Commercial Vehicle & Off-Highway Radar Market by frequency (24-GHz & 77-81 GHz), component (LRR, S&MRR, Mono Camera, and Stereo Camera), vehicle (CV & Off-highway), Application (ACC, AEB,BSD, FCW & IPA) and Region - Global Forecast to 2027

Commercial Vehicle & Off-Highway Radar Market

Radar is a detection system that uses radio waves to determine the distance, velocity, and direction of an object/vehicle/pedestrian. The transmitter of a radar emits radio waves that, after striking an object, are captured by the receiver. This signal received is then processed by the processing unit to derive the information.

Key Drivers

- Increasing demand for autonomous driving and safe commercial vehicles

- Ability to determine velocity of the object accurately

Key Restraints

- Signal Interference

- Inability in distinguishing multiple targets

Top Players

- Robert Bosch (Germany)

- Continental (Germany)

- Aptiv (Ireland)

- Denso Corporation (Japan)

- Infineon Technologies (Germany)

- NXP Semiconductors (Netherlands)

- Analog Devices (US)

- HELLA (Germany)

- Valeo (France)

- Texas Instruments (US)

- ZF (Germany)

- Magna International (Canada)

- Continental – Continental AG was established in the year 1871, with its headquarters situated in Hanover, Germany. Continental AG offers both long- and short-range radars for the application of ADAS features in commercial vehicles. In December 2019, Continental announced the launch of the 5th generation automotive radar. The new radar has greater capacity, and it is also based on a scalable modular principle, which, with its graduated function scopes and flexibly, supports vehicle manufacturers’ different requirements and electrical-electronic (E/E) architectures.

- Denso – Denso Corporation was established in 1949, with its headquarters in Aichi, Japan. Denso Corporation offers a variety of radars for applications in commercial and off-highway vehicles. In august 2017, Denso Corporation developed a 24-GHz submillimeter-wave rear and side radar sensor to help enhance vehicle safety systems. The sensor was used in the 2018 Toyota Camry.

- HELLA – HELLA GmbH & Co. KGaA was established in the year 1899, with its headquarters in Lippstadt, Germany. The company operates in the automotive, aftermarket, and special application segments. It develops vehicle-specific solutions for innovative automotive applications like intelligent battery sensors, radar-based driver assistance systems, and adaptive lighting systems. In February 2020, HELLA introduced its latest 77 GHz radar technology. Initially, the company will supply it to Asian manufacturers of trucks and buses.

Commercial Vehicle Radar Market and Key Technology

- 77-81 GHz Radar – The 77–81 GHz radar operates in the 4 GHz bandwidth with a maximum frequency range of 81 GHz. This bandwidth is best suited for short range radar applications. The application of 77 GHz radar includes ADAS applications such as Autonomous Emergency Braking (AEB) and Adaptive Cruise Control (ACC). Currently, 77 GHz radars are widely used in the automotive industry.

- 24 GHz Radar – 24 GHz band ranges from 24.0 GHz to 24.25 GHz and is called narrowband (NB). This has a bandwidth of 250 MHz. This is a relatively older technology than 77 GHz radar. The 24 GHz radar solution for commercial vehicles is aimed at ADAS features such as BSD and lane change assist.

- Radar used in ADAS for commercial vehicles – Commercial vehicles include trucks, buses, vans, and pickup trucks, etc. Many ADAS features have now been quipped in these commercial vehicles which uses radar as one of the sensors. Radar is more cost effective than other technologies such as LiDAR, without compromising on major features.

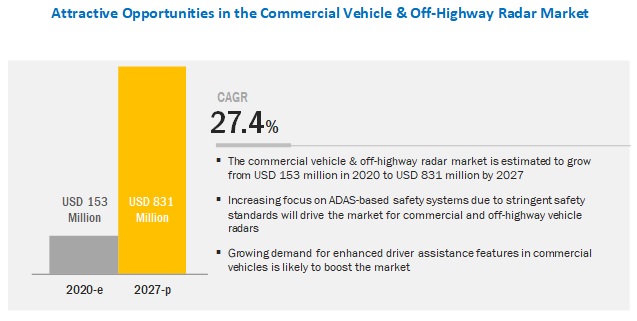

[181 Pages Report] The commercial vehicle & off-highway radar market is estimated to be USD 153 million in 2020 and is projected to reach USD 831 million by 2027, at a CAGR of 27.4% during the forecast period. High demand for vehicles with ADAS features to increase safety on the road, reduce collisions, and decrease fuel consumption has pushed for the adoption of commercial vehicle and off-highway radars.

