Connected Device Analytics Market by Component, Deployment Mode, Organization Size, Application (Security and Emergency Management, and Sales and Customer Management), Industry Vertical, and Region - Global Forecast to 2025

Connected Device Analytics Market Size & Trends

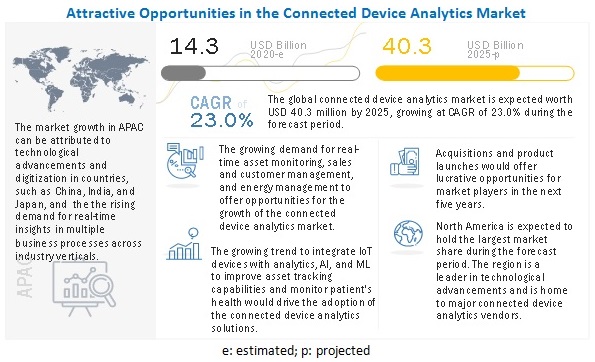

The global Connected Device Analytics Market size was valued at $14.3 billion in 2020 and it is projected to reach $40.3 billion by the end of 2025 at a CAGR of 23.0% during the forecast period. The major growth drivers of the market include the increasing focus on remote monitoring in support of work from home initiative, growing adoption of smart payment technologies, and business need to build digital infrastructure for large-scale deployments.

COVID-19 Impact on Global Connected Device Analytics Market

In a short time, the COVID-19 outbreak has affected markets and customers' behavior and has a substantial impact on economies and societies. Connected device analytics companies are witnessing a slowdown due to the global lockdown and lack of workforce. The competition among major connected device analytics companies is expected to intensify as most upcoming IoT and analytics projects are kept on hold due to the pandemic. New practices, such as work for home and social distancing, are creating the need for remote monitoring, smart payment technologies, and building digital infrastructure for large scale deployments. With increased focus on health, there has been an increase in the demand for health-related wearable devices. The connected device analytics market is expected to witness a slowdown in 2020 due to the global lockdown. The lockdown is impacting global manufacturing, and supply chains and logistics as the continuity of operations for various verticals is badly impacted.

Connected Device Analytics Market Dynamics

Driver: Increasing focus on remote monitoring in support of work from home initiative

Remote work monitoring, including time tracking, is a vital tool in a business that drive their revenue and productivity. The adoption of remote monitoring is becoming a commonplace business practice as several organizations embrace the trend of enabling their workforce with the flexibility of work from home. With businesses moving toward developments, the technology demand would boom immensely and the increase in the adoption of technologies, such as AI, IoT, and ML, would drive the business revenue growth. Factors contributing to company’s business growth include training and knowledge transfer, infrastructure, and new software accreditation in the next financial year. Remote monitoring can enhance teamwork capability of working with better work productivity whether it is a permanent move or transitioning to remote work temporarily, thus limiting the exposure to COVID-19. Verticals, such as manufacturing, energy and utilities, aviation, and logistics, are facing challenges in managing asset tracking and maintaining reduced costs. With the adoption of remote monitoring along booming technologies, such as IoT, to collect new and additional operational data and enable improved asset management through deeper data analysis would increase companies’ growth post-COVID-19 pandemic.

Restraint: Lack of skilled workforce

Trained workers are required to handle the latest software systems to deploy AI-based IoT technologies and skillsets. Hence, the existing workers are required to be trained on how to operate new and upgraded systems. Verticals are dynamic toward adopting new technologies; however, they are facing a shortage of highly skilled workforce and proficient workers. As most of the global vendors are leveraging IoT analytics solutions, the demand for a highly skilled workforce is increasing. Companies need to acquire expertise in areas, such as cybersecurity, networking, and applications. They seek to use the IoT data for predicting outcomes, preventing failures, optimizing operations, developing new products, and providing advanced analytics competency, which includes AI and ML. These technologies would play a critical role in the overall reduction of operational costs. With enterprises integrating IoT devices through sensors data and other connected devices, there would be a growing need for operational intelligence-oriented data analyst teams to handle huge amounts of data generated from IoT devices

Opportunity: Real-time analytics emerging as a key vital IoT initiative

The growing realization of the need to generate real-time insights that can be acted upon in real time through IoT sensors data will create a tremendous opportunity for businesses to sustain in the digital transformation environment. Organizations across consumer, industrial, and enterprise sectors are rapidly evaluating and implementing programs to realize immediate value from the IoT to focus on cost reduction, maintenance, and monitoring to compile real-time services for timely decision-making. Organizations generate a huge amount of unstructured data, which creates complexities in making critical business decisions. These complexities arise due to the increasing use of cloud-based applications, sensors, machines, mobile devices, and IoT, such as smart homes device and Point-of-Sale (PoS) machines.

