Cosmetic Applicator Foam Market by Shape (Egg-shaped Sponges, Cosmetic Wedges, Others), Material Type (PU, Others), Region (North America, Asia Pacific, Europe, South America, Middle East & Africa) - Global Forecast to 2025

Updated on : March 21, 2024

Cosmetic Applicator Foam Market

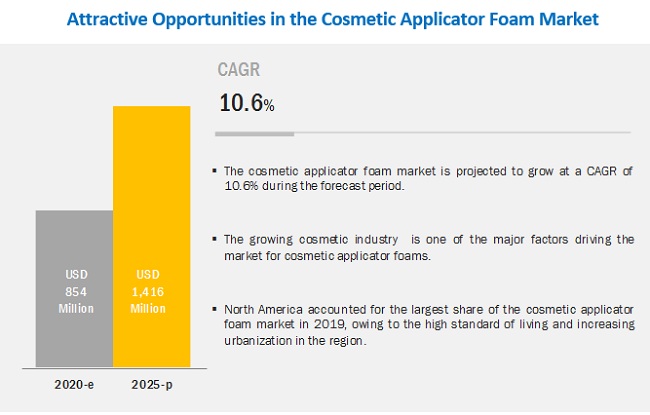

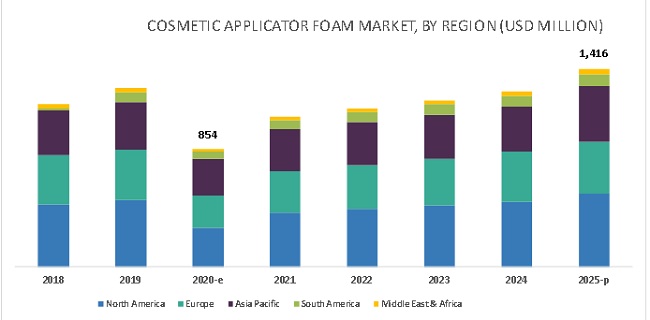

Cosmetic Applicator Foam Market was valued at USD 854 million in 2020 and is projected to reach USD 1,416 million by 2025, growing at 10.6% cagr from 2020 to 2025. The growing cosmetic industry and the benefits of cosmetic applicator foams are the major factors driving the market for cosmetic applicator foams.

Based on material type, the polyurethane (PU) segment accounted for a larger market share in 2019

Based on material type, the PU segment accounted for a larger share of the cosmetic applicator foam market in 2019 as compared to the others segment. Polyurethane foam products with low-density semi-closed cells are ideal for skincare applications as they help in effective and uniform application of products on the skin. They can be used with or without water. These materials absorb and retain the beauty product on the skin, leaving a smooth finish. The polymer matrix of these materials can be formulated with various chemical agents, including disinfectants, odor suppressants, surfactants, and antibiotics, due to their high absorbent and impregnation capacity. Open and elastic cell structures make these materials resistant to oxidation and aging, especially when compared to latex foams. The advantages of PU over other materials is expected to drive its market during the forecast period.

Based on shape, the egg-shaped sponges segment accounted for the largest market share in 2019

Based on shape, the egg-shaped sponges segment accounted for the largest share of the cosmetic applicator foam market in 2019. Egg-shaped sponges are an edgeless sphere-shaped, porous structured cosmetic applicator foam. They were designed to apply and blend any cream or liquid makeup product onto the skin for a smooth, poreless finish. These sponges are known for their exclusive aqua-activated foam and sphere shape that can reach almost every contour on the face. The material used in these sponges is PU or latex. The advantages of egg-shaped sponges over other sponges is the major driver for the growth of the egg-shaped sponges segment of the cosmetic applicator foam market.

North America accounted for the largest market share of the cosmetic applicator foam market in 2019

By region, North America accounted for the largest share of the cosmetic applicator foam market in 2019. The rise in the disposable income of individuals over the past decade is influencing the market growth. Changing lifestyles, increasing per capita expenditure on personal appearance, and growth of the beauty and cosmetics market are some of the factors expected to propel the demand for cosmetics applicator foam in the North American region during the forecast period.

