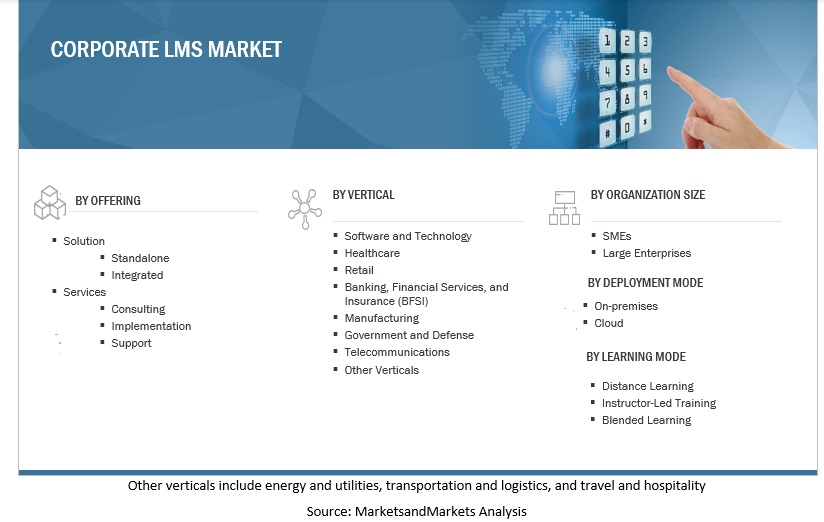

Corporate Learning Management System (LMS) Market by Offering (Solutions, Services), Deployment Mode, Organization Size, Vertical (Software and Technology, Healthcare, Retail, BFSI, Telecommunications), and Region - Global Forecast to 2027

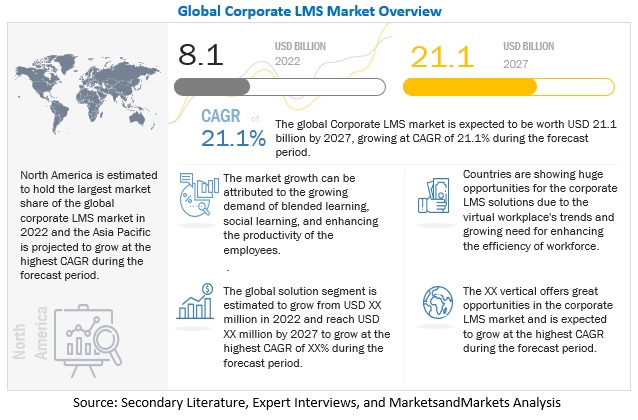

The Corporate Learning Management Systems Market was evaluated at USD 8.1 billion in 2022 and is projected to increase at a compound annual growth rate (CAGR) of 21.1% from 2023 to 2027, to reach USD 21.1 billion. Some factors driving the market growth include ease to analyze and track the employee performance, to boost the employees’ productivity more efficiently, easy access to the learning content, and advancements in the LMS solutions. However, the lack of enterprises to convert the existing training content into microcontent and shortage of skilled workforce to articulate business operations are expected to hinder the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact

Due to COVID-19, people are restricted to work from home. Thus, companies are feeling the need to revise their training platforms according to growing needs. Many institutes or companies with existing LMS are looking for more customizable LMS, which can easily integrate with their existing applications. Covid-19 pandemic has further fueled this need of adopting cloud-based solutions amongst SMEs. SMEs required an efficient and effective LMS solutions and services to train their workforce about new technologies and platforms. As compared to on-premises LMS solution cloud and SaaS based LMS are gaining more traction in SME market segment due to its many capabilities associated with cost and accessibility. The rising use of technologies for online learning during the pandemic is expected to drive the demand for services associated with the corporate LMS market.

Corporate LMS Market Dynamics

Driver: Growing need for skill-based and objective-driven training to boost employees’ performance

Corporate LMS ensures that employees are getting custom and job-specific training to understand their job and responsibilities better. Whether organizations are onboarding new candidates or upskilling current employees, corporate training plays a vital role in acquiring new skills, increasing productivity, and performing better. Every company needs to encourage a culture of continual learning among employees. Companies that invest in corporate training can see productivity increase significantly. The major challenge many companies face is achieving sustainable efficiency in their operations. Training is critical for human resource development, helping employees develop their strengths and contribute to an organization. It can also help the company achieve greater consistency in process adherence, thereby meeting business goals and targets. That is why enterprises are adopting corporate LMS solutions to enhance and upskill their employees’ performance, which can help drive market growth.