Challenge: Decline in industrial operation and manufacturing operations

Owing to the regulations imposed by governments across the globe related to the lockdown, the manufacturing industry vertical is witnessing a huge hit. While small scale industries are in a complete shutdown, large scale industries are either completely shut or are operating with a maximum of 25% capacity. According to a survey by the National Association of Manufacturers (US), 78.3% of manufacturers anticipate a financial impact, whereas 53.1% of manufacturers anticipate a change in operations. In addition, 35.5% of manufacturers are facing supply chain disruptions. Some of the reasons attributed to such disruption are the lack of resources or manpower, disturbed import and export, and financial crunch. There are several manufacturing companies that are de-prioritizing their main production and are changing their operations.

Among industry verticals, the retail and eCommerce segment to grow at the highest CAGR during the forecast period

Connected device analytics market is segmented based on industry verticals. The industry verticals include manufacturing, transportation and logistics, energy and utilities, retail and eCommerce, BFSI, healthcare and life sciences, government and defense, and others (media and entertainment, travel and hospitality and education). The retail and eCommerce vendors are expected to adopt connected device analytics solutions to identify product demand and maintain their inventory efficiently. The growing need for retailers to deliver a more holistic shopping experience with personalized and contextualized interactions that leads to a high level of customer engagement to drives the growth of connected device analytics solutions.

Security and emergency management application to hold the largest market share during the forecast period

Connected device analytics market is segmented based on applications. The applications include security and emergency management, sales and customer management, remote monitoring, predictive maintenance and asset management, inventory management, energy management, building automation, and others (product and process management, IT infrastructure management, and cost optimization). The security and emergency managed applications is expected to hold the largest market share during the forecast period. The growth can be attributed to the focus of companies for reducing cyber threats and hacking to maintain data confidentiality, integrity, and availability across the IT infrastructure. New threats are bound to emerge in the future as hackers are persistent in their attacks on IoT devices and the data obtained from them, so the “things” in IoT will need updatable solutions and services to adapt during their life span.

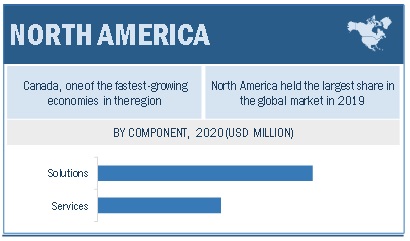

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global connected device analytics market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The increasing investments in developments of various smart infrastructures, smart cities, and IIoT projects in APAC may drive the growth of the market. North America is expected to be the leading region in terms of adopting and developing connected device analytics solutions. The rising investments in emerging technologies such as IoT, analytics, AI, and ML, the large presence of connected device analytics vendors, and growing government support for regulatory compliance are the major factors expected to contribute to the market growth during the forecast period.

Key Market Players

The connected device analytics solution and service vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors in the global connected device analytics market include Microsoft (US), Oracle (US), IBM (US), SAP (Germany), PTC (US), Cisco (US), Google (US), SAS Institute (US), Adobe (US), Teradata (US), AWS (US), HPE (US), Hitachi (Japan), Software AG (Germany), GE (US), Cloudera (US), Guavus (US), Splunk (US), TIBCO Software (US), Qlik (US), Salesforce (US), Infor (US), Mnubo (Canada), Arundo Analytics (US), Iguazio (Israel), and Striim (US). The study includes an in-depth competitive analysis of these key players in the connected device analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Million |

|

Segments covered |

Component, deployment mode, organization size, application, industry vertical, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Microsoft (US), Oracle (US), IBM (US), SAP (Germany), PTC (US), Cisco (US), Google (US), SAS Institute (US), Adobe (US), Teradata (US), AWS (US), HPE (US), Hitachi (Japan), Software AG (Germany), GE (US), Cloudera (US), Guavus (US), Splunk (US), TIBCO Software (US), Qlik (US), Salesforce (US), Infor (US), Mnubo (Canada), Arundo Analytics (US), Iguazio (Israel), and Striim (US) |

This research report categorizes the Connected Device Analytics Market based on components, deployment modes, organization size, verticals, and regions.

