Companion Animal Pharmaceuticals Market by Animal Type (Dogs, Cats, Horses), Route of Administration (Oral, Injectable, Topical), Indication (Antibiotics, Parasiticides), Distribution Channel (Veterinary Hospitals & Clinics) & Region - Global Forecasts to 2027

Updated on : March 23, 2023

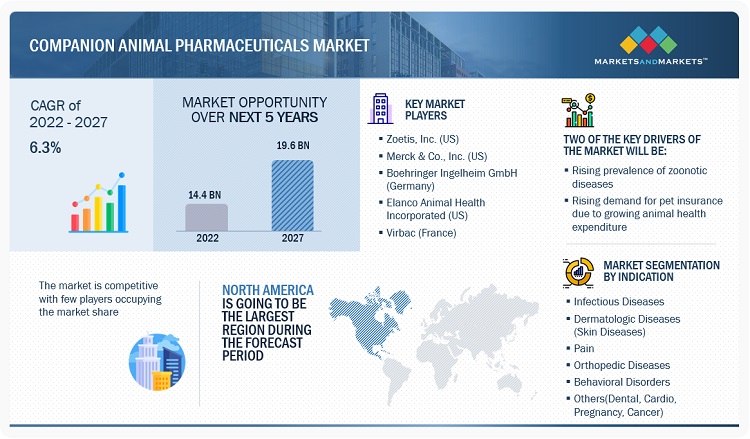

The global companion animal pharmaceuticals market in terms of revenue was estimated to be worth $14.4 billion in 2022 and is poised to reach $19.6 billion by 2027, growing at a CAGR of 6.3% from 2022 to 2027.

The growth in this market is majorly driven by the growth in adoption rate of companion animals, rising zoonotic diseases in companion animals, rising demand for pet insurance, and initiatives by various government agencies and animal associations. On the other hand, the limited launch of new antibiotics, rising pet care costs, and high cost of vaccines and complexities associated with storage are expected to restrain the growth of this market during the forecast period.

Attractive Opportunities in the Companion Animal Pharmaceuticals Market

To know about the assumptions considered for the study, Request for Free Sample Report

Companion Animal Pharmaceuticals Market Dynamics

Drivers: Rising demand for pet insurance due to growing animal health expenditure

Pet healthcare expenditure has significantly increased in recent years. Pet healthcare spending includes pet food, supplies/OTC medication, veterinary care, pet insurance policies, live animal purchases, and other services such as companion animal diagnostic and treatment services. According to the American Pet Products Association (APPA), veterinary expenditure in the US increased from USD 66.75 billion in 2016 to USD 103.6 billion in 2020 and USD 109.6 billion by 2021. Moreover, the APPA estimated that pet owners in the US spent USD 32.3 billion on vet care and product sales alone in 2021, up from USD 31.4 billion in 2020. This shows that the number of consumers (pet owners) spending on pet medical care has consistently risen yearly. The North American Pet Health Insurance Association (NAPHIA) announced that North America’s pet insurance sector exceeded USD 2.83 billion at the end of 2021, and industry growth more than doubled over the past four years (2018–2021). The adoption of pet insurance is also on the rise as insurance helps pet owners manage the cost of preventive care, acute & chronic illnesses, and emergency medical care costs for their respective pets.

Restraints: Limited number of new product developments

The current pipeline for novel pharmaceuticals for human and veterinary use is very limited. There are a limited number of new chemical entities entering and many novel drugs leaving the pipeline. Big pharmaceutical companies have been continuously halting funding for research on anti-infectives in favor of more lucrative pharmaceuticals.

The overuse and misuse of drugs in animals and humans are contributing to the rising threat of drug-drug reactions and drug resistance. The WHO introduced new recommendations that aim to help preserve the effectiveness of pharmaceuticals that are important for humans by reducing their unnecessary use in animals. In some countries, approximately 80% of the total consumption of medically important anti-infectives is in the animal sector, largely for growth promotion in healthy animals; this leads to the limited production of new pharmaceuticals. Typically, antibiotics are the last line of therapy in most serious infections, limiting their revenue potential. As antibiotics are used for a short duration, their revenue per treatment cycle is also lower than other drug classes. Moreover, there are numerous antibiotics available as generics, which are priced significantly lower than their branded counterparts. Also, the market life of anti-infectives is often short as bacteria become resistant despite preventive measures. All these factors add to the reluctance of pharmaceutical manufacturers to invest in this market, resulting in a shorter pipeline than the other segments in the pharmaceutical industry

Opportunities: Growing prevalence of chronic animal diseases

Globally, the prevalence of several chronic conditions has increased in companion animals over the last decade. According to Banfield Pet Hospital’s 2019 State of Pet Health report, one in six pets in the US is overweight. The report also states that between 2010 and 2019, the number of overweight dogs in the US has increased by 183%, and this figure is 174% in cats. Similarly, the prevalence of diabetes mellitus in dogs increased from 15.2 cases per 10,000 in 2008 to 28.5 cases per 10,000 in 2019, representing a 79.7% increase. In cats, the prevalence of diabetes mellitus increased from 60.2 cases per 10,000 in 2008 to 69.6 cases per 10,000 in 2019. Also, in 2018, Nationwide Pet Insurance received more than 82,000 claims from policyholders whose pets were either diagnosed and/or treated for cancer, which was an increase of 12% from the previous year.