Key Market Players

Coty, Inc. (US), L'Oréal SA (France), Estée Lauder Companies Inc. (US), New Avon Company (US), Shenzhen Karina Makeup Tools Ltd (China), Yumark Enterprises Corp. (Taiwan), Qual Cosmetics (China), PUSPONGE (China), TaikiUSA Inc. (US), KTT Enterprises (US), Kryolan (US), Huntsman Corporation (US), UFP Technologies, Inc. (US), FXI Holdings, Inc. (US), FoamPartner Group (Switzerland), The Woodbridge Group (Canada), and Porex Corporation (US) are some of the leading players in the value chain of the cosmetic applicator foam market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Shape and Material Type |

|

Geographies Covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies Covered |

Coty, Inc. (US), L'Oréal SA (France), Estée Lauder Companies Inc. (US), New Avon Company (US), Shenzhen Karina Makeup Tools Ltd (China), Yumark Enterprises Corp. (Taiwan), Qual Cosmetics (China), PUSPONGE (China), TaikiUSA Inc. (US), KTT Enterprises (US), Kryolan (US), Huntsman Corporation (US), UFP Technologies, Inc. (US), FXI Holdings, Inc. (US), FoamPartner Group (Switzerland), The Woodbridge Group (Canada), and Porex Corporation (US) |

This research report categorizes the cosmetic applicator foam market based on shape, material type, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on material type, the cosmetic applicator foam market is segmented into:

- PU

- Others (polyvinyl alcohol, latex, and silicone)

Based on shape, the cosmetic applicator foam market is segmented into:

- Egg-shaped Sponges

- Cosmetic Wedges

- Silicone Sponges

- Round Disc Sponges

Based on Region, the cosmetic applicator foam market is segmented into:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2020, Coty, Inc., and Kylie Cosmetics (US) entered into a long-term strategic partnership to jointly build and expand Kylie Cosmetics' existing beauty business into a global powerhouse brand.

- In March 2019, FXI Holdings, Inc. and Innocor, Inc. (US), signed an agreement to accelerate research & development in the foam industry. This agreement led to the introduction of new products to cater to the bedding, furniture, transportation, medical, filtration, acoustics, and other industrial sectors.

- In August 2017, The Woodbridge Group acquired full ownership of its joint venture Woodbridge FoamPartner Company located in Chattanooga (US) and named it Woodbridge Technical Products Company. This acquisition helped the company strengthen its technical polyurethane foam solutions.

Key Questions Addressed by the Report:

- How had the developments undertaken by various companies expected to affect the cosmetic applicator foam market in the mid- to long-term?

- What are the different types of cosmetic applicator foams?

- What are the drivers, restraints, opportunities, and challenges for the cosmetic applicator foam market?

- What is the estimated size of the cosmetic applicator foam market in 2020?

- What are the different materials used in cosmetic applicator foam?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE OPPORTUNITIES IN THE COSMETIC APPLICATOR FOAM MARKET