By component:

- Solutions

-

Services

- Managed Services

-

Professional Services

- Deployment and Integration

- Support and Maintenance

- Consulting

By deployment mode:

-

Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

- On-premises

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By application

- Security and Emergency Management

- Sales and Customer Management

- Remote Monitoring

- Predictive Maintenance and Asset Management

- Inventory Management

- Energy Management

- Building Automation

- Others (Product and Process Management, IT Infrastructure Management, and Cost Optimization)

Industry vertical:

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Retail and eCommerce

- BFSI

- Healthcare and Life Sciences

- Government and Defense

- Others (Media and Entertainment, Education, and Travel and Hospitality)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2020, Microsoft acquired CyberX to solve the challenges of customers by giving customers visibility into IoT devices that are connected to their networks and manage the security on the existing IoT devices.

- In June 2020, IBM and Siemens partnered to deliver a service life cycle management solution. The solution combines elements of Siemens’ Xcelerator portfolio and IBM Maximo to continuously improve product performance, maintenance, and operations. The solution also enables OEMs to receive critical data about asset performance, maintenance, and failures in the field.

- In June 2020, PTC launched the latest version of its market-leading ThingWorx IIoT platform. ThingWorx 9.0 will deliver new and expanded features to help industrial companies create, implement, customize, and scale their solutions.

- In June 2020, PTC extended alliance with Rockwell Automation to launch Factory Insights as a Service offering for industrial enterprises.

- In April 2019, Microsoft invested USD 5 billion in IoT and intelligent edge technology that is accelerating ubiquitous computing and bringing an unparalleled opportunity for transformation across industry verticals.

- In April 2019, Hitachi announced Digital Solution for Logistics/Delivery Optimization Service that creates effective delivery plans by utilizing advanced digital technology, such as AI and IoT, for logistics operations in Japan, the People's Republic of China (China), and the Kingdom of Thailand (Thailand).

- In March 2019, SAP announced enhancements to the SAP Analytics Cloud solution, which includes augmented analytics, BI, enterprise planning workflows, and data integration capabilities.

- In November 2018, SAP signed an agreement to acquire Qualtrics, the global pioneer of the Experience Management (XM) software category, to accelerate the new XM category by combining experience data and operational data to power the experience economy.

- In November 2018, SAP launched the SAP Intelligent Asset Management solution to bring collaborative asset intelligence, planning, prediction, and simulation for equipment maintenance and operations.

- In June 2018, IBM acquired Oniqua to strengthen its leading IoT capabilities for helping businesses proactively maintain vital assets.

- In March 2018, Hitachi developed a system to increase productivity and safety on the front lines of construction using IoT.

Frequently Asked Questions (FAQ):

What is connected device analytics?

Connected device analytics is the application of specialized analytical tools and procedures to extract value from huge volumes of data generated from connected devices. It is used to understand and improve the digital customer experience, attract and retain users, and analyze operations and actions taken across connected devices.

Which countries are considered in the European region?

The report includes analysis of UK, Germany, and France in the European region.

Which are key industry verticals adopting connected device analytics solutions and services?

Key industry verticals adopting connected device analytics solutions are services include manufacturing, transportation and logistics, energy and utilities, retail and eCommerce, BFSI, healthcare and life sciences, and government and defense.

Which are the key applications of connected device analytics?

The key applications of connected device analytics include security and emergency management, sales and customer management, remote monitoring, and energy management.

Who are the key vendors in the connected device analytics market?

The key vendors operating in the connected device analytics market include Microsoft, SAP, Oracle, AWS, Cisco, Google, PTC, Hitachi, HPE, IBM, Software AG, GE, and Salesforce. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

#

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 6 CONNECTED DEVICE ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 CONNECTED DEVICE ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SHARE OF CONNECTED DEVICE ANALYTICS THROUGH OVERALL CONNECTED DEVICE ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 61)

TABLE 4 GLOBAL CONNECTED DEVICE ANALYTICS MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y%)

