Construction Equipment Rental Market by Equipment (Earthmoving, Material Handling, Road Building & Concrete), Product (Backhoes, Excavators, Loaders, Crawler Dozers, Cranes, Compactors, Concrete Pumps), Region - Global Forecast to 2024

Updated on : February 16, 2023

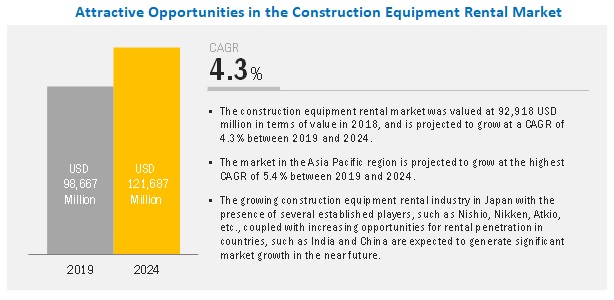

The global construction equipment rental market was valued at USD 93 billion in 2018 and is projected to reach USD 122 billion by 2024, growing at a cagr 4.3% from 2019 to 2024. This is attributed mainly to the increasing revenue of construction equipment rental providers driven by major infrastructure projects in emerging markets and boom in residential construction in the US and Europe. Sales of construction equipment witnessed substantial growth in 2018, reaching 1.13 million units. After undergoing significant financial crisis in 2007-2008, the construction equipment rental market has exhibited steady growth in recent years.

Worldwide infrastructure projects, such as China’s Belt and Road program, an unprecedented USD 1 trillion investment in ports, roads, and rail infrastructure across more than 150 countries, is one factor responsible for the rise in sales of construction equipment as well as rental revenues. China’s Belt and Road Program, which aims to link China with other parts of Asia, Russia, and Europe by land and sea corridors, coupled with other large-scale infrastructure programs in the emerging world, have helped drive global growth. In emerging markets, construction equipment revenue grew as the result of a boom in residential construction. Furthermore, high-value infrastructure projects in Britain, which include road improvements, new nuclear reactors, and high-speed rail and North America’s road infrastructure improvement projects are expected to generate a steady flow of rental revenues in construction equipment rental in the near future.

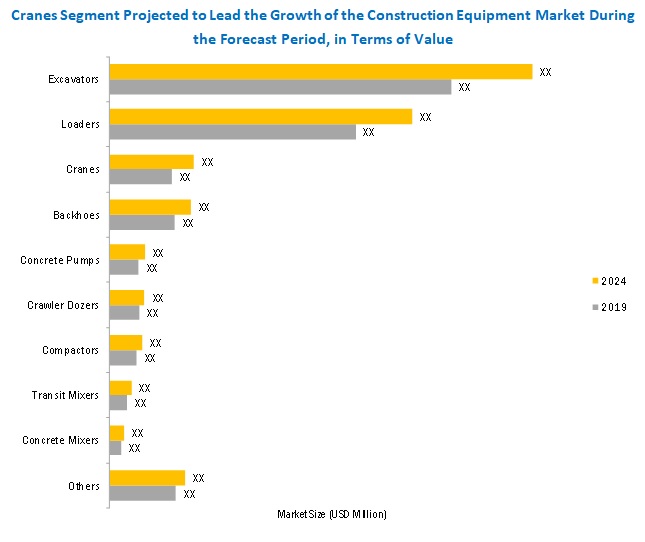

The cranes sub-segment in the product segment is projected to witness the highest CAGR during the forecast period

The cranes segment is expected to register the highest CAGR during the forecast period. This is due to the increasing use of various types of cranes by contractors for building and construction purposes. Additionally, 60–65% of the crane fleet is currently owned by equipment rental companies. This is indicative of the explosive growth this segment is poised to witness during the forecast period.

Asia Pacific is expected to witness the highest growth over the forecast period.

This growth is attributed to the increasing building & construction activities, especially in China, Japan, and India, coupled with increasing investments from domestic & foreign investors in public & private sectors, which is expected to drive the Asia Pacific market during the forecast period.