MnM was able to help a leading radar manufacturer with the potential market size of the commercial vehicle & off-highway radar market at a global level

Client’s Problem Statement

A global manufacturer of electrical and electronic components engaged MarketsandMarkets (MnM) for a custom study on the commercial vehicle & off-highway radar market

The purchaser of the report requested for:

. The forecast of the overall market (market size from 2018–2027) for all segments covered in the report, in terms of value and volume

. Insights on the regulations and mandates for safety features in commercial vehicles

. Insights on the type of radar (short-range, medium-range, and long-range) most suitable for ADAS applications

. The overall radar market (market size from 2018–2027) for off-highway vehicles in terms of value and volume

. A list of the top 25 radar manufacturers for commercial and off-highway vehicles at the global level, along with key details, such as financial snapshots, key strategies, and product portfolio

MnM Approach

Methodology Adopted by MnM

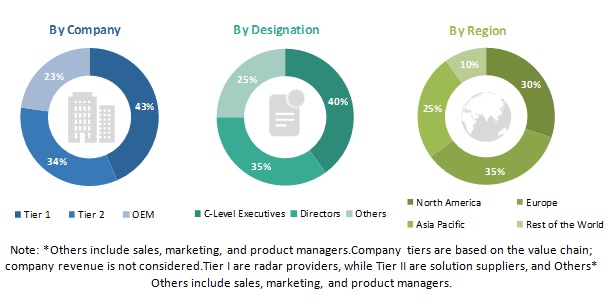

. The research team at MnM that undertook this study collected information via secondary research and primary interviews with industry experts

. The forecast of the overall market was undertaken after carefully analyzing the model mapping associated with the commercial vehicle & off-highway radar market

. The total market size of the commercial vehicle & off-highway radar market was derived by analyzing the average number of commercial and off-highway vehicles equipped with radar at the country level and forecast with the data points gathered from secondary and primary research

. The top 25 radar manufacturers were identified through secondary research, paid databases such as Marklines, and other secondary sources.

Revenue Impact (RI)

After going through the detailed analysis developed by MnM, the client was able to assist its client in targeting innovative areas and regions of primary importance. From a commercial perspective, MnM’s analysis enabled the client to build a strong relationship with their existing customers. With this research study, MarketsandMarkets helped the client tap an additional opportunity of USD 40 million at the global level.

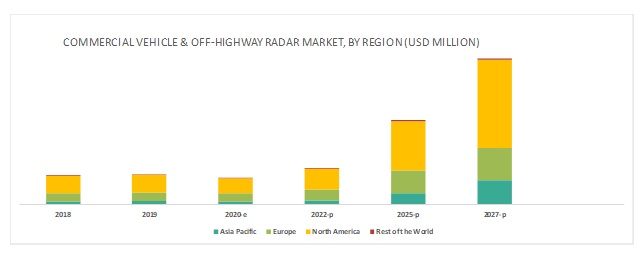

The off-highway vehicle segment is expected to have the fastest-growing market in Asia-Pacific region, by vehicle type, during the forecast period.

As off-highway vehciles work alongside in construction and mining sites, BSD can alert the driver about the presence of a pedestrian/worker, which is of more importance in off-highway vehicles than commercial vehicles. Off-highway vehicles encounter different terrains that have no lanes, no marking, and improper visibility. The radar system is capable of performing in bad weather/ lighting conditions, which match the working conditions of off-highways vehicles. Asia Pacific is the fastest market for off-highway vehicle radars due to maximum infrastructure projects initiated by governments in the region.

The commercial vehicle is expected to have the largest market share in the commercial vehicle & off-highway radar market, by vehicle type, during the forecast period.