FIGURE 13 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN MARKET IN 2020

FIGURE 14 PROFESSIONAL SERVICES SEGMENT TO HOLD HIGHER MARKET SHARE IN MARKET IN 2020

FIGURE 15 DEPLOYMENT AND INTEGRATION SEGMENT TO HOLD LARGEST MARKET SIZE IN MARKET IN 2020

FIGURE 16 ON-PREMISES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 17 PUBLIC CLOUD SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 19 SECURITY AND EMERGENCY MANAGEMENT SEGMENT TO HOLD HIGHEST MARKET SHARE IN MARKET IN 2020

FIGURE 20 MANUFACTURING INDUSTRY VERTICAL TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 21 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR IN MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 ATTRACTIVE OPPORTUNITIES IN CONNECTED DEVICE ANALYTICS MARKET

FIGURE 22 INCREASING NEED TO ANALYZE THE DATA COLLECTED THROUGH CONNECTED DEVICES CONTRIBUTE TO GROWTH OF MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 23 SALES AND CUSTOMER MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY COMPONENT AND TOP THREE INDUSTRY VERTICALS

FIGURE 24 SOLUTIONS SEGMENT AND MANUFACTURING INDUSTRY VERTICAL TO HOLD HIGH MARKET SHARES IN 2020

4.4 MARKET: BY REGION

FIGURE 25 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 71)

5.1 INTRODUCTION

FIGURE 26 KEY FACTORS LEADING TO INTERNET OF THINGS ADOPTION

5.2 MARKET DYNAMICS

FIGURE 27 CONNECTED DEVICE ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing focus on remote monitoring in support of work from home initiative

5.2.1.2 Growing adoption of smart payment technologies

5.2.1.3 Business need to build digital infrastructure for large-scale deployments

5.2.2 RESTRAINTS

5.2.2.1 Legacy database technologies limiting IoT product integration

5.2.2.2 Lack of skilled professional workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Real-time analytics emerging as a key vital IoT initiative

5.2.3.2 Rising internet penetration and adoption of IoT devices

5.2.3.3 Increasing need for remote patient care and tracking infected people in COVID-19 pandemic scenario

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity concerns

5.2.4.2 Decline in industrial operation and manufacturing operations

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 CASE STUDY ANALYSIS

5.3.1 ROCKWELL AUTOMATION USED AZURE IOT SOLUTION TO UNLOCK BUSINESS INSIGHTS

5.3.2 ORACLE HELPED VINCI FACILITIES TO DELIVER BUSINESS SERVICE AND REINVENT BUSINESS MODEL

5.3.3 TOWN OF CARY USES SAS ANALYTICS FOR IOT SOLUTION FOR ANALYZING WATER CONSUMPTION RATE

5.3.4 TRANS-SIBERIAN ODYSSEY, A THREE-PERSON MOTORCYCLE TEAM, ADOPTED HPE UNIVERSAL IOT SOLUTION FOR TRACKING RIDERS JOURNEY

5.3.5 TERADATA HELPED PACIFIC, GAS, AND ELECTRIC UTILITY PROVIDER TO SERVE DIVERSE CUSTOMER WITH SPECIFIC NEEDS

5.3.6 CORT ADOPTED ADOBE ANALYTICS SOLUTION TO REACH THE KEY DEMOGRAPHICS CUSTOMER

5.3.7 SMART PARKING ADOPTED GOOGLE CLOUD IOT SOLUTION TO SEIZE OPPORTUNITIES IN SMART SEIZE DEVELOPMENTS

5.3.8 SMC REACHED OUT TO SOFTWARE AG TO PROVIDE EASY SCALABLE SOLUTION FOR ITS CLIENTS

5.4 ECOSYSTEM

FIGURE 28 CONNECTED DEVICE ANALYTICS ECOSYSTEM

5.5 IOT: DATA SOURCES

5.6 PATENT ANALYSIS

5.6.1 IOT PATENTS FILED

5.7 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.8.1 CONNECTED DEVICE ANALYTICS AND AI

5.8.2 CONNECTED DEVICE ANALYTICS AND BLOCKCHAIN

5.8.3 CONNECTED DEVICE ANALYTICS AND 5G

5.9 PRICING ANALYSIS

5.1 CONNECTED DEVICE ANALYTICS MARKET: COVID-19 IMPACT

FIGURE 30 MARKET TO WITNESS A DECLINE IN 2020 AND 2021

6 CONNECTED DEVICE ANALYTICS MARKET, BY DEVICE CONNECTIVITY (Page No. - 91)

6.1 OVERVIEW

6.2 WIRELESS PERSONAL AREA NETWORKS

6.3 WIRELESS LOCAL AREA NETWORKS

6.4 LOW-POWER WIDE AREA NETWORKS

6.5 CELLULAR/MACHINE TO MACHINE

6.6 WIRED

7 CONNECTED DEVICE ANALYTICS MARKET, BY COMPONENT (Page No. - 93)

7.1 INTRODUCTION

7.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 31 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 SOLUTIONS