Restraint: Reluctance of enterprises to convert the existing training content into microcontent

Though microlearning offers many benefits such as ease to create and update the lessons, helps to improve the employees’ effectiveness and efficiency, boosts the employees’ engagement. Organizations across many industries have their own training and development courses for employees and they provide these courses to the workforce through classroom learnings. These detailed courses or programs can be extensive in terms of concepts covered and sub-modules. Organizations tend not to invest large amount in converting the existing training programs into microcontent as it can be very costly and hectic in the transforming process. As organizations have large training modules and programs so it can be a big challenge for them to organize the content as per the micro-framework. Moreover, force-fitting of the current training content into a microlearning solution can impact the purpose of a training and development program. The organizations may need to build their training courses from basics to constructively execute the microlearning based training.

Opportunity: Incorporation of advanced technologies such as AR/VR and AI/ML for better training environment

Enterprises across industries are incorporating advanced technologies such as AR, VR, AI, and gamification in their training and development programs to enhance their learners’ experience. In addition, mobile technology has revolutionized how content is delivered to learners. Vendors are offering mobile-based microlearning applications so learners can access content on the go. Using AR/VR technologies in employees’ training makes learning exciting and effective for busy employees. These technologies enable enterprises to offer learners an immersive and enhanced learning experience, leading to improved content retention. AI and ML can revolutionize corporate training and development in the upcoming years, personalize learners’ experience, measure training effectiveness, reinforce training, create content at scale, and offer unique and innovative ways of learning.

Challenge: Lack of LMS solutions with multi-language support

Language can be a barrier for students whose first language is not English. According to a study by Statista in 2022, around 18% of the world’s population speaks English. In cases such as this, LMS vendors need to provide multiple-language support for different regions. For instance, English is only the third language spoken, with Chinese being the most spoken, followed by Spanish. Limited vocabulary and language skills may prevent some students from actively participating in class, socializing with peers, and learning to their full potential. Thus, corporate LMS vendors need to overcome this challenge to help put students at ease and empower them to have a smooth and meaningful learning experience.

Corporate LMS Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By vertical, the software and technology verticals to grow at the highest CAGR during the forecast period

Companies in the software and technology vertical have a higher need for continuous training of their employees, as the technology upgrades in this vertical are more frequent than in any other vertical, and the companies must be competitive. This vertical caters to a huge customer base and offers a comprehensive range of software, hardware, and services. It is the fastest evolving vertical in an economy, and there is some new information available every day. It becomes essential to keep employees informed about the latest developments. IT companies usually have a global operational presence. Corporate LMS solutions help these companies fulfill their training needs in lesser time and cost in an automated and centralized manner. As companies in the software and technology vertical experience rapid technology changes and constant innovations, they require a solution that can quickly respond to new challenges, offer scalability to thousands of learners, and cater to the learning needs of employees in different locations and countries. The solution also needs to be cost-effective, provide automatic updates, and offer the option of centralized resources.

By vertical, the retail vertical is to have the highest market size during the forecast period

Enterprises in the retail vertical require eLearning solutions to address all their training needs and help save time and money. This vertical has the highest employee turnover rate, with a never-ending need for new employees, increasing the necessity to train these new joiners in a short period. Managers use eLearning methods, webinars, and blended learning to fulfill these requirements. Corporate LMS helps managers effectively train employees and track training activities. The other major issue in the retail vertical is that employees are located at different workplaces and stores. These scattered employees have different roles and responsibilities, and they have specific training needs. Therefore, tracking their learning activities on an individual user level becomes challenging. To overcome this issue, enterprises in this vertical use LMS to help managers easily classify profiles, create user groups, and assign courses based on the created profiles of employees, channel partners, and customers.

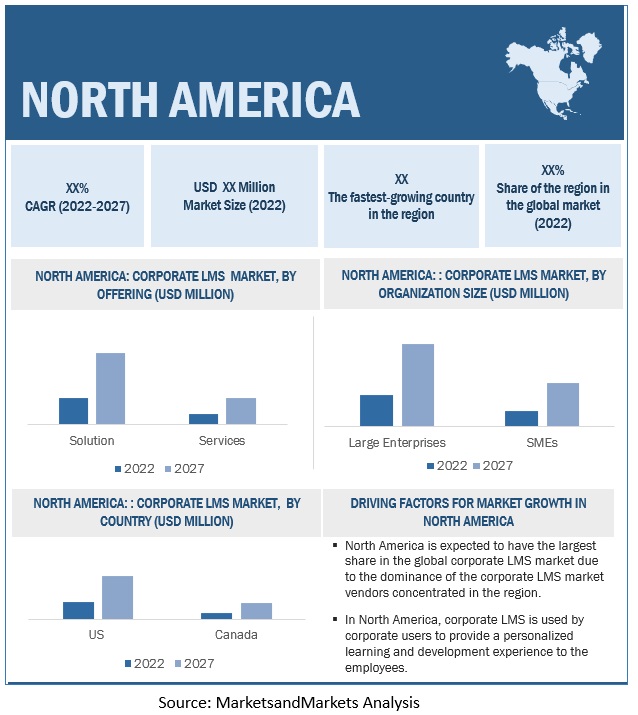

By region, North America is to have the highest market size during the forecast period