Market Dynamics

Driver: Shift in trends toward rental

In today’s economy and considering the cyclical nature of the construction industry, the benefits of renting construction equipment are amplified. Many contractors, construction companies, and a wide variety of industries are more and more exploring rental options. As cited by Keith Homes, Vice President of operations at the equipment rental platform BigRentz, there has been a significant shift from purchasing new equipment to the rental model among the contractors and construction companies that use the site. Many economists and business leaders foresee economic recession to be on the horizon, which may further fuel the demand for equipment rental and push companies even further away from leasing and ownership. There are several costs associated with the purchase of new equipment, such as the cost of equipment ownership, the initial asset cost, and the tenure to pay off equipment financing, plus maintenance and repair costs. Construction companies are wary of such costs and, on top of this cost factor, the cyclical nature of the construction industry and economic fluctuations can make it difficult for organizations to fully utilize the equipment they have purchased and obtain the most value, especially when that equipment is idle during slow business conditions. In this case, rental is an attractive alternative, particularly as some companies brace for economic recession and the potential implication of operational slowdown.

Restraint: Susceptibility of the construction industry to an economic recession

The construction industry is prone to the impacts of recession and economic slump. The construction equipment rental market is influenced by the business cycles of an economy, which witnesses several business cycles over its lifetime, during which it exhibits high or low economic activity. Economic transitions can be divided into periodic stages of expansion, recession, trough, and recovery. In the case of economies that experience an expansionary trajectory, the construction industry also experiences robust growth, so does the construction equipment rental industry, with an exponential increase in profitability. This growth can be attributed to high consumer demand and easy access to public-private capital investments. Alternatively, the construction industry suffers under a recession-plagued economy, as the shortage of consumer demand results in a reduction in the final output. The resultant decrease in construction activities, in turn, impacts the construction equipment rental market

Opportunity: Low rental penetration in emerging nations

Rental penetration is an important measure to assess the opportunity in terms of potential markets versus the current market. A relatively low level of rental penetration suggests a significant market opportunity for rental companies to expand their business. On the other hand, a high level of rental penetration indicates the market is saturated and will only expand at the rate of overall fleet expansion. As compared to the global average among developed nations and even the BRICS countries, countries such as India and China have a marginal penetration of construction equipment rental

Challenge: Labor shortage may lead to automation

The shortage of suitable labor has a significant impact on the equipment rental industry. This industry employs a variety of workers, such as service technicians, qualified mechanics, and delivery drivers, for several operations. However, such employees are hard to come by in this industry. This worker shortage is driving the construction equipment industry toward further automation, i.e., driverless vehicles. The construction equipment industry is facing the challenge of employing skilled technicians and is, hence, looking forward to public policy solutions aimed at getting more young people into the business. On the other hand, from a contractor’s perspective, this worker shortage could result in greater utilization of rental equipment

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

USD million |

|

Segments covered |

Equipment, Product, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

H&E Equipment Services, Inc (US), Cramo (Finland), Ramirent Plc (Finland), Maxim Crane Works, L.P. (US), Kiloutou (France), Sarens NV (Belgium), Taiyokenki Rental Co., Ltd. (Japan), Boels Rentals (Netherlands), Speedy Hire Plc (UK), United Rentals Inc. (US), Ashtead Group Plc (UK), Loxam (Paris), Herc Holdings Inc. (US), Aktio Corporation (Japan), Nishio Rent All Co. Ltd. (Japan) Kanamoto Co. Ltd. (Japan), Nishio Rent All Co. Ltd (Japan), Nikken Corporation (Japan), Ahern Rentals (US) |

On the basis of equipment:

- Earthmoving

- Material Handling

- Road Building & Concrete

On the basis product:

- Backhoes

- Excavators

- Loaders

- Crawler Dozers

- Cranes

- Concrete Pumps

- Compactors

- Transit Mixers

- Concrete Mixers

- Others

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Key Market Players

United Rentals Inc. (US), Ashtead Group Plc (UK), Loxam (Paris), Herc Holdings Inc. (US), Aktio Corporation (Japan)

Recent Developments

- In January 2019, Nationwide Platforms Limited, Loxam’s wholly-owned UK subsidiary, completed the acquisition of UK Platforms Limited (UKP) from HSS Hire Group plc. UKP has approximately 120 employees and operates a fleet of circa 3,000 powered access units.

- In October 2018, United Rentals, Inc. acquired WesternOne Rentals & Sales LP, a Canada-based leading equipment rental provider of aerial lifts and heat solutions, to expand its business in Western Canada.