7.2.1 SOLUTIONS: MARKET DRIVERS

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 11 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 12 SERVICES: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.2 MANAGED SERVICES

TABLE 14 MANAGED SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3 PROFESSIONAL SERVICES

FIGURE 33 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 17 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3.1 Consulting

TABLE 20 CONSULTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 CONSULTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3.2 Support and maintenance

TABLE 22 SUPPORT AND MAINTENANCE: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3.3 Deployment and integration

TABLE 24 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 25 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 CONNECTED DEVICE ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 107)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 34 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

8.2 ON-PREMISES

8.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 28 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 CLOUD

8.3.1 CLOUD: MARKET DRIVERS

FIGURE 35 HYBRID CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 CLOUD: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 31 CLOUD: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.2 PUBLIC CLOUD

TABLE 34 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 35 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 PRIVATE CLOUD

TABLE 36 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 37 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.4 HYBRID CLOUD

TABLE 38 HYBRID CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 HYBRID CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 CONNECTED DEVICE ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 117)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 36 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 42 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 CONNECTED DEVICE ANALYTICS MARKET, BY APPLICATION (Page No. - 123)

10.1 INTRODUCTION

10.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 37 SALES AND CUSTOMER MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.2 ENERGY MANAGEMENT

10.2.1 ENERGY MANAGEMENT: MARKET DRIVERS

TABLE 48 ENERGY MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 49 ENERGY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 PREDICTIVE MAINTENANCE AND ASSET MANAGEMENT

10.3.1 PREDICTIVE MAINTENANCE AND ASSET MANAGEMENT: MARKET DRIVERS

TABLE 50 PREDICTIVE MAINTENANCE AND ASSET MANAGEMENT: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 51 PREDICTIVE MAINTENANCE AND ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.4 INVENTORY MANAGEMENT

10.4.1 INVENTORY MANAGEMENT: MARKET DRIVERS

TABLE 52 INVENTORY MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 INVENTORY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.5 SECURITY AND EMERGENCY MANAGEMENT

10.5.1 SECURITY AND EMERGENCY MANAGEMENT: MARKET DRIVERS

TABLE 54 SECURITY AND EMERGENCY MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 SECURITY AND EMERGENCY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.6 SALES AND CUSTOMER MANAGEMENT

10.6.1 SALES AND CUSTOMER MANAGEMENT: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

TABLE 56 SALES AND CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 57 SALES AND CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.7 BUILDING AUTOMATION

10.7.1 BUILDING AUTOMATION: MARKET DRIVERS

TABLE 58 BUILDING AUTOMATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 BUILDING AUTOMATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.8 REMOTE MONITORING

10.8.1 REMOTE MONITORING: MARKET DRIVERS

TABLE 60 REMOTE MONITORING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 REMOTE MONITORING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.9 OTHERS

TABLE 62 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 63 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 CONNECTED DEVICE ANALYTICS MARKET, BY INDUSTRY VERTICAL (Page No. - 138)

11.1 INTRODUCTION

11.2 CONNECTED DEVICE ANALYTICS: USE CASES

FIGURE 38 RETAIL AND ECOMMERCE INDUSTRY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 65 MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

11.3 MANUFACTURING

TABLE 66 MANUFACTURING: USE CASES

11.3.1 MANUFACTURING: MARKET DRIVERS

11.3.2 MANUFACTURING: COVID-19 IMPACT

TABLE 67 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 68 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.4 TRANSPORTATION AND LOGISTICS

TABLE 69 TRANSPORTATION AND LOGISTICS: USE CASES

11.4.1 TRANSPORTATION AND LOGISTICS: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

11.4.2 TRANSPORTATION AND LOGISTICS: COVID-19 IMPACT

TABLE 70 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.5 ENERGY AND UTILITIES

