Construction Adhesive Tapes Market by Technology, Resin Type, Application, End-Use Industry (Non-Residential, Residential), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Global Forecast to 2028

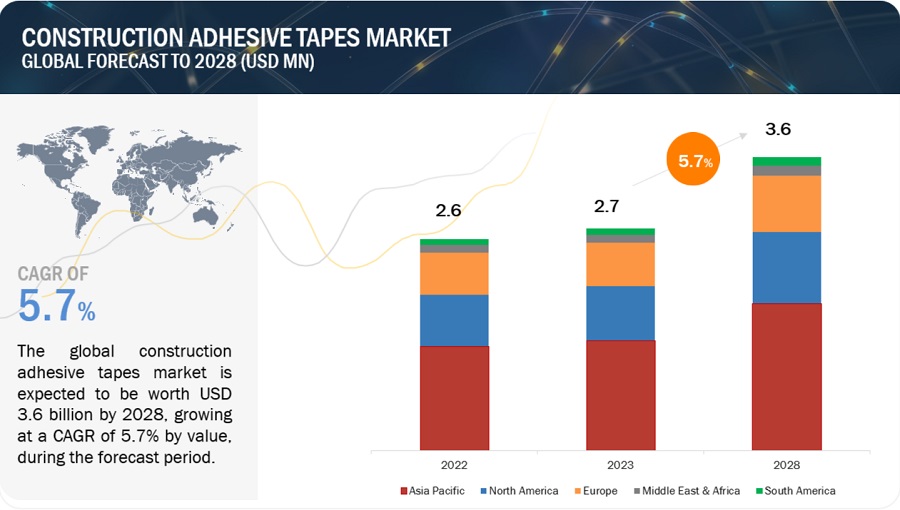

The global market for construction adhesive tapes is expected to rise at a compound annual growth rate (CAGR) of 5.7%, from 2.7 USD billion in 2023 to 3.6 USD billion by 2028. The construction industry has witnessed a notable increase in demand for construction adhesive tapes owing to their extensive range of uses. Strong adhesion and bonding solutions for a variety of building demands make these tapes invaluable tools. They play a crucial role in a variety of operations, from providing insulation and soundproofing to connecting materials and strengthening buildings. Their versatility in construction contexts stems from their ability to stick to a variety of surfaces, including concrete, metal, and wood. The construction adhesive tape market is seeing exponential growth due to the growing emphasis on efficiency, durability, and customized solutions in the sector. These tapes play a crucial role in maintaining structural integrity and optimizing construction processes.

Attractive Opportunities in the Construction Adhesive Tapes Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Construction Adhesive Tapes Market Dynamics:

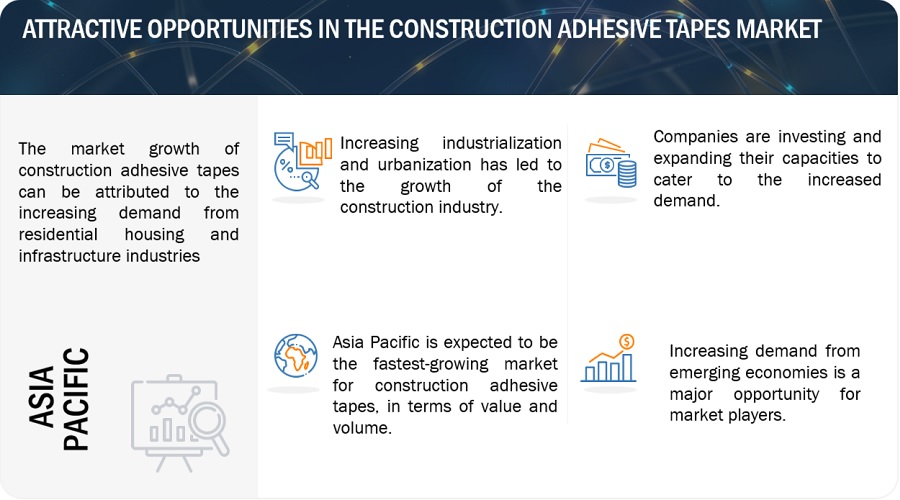

Drivers: Increasing investments in construction industry to propel the market growth

Fast urbanization and population increase worldwide are the main factors driving the construction adhesive tapes market and are also major contributors to the building industry's explosive growth. The main causes of this construction boom are large investments from well-known corporate companies and increased public spending, which is especially evident in developing nations. The building sector is divided into three main areas worldwide: infrastructure, commercial, and residential. The infrastructure market, which is expanding at a significant rate, is primarily propelled by the rapid urbanization of developing nations such as China and India, as well as the creation of new metropolitan centers. Notably, the construction market in the Asia Pacific region is expanding at the highest rate, which in turn is driving up demand for construction adhesive tapes in this expanding industry.