- In March 2018, Ashtead Group acquired the business and assets of Above and Beyond Equipment Rentals, LLC, and Above and Beyond of Fairfield County, Inc. (A&B). A&B is an aerial work platform rental business in Connecticut, US.

- In August 2017, Kanamoto acquired Toyu Engineering Co., Ltd. and Meigi Engineering Co., Ltd., both of which deal in the renting or leasing of heavy construction equipment.

Critical questions the report answers:

- What are the upcoming trends for the construction equipment rental market?

- Which segment in the construction equipment rental market provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants in the construction equipment rental market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Construction Equipment Rental Market

4.2 Construction Equipment Rental Market, By Equipment

4.3 Construction Equipment Rental Market, By Product

4.4 Construction Equipment Rental Market, By Region

4.5 Asia Pacific to Lead the Growth of the Construction Equipment Rental Market During the Forecast Period

5 Market Overview (Page No. - 34)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Benefits of Rental

5.1.1.2 Increasing Construction Equipment Demand

5.1.1.3 Shift in Trends Toward Rental

5.1.2 Restraints

5.1.2.1 Susceptibility of the Construction Industry to Economic Recession

5.1.3 Opportunities

5.1.3.1 Low Rental Penetration in Emerging Nations

5.1.3.2 Provision in the Tax Code and Adoption of Technology Provide Ample Opportunities for Contractors to Optimize their Rental Fleet and Generate More Revenue

5.1.3.3 Increasing Investment in Infrastructure

5.1.4 Challenges

5.1.4.1 Labor Shortage May Lead to Automation

5.1.4.2 Lack of Incentives and Favorable Tax Policy

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Threat of New Entrants

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Construction Equipment Rental Market, By Equipment (Page No. - 43)

6.1 Introduction

6.2 Earthmoving

6.2.1 High Purchasing Cost of Earthmoving Equipment Makes Rental A Preferred Choice

6.3 Material Handling

6.3.1 Increasing Demand for Cranes in the Building & Construction Industry to Drive the Growth of the Material Handling Segment

6.4 Road Building & Concrete

6.4.1 Capital-Intensive Infrastructure Projects in Asia Pacific, Latin America, and the Middle East are Expected to Create Marginal Demand for Road Building & Concrete Equipment Rental

7 Construction Equipment Rental Market, By Product (Page No. - 48)

7.1 Introduction

7.2 Excavators

7.2.1 Wide Acceptance for Renting of Excavators Among Contractors Due to the High Price of Equipment Purchase

7.3 Loaders

7.3.1 Ongoing Electrification By Oem to Target Rental Customers Expected to Impact the Market for Loaders

7.4 Backhoes

7.4.1 Although Popular in Asia and the Middle East, Backhoes Face Stiff Competition From Crawler Excavators and Loaders in North America and Europe

7.5 Cranes

7.5.1 Increasing Demand for Fixed Construction Products in the Building & Construction Industry Expected to Drive the Market for Cranes Rental

7.6 Crawler Dozers

7.6.1 Road Building and Highway Construction Activities in Asia Pacific to Drive the Demand for Crawler Dozers

7.7 Concrete Pumps

7.7.1 Rapid Expansion of Housing and Infrastructure Sectors Expected to Drive the Market for Concrete Pumps Rental

7.8 Compactors

7.8.1 Road Building and Infrastructure Activities in Emerging Nations Expected to Drive the Demand for Compactors

7.9 Transit Mixers

7.9.1 Less Rental Penetration to Affect the Future Rental Revenue of Transit Mixers

7.1 Concrete Mixers

7.10.1 Contractors Prefer Purchase of Concrete Mixers Over Rental Because of their Continuous Use

7.11 Others

7.11.1 Minimum Rental Penetration Expected to Impact the Rental Revenue Pf Other Products in the Near Future

8 Regional Analysis (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Rental Penetration is Expected to Create Market Opportunities in the Near Future

8.2.2 Canada

8.2.2.1 Increase in Investments in Infrastructure Development to Drive the Growth of the Market in Canada

8.3 Asia Pacific

8.3.1 China

8.3.1.1 China is Projected to Lead the Global Construction Equipment Rental Market in the Asia Pacific Region During the Forecast Period