4.2 COSMETIC APPLICATOR FOAM MARKET, BY REGION

4.3 NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET, BY SHAPE & COUNTRY

4.4 COSMETIC APPLICATOR FOAM MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing cosmetic industry

5.2.1.2 Benefits of cosmetic applicator foams

5.2.2 RESTRAINTS

5.2.2.1 High costs of celebrity endorsements or advertisements

5.2.3 OPPORTUNITIES

5.2.3.1 Innovations and advancements in cosmetic applicators

5.2.4 CHALLENGES

5.2.4.1 Availability of several makeup brushes

5.3 PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

5.4 IMPACT OF COVID-19 ON THE GLOBAL COSMETIC INDUSTRY

5.4.1 COVID-19 IMPACT ON LIVES AND LIVELIHOODS

5.4.1.1 Loss of life

5.4.1.2 Economic outlook by the International Monetary Fund (IMF)

5.4.1.3 Stimulus package by G-20 countries

5.4.2 IMPACT OF COVID-19 ON THE COSMETIC APPLICATOR FOAM MARKET

5.4.2.1 Demand for Do It Yourself (DIY) products

5.4.2.2 Demand for virgin cosmetic applicators in salons

5.4.2.3 Limited new product launches in 2020

5.4.2.4 Change in consumer behavior

5.4.2.5 Increased preference for online shopping

6 COSMETIC APPLICATOR FOAM MARKET, BY MATERIAL TYPE (Page No. - 42)

6.1 INTRODUCTION

6.2 POLYURETHANE (PU)

6.3 OTHERS

7 COSMETIC APPLICATOR FOAM MARKET, BY SHAPE (Page No. - 46)

7.1 INTRODUCTION

7.2 EGG-SHAPED SPONGES

7.3 COSMETIC WEDGES

7.4 SILICONE SPONGES

7.5 ROUND DISC SPONGES

8 COSMETIC APPLICATOR FOAM MARKET, BY REGION (Page No. - 51)

8.1 INTRODUCTION

8.2 ASIA PACIFIC

8.2.1 CHINA

8.2.2 INDIA

8.2.3 JAPAN

8.2.4 SOUTH KOREA

8.2.5 INDONESIA

8.2.6 THAILAND

8.2.7 REST OF ASIA PACIFIC

8.3 NORTH AMERICA

8.3.1 US

8.3.2 CANADA

8.3.3 MEXICO

8.4 EUROPE

8.4.1 GERMANY

8.4.2 UK

8.4.3 FRANCE

8.4.4 ITALY

8.4.5 RUSSIA

8.4.6 TURKEY

8.4.7 SPAIN

8.4.8 POLAND

8.4.9 REST OF EUROPE

8.5 SOUTH AMERICA

8.5.1 BRAZIL

8.5.2 CHILE

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

8.6.1 SOUTH AFRICA

8.6.2 SAUDI ARABIA

8.6.3 UAE

8.6.4 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 86)

9.1 INTRODUCTION

9.2 COMPETITIVE LANDSCAPE MAPPING

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 BUSINESS STRATEGY EXCELLENCE

9.5 OVERVIEW

9.6 COMPETITIVE SITUATIONS & TRENDS

9.6.1 EXPANSIONS

9.6.2 ACQUISITIONS

9.6.3 PARTNERSHIPS

9.6.4 AGREEMENTS

9.7 MARKET SHARE ANALYSIS

10 COMPANY PROFILES (Page No. - 94)

(Business Overview, Recent Developments, SWOT Analysis, MnM View)*

10.1 FOAM MANUFACTURERS (RESIN COMPOUNDERS)

10.1.1 DOW INC.

10.1.2 BASF SE

10.1.3 HUNTSMAN CORPORATION

10.1.4 ARMACELL INTERNATIONAL S.A.

10.1.5 UFP TECHNOLOGIES, INC.

10.1.6 INOAC CORPORATION

10.1.7 FXI HOLDINGS, INC.

10.1.8 FOAMPARTNER GROUP

10.1.9 THE WOODBRIDGE GROUP

10.1.10 GENERAL PLASTICS MANUFACTURING COMPANY

10.2 FABRICATORS

10.2.1 WISCONSIN FOAM PRODUCTS

10.2.2 KTT ENTERPRISES

10.2.3 LUXAIRE CUSHION CO.

10.2.4 TAIKIUSA INC.

10.2.5 POREX CORPORATION

10.2.6 REILLY FOAM CORPORATION

10.3 OEMS

10.3.1 COTY, INC.

10.3.2 ESTÉE LAUDER COMPANIES INC.

10.3.3 L'ORÉAL SA

10.3.4 NEW AVON COMPANY

10.3.5 BEAUTY BAKERIE

10.3.6 KRYOLAN

10.3.7 SHENZHEN KARINA MAKEUP TOOLS LTD

10.3.8 YUMARK ENTERPRISES CORP.

10.3.9 QUAL COSMETICS

10.3.10 PUSPONGE

*Details on Business Overview, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 135)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (84 TABLES)

