Corrugated Bulk Bins Market by type (Hinged, Totes, Pallets), format (Single Wall, Double Wall, Triple wall), load capacity, Application (Food, Pharmaceutical, Chemical, Consumer Goods, Tobacco) and Region - Global Forecast to 2025

Updated on : August 05, 2025

Corrugated Bulk Bins Market

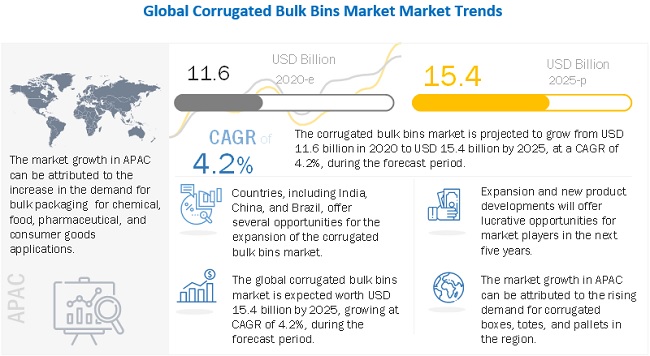

The global corrugated bulk bins market was valued at USD 11.6 billion in 2020 and is projected to reach USD 15.4 billion by 2025, growing at 4.2% cagr from 2020 to 2025. The market is expected to witness significant growth in the future due to its increased demand in end-use industries, such as food & beverage and pharmaceutical. Growth in modern retailing, high consumer income, and acceleration in industrial activities, especially in the emerging economies, are likely to support the growth of the corrugated bulk bins market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global corrugated bulk bins market

The global corrugated bulk bins market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the bulk packaging for chemicals, luxury goods, electronics, and automotive amongst other applications, will witness a significant decline in its demand. However, there will be an increase in the demand for corrugated bulk bins solutions for food & beverage and pharmaceutical applications, during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for bulk packaging solutions. Governments of many affected countries, for instance, India, have asked the food industry players to ramp up production to avoid supply-side shocks and shortages and maintain uninterrupted supply. FMCG companies are responding by demanding more of corrugated bulk bins products. For example, Britannia Industries has urged the Indian government to ensure interstate movements of suppliers of raw materials and packaging materials.

- The demand for corrugated bulk bins in the pharmaceutical industry, is expected to remain robust as hospitals, drugs, and PPE manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase. This in turn, boosts the demand for corrugated bulk bins for the timely delivery of raw materials and finished goods to their respective end users.

Corrugated Bulk Bins Market Dynamics

Driver: Recyclability of corrugated bulk bins

Corrugated bulk bins are made of wood pulp, which can be recycled. Recycling helps in reducing solid waste disposal. It has a ripple effect, which reduces energy & water consumption and other resources required to make a material. Recycling of corrugated bulk bins or boxes saves tons of waste generated from packaging, thereby saving considerable landfill space. It also leads to a reduction in greenhouse gas emissions that contribute to climate change. These factors collectively drive the market for corrugated bulk bins.

The increasing regulations over the use of non-biodegradable materials in North America and Europe have also led to the growth in demand for corrugated bulk bins in these regions. Thus, recycling acts as a driver for the growth of the industry as consumers and goods manufacturers are more inclined toward using recycled and eco-friendly packaging materials.

Additionally, the extensive use of corrugated boxes and bins in the American economy makes it the biggest manufactured product in the waste stream by weight. However, old corrugated cartons are easily recyclable, which also makes it the most recycled product by weight and greatly diminishes the amount sent to disposal. Since 1960, the old corrugated carton generation increased by 302%; its MSW market share increased by 42%, its recycling rate increased by 164%, and its disposal share decreased by 72%. Corrugated bins and box production have benefitted from the rise in online shopping due to the need for more small shipping boxes for those shipments than the much larger bins used to ship products to brick and mortar stores.

Restraint: Availability of low-cost alternatives

There are a few alternatives available, which compete with corrugated bulk bins. One such alternative is the corrugated plastic box and jute sacks, which are more durable, attractive, and economical than corrugated bulk bins. Unlike corrugated bulk bins, corrugated plastic boxes are reusable, water-resistant, have a longer shelf life, and can withstand rain, moisture, and snow. Moreover, manufacturing a plastic box is cheaper compared to a corrugated bulk bin. This has helped it to gain widespread acceptance in the packaging industry. Thus, the availability of cost-efficient alternatives may act as a restraint for the corrugated bulk bins market.