Radar is much more cost-effective compared to other technology such as LiDAR without compromising on significant features. This has enabled its full application across the globe. To tackle speed, distance, direction, and angle of arrival, radars detect moving objects and measure speed which helps in lane maintenance and avoids accidents. Companies are launching and shifting towards ADAS features in commercial vehicles. For instance, in 2017, Volvo Trucks launched its new VNL series of semi-trucks. The truck is equipped with Advanced Driver Assist Systems (ADAS), which includes forward-collision warning, adaptive cruise control, lane departure warning, and automatic emergency braking.

Europe is expected to account for the second-largest market size during the forecast period.

The European region is expected to be the second-largest market during the forecast period. Europe has been at the forefront to improve the safety of commercial vehicles, for which the EU institutions have announced their plans to mandate vehicles with safety features by 2022. Many of the automotive OEMs in this region have equipped their vehicles with ADAS features as a standard. The trend of adoption of vehicles with advanced safety features in Europe is expected to continue during the forecast period which is also another key factor fuelling the growth of the commercial vehicle & off-highway radar market during the forecast period. However, due to global wave of CONVID-19, Europe and other regions as well will have a direct impact on auto industry. The impact has started with the recent shut down and halt of companies like Ford, Nissan and Vauxhall to close plants due to falling sales and lack of parts. This will be casuing economic slow down in Europe for time being.

Key Market Players

The major players in the commercial vehicle & off-highway radar market include Robert Bosch GmBH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and Infineon Technologies AG (Germany).

Robert Bosch GmBH is a critical player in the commercial vehicle & off-highway radar market. The company offers long-range radar (LRR) sensors, mid-range radar (MRR) sensors, front radar plus, multipurpose cameras, and stereo video cameras for the LCVs to perform safety functions such as ACC and AEB. The company offers multi-purpose cameras for lane-keep support functions in commercial vehicles. For off-highway vehicles, Bosch provides a near-range camera that provides a 360° surrounding view, which eliminates blind spots.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2020–2027 |

|

Forecast Units |

Volume (Thousand Units) & Value (USD million) |

|

Segments Covered |

application, frequency type, vehicle type, component type, and region. |

|

Geographies Covered |

Asia Pacific, Europe, North America, and the Rest of the World. |

|

Companies Covered |

Robert Bosch GmBH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and Infineon Technologies AG (Germany). |

This research report categorizes the commercial vehicle & off-highway radar market based on application, frequency type, vehicle type, component type, and region.

Commercial vehicle radar market, by application

- Adaptive Cruise Control (ACC)

- Blind Spot Detection (BSD)

- Forward Collision Warning System

- Intelligent Park Assist

- Autonomous Emergency Braking (AEB)

Commercial vehicle radar market, by frequency type

- 24 GHz

- 77-82 GHz

Commercial vehicle & off-highway radar market, by vehicle type

- Commercial Vehicle

- Off-highway Vehicle

Commercial vehicle radar market, by component type

- Long-Range Radar (LRR)

- Short & Medium Range Radar (S&MRR)

- Mono Camera

- Stereo Camera

Commercial vehicle radar market, By Region

- Asia Pacific

- Europe

- North America

- RoW

Recent Developments

- In December 2019, Continental announced the launch of the 5th generation automotive radar in 2019. The new detector has higher capacity, and it is also based on a scalable modular principle, which, with its graduated function scopes and flexibly, supports vehicle manufacturers’ different requirements and electrical-electronic (E/E) architectures.

- In August 2017, Denso Corporation developed a 24-GHz submillimeter-wave rear and sided radar sensor to help enhance vehicle safety systems. The sensor was used in the 2018 Toyota Camry. It is built into the rear bumper of the vehicle to detect other vehicles likely to enter the driver’s blind spot from the rear and side, as well as vehicles approaching from the rear on the left and right when reversing.

- In March 2018, Analog Devices, Inc. (ADI) acquired Symeo GmbH, a company that specializes in RADAR hardware and software for emerging autonomous automotive and industrial applications. With this acquisition, ADI now delivers more comprehensive and compelling radar solutions.

- In November 2019, Denso partnered with Metawave to accelerate the development of smart radar systems for autonomous cars. Metawave has been working in radar sensing with its state-of-the-art analog beam-steering radar, which the company claims provides more extended range, higher resolution, and greater accuracy and intelligent object classification compared to traditional detectors.

- In February 2020, HELLA introduced its latest 77 GHz radar technology. Initially, the company will supply it to Asian manufacturers of trucks and buses.