TABLE 1 COSMETIC APPLICATOR FOAM MARKET SNAPSHOT, 2020 & 2025

TABLE 2 COUNTRY-WISE ANALYSIS OF COVID-19 CASES

TABLE 3 COVID-19 IMPACT: THE ECONOMIC OUTLOOK, 2020 -2021

TABLE 4 RELIEF PACKAGES ANNOUNCED BY G-20 COUNTRIES

TABLE 5 COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 6 PU MATERIAL TYPE: COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 OTHERS MATERIAL TYPES: COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 9 EGG-SHAPED SPONGES: COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 COSMETIC WEDGES: COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 SILICONE SPONGE COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 ROUND DISC SPONGES: COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 COSMETIC APPLICATOR FOAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 ASIA PACIFIC COSMETIC APPLICATOR FOAM MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 ASIA PACIFIC COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 16 ASIA PACIFIC COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 17 CHINA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 18 CHINA APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 19 INDIA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 20 INDIA APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 21 JAPAN COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 22 JAPAN APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 23 SOUTH KOREA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 24 SOUTH KOREA APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 25 INDONESIA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 26 INDONESIA APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 27 THAILAND COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 28 THAILAND APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 29 REST OF ASIA PACIFIC COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 30 REST OF ASIA PACIFIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 34 US COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 35 US COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 36 CANADA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 37 CANADA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 38 MEXICO COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 39 MEXICO COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 40 EUROPE COSMETIC APPLICATOR FOAM MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 EUROPE COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 42 EUROPE COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 43 GERMANY COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 44 GERMANY APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 45 UK COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 46 UK APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 47 FRANCE COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 48 FRANCE APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 49 ITALY COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 50 ITALY APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 51 RUSSIA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 52 RUSSIA APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 53 TURKEY COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 54 TURKEY APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 55 SPAIN COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 56 SPAIN COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 57 POLAND COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 58 POLAND APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 59 REST OF EUROPE COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 60 REST OF EUROPE APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 61 SOUTH AMERICA COSMETIC APPLICATOR FOAM MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 62 SOUTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 63 SOUTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 64 BRAZIL COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 65 BRAZIL COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 66 CHILE COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 67 CHILE COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 68 REST OF SOUTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 69 REST OF SOUTH AMERICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 73 SOUTH AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 74 SOUTH AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 75 SAUDI ARABIA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 76 SAUDI ARABIA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 77 UAE COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 78 UAE COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 79 REST OF MIDDLE EAST & AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST & AFRICA COSMETIC APPLICATOR FOAM MARKET SIZE, BY SHAPE, 2018–2025 (USD MILLION)

TABLE 81 EXPANSIONS, 2016–2020

TABLE 82 ACQUISITIONS, 2016–2020

TABLE 83 PARTNERSHIPS, 2016–2020

TABLE 84 AGREEMENTS, 2016–2020

LIST OF FIGURES (42 FIGURES)

FIGURE 1 COSMETIC APPLICATOR FOAM MARKET SEGMENTATION

FIGURE 2 COSMETIC APPLICATOR FOAM MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION: COSMETIC APPLICATOR FOAM MARKET

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 PU MATERIAL TYPE SEGMENT ACCOUNTED FOR A LARGER SHARE OF COSMETIC APPLICATOR MARKET IN 2019

FIGURE 7 EGG-SHAPED SPONGES SEGMENT ACCOUNTED FOR LARGEST SHARE OF COSMETIC APPLICATOR MARKET IN 2019

FIGURE 8 NORTH AMERICA EXPECTED TO LEAD COSMETIC APPLICATOR FOAM MARKET FROM 2020 TO 2025

FIGURE 9 GROWING COSMETIC INDUSTRY DRIVING COSMETIC APPLICATOR FOAM MARKET

FIGURE 10 COSMETIC APPLICATOR MARKET IN NORTH AMERICA PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 11 EGG-SHAPED SPONGES SEGMENT AND THE US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET IN 2019

FIGURE 12 COSMETIC APPLICATOR FOAM MARKET IN ITALY PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 13 COSMETIC APPLICATOR FOAM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

FIGURE 14 COSMETIC APPLICATOR FOAM MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 15 PU MATERIAL SEGMENT EXPECTED TO LEAD COSMETIC APPLICATOR FOAM MATERIAL DURING FORECAST PERIOD

