMART CONTROLLERS ARE EXPECTED TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 15 MARKET FOR AUTOMATION AND CONTROL DEVICES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR AUTOMATION AND CONTROL DEVICES, BY FARM SIZE, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR AUTOMATION AND CONTROL DEVICES, BY REGION, 2017–2025 (USD MILLION)

7.2.2.1 GNSS/GPS

FIGURE 34 MARKET FOR RTK IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET FOR GPS/GNSS DEVICES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 19 MARKET FOR GPS DEVICES, BY FARM SIZE, 2017–2025 (USD MILLION)

7.2.2.1.1 DGPS

7.2.2.1.1.1 High demand for DGPS devices in variable rate applications

7.2.2.1.2 RTK

7.2.2.1.2.1 RTK receivers to witness higher growth owing to higher accuracy in signal correction

7.2.2.2 Displays

7.2.2.2.1 Integration of display devices into crop monitoring systems is expected to drive market growth

7.2.2.3 Smart controllers

7.2.2.3.1 Demand for irrigation controllers and fertilizer controllers to witness substantial growth during post-COVID-19 pandemic

7.2.2.4 Others

7.3 SOFTWARE

FIGURE 35 MARKET FOR ON-CLOUD SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 20 MARKET FOR SOFTWARE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 21 MARKET FOR SOFTWARE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 22 MARKET FOR SOFTWARE, BY FARM SIZE, 2017–2025 (USD MILLION)

TABLE 23 MARKET FOR SOFTWARE, BY REGION, 2017–2025 (USD MILLION)

7.3.1 ON CLOUD

7.3.1.1 Increasing popularity of software-as-a-service model fuels demand for cloud technology to ensure remote access to crucial data

7.3.2 ON PREMISE

7.3.2.1 On-premise delivery model held smaller share of crop monitoring software market in 2019

7.4 SERVICES

FIGURE 36 SYSTEM INTEGRATION AND CONSULTING SERVICES TO HOLD LARGEST MARKET SHARE AMONG OTHER SERVICES IN 2020

TABLE 24 CROP MONITORING MARKET FOR SERVICES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR SERVICES, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR SERVICES, BY FARM SIZE, 2017–2025 (USD MILLION)

FIGURE 37 MARKET IN APAC IS EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 27 MARKET FOR SERVICES, BY REGION, 2017–2025 (USD MILLION)

7.4.1 SYSTEM INTEGRATION AND CONSULTING

7.4.1.1 System integration and consulting services held largest share in 2019

7.4.2 MANAGED SERVICES

TABLE 28 MARKET FOR MANAGED SERVICES, BY TYPE, 2017–2025 (USD MILLION)

7.4.2.1 Farm operations

7.4.2.1.1 Transforming traditional farm operations toward digital platform to boost market for farm operation services

7.4.2.2 Data services

7.4.2.2.1 Increasing penetration of mobile applications has contributed toward higher demand for data services

7.4.2.3 AI-based analytics

7.4.2.3.1 AI-based analytics to provide actionable insights to farmers by addressing crop health-related issues

7.4.3 CONNECTED SERVICES

7.4.3.1 Connected Services have strong growth potential in coming years

7.4.4 ASSISTED PROFESSIONAL SERVICES

7.4.4.1 Supply chain management services

7.4.4.2 Climate information services

8 CROP MONITORING MARKET, BY TECHNOLOGY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 38 AUTOMATION & ROBOTICS TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2020 TO 2025

TABLE 29 MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

8.2 SENSING & IMAGERY

TABLE 30 MARKET FOR SENSING & IMAGERY TECHNOLOGY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 31 MARKET FOR SENSING & IMAGERY TECHNOLOGY, BY OFFERING, 2017–2025 (USD MILLION)

FIGURE 39 MARKET FOR WEATHER TRACKING & FORECASTING TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 32 MARKET FOR SENSING & IMAGERY TECHNOLOGY, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 33 MARKET FOR SENSING & IMAGERY TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 34 MARKET FOR SENSING & IMAGERY TECHNOLOGY, BY FARM SIZE, 2017–2025 (USD MILLION)