Challenges: Limited awareness on vaccines coverage

In many cases, despite initiatives to promote the use of vaccines, the overall vaccine coverage is found to be low. This is mainly due to the lack of awareness about vaccination and inadequate surveillance and reporting systems. Even when vaccines are available, inadequate data can complicate decisions on vaccine requirement for various areas. Moreover, surveillance and reporting systems are still inadequate for many diseases and in many countries, which is resulting in the late diagnosis and reporting of disease outbreaks. This issue is primarily related to funding, as pet owners are often reluctant to pay for diagnostic tests or surveillance and reporting. Investments and funding for improving surveillance and reporting systems are expected to ultimately transfer the benefits to human health by reducing the overall prevalence of zoonotic diseases. However, until such investments are made available, the inadequate surveillance and reporting systems for vaccines is expected to restrain the adoption of vaccines for companion animals.

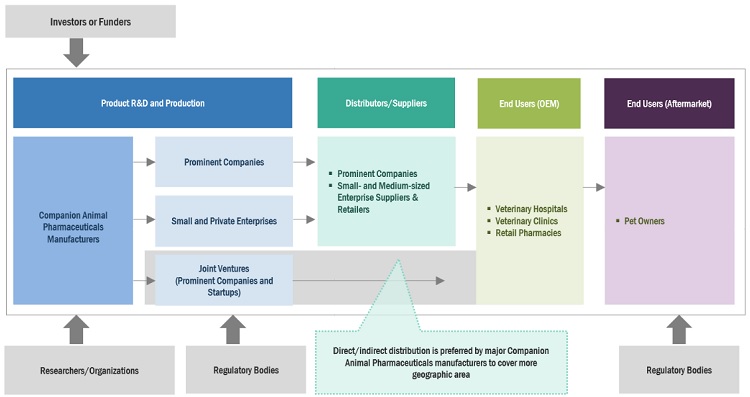

Companion Animal Pharmaceuticals Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Companion Animal Pharmaceuticals. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Zoetis Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim GmbH (Germany), Elanco Animal Health Incorporated (US), Virbac (France), Ceva Santé Animale (France), Vetoquinol S.A. (France), and Dechra Pharmaceuticals plc (UK).

The dermatologic diseases segment is expected to grow at the highest CAGR, in the companion animal pharmaceuticals market by indication, in the forecast period

The market is divided into infectious diseases, dermatologic diseases, orthopaedic diseases, pain, behavioural diseases, and other indications based on the prescription of medications for a wide range of illnesses commonly seen in animals. Throughout the projected period, the segment for dermatologic disorders is anticipated to increase at the greatest CAGR. Some of the main reasons influencing the growth of this market include the rising prevalence of arthritis, the rising need for cutting-edge orthopaedic medications, and the rising pet population.

The dogs segment holds the largest share in the animal type segment of Companion Animal Pharmaceuticals Market, in the forecast period.

The market is segmented into dogs, cats, horses, and other companion animals based on animal type. The market segment 2021 that accounts for the biggest share belongs to dogs. The large share of this market is driven to factors such the rising ownership rate and dog population, the prevalence of zoonotic infections and other skin allergies in dogs, the rising cost of veterinary care for dogs, and the expansion of pet insurers globally.

Veterinary hospitals is expected to grow at the highest CAGR in the companion animal pharmaceuticals market by distribution channel segment in the forecast period.

The global market, based on the distribution channel is divided segmented into veterinary hospitals, veterinary clinics, and retail pharmacies. Throughout the projected period, the segment for veterinary hospitals is projected to grow at the greatest CAGR. Some of the major factors propelling the growth of this market include the increased use of animal parasiticides and antibiotics in hospitals, rising incidence of infectious diseases, rising number of veterinary hospitals, rising ownership of companion animals, rising veterinary expenses, and rising awareness of animal health in developing nations.