TABLE 72 ENERGY AND UTILITIES: USE CASES

11.5.1 ENERGY AND UTILITIES: MARKET DRIVERS

11.5.2 ENERGY AND UTILITIES: COVID-19 IMPACT

TABLE 73 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 74 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.6 RETAIL AND ECOMMERCE

TABLE 75 RETAIL AND ECOMMERCE: USE CASES

11.6.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

11.6.2 RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 76 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 77 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.7 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 78 BANKING, FINANCIAL SERVICES, AND INSURANCE: USE CASES

11.7.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

11.7.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

TABLE 79 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 80 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.8 HEALTHCARE AND LIFE SCIENCES

TABLE 81 HEALTHCARE AND LIFE SCIENCES: USE CASES

11.8.1 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

11.8.2 HEALTHCARE AND LIFE SCIENCES: COVID-19 IMPACT

TABLE 82 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 83 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.9 GOVERNMENT AND DEFENSE

TABLE 84 GOVERNMENT AND DEFENSE: USE CASES

11.9.1 GOVERNMENT AND DEFENSE: MARKET DRIVERS

11.9.2 GOVERNMENT AND DEFENSE: COVID-19 IMPACT

TABLE 85 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 86 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.10 OTHERS

TABLE 87 OTHER INDUSTRY VERTICAL: USE CASES

TABLE 88 OTHER INDUSTRY VERTICAL: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 89 OTHER INDUSTRY VERTICAL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 CONNECTED DEVICE ANALYTICS MARKET, BY REGION (Page No. - 163)

12.1 INTRODUCTION

FIGURE 39 JAPAN TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 40 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 90 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 91 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 EFFECT

12.2.3 NORTH AMERICA: REGULATIONS

12.2.3.1 Health Insurance Portability and Accountability Act of 1996

12.2.3.2 California Consumer Privacy Act

12.2.3.3 Gramm–Leach–Bliley Act

12.2.3.4 Institute of Electrical and Electronics Engineers Standards Association

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 92 NORTH AMERICA: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY CLOUD, 2014–2019 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY CLOUD, 2019–2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.2.4 UNITED STATES

TABLE 110 UNITED STATES: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.2.5 CANADA

TABLE 112 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

12.3.2 EUROPE: COVID-19 EFFECT

12.3.3 EUROPE: REGULATIONS

12.3.3.1 General Data Protection Regulation

12.3.3.2 European Committee for Standardization

12.3.3.3 European Technical Standards Institute

TABLE 114 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 119 EUROPE MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY CLOUD, 2014–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY CLOUD, 2019–2025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.3.4 UNITED KINGDOM

TABLE 132 UNITED KINGDOM: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.5 GERMANY

TABLE 134 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.6 FRANCE

TABLE 136 FRANCE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 137 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 138 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 EFFECT

12.4.3 ASIA PACIFIC: REGULATIONS

12.4.3.1 International Organization for Standardization 27001

12.4.3.2 Personal Data Protection Act

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY CLOUD, 2014–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY CLOUD, 2019–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.4.4 CHINA

TABLE 158 CHINA: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 159 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.5 JAPAN

TABLE 160 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 161 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.6 INDIA

TABLE 162 INDIA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 163 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

TABLE 164 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 EFFECT

12.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.3.1 Israeli privacy protection regulations (Data Security), 5777-2017

12.5.3.2 Cloud Computing Regulatory Framework

12.5.3.3 GDPR applicability in KSA

12.5.3.4 Protection of Personal Information Act

12.5.3.5 TRA’s IoT Regulatory Policy

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CLOUD, 2014–2019 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CLOUD, 2019–2025 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.5.4 KINGDOM OF SAUDI ARABIA

TABLE 184 KINGDOM OF SAUDI ARABIA: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 185 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.5 UNITED ARAB EMIRATES

TABLE 186 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 187 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.6 SOUTH AFRICA

TABLE 188 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 189 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.7 REST OF MIDDLE EAST AND AFRICA

TABLE 190 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 191 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: CONNECTED DEVICE ANALYTICS MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATIONS

12.6.3.1 Brazil Data Protection Law

12.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 192 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY CLOUD, 2014–2019 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY CLOUD, 2019–2025 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.6.4 BRAZIL

TABLE 210 BRAZIL: CONNECTED DEVICE ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 211 BRAZIL: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6.5 MEXICO