8.3.2 Japan

8.3.2.1 Mature Market With High Rental Penetration

8.3.3 India

8.3.3.1 Increasing Investments for the Construction of Infrastructure are Expected to Drive the Market In

8.3.4 South Korea

8.3.4.1 Rental Revenues From Excavators to Drive Demand

8.3.5 Rest of Asia Pacific

8.3.5.1 Increasing Investments & Growth in Industries is Expected to Drive the Growth of the Market in the Rest of Asia Pacific Countries

8.4 Middle East & Africa

8.4.1 UAE

8.4.1.1 Investments From Government and Recovery of the Construction Industry are Expected to Drive Demand in the Construction Equipment Rental Market in the UAE

8.4.2 Qatar

8.4.2.1 International Events to Drive Demand for Construction Equipment Rental Market in Qatar

8.4.3 Saudi Arabia

8.4.3.1 Growth in the Oil & Gas Industry is Expected to Drive Demand for Construction Equipment Rental in Saudi Arabia

8.4.4 Rest of Middle East & Africa

8.4.4.1 Rest of Middle East Countries Offer Attractive Opportunities for Construction Equipment Rental While Growth is Expected to Be Subdued in the Rest of Africa Region

8.5 Europe

8.5.1 Germany

8.5.1.1 Increasing Investments in Infrastructure are Expected to Drive Market Growth in Germany

8.5.2 France

8.5.2.1 Fastest-Growing Market for Construction Equipment Rental

8.5.3 UK

8.5.3.1 The Construction Industry is Expected to Witness Sluggish Growth and Thus Impact the Market

8.5.4 Italy

8.5.4.1 Recovery of the Construction Industry is Expected to Drive the Growth of the Market in Italy

8.5.5 Spain

8.5.5.1 Recovery in Residential Construction is Expected to Drive the Growth of the Market in Spain

8.5.6 Sweden

8.5.6.1 Government Initiatives and Growth in Non-Residential Sector is Expected to Drive the Growth of the Market in Sweden

8.5.7 Rest of Europe Construction Equipment Rental Market, By Product

8.5.7.1 Booming Construction Industry Especially in Poland in Rest of Europe Countries is Projected to Boost the Growth of the Market

8.6 Latin America

8.6.1 Brazil

8.6.1.1 Government Focus on Infrastructure Spending to Drive Market During the Forecast Period

8.6.2 Mexico

8.6.2.1 Trade Agreements to Attract Foreign Investments in Construction and Infrastructure to Drive the Market

8.6.3 Rest of Latin America

8.6.3.1 the Revival of the Construction Sector in Countries, Such as Peru, Colombia, and Argentina to Drive the Growth of the Market in the Region

9 Competitive Landscape (Page No. - 96)

9.1 Introduction

9.2 Competitive Leadership Mapping

9.2.1 Visionaries

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Ranking of Key Market Players in the Construction Equipment Rental Market

10 Company Profiles (Page No. - 99)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

10.1 United Rentals, Inc.

10.2 Herc Holdings Inc.

10.3 Ashtead Group Plc

10.4 Aktio Corporation

10.5 Loxam Sas

10.6 Kanamoto Co., Ltd.

10.7 Nishio Rent All Co., Ltd.

10.8 H&E Equipment Services, Inc.

10.9 Nikken Corporation

10.10 Cramo Group

10.11 Ramirent Plc

10.12 Maxim Crane Works, L.P.

10.13 Kiloutou

10.14 Sarens Nv

10.15 Taiyokenki Rental Co., Ltd.

10.16 Ahern Rentals, Inc.

10.17 Boels Rental

10.18 Speedy Hire Plc

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

10.19 Other Key Players

10.19.1 Coates Hire

10.19.2 Sunstate Equipment Company

10.19.3 Zeppelin Rental

10.19.4 Liebherr Mietpartner

10.19.5 Hitachi Construction Machinery Japan Co., Ltd.

10.19.5.1 Recent Developments

10.19.6 Hss Hire

10.19.7 Ameco Inc.

11 Appendix (Page No. - 144)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (54 Tables)

Table 1 Construction Equipment Rental Market Snapshot

Table 2 Global Airport Construction Projects By Country

Table 3 Construction Equipment Rental Market, By Equipment, 2017–2024 (USD Million)

Table 4 Earthmoving Construction Equipment Rental Market, By Region, 2017–2024 (USD Million)

Table 5 Material Handling Construction Equipment Rental Market, By Region, 2017–2024 (USD Million)