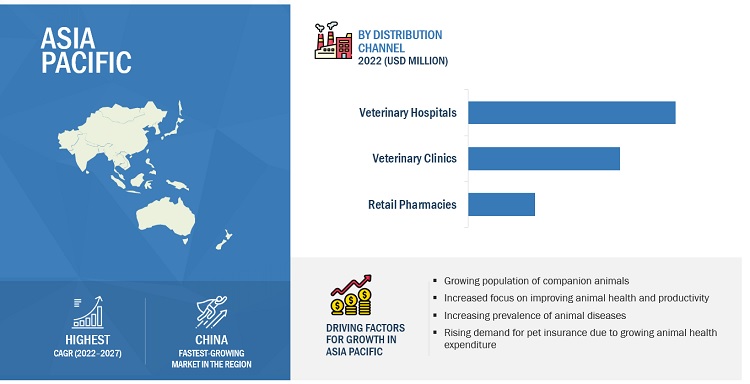

Asia Pacific will grow by highest CAGR in the companion animal pharmaceuticals market, by region.

In 2021, Asia Pacific will grow by highest CAGR in the market, by region, followed by Latin America, Europe, Middle East & Africa and North America. The highest CAGR of Asia Pacific can be attributed to the well-established base of animal health industries, the high adoption of companion animals, rising incidence of parasitic infections, the large number of hospitals and clinics, growing pool of veterinarians, and growing expenditure on animal health in the region. The growing number of research activities and funding and awareness campaigns in the field of veterinary health management is also expected to drive the growth of this market.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global companion animal pharmaceuticals market are Zoetis Inc. (US) Merck & Co., Inc. (US) Boehringer Ingelheim International GmbH (Germany) Elanco Animal Health Incorporated (US) Virbac (France) Ceva Santé Animale (France) Vetoquinol (France) Dechra Pharmaceuticals plc (UK).

Companion Animal Pharmaceuticals Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Indication, By Route of Administration, By Animal type, By Distribution Channel |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies Covered |

Zoetis, Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim International GmbH (Germany), Elanco Animal Health Incorporated (US), Eco Animal Health Group PlC (UK), Virbac (France), Dechra Pharmaceuticals PLC (UK), Vetoquinol (France), Neogen Corporation (US), Orion Group (Finland), Zenex Animal Health India Private Limited (India), Norbrook Holdings Limited (UK), Chanelle Pharma (Ireland), HIPRA (Spain), Ceva Sante Animale (France), Tianjin Ringpu Bio-Technology Co Ltd. (China), Kyoritsu Seiyaku (Japan), Endovac Animal Health (US), Indian Immunologicals Ltd (India), Ashish Life Sciences Pvt Ltd (India), Lutim Pharma Pvt Ltd (India), Biogénesis Bagó (US), Brilliant Bio Pharma (India), Intas Pharmaceuticals (India), and Vetindia Pharmaceuticals limited (India). |

The study categorizes the Companion Animal Pharmaceuticals market into following segments & sub-segments:

By Indication

- Infectious Diseases

- Dermatologic Diseases (Skin Diseases)

- Pain

- Orthopedic Diseases

- Behavioral Disorders

- Others(Dental, Cardio, Pregnancy, Cancer)

By Route of Administration

- Oral

- Injectable

- Topical

By Animal Type

- Dogs

- Cats

- Horses

- Other Companion Animals

By Distribution Channel

- Veterinary Hospitals

- Veterinary Clinics

- Retail Pharmacies

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments:

- In November 2022, The company launched MOVOFLEX, a new joint supplement for dogs, in Europe

- In January 2022, Zoetis received the US FDA Approval of Simparica Trio (sarolaner, moxidectin, and pyrantel chewable tablets), a new label Indication for the prevention of Borrelia burgdorferi Infections in dogs.

- In July 2020, Merck acquired the US rights from Virbac for the SENTINEL brand of combination parasiticides used to protect dogs against fleas and common intestinal parasites.

- In December 2020, Elanco entered into an agreement with Kindred Biosciences to acquire the exclusive global rights to KIND-030, a first-of-its-kind monoclonal antibody developed to treat and prevent canine parvovirus (CPV).

Frequently Asked Questions (FAQ):

What is the projected market value of the global companion animal pharmaceuticals market?

The global market of companion animal pharmaceuticals is projected to reach USD 19.6 billion.

What is the estimated growth rate (CAGR) of the global companion animal pharmaceuticals market for the next five years?

The global companion animal pharmaceuticals market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% from 2022 to 2027.

What are the major revenue pockets in the companion animal pharmaceuticals market currently?

