Corrosion Resistant Resin Market by Type (Epoxy, Polyester), Application (Coatings, Composites), End-Use Industry (Oil & gas, Heavy industries, Automotive & transportation) - Global Trends & Forecasts to 2026

[156 Pages Report] The global corrosion resistant resin (CRR) market was valued at USD 6.30 Billion by 2015 and is projected to reach USD 12.56 Billion by 2026. The market is projected to grow at a CAGR of 5.7% between 2016 and 2026. In this study, 2015 has been considered as the base year. The time period between 2016 and 2026 has been considered as the long-term forecast period while the time period between 2016 and 2021 has been considered as the midterm forecast period.

The main objective of the study is to define, describe, and forecast the CRR market on the basis of type, end-use industry, and application. The report includes detailed information about major factors influencing the growth of the market (drivers, restraints, opportunities, and industry specific challenges). The report strategically analyzes market segments with respect to individual growth trends, growth prospects, and contribution to the total market. In the report, the market size has been estimated for segments, in terms of value, with respect to five major regions, namely North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

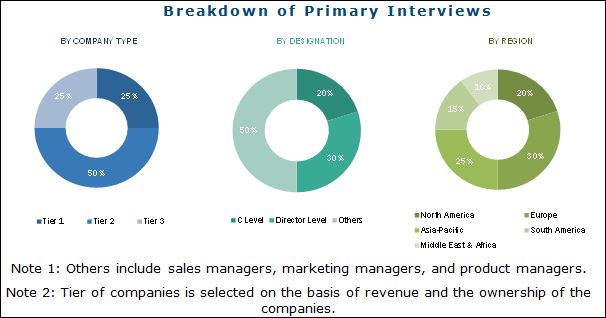

In this report, market sizes have been derived through various research methodologies. In the secondary research process, different sources have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized authors. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate market size, in terms of value and volume. The top-down approach has been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

The CRR market includes raw material suppliers, manufacturers, and end-users. Raw material suppliers include Eastman Chemical Company (U.S.), BASF SE (Germany), GE Plastics Hexion Inc. (U.S.), among others. Manufacturers in the CRR market are Ashland Inc. (U.S.), Reichhold LLC (U.S.), Hexion Inc. (U.S.), Huntsman Corporation (U.S.), among others. The end-user segment includes industries, such as oil & gas, heavy industries, automotive & transportation, infrastructure, and others.

Please visit 360Quadrants to see the vendor listing of Top 20 Composites Companies, Worldwide 2023

The stakeholders of the CRR market are:

- CRR manufacturing companies

- CRR distributors

- Raw material suppliers

- Commercial Research & Development (R&D) institutes

- Research institute, trade association, and government agencies

Scope of the Report:

The report forecasts revenue growth and analysis of trends in each of the sub segments. This research report categorizes the corrosion resistant resin (CRR) market based on the following:

By Type:

- Epoxy

- Polyester

- Polyurethane

- Vinyl Ester

- Others

By Application:

- Coatings

- Composites

- Others

By End-use Industry:

- Marine

- Automotive & transportation

- Oil & gas

- Infrastructure

- Heavy industries

- Others

By Region:

- Europe

- North America

- Asia-Pacific

- South America

- Middle East & Africa

Each region is further segmented into key countries.

Available Customizations:

The following customization options are available for the report:

-

Country Information

- CRR market analysis for additional countries

-

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The global corrosion resistant resin (CRR) market is projected to reach USD 12.56 Billion by 2026. It is estimated to grow at a CAGR of 5.7% during the long-term forecast period, 2016-2026. The CRR market is driven by increasing monetary losses due to corrosion and growth of the end-use industries. Another prime factor that is expected to bring momentum to this market is modernization of infrastructure.

Based on type, the epoxy and polyester segments are expected to grow at high CAGRs between 2016 and 2026, in terms of volume. The epoxy segment is estimated to account for the largest market share in 2016, as epoxy is highly used in coatings and composites application, and possesses excellent corrosion resistance properties.

Based on end-use industry, the oil & gas segment is projected to lead the CRR market during the forecast period. Corrosion resistant resins are widely used in the oil & gas industry as coatings and composites. Coatings are done on underground fuel storage tanks, pipelines to protect them from corrosion.