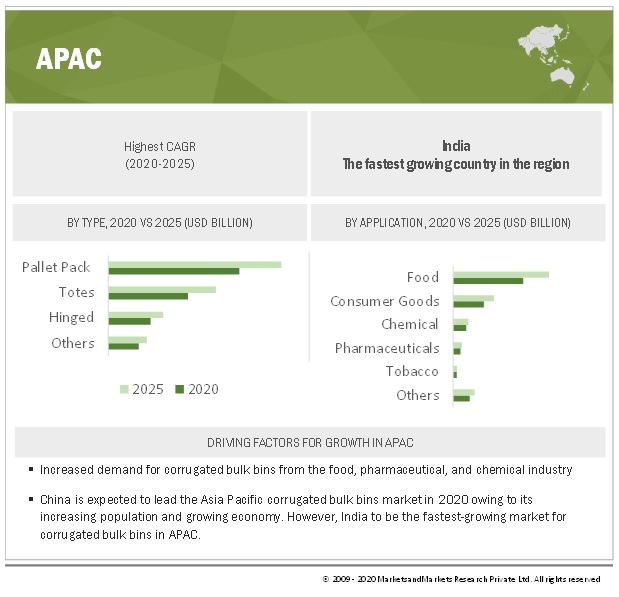

Opportunity: Rising demand for corrugated bulk bins from APAC region

The corrugated bulk bins market in APAC is expected to witness tremendous growth during the forecast period because of the growing population and the rise in currency rates. Growth in the market has come in the backdrop of strong production and consumption of bulk packaging products from economies, such as China and India, which have been witnessing stable demand from major consuming countries. Apart from leading countries (which include China and India), there is high market growth in other countries, including Singapore, Hong Kong, and New Zealand, due to the efficient labor market, excellent infrastructure, and a good transportation system. Grain mill products and vegetables will drive the food industry in corrugated bulk bins in APAC during the forecast period. The growth in these sectors in the emerging economies will lead to considerable demand for packaging sacks.

Challenge: Pricing pressures for small manufacturers

Corrugated bulk bins manufacturers are facing stiff competition in the market because of the variance in product pricing, which especially affects the small vendors as large companies are able to adapt to these changes. Corrugated bulk bin manufacturers are facing issues with respect to customers’ demand for lower-cost packaging materials while they have to maintain their profit margins and their standards and reputation for the quality of packaging materials that they offer. Large companies are able to provide integrated packaging solutions, including value-added design, engineering, and integration services, along with after-sales service and support. They are capital-intensive and concerned with value-added activities such as material production, innovation in products, and high-volume supplies. Small vendors are unable to provide these at lower costs and to supplement them with a higher level of value-added engineering.

Most of the manufacturers are operating in the US, Japan, Germany, Italy, and China. Even with the newly developing market in APAC, Latin America, and the Middle East. Small vendors are unable to export their products to these markets because of the high transportation costs. Price wars can be expected to creep in, with regional and local vendors providing substitute products at much lower prices. While large organizations try to emulate the same strategy to maintain their market share, they might run the risk of lower profitability, which is expected to affect their investments in R&D and product development.

Corrugated boxes widely preferred for corrugated bulk bins

Based on product type, the corrugated boxes segment is projected to be the largest market for corrugated bulk bins. The dominant market position of the segment can be attributed to the increase in the demand for these product type across various applications in food & beverage, pharmaceutical and automotive industries. The increase in the demand for corrugated boxes can be attributed to the rise in the demand for lightweight and convenient packaging solutions.

Significant increase in the food products during COVID-19 pandemic

By application, the food segment is projected to be the largest segment in the corrugated bulk bins market. People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily needs, FMCG, and fresh food through e-commerce & online channels, which leads to an increase in the demand for bulk packaging solutions. This in turn, boost the demand for corrugated bulk bins for food application.