In 2021, Asia Pacific will grow by highest CAGR in the market, by region, followed by Latin America, Europe, Middle East & Africa and North America. The highest CAGR of Asia Pacific can be attributed to the well-established base of animal health industries, the high adoption of companion animals, rising incidence of parasitic infections, the large number of hospitals and clinics, growing pool of veterinarians, and growing expenditure on animal health in the region. The growing number of research activities and funding and awareness campaigns in the field of veterinary health management is also expected to drive the growth of this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSMARKET DRIVERS- Rising prevalence of zoonotic diseases- Rising demand for pet insurance due to growing animal health expenditure- Increasing R&D investments for animal healthcare- Rising awareness initiatives by government agencies and animal welfare organizations- High pet ownership rates worldwideMARKET RESTRAINTS- Rising pet care costs- Limited number of novel pharmaceuticals for veterinary care- High cost of vaccines and complexities associated with storage- Growing resistance to antimicrobials and antibioticsMARKET OPPORTUNITIES- Lucrative growth opportunities in emerging markets- Growing prevalence of chronic animal diseases- Rising technological advancements in vaccine manufacturingMARKET CHALLENGES- Stringent regulatory approval process for pharmaceuticals- Limited awareness of vaccine coverage- Misdiagnosis due to diversity of parasites- Low animal healthcare expenditure in emerging markets

- 6.1 INTRODUCTION

-

6.2 INDUSTRY TRENDSRISING ACQUISITIONS OF SMALLER COMPANIES BY GLOBAL PLAYERSINCREASING PRODUCT INNOVATIONS FOR ANIMAL HEALTHCAREEXPANDING VETERINARY BUSINESSES WORLDWIDE

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- US- Europe- Rest of the World

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 SUPPLY CHAIN ANALYSIS

-

6.7 ECOSYSTEM ANALYSISCOMPANION ANIMAL PHARMACEUTICALS MARKET: ECOSYSTEM ANALYSIS

-

6.8 PATENT ANALYSISCOMPANION ANIMAL PHARMACEUTICALS MARKET: PATENT ANALYSIS TRENDSTOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR COMPANION ANIMAL PHARMACEUTICALSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR COMPANION ANIMAL PHARMACEUTICALS

- 6.9 PRICING ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS FROM 2023 TO 2024

-

6.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 6.12 TRADE ANALYSIS

- 7.1 INTRODUCTION

-

7.2 INFECTIOUS DISEASESPARASITICIDES- Growing regulatory guidelines to control parasite-related diseases to fuel marketVACCINES- Growing awareness among pet owners for canine & feline vaccines to drive marketANTIBIOTICS AND ANTIMICROBIALS- Effective prevention for clinical and subclinical diseases in companion animals to fuel uptakeOTHERS

-

7.3 DERMATOLOGIC DISEASESRISING CASES OF DERMATITIS DUE TO NUTRITIONAL DEFICIENCIES TO DRIVE MARKET

-

7.4 PAINRISING DEMAND FOR ANTI-INFLAMMATORY DRUGS AND OPIOIDS TO DRIVE MARKET

-

7.5 ORTHOPEDIC DISEASESGROWING PREVALENCE OF OSTEOARTHRITIS DUE TO INCREASING OBESITY IN PETS TO DRIVE MARKET

-

7.6 BEHAVIORAL DISORDERSINCREASING AWARENESS AMONG PET OWNERS FOR APPROPRIATE PET BEHAVIOR TO SUPPORT MARKET GROWTH

- 7.7 OTHER INDICATIONS

- 8.1 INTRODUCTION

-

8.2 ORAL ADMINISTRATIONABILITY TO TREAT A WIDE RANGE OF DISEASES AND AFFORDABILITY OF MEDICATION TO DRIVE DEMAND

-

8.3 INJECTABLE ADMINISTRATIONADVANTAGES OF COMPLETE ABSORPTION AND BIOAVAILABILITY TO FUEL MARKET

-

8.4 TOPICAL ADMINISTRATIONTEMPORARY EFFECTS OF TOPICAL DRUGS COMPARED TO ORAL AND PARENTERAL DRUGS TO RESTRAIN MARKET

- 9.1 INTRODUCTION

-

9.2 DOGSRISING PET DOG POPULATION WORLDWIDE TO DRIVE MARKET

-

9.3 CATSINCREASING R&D ACTIVITIES ON FELINE HEALTH TO DRIVE MARKET

-

9.4 HORSESRISING PREVALENCE OF INFECTIOUS DISEASES TO SUPPORT MARKET GROWTH

- 9.5 OTHER COMPANION ANIMALS

- 10.1 INTRODUCTION

-

10.2 VETERINARY HOSPITALSGROWING FOCUS ON HEALTHCARE AND COMPANION ANIMAL DIAGNOSTIC SERVICES TO DRIVE MARKET

-

10.3 VETERINARY CLINICSRISING NUMBER OF PRIVATE CLINICAL PRACTICES TO DRIVE MARKET

-

10.4 RETAIL PHARMACIESACCESSIBILITY OF PHARMACEUTICALS THROUGH PRESCRIPTIONS AND OTC MEDICATION TO SUPPORT MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising pet expenditure to fuel marketCANADA- Increasing pet ownership rates to drive demand for vaccines