Based on application, the coatings segment is estimated to lead the CRR market during the forecast period, as these coatings are most effective, durable, and cost-efficient. The composites application segment is expected to register high growth rate during the forecast period, owing to the growing demand for lightweight materials from automotive & transportation, oil & gas, heavy industries, and various other end-use industries to reduce the maintenance cost.

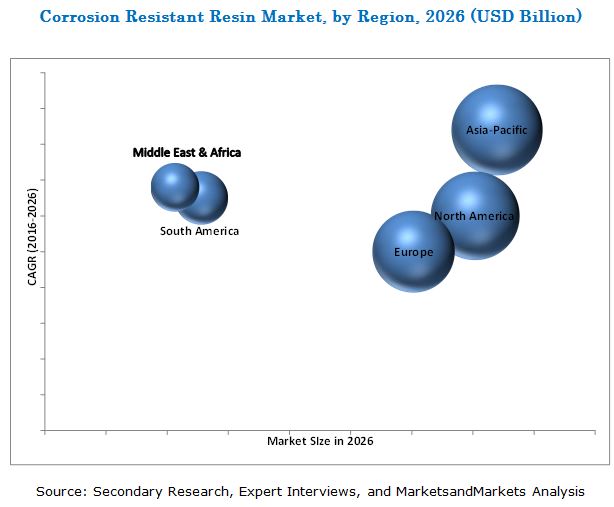

The Asia-Pacific region accounted for the largest share of the global corrosion resistant resin market in 2015 and is expected to continue its dominance during the forecast period. The Middle East & Africa is projected to grow at the highest CAGR during the forecast period, owing to a large oil & gas industry in the region. Saturation in North America and Europe is posing a challenge for the CRR market to grow in these regions. Countries in these regions have a well-established infrastructure for public, commercial, and transport sectors, which is affecting the growth of the CRR market in these regions.

Innovations are a must in the CRR market to serve applications better. Continuous portfolio optimization in the CRR market is important to stay competitive. In order to develop new and innovative products, technologies, and manufacturing processes, market players are collaborating with each other. These collaborations are expected to reduce competition in the CRR market during the forecast period.

Major players adopted both, organic and inorganic growth strategies between 2012 and 2016 to strengthen their market position. Investments & expansions, and partnerships & agreements & collaborations were the major organic growth strategies adopted by the market players to enhance their regional presence and meet the growing demand for corrosion resistant resins in emerging economies. Ashland Inc. (U.S.), Hexion Inc. (U.S.), Reichhold LLC (U.S.) and Huntsman Corporation (U.S.), Scott Bader Company Limited (U.K.) are some of the prominent players in the CRR market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in Global CRR Market

4.2 CRR Market – Fastest Growing Application

4.3 CRR Market Share, By Region

4.4 CRR Market Share, By End-Use Industry and By Region

4.5 CRR Market, By End–Use Industries, 2014–2021

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Type

5.2.3 By End-Use Industries

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Growth in End-Use Industries

5.3.1.2 Increasing Losses Due to Corrosion

5.3.1.3 Modernization of Infrastructure

5.3.2 Restraints

5.3.2.1 Fluctuating Raw Material Price

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Composites Application

5.3.4 Challenges

5.3.4.1 Need for Continuous Improvement in Product Offering

5.3.4.2 Slow Growth Rate in Developed Countries Compared to Developing Countries

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 CRR Raw Material Manufacturers