APAC region to lead the global corrugated bulk bins market by 2025

The APAC region accounted for the largest market share in 2019. Factors such as improving global economy, expanding working population, rising domestic demand for ready-to-eat & convinence food products are expected to boost the market for corrugated bulk bins. The market for corrugated bulk bins in APAC is growing in the food, automotive, chemical, pharmaceutical, and consumer goods industries due to the functional properties offered by corrugated bulk bins, such as safety, cost-effectiveness, durability, strength, sustainability, and logistical convenience.

To know about the assumptions considered for the study, download the pdf brochure

Corrugated Bulk Bins Market Players

The corrugated bulk bins market is dominated by a few globally established players, such as Greif Inc. (US), WestRock Company (US), International Paper Company (US), Mondi (Austria), and Sonoco (US) among many others.

Corrugated Bulk Bins Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 11.6 billion |

|

Revenue Forecast in 2025 |

USD 15.4 billion |

|

CAGR |

4.2% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Million Square meter) |

|

Segments covered |

Type, Load Capacity, Format, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Greif Inc. (US), WestRock Company (US), International Paper Company (US), Mondi (Austria), and Sonoco (US) |

This research report categorizes the corrugated bulk bins market based on type, format, load capacity, application and region.

On the basis of type:

- Pallet Packs

- Hinged

- Totes

- Others (includes crates, skid boxes, and cargo boxes)

On the basis of load capacity

- Below 1000 KG

- 1000-1500 KG

- More Than 1500 KG

On the basis of Format

- Single wall

- Double wall

- Tripple wall

- Others (Four walls and above till 8 walls)

On the basis of application

- Food & beverage

- Automotive

- Pharmaceutical

- Chemical

- Oil & Lubricant

- Building & Construction

- Others (includes rubber & plastic, agricultural, and metal fabrication)

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2020, International Paper has committed to donate 2 million corrugated bulk bin boxes to hunger relief organizations in the North American region due to the COVID-19 pandemic.

- In April 2020, Greif, Inc. acquired a minority stake in Centurion Container LLC to expand its intermediate bulk container (IBC) reconditioning network in North America. The investment in Centurion Container LLC is expected to enhance the company’s IBC and IBC reconditioning businesses.

- In October 2018, Packaging Corporation of America (PCA) acquired the assets of Englander dZignPak, a corrugated product's manufacturer company, for USD 56.3 million. The assets include two sheet plants located in Waco, Texas and Carrollton, Texas. Englander dZignPak joined Packaging Corporation of America to help better serve and grow the communities and customers that have been integral to 50 plus years of business.

Frequently Asked Questions (FAQ):

What is the current size of global corrugated bulk bins market?

The global corrugated bulk bins market size is projected to grow from USD 11.6 billion in 2020 to USD 15.4 billion by 2025, at a CAGR of 4.2% from 2020 to 2025.

How is the corrugated bulk bins market aligned?

The corrugated bulk bins market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global corrugated bulk bins market?

The key players operating in the corrugated bulk bins market are WestRock Company (US), International Paper Company (US), Mondi (Austria), Sonoco (US), and Greif Inc. (US).

What are the latest ongoing trends in the corrugated bulk bins market?

The players operating in the corrugated bulk bins market aim to offer a low-cost, sustainable, and environmentally friendly, owing to a shift in trend (use of durable, and recycled materials for the corrugated bulk bins) among the end-users who are engaged in the production of food, pharmaceutical, chemicals, tobacco, and other products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 CORRUGATED BULK BINS MARKET SCOPE: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 CORRUGATED BULK BINS MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 MARKET ENGINEERING PROCESS

2.2.1 TOP-DOWN APPROACH

FIGURE 1 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 FORECAST NUMBER CALCULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 3 TOTES TO BE THE FASTEST-GROWING TYPE OF CORRUGATED BULK BINS

FIGURE 4 FOOD TO BE THE LARGEST APPLICATION OF CORRUGATED BULK BINS

FIGURE 5 APAC DOMINATED THE CORRUGATED BULK BINS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 EMERGING ECONOMIES TO WITNESS HIGHER DEMAND FOR CORRUGATED BULK BINS

FIGURE 6 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN CORRUGATED BULK BINS MARKET