Key questions addressed by the report

- Where will all these developments take the industry in the mid- to long-term?

- How is the increasing adoption of electric vehicles and changing environmental norms affecting the commercial vehicle radar market?

- What are the features in which mono camera outperforms in commercial vehicles?

- Who are the key players in the market, and how intense is the competition?

- How will the combination of radar and 4D vision will work in a real-world situations?

Frequently Asked Questions (FAQ):

What is the market size of the commercial vehicle & off-highway radar market?

The commercial vehicle & off-highway radar market is estimated to be USD 153 million in 2020 and is projected to reach USD 831 million by 2027, at a CAGR of 27.4%.

Who are the top players in the commercial vehicle & off-highway radar market?

The major players in the commercial vehicle & off-highway radar market consists of companies such as Robert Bosch GmBH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and Infineon Technologies AG (Germany).These companies have adopted new product developments, collaboration, acquisitions, and joint venture strategies to their hold positions in this market.

Which vehicle segment ( commercial or off-highway)is the fastest growing in this market?

Off-highway vehicle segment is expected to show the fastest market for commercial vehicle & off-highway radar. The fact that off-highway vehicles are operated alongside in construction and mining sites, thus require safety alerts like BSD to warn the driver about the presence of a pedestrian/worker. This could reduce accidents rates and hence is expected to have fastest market.

Which is the largest market for commercial vehicle & off-highway radar?

North America is expected to be the largest market. The region is considered to be the early adopter of technologies like ADAS in Passenger and commercial vehicles. Also presence of players like Visteon, Velodyne Lidar, Texas, FCA, and GM are key factor to growth of commercial vehicle & Off-highway radar market.

What are the restraints to this market?

Signal interference and inability to distinguish multiple targets by radars are the key restraints to this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH: COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET

2.4.2 TOP-DOWN APPROACH: COMMERCIAL VEHICLE RADAR MARKET

2.5 COMMERCIAL VEHICLE RADAR MARKET: RESEARCH DESIGN & METHODOLOGY

2.6 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF COMPANY-BASED REVENUE ESTIMATION

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.8 ASSUMPTIONS & LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 MARKET TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD

4.2 NORTH AMERICA IS ESTIMATED TO LEAD THE GLOBAL COMMERCIAL VEHICLE RADAR MARKET IN 2020

4.3 GLOBAL MARKET, BY VEHICLE TYPE AND FREQUENCY

4.4 COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT

4.5 COMMERCIAL VEHICLE RADAR MARKET, BY APPLICATION

4.6 MARKET, BY VEHICLE TYPE

4.7 COMMERCIAL VEHICLE RADAR MARKET, BY FREQUENCY

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for autonomous driving and safe commercial vehicles

