Cosmetic Preservatives Market by Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic Acids & Their Salts), Application and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

Updated on : September 02, 2025

Cosmetic Preservatives Market

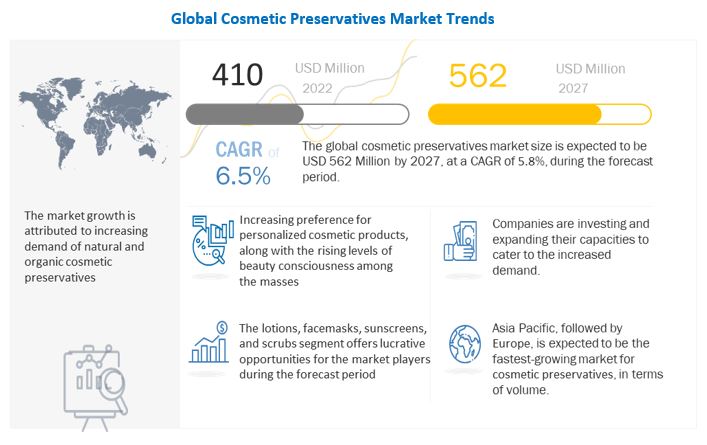

The global cosmetic preservatives market was valued at USD 410 million in 2022 and is projected to reach USD 562 million by 2027, growing at 6.5% cagr from 2022 to 2027. The growth of various applications such as lotions, shampoos, sunscreens, and hair oils are driving the market. Factors such as changing lifestyles, rising consciousness in personal hygiene and purchasing power are expected to drive the growth of the market during the forecast period. However, the stringent rules for labeling cosmetic ingredients and the availability of cheaper substitutes for cosmetic preservatives are some of the challenges which restrict the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 outbreak has disrupted the supply chain of cosmetic preservatives in the cosmetics industry. More than 100 countries shut their boundaries for internal and external trade and transportation in 2020. Economic activity was almost at a standstill in the UK, the US, Italy, Spain, Germany, Japan, China, and France, which are the leading consumers of cosmetic products. These countries were severely affected by the outbreak of the virus. Owing to restrictions on trade and transportation, companies in less-affected countries were unable to deliver products to their clients. Thus, disruptions in the supply chain due to the pandemic have severely affected the cosmetic preservatives market.

Cosmetic Preservatives Market Dynamics

Driver: Increase in purchasing power of consumers

The standard of living of consumers has improved over the last few years, leading to an increase in the purchasing power of the population and thereby rising preference for premium cosmetic products and organic personal care products. This is expected to help accelerate growth in the cosmetic preservatives industry. The rate of urbanization and improvements in technologies around the globe have paved the way for access to global brands with ease. Average spending capacity has increased multiple folds due to economic improvements and advent of various methods of buying products, replacing the traditional forms.

Disposable income has increased in recent years. According to the Reserve Bank of India’s report on Indian income, the country’s gross national disposable income for the 2020-2021 period was 27,17,345.34 USD million. According to the report of the Bureau of Economic Analysis of the US, the total disposable income in the US in 2021 was approximately 74,030,500 USD million. This increase in disposable income increases the utilization of luxury items in daily life, increasing the consumption of cosmetic products around the globe, thereby leading to the growth of the cosmetic preservatives market

Restraint: High cost of organic products

Various side effects are associated with the use of synthetic ingredients in cosmetic formulations. One such example is the use of hydroquinone and mercury. Hydroquinone is used extensively in skin-lightening agents in concentrations of up to two percent. This product affects health as it causes skin cancer, organ system toxicity, and respiratory tract irritation. Whereas mercury as a functional cosmetic reduces dark spots and lightens the skin tone; however, it can damage the kidneys, liver, and brain.

Natural/organic products have highlighted the risks associated with the use of conventional synthetic cosmetics. To curb issues associated with synthetic products which are harsh to the skin, there is a shift towards the use of natural alternatives. Alternatives such as the incorporation of natural or organic compounds in cosmetic formulations is increasing. Manufacturers are shifting their focus towards mild and gentle products that do not pose health risks. However, the major concern remains in terms of the cost of organic cosmetics due to the higher costs of raw materials or feedstock and thus can only cater to the demand for products in the premium range. This also leads to difficulties for manufacturers in employing the required resources for R&D activities. Hence, the high cost of organic raw materials and other overhead costs restrain the growth of the cosmetic preservatives market.