4.2 APAC: CORRUGATED BULK BINS MARKET, BY APPLICATION AND COUNTRY, 2019

FIGURE 7 CHINA AND FOOD SEGMENT ACCOUNTED FOR LARGEST SHARES

4.3 CORRUGATED BULK BINS MARKET, BY TYPE

FIGURE 8 PALLET PACKS TO LEAD THE CORRUGATED BULK BINS MARKET

4.4 CORRUGATED BULK BINS MARKET, BY FORMAT

FIGURE 9 DOUBLE WALL SEGMENT TO LEAD THE CORRUGATED BULK BINS MARKET

4.5 CORRUGATED BULK BINS MARKET, BY LOAD CAPACITY

FIGURE 10 LESS THAN 1000 KG BULK BINS FIND LARGEST APPLICATION

4.6 CORRUGATED BULK BINS MARKET, BY APPLICATION

FIGURE 11 FOOD TO BE THE LARGEST APPLICATION OF CORRUGATED BULK BINS

4.7 CORRUGATED BULK BINS MARKET, BY KEY COUNTRIES

FIGURE 12 CORRUGATED BULK BINS MARKET IN INDIA TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORRUGATED BULK BINS MARKET

5.2.1 DRIVERS

5.2.1.1 Recyclability of corrugated bulk bins

5.2.1.2 Rise in demand for bulk packaging from the chemical industry

5.2.1.3 High optimization in pack size and greater printable space for brand recognition

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost alternatives

5.2.2.2 Volatility in raw material prices.

5.2.2.3 Stringent packaging regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Globalization and international trade