5.2.1.2 Ability to determine the velocity of an object accurately

5.2.2 RESTRAINTS

5.2.2.1 Signal interference

5.2.2.2 Inability to distinguish multiple targets

5.2.3 OPPORTUNITIES

5.2.3.1 4D imaging radar

5.2.3.2 Advancements in providing accurate angular information

5.2.4 CHALLENGES

5.2.4.1 Advancements in LiDAR technology

5.3 OEM COUNTRY-WISE MODEL DETAILS IN ASIA PACIFIC

5.3.1 CHINA

5.3.2 INDIA

5.3.3 JAPAN

5.3.4 KOREA

5.4 OEM COUNTRY-WISE MODEL DETAILS IN NORTH AMERICA

5.4.1 US

5.4.2 CANADA

5.4.3 MEXICO

5.5 OEM COUNTRY-WISE MODEL DETAILS IN EUROPE

5.5.1 UK

5.5.2 GERMANY

5.5.3 ITALY

5.5.4 SPAIN

5.5.5 FRANCE

5.6 OEM COUNTRY-WISE MODEL DETAILS IN REST OF THE WORLD

5.6.1 RUSSIA

5.6.2 BRAZIL

5.7 COMMERCIAL VEHICLE RADAR MARKET SCENARIOS (2020–2027)

5.7.1 COMMERCIAL VEHICLE RADAR MARKET: MOST LIKELY SCENARIO

5.7.2 COMMERCIAL VEHICLE RADAR MARKET: OPTIMISTIC SCENARIO

5.7.3 COMMERCIAL VEHICLE RADAR MARKET: PESSIMISTIC SCENARIO

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 PORTER’S 5 FORCES

6.3 VALUE CHAIN ANALYSIS

6.4 TECHNOLOGICAL ANALYSIS

6.4.1 4D IMAGING RADAR

6.4.2 LOCALIZATION AND MAPPING

6.5 REGULATIONS/GUIDELINES FOR TRUCKS AND BUS MARKET:

7 COVID–19 IMPACT ON COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET (Page No. - 66)

7.1 OEM ANNOUNCEMENTS

7.2 TIER I MANUFACTURERS ANNOUNCEMENTS

7.3 IMPACT ON GLOBAL AUTOMOTIVE INDUSTRY

7.4 IMPACT ON MARKET

8 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY COMPONENT (Page No. - 70)

8.1 INTRODUCTION

8.2 OPERATIONAL DATA

8.2.1 ASSUMPTIONS

8.2.2 RESEARCH METHODOLOGY

8.3 MONO CAMERA

8.3.1 CAPABILITY TO CLASSIFY OBJECTS WILL DRIVE MONO CAMERA DEMAND

8.4 STEREO CAMERA

8.4.1 3D IMAGE FRAME VIEW AND HIGH RESOLUTION OF STEREO CAMERA MAKE IT MOST EFFICIENT FOR ADOPTION IN COMMERCIAL VEHICLES

8.5 LONG RANGE RADAR (LRR)

8.5.1 HIGHER FREQUENCY RANGE OFFERED BY LRR SUPPORTS ADAPTIVE CRUISE CONTROL WHICH WILL DRIVE ITS DEMAND

8.6 SHORT & MEDIUM RANGE RADAR (S&MRR)

8.6.1 LOW COST OF SHORT & MEDIUM RANGE RADAR WILL DRIVE ITS DEMAND

8.7 KEY INDUSTRY INSIGHTS

9 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY VEHICLE TYPE (Page No. - 79)

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 COMMERCIAL VEHICLE

9.3.1 COST EFFECTIVENESS OF RADAR SYSTEMS IN COMMERCIAL VEHICLES AND SAFETY CONCERNS WILL FUEL THE MARKET

9.4 BUSES

9.4.1 INCREASING RATE OF ROAD ACCIDENTS WILL DRIVE THE DEMAND FOR SAFETY FEATURES IN BUSES

9.5 MEDIUM & HEAVY TRUCKS

9.5.1 DEMAND FOR HIGHER LOAD CAPACITY TRUCKS IN LOGISTICS TO ACCOMMODATE HIGHER VOLUMES WILL DRIVE THE MARKET

9.6 PICKUP TRUCKS & VANS

9.6.1 ALLOCATION OF LARGE BUDGETS BY REGULATORY BODIES FOR SAFETY FEATURES IN LOAD CARRYING VEHICLES WILL BOOST THE MARKET

9.7 OFF-HIGHWAY VEHICLES

9.7.1 COMPLEXITY OF IMPROPER VISIBILITY WOULD INCREASE THE DEMAND FOR OFF-HIGHWAY VEHICLE RADARS

9.8 CONSTRUCTION EQUIPMENT

9.8.1 NEED TO REDUCE ACCIDENTS IN CONSTRUCTION SITES WOULD DRIVE THE DEMAND FOR RADARS IN CONSTRUCTION EQUIPMENT

9.9 MINING EQUIPMENT

9.9.1 DEMAND FOR COLLISION AVOIDANCE IN MINING SITES WOULD DRIVE THE MARKET FOR RADARS IN MINING EQUIPMENT

9.1 AGRICULTURE EQUIPMENT

9.10.1 NEED FOR ADAS FUNCTIONS IN FARMING WOULD DRIVE THE DEMAND FOR RADARS IN AGRICULTURE EQUIPMENT

9.11 KEY INDUSTRY INSIGHTS

10 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY FREQUENCY (Page No. - 91)