Opportunity: Rising demand for natural and organic preservatives in cosmetics

Organic preservatives are preferred over traditional preservatives such as parabens, formaldehyde donors, and others by manufacturers of personal care products. Organic or natural preservatives are preferred as they do not result in skin problems. Organic preservatives tend to have lower or no side effects on the skin. The market for organic and natural cosmetic preservatives is projected to grow at a significant pace in the European and North American markets.

Challenge: Paraben-free preservatives in cosmetics

Paraben-free preservatives for cosmetic and personal care products are leading to a rising market share due to the increasing demand for natural and organic cosmetic products. Parabens are the most commonly and widely used cosmetic preservatives in thousands of products which include toothpastes, lubricants, moisturizers, lotions, shampoos, soaps, and gels. However, an increasing number of manufacturers are avoiding their utilization because of safety concerns. Governments in France and Denmark are considering implementing bans on paraben-based cosmetic products because of the possible drawbacks and diseases caused. Concerns about possible bans in other regions are leading manufacturers of cosmetics in developing paraben-free products. Many cosmetic manufacturers are constantly developing organic alternatives due to the increasing demand for paraben-free cosmetic products.

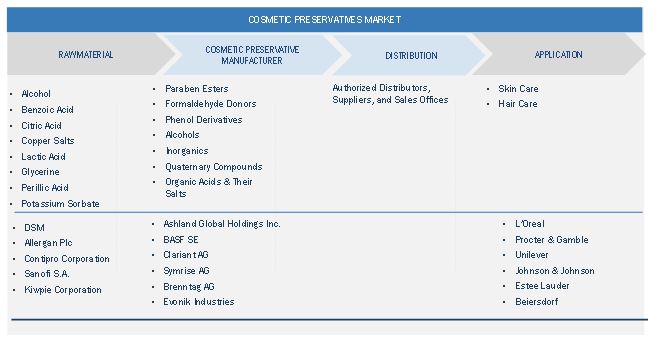

Cosmetic Preservatives Market Ecosystem

Quarternary compounds to follow organic acids and their salts segment in terms of value during the forecast period

Based on type, the cosmetic preservatives has been segmented into organic acids and their salts, phenol derivatives, quaternary compounds and others. The quarternary compounds segment of the cosmetic preservatives market had the third largest market share in 2021, in terms of value and volume. Compounds that contain nitrogen and also have positive charge when added in a chemical solution are called quaternary compounds, also known as quats. Quaternary compounds demonstrate an ability to prevent microbial growth in cosmetic products. Quats include ingredients such as benzalkonium chloride, benzethonium chloride, cetalkonium chloride, cetrimide, and cetrimonium bromide, among others. Benzalkonium chloride is used to prevent the growth and reproduction of microorganisms in cosmetic products. Quaternary compounds in cosmetics significantly help hair conditioning in both, wet and dry conditions. This is because the product's cationic charge makes it significant on anionic surfaces such as hair and skin

Shampoo and conditioners holds the second highest share in the cosmetic preservatives market both in terms of value and volume.

Based on application, the cosmetic preservatives has been segmented into lotions, facemasks,sunscreens and scrubs, mouthwash and toothpaste, shampoo and conditioners and others. Shampoo and conditioners segment is expected to grow with the second highest CAGR during the forecast period both in terms of value and volume. Manufacturers use preservatives in shampoos and conditioners to extend their shelf life. As shampoos and conditioners have high water and oxygen content, the use of either natural or synthetic preservatives is recommended in their composition. The common preservatives used in shampoos and conditioners are piroctone olamine, quaternary compounds, and phenol derivatives

To know about the assumptions considered for the study, download the pdf brochure