Restraints: Raw Material Price Volatility

The fluctuations in raw material prices provide substantial challenges to the worldwide construction adhesive tape industry. Manufacturing costs are directly impacted by fluctuations in necessary components like resins and solvents, since firms that primarily rely on petroleum-derived materials are vulnerable to changes in global oil markets. Unexpected increases in the cost of raw materials put businesses under severe financial strain, which affects their profit margins and pricing policies. The unpredictability of the market makes it difficult for companies to project costs, which affects their capacity to remain competitive and set a steady price. Furthermore, these price swings make it difficult to allocate funds for R&D for novel tape formulations or technologies, which restricts the industry's ability to advance and satisfy changing consumer demands.

Opportunities: Increasing demand in emerging economies to create lucrative opportunities for the market

The global economy has rebounded from the slowdown experienced in 2020, consequently fueling the construction industry and directly amplifying the utilization of construction adhesive tapes. Concurrently, developing economies such as China, India, Brazil, and the Middle East have shifted their focus to improving public infrastructure. The market for construction adhesive tapes is expected to grow significantly as a result of this rapid infrastructure development. According to the India Brand Equity Foundation, India's economy is mostly dependent on the infrastructure sector, which propels the country's advancement as a whole. The administration is putting a lot of effort into developing regulations that would guarantee the prompt construction of high-grade infrastructure throughout the nation. Furthermore, China's demand for construction adhesive tapes has expanded dramatically as a result of increased government investments in the country.

Challenges: Established infrastructure in dwveloped countries to be a major challenge for market growth

Developed countries with well-established public, commercial, and transportation infrastructure include the US, Germany, the UK, Japan, and other Western European nations. These areas' developed infrastructure restricts the potential for large-scale new building projects. Moreover, long-term sustainability is supported by the strength of the current infrastructure, which presents few opportunities for the construction adhesive tapes market to grow significantly. Over the next five years, demand for construction adhesive tapes is expected to climb somewhat, mostly due to increased activity in the building sector.

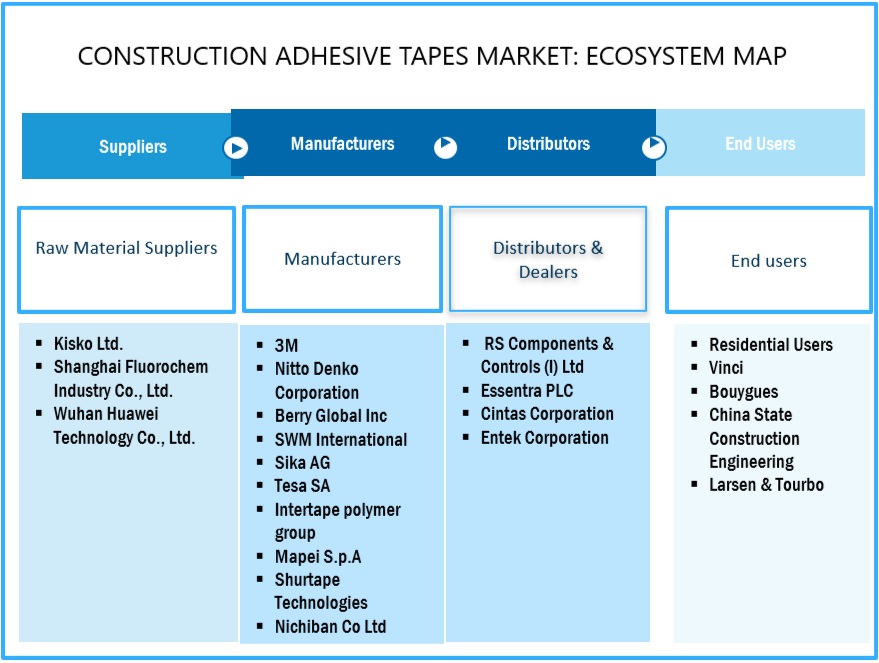

Construction Adhesive Tapes Market: Ecosystem

Hot-melt based technology estimated to grow with the highest CAGR, in terms of value and volume

Based on technology, the Hot Melt technology segment for construction adhesive tapes has witnessed a remarkable surge in its Compound Annual Growth Rate (CAGR) owing to several key factors. This technology, which uses only 100% solid adhesives made of thermoplastic polymers, has gained a lot of popularity because of its remarkable performance and wide range of applications. This segment's strong growth can be ascribed to its quick-setting characteristics, which considerably accelerate building processes, decrease downtime, and boost operational effectiveness. In addition, comparatively cheaper material and processing costs as well as a smaller environmental footprint have drawn a lot of interest from the sector. Hot Melt technology for construction adhesive tapes continues to exhibit a notably high compound annual growth rate (CAGR), indicating its pivotal role and promising future in the market as demands for faster construction and enhanced durability surge across various sectors, from infrastructure to residential and commercial projects.