TABLE 212 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 213 MEXICO: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6.6 REST OF LATIN AMERICA

TABLE 214 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 215 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 230)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 43 MARKET EVALUATION FRAMEWORK: PARTNERSHIP AND EXPANSION BETWEEN 2019 AND 2020

13.3 MARKET SHARE, 2019

FIGURE 44 MICROSOFT LED CONNECTED DEVICE ANALYTICS MARKET IN 2019

13.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 45 REVENUE ANALYSIS OF KEY MARKET PLAYERS

13.5 KEY MARKET DEVELOPMENTS

13.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 216 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2020

13.5.2 BUSINESS EXPANSIONS

TABLE 217 BUSINESS EXPANSIONS, 2020

13.5.3 MERGERS AND ACQUISITIONS

TABLE 218 MERGERS AND ACQUISITIONS, 2018–2020

13.5.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 219 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2019–2020

14 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 238)

14.1 OVERVIEW

14.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

14.2.1 MARKET RANKING ANALYSIS, BY COMPANY

FIGURE 46 RANKING OF KEY PLAYERS, 2020

14.2.2 STAR

14.2.3 EMERGING LEADER

14.2.4 PERVASIVE

14.3 COMPANY EVALUATION MATRIX, 2020

FIGURE 47 CONNECTED DEVICE ANALYTICS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14.4 COMPANY PROFILES

14.4.1 INTRODUCTION

(Business overview, Solutions and services offered, Recent developments, SWOT analysis, Right to win & MnM View)*

14.4.2 MICROSOFT

FIGURE 48 MICROSOFT: COMPANY SNAPSHOT

FIGURE 49 MICROSOFT: SWOT ANALYSIS

14.4.3 ORACLE

FIGURE 50 ORACLE: COMPANY SNAPSHOT

FIGURE 51 ORACLE: SWOT ANALYSIS

14.4.4 SAP

FIGURE 52 SAP: COMPANY SNAPSHOT

FIGURE 53 SAP: SWOT ANALYSIS

14.4.5 IBM

FIGURE 54 IBM: COMPANY SNAPSHOT

FIGURE 55 IBM: SWOT ANALYSIS

14.4.6 PTC

FIGURE 56 PTC: COMPANY SNAPSHOT

FIGURE 57 PTC: SWOT ANALYSIS

14.4.7 AWS

FIGURE 58 AWS: COMPANY SNAPSHOT

FIGURE 59 AWS: SWOT ANALYSIS

14.4.8 CISCO

FIGURE 60 CISCO: COMPANY SNAPSHOT

FIGURE 61 CISCO: SWOT ANALYSIS

14.4.9 GOOGLE

FIGURE 62 GOOGLE: COMPANY SNAPSHOT

FIGURE 63 GOOGLE: SWOT ANALYSIS

14.4.10 ADOBE

FIGURE 64 ADOBE: COMPANY SNAPSHOT

14.4.11 TERADATA

FIGURE 65 TERADATA: COMPANY SNAPSHOT

14.4.12 HITACHI

FIGURE 66 HITACHI: COMPANY SNAPSHOT

14.4.13 HPE

FIGURE 67 HPE: COMPANY SNAPSHOT

14.4.14 SAS INSTITUTE

FIGURE 68 SAS INSTITUTE: COMPANY SNAPSHOT

14.4.15 SOFTWARE AG

FIGURE 69 SOFTWARE AG: COMPANY SNAPSHOT

14.4.16 GE

FIGURE 70 GE: COMPANY SNAPSHOT

14.4.17 CLOUDERA

14.4.18 GUAVUS

14.4.19 SPLUNK

14.4.20 TIBCO SOFTWARE

14.4.21 QLIK

14.4.22 SALESFORCE

14.4.23 INFOR

14.4.24 MNUBO

14.4.25 ARUNDO ANALYTICS

14.4.26 STRIIM

14.4.27 IGUAZIO

*Details on Business overview, Solutions and services offered, Recent developments, SWOT analysis, Right to win & MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 321)

15.1 ADJACENT AND RELATED MARKETS

15.1.1 INTRODUCTION

15.1.2 BIG DATA MARKET—GLOBAL FORECAST 2025

15.1.2.1 Market definition

15.1.2.2 Market overview

TABLE 220 GLOBAL BIG DATA MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION AND Y-O-Y %)