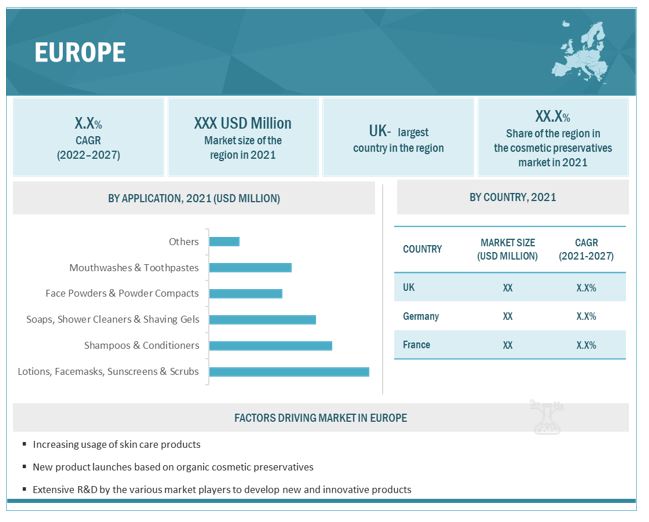

Europe held the largest market share in the cosmetic preservatives market

Europe is the largest market for cosmetic preservatives in 2021. It has a significant number of manufacturers that are actively participating in development activities, especially in expansions and new product launches. The region has the presence of major cosmetic preservative manufacturers, such as BASF SE (Germany), Akema S.r.l. (Italy), Symrise AG(Germany), Evonik Industries AG (Germany), Brenntag AG (Germany), Thor Group Ltd.(UK) and Isca UK Ltd.(UK). Europe is an attractive market for the cosmetic product manufacturers.The people of this region take beauty and personal-care quite seriously as they believe that it is an important factor in maintaining a healthy and hygienic life. The leading players in the cosmetic preservatives market also see opportunities for greater brand penetration due to the rising demand for natural ingredients and the expanding customer base that is concerned about the composition of raw materials.

Cosmetic Preservatives Market Players

Some of the key players in the global cosmetic preservatives market are Ashland Group Holding Inc. (US), BASF SE (Germany), Akema S.r.l. (Italy), Symrise AG (Germany), Clariant AG (Switzerland), Salicylates and Chemicals Pvt. Ltd (India), Chemipol (Spain), Evonik Industries AG (Germany), International Flavors and Fragrances Inc. (US), and Sharon Laboratories (Israel).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the cosmetic preservatives industry. The study includes an in-depth competitive analysis of these key players in the cosmetic preservatives market, with their company profiles, recent developments, and key market strategies.

Cosmetic Preservatives Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million), Volume (Tons) |

|

Segments |

Type, Application, and Region |

|

Regions |

Europe, North America, Asia Pacific, Rest of the world |

|

Companies |

Ashland Group Holding Inc. (US), BASF SE (Germany), Arkema S.r.l (Italy), Symrise AG (Germany), Evonik Industries (Germany), Clariant AG (Switzerland), Salicylates & Chemicals Pvt. Ltd (India), Chemipol (Spain), International Flavors & Fragrances Inc. (US), Sharon Laboratories (Israel), The Dow Chemical Company (US), Brenntag AG (Germany), Thor Group Ltd. (UK), Dadia Chemical Industries (India) and ISCA UK Ltd. (UK) |

This research report categorizes the cosmetic preservatives market based on type, application, and region.

Cosmetic Preservatives Market by Type:

- Paraben Esters

- Formaldehyde Donors

- Phenol Derivatives

- Alcohols

- Inorganics

- Quaternary Compounds

- Organic Acids & Their Salts

- Others

Cosmetic Preservatives Market by Application:

- Lotions, Facemasks, Sunscreens, & Scrubs

- Shampoos & Conditioners

- Soaps, Shower Cleansers & Shaving Gels

- Face Powders & Powder compacts

- Mouthwashes & Toothpastes

- Others

Cosmetic Preservatives Market by Region:

- North America

- Europe

- Asia Pacific

- ROW

Recent Developments

- On January 2022, Symrise AG entered into a purchase agreement to acquire Schaffelaarbos, the European market leader in egg protein in pet food. Symrise expects to take a major strategic step forward in its rapid global expansion in pet nutrition with this deal. Symrise's current capabilities are expected to be ideally supplemented by integrating the activities of ADF/IsoNova in the US with the state-of-the-art facilities of Schaffelaarbos in Barneveld, NL.

- In March 2022, Sharon Labs agreed to buy RES Pharma Industriale, a specialized chemical manufacturer in Trezzo sull'Adda, Italy (RPI). The acquisition of RPI is planned to close in March 2022, with RPI's technology, R&D, production, commercial development, and customer service capabilities being incorporated into Sharon Laboratories' Personal Care division.

- In December 2021,, Symrise AG acquired Giraffe Foods Inc., a Canada-based manufacturer of customized sauces, dips, dressings, syrups, and beverage concentrates for B2B customers in the home meal replacement, food service, and retail industries. This agreement is expected to lead to a significant step ahead in the value chain as a result of this deal, offering a broader range of innovative solutions of flavors to a larger customer base in North America. Symrise's Flavor & Nutrition sector is expected to see faster growth in the region as a result of this relocation.

- In August 2021, Clariant has agreed to buy the remaining 70% of Beraca, a Brazilian Personal Care Specialties company from its founders, the Sabará family. Since 2015, Clariant owned a 30% share in the company. The acquisition price is expected to remain a secret. The transaction is expected to be finalized in Q4 2021 pending regulatory approvals.