Acrylic resin type segment segment dominated the construction adhesive tapes market, in terms of value and volume

Based on resin type, The construction adhesive tapes market categorizes its segments into acrylic, rubber, and other categories. Forecasts indicate that the acrylic segment will take the lead in the market, both in terms of value and volume, throughout the projected period. Due to its remarkable qualities, acrylic resin has become the industry leader in adhesive tapes for construction, driving significant demand. Its appeal stems from a combination of favorable chemical and physical characteristics that make it a top option. Adhesive tapes based on acrylic are unique in that they are both inexpensive and incredibly versatile, exhibiting exceptional performance in a variety of building applications. They stand out in particular because of their compatibility with water- and solvent-based technologies, which demonstrates their innate resistance to a variety of chemicals, solvents, and water. This natural resistance increases their flexibility, making acrylic-based adhesive tapes incredibly trustworthy and adaptable in a variety of construction applications. Their resistance to different environmental conditions makes them an excellent option for bonding, sealing, and insulation in the building industry.

Flooring segment lead the construction adhesive tapes market

The flooring application segment lead the construction adhesive tapes market, in terms of value and volume. Construction adhesive tape usage has increased dramatically in recent years, with a particular spike in demand for these tapes in flooring applications. The development of novel flooring materials and methods, including pre-finished panels, ceramic tiles, countertop lamination, and specialty flooring underlayment, is closely related to this increased demand. The use of adhesive tapes in flooring applications has been further aided by developments in construction methods, particularly the creation of rapid cure procedures. These developments have particularly affected the construction sector, where it is critical to have solutions that accelerate installation while minimizing downtime. In flooring applications, adhesive tapes provide accurate, effective, and long-lasting bonding solutions, meeting the industry's need for fast-setting materials without sacrificing quality.

Residential end-use industry segment to grow with highest CAGR during forecasted period

The market for construction adhesive tapes is primarily driven by the residential end-use industry, which is indicative of the industry's significant influence and promising growth prospects. The numerous uses of adhesive tapes in residential settings, including new construction, remodeling, repairs, and continuous maintenance duties, highlight its supremacy in fueling this need. This market segment has solidified its place as a major player in the adhesive tape industry by continuously looking for adhesive solutions for a variety of applications, including flooring, wall coverings, thermal insulation, tiling, and more. Moreover, the quick rise and ongoing demand for these cassettes is indicated by the residential sector's strong Compound Annual Growth Rate (CAGR). Urbanization patterns, changing demographics, and regional government efforts all contribute to the expansion of the residential building industry and, in turn, the rising demand for construction adhesive tapes.

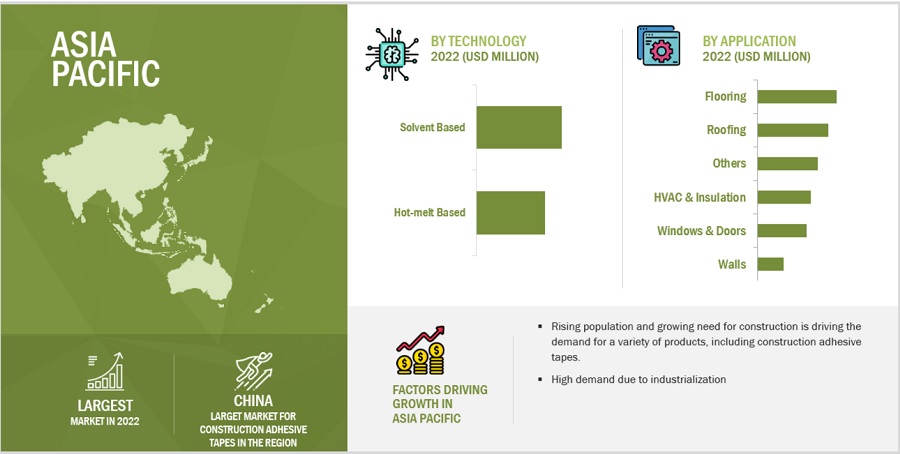

Asia Pacific is the largest regional market for construction adhesive tapes globally

Asia Pacific has emerged as a key consumer and producer of construction adhesive tapes, driven by escalating building and construction activities in the region's emerging economies. Increased income levels, booming domestic demand, and easily accessible resources are the main drivers of this rise. The availability of cheap labor and readily available raw resources attracts foreign investment, which therefore plays a major role in the growth of the sector. Additionally, government programs to support public infrastructure and the rise in affordable non-residential building are driving the expansion of the construction adhesive tapes market in the area. In spite of this, established brand recognition and high-quality products continue to draw consumers in North America and Europe. However, the Asia Pacific market, where competitive price is crucial, presents fierce rivalry for businesses in these areas. Local producers in Asia Pacific are able to sway end users' preferences by providing comparable construction adhesive tapes at more affordable prices.

To know about the assumptions considered for the study, download the pdf brochure

Riseing demand due to the safety and ease of application

Adhesive tapes have many benefits, two of which are their ease of application and versatility. For example, construction adhesive tapes are used to link materials that are similar or dissimilar, but they also prevent corrosion and absorb vibrations. The market for construction adhesives is expanding due to the increasing need for improved performance in a variety of contemporary applications. This is encouraging the development of new application techniques and performance features for these tapes. Adhesive tapes with quick cure times, easy application, and affordable prices are in great demand. In response to these changing needs, silicone and acrylic adhesive tapes have been developed recently. Modern materials such as plastic, granite, marble, tub & shower surrounds, and artificial stone fascia call for specially designed construction adhesive tapes, which take the place of more conventional fasteners like screws, staples, or nails. Construction adhesive tape demand is rising, especially in the non-residential, residential, and infrastructure segments. This demand reduces labor needs and speeds up application processes. This eliminates the need to fill, finish, or prime nail holes when joining materials like wood, drywall, and other surfaces.