Table 6 Road Building & Concrete Construction Equipment Rental Market, By Region, 2017–2024 (USD Million)

Table 7 Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 8 Construction Equipment Rental Market for Excavators, By Region, 2017–2024 (USD Million)

Table 9 Construction Equipment Rental Market for Loaders, By Region, 2017–2024 (USD Million)

Table 10 Construction Equipment Rental Market for Backhoes, By Region, 2017–2024 (USD Million)

Table 11 Construction Equipment Rental Market for Cranes, By Region, 2017–2024 (USD Million)

Table 12 Construction Equipment Rental Market for Crawler Dozers, By Region, 2017–2024 (USD Million)

Table 13 Construction Equipment Rental Market for Concrete Pumps, By Region, 2017–2024 (USD Million)

Table 14 Construction Equipment Rental Market for Compactors, By Region, 2017–2024 (USD Million)

Table 15 Construction Equipment Rental Market for Transit Mixers, By Region, 2017–2024 (USD Million)

Table 16 Construction Equipment Rental Market for Concrete Mixers, By Region, 2017–2024 (USD Million)

Table 17 Construction Equipment Rental Market for Other Products, By Region, 2017–2024 (USD Million)

Table 18 Construction Equipment Rental Market, By Region, 2017–2024 (USD Million)

Table 19 North America Construction Equipment Rental Market, By Country, 2017–2024 (USD Million)

Table 20 North America Construction Machinary Leasing Market, By Equipment, 2017–2024 (USD Million)

Table 21 North America Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 22 US Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 23 Canada Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 24 Asia Pacific Construction Equipment Rental Market, By Country, 2017–2024 (USD Million)

Table 25 Asia Pacific Construction Machinary Leasing Market, By Equipment, 2017–2024 (USD Million)

Table 26 Asia Pacific Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 27 China Construction Equipment Rental Market, By Product, 2017–2024 (USD Million

Table 28 Japan Heavy Machinary Rental Market, By Product, 2017–2024 (USD Million)

Table 29 India Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 30 South Korea Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 31 Rest of Asia Pacific Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 32 Middle East & Africa Construction Equipment Rental Market, By Country, 2017–2024 (USD Million)

Table 33 Middle East & Africa Construction Machinary Leasing Market, By Equipment,2017–2024 (USD Million)

Table 34 Middle East & Africa Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 35 UAE Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 36 Qatar Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 37 Saudi Arabia Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 38 Rest of Middle East & Africa Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 39 Europe Construction Equipment Rental Market, By Country, 2017–2024 (USD Million)

Table 40 Europe Heavy Machinary Rental Market, By Equipment, 2017–2024 (USD Million)

Table 41 Europe Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 42 Germany Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 43 France Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 44 UK Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 45 Italy Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 46 Spain Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 47 Sweden Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 48 Rest of Europe Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 49 Latin America Construction Equipment Rental Market, By Country, 2017–2024 (USD Million)

Table 50 Latin America Heavy Machinary Rental Market, By Equipment, 2017–2024 (USD Million)

Table 51 Latin America Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 52 Brazil Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

Table 53 Mexico Heavy Machinary Rental Market, By Product, 2017–2024 (USD Million)

Table 54 Rest of Latin America Construction Equipment Rental Market, By Product, 2017–2024 (USD Million)

List of Figures (49 Figures)

Figure 1 Construction Equipment Rental Market Segmentation

Figure 2 Construction Equipment Rental Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Construction Equipment Rental Market: Data Triangulation

Figure 6 Earthmoving is Projected to Be the Leading Rental Construction Equipment Between 2019 and 2024, in Terms of Value

Figure 7 Excavators is Projected to Be the Leading Product Segment of the Construction Equipment Rental Market Between 2019 and 2024, in Terms of Value

Figure 8 Asia Pacific Construction Equipment Rental Market to Grow at the Highest CAGR During Forecast Period, in Terms of Value

Figure 9 Earthmoving Segment Projected to Lead Market Growth During the Forecast Period, in Terms of Value

Figure 10 Cranes Segment Projected to Lead the Growth of the Construction Equipment Market During the Forecast Period, in Terms of Value

Figure 11 North America Accounted for the Largest Share of the Construction Equipment Rental Market in 2018, in Terms of Value

Figure 12 Japan Led the Demand for Construction Equipment Rental Market in Asia Pacific in 2018, in Terms of Value