- In February 2021,the USD 42.9 billion merger of International Flavors & Fragrances Inc (IFF) and DuPont's Nutrition & Biosciences (N&B) has been finalized, and the new industry has unveiled a modernized brand.

- In December 2021, Clariant purchased assets in North America from the German competitor BASF in a USD 60 million cash agreement that is expected to help the company expand its sustainable business. Clariant hopes to complete the acquisition of BASF's US attapulgite business in the summer of 2022, making it one of the major miners and producers of the clay material, which Clariant claims is expected to help eliminate pollutants in the production of renewable fuel.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the cosmetic preservatives market?

Increase in purchasing power of consumers and rise in female working population is driving the market.

Which is the largest country-level market for cosmetic preservatives?

Europe is the largest cosmetic preservatives market due to presence of large number of cosmetic product manufacturers.

What are the factors contributing to the final price of cosmetic preservatives?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of cosmetic preservatives.

What are the challenges in the cosmetic preservatives market?

High prices of organic and natural cosmetic preservatives is the major challenge in the cosmetic preservatives market..

Which type of cosmetic preservative holds the largest market share?

Organic acids & their salts hold the largest share in terms of value, in the cosmetic preservatives market.

How is the cosmetic preservatives market aligned?

The market is growing at a moderate pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Ashland Group Holding Inc. (US), BASF SE (Germany), Arkema S.r.l. (Italy), Symrise AG(Germany), Clariant AG (Switzerland), Salicylates and Chemicals Pvt.Ltd (India), Chemipol (Spain), Evonik Industries AG (Germany), International Flavors and Fragrances Inc.(US), and Sharon Laboratories (Israel).

What is the biggest restraint in the cosmetic preservatives market?

Stringent regulatory norms is one of the biggest restraining factors for the market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 COSMETIC PRESERVATIVES MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

FIGURE 1 COSMETIC PRESERVATIVES MARKET: RESEARCH DESIGN

FIGURE 2 MARKET: RESEARCH APPROACH

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Primary interviews – demand- and supply-sides

2.2.2.3 Breakdown of primary interviews

2.2.2.4 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 COSMETIC PRESERVATIVES MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.8 LIMITATIONS

2.9 RISKS ASSOCIATED WITH COSMETIC PRESERVATIVES MARKET

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 6 ORGANIC ACIDS & THEIR SALTS SEGMENT LED COSMETIC PRESERVATIVES MARKET IN 2021

FIGURE 7 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS APPLICATION LED COSMETIC PRESERVATIVES MARKET IN 2021

FIGURE 8 UK PROJECTED TO LEAD GLOBAL COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

FIGURE 9 EUROPE LED GLOBAL COSMETIC PRESERVATIVES MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COSMETIC PRESERVATIVES MARKET

FIGURE 10 DEMAND FOR NATURAL AND ORGANIC PRESERVATIVES TO DRIVE COSMETIC PRESERVATIVES MARKET

4.2 MARKET, BY TYPE

FIGURE 11 PHENOL DERIVATIVES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 MARKET, BY APPLICATION

FIGURE 12 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS WAS LARGEST APPLICATION IN 2021

4.4 MARKET, BY KEY COUNTRIES

FIGURE 13 MARKETS IN FRANCE AND GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET SEGMENTATION

5.2.1 BY TYPE

5.2.2 BY APPLICATION

5.2.3 BY REGION

5.3 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COSMETIC PRESERVATIVES MARKET

5.3.1 DRIVERS

5.3.1.1 Increase in purchasing power of consumers

5.3.1.2 Increase in female working population

5.3.1.3 Shelf-life enhancement

5.3.2 RESTRAINTS

5.3.2.1 High cost of organic products

5.3.2.2 Stringent regulatory norms

5.3.2.3 Possibilities of skin infections

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing demand in Asia Pacific region

5.3.3.2 Rising demand for natural and organic preservatives in cosmetics

5.3.3.3 Increasing focus on male-specific cosmetics

5.3.4 CHALLENGES

5.3.4.1 Paraben-free preservatives in cosmetics

5.3.4.2 High price of organic and natural cosmetic preservatives

5.4 INDUSTRY TRENDS

5.4.1 PORTER'S FIVE FORCE ANALYSIS

FIGURE 15 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF NEW ENTRANTS

5.4.5 THREAT OF SUBSTITUTES

5.4.6 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 2 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.5.2 BUYING CRITERIA

FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.6 SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM: COSMETIC PRESERVATIVES MARKET

5.8 VALUE CHAIN ANALYSIS

FIGURE 18 COSMETIC PRESERVATIVES: VALUE CHAIN ANALYSIS

5.9 TECHNOLOGY ANALYSIS

TABLE 4 LIST OF PRESERVATIVES IN COSMETIC PRODUCTS

5.10 PRICING ANALYSIS

5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

TABLE 5 AVERAGE SELLING PRICES OF KEY PLAYERS (USD/KG)

5.10.2 TRENDS IN AVERAGE SELLING PRICE

TABLE 6 COSMETIC PRESERVATIVES: AVERAGE SELLING PRICES

5.11 COSMETIC PRESERVATIVES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 7 MARKET: CAGRS (IN TERMS OF VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

5.11.1 OPTIMISTIC SCENARIO

5.11.2 PESSIMISTIC SCENARIO

5.11.3 REALISTIC SCENARIO

5.12 KEY MARKETS FOR IMPORT/EXPORT

5.12.1 US

5.12.2 GERMANY

5.12.3 CHINA

5.12.4 JAPAN

5.12.5 INDIA

5.13 IMPACT OF COVID-19 ON COSMETIC PRESERVATIVES MARKET

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 8 COSMETIC PRESERVATIVES MARKET: GLOBAL PATENTS

FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

5.14.4 INSIGHTS

5.14.5 LEGAL STATUS OF PATENTS

FIGURE 21 COSMETIC PRESERVATIVES MARKET: LEGAL STATUS OF PATENTS

5.14.6 JURISDICTION ANALYSIS

FIGURE 22 GLOBAL JURISDICTION ANALYSIS

5.14.7 TOP APPLICANTS’ ANALYSIS

FIGURE 23 CANTON DAMEKISS DAILY CHEMICAL FACTORY LTD CO. HAS HIGHEST NUMBER OF PATENTS

5.14.8 LIST OF PATENTS BY CANTON DAMEKISS DAILY CHEMICAL FACTORY LTD CO.

5.14.9 LIST OF PATENTS BY L’OREAL PERSONAL CARE

5.14.10 LIST OF PATENTS BY BEIERSDORF AG

5.14.11 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

5.15 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 COSMETIC PRESERVATIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.16 TARIFF AND REGULATORY LANDSCAPE

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16.2 REGULATIONS IN COSMETIC PRESERVATIVES MARKET

TABLE 12 REGULATIONS ON COSMETIC PRESERVATIVES

5.17 CASE STUDY ANALYSIS

5.18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 24 TRENDS IN COSMETIC PRESERVATIVES MARKET IMPACTING FUTURE REVENUE MIX

6 COSMETIC PRESERVATIVES MARKET, BY TYPE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 25 ORGANIC ACIDS & THEIR SALTS SEGMENT TO LEAD COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

TABLE 13 COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 14 MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 15 MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 16 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.2 PARABEN ESTERS

6.2.1 WIDELY USED IN HIGH WATER CONTENT COSMETIC PRODUCTS

FIGURE 26 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR PARABEN ESTERS

6.2.2 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 17 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET, BY REGION, 2018–2021 (TON)

TABLE 18 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 20 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 FORMALDEHYDE DONORS

6.3.1 INCREASED LIFESPAN OF WATER-BASED COSMETIC PRODUCTS

FIGURE 27 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR FORMALDEHYDE DONORS

6.3.2 FORMALDEHYDE DONORS: MARKET, BY REGION

TABLE 21 FORMALDEHYDE DONORS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 22 FORMALDEHYDE DONORS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 FORMALDEHYDE DONORS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 24 FORMALDEHYDE DONORS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 PHENOL DERIVATIVES

6.4.1 EFFECTIVE AGAINST WIDE RANGE OF MICROBES

FIGURE 28 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR PHENOL DERIVATIVES

6.4.2 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 25 PHENOL DERIVATIVES: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 26 PHENOL DERIVATIVES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 PHENOL DERIVATIVES: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 28 PHENOL DERIVATIVES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.5 ALCOHOLS

6.5.1 USED DUE TO THEIR ANTISEPTIC PROPERTIES

FIGURE 29 EUROPE TO BE LARGEST COSMETIC PRESERVATIVES MARKET FOR ALCOHOLS

6.5.2 ALCOHOLS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 29 ALCOHOLS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 30 ALCOHOLS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 ALCOHOLS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 32 ALCOHOLS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.6 INORGANICS