Prominent companies in the construction adhesive tapes market include 3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Scapa Group Ltd (UK), Intertape Polymer Group (Canada), Beery Global Inc. (US), Nichiban Co., Ltd. (Japan), and Sika AG (Switzerland).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the construction adhesive tapes industry. The study includes an in-depth competitive analysis of these key players in the construction adhesive tapes market, with their company profiles, recent developments, and key market strategies.

Read More: Construction Adhesive Tapes Companies

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2020–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD million), Volume (Million Square Meter) |

|

Segments |

Technology, Resin Type, Application, End-Use Industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Scapa Group Ltd (UK), Intertape Polymer Group (Canada), Beery Global Inc. (US), Nichiban Co., Ltd. (Japan), and Sika AG (Switzerland). |

This research report categorizes the construction adhesive tapes market based on resin type, manufacturing process, application, and region.

By Technology:

- Hot-Melt Based

- Solvent-Based

- Others

By Resin Type:

- Acrylic

- Rubber

- Others

By Application:

- Flooring

- Roofing

- Windows & Doors

- Walls

- HVAC & Insulation

- Others

By End-User:

- Residential

- Non-Residential

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Nitto Denko Corporation launched a new product. The product launched was a bio-adhesive tape which is a step to eco friendly product. The company launched bio-based adhesive tape, PlanetFlags. It is double sided tape that has been manufactured by recycling films.

- In October 2023, Tesa SE opened a new site in Haiphong, Vietnam aiming to expand its presence in Asia region. This site has production capacity of 40 million square meter of adhesive tapes per year.

- In May 2022, Shurtape Technologies LLC launched a new product, named Duck Pro. This is high-performance tape available in four grades: general purpose, utility, premium, and professional.

Frequently Asked Questions (FAQ):

Which are the key players of construction adhesive tapes market and what are their strategies to strengthen their market presence/shares?

Some of the key players of polyester fiber market are 3M (US), Nitto Denko Corporation (Japan), Tesa SE (Germany), Scapa Group Ltd (UK)/ SWM Internationals, Intertape Polymer Group (Canada), Beery Global Inc. (US), Nichiban Co., Ltd. (Japan), Sika AG (Switzerland), among others, are the key manufacturers that secured contracts, deals in the last few years. Agreements, expansions, technological developments, contracts, and deals was the key strategies adopted by these companies to strengthen their market presence.

Which is the fastest growing country-level market for construction adhesive tapes?

India is the fastest growing market for construction adhesive tapes due to high demand from residential end-use industries.

What are the factors contributing to the final price of construction adhesive tapes?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of construction adhesive tapes.

What are the restraints in the construction adhesive tapes market?

Regularty compliance and environmental concerns is the major restraints in the construction adhesive tapes market.

Which type of construction adhesive tapes holds the largest market share and why?

Acrylic resin type hold the largest share in terms of value and volume, in the construction adhesive tapes market due to the properties like excellent adhesion to various surfaces, durability, resistance to weathering, and exceptional chemical and solvent resistance. .

How is the construction adhesive tapes market aligned?

The market is growing at the nominal pace but is expected to grow along with the growth in construction industry. It is a potential market and many manufacturers are undertaking business strategies to expand their business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in global construction industry- Increased demand in residential housing and infrastructure sectors- Versatility and ease of applicationRESTRAINTS- Established infrastructure in developed countries- Volatility in price of raw materialsOPPORTUNITIES- Increasing demand in emerging economies- Technological advancements and innovationCHALLENGES- Changing regulations and environmental concerns

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- 5.5 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- 5.6 AVERAGE SELLING PRICE, BY REGION

-

5.7 ECOSYSTEM ANALYSIS: CONSTRUCTION ADHESIVE TAPES MARKETRAW MATERIAL PROVIDERSADHESIVE TAPE MANUFACTURERSDISTRIBUTORSEND USERS

-

5.8 TECHNOLOGY ANALYSISSOLVENT-BASEDHOT-MELT

-

5.9 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANT'S ANALYSISACTIVE PATENTS BY 3MACTIVE PATENTS BY STATE GRID CORP. CHINATOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 CASE STUDY ANALYSIS

-

5.12 TRADE ANALYSISEXPORT SCENARIO OF ADHESIVE TAPESIMPORT SCENARIO OF ADHESIVE TAPES

-

5.13 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS

-

5.15 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPESLOW COST AND LOW ENVIRONMENTAL IMPACT TO BOOST DEMAND

-

6.3 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPESSTRINGENT REGULATIONS ON VOC EMISSION LIMITING USE OF SOLVENT-BASED TECHNOLOGY

- 7.1 INTRODUCTION

-

7.2 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPESHIGH DURABILITY BOOSTING DEMAND