8.2.1 SATELLITE REMOTE SENSING

8.2.1.1 Satellite remote sensing held largest share of market for sensing and imagery technology in 2019

8.2.2 DRONE BASED/ AERIAL SENSING

8.2.2.1 Market for Drone imaging is expected to grow at fastest rate during forecast period

8.2.3 GROUND-BASED SENSING

8.2.3.1 Surging adoption of telematics has resulted in demand for ground-based sensing devices

8.3 VARIABLE RATE TECHNOLOGY

8.3.1 VARIABLE RATE TECHNOLOGY IS GAINING MOMENTUM DUE TO INCREASING AWARENESS AMONG FARMERS

FIGURE 40 HARDWARE SEGMENT IS EXPECTED TO HOLD A MAJOR SHARE OF MARKET FOR VRT IN 2020

TABLE 35 MARKET FOR VRT, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 36 MARKET FOR VRT, BY REGION, 2017–2025 (USD MILLION)

TABLE 37 MARKET FOR VRT, BY FARM SIZE, 2017–2025 (USD MILLION)

8.4 AUTOMATION AND ROBOTICS

8.4.1 MARKET FOR AUTOMATION AND ROBOTICS IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 38 MARKET FOR AUTOMATION & ROBOTICS, BY OFFERING, 2017–2025 (USD MILLION)

FIGURE 41 MARKET FOR AUTOMATION AND ROBOTICS IN APAC IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 39 MARKET FOR AUTOMATION & ROBOTICS TECHNOLOGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 40 MARKET FOR AUTOMATION & ROBOTICS TECHNOLOGY, BY FARM SIZE, 2017–2025 (USD MILLION)

9 CROP MONITORING MARKET, BY APPLICATION (Page No. - 109)

9.1 INTRODUCTION

FIGURE 42 MARKET FOR WEATHER TRACKING & FORECASTING APPLICATION IS EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 41 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

9.2 FIELD MAPPING

TABLE 42 MARKET FOR FIELD MAPPING APPLICATION, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 43 MARKET FOR FIELD MAPPING, BY REGION, 2017–2025 (USD MILLION)

9.2.1 BOUNDARY MAPPING

9.2.1.1 Boundary mapping is expected to exhibit higher growth

9.2.2 DRAINAGE MAPPING

9.2.2.1 Drainage mapping to witness high demand owing to rising use of precision agriculture technology

9.3 SOIL MONITORING

9.3.1 SOIL MONITORING IS WITNESSING SURGE IN DEMAND FOR MEASURING SOIL MOISTURE CONTENT, SALINITY, AND TEMPERATURE

FIGURE 43 SENSING AND IMAGERY HOLDS LARGER SHARE OF MARKET FOR SOIL MONITORING APPLICATION

TABLE 44 MARKET FOR SOIL MONITORING APPLICATION, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 45 MARKET FOR SOIL MONITORING APPLICATION, BY REGION, 2017–2025 (USD MILLION)

9.4 CROP SCOUTING AND MONITORING

9.4.1 CROP SCOUTING AND MONITORING APPLICATION HOLDS MAJOR CHUNK OF MARKET

TABLE 46 MARKET FOR CROP SCOUTING APPLICATION, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 47 MARKET FOR CROP SCOUTING AND MONITORING APPLICATION, BY REGION, 2017–2025 (USD MILLION)

9.5 YIELD MAPPING AND MONITORING

9.5.1 YIELD MONITORING PROVIDES FARMERS INFORMATION ABOUT WEATHER CONDITIONS, SOIL PROPERTIES, AND FERTILIZERS

TABLE 48 BENEFITS OF YIELD MONITORING

TABLE 49 MARKET FOR YIELD MONITORING APPLICATION, BY TECHNOLOGY, 2017–2025 (USD MILLION)