6.6.1 EFFECTIVE IN PROTECTION FROM UV RAYS

FIGURE 30 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR INORGANICS

6.6.2 INORGANICS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 33 INORGANICS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 34 INORGANICS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 INORGANICS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 36 INORGANICS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.7 QUATERNARY COMPOUNDS

6.7.1 PREVENT REPRODUCTION OF MICROORGANISMS IN COSMETIC PRODUCTS

FIGURE 31 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR QUATERNARY COMPOUNDS

6.7.2 QUATERNARY COMPOUNDS: MARKET, BY REGION

TABLE 37 QUATERNARY COMPOUNDS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 38 QUATERNARY COMPOUNDS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 QUATERNARY COMPOUNDS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 40 QUATERNARY COMPOUNDS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.8 ORGANIC ACIDS & THEIR SALTS

6.8.1 HIGH DEMAND FOR ORGANIC COSMETIC PRODUCTS

FIGURE 32 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR ORGANIC ACIDS & THEIR SALTS

6.8.2 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 41 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 42 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 44 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.9 OTHER TYPES

6.9.1 OTHER TYPES: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 45 OTHER TYPES: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 46 OTHER TYPES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 OTHER TYPES: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 48 OTHER TYPES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 COSMETIC PRESERVATIVES MARKET, BY APPLICATION (Page No. - 102)

7.1 INTRODUCTION

FIGURE 33 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS SEGMENT TO LEAD COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

TABLE 49 COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 50 MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 52 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS

7.2.1 LARGEST APPLICATION SEGMENT

FIGURE 34 EUROPE TO BE LARGEST MARKET FOR LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS

7.2.2 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 53 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 54 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 56 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 SHAMPOOS & CONDITIONERS

7.3.1 HIGH WATER CONTENT IN PRODUCTS DRIVES DEMAND FOR PRESERVATIVES

FIGURE 35 EUROPE TO BE LARGEST MARKET IN SHAMPOOS & CONDITIONERS SEGMENT

7.3.2 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 57 SHAMPOOS & CONDITIONERS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 58 SHAMPOOS & CONDITIONERS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 SHAMPOOS & CONDITIONERS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 60 SHAMPOOS & CONDITIONERS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 SOAPS, SHOWER CLEANSERS, & SHAVING GELS

7.4.1 INCREASING AWARENESS ABOUT PERSONAL GROOMING

FIGURE 36 EUROPE TO BE LARGEST MARKET IN SOAPS, SHOWER CLEANSERS, & SHAVING GELS SEGMENT

7.4.2 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 61 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 62 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 64 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 FACE POWDERS & POWDER COMPACTS

7.5.1 INCREASING DEMAND FOR ORGANIC PRESERVATIVES

FIGURE 37 EUROPE TO BE LARGEST MARKET IN FACE POWDERS & POWDER COMPACTS SEGMENT

7.5.2 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 65 FACE POWDERS & POWDER COMPACTS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 66 FACE POWDERS & POWDER COMPACTS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 FACE POWDERS & POWDER COMPACTS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 68 FACE POWDERS & POWDER COMPACTS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 MOUTHWASHES & TOOTHPASTES

7.6.1 RISING AWARENESS ABOUT ORAL HYGIENE

FIGURE 38 EUROPE TO BE LARGEST MARKET IN MOUTHWASHES & TOOTHPASTES SEGMENT

7.6.2 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 69 MOUTHWASHES & TOOTHPASTES: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 70 MOUTHWASHES & TOOTHPASTES: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MOUTHWASHES & TOOTHPASTES: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 72 MOUTHWASHES & TOOTHPASTES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHER APPLICATIONS

7.7.1 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET, BY REGION

TABLE 73 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 74 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 76 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 COSMETIC PRESERVATIVES MARKET, BY REGION (Page No. - 117)

8.1 INTRODUCTION

FIGURE 39 INDIA TO BE FASTEST-GROWING COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

TABLE 77 COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 78 MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 80 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SNAPSHOT

8.2.1 NORTH AMERICA: MARKET, BY TYPE

TABLE 81 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.2.2 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

TABLE 85 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.3 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

8.2.3.1 US

8.2.3.1.1 Strong production base for personal care and cosmetic products

TABLE 93 US: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 94 US: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 US: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 96 US: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.3.2 Canada

8.2.3.2.1 Rising population to drive demand for personal care products

TABLE 97 CANADA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 98 CANADA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 100 CANADA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.3.3 Mexico