North America is expected to be the largest contributor, in terms of the market size, in the global corporate LMS market. It offers the most innovative and fastest services available in the world through its network infrastructure. North America has also witnessed the earliest adoption of cloud and mobile technologies, which has been a significant booster for adopting corporate LMS solutions to improve employee efficiency and productivity. North America has an advanced communication infrastructure that helps corporate LMS solution providers offer quality services to their clients. In North America, corporate LMS is used by corporate users to provide employees with a personalized learning and development experience. The region is also one of the earliest adopters of 5G technology, which has helped the early adoption of corporate LMS solutions. The US and Canada are expected to be key revenue contributors in the North American corporate LMS market.

Key Market Players:

The key players in the global corporate LMS market include Cornerstone OnDemand (US), Blackboard (US), Instructure (US), SAP (Germany), Docebo (Canada), Adobe (US), D2L (Canada), Paylocity (US), Seismic (US), Paycor (US), Absorb Software (Canada), Zoho (India), LearnUpon (Ireland), iSpring Solutions (US), ProProfs (US), Paradiso Solutions (US), Brainier (US), CrossKnowledge (France), Epignosis (US), ExpertusONE (US), Trakstar (US), Axonify (Canada), Thinkific (Canada), Bigtincan (Australia), Neovation (Canada), Knowledge Anywhere (US), iTacit (Canada), Skyllful (US), Disprz (India), Rippling (US), Trainual (US), Tovuti (US), and eduMe (UK).

Scope of the Report

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 21.1 Billion |

|

Market value in 2022 |

USD 8.1 Billion |

|

Market Growth Rate |

21.1% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments Covered |

Offering, deployment mode, organization size, learning mode, vertical, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa (MEA), and Latin America |

|

Major companies covered |

Major vendors in the global corporate LMS market include Cornerstone OnDemand (US), Blackboard (US), Instructure (US), SAP (Germany), Docebo (Canada), Adobe (US), D2L (Canada), Paylocity (US), Seismic (US), Paycor (US), Absorb Software (Canada), Zoho (India), LearnUpon (Ireland), iSpring Solutions (US), ProProfs (US), Paradiso Solutions (US), Brainier (US), CrossKnowledge (France), Epignosis (US), ExpertusONE (US), Trakstar (US), Axonify (Canada), Thinkific (Canada), Bigtincan (Australia), Neovation (Canada), Knowledge Anywhere (US), iTacit (Canada), Skyllful (US), Disprz (India), Rippling (US), Trainual (US), Tovuti (US), and eduMe (UK). |

Market Segmentation:

Recent Development

- In September 2022, Cornerstone OnDemand collaborated with BBVA to develop and enhance its employee growth strategies and manage various talent areas, including recruitment, assessment, learning, and mobility.

- In July 2022, Blackboard launched Anthology Intelligent Experiences that will create interactive moments by breaking down data silos and combining insights across critical systems to inform more relevant engagement between staff, faculty, and learners.

- In April 2022, Instructure acquired Concentric Sky which is the makers of Badgr. Under this deal, Badgr will be rebranded as “Canvas Badges” as it joins the Instructure Learning Platform. Canvas LMS customers can also upgrade to Badgr Pro’s advanced suite of tools in new “Canvas Credentials,” offering unlimited badging, leaderboards, analytics, and personalized pathway progress visualizations.

Frequently Asked Questions (FAQ):

What is the definition of corporate LMS?

MarketsandMarkets defines Corporate LMS as “a learning management platform and solution that delivers online training, onboarding and compliance capabilities for employees, partners, and sales network of an organization. Human Resource (HR) department, training and consulting institutes, and top-level management teams are the prime users of a corporate LMS solution and services”.

What is the projected market value of the global corporate LMS market?

The global corporate LMS market size is expected to grow from an estimated value of USD 8.1 billion in 2022 to 21.1 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 21.1% from 2022 to 2027.

Which are the key companies influencing the market growth of the corporate LMS market?