15.1.2.2.1 Big data market, by component

TABLE 221 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

15.1.2.2.2 Big data market, by deployment mode

TABLE 222 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

15.1.2.2.3 Big data market, by organization size

TABLE 223 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

15.1.2.2.4 Big analytics market, by business function

TABLE 224 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

15.1.2.2.5 Big data market, by industry

TABLE 225 BIG DATA MARKET SIZE, BY INDUSTRY, 2018–2025 (USD MILLION)

15.1.2.2.6 Big data market, by region

TABLE 226 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.1.3 INTERNET OF THINGS MARKET– GLOBAL FORECAST 2022

15.1.3.1 Market definition

15.1.3.2 Market overview

TABLE 227 GLOBAL IOT MARKET SIZE AND GROWTH RATE, 2015–2022 (USD MILLION AND Y-O-Y %)

15.1.3.2.1 IoT market, by component

TABLE 228 IOT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 229 IOT MARKET SIZE, BY PLATFORM, 2015–2022 (USD MILLION)

TABLE 230 IOT MARKET SIZE, BY SOFTWARE SOLUTION, 2015–2022 (USD MILLION)

TABLE 231 IOT MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

15.1.3.2.2 IoT market, by application area

TABLE 232 IOT MARKET SIZE, BY APPLICATION AREA, 2015–2022 (USD MILLION)

15.1.3.2.3 IoT market, by region

TABLE 233 IOT MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

15.1.4 MANUFACTURING ANALYTICS MARKET—GLOBAL FORECAST 2021

15.1.4.1 Market definition

15.1.4.2 Market overview

TABLE 234 GLOBAL MANUFACTURING ANALYTICS MARKET SIZE AND GROWTH RATE, 2014–2021 (USD MILLION AND Y-O-Y %)

15.1.4.2.1 Manufacturing analytics market, by type

TABLE 235 MANUFACTURING ANALYTICS MARKET SIZE, BY TYPE, 2014–2021 (USD MILLION)

TABLE 236 MANUFACTURING ANALYTICS MARKET SIZE, BY SERVICE, 2014–2021 (USD MILLION)

15.1.4.2.2 Manufacturing analytics market, by application

TABLE 237 MANUFACTURING ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2021 (USD MILLION)

15.1.4.2.3 Manufacturing analytics market, by deployment model

TABLE 238 MANUFACTURING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2021 (USD MILLION)

15.1.4.2.4 Manufacturing analytics market, by industry vertical

TABLE 239 MANUFACTURING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2021 (USD MILLION)

15.1.4.2.5 Manufacturing analytics market, by region

TABLE 240 MANUFACTURING ANALYTICS MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

15.2 INDUSTRY EXPERTS

15.3 DISCUSSION GUIDE

15.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.5 AVAILABLE CUSTOMIZATIONS

15.6 RELATED REPORTS

15.7 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the connected device analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Connected Device Analytics Market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from connected device analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

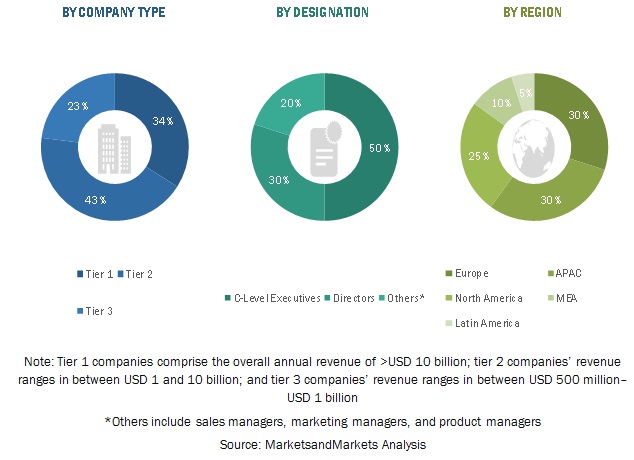

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the connected device analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global connected device analytics market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size of the connected device analytics market

- To understand the structure of the connected device analytics market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze the market by component, deployment mode, application, organization size, industry vertical, and region

- To project the size of the market and its submarkets, in terms of value, for North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions and funding, new product launches, mergers and acquisitions, strategic partnerships, and agreements, in the connected device analytics market

- To analyze the impact of COVID-19 pandemic on market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American connected device analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Connected Device Analytics Market