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.3 24 GHZ

10.3.1 LOW COST OF 24 GHZ RADAR WILL DRIVE ITS GROWTH IN COMMERCIAL VEHICLE RADAR MARKET

10.4 77–81 GHZ

10.4.1 DEMAND FOR HIGH RESOLUTION TO ACHIEVE AUTOMOTIVE SAFETY IN COMMERCIAL VEHICLES WILL DRIVE THE 77–81 GHZ SEGMENT

10.5 KEY INDUSTRY INSIGHTS

11 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY APPLICATION (Page No. - 98)

11.1 INTRODUCTION

11.2 OPERATIONAL DATA

11.2.1 ASSUMPTIONS

11.2.2 RESEARCH METHODOLOGY

11.3 ADAPTIVE CRUISE CONTROL (ACC)

11.3.1 REDUCTION IN FUEL CONSUMPTION DUE TO ACC WILL DRIVE ITS DEMAND

11.4 BLIND SPOT DETECTION (BSD)

11.4.1 ADVANCEMENTS IN BSD WILL BOOST DEMAND FOR COMMERCIAL VEHICLE RADARS

11.5 FORWARD COLLISION WARNING (FCW)

11.5.1 DEMAND FOR FCW WILL RISE SIGNIFICANTLY TO PREVENT FRONT-ON COLLISIONS

11.6 INTELLIGENT PARK ASSIST (IPA)

11.6.1 EASE OF PARKING OF COMMERCIAL VEHICLES WITH MINIMAL DRIVER ASSISTANCE WILL FUEL DEMAND FOR IPA

11.7 AUTOMATIC EMERGENCY BRAKING (AEB)

11.7.1 DEMAND FOR SAFETY IN COMMERCIAL VEHICLES WOULD BOOST THE AEB SEGMENT

11.8 KEY INDUSTRY INSIGHTS

12 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY REGION (Page No. - 108)

12.1 INTRODUCTION

12.1.1 INCREASING DEMAND FOR SAFE COMMERCIAL VEHICLES IS EXPECTED TO IMPACT THE MARKET

12.2 EUROPE

12.2.1 GERMANY

12.2.1.1 Presence of key players to drive the German market

12.2.2 ITALY

12.2.2.1 Increasing vehicle safety concerns will fuel the Italian market

12.2.3 UK

12.2.3.1 Increasing initiatives from various institutions for installation of ADAS features will drive the UK market

12.2.4 SPAIN

12.2.4.1 Increasing adoption of safe vehicles with fuel the Spanish market

12.2.5 FRANCE

12.2.5.1 Increasing trend of adoption of safe vehicles with fuel the French market

12.3 NORTH AMERICA

12.3.1 US

12.3.1.1 Increasing efforts from government for adoption of radars in vehicles to drive the US market

12.3.2 CANADA

12.3.2.1 Increasing number of tests conducted by the government will drive the Canadian market

12.3.3 MEXICO

12.3.3.1 Trade agreements like NAFTA will drive the Mexican market

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.1.1 Increasing sales of ADAS-equipped commercial vehicles will fuel the Chinese market

12.4.2 JAPAN

12.4.2.1 Increasing demand for specialized vehicles will drive the Japanese market

12.4.3 INDIA

12.4.3.1 Increasing government initiatives toward improving road safety to drive the Indian market

12.4.4 SOUTH KOREA

12.4.4.1 Mandating of AEB and LDW will fuel the South Korean market

12.5 REST OF THE WORLD (ROW)

12.5.1 BRAZIL

12.5.1.1 Need to reduce traffic accidents to drive the demand for radars in Brazil

12.5.2 RUSSIA

12.5.2.1 Growing sales of commercial vehicles with ADAS features will encourage more companies to introduce them to Russia