6.2.2 CRR Material Manufacturers

6.2.3 CRR End Application Users

6.2.4 CRR End Industry Users

6.3 Porter’s Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Cost Structure Analysis

7 Corrosion Resistant Resin Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Coatings

7.3 Composites

7.4 Others

8 Corrosion Resistant Resin Market, By Type (Page No. - 49)

8.1 Introduction

8.2 Epoxy

8.3 Polyester

8.4 Polyurethane

8.5 Vinyl Ester

8.6 Others

9 Corrosion Resistant Resin Market, By End-Use Industry (Page No. - 54)

9.1 Introduction

9.2 Oil & Gas

9.3 Heavy Industries

9.4 Automotive & Transportation

9.5 Infrastructure

9.6 Marine

9.7 Others

10 CRR Market, By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 Netherlands

10.3.4 France

10.3.5 Russia

10.3.6 Italy

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Australia

10.4.6 Indonesia

10.4.7 Taiwan

10.4.8 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East and Africa

10.6.1 Turkey

10.6.2 UAE

10.6.3 Saudi Arabia

10.6.4 South Africa

10.6.5 Egypt

10.6.6 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation & Trends

11.3.1 New Product Launches

11.3.2 Investments & Expansions

11.3.3 Mergers & Acquisitions

11.3.4 Partnerships & Agreements & Collaboration

12 Company Profiles (Page No. - 121)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.1 Ashland Inc.

12.2 Oiln Corporation

12.3 Hexion Inc.

12.4 Huntsman Corporation

12.5 Reichhold LLC

12.6 Scott Bader Company Limited

12.7 Alpha Owens-Corning (AOC) LLC

12.8 Polynt SPA

12.9 Aditya Birla Chemicals

12.10 Sino Polymer Co. Ltd.

12.11 Other Players

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 146)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (109 Tables)

Table 1 Corrosion Resistant Resin – Cost Structure

Table 2 Corrosion Resistant Resin Market Size, By Application, 2014-2026 (Kiloton)

Table 3 Corrosion Resistant Resin Market Size, By Application, 2014-2026 (USD Million)

Table 4 CRR Market Size, By Type, 2014–2026 (Kiloton)

Table 5 CRR Market Size, By Type, 2014–2026 (USD Million)

Table 6 CRR Market Size, By End-Use Industry, 2014–2026 (USD Million)

Table 7 CRR Market Size, By End-Use Industry, 2014–2026 (Kiloton)

Table 8 CRR Market Size, By Region, 2014-2026 (USD Million)

Table 9 CRR Market Size, By Region, 2013-2026 (Kiloton)

Table 10 North America: CRR Market Size, By Country, 2014-2026 (USD Million)

Table 11 North America: CRR Market Size, By Country, 2014-2026 (Kiloton)

Table 12 North America: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 13 North America: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 14 U.S.: Economic Outlook (2015)

Table 15 U.S.: CRR Market Size, By End-Use Industries, 2014-2026 (USD Million)

Table 16 U.S.: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 17 Canada : Economic Outlook (2015)

Table 18 Canada: CRR Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 19 Canada: CRR Market Size, By End-Use Industry, 2013-2020 (Kilotons)

Table 20 Mexico: Economic Outlook (2015)

Table 21 Mexico: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 22 Mexico: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 23 Europe: CRR Market Size, By Country, 2014-2026 (USD Million)

Table 24 Europe: CRR Market Size, By Country, 2013-2020 (Kiloton)

Table 25 Europe: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 26 Europe: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 27 Germany: Economic Outlook (2015)

Table 28 Germany: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 29 Germany : CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 30 U.K.: Economic Outlook (2015)

Table 31 U.K.: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 32 U.K.: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 33 Netherlands: Economic Outlook (2015)

Table 34 The Netherlands: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 35 The Netherlands: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 36 France: Economic Outlook (2015)

Table 37 France : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 38 France: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 39 Russia: Economic Outlook (2015)

Table 40 Russia: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 41 Russia: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 42 Italy: Economic Outlook (2015)

Table 43 Italy: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 44 Italy: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 45 Rest of Europe: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 46 Rest of Europe: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 47 Asia-Pacific: CRR Market Size, By Country, 2014-2026 (USD Million)

Table 48 Asia-Pacific: CRR Market Size, By Country, 2014-2026 (Kiloton)

Table 49 Asia-Pacific: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 50 Asia-Pacific: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 51 China: Economic Outlook (2015)

Table 52 China: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 53 China: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 54 Japan: Economic Outlook (2015)

Table 55 Japan: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 56 Japan: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 57 India: Economic Outlook (2015)

Table 58 India: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 59 India: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 60 South Korea: Economic Outlook (2015)

Table 61 South Korea: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 62 South Korea: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 63 Australia: Economic Outlook (2015)

Table 64 Australia: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 65 Australia: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 66 Indonesia: Economic Outlook (2015)

Table 67 Indonesia: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 68 Indonesia: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 69 Taiwan: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 70 Taiwan: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 71 Rest of Asia-Pacific: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 72 Rest of Asia-Pacific: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 73 South America: CRR Market Size, By Country, 2014-2026 (USD Million)

Table 74 South America: CRR Market Size, By Country, 2014-2026 (Kiloton)

Table 75 South America : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 76 South America : CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 77 Brazil: Economic Outlook (2015)

Table 78 Brazil : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 79 Brazil : CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 80 Argentina: Economic Outlook (2015)

Table 81 Argentina : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 82 Argentina : CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 83 Rest of South America : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 84 Rest of South America: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 85 Middle East and Africa: CRR Market Size, By Country, 2014-2026 (USD Million)

Table 86 Middle East and Africa: CRR Market Size, By Country, 2014-2026 (Kiloton)

Table 87 Middle East and Africa: CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 88 Middle East and Africa : CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 89 Turkey: Economic Outlook (2015)

Table 90 Turkey : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 91 Turkey: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 92 UAE: Economic Outlook (2015)

Table 93 UAE : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 94 UAE: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 95 Saudi Arabia : Economic Outlook (2015)

Table 96 Saudi Arabia : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 97 Saudi Arabia: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 98 South Africa : Economic Outlook (2015)

Table 99 South Africa : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 100 South Africa: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 101 Egypt: Economic Outlook (2015)

Table 102 Egypt : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 103 Eygpt: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 104 Rest of Middle East and Africa : CRR Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 105 Rest of Middle East and Africa: CRR Market Size, By End-Use Industry, 2014-2026 (Kiloton)

Table 106 New Product Launches, 2012–2016

Table 107 Investments & Expansions, 2012–2016

Table 108 Mergers & Acquisitions, 2012–2016

Table 109 Partnerships & Agreements & Collaboration, 2012–2016

List of Figures (43 Figures)

Figure 1 Corrosion Resistant Resin: Market Segmentation

Figure 2 Corrosion Resistant Resin Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Data Triangulation

Figure 6 Epoxy Resin: the Fastest–Growing Material in CRR Market

Figure 7 Coating Application Accounts for the Highest Market Size

Figure 8 Oil & Gas Accounted for the Largest Market in CRR Market

Figure 9 Asia-Pacific Accounted for the Largest Share in the CRR Market, 2015

Figure 10 CRR Market, 2016 vs 2021 (USD Billion)

Figure 11 Composite is Projected to Be the Fastest Growing Application in the CRR Market 2016 to 2021

Figure 12 APAC Accounted for the Largest Share in the CRR Market During the Forecast Period

Figure 13 Oil & Gas Accounted for the Largest Share in the CRR Market, 2015

Figure 14 Oil & Gas Estimated to Dominate Global CRR Market

Figure 15 CRR Segmentation, By Region

Figure 16 CRR Market : Drivers, Restraints, Opportunities, and Challenges

Figure 17 Increasing Contribution of End-Use Industries Driving the Growth of CRR Market

Figure 18 Oil Price Fluctuation

Figure 19 Overview of CRR Value Chain

Figure 20 Porter’s Five Forces Analysis

Figure 21 Corrosion Resistant Resin – Cost Structure

Figure 22 Composites Application is Projected to Grow With the Highest CAGR Between 2016 and 2021

Figure 23 Epoxy CRR Accounted for the Largest Market Share, Between 2016 and 2021

Figure 24 CRR Market in Heavy Industry is Projected to Have the Highest CAGR, Between 2016 and 2026

Figure 25 China Market Projected to Witness the Highest Growth During Forecast Period

Figure 26 North American Market Snapshot: the Demand Will Be Driven By Oil & Gas End-Use Industry

Figure 27 Asia-Pacific CRR Market Snapshot – China, Japan & South Korea are the Most Lucrative Markets

Figure 28 Overview of the Taiwan Manufacturing Industry

Figure 29 MEA is the Second-Fastest Growing Region in the World

Figure 30 Companies Adopted Partnerships, Agreements, and Collaborations as the Key Growth Strategy Over the Last Five Years

Figure 31 Hexion Inc. Captured the Largest Share of the CRR Market, 2015

Figure 32 2014 Witnessed Maximum Developments

Figure 33 Battle for Developmental Market Share: Partnership & Agreements & Collaboration Was the Key Strategy, 2012 – 2016

Figure 34 Ashland Inc.: Company Snapshot

Figure 35 Ashland Inc.: SWOT Analysis

Figure 36 Olin Corporation: Company Snapshot

Figure 37 Oiln Corporation: SWOT Analysis

Figure 38 Hexion Inc.: Company Snapshot

Figure 39 Hexion Inc.: SWOT Analysis

Figure 40 Huntsman Corporation : Company Snapshot

Figure 41 Huntsman Corporation: SWOT Analysis

Figure 42 Scott Bader Company Limited: Company Snapshot

Figure 43 Polynt SPA.: Company Snapshot

Growth opportunities and latent adjacency in Corrosion Resistant Resin Market