Cornerstone OnDemand, Blackboard, D2L, Adobe, Docebo, Instructure, SAP, Paylocity, Paycor, Seismic, Zoho, ProProfs, Absorb Software, LearnUpon, are some key companies in the corporate LMS market and are recognized as the star players. These companies account for a major share of the corporate LMS market. They offer wide solutions related to corporate LMS solutions and services. These vendors offer customized solutions per user requirements and adopt growth strategies to consistently achieve the desired growth and make their presence in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 1 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 MARKET: DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OF CORPORATE LMS VENDORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE) ANALYSIS

FIGURE 5 MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 6 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 EVALUATION QUADRANT METHODOLOGY FOR STARTUPS

FIGURE 7 EVALUATION QUADRANT FOR STARTUPS: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS

FIGURE 8 LIMITATIONS OF MARKET REPORT

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 9 GLOBAL CORPORATE LEARNING MANAGEMENT SYSTEM MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 10 SYSTEM MARKET: SEGMENT SNAPSHOT

FIGURE 11 SYSTEM MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

FIGURE 12 GROWING DEMAND FOR BLENDED LEARNING AND ADOPTION OF CLOUD-BASED CORPORATE LEARNING MANAGEMENT SYSTEM SOLUTIONS TO DRIVE MARKET

4.2 MARKET, BY OFFERING, 2022

FIGURE 13 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODE, 2022–2027

FIGURE 14 CLOUD SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY VERTICAL, 2022–2027

FIGURE 15 SOFTWARE AND TECHNOLOGY SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET, BY REGION, 2022–2027

FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand for advanced LMS solutions to effectively manage learning content

5.2.1.2 Growing need for skill-based and objective-driven training to boost employee performance

5.2.1.3 Need to integrate interactive and personalized training environments

5.2.2 RESTRAINTS

5.2.2.1 Lack of performance monitoring and measuring RoI

5.2.2.2 Reluctance of enterprises to convert existing training content into microcontent

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for virtual online training due to COVID-19

5.2.3.2 Incorporation of advanced technologies for better training environment

5.2.4 CHALLENGES

5.2.4.1 Lack of LMS solutions with multi-language support

5.2.4.2 Shortage of skilled workforce to articulate business operations

5.2.4.3 Dearth of momentum and communication among employees

5.3 ECOSYSTEM

FIGURE 19 ECOSYSTEM: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

TABLE 3 MARKET: ECOSYSTEM

5.4 TECHNOLOGY ANALYSIS

5.4.1 AI/ML AND CORPORATE LEARNING MANAGEMENT SYSTEM

5.4.2 DATA ANALYTICS AND CORPORATE LEARNING MANAGEMENT SYSTEM

5.4.3 CLOUD COMPUTING AND CORPORATE LEARNING MANAGEMENT SYSTEM

5.4.4 METAVERSE AND CORPORATE LEARNING MANAGEMENT SYSTEM

5.4.5 AR/VR AND CORPORATE LEARNING MANAGEMENT SYSTEM

5.5 REGULATORY IMPLICATIONS

5.5.1 AVIATION INDUSTRY COMPUTER-BASED TRAINING (CBT) COMMITTEE (AICC)

5.5.2 LEARNING TOOLS INTEROPERABILITY (LTI)

5.5.3 SHAREABLE CONTENT OBJECT REFERENCE MODEL (SCORM)

5.5.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.6 PATENT ANALYSIS

FIGURE 20 PATENT ANALYSIS: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

5.7 VALUE CHAIN

FIGURE 21 VALUE CHAIN: MARKET

5.7.1 CORPORATE LMS SOLUTION PROVIDERS

5.7.2 SERVICE PROVIDERS

5.7.3 SYSTEM INTEGRATORS

5.7.4 ECOMMERCE MARKETPLACE

5.7.5 END USERS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON MARKET

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 DEGREE OF COMPETITION

5.9 USE CASES

5.9.1 USE CASE 1: EDUME HELPED UBER REDUCE ONBOARDING TIME OF PARTNER DRIVERS

5.9.2 USE CASE 2: ISPRING HELPED UNICHEM LABORATORIES COMPLETE ITS COMPLIANCE TRAINING FOR OVER 3,200 EMPLOYEES

5.9.3 USE CASE 3: PAYCOR HELPED DOLPHIN HOTEL MANAGEMENT IMPROVE HIRING EXPERIENCE FOR MANAGERS AND CANDIDATES

5.9.4 USE CASE 4: PARADISO SOLUTIONS HELPED CROMA AUTOMATE EMPLOYEE TRAINING FOR EXCEPTIONAL CUSTOMER SERVICE

5.10 PRICING ANALYSIS

TABLE 6 AVERAGE SELLING PRICE/PRICING MODEL– CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 23 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS ON BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 8 MARKET: LIST OF CONFERENCES AND EVENTS