FIGURE 44 MARKET FOR YIELD MONITORING APPLICATION IN APAC IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 50 MARKET FOR YIELD MONITORING, BY REGION, 2017–2025 (USD MILLION)

9.5.2 ON-FARM YIELD MONITORING

9.5.3 OFF-FARM YIELD MONITORING

9.6 VARIABLE RATE APPLICATION

9.6.1 RISE OF CROP MONITORING TECHNIQUES WILL LEAD TO WIDER ADOPTION OF VARIABLE RATE TECHNOLOGY

TABLE 51 CROP MONITORING MARKET FOR VARIABLE RATE APPLICATION, BY REGION, 2017–2025 (USD MILLION)

9.6.2 PRECISION IRRIGATION

9.6.3 PRECISION FERTILIZING

9.6.3.1 Nitrogen VRA

9.6.3.2 Phosphorous VRA

9.6.3.3 Lime VRA

9.6.4 PESTICIDE VRA

9.7 WEATHER TRACKING & FORECASTING

9.7.1 MARKET FOR WEATHER TRACKING & FORECASTING APPLICATION TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 45 MARKET FOR WEATHER TRACKING & FORECASTING APPLICATION IN APAC IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 52 MARKET FOR WEATHER TRACKING AND FORECASTING APPLICATION, BY REGION, 2017–2025 (USD MILLION)

9.8 OTHERS

10 CROP MONITORING MARKET, BY FARM SIZE (Page No. - 125)

10.1 INTRODUCTION

FIGURE 46 PENETRATION OF CROP MONITORING TECHNOLOGIES IN SMALL-SIZED FARMS IS EXPECTED TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 53 MARKET, BY FARM SIZE, 2017–2025 (USD MILLION)

10.2 LARGE-SIZED FARMS (ABOVE 400 HECTARES)

TABLE 54 MARKET FOR LARGE FARMS, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 55 MARKET FOR LARGE FARMS, BY OFFERING, 2017–2025 (USD MILLION)

10.3 MEDIUM-SIZED FARMS (100 TO 400 HECTARES)

TABLE 56 MARKET FOR MEDIUM-SIZED FARMS, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 57 MARKET FOR MEDIUM-SIZED FARMS, BY OFFERING, 2017–2025 (USD MILLION)

10.4 SMALL-SIZED FARMS (LESS THAN 100 HECTARES)

FIGURE 47 MARKET FOR AUTOMATION & ROBOTICS IS EXPECTED TO GROW HIGHEST RATE DURING FORECAST PERIOD

TABLE 58 MARKET FOR SMALL-SIZED FARMS, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 59 MARKET FOR SMALL-SIZED FARMS, BY OFFERING, 2017–2025 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 131)

11.1 INTRODUCTION

FIGURE 48 GROWTH RATE OF CROP MONITORING MARKET, BY REGION

TABLE 60 MARKET, BY REGION, 2017–2025 (USD MILLION)

11.2 AMERICAS

FIGURE 49 SNAPSHOT OF MARKET IN AMERICAS

TABLE 61 MARKET IN AMERICAS, 2017–2025 (USD MILLION)

TABLE 62 MARKET IN AMERICAS, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 63 MARKET IN AMERICAS, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 64 MARKET IN AMERICAS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 65 MARKET IN AMERICAS, BY FARM SIZE, 2017–2025 (USD MILLION)

11.2.1 NORTH AMERICA

TABLE 66 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 69 MARKET IN NORTH AMERICA, BY FARM SIZE, 2017–2025 (USD MILLION)

11.2.2 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

11.2.2.1 US

11.2.2.1.1 Growing awareness related to precision agriculture technology and shortage of labor

TABLE 70 MARKET IN US, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 71 MARKET IN US, BY OFFERING, 2017–2025 (USD MILLION)

11.2.2.2 Canada

11.2.2.2.1 Growing concern regarding labor force crisis in Canada

TABLE 72 MARKET IN CANADA, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 73 MARKET IN CANADA, BY OFFERING, 2017–2025 (USD MILLION)