FIGURE 16 EGG-SHAPED SPONGES SEGMENT EXPECTED TO LEAD COSMETIC APPLICATOR FOAM MARKET DURING FORECAST PERIOD

FIGURE 17 ITALY IS EXPECTED TO BE THE FASTEST-GROWING MARKET FOR COSMETIC APPLICATOR FOAM DURING FORECAST PERIOD

FIGURE 18 ASIA PACIFIC COSMETIC APPLICATOR FOAM MARKET SNAPSHOT

FIGURE 19 NORTH AMERICA COSMETIC APPLICATOR FOAM MARKET SNAPSHOT

FIGURE 20 EUROPE COSMETIC APPLICATOR FOAM MARKET SNAPSHOT

FIGURE 21 COMPETITIVE LANDSCAPE MAPPING

FIGURE 22 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COSMETIC APPLICATOR FOAM MARKET

FIGURE 23 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COSMETIC APPLICATOR FOAM MARKET

FIGURE 24 KEY GROWTH STRATEGIES ADOPTED BY COMPANIES IN THE COSMETIC APPLICATOR FOAM MARKET BETWEEN 2016 AND 2020

FIGURE 25 RANKING OF COMPANIES OPERATING IN COSMETIC APPLICATOR FOAM MARKET, 2019

FIGURE 26 DOW INC.: COMPANY SNAPSHOT

FIGURE 27 DOW INC.: SWOT ANALYSIS

FIGURE 28 BASF SE: COMPANY SNAPSHOT

FIGURE 29 BASF SE: SWOT ANALYSIS

FIGURE 30 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 31 HUNTSMAN CORPORATION: SWOT ANALYSIS

FIGURE 32 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

FIGURE 33 ARMACELL INTERNATIONAL S.A.: SWOT ANALYSIS

FIGURE 34 UFP TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FIGURE 35 UFP TECHNOLOGIES, INC.: SWOT ANALYSIS

FIGURE 36 INOAC CORPORATION: COMPANY SNAPSHOT

FIGURE 37 COTY, INC.: COMPANY SNAPSHOT

FIGURE 38 COTY, INC.: SWOT ANALYSIS

FIGURE 39 ESTÉE LAUDER COMPANIES INC.: COMPANY SNAPSHOT

FIGURE 40 ESTÉE LAUDER COMPANIES INC.: SWOT ANALYSIS

FIGURE 41 L'ORÉAL SA: COMPANY SNAPSHOT

FIGURE 42 L'ORÉAL SA: SWOT ANALYSIS

This study involved four major activities in estimating the current size of the cosmetic applicator foam market. Exhaustive secondary research was undertaken to collect information on the cosmetic applicator foam market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the cosmetic applicator foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to determine the sizes of different segments and subsegments of the cosmetic applicator foam market.

Secondary Research

As a part of the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva, were referred for identifying and collecting information for this study on the cosmetic applicator foam market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both the market- and technology-oriented perspectives.

Primary Research

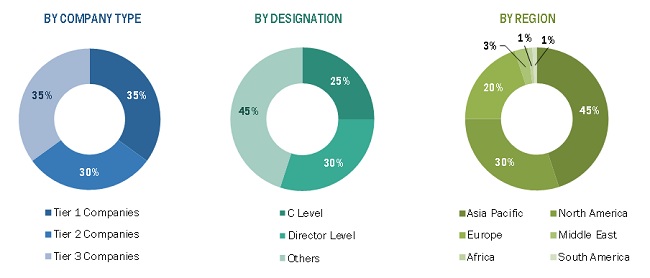

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the cosmetic applicator foam market. Primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cosmetic applicator foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cosmetic applicator foam market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the size of the cosmetic applicator foam market based on material type, shape, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To forecast the size of the various segments of the cosmetic applicator foam market based on five regions— North America, Asia Pacific, Europe, South America, and the Middle East & Africa, along with key countries in each of these regions

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent developments, such as expansions, acquisitions, agreements, and partnerships in the cosmetic applicator foam market

- To strategically profile the key players in the market and comprehensively analyze their core competencies*

The following customization options are available for the report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Cosmetic Applicator Foam Market