Figure 13 Market Dynamics: Construction Equipment Rental Market

Figure 14 Global Construction Equipment Unit Sales, 2016–2025

Figure 15 Rental Penetration Rate Across the Us, 2011–2018 (%)

Figure 16 Porter’s Five Forces Analysis

Figure 17 Material Handling Segment to Grow at the Highest Rate During Forecast Period, in Terms of Value

Figure 18 Cranes Segment to Grow at Higher CAGR During Forecast Period, in Terms of Value

Figure 19 Asia Pacific is Projected to Grow at the Highest CAGR in the Construction Equipment Rental Market During the Forecast Period

Figure 20 North America Construction Equipment Rental Market Snapshot

Figure 21 Rental Penetration Rate Across the US, 2003 – 2018, (%)

Figure 22 Asia Pacific Construction Equipment Rental Market Snapshot

Figure 23 Middle East & Africa Construction Equipment Rental Market Snapshot

Figure 24 Europe Construction Equipment Rental Market Snapshot

Figure 25 Latin America Construction Equipment Rental Market Snapshot

Figure 26 Construction Equipment Rental Market (Global): Competitive Leadership Mapping, 2018

Figure 27 Top Five Companies Construction Equipment Rental 2018

Figure 28 United Rentals, Inc.: Company Snapshot

Figure 29 United Rentals, Inc.: SWOT Analysis

Figure 30 Herc Holdings Inc.: Company Snapshot

Figure 31 Herc Holdings Inc.

Figure 32 Ashtead Group Plc: Company Snapshot

Figure 33 Ashtead Group Plc: SWOT Analysis

Figure 34 Loxam Sas: Company Snapshot

Figure 35 Loxam Sas: SWOT Analysis

Figure 36 Kanamoto Co., Ltd.: Company Snapshot

Figure 37 Kanamoto Co., Ltd.: SWOT Analysis

Figure 38 Nishio Rent All Co., Ltd.: Company Snapshot

Figure 39 Nishio Rent All Co., Ltd.: SWOT Analysis

Figure 40 H&E Equipment Services, Inc.: Company Snapshot

Figure 41 H&E Equipment Services, Inc.: SWOT Analysis

Figure 42 Nikken Corporation: Company Snapshot

Figure 43 Cramo Group: Company Snapshot

Figure 44 Cramo Group: SWOT Analysis

Figure 45 Ramirent Plc: Company Snapshot

Figure 46 Maxim Crane Works, L.P.: SWOT Analysis

Figure 47 Sarens Nv: Company Snapshot

Figure 48 Sarens Nv: SWOT Analysis

Figure 49 Speedy Hire Plc.: Company Snapshot

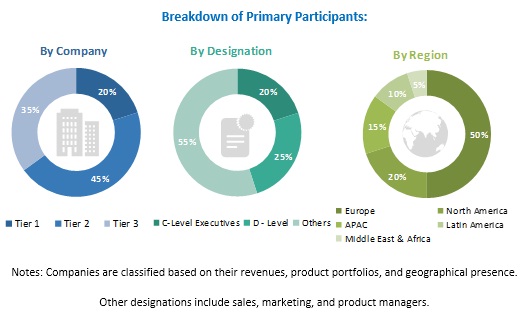

The study involved 4 major activities in estimating the current market size for construction equipment rental. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. Secondary sources include annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

The construction equipment rental market comprises several stakeholders, such as construction equipment manufacturers, construction equipment renting companies, OEMs, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in the building & construction industry. The supply side is characterized by market consolidation activities undertaken by construction equipment rental providers. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the construction equipment rental market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the construction equipment rental market based on equipment, product, and region

- To estimate and forecast the size of the construction equipment rental market in terms of value

- To estimate and forecast the size of the construction equipment rental market by equipment, and product for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To identify and analyze the drivers, restraints, challenges, and opportunities that are influencing the growth of the construction equipment rental market

- To analyze region-specific trends in North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze markets with respect to individual growth trends, future prospects, and their contribution to the market

- To track and analyze recent developments and competitive strategies, such as partnerships, contracts, acquisitions, new product launches, and expansions adopted by the leading players to strengthen their positions in the construction equipment rental market

- To identify and profile key players in the construction equipment rental market and analyze their core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional construction equipment rental market to the country level by type

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Construction Equipment Rental Market