11.2.2.3 Mexico

11.2.2.3.1 Growing adoption of advanced agriculture technology in Mexico

11.2.3 SOUTH AMERICA

TABLE 74 CROP MONITORING MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 75 MARKET IN SOUTH AMERICA, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 76 MARKET IN SOUTH AMERICA, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 77 MARKET IN SOUTH AMERICA, BY FARM SIZE, 2017–2025 (USD MILLION)

11.2.4 IMPACT OF COVID-19 ON MARKET IN SOUTH AMERICA

11.2.4.1 Brazil

11.2.4.1.1 Government reforms to digitize agriculture

TABLE 78 MARKET IN BRAZIL, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 79 MARKET IN BRAZIL, BY OFFERING, 2017–2025 (USD MILLION)

11.2.4.2 Argentina

11.2.4.2.1 Vast croplands and implementation of IoT and AI technology in agriculture practices

11.2.4.3 Rest of South America

11.3 EUROPE

FIGURE 50 SNAPSHOT OF CROP MONITORING MARKET IN EUROPE

TABLE 80 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 81 MARKET IN EUROPE, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY FARM SIZE, 2017–2025 (USD MILLION)

11.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

11.3.2 GERMANY

11.3.2.1 Increasing focus of government on reducing food import and becoming self-sufficient

TABLE 85 MARKET IN GERMANY, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 86 MARKET IN GERMANY, BY OFFERING, 2017–2025 (USD MILLION)

11.3.3 UK

11.3.3.1 Increasing investments in ag-tech sector in UK

TABLE 87 MARKET IN UK, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 88 MARKET IN UK, BY OFFERING, 2017–2025 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Adoption of digital agriculture is critical success factor for development of market

TABLE 89 ARKET IN ITALY, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 90 MARKET IN ITALY, BY OFFERING, 2017–2025 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Growing awareness regarding digital agriculture technology among farmers

TABLE 91 MARKET IN FRANCE, BY TECHNOLOGY,2017–2025 (USD MILLION)

TABLE 92 MARKET IN FRANCE, BY OFFERING, 2017–2025 (USD MILLION)

11.3.6 REST OF EUROPE

11.4 APAC

FIGURE 51 SNAPSHOT OF CROP MONITORING MARKET IN APAC

TABLE 93 MARKET IN APAC, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 94 MARKET IN APAC, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 95 MARKET IN APAC, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 96 MARKET IN APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 97 MARKET IN APAC, BY FARM SIZE, 2017–2025 (USD MILLION)

11.4.1 IMPACT OF COVID-19 ON MARKET IN APAC

11.4.2 CHINA

11.4.2.1 High investments and technological advancements in ag-tech sector

11.4.3 JAPAN

11.4.3.1 Rising average age of farmers and concerns to meet domestic food demand is prominent factor for adoption of agriculture technology

11.4.4 AUSTRALIA

11.4.4.1 Large farm sizes and high-cost of labor

TABLE 98 MARKET IN AUSTRALIA, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 99 CROP MONITORING MARKET IN AUSTRALIA, BY OFFERING, 2017–2025 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Growing awareness regarding digitization of agriculture and emergence of digital infrastructure

11.4.6 SOUTH KOREA

11.4.6.1 Adoption of advanced agriculture technologies by progressive farmers has led to growth of market in country

11.4.7 REST OF APAC

11.5 ROW

TABLE 100 MARKET IN ROW, BY REGION 2017–2025 (USD MILLION)

TABLE 101 MARKET IN ROW, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 102 MARKET IN ROW, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 103 MARKET IN ROW, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 104 MARKET IN ROW, BY FARM SIZE, 2017–2025 (USD MILLION)

11.5.1 IMPACT OF COVID-19 ON MARKET IN ROW

11.5.2 AFRICA

11.5.3 MIDDLE EAST

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 INTRODUCTION

FIGURE 52 COMPANIES ADOPTED COLLABORATIONS, AGREEMENTS, AND PARTNERSHIPS AS KEY GROWTH STRATEGIES

12.2 MARKET SHARE ANALYSIS

TABLE 105 MARKET SHARE OF TOP 5 PLAYERS FOR SENSING & IMAGERY TECHNOLOGY IN MARKET (2019)