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rising focus on animal health due to increasing vet practices to drive marketUK- Availability of animal health insurance policies to fuel market for pharmaceuticalsFRANCE- Rising prevalence of infectious diseases to drive demand for animal health productsSPAIN- Increasing adoption rates of dogs and cats to fuel marketITALY- Lucrative animal and pet health sectors to drive market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising number of zoonotic & infectious diseases in animals to drive marketJAPAN- Rising demand for imported breeds to support market growthINDIA- Rising focus on pet care due to a large population of domesticated animals to drive marketSOUTH KOREA- Pet care initiatives for street dogs and cats to fuel market for animal care productsAUSTRALIA- Growing awareness of parasitic infections to drive demand for parasiticidesREST OF ASIA PACIFIC

-

11.5 LATIN AMERICAGROWING POOL OF SKILLED VETERINARIANS OWING TO RISING PET POPULATION TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EAST & AFRICAEMERGING MARKET FOR ANIMAL HEALTHCARE PRACTISES TO SUPPORT UPTAKEMIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.1 OVERVIEW

- 12.2 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 EVALUATION QUADRANT FOR STARTUPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

- 12.6 COMPETITIVE BENCHMARKING

- 12.7 COMPANY GEOGRAPHIC FOOTPRINT

-

12.8 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSZOETIS INC.- Business overview- Products offered- Recent developments- MnM viewMERCK & CO., INC.- Business overview- Products offered- Recent developments- MnM viewBOEHRINGER INGELHEIM INTERNATIONAL GMBH- Business overview- Products offered- Recent developments- MnM viewELANCO ANIMAL HEALTH INCORPORATED- Business overview- Products offered- Recent developmentsVIRBAC- Business overview- Products offered- Recent developmentsDECHRA PHARMACEUTICALS PLC- Business overview- Products offered- Recent developmentsVETOQUINOL- Business overview- Products offered- Recent developmentsNEOGEN CORPORATION- Business overview- Products offered- Recent developmentsORION GROUP- Business overview- Products offered- Recent developmentsECO ANIMAL HEALTH GROUP PLC- Business overview- Products offered

-

13.2 OTHER PLAYERSZENEX ANIMAL HEALTH INDIA PRIVATE LIMITEDNORBROOKCHANELLE PHARMAHIPRACEVA SANTÉ ANIMALETIANJIN RINPU BIO-TECHNOLOGY CO., LTD.KYORITSU SEIYAKUENDOVAC ANIMAL HEALTHINDIAN IMMUNOLOGICALS LTD.ASHISH LIFE SCIENCE PVT. LTD.PHARMA PVT. LTD.BIOGENESIS BAGO S.A.INTAS PHARMACEUTICALSBRILLIANT BIOPHARMAVETINDIA PHARMACEUTICALS LIMITED

- 14.1 INDUSTRY EXPERT INSIGHTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

- TABLE 2 ANIMAL DISEASE OUTBREAKS IN ASIA PACIFIC COUNTRIES (2013–2019)

- TABLE 3 US: AVERAGE PREMIUM RATES (2019–2021)

- TABLE 4 NORTH AMERICA: PET HEALTH INSURANCE MARKET, 2012–2021 (USD MILLION)

- TABLE 5 PET POPULATION, BY ANIMAL, 2014–2020 (MILLION)

- TABLE 6 MARKET DRIVERS: IMPACT ANALYSIS

- TABLE 7 MARKET RESTRAINTS: IMPACT ANALYSIS

- TABLE 8 MARKET OPPORTUNITIES: IMPACT ANALYSIS

- TABLE 9 MARKET CHALLENGES: IMPACT ANALYSIS

- TABLE 10 COMPANION ANIMAL PHARMACEUTICALS MARKET: MAJOR ACQUISITIONS (2017–2022)

- TABLE 11 INNOVATIVE COMPANION ANIMAL PHARMACEUTICAL TRENDS

- TABLE 12 PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 US: RECENT DEVELOPMENTS IN REGULATIONS FOR VETERINARY DRUGS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 AVERAGE SELLING PRICES OF COMPANION ANIMAL PHARMACEUTICALS BY APPLICATION (USD)

- TABLE 18 COMPANION ANIMAL PHARMACEUTICALS MARKET: CONFERENCES AND EVENTS

- TABLE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 21 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 22 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 23 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR PARASITICIDES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR VACCINES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR ANTIBIOTICS AND ANTIMICROBIALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR OTHERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR DERMATOLOGIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR PAIN, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR ORTHOPEDIC DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR BEHAVIORAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 ROUTES OF ADMINISTRATION FOR KEY COMPANION ANIMAL PHARMACEUTICALS