6 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING (Page No. - 90)

6.1 INTRODUCTION

FIGURE 25 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 9 MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 10 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKETDRIVERS

TABLE 11 SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 12 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 STANDALONE SOLUTIONS

6.2.3 INTEGRATED SOLUTIONS

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

TABLE 13 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 CONSULTING SERVICES

6.3.3 IMPLEMENTATION SERVICES

6.3.4 SUPPORT SERVICES

7 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 26 CLOUD-BASED DEPLOYMENT MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 16 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 CLOUD: MARKET DRIVERS

TABLE 17 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 CLOUD: TEM MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ON-PREMISES: MARKET DRIVERS

TABLE 19 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE (Page No. - 101)

8.1 INTRODUCTION

FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 22 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 23 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 25 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY LEARNING MODE (Page No. - 106)

9.1 INTRODUCTION

9.2 DISTANCE LEARNING

9.3 INSTRUCTOR-LED TRAINING

9.4 BLENDED LEARNING

10 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY VERTICAL (Page No. - 108)

10.1 INTRODUCTION

FIGURE 28 SOFTWARE AND TECHNOLOGY VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 27 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 28 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

TABLE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 HEALTHCARE

10.3.1 HEALTHCARE: MARKET DRIVERS

TABLE 31 HEALTHCARE: STEM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 SOFTWARE AND TECHNOLOGY

10.4.1 SOFTWARE AND TECHNOLOGY: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 33 SOFTWARE AND TECHNOLOGY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 SOFTWARE AND TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 TELECOMMUNICATIONS

10.5.1 TELECOMMUNICATIONS: MARKET DRIVERS

TABLE 35 TELECOMMUNICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 RETAIL

10.6.1 RETAIL: MARKET DRIVERS

TABLE 37 RETAIL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 MANUFACTURING

10.7.1 MANUFACTURING: MARKET DRIVERS

TABLE 39 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 GOVERNMENT AND DEFENSE

10.8.1 GOVERNMENT AND DEFENSE: MARKET DRIVERS

TABLE 41 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 OTHER VERTICALS

11 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 122)

11.1 INTRODUCTION

FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.3 US

TABLE 55 UNITED STATES: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 56 UNITED STATES: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 57 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 58 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 59 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 60 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 61 UNITED STATES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 62 UNITED STATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.4 CANADA

TABLE 63 CANADA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 64 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 65 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 66 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 67 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 69 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 70 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET DRIVERS

11.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 71 EUROPE: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.3 UK

TABLE 81 UNITED KINGDOM: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 82 UNITED KINGDOM: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 83 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 84 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.4 GERMANY

TABLE 89 GERMANY: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 90 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 96 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.5 FRANCE

TABLE 97 FRANCE: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 99 FRANCE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 100 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 101 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 102 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 104 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.6 NORDIC COUNTRIES

TABLE 105 NORDIC COUNTRIES: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 106 NORDIC COUNTRIES: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 107 NORDIC COUNTRIES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 108 NORDIC COUNTRIES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 109 NORDIC COUNTRIES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 110 NORDIC COUNTRIES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 111 NORDIC COUNTRIES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 112 NORDIC COUNTRIES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.7 ITALY

TABLE 113 ITALY: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 114 ITALY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 115 ITALY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 116 ITALY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 117 ITALY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 118 ITALY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 119 ITALY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 120 ITALY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.8 SPAIN

TABLE 121 SPAIN: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 122 SPAIN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 123 SPAIN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 124 SPAIN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 125 SPAIN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 126 SPAIN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 127 SPAIN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 128 SPAIN: M MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.9 RUSSIA

TABLE 129 RUSSIA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 130 RUSSIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 131 RUSSIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 132 RUSSIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 133 RUSSIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 134 RUSSIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 135 RUSSIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 136 RUSSIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.10 REST OF EUROPE

TABLE 137 REST OF EUROPE: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET DRIVERS

11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 145 ASIA PACIFIC: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.3 CHINA

TABLE 155 CHINA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 156 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 157 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 158 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 159 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 160 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 161 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 162 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.4 JAPAN

TABLE 163 JAPAN: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 167 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 169 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 170 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.5 INDIA

TABLE 171 INDIA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 172 INDIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 173 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 174 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 175 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 176 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 177 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 178 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 179 AUSTRALIA AND NEW ZEALAND: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 180 AUSTRALIA AND NEW ZEALAND: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 181 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 182 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 183 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 184 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 185 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 186 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.7 SINGAPORE

TABLE 187 SINGAPORE: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 188 SINGAPORE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 189 SINGAPORE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 190 SINGAPORE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 191 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 192 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 193 SINGAPORE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 194 SINGAPORE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.8 SOUTH KOREA