-

7.3 RUBBER-BASED CONSTRUCTION ADHESIVE TAPESHIGH ADHESION TO NON-POLAR AND LOW-ENERGY SURFACES TO INCREASE DEMAND

-

7.4 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKETINCREASING DEMAND DUE TO MALLEABILITY AND IMPERMEABILITY OF AIR

- 8.1 INTRODUCTION

-

8.2 FLOORINGSMOOTH SURFACE FINISH AND HIGH-QUALITY ADHESION TO DRIVE MARKET IN FLOORING APPLICATION

-

8.3 ROOFINGUSAGE OF PRE-CASTED PANELS TO INCREASE CONSUMPTION

-

8.4 WINDOWS & DOORSASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

-

8.5 WALLSEXPANSION OF HOME RENOVATION SECTOR TO FUEL DEMAND

-

8.6 HVAC & INSULATIONRAPID URBANIZATION TO DRIVE DEMAND IN HVAC SEGMENT

- 8.7 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 RESIDENTIALINCREASED STRENGTH AND SUPERIOR FINISH TO DRIVE MARKET

-

9.3 NON-RESIDENTIALCONSTRUCTION OF NEW HOSPITALS AND OFFICES TO BOOST DEMAND IN NON-RESIDENTIAL SEGMENT

-

9.4 OTHER END-USE INDUSTRIESGROWING DEMAND IN RAILWAY AND ROAD CONSTRUCTION TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSIONCONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY RESIN TYPECONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY TECHNOLOGYCONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY APPLICATIONCONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY END-USE INDUSTRYCONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY COUNTRYUS- Increasing demand from residential sector to drive marketCANADA- Growing residential sector fueling demand for construction adhesive tapesMEXICO- Rising demand from flooring application to support market growth

-

10.3 ASIA PACIFICIMPACT OF RECESSIONCONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY RESIN TYPECONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY TECHNOLOGYCONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY APPLICATIONCONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY END-USE INDUSTRYCONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY COUNTRYCHINA- High demand for construction adhesive tapes from roofing and flooring applicationsINDIA- Fastest-growing market for construction adhesive tapes in Asia PacificJAPAN- Second-largest construction adhesive tapes market in Asia PacificSOUTH KOREA- Stringent environmental regulations to reduce use of high-VOC content tapesINDONESIA- Availability of cheap labor and raw materials to propel market growthTAIWAN- Country experiencing higher exports of construction adhesive tapes than domestic demandREST OF ASIA PACIFIC

-

10.4 EUROPEIMPACT OF RECESSIONCONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY RESIN TYPECONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY TECHNOLOGYCONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY APPLICATIONCONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY END-USE INDUSTRYCONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY COUNTRYGERMANY- Increasing demand for construction adhesive tapes from residential sectorITALY- Growing residential sector to fuel demandFRANCE- Flooring application to be largest consumer of adhesive tapesUK- HVAC & insulation to be fastest-growing application during forecast periodPOLAND- Growing demand in HVAC & insulation application to drive marketRUSSIA- Flooring application to be largest consumer of construction adhesiveREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONCONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY RESIN TYPECONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY TECHNOLOGYCONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY APPLICATIONCONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRYCONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY COUNTRYSAUDI ARABIA- Increasing government investments in infrastructure to fuel demandUAE- Growing economy and investments to drive market growthREST OF GCC- Growing economy and investments to drive market growthSOUTH AFRICA- Increasing government investments in infrastructure to fuel demandREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICAIMPACT OF RECESSIONCONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY RESIN TYPECONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY TECHNOLOGYCONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY APPLICATIONCONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY END-USE INDUSTRYCONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY COUNTRYBRAZIL- Initiatives and investments by government in infrastructure development projects to propel demandREST OF SOUTH AMERICA

- 11.1 KEY PLAYER'S STRATEGIES

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.5 COMPANY FOOTPRINT

-

11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS- Competitive benchmarking of key startups/SMEs

- 11.7 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY COMPANIES3M- Business overview- Products/Solutions/Services offered- MnM viewNITTO DENKO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTESA SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCAPA GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERTAPE POLYMER GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBERRY GLOBAL INC.- Business overview- Products/Solutions/Services offered- MnM viewSHURTAPE TECHNOLOGIES, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMAPEI S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOHMANN GMBH & CO. KG- Business overview- Products/Solutions/Services offered- MnM viewIDEAL TAPE- Business overview- Products/Solutions/Services offered- MnM viewSEAL FOR LIFE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNICHIBAN CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewADVANCE TAPES INTERNATIONAL- Business overview- Products/Solutions/Services offered- MnM viewCARLISLE COMPANIES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER COMPANIESHICUBE COATINGPOLYGUARD PRODUCTS, INC.DENSO-HOLDING GMBH & CO.BOSTIK SAARDEX GMBHFRANKLIN INTERNATIONALAVERY DENNISONLATICRETE INTERNATIONALTERRACOSAINT-GOBAIN WEBER

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019–2030)