8.2.3.3.1 Increasing middle-class population to drive demand

TABLE 101 MEXICO: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 102 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 104 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3 EUROPE

FIGURE 41 EUROPE: COSMETICS PRESERVATIVES MARKET SNAPSHOT

8.3.1 EUROPE: COSMETIC PRESERVATIVES MARKET, BY TYPE

TABLE 105 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 106 EUROPE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 108 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.3.2 EUROPE: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

TABLE 109 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 110 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 112 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3 EUROPE: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

TABLE 113 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 114 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

8.3.3.1 UK

8.3.3.1.1 UK leading European cosmetic preservatives market

TABLE 117 UK: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 118 UK: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 UK: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 120 UK: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3.2 Germany

8.3.3.2.1 Demand for environment-friendly products is leading to increasing demand

TABLE 121 GERMANY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 122 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 124 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3.3 France

8.3.3.3.1 Increasing distribution channels for cosmetic products fueling market growth

TABLE 125 FRANCE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 126 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 128 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3.4 Rest of Europe

TABLE 129 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 130 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 132 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SNAPSHOT

8.4.1 ASIA PACIFIC: MARKET, BY TYPE

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.4.2 ASIA PACIFIC: MARKET, BY APPLICATION

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3 ASIA PACIFIC: MARKET, BY COUNTRY

TABLE 141 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

8.4.3.1 China

8.4.3.1.1 Demand for high-end cosmetic products driving market in China

TABLE 145 CHINA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 146 CHINA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 147 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 148 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3.2 Japan

8.4.3.2.1 Rise in demand for bio-based products in Japan

TABLE 149 JAPAN: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 150 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 151 JAPAN: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 152 JAPAN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3.3 India

8.4.3.3.1 Rising middle-class population with increasing disposable income fueling growth of market in India

TABLE 153 INDIA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 154 INDIA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 INDIA: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 156 INDIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3.4 Rest of Asia Pacific

TABLE 157 REST OF ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 158 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 160 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5 REST OF THE WORLD

8.5.1 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET, BY TYPE

TABLE 161 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 162 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 163 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 164 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.5.2 REST OF THE WORLD: MARKET, BY APPLICATION

TABLE 165 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 166 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 167 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 168 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3 REST OF THE WORLD: MARKET, BY COUNTRY

TABLE 169 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 170 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 171 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 172 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

8.5.3.1 South Africa

8.5.3.1.1 Rising demand for skin care products to drive market

TABLE 173 SOUTH AFRICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 174 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 175 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 176 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3.2 Turkey

8.5.3.2.1 Increasing disposable income of middle-class population to be governing factor for market growth

TABLE 177 TURKEY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 178 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 179 TURKEY: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 180 TURKEY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3.3 Brazil

8.5.3.3.1 Growing production and demand for natural and bio-degradable personal care products to propel market

TABLE 181 BRAZIL: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 182 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 183 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 184 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3.4 Other countries

TABLE 185 OTHER COUNTRIES: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 186 OTHER COUNTRIES: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 187 OTHER COUNTRIES: MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 188 OTHER COUNTRIES: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 170)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 43 SHARE OF TOP FIVE COMPANIES IN COSMETIC PRESERVATIVES MARKET

TABLE 189 DEGREE OF COMPETITION: COSMETIC PRESERVATIVES MARKET

9.3 MARKET RANKING

FIGURE 44 RANKING OF TOP FIVE PLAYERS IN COSMETIC PRESERVATIVES MARKET

9.4 MARKET EVALUATION FRAMEWORK

TABLE 190 COSMETIC PRESERVATIVE MARKET: DEALS, 2017–2021

TABLE 191 COSMETIC PRESERVATIVES MARKET: OTHERS, 2017–2021

TABLE 192 MARKET: NEW PRODUCT DEVELOPMENTS, 2017–2021

9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES IN 2021

9.6 COMPANY EVALUATION MATRIX

TABLE 193 COMPANY PRODUCT FOOTPRINT

TABLE 194 COMPANY TYPE FOOTPRINT

TABLE 195 COMPANY APPLICATION FOOTPRINT

TABLE 196 COMPANY REGION FOOTPRINT

9.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COSMETIC PRESERVATIVES MARKET

9.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

9.7 COMPANY EVALUATION QUADRANT

9.7.1 STARS

9.7.2 PERVASIVE PLAYERS

9.7.3 PARTICIPANTS

9.7.4 EMERGING LEADERS

FIGURE 48 COSMETIC PRESERVATIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