5.2.3.2 Rising demand for corrugated bulk bins from APAC

5.2.3.3 Rise in product innovation for industrial packaging

5.2.4 CHALLENGES

5.2.4.1 Pricing pressures for small manufacturers

6 COVID-19 IMPACT ON CORRUGATED BULK BINS MARKET (Page No. - 50)

6.1 COVID-19 IMPACT: OVERVIEW

6.1.1 COVID-19 IMPACT ON KEY END-USE INDUSTRIES OF CORRUGATED BULK BINS

6.1.2 NEW OPPORTUNITIES AND DISRUPTIONS

6.1.3 SUPPLY CHAIN DISRUPTION

6.2 CUSTOMER ANALYSIS

6.2.1 SHIFT IN HEALTHCARE INDUSTRY

6.2.1.1 Disruption in the industry

6.2.1.2 Impact on customers’ output & strategies to resume/ improve production

6.2.1.2.1 Short-term strategies to manage cost structure and supply chains

6.2.1.3 New market opportunities/growth opportunities

6.2.1.3.1 Measures taken by the customers

6.2.1.3.2 Customers’ perspective on the growth outlook

6.2.2 SHIFT IN FOOD & BEVERAGE INDUSTRY

6.2.2.1 Disruption in the industry

6.2.2.2 Impact on customers’ output & strategies to resume/ improve production

6.2.2.2.1 Short-term strategies to manage cost structure and supply chains

6.2.2.3 New market opportunities/growth opportunities

6.2.2.3.1 Measures taken by the customers

6.2.2.3.2 Customers’ perspective on the growth outlook

6.2.3 SHIFT IN BEAUTY & PERSONAL CARE INDUSTRY

6.2.3.1 Disruption in the industry

6.2.3.2 Impact on customers’ output & strategies to resume/ improve production

6.2.3.2.1 Impact on customers’ revenues

6.2.3.2.2 Customer’s most impacted regions

6.2.3.2.3 Short-term strategies to manage cost structure and supply chains

6.2.3.3 New market opportunities/growth opportunities

6.2.3.3.1 Measures taken by the customers

6.2.3.3.2 Customers’ perspective on the growth outlook

6.2.4 SHIFT IN ELECTRICAL & ELECTRONICS INDUSTRY

6.2.4.1 Disruption in the industry

6.2.4.2 Impact on customers’ output & strategies to resume/ improve production

6.2.4.2.1 Impact on customers’ revenues

6.2.4.2.2 Customer’s most impacted regions

6.2.4.2.3 Short-term strategies to manage cost structure and supply chains

6.2.4.3 New market opportunities/growth opportunities

6.2.4.3.1 Measures taken by customers

6.2.4.3.2 Customers’ perspective on growth outlook

7 INDUSTRY TRENDS (Page No. - 63)

7.1 INTRODUCTION

7.2 VALUE CHAIN ANALYSIS

FIGURE 14 MAXIMUM VALUE IS ADDED TO THE FINAL PRODUCT DURING THE MANUFACTURING PHASE

7.2.1 PROMINENT COMPANIES

7.2.2 SMALL & MEDIUM ENTERPRISES

7.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 CORRUGATED BULK BINS MARKET: PORTER’S FIVE FORCES ANALYSIS

7.3.1 THREAT OF NEW ENTRANTS

7.3.2 THREAT OF SUBSTITUTES

7.3.3 BARGAINING POWER OF SUPPLIERS

7.3.4 BARGAINING POWER OF BUYERS

7.3.5 INTENSITY OF COMPETITIVE RIVALRY

7.4 ANALYSIS OF SUBSTITUTE PRODUCTS AND SUSTAINABILITY ASPECTS

7.4.1 COMPARISON OF CBB WITH SUPER SACKS/FIBCS

7.4.2 REGIONAL ANALYSIS OF SUBSTITUTE PRODUCTS

7.4.2.1 North America

7.4.2.2 Europe

7.4.2.3 Asia Pacific (APAC)

7.4.2.4 Middle East & Africa (MEA)

7.4.2.5 South America

7.4.3 SUSTAINABLE DEVELOPMENTS BY KEY COMPANIES

7.4.4 REUSABLE & RECYCLABLE OPTIONS

7.5 CUSTOMER REQUIREMENT ANALYSIS

7.5.1 NORTH AMERICA

7.5.2 EUROPE

7.5.3 APAC

7.5.4 MEA

7.5.5 SOUTH AMERICA

7.6 ADHESIVE APPLICATION AND USAGE OF COATED TAPES

7.7 AVERAGE PRICING ANALYSIS, BY FORMAT

TABLE 1 AVERAGE PRICES OF CORRUGATED BULK BINS, BY REGION (USD/SQUARE METER)

7.8 TRADE DATA ANALYSIS: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 2 HS CODE 481910: EXPORT AND IMPORT INFORMATION FOR KEY COUNTRY IN 2019

7.9 ECOSYSTEM MAPPING

7.10 REGULATORY FRAMEWORK

7.11 PATENT ANALYSIS

8 CORRUGATED BULK BINS MARKET, BY TYPE (Page No. - 80)

8.1 INTRODUCTION

FIGURE 16 PALLET PACKS TO EXHIBIT HIGH GROWTH RATE DURING THE FORECAST PERIOD

TABLE 3 CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

8.2 PALLET PACKS

8.2.1 OFFER REUSE AND RE-CONDITIONED OPTIONS TO END-USE INDUSTRIES

8.3 HINGED

8.3.1 REUSABLE INDUSTRIAL CONTAINERS FOR TRANSPORT AND STORAGE OF BULK PRODUCTS AND GRANULATED SUBSTANCES

8.4 TOTES

8.4.1 FOOD INDUSTRY CONTRIBUTES TO THE LARGEST DEMAND FOR TOTES

8.5 OTHERS

9 CORRUGATED BULK BINS MARKET, BY FORMAT (Page No. - 84)

9.1 INTRODUCTION

FIGURE 17 DOUBLE WALL SEGMENT TO LEAD THE GLOBAL CORRUGATED BULK BINS MARKET

TABLE 5 CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 6 CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

9.2 SINGLE WALL

9.2.1 LESS DURABLE THAN DOUBLE-WALL AND TRIPLE-WALL BINS

9.3 DOUBLE WALL

9.3.1 TO BE THE LARGELY USED FORMAT FOR CORRUGATED BULK BINS

9.4 TRIPLE WALL

9.4.1 CONSIDERED THE STRONGEST BINS/BOXES FOR HEAVY-DUTY PACKAGING

9.5 OTHERS

10 CORRUGATED BULK BINS MARKET, BY LOAD CAPACITY (Page No. - 88)

10.1 INTRODUCTION

FIGURE 18 LESS THAN 1000 KG CAPACITY TO LEAD THE CORRUGATED BULK BINS MARKET, BY LOAD CAPACITY

TABLE 7 CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 8 CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