- TABLE 2 AVERAGE SELLING PRICE OF CONSTRUCTION ADHESIVE TAPES, BY REGION

- TABLE 3 CONSTRUCTION ADHESIVE TAPES MARKET: ROLE IN ECOSYSTEM

- TABLE 4 CONSTRUCTION ADHESIVE TAPES MARKET: GLOBAL PATENTS

- TABLE 5 TOP 10 ADHESIVE TAPES EXPORTING COUNTRIES IN 2022

- TABLE 6 TOP 10 ADHESIVE TAPES IMPORTING COUNTRIES IN 2022

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REGULATIONS/STANDARDS FOR CONSTRUCTION ADHESIVE TAPES

- TABLE 12 CONSTRUCTION ADHESIVE TAPES MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 13 CONSTRUCTION ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 17 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 18 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 19 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 20 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 21 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 22 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 24 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 25 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 26 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 28 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 29 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 30 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 31 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 32 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 33 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 34 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 36 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 37 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 38 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 40 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 41 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 42 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 44 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 45 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 46 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 48 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2020–2022 (USD MILLION)

- TABLE 49 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 50 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 52 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2020–2022 (USD MILLION)

- TABLE 53 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 54 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 56 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 57 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 58 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 60 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 61 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 62 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 64 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 65 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 66 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 68 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 69 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 70 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 72 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 73 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 74 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 76 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2020–2022 (USD MILLION)

- TABLE 77 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 78 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 80 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2020–2022 (USD MILLION)

- TABLE 81 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 82 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 84 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 85 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 86 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 88 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2020–2022 (USD MILLION)

- TABLE 89 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2020–2022 (MILLION SQUARE METER)

- TABLE 90 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 92 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 94 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 96 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 98 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 100 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 102 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 104 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 106 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 108 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 110 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 112 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 113 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 114 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 116 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 117 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 118 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 120 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 121 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 122 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 124 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 126 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 128 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 130 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 132 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 134 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 136 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 138 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY 2023–2028 (MILLION SQUARE METER)

- TABLE 140 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 142 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 144 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 145 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 146 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 148 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 149 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 150 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 152 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 153 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 154 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 155 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 156 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 157 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 158 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 160 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 161 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 162 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 164 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 165 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 166 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 168 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 170 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 172 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 173 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 174 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 175 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 176 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 177 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 178 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 179 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 180 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 181 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 182 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 184 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 185 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 186 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 187 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 188 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 189 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 190 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 191 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 192 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 193 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 194 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 196 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 197 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 198 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 200 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 201 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 202 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 203 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 204 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 205 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 206 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 207 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 208 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 209 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 210 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 212 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 213 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 214 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 215 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 216 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 217 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 218 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 219 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 220 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 222 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 224 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 226 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 228 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 230 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 232 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 234 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 236 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 238 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 240 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 241 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 242 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 244 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 245 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 246 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 247 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 248 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 249 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 250 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 251 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 252 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 253 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 254 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 255 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 260 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020–2022 (MILLION SQUARE METER)

- TABLE 262 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 264 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020–2022 (MILLION SQUARE METER)

- TABLE 266 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023–2028 (MILLION SQUARE METER)

- TABLE 268 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 269 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 270 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 272 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 273 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 274 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 275 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 276 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 277 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020–2022 (MILLION SQUARE METER)

- TABLE 278 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 279 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 280 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 281 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 282 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 283 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 284 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 285 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020–2022 (MILLION SQUARE METER)

- TABLE 286 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 287 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 288 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 289 CONSTRUCTION ADHESIVE TAPES MARKET: DEGREE OF COMPETITION

- TABLE 290 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY OVERALL FOOTPRINT

- TABLE 291 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY RESIN TYPE FOOTPRINT

- TABLE 292 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 293 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY TAPE TYPE FOOTPRINT

- TABLE 294 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY REGION FOOTPRINT

- TABLE 295 CONSTRUCTION ADHESIVE TAPES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 296 CONSTRUCTION ADHESIVE TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 297 CONSTRUCTION ADHESIVE TAPES MARKET: DEALS, 2018–2023

- TABLE 298 CONSTRUCTION ADHESIVE TAPES MARKET: OTHERS, 2018–2023

- TABLE 299 CONSTRUCTION ADHESIVE TAPES MARKET: PRODUCT DEVELOPMENTS, 2018–2023

- TABLE 300 3M: COMPANY OVERVIEW

- TABLE 301 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- TABLE 303 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 NITTO DENKO CORPORATION: PRODUCT DEVELOPMENT

- TABLE 305 NITTO DENKO CORPORATION: OTHERS

- TABLE 306 TESA SE: COMPANY OVERVIEW

- TABLE 307 TESA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 TESA SE: OTHERS

- TABLE 309 SCAPA GROUP LTD.: COMPANY OVERVIEW

- TABLE 310 SCAPA GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 SCAPA GROUP LTD.: DEALS

- TABLE 312 SIKA AG: COMPANY OVERVIEW

- TABLE 313 SIKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 SIKA AG: DEALS