9.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 197 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 198 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

9.8 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 49 MARKET: SMALL- AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

10 COMPANY PROFILES (Page No. - 185)

10.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weakness competitive threats)*

10.1.1 ASHLAND GROUP HOLDINGS INC.

TABLE 199 ASHLAND GROUP HOLDINGS INC.: COMPANY OVERVIEW

FIGURE 50 ASHLAND GLOBAL HOLDING INC.: COMPANY SNAPSHOT

10.1.2 BASF SE

TABLE 200 BASF SE: COMPANY OVERVIEW

FIGURE 51 BASF SE: COMPANY SNAPSHOT

10.1.3 AKEMA S.R.L.

TABLE 201 AKEMA S.R.L.: COMPANY OVERVIEW

10.1.4 SYMRISE AG

TABLE 202 SYMRISE AG: COMPANY OVERVIEW

FIGURE 52 SYMRISE AG: COMPANY SNAPSHOT

10.1.5 CLARIANT AG

TABLE 203 CLARIANT AG: COMPANY OVERVIEW

FIGURE 53 CLARIANT AG: COMPANY SNAPSHOT

10.1.6 SALICYLATES & CHEMICALS PVT. LTD

TABLE 204 SALICYLATES & CHEMICALS PVT. LTD: COMPANY OVERVIEW

10.1.7 CHEMIPOL S.A.

TABLE 205 CHEMIPOL S.A.: COMPANY OVERVIEW

10.1.8 EVONIK INDUSTRIES AG

TABLE 206 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 54 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

10.1.9 INTERNATIONAL FLAVORS & FRAGRANCES INC.

TABLE 207 INTERNATIONAL FLAVORS & FRAGRANCES: COMPANY OVERVIEW

FIGURE 55 INTERNATIONAL FLAVORS & FRAGRANCES: COMPANY SNAPSHOT

10.1.10 SHARON LABORATORIES

TABLE 208 SHARON LABORATORIES: COMPANY OVERVIEW

10.2 OTHER PLAYERS

10.2.1 BRENNTAG AG

10.2.2 THOR GROUP LTD.

10.2.3 DADIA CHEMICAL INDUSTRIES

10.2.4 GUJARAT ORGANICS LIMITED

10.2.5 ISCA UK LIMITED

10.2.6 LANXESS

10.2.7 CISME ITALY S.R.L

10.2.8 KUMAR ORGANIC PRODUCTS LIMITED

10.2.9 COBIOSA

10.2.10 SACHEM INC

10.2.11 AE CHEMIE INC.

10.2.12 SPECTRUM CHEMICAL MFG CORP.

10.2.13 STRUCHEM CO LTD.

10.2.14 NEVER NOT SKINCARE

10.2.15 THE DOW CHEMICAL COMPANY

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weakness competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 221)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATION

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

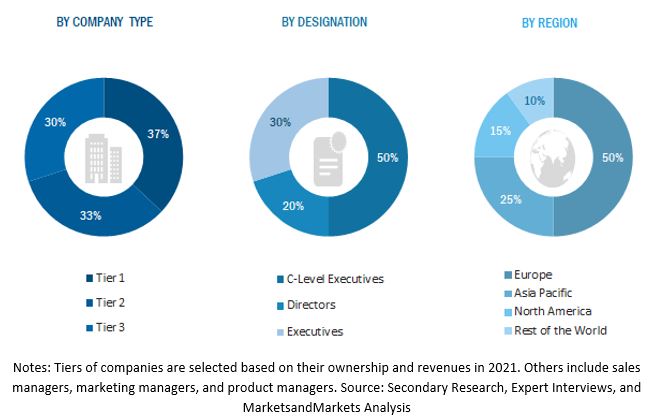

The study involves two major activities in estimating the current size of the cosmetic preservatives market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the cosmetic preservatives market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total cosmetic preservatives market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall cosmetic preservatives market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the lotions, sunscreens, soaps, shower cleansers, mouthwashes, shampoos, and other applications.

Report Objectives

- To analyze and forecast the global market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type and application.

- To analyze and forecast the market size based on four main regions, namely, Asia Pacific (APAC), Europe, North America, and Rest of the World.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific cosmetic preservatives market

- Further breakdown of Rest of European cosmetic preservatives market

- Further breakdown of Rest of Middle East & Africa cosmetic preservatives market

- Further breakdown of Rest of Latin American cosmetic preservatives market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cosmetic Preservatives Market