- TABLE 34 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 35 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR ORAL ADMINISTRATION, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INJECTABLE ADMINISTRATION, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 37 COMPANION ANIMAL PHARMACEUTICAL MARKET FOR TOPICAL ADMINISTRATION, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 39 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR DOGS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR CATS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 HORSE POPULATION, BY REGION, 2016–2020 (MILLION)

- TABLE 42 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR HORSES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 45 VETERINARY VISIT EXPENSES FOR CATS AND DOGS (US)

- TABLE 46 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR VETERINARY HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 47 NUMBER OF PRIVATE CLINICAL PRACTICES, BY COUNTRY (2019 VS. 2021)

- TABLE 48 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 49 COMPANION ANIMAL PHARMACEUTICALS MARKET FOR RETAIL PHARMACIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 COMPANION ANIMAL POPULATION, BY COUNTRY, 2022 (THOUSAND)

- TABLE 51 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 58 US: PRIVATE CLINICAL PRACTICES, BY ANIMAL TYPE, 2019–2021

- TABLE 59 US: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 60 US: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 US: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 62 US: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 63 US: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 64 CANADA: COMPANION ANIMAL POPULATION, 2016–2020 (MILLION)

- TABLE 65 CANADA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 66 CANADA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 CANADA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 68 CANADA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 69 CANADA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 70 EUROPE: COMPANION ANIMAL POPULATION, 2021 (MILLION)

- TABLE 71 EUROPE: NUMBER OF VETERINARIANS, 2014–2020

- TABLE 72 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 74 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 76 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 77 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 78 GERMANY: COMPANION ANIMAL POPULATION, 2016–2021 (MILLION)

- TABLE 79 GERMANY: NUMBER OF VETERINARIANS, 2015 VS. 2020

- TABLE 80 GERMANY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 81 GERMANY: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 GERMANY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 83 GERMANY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 84 GERMANY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 85 UK: COMPANION ANIMAL POPULATION, 2017–2020 (MILLION)

- TABLE 86 UK: NUMBER OF VETERINARIANS, 2016 VS. 2020

- TABLE 87 UK: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 88 UK: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 89 UK: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 90 UK: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 91 UK: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 92 FRANCE: COMPANION ANIMAL POPULATION, 2010–2021 (MILLION)

- TABLE 93 FRANCE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 94 FRANCE: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 FRANCE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 96 FRANCE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 97 FRANCE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 98 SPAIN: COMPANION ANIMAL POPULATION, 2016–2021 (MILLION)

- TABLE 99 SPAIN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 100 SPAIN: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 101 SPAIN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 102 SPAIN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 103 SPAIN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 104 ITALY: PET POPULATION, 2017–2021 (MILLION)

- TABLE 105 ITALY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 106 ITALY: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 107 ITALY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 108 ITALY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 109 ITALY: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 110 REST OF EUROPE: COMPANION ANIMAL OWNERSHIP, 2018 (MILLION)

- TABLE 111 REST OF EUROPE: NUMBER OF VETERINARIANS AND PARAVETERINARIANS, 2019 VS. 2020

- TABLE 112 REST OF EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 113 REST OF EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 REST OF EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 115 REST OF EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 116 REST OF EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 123 CHINA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 124 CHINA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 125 CHINA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 126 CHINA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 127 CHINA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 128 JAPAN: DOMESTICATED DOG AND CAT POPULATION, 2012–2020 (THOUSAND)

- TABLE 129 JAPAN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 130 JAPAN: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 131 JAPAN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 132 JAPAN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 133 JAPAN: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 134 INDIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 135 INDIA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 136 INDIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 137 INDIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 138 INDIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 139 SOUTH KOREA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 140 SOUTH KOREA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 141 SOUTH KOREA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 142 SOUTH KOREA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 143 SOUTH KOREA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 144 AUSTRALIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 145 AUSTRALIA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 146 AUSTRALIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 147 AUSTRALIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 148 AUSTRALIA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: NUMBER OF VETERINARIANS, 2012−2021

- TABLE 150 REST OF ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 155 NUMBER OF VETERINARIANS AND VETERINARY PARA-PROFESSIONALS IN LATIN AMERICA (2016 VS. 2019)

- TABLE 156 LATIN AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 158 LATIN AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 160 LATIN AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2020–2027 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: COMPANION ANIMAL PHARMACEUTICALS MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 166 COMPANION ANIMAL PHARMACEUTICALS MARKET: INDICATION PORTFOLIO ANALYSIS:

- TABLE 167 COMPANION ANIMAL PHARMACEUTICALS MARKET: ROUTE OF ADMINISTRATION PORTFOLIO ANALYSIS

- TABLE 168 COMPANION ANIMAL PHARMACEUTICALS MARKET: ANIMAL TYPE PORTFOLIO ANALYSIS

- TABLE 169 COMPANION ANIMAL PHARMACEUTICALS MARKET: DISTRIBUTION CHANNEL PORTFOLIO ANALYSIS

- TABLE 170 COMPANION ANIMAL PHARMACEUTICALS MARKET: REGIONAL REVENUE MIX

- TABLE 171 PRODUCT LAUNCHES & APPROVALS

- TABLE 172 DEALS

- TABLE 173 OTHER DEVELOPMENTS

- TABLE 174 ZOETIS INC.: BUSINESS OVERVIEW

- TABLE 175 MERCK & CO., INC.: BUSINESS OVERVIEW

- TABLE 176 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: BUSINESS OVERVIEW

- TABLE 177 ELANCO ANIMAL HEALTH INCORPORATED: BUSINESS OVERVIEW

- TABLE 178 VIRBAC: BUSINESS OVERVIEW

- TABLE 179 DECHRA PHARMACEUTICALS PLC: BUSINESS OVERVIEW

- TABLE 180 VETOQUINOL: BUSINESS OVERVIEW

- TABLE 181 NEOGEN CORPORATION: BUSINESS OVERVIEW

- TABLE 182 ORION GROUP: BUSINESS OVERVIEW

- TABLE 183 ECO ANIMAL HEALTH GROUP PLC: BUSINESS OVERVIEW

- FIGURE 1 COMPANION ANIMAL PHARMACEUTICALS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: ZOETIS INC.

- FIGURE 6 COMPANION ANIMAL PHARMACEUTICALS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET ANALYSIS APPROACH

- FIGURE 8 EUROPE: COMPANION ANIMAL PHARMACEUTICALS MARKET APPROACH

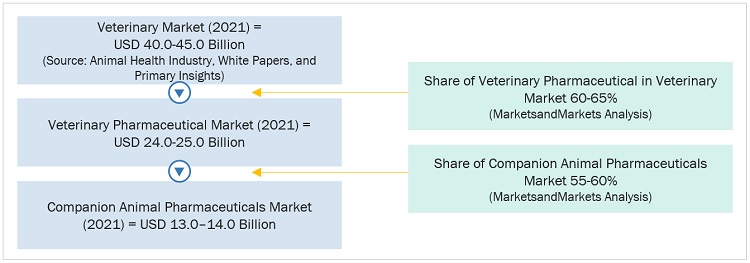

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 CAGR PROJECTIONS

- FIGURE 11 COMPANION ANIMAL PHARMACEUTICALS MARKET (2022–2027): IMPACT ANALYSIS ON DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY INDICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 COMPANION ANIMAL PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 COMPANION ANIMAL PHARMACEUTICALS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 18 INCREASING PREVALENCE OF ZOONOTIC DISEASES AND RISING PET OWNERSHIP RATES WORLDWIDE TO DRIVE MARKET

- FIGURE 19 INFECTIOUS DISEASES SEGMENT IN GERMANY ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 20 CHINA & INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 COMPANION ANIMAL PHARMACEUTICALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 CANADA: AVERAGE ANNUAL PREMIUMS (2017–2021)

- FIGURE 25 US: PET INDUSTRY EXPENDITURE, 2010–2020

- FIGURE 26 COMPANION ANIMAL PHARMACEUTICAL MARKET: DEVELOPMENT AND APPROVAL PROCESS FOR PRODUCTS

- FIGURE 27 COMPANION ANIMAL PHARMACEUTICAL MARKET: PRODUCT APPROVAL PROCESS IN EUROPE

- FIGURE 28 COMPANION ANIMAL PHARMACEUTICALS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 COMPANION ANIMAL PHARMACEUTICALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 COMPANION ANIMAL PHARMACEUTICALS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 PATENT PUBLICATION TRENDS (JANUARY 2013–DECEMBER 2022)

- FIGURE 32 COMPANION ANIMAL PHARMACEUTICALS MARKET: TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR PATENTS (2017–2022)

- FIGURE 33 COMPANION ANIMAL PHARMACEUTICAL MARKET: TOP APPLICANT COUNTRIES FOR PATENTS (2017–2022)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 35 BUYING CRITERIA

- FIGURE 36 GROWING PET DOG POPULATION IN INDIA (MILLION)

- FIGURE 37 POPULATION OF PET DOGS GLOBALLY (MILLION)

- FIGURE 38 COMPANION ANIMAL PHARMACEUTICALS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 39 EXPECTED GROWTH FOR NUMBER OF VETERINARIANS IN NORTH AMERICA (2012 VS. 2030)