TABLE 195 SOUTH KOREA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 196 SOUTH KOREA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 197 SOUTH KOREA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 198 SOUTH KOREA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 199 SOUTH KOREA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 200 SOUTH KOREA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 201 SOUTH KOREA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 202 SOUTH KOREA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.9 REST OF ASIA PACIFIC

TABLE 203 REST OF ASIA PACIFIC: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 211 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 217 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.3 UAE

TABLE 221 UNITED ARAB EMIRATES: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 222 UNITED ARAB EMIRATES: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 223 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 224 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 225 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 226 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 227 UNITED ARAB EMIRATES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 228 UNITED ARAB EMIRATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.4 KSA

TABLE 229 KINGDOM OF SAUDI ARABIA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 230 KINGDOM OF SAUDI ARABIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 231 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 232 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 233 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 234 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 235 KINGDOM OF SAUDI ARABIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 236 KINGDOM OF SAUDI ARABIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.5 SOUTH AFRICA

TABLE 237 SOUTH AFRICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 238 SOUTH AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 239 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 240 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 241 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 242 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 243 SOUTH AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 244 SOUTH AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.6 ISRAEL

TABLE 245 ISRAEL: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 246 ISRAEL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 247 ISRAEL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 248 ISRAEL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 249 ISRAEL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 250 ISRAEL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 251 ISRAEL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 252 ISRAEL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.7 QATAR

TABLE 253 QATAR: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 254 QATAR: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 255 QATAR: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 256 QATAR: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 257 QATAR: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 258 QATAR: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 259 QATAR: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 260 QATAR: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.8 REST OF MIDDLE EAST AND AFRICA

TABLE 261 REST OF MIDDLE EAST AND AFRICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 262 REST OF MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 263 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 264 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 265 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 266 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 267 REST OF MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET DRIVERS

11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 269 LATIN AMERICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 272 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 276 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.3 BRAZIL

TABLE 279 BRAZIL: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 280 BRAZIL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 281 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 282 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 283 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 284 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 285 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 286 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.4 MEXICO

TABLE 287 MEXICO: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 288 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 289 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 290 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 291 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 292 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 293 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 294 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 295 REST OF LATIN AMERICA: CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 296 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 297 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 298 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 299 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 300 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 301 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 302 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 219)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 32 MARKET EVALUATION FRAMEWORK FOR CORPORATE LEARNING MANAGEMENT SYSTEM MARKET

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 33 REVENUE ANALYSIS OF KEY CORPORATE LEARNING MANAGEMENT SYSTEM VENDORS, 2017–2021 (USD MILLION)

12.4 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARE, 2021

TABLE 303 DEGREE OF COMPETITION

12.5 RANKING OF KEY PLAYERS IN MARKET

FIGURE 35 KEY PLAYERS RANKING, 2021

12.6 COMPANY EVALUATION QUADRANT

12.6.1 OVERALL FOOTPRINT

FIGURE 36 OVERALL FOOTPRINT OF KEY COMPANIES

12.6.2 COMPANY EVALUATION QUADRANT MATRIX

TABLE 304 EVALUATION CRITERIA

12.6.3 STARS

12.6.4 EMERGING LEADERS

12.6.5 PERVASIVE PLAYERS

12.6.6 PARTICIPANTS

FIGURE 37 CORPORATE LEARNING MANAGEMENT SYSTEM MARKET, COMPANY EVALUATION QUADRANT, 2021

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 38 MARKET, STARTUP/ SME EVALUATION QUADRANT, 2021

12.7.5 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

TABLE 305 MARKET: LIST OF STARTUPS/SMES

TABLE 306 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.8 COMPETITIVE SCENARIO AND TRENDS

TABLE 307 PRODUCT LAUNCHES, 2020–2022

TABLE 308 DEALS, 2020–2022

13 COMPANY PROFILES (Page No. - 238)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 CORNERSTONE ONDEMAND

TABLE 309 CORNERSTONE ONDEMAND: BUSINESS OVERVIEW

FIGURE 39 CORNERSTONE ONDEMAND: COMPANY SNAPSHOT

TABLE 310 CORNERSTONE ONDEMAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 311 CORNERSTONE ONDEMAND: PRODUCT LAUNCHES