TABLE 106 MAJOR REMOTE SENSING TECHNOLOGY PROVIDERS (2019)

12.3 COMPETITIVE LEADERSHIP MAPPING, 2019

12.3.1 VISIONARY LEADERS

12.3.2 DYNAMIC DIFFERENTIATORS

12.3.3 INNOVATORS

12.3.4 EMERGING COMPANIES

FIGURE 53 CROP MONITORING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.4 RECENT DEVELOPMENTS

12.4.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 107 PRODUCT LAUNCHES AND DEVELOPMENTS, 2018–2020

12.4.2 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 108 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2018-2020

12.4.3 MERGERS AND ACQUISITIONS

TABLE 109 MERGER AND ACQUISITIONS, 2018–2020

13 COMPANY PROFILES (Page No. - 178)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 TOPCON CORPORATION

FIGURE 54 TOPCON CORPORATION: COMPANY SNAPSHOT

13.2.2 TRIMBLE

FIGURE 55 TRIMBLE: COMPANY SNAPSHOT

13.2.3 THE CLIMATE CORPORATION (SUBSIDIARY OF BAYER)

13.2.4 YARA INTERNATIONAL

FIGURE 56 YARA INTERNATIONAL: COMPANY SNAPSHOT

13.2.5 CROPX TECHNOLOGIES

13.2.6 CROPIO

13.2.7 EARTH OBSERVING SYSTEM (EOS)

13.2.8 PRECISIONHAWK

13.2.9 AG LEADER

13.2.10 TARANIS

13.2.11 ABACO GROUP

13.3 OTHER COMPANIES

13.3.1 CROPIN TECHNOLOGY SOLUTIONS

13.3.2 GAMAYA

13.3.3 SLANTRANGE

13.3.4 SENETERA

13.3.5 AMERICAN ROBOTICS

13.3.6 SENSEFLY

13.3.7 SURFACE OPTICS CORPORATION

13.3.8 CROPOM

13.3.9 AGREMO

13.3.10 SGS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.4 RIGHT TO WIN

14 APPENDIX (Page No. - 208)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATION

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The research study involved 4 major activities in estimating the size of the crop monitoring market. Exhaustive secondary research has been done to collect significant information on the crop monitoring market, peer market, and parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. Post which the market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred for this research study includes International Society for Precision Agriculture (ISPA) (US), Precision Ag Institute (US), SPAA Precision Agriculture (Australia) and Agricultural Research Organization (Israel).

In the crop monitoring market report, the top-down as well as the bottom-up approaches have been used for the estimation and validation of the size of the crop monitoring market, along with several other dependent submarkets. The major players in the crop monitoring market were identified using extensive secondary research and their presence using primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the crop monitoring market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (Russia, the Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the crop monitoring market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the market for crop monitoring-based hardware, software, and services in each country

- Identifying major applications of crop monitoring-related products, along with the types of hardware, software, and services required for various applications

- Estimating the size of the market in each region by adding the size of the country-wise markets

- Tracking the ongoing and upcoming implementation of crop monitoring projects by various companies in each region and forecasting the size of the crop monitoring market based on these developments and other critical parameters

- Arriving at the size of the global market by adding the size of the region-wise markets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall crop monitoring market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the crop monitoring market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the crop monitoring market, in terms of value and volume, by offering, technology, farm size, application, and region

- To forecast the market, for various segments with respect to 4 main regions—the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value and volume

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall crop monitoring market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the crop monitoring market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the crop monitoring market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the crop monitoring market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the crop monitoring market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of remote sensing technology, and variable rate technology in crop monitoring market

- Profiling of additional market players (up to 5)

- Country-level analysis of hardware, software, and services in each country

Growth opportunities and latent adjacency in Crop Monitoring Market