- TABLE 315 INTERTAPE POLYMER GROUP: COMPANY OVERVIEW

- TABLE 316 INTERTAPE POLYMER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 INTERTAPE POLYMER GROUP: PRODUCT DEVELOPMENT

- TABLE 318 INTERTAPE POLYMER GROUP: OTHERS

- TABLE 319 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 320 BERRY GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 SHURTAPE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 322 SHURTAPE TECHNOLOGIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 SHURTAPE TECHNOLOGIES, LLC: PRODUCT DEVELOPMENT

- TABLE 324 SHURTAPE TECHNOLOGIES, LLC: DEALS

- TABLE 325 SHURTAPE TECHNOLOGIES, LLC: OTHERS

- TABLE 326 MAPEI S.P.A.: COMPANY OVERVIEW

- TABLE 327 MAPEI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 MAPEI S.P.A.: DEALS

- TABLE 329 MAPEI S.P.A.: OTHERS

- TABLE 330 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 331 LOHMANN GMBH & CO. KG.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 IDEAL TAPE: COMPANY OVERVIEW

- TABLE 333 IDEAL TAPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 SEAL FOR LIFE: COMPANY OVERVIEW

- TABLE 335 SEAL FOR LIFE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 SEAL FOR LIFE: DEALS

- TABLE 337 NICHIBAN CO., LTD.: COMPANY OVERVIEW

- TABLE 338 NICHIBAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 340 ADVANCE TAPES INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 CARLISLE COMPANIES INC.: COMPANY OVERVIEW

- TABLE 342 CARLISLE COMPANIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 CARLISLE COMPANIES INC.: OTHERS

- TABLE 344 HICUBE COATING: COMPANY OVERVIEW

- TABLE 345 POLYGUARD PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 346 DENSO-HOLDING GMBH & CO.: COMPANY OVERVIEW

- TABLE 347 BOSTIK SA: COMPANY OVERVIEW

- TABLE 348 ARDEX GMBH: COMPANY OVERVIEW

- TABLE 349 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 350 AVERY DENNISON: COMPANY OVERVIEW

- TABLE 351 LATICRETE INTERNATIONAL: COMPANY OVERVIEW

- TABLE 352 TERRACO: COMPANY OVERVIEW

- TABLE 353 SAINT-GOBAIN WEBER: COMPANY OVERVIEW

- FIGURE 1 CONSTRUCTION ADHESIVE TAPES MARKET SEGMENTATION

- FIGURE 2 CONSTRUCTION ADHESIVE TAPES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 CONSTRUCTION ADHESIVE TAPES MARKET: DATA TRIANGULATION

- FIGURE 6 SOLVENT-BASED TECHNOLOGY LED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 7 ACRYLIC RESIN SEGMENT DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 8 FLOORING APPLICATION LED OVERALL CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 9 RESIDENTIAL SEGMENT DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 10 ASIA PACIFIC LED GLOBAL CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN CONSTRUCTION ADHESIVE TAPES MARKET BETWEEN 2023 AND 2028

- FIGURE 12 FLOORING APPLICATION ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 13 ASIA PACIFIC TO BE LARGEST CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 14 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES SEGMENT DOMINATED MARKET IN 2022

- FIGURE 15 RESIDENTIAL INDUSTRY DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 16 CHINA TO BE FASTEST-GROWING CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS IN CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 19 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS, BY KEY PLAYERS (USD/SQUARE METER)

- FIGURE 20 AVERAGE SELLING PRICE BASED ON END-USE INDUSTRY (USD/SQUARE METER)

- FIGURE 21 KEY PLAYERS IN CONSTRUCTION ADHESIVE TAPES MARKET ECOSYSTEM

- FIGURE 22 GLOBAL PATENT PUBLICATION TREND ANALYSIS, 2013–2023

- FIGURE 23 LEGAL STATUS OF PATENTS

- FIGURE 24 GLOBAL JURISDICTION ANALYSIS, 2013–2023

- FIGURE 25 3M REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 26 VALUE CHAIN ANALYSIS: CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 27 ADHESIVE TAPES EXPORT, BY KEY COUNTRIES, 2018–2022 (USD THOUSAND)

- FIGURE 28 ADHESIVE TAPES IMPORT, BY KEY COUNTRIES, 2018–2022 (USD THOUSAND)

- FIGURE 29 CONSTRUCTION ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 SOLVENT-BASED TECHNOLOGY TO LEAD CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 33 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 FLOORING APPLICATION TO DOMINATE CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 35 RESIDENTIAL SEGMENT TO DOMINATE CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- FIGURE 36 INDIA TO BE FASTEST-GROWING CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 37 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 39 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS (2018–2022)

- FIGURE 41 3M LED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 42 CONSTRUCTION ADHESIVE TAPES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 43 CONSTRUCTION ADHESIVE TAPES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 44 3M: COMPANY SNAPSHOT

- FIGURE 45 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 SCAPA GROUP LTD.: COMPANY SNAPSHOT

- FIGURE 47 SIKA AG: COMPANY SNAPSHOT

- FIGURE 48 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 49 MAPEI S.P.A.: COMPANY SNAPSHOT

- FIGURE 50 NICHIBAN CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 CARLISLE COMPANIES INC.: COMPANY SNAPSHOT

The study involves two major activities in estimating the current size of the construction adhesive tapes market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering construction adhesive tape and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the construction adhesive tapes market, which was validated by primary respondents.