10.1.1 BELOW 1000 KG

10.1.2 1000-1500 KG

10.1.3 MORE THAN 1500 KG

11 CORRUGATED BULK BINS MARKET, BY APPLICATION (Page No. - 91)

11.1 INTRODUCTION

FIGURE 19 FOOD APPLICATION TO LEAD THE GLOBAL CORRUGATED BULK BINS MARKET

TABLE 9 CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 10 CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

11.2 CHEMICALS

11.2.1 CORRUGATED BULK BINS ARE USED FOR THE PACKAGING OF SOLID AND GRANULAR CHEMICALS & DERIVATIVES

11.3 PHARMACEUTICALS

11.3.1 CORRUGATED BULK BINS MADE OF SPECIAL HYGIENIC MATERIALS ARE USED IN THIS SECTOR

11.4 FOOD

11.4.1 FOOD INDUSTRY TO DOMINATE THE CORRUGATED BULK BINS MARKET BY 2025

11.4.2 FRESH PRODUCE

11.4.3 PROTEIN SUPPLEMENTS

11.4.4 SNACK FOOD

11.4.5 POULTRY & SEAFOOD

11.5 CONSUMER GOODS

11.5.1 CONSUMER GOODS MANUFACTURERS SWITCHING TO ENVIRONMENT-FRIENDLY AND BIODEGRADABLE PACKAGING SOLUTIONS

11.6 TOBACCO

11.6.1 CHANGING LIFESTYLE INCREASING THE CONSUMPTION OF TOBACCO WORLDWIDE

11.7 OTHERS

12 CORRUGATED BULK BINS MARKET, BY REGION (Page No. - 97)

12.1 INTRODUCTION

FIGURE 20 REGIONAL SNAPSHOT: INDIA TO BE THE FASTEST-GROWING MARKET FROM 2020 TO 2025

TABLE 11 CORRUGATED BULK BINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 CORRUGATED BULK BINS MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE METER)

12.2 APAC

FIGURE 21 APAC: CORRUGATED BULK BINS MARKET SNAPSHOT

TABLE 13 APAC: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 APAC: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 15 APAC: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 16 APAC: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

TABLE 17 APAC: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 18 APAC: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

TABLE 19 APAC: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 20 APAC: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 21 APAC: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 22 APAC: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.1 CHINA

12.2.1.1 Largest consumer of corrugated bulk bins in APAC

TABLE 23 CHINA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 24 CHINA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.2 JAPAN

12.2.2.1 Increase in demand for packed foods

TABLE 25 JAPAN: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 26 JAPAN: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.3 INDIA

12.2.3.1 Government investments in food processing industry to propel market growth

TABLE 27 INDIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 28 INDIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.4 AUSTRALIA

12.2.4.1 Urbanization and demand for packaged food items to boost market growth

TABLE 29 AUSTRALIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 30 AUSTRALIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.5 SOUTH KOREA

12.2.5.1 Increased e-commerce sales, imports, and exports

TABLE 31 SOUTH KOREA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 32 SOUTH KOREA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.2.6 REST OF APAC

TABLE 33 REST OF APAC: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 34 REST OF APAC: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3 EUROPE

TABLE 35 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 37 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 38 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

TABLE 39 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

TABLE 41 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 43 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.1 GERMANY

TABLE 45 GERMANY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 GERMANY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.2 UK

12.3.2.1 Increase in construction spending to boost the market for industrial packaging

TABLE 47 UK: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 UK: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.3 FRANCE

12.3.3.1 Growth in demand for bulk packaging in automotive industry

TABLE 49 FRANCE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 FRANCE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.4 RUSSIA

12.3.4.1 Increase in construction activities to drive consumption of industrial packaging products

TABLE 51 RUSSIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 RUSSIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.5 ITALY

12.3.5.1 Significant boost in pharmaceutical industry to increase demand for bulk packaging

TABLE 53 ITALY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 ITALY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.6 SPAIN

12.3.6.1 Largest market for manufacturing of industrial vehicles

TABLE 55 SPAIN: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 SPAIN: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.3.7 REST OF EUROPE

TABLE 57 REST OF EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 REST OF EUROPE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.4 NORTH AMERICA

TABLE 59 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 61 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

TABLE 63 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

TABLE 65 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 67 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.4.1 US