13 COMPETITIVE LANDSCAPE (Page No. - 132)

13.1 OVERVIEW

13.2 MARKET RANKING ANALYSIS

13.3 COMPETITIVE LEADERSHIP MAPPING

13.3.1 VISIONARY LEADERS

13.3.2 INNOVATORS

13.3.3 DYNAMIC DIFFERENTIATORS

13.3.4 EMERGING COMPANIES

13.4 STRENGTH OF PRODUCT PORTFOLIO

13.5 BUSINESS STRATEGY EXCELLENCE

13.6 WINNERS VS. TAIL-ENDERS

13.7 COMPETITIVE SCENARIO

13.7.1 NEW PRODUCT DEVELOPMENT

13.7.2 ACQUISITIONS, 2017–2019

13.7.3 JOINT VENTURE

13.7.4 EXPANSION

14 COMPANY PROFILES (Page No. - 141)

14.1 ROBERT BOSCH GMBH

14.1.1 BUSINESS OVERVIEW

14.1.2 PRODUCT OFFERINGS

14.1.3 SWOT ANALYSIS

14.1.4 MNM VIEW

14.2 CONTINENTAL AG

14.2.1 BUSINESS OVERVIEW

14.2.2 RECENT DEVELOPMENTS

14.2.3 SWOT ANALYSIS

14.2.4 MNM VIEW

14.3 APTIV

14.3.1 BUSINESS OVERVIEW

14.3.2 RECENT DEVELOPMENTS

14.3.3 SWOT ANALYSIS

14.3.4 MNM VIEW

14.4 DENSO CORPORATION

14.4.1 BUSINESS OVERVIEW

14.4.2 RECENT DEVELOPMENTS

14.4.3 SWOT ANALYSIS

14.4.4 MNM VIEW

14.5 INFINEON TECHNOLOGIES AG

14.5.1 BUSINESS OVERVIEW

14.5.2 SWOT ANALYSIS

14.5.3 MNM VIEW

14.6 NXP SEMICONDUCTORS N.V.

14.6.1 BUSINESS OVERVIEW

14.7 ANALOG DEVICES, INC.

14.7.1 BUSINESS OVERVIEW

14.8 HELLA KGAA HUECK & CO

14.8.1 BUSINESS OVERVIEW

14.8.2 RECENT DEVELOPMENTS

14.9 VALEO

14.9.1 BUSINESS OVERVIEW

14.10 TEXAS INSTRUMENTS

14.10.1 BUSINESS OVERVIEW

14.11 ZF FRIEDRICHSHAFEN AG

14.11.1 BUSINESS OVERVIEW

14.12 MAGNA INTERNATIONAL INC.

14.12.1 BUSINESS OVERVIEW

14.13 OTHER MAJOR PLAYERS

14.13.1 NORTH AMERICA

14.13.1.1 Ambarella Inc.

14.13.1.2 Gentex Corporation

14.13.1.3 Harman International

14.13.1.4 NVIDIA Corporation

14.13.1.5 Maxim Integrated

14.13.2 EUROPE

14.13.2.1 AImotive

14.13.2.2 Arm Holdings

14.13.2.3 Autoliv

14.13.2.4 Elektrobit

14.13.3 ASIA PACIFIC

14.13.3.1 Aisin Seiki Co. Ltd.

14.13.3.2 Mitsubishi Electric Corporation

14.13.3.3 Panasonic

14.13.3.4 Hitachi

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 174)

15.1 NORTH AMERICA WILL BE THE MAJOR COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET

15.2 HIGH FREQUENCY RADAR IS KEY FOR MARKET IN COMING YEARS

15.3 CONCLUSION

16 APPENDIX (Page No. - 175)

16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

LIST OF TABLES (136 Tables)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET

TABLE 2 COMPARISON OF WAVE-BASED RADAR, IMAGE-BASED CAMERA, AND LIGHT-BASED LIDAR SENSING TECHNOLOGIES

TABLE 3 COMMERCIAL VEHICLE RADAR MARKET (MOST LIKELY), BY REGION, 2020–2027 (USD MILLION)

TABLE 4 COMMERCIAL VEHICLE RADAR MARKET (OPTIMISTIC), BY REGION, 2020–2027 (USD MILLION)

TABLE 5 COMMERCIAL VEHICLE RADAR MARKET (PESSIMISTIC), BY REGION, 2020–2027 (USD MILLION)

TABLE 6 OEM ANNOUNCEMENTS

TABLE 7 TIER I MANUFACTURERS ANNOUNCEMENTS

TABLE 8 COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 9 COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 10 MONO VS STEREO CAMERA ADAS SYSTEM

TABLE 11 COMPARISON OF S&MRR AND LRR

TABLE 12 MONO CAMERA: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 13 MONO CAMERA: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 14 STEREO CAMERA: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 15 STEREO CAMERA: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 16 LONG RANGE RADAR: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 17 LONG RANGE RADAR: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 18 SHORT & MEDIUM RANGE RADAR: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 19 SHORT & MEDIUM RANGE RADAR: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 20 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 21 MARKET, BY VEHICLE TYPE, 2018–2027 (USD MILLION)