- FIGURE 40 NORTH AMERICA: COMPANION ANIMAL PHARMACEUTICALS MARKET SNAPSHOT

- FIGURE 41 US: POPULATION OF DOGS, 2012–2020 (MILLION)

- FIGURE 42 US: EXPENDITURE ON VET VISITS, 2013–2020

- FIGURE 43 ASIA PACIFIC: COMPANION ANIMAL PHARMACEUTICALS MARKET SNAPSHOT

- FIGURE 44 CHINA: PROJECTED COMPANION ANIMAL POPULATION, 2018–2025 (MILLION)

- FIGURE 45 INDIA: PROJECTED COMPANION ANIMAL POPULATION, 2018–2025 (MILLION)

- FIGURE 46 AUSTRALIA: PROJECTED COMPANION ANIMAL POPULATION, 2018–2025 (MILLION)

- FIGURE 47 KEY PLAYER STRATEGIES ADOPTED BY MARKET PLAYERS (2019–2022)

- FIGURE 48 COMPANION ANIMAL PHARMACEUTICALS MARKET: REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS (2017–2021)

- FIGURE 49 COMPANION ANIMAL PHARMACEUTICALS MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 50 COMPANION ANIMAL PHARMACEUTICALS MARKET: COMPANY EVALUATION QUADRANT (2021)

- FIGURE 51 COMPANION ANIMAL PHARMACEUTICALS MARKET: STARTUPS/SME EVALUATION QUADRANT (2021)

- FIGURE 52 ZOETIS: COMPANY SNAPSHOT (2021)

- FIGURE 53 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

- FIGURE 54 BOEHRINGER INGELHEIM GMBH: COMPANY SNAPSHOT (2021)

- FIGURE 55 ELANCO ANIMAL HEALTH INCORPORATED: COMPANY SNAPSHOT (2021)

- FIGURE 56 VIRBAC: COMPANY SNAPSHOT (2021)

- FIGURE 57 DECHRA PHARMACEUTICALS PLC: COMPANY SNAPSHOT (2021)

- FIGURE 58 VETOQUINOL: COMPANY SNAPSHOT (2021)

- FIGURE 59 NEOGEN CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 60 ORION GROUP: COMPANY SNAPSHOT (2021)

- FIGURE 61 ECO ANIMAL HEALTH GROUP PLC: COMPANY SNAPSHOT (2021)

The study involved four major activities in estimating the current size of the Companion Animal Pharmaceuticals market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Companion Animal Pharmaceuticals and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Companion Animal Pharmaceuticals market, which was validated by primary respondents.

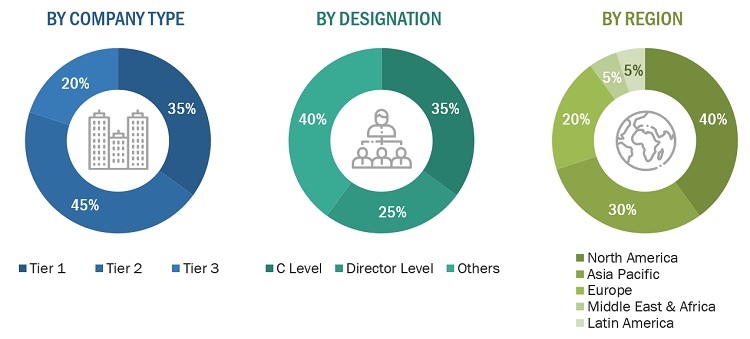

Primary Research

Extensive primary research was conducted after obtaining information regarding the Companion Animal Pharmaceuticals market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Companion Animal Pharmaceuticals manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, customer/end users who are using Companion Animal Pharmaceuticals were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of Companion Animal Pharmaceuticals and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Companion Animal Pharmaceuticals market includes the following details.

The market sizing of the market was undertaken from the global side.

Global Companion Animal Pharmaceuticals Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Companion animal pharmaceuticals are used to treat animals to improve their performance and health. Animal health products, especially pharmaceuticals, are the most widely used products for animal healthcare. The animal health products covered in this report include antimicrobials, antibiotics, vaccines, and parasiticides for treating infectious diseases or other disorders in companion animals.

Key Stakeholders

- Senior Management

- End Users

- Veterinarians

- Finance/Procurement Department

Report Objectives

- To define, describe, segment, and forecast the companion animal pharmaceuticals market by indication, route of administration, animal type, distribution channel, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, and partnerships of the leading players in the market

- To evaluate and analyze the impact of the recession on the market across the globe

Available Customizations

- MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Companion Animal Pharmaceuticals market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Companion Animal Pharmaceuticals Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Companion Animal Pharmaceuticals Market