12.4.1.1 US to lead the corrugated bulk bins market in the region from 2020 to 2025

TABLE 69 US: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 US: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.4.2 CANADA

12.4.2.1 Increasing demand from the manufacturing industry to spur market growth

TABLE 71 CANADA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 CANADA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.4.3 MEXICO

12.4.3.1 To be the fastest-growing corrugated bulk bins market in the region

TABLE 73 MEXICO: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 MEXICO: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5 MIDDLE EAST & AFRICA

TABLE 75 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 77 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

TABLE 79 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

TABLE 81 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 83 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5.1 UAE

12.5.1.1 To be the fastest-growing market for industrial packaging in the region

TABLE 85 UAE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 UAE: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5.2 SAUDI ARABIA

12.5.2.1 Demand for convenient packaging to fuel market growth

TABLE 87 SAUDI ARABIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 SAUDI ARABIA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5.3 SOUTH AFRICA

12.5.3.1 Increase in the number of healthcare units to boost the use of corrugated bulk bins

TABLE 89 SOUTH AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 SOUTH AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5.4 TURKEY

12.5.4.1 To dominate the corrugated bulk bins market in the region by 2025

TABLE 91 TURKEY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 TURKEY: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 93 REST OF MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 94 REST OF MIDDLE EAST & AFRICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.6 SOUTH AMERICA

TABLE 95 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 97 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY FORMAT, 2018–2025 (MILLION SQUARE METER)

TABLE 99 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (USD MILLION)

TABLE 100 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY LOAD CAPACITY, 2018–2025 (MILLION SQUARE METER)

TABLE 101 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY TYPE, 2018–2025 (MILLION SQUARE METER)

TABLE 103 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.6.1 BRAZIL

12.6.1.1 Brazil to dominate the corrugated bulk bins market in South America

TABLE 105 BRAZIL: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 106 BRAZIL: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.6.2 ARGENTINA

12.6.2.1 Increased investment in infrastructural development to boost the demand for industrial packaging in the country

TABLE 107 ARGENTINA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 108 ARGENTINA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

12.6.3 REST OF SOUTH AMERICA

TABLE 109 REST OF SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 REST OF SOUTH AMERICA: CORRUGATED BULK BINS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

13 COMPETITIVE LANDSCAPE (Page No. - 145)

13.1 OVERVIEW

FIGURE 22 COMPANIES ADOPTED ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

13.2 MARKET RANKING

FIGURE 23 MARKET RANKING OF KEY PLAYERS, 2019

13.3 SHARE OF KEY PLAYERS IN THE CORRUGATED BULK BINS MARKET

FIGURE 24 WESTROCK COMPANY LED THE CORRUGATED BULK BINS MARKET IN 2019

13.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 111 REVENUE ANALYSIS OF KEY PLAYERS

13.5 COMPETITIVE LEADERSHIP MAPPING

13.5.1 STAR

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 EMERGING COMPANIES

FIGURE 25 CORRUGATED BULK BINS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

13.5.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 26 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CORRUGATED BULK BINS MARKET

13.5.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 27 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN CORRUGATED BULK BINS MARKET

14 COMPANY PROFILES (Page No. - 152)

(Business Overview, financial Assessment, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, current focus and strategies, threat from competition, right to win)*

14.1 WESTROCK COMPANY

FIGURE 28 WESTROCK COMPANY: COMPANY SNAPSHOT

FIGURE 29 WESTROCK COMPANY: SWOT ANALYSIS

14.2 INTERNATIONAL PAPER COMPANY

FIGURE 30 INTERNATIONAL PAPER COMPANY: COMPANY SNAPSHOT

FIGURE 31 INTERNATIONAL PAPER COMPANY: SWOT ANALYSIS

FIGURE 32 INTERNATIONAL PAPER COMPANY: WINNING IMPERATIVES

14.3 MONDI GROUP

FIGURE 33 MONDI GROUP: COMPANY SNAPSHOT

FIGURE 34 MONDI GROUP: SWOT ANALYSIS

FIGURE 35 MONDI GROUP: WINNING IMPERATIVES

14.4 SONOCO PRODUCTS COMPANY

FIGURE 36 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 37 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