TABLE 22 COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 23 COMMERCIAL VEHICLE: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 24 COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 25 BUSES: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 26 MEDIUM & HEAVY TRUCKS: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 27 PICKUP TRUCKS & VANS: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 28 OFF-HIGHWAY VEHICLES: OFF-HIGHWAY VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 29 OFF-HIGHWAY VEHICLES: OFF-HIGHWAY VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 30 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 31 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 32 MINING EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 33 MINING EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 34 AGRICULTURE EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 35 AGRICULTURE EQUIPMENT: OFF-HIGHWAY RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 36 COMMERCIAL VEHICLE RADAR MARKET, BY FREQUENCY, 2018–2027 (THOUSAND UNITS)

TABLE 37 COMMERCIAL VEHICLE RADAR MARKET, BY FREQUENCY, 2018–2027 (USD MILLION)

TABLE 38 AUTOMOTIVE RADAR FREQUENCY BAND

TABLE 39 24 GHZ: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 40 24 GHZ: MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 41 ADAS FEATURE SPECIFICATIONS USING 77 GHZ

TABLE 42 77–81 GHZ: COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 43 77–81 GHZ: MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 44 CRASH REDUCTION THROUGH APPLICATION OF ADAS SYSTEMS

TABLE 45 COMMERCIAL VEHICLE RADAR MARKET, BY APPLICATION, 2018–2027 (THOUSAND UNITS)

TABLE 46 COMMERCIAL VEHICLE RADAR MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 47 LARGE TRUCK CRASHES BY ROAD TYPE IN 2018, US

TABLE 48 ADAPTIVE CRUISE CONTROL (ACC): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 49 ADAPTIVE CRUISE CONTROL (ACC): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 50 BLIND SPOT DETECTION (BSD): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 51 BLIND SPOT DETECTION (BSD): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 52 FORWARD COLLISION WARNING (FCW): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 53 FORWARD COLLISION WARNING (FCW): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 54 INTELLIGENT PARK ASSIST (IPA): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 55 INTELLIGENT PARK ASSIST (IPA): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 56 AUTOMATIC EMERGENCY BRAKING (AEB): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 57 AUTOMATIC EMERGENCY BRAKING (AEB): COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 58 COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 59 COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 60 EUROPE: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 61 EUROPE: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 62 GERMANY: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 63 GERMANY: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 64 GERMANY: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 65 ITALY: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 66 ITALY: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 67 ITALY: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 68 UK: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 69 UK: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 70 UK: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 71 SPAIN: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 72 SPAIN: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 73 SPAIN: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 74 FRANCE: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 75 FRANCE: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 76 FRANCE: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 78 NORTH AMERICA: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 79 US: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 80 US: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 81 US: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 82 CANADA: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 83 CANADA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 84 CANADA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 85 MEXICO: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 86 MEXICO: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 87 MEXICO: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 89 ASIA PACIFIC: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 90 CHINA: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 91 CHINA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 92 CHINA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 93 JAPAN: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 94 JAPAN: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 95 JAPAN: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 96 INDIA: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 97 INDIA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 98 INDIA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 99 SOUTH KOREA: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 100 SOUTH KOREA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 101 SOUTH KOREA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 102 ROW: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 103 ROW: COMMERCIAL VEHICLE RADAR MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 104 BRAZIL: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 105 BRAZIL: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 106 BRAZIL: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 107 RUSSIA: COMMERCIAL VEHICLE SALES DATA IN UNITS

TABLE 108 RUSSIA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (THOUSAND UNITS)

TABLE 109 RUSSIA: COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2018–2027 (USD MILLION)

TABLE 110 NEW PRODUCT DEVELOPMENT, 2018–2019

TABLE 111 ACQUISITIONS, 2017–2019

TABLE 112 JOINT VENTURE/PARTNERSHIP, 2018–2019

TABLE 113 EXPANSION, 2018–2019

TABLE 114 MOBILITY SOLUTIONS REVENUE SHARE OVER THE YEARS

TABLE 115 CONTINENTAL AG: PRODUCT OFFERINGS

TABLE 116 CