Computer Graphics Market by Software (CAD/CAM, Visualization/Simulation, Digital video, Imaging, Modeling/Animation), Service (Consulting, Training & Support, Integration), End-User (Enterprise and SMB) - Worldwide Forecasts & Analysis (2014-2019)

[213 Pages Report] MarketsandMarkets forecasts the Computer Graphics Market to grow from $23.33 billion in 2014 to $32.68 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 6.97% during the forecast period.

Objects that can be represented in the form of images or visuals are known as graphics. Often graphics are misinterpreted with texts or sound that comprises of letters and numbers, rather than images. Computer graphics are majorly images that are displayed on-screen as well as creation and manipulation of graphics by computer. These images are either 2-dimensional or 3-dimensional. Earlier computers were only capable of creating 2 dimensional images as technology was not so advanced. Today, innovations and technological advancements are driving the Computer Graphics Market. Basic requirement is a personal computer or desktop and besides that, new as well as special software and devices are needed for these graphics.

As users realize the benefits associated with upcoming 3D software, many industries started using these graphics to promote their brand and products. Also, industrial sectors such as manufacturing, automobile, and aerospace & defense adopted and implemented high-end software into their systems in order to design products and their ancillaries with more efficiency. While industries look forward to better prices and multiple options in software of graphics, leading software developers are creating software with variable options like creating 3D objects, editing and etc.

MarketsandMarkets believes that the changing user behavior towards the new software with various presets is propelling the growth in the Computer Graphics Market. Though the adoption of these graphics was initially gradual, due to concerns about cost, trained labor, and high configuration requirements - these solutions are now witnessing wide acceptance across various verticals. The convenience of flexible and the seamless support for creating characters and objects in high definition are expected to bring more demand for these solutions. To serve an audience with different and more realistic three dimensional visuals, the solution providers and their industry partners are addressing the installation challenges by making software and support tools that adhere to the compliance standards. The consolidation of new and advanced software within the existing systems will improve workforce productivity and enhance the ability to produce more realistic three dimensional images with minute details.

The market research is a comprehensive study of the global Computer Graphics Market. The report forecasts the revenues and trends in the market into the following sub-markets:

Please visit 360Quadrants to see the vendor listing of Best UX Software Quadrant

On the basis of software:

- CAD/CAM

- Visualization / Simulation

- Digital Video

- Imaging

- Modeling / Animation

- Others

On the basis of services:

- Consulting

- Integration

- Training and Support

On the basis of end-users:

- Small and Medium Businesses (SMBs)

- Enterprises

On the basis of verticals

- Aerospace and defense

- Automobile

- Entertainment and Advertising

- Academia and Education

- Healthcare

- Manufacturing

- Architecture, Building and Construction

- Others

On the basis of regions

- North America (NA)

- Europe (EU)

- Asia-Pacific (APAC)

- Latin America (LA)

- Middle East (MEA)

The Computer Graphics Market is gaining traction as it addresses the needs of many industry verticals. This diverse technology, can be utilized in numerous fields such as designing, entertainment, manufacturing, aerospace and defense, healthcare and etc. Diversity of the graphics software are enhancing the capabilities of firms to complete their respective task of creating and designing spectacular 3D objects and machines. These software are very efficient in providing every single minute detail. Earlier adoption of these graphics was limited as quality of visualization was very low and cost was apparently one of the major concerns. Eventually, with evolution of technology, such as CAD/CAM software, 3D visualization, and 3D displays - the adoption of rate has increased evidently.

Today, computer graphics are becoming relevant as they help in improving the overall productivity. This is done by getting more realistic 3D images of objects or products right from the initial phase. Engineers and graphics designers are able to understand better where they are lacking and what necessary changes are to be made. These graphics have a wide portfolio of applications, other than the entertainment industry. It is also contributing to the manufacturing and automobile industry via modeling, animation and visualization. Also it is contributing majorly in aerospace and defense industry via its usage in simulation. Recent growth in real estate sector as well as healthcare sector where doctors are taking help of new advanced software that can help in understanding the health issues properly via 3D imaging and animation are propelling the Computer Graphics Market.

Computer graphics have emerged along with software which they reinforce with advent new technologies graphics providers are coming out with new updates of software and also new software that are helping each and every industry verticals. With the help of software - dummy parts are being made in automobile industry, manufacturing industry, and other ancillary parts related industry. Computer graphics software today is majorly implemented in education institutes where machine designing and engineering design is the part of curriculum. With the help of CAD/CAM software students are able to design and create new objects with perfect details that are very helpful for their future endeavors. With development in traditional software like CAD/CAM over the time with new design approaches and increase in usage of visualization software, the market is growing steadily. Few years down the line, the adoption rate is expected to increase within every industry vertical.

MarketsandMarkets expects an increasing adoption of computer graphics software solutions across the globe for better overall efficiency. The uptake of these solutions is increasing rapidly, as organizations are now focusing on quality of product they wish to offer to their customers. The software solutions available in this industry are expected to gain attention of the users with time, as the features are giving quit realistic approach to the end-users.

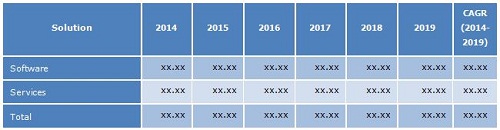

MarketsandMarkets forecasts the Computer Graphics Market to grow from $23.33 billion in 2014 to $32.68 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 6.97% during the forecast period. The table given below highlights the overall size of the market which equals the sum of revenues from “software” and “services.”

Computer Graphics Market Size, by Solution, 2014-2019 ($ Billion)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Key Data Sources

1.5.2 Data Triangulation & Market Forecasting

1.6 Forecast Assumptions

2 Executive Summary (Page No. - 27)

2.1 Overall Market Size

3 Computer Graphics Market Overview (Page No. - 31)

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Growing Web

3.4.1.2 Smart Mobile Penetration

3.4.1.3 Demand for Graphics Software in Business Processes

3.4.1.4 Booming Entertainment Industry

3.4.2 Restraints

3.4.2.1 Price Sensitive Market

3.4.2.2 Concentrated Demand

3.4.3 Opportunities

3.4.3.1 Shift From Proprietary Software to Cloud-Based Subscription

3.4.3.2 4d Technology

3.4.4 Impact Analysis of Dros

3.4.5 Value Chain

4 Computer Graphics Market Size & Forecast, By Software (Page No. - 39)

4.1 Introduction

4.2 Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM)

4.2.1 Overview

4.2.2 Market Size & Forecast

4.3 Visualization/Simulation

4.3.1 Overview

4.3.2 Market Size & Forecast

4.4 Digital Video

4.4.1 Overview

4.4.2 Market Size & Forecast

4.5 Imaging

4.5.1 Overview

4.5.2 Market Size & Forecast

4.6 Modeling/Animation

4.6.1 Overview

4.6.2 Market Size & Forecast

4.7 Others

4.7.1 Overview

4.7.2 Market Size & Forecast

5 Computer Graphics Market Size & Forecast By Service (Page No. - 91)

5.1 Introduction

5.2 Consulting

5.2.1 Overview

5.2.2 Market Size & Forecast

5.3 Training & Support

5.3.1 Overview

5.3.2 Market Size & Forecast

5.4 Integration

5.4.1 Overview

5.4.2 Market Size & Forecast

6 Computer Graphics Market Size & Forecast By End User (Page No. - 112)

6.1 Introduction

6.2 Small & Medium Businesses

6.2.1 Overview

6.3 Enterprises

6.3.1 Overview

7 Computer Graphics Market Size and Forecast By Vertical (Page No. - 116)

7.1 Introduction

7.2 Aerospace & Defense

7.2.1 Overview

7.2.2 Market Size & Forecast

7.3 Automobile

7.3.1 Overview

7.3.2 Market Size & Forecast

7.4 Entertainment & Advertising

7.4.1 Overview

7.4.2 Market Size & Forecast

7.5 Academia & Education

7.5.1 Overview

7.5.2 Market Size & Forecast

7.6 Healthcare

7.6.1 Overview

7.6.2 Market Size & Forecast

7.7 Manufacturing

7.7.1 Overview

7.7.2 Market Size & Forecast

7.8 Architecture, Building, & Construction

7.8.1 Overview

7.8.2 Market Size & Forecast

7.9 Others

7.9.1 Overview

7.9.2 Market Size & Forecast

8 Computer Graphics Market Size & Forecast By Region (Page No. - 140)

8.1 Introduction

8.2 North America (NA)

8.2.1 Overview

8.2.2 Market Size & Forecast

8.3 Europe

8.3.1 Overview

8.3.2 Market Size & Forecast

8.4 Asia-Pacific (APAC)

8.4.1 Overview

8.4.2 Market Size & Forecast

8.5 Middle East & Africa (MEA)

8.5.1 Overview

8.5.2 Market Size & Forecast

8.6 Latin America (LA)

8.6.1 Overview

8.6.2 Market Size & Forecast

9 Computer Graphics Market Landscape (Page No. - 163)

9.1 Competitive Landscape

9.1.1 Ecosystem & Roles

9.1.2 Portfolio Comparison

9.2 End-User Landscape

9.2.1 Market Opportunity Landscape

9.2.2 End-User Analysis

9.2.2.1 Thriving CAD/CAM Software Market

9.2.2.2 Education & Academia Adopting Computer Graphics Software

9.2.2.3 3d Cinema

10 Company Profiles (Page No. - 169)

(Overview, Products & Services, Strategies & Insights, Developments and MNM View)*

10.1 Adobe Systems

10.2 Advanced Micro Devices (AMD)

10.3 Autodesk

10.4 Dassault Systemes

10.5 Intel Corporation

10.6 Mentor Graphics

10.7 Microsoft

10.8 Nvidia

10.9 Siemens PLM Software

10.10 Sony

*Details on Overview, Products & Services, Strategies & Insights, Developments and MNM View Might Not Be Captured in Case of Unlisted Companies.

List of Tables (86 Tables)

Table 1 Computer Graphics Market Size, By Solution, 2014-2019 ($Billion)

Table 2 Market Growth, 2015-2019 (Y-O-Y %)

Table 3 Market Size, By Software, 2014-2019 ($Billion)

Table 4 Market Growth, By Software, 2015-2019 (Y-O-Y %)

Table 5 CAD/CAM Market Size, By End User, 2014-2019 ($Billion)

Table 6 CAD/CAM Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 7 CAD/CAM Market Size, By Vertical, 2014-2019 ($Billion)

Table 8 CAD/CAM Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 9 CAD/CAM Market Size, By Region, 2014-2019 ($Million)

Table 10 CAD/CAM Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 11 Visualization/Simulation Market Size, By End User, 2014-2019 ($Billion)

Table 12 Visualization/Simulation Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 13 Visualization/Simulation Market Size, By Vertical, 2014-2019 ($Million)

Table 14 Visualization/Simulation Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 15 Visualization/Simulation Market Size, By Region, 2014-2019 ($Million)

Table 16 Visualization/Simulation Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 17 Digital Video Market Size, By End User, 2014-2019 ($Billion)

Table 18 Digital Video: Market Growth, By End User, 2015-2019(Y-O-Y %)

Table 19 Digital Video Market Size, By Vertical, 2014-2019 ($Million)

Table 20 Digital Video: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 21 Digital Video Market Size, By Region, 2014-2019 ($Million)

Table 22 Digital Video Market Growth, By Region, 2015-2019(Y-O-Y %)

Table 23 Imaging Market Size, By End User, 2014-2019 ($Billion)

Table 24 Imaging Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 25 Imaging Market Size, By Vertical, 2014-2019 ($Million)

Table 26 Imaging Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 27 Imaging Market Size, By Region, 2014-2019 ($Million)

Table 28 Imaging Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 29 Modeling/Animation Market Size, By End User, 2014-2019 ($Million)

Table 30 Modeling/Animation Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 31 Modeling/Animation Market Size, By Vertical, 2014-2019 ($Million)

Table 32 Modeling/Animation Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 33 Modeling/Animation Market Size, By Region, 2014-2019 ($Million)

Table 34 Modeling/Animation Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 35 Other Software Market Size, By End User, 2014-2019 ($Million)

Table 36 Other Software Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 37 Other Software Market Size, By Vertical, 2014-2019 ($Million)

Table 38 Other Software Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 39 Other Software Market Size, By Region, 2014-2019 ($Million)

Table 40 Other Software Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 41 Computer Graphics: Market Size, By Service, 2014-2019 ($Billion)

Table 42 Computer Graphics: Market Growth, By Service, 2015-2019 (Y-O-Y %)

Table 43 Consulting Services Market Size, By Region, 2014-2019 ($Million)

Table 44 Consulting Services: Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 45 Consulting Services Market Size, By Vertical, 2014-2019 ($Million)

Table 46 Consulting Services: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 47 Training and Support Services Market Size, By Region, 2014-2019 ($Million)

Table 48 Training and Support Services Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 49 Training and Support Services Market Size, By Vertical, 2014-2019 ($Million)

Table 50 Training and Support Services Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 51 Integration Services Market Size, By Region, 2014-2019 ($Million)

Table 52 Integration Services Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 53 Integration Services Market Size, By Vertical, 2014-2019 ($Million)

Table 54 Integration Services Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 55 Computer Graphics Market Size, By End User, 2014-2019 ($Billion)

Table 56 Computer Graphics: Market Growth, By End User, 2015-2019 (Y-O-Y %)

Table 57 Computer Graphics: Market Size, By Vertical, 2014-2019 ($Billion)

Table 58 Computer Graphics: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 59 Aerospace and Defense Market Size, By Solution, 2014-2019 ($Million)

Table 60 Aerospace and Defense Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 61 Automobile Market Size, By Solution, 2014-2019 ($Million)

Table 62 Automobile Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 63 Entertainment and Advertising Market Size, By Solution, 2014-2019 ($Billion)

Table 64 Entertainment and Advertising Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 65 Academia and Education Market Size, By Solution, 2014-2019 ($Million)

Table 66 Academia and Education Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 67 Healthcare Market Size, By Solution, 2014-2019 ($Billion)

Table 68 Healthcare Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 69 Manufacturing Market Size, By Solution, 2014-2019 ($Billion)

Table 70 Manufacturing Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 71 Architecture, Building, and Construction Market Size, By Solution, 2014-2019 ($Billion)

Table 72 Architecture, Building, and Construction Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 73 Others Market Size, By Solution, 2014-2019 ($Million)

Table 74 Others Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Table 75 Computer Graphics Market Size, By Region, 2014-2019 ($Billion)

Table 76 Computer Graphics: Market Growth, By Region, 2015-2019 (Y-O-Y %)

Table 77 North America: Computer Graphics Market Size, By Vertical, 2014-2019 ($Billion)

Table 78 North America: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 79 Europe: Market Size, By Vertical, 2014-2019 ($Billion)

Table 80 Europe: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 81 APAC: Computer Graphics Market Size, By Vertical,2014-2019 ($Million)

Table 82 APAC: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 83 MEA: Market Size, By Vertical, 2014-2019 ($Million)

Table 84 MEA: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Table 85 Latin America: Computer Graphics Market Size, By Vertical, 2014-2019 ($Million)

Table 86 Latin America: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

List of Figures (52 Figures)

Figure 1 Computer Graphics Market : Research Methodology

Figure 2 Data Triangulation

Figure 3 Computer Graphics: Market Growth, 2015-2019 (Y-O-Y %)

Figure 4 Computer Graphics: Market Evolution

Figure 5 Computer Graphics: Market Segmentation

Figure 6 Computer Graphics: Time-Impact Analysis of Dynamics

Figure 7 Computer Graphics Market: Value Chain

Figure 8 Computer Graphics: Market Growth, By Software, 2015-2019 (Y-O-Y %)

Figure 9 CAD/CAM Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 10 CAD/CAM Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 11 CAD/CAM Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 12 Visualization/Simulation Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 13 Visualization/Simulation Market Growth, By Vertical, 2015-2019(Y-O-Y %)

Figure 14 Visualization/Simulation Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 15 Digital Video: Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 16 Digital Video: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 17 Digital Video Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 18 Imaging Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 19 Imaging Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 20 Imaging Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 21 Modeling/Animation Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 22 Modeling/Animation Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 23 Modeling/Animation Market Growth, By Region, 2015-2019(Y-O-Y %)

Figure 24 Other Software Market Growth, By End User, 2015-2019 (Y-O-Y %)

Figure 25 Other Software Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 26 Other Software Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 27 Computer Graphics: Market Growth, By Service, 2015-2019 (Y-O-Y %)

Figure 28 Consulting Services: Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 29 Consulting Services: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 30 Training and Support Services Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 31 Training and Support Services Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 32 Integration Services Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 33 Integration Services Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 34 Computer Graphics: Market Growth, By End User,2015-2019 (Y-O-Y %)

Figure 35 Computer Graphics: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 36 Aerospace and Defense Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 37 Automobile Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 38 Entertainment and Advertising Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 39 Academia and Education Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 40 Healthcare Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 41 Manufacturing Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 42 Architecture, Building, and Construction Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 43 Others Market Growth, By Solution, 2015-2019 (Y-O-Y %)

Figure 44 Computer Graphics Market Growth, By Region, 2015-2019 (Y-O-Y %)

Figure 45 North America: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 46 Europe: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 47 APAC: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 48 MEA: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 49 Latin America: Market Growth, By Vertical, 2015-2019 (Y-O-Y %)

Figure 50 Computer Graphics Market Ecosystem

Figure 51 Portfolio Comparison

Figure 52 Opportunity Plot

Growth opportunities and latent adjacency in Computer Graphics Market

Interested in marketing analytics wrt CAD software in ASEAN countries