TABLE 312 CORNERSTONE ONDEMAND: DEALS

13.1.2 BLACKBOARD

TABLE 313 BLACKBOARD: BUSINESS OVERVIEW

TABLE 314 BLACKBOARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 315 BLACKBOARD: PRODUCT LAUNCHES

TABLE 316 BLACKBOARD: DEALS

13.1.3 INSTRUCTURE

TABLE 317 INSTRUCTURE: BUSINESS OVERVIEW

FIGURE 40 INSTRUCTURE: COMPANY SNAPSHOT

TABLE 318 INSTRUCTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 319 INSTRUCTURE: PRODUCT LAUNCHES

TABLE 320 INSTRUCTURE: DEALS

13.1.4 SAP

TABLE 321 SAP: BUSINESS OVERVIEW

FIGURE 41 SAP: COMPANY SNAPSHOT

TABLE 322 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 323 SAP: DEALS

13.1.5 DOCEBO

TABLE 324 DOCEBO: BUSINESS OVERVIEW

FIGURE 42 DOCEBO: COMPANY SNAPSHOT

TABLE 325 DOCEBO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 326 DOCEBO: PRODUCT LAUNCHES

TABLE 327 DOCEBO: DEALS

13.1.6 ADOBE

TABLE 328 ADOBE: BUSINESS OVERVIEW

FIGURE 43 ADOBE: COMPANY SNAPSHOT

TABLE 329 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 330 ADOBE: DEALS

13.1.7 D2L

TABLE 331 D2L: BUSINESS OVERVIEW

FIGURE 44 D2L: COMPANY SNAPSHOT

TABLE 332 D2L: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 333 D2L: PRODUCT LAUNCHES

TABLE 334 D2L: DEALS

13.1.8 PAYLOCITY

TABLE 335 PAYLOCITY: BUSINESS OVERVIEW

FIGURE 45 PAYLOCITY: COMPANY SNAPSHOT

TABLE 336 PAYLOCITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 337 PAYLOCITY: PRODUCT LAUNCHES

TABLE 338 PAYLOCITY: DEALS

TABLE 339 SEISMIC: BUSINESS OVERVIEW

FIGURE 46 SEISMIC: COMPANY SNAPSHOT

TABLE 340 SEISMIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 341 SEISMIC: DEALS

13.1.10 PAYCOR

TABLE 342 PAYCOR: BUSINESS OVERVIEW

TABLE 343 PAYCOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 344 PAYCOR: PRODUCT LAUNCHES

TABLE 345 PAYCOR: DEALS

13.1.11 ABSORB SOFTWARE

TABLE 346 ABSORB SOFTWARE: BUSINESS OVERVIEW

TABLE 347 ABSORB SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 348 ABSORB SOFTWARE: PRODUCT LAUNCHES

TABLE 349 ABSORB SOFTWARE: DEALS

13.1.12 ZOHO

TABLE 350 ZOHO: BUSINESS OVERVIEW

TABLE 351 ZOHO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.13 LEARNUPON

TABLE 352 LEARNUPON: BUSINESS OVERVIEW

TABLE 353 LEARNUPON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.14 ISPRING SOLUTIONS

TABLE 354 ISPRING SOLUTIONS: BUSINESS OVERVIEW

TABLE 355 ISPRING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 356 ISPRING SOLUTIONS: PRODUCT LAUNCHES

13.1.15 PROPROFS

TABLE 357 PROPROFS: BUSINESS OVERVIEW

TABLE 358 PROPROFS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2 OTHER KEY PLAYERS

13.2.1 PARADISO SOLUTIONS

13.2.2 BRAINIER

13.2.3 CROSSKNOWLEDGE

13.2.4 EPIGNOSIS

13.2.5 EXPERTUSONE

13.2.6 TRAKSTAR

13.2.7 AXONIFY

13.2.8 THINKIFIC

13.2.9 BIGTINCAN

13.2.10 NEOVATION

13.2.11 KNOWLEDGE ANYWHERE

13.2.12 ITACIT

13.2.13 SKYLLFUL

13.2.14 DISPRZ

13.2.15 RIPPLING

13.2.16 TRAINUAL

13.2.17 TOVUTI

13.2.18 EDUME

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 289)

14.1 ADJACENT MARKETS

TABLE 359 ADJACENT MARKETS AND FORECASTS

14.1.1 LEARNING MANAGEMENT SYSTEM (LMS) MARKET

TABLE 360 LEARNING MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 361 LEARNING MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 362 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2015–2020 (USD MILLION)

TABLE 363 LEARNING MANAGEMENT SYSTEM MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 364 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2015–2020 (USD MILLION)

TABLE 365 LEARNING MANAGEMENT SYSTEM MARKET, BY USER TYPE, 2021–2026 (USD MILLION)

TABLE 366 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2015–2020 (USD MILLION)

TABLE 367 LEARNING MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 368 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 369 LEARNING MANAGEMENT SYSTEM MARKET, BY REGION, 2021–2026 (USD MILLION)