Primary Research

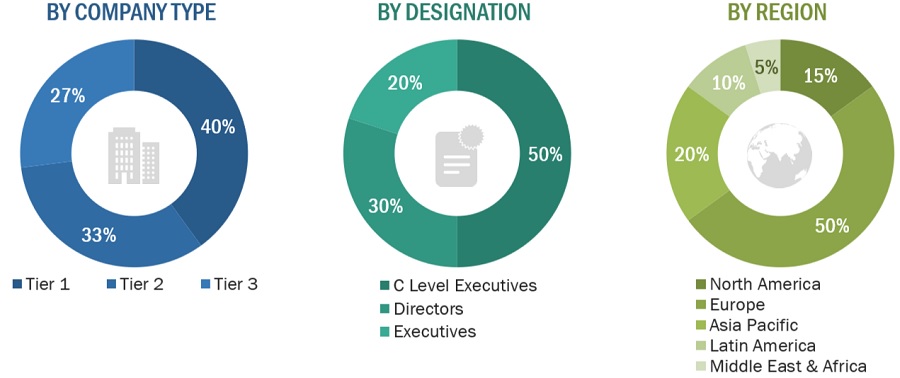

Extensive primary research was conducted after obtaining information regarding the construction adhesive tapes market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from construction adhesive tapes industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the construction adhesive tapes, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of construction adhesive tapes and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

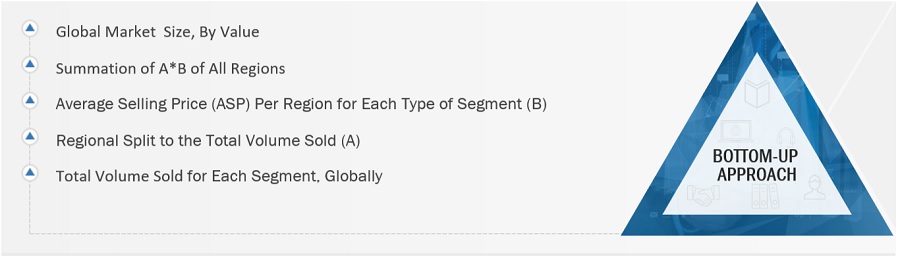

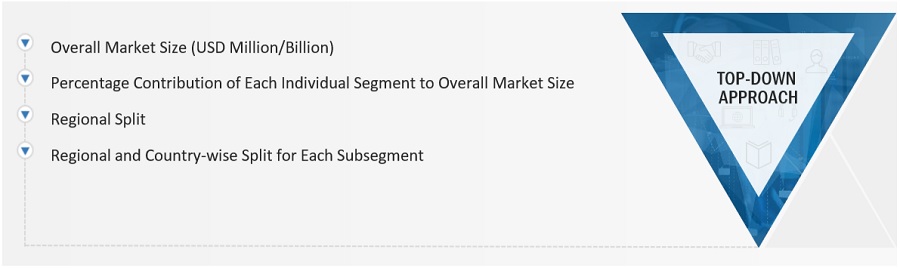

The research methodology used to estimate the size of the construction adhesive tapes market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations of construction adhesive tapes in different applications at a regional level. Such procurements provide information on the demand aspects of the construction adhesive tapes industry for each application. For each application, all possible segments of the construction adhesive tapes market were integrated and mapped.

Construction Adhesive Tapes Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Construction Adhesive Tapes Market Size: Top Down Approach

Data Triangulation:

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Specialized adhesive-based goods are called construction adhesive tapes, and they are made for different uses in the construction sector. These tapes are designed to offer mounting, bonding, and sealing solutions for a range of construction applications, such as infrastructural, commercial, and residential projects. They are distinguished by their robust and long-lasting adherence to a variety of surfaces, including concrete, metal, plastic, and wood. Adhesive tapes used in construction have several uses, such as adhering materials together, strengthening structures, insulating, waterproofing, and soundproofing, among others. They are made utilizing a variety of technologies, including hot-melt, solvent-based, and acrylic-based processes, and they are available in a variety of forms, such as single-sided and double-sided tapes. These tapes are essential for improving construction efficiency, guaranteeing structural integrity, and meeting certain application requirements in the building industry.

Key Stakeholders

- Adhesive tapes manufacturers and distributors

- Key application segments for adhesive tapes

- Research and consulting firms

- R&D institutions

- Associations and government institutions

- Environmental support agencies

Report Objectives

- To analyze and forecast the global construction adhesive tapes market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on technology, resin type, application, and end-use industry.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific construction adhesive tapes market

- Further breakdown of Rest of European construction adhesive tapes market

- Further breakdown of Rest of Middle East & Africa construction adhesive tapes market

- Further breakdown of Rest of South American construction adhesive tapes market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Construction Adhesive Tapes Market

Specific information on construction adhesive tapes market, segmentation by type and by region