FIGURE 38 SONOCO PRODUCTS COMPANY: WINNING IMPERATIVES

14.5 GEORGIA-PACIFIC, LLC

FIGURE 39 GEORGIA-PACIFIC, LLC: SWOT ANALYSIS

FIGURE 40 GEORGIA-PACIFIC, LLC: WINNING IMPERATIVES

14.6 GREIF, INC.

FIGURE 41 GREIF, INC.: COMPANY SNAPSHOT

FIGURE 42 GREIF, INC.: SWOT ANALYSIS

14.7 SMURFIT KAPPA

FIGURE 43 SMURFIT KAPPA: COMPANY SNAPSHOT

FIGURE 44 SMURFIT KAPPA: SWOT ANALYSIS

FIGURE 45 WINNING IMPERATIVES: SMURFIT KAPPA

14.8 ORORA LIMITED

FIGURE 46 ORORA LIMITED: COMPANY SNAPSHOT

14.9 PACKAGING CORPORATION OF AMERICA (PCA)

FIGURE 47 PACKAGING CORPORATION OF AMERICA (PCA): COMPANY SNAPSHOT

14.10 LARSEN PACKAGING PRODUCTS, INC.

14.11 SUPAK INDUSTRIES PVT. LTD.

14.12 JAYARAJ FORTUNE PACKAGING PVT. LTD.

14.13 B&B TRIPLEWALL CONTAINERS LIMITED

FIGURE 48 B&B TRIPLEWALL CONTAINERS LIMITED : COMPANY SNAPSHOT

14.14 SAICA GROUP

14.15 CARTOCOR S.A.

14.16 DS SMITH

FIGURE 49 DS SMITH: COMPANY SNAPSHOT

FIGURE 50 DS SMITH: SWOT ANALYSIS

14.17 OTHER PLAYERS

14.17.1 EMENAC PACKAGING

14.17.2 DELUXE PACKAGING

14.17.3 ELITE PACKAGING

14.17.4 NEW-INDY TRIPAQ

14.17.5 B.A.G. CORP.

14.17.6 ELSONS INTERNATIONAL

14.17.7 BULK BIN PACKAGING COMPANY

*Details on Business Overview, financial Assessment, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, current focus and strategies, threat from competition, right to win might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 203)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

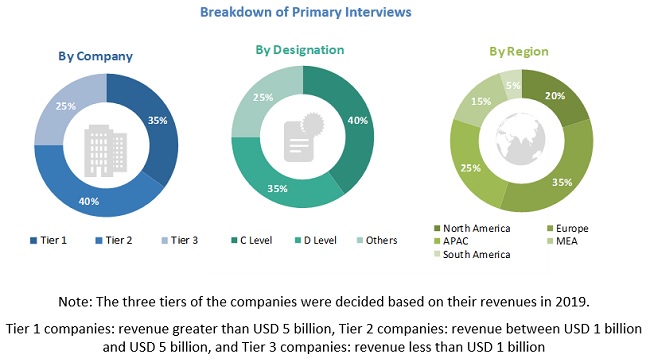

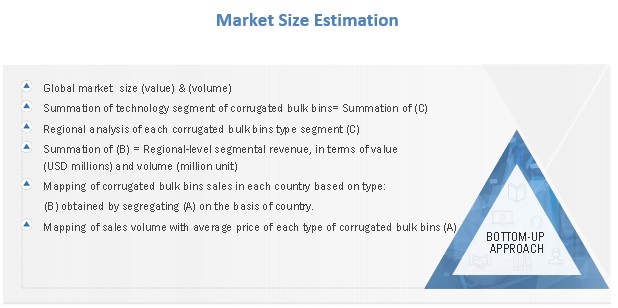

The study involved four major activities for estimating the current global size of the corrugated bulk bins market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of corrugated bulk bins through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the corrugated bulk bins market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the corrugated bulk bins market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the corrugated bulk bins market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the corrugated bulk bins industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the corrugated bulk bins market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the corrugated bulk bins market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the corrugated bulk bins market in terms of value and volume based on type, load capacity, format, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product developments, expansions & investments, acquisitions, and agreements in the corrugated bulk bins market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the corrugated bulk bins report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the corrugated bulk bins market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corrugated Bulk Bins Market