14.1.2 FRONTLINE WORKERS TRAINING MARKET

TABLE 370 FRONTLINE WORKERS TRAINING MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 371 FRONTLINE WORKERS TRAINING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 372 FRONTLINE WORKERS TRAINING MARKET, BY MODE OF LEARNING, 2018–2021 (USD MILLION)

TABLE 373 FRONTLINE WORKERS TRAINING MARKET, BY MODE OF LEARNING, 2022–2027 (USD MILLION)

TABLE 374 FRONTLINE WORKERS TRAINING MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 375 FRONTLINE WORKERS TRAINING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 376 FRONTLINE WORKERS TRAINING MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 377 FRONTLINE WORKERS TRAINING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 378 FRONTLINE WORKERS TRAINING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 379 FRONTLINE WORKERS TRAINING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 380 FRONTLINE WORKERS TRAINING MARKET, BY TRAINING TYPE, 2018–2021 (USD MILLION)

TABLE 381 FRONTLINE WORKERS TRAINING MARKET, BY TRAINING TYPE, 2022–2027 (USD MILLION)

TABLE 382 FRONTLINE WORKERS TRAINING MARKET, BY END-USER TYPE, 2018–2021 (USD MILLION)

TABLE 383 FRONTLINE WORKERS TRAINING MARKET, BY END-USER TYPE, 2022–2027 (USD MILLION)

TABLE 384 FRONTLINE WORKERS TRAINING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 385 FRONTLINE WORKERS TRAINING MARKET, BY REGION, 2022–2027 (USD MILLION)

14.1.3 MICROLEARNING MARKET

TABLE 386 MICROLEARNING MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 387 MICROLEARNING MARKET, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 388 MICROLEARNING MARKET, BY DEPLOYMENT TYPE, 2017–2024 (USD MILLION)

TABLE 389 MICROLEARNING MARKET, BY INDUSTRY, 2017–2024 (USD MILLION)

TABLE 390 MICROLEARNING MARKET, BY REGION, 2017–2024 (USD MILLION)

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

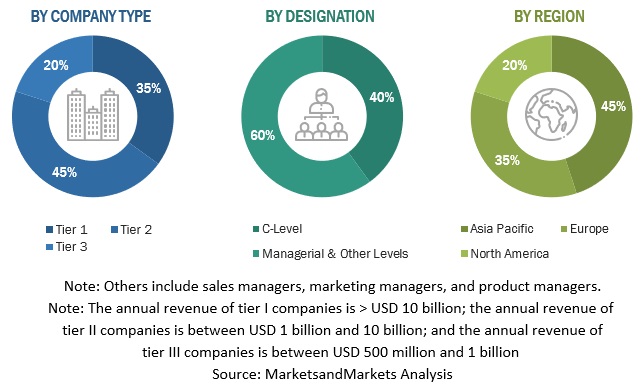

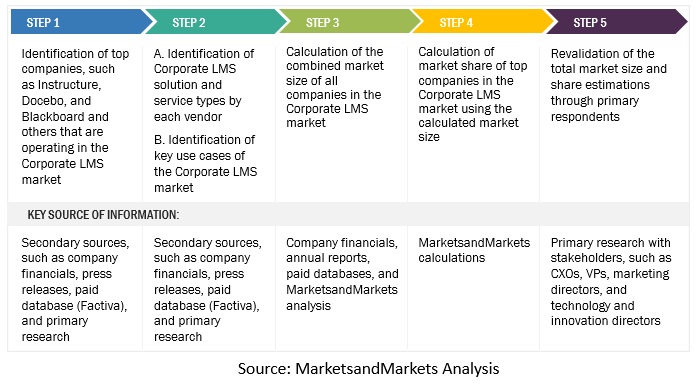

The study involved major activities in estimating the current market size for the corporate LMS market. Exhaustive secondary research was done to collect information on the corporate LMS industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, and bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the corporate LMS market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. The secondary research was mainly used to obtain key information about the industry’s value chain, market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major corporate LMS solution providers.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from corporate LMS solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side include Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use LMS solutions. These stakeholders were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of LMS solutions, which is expected to affect the overall corporate LMS market growth.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down and bottom-up approaches were used to estimate and validate the size of the global corporate LMS market and estimate the size of various other dependent sub-segments in the overall corporate LMS market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives, All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global corporate Learning Management System (LMS) market by offering, deployment mode, organization size, learning mode, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the corporate LMS market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as Mergers and Acquisitions (M&A), new product developments, and partnerships and collaborations in the market

- To track and analyze the impact of COVID-19 on the corporate LMS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corporate Learning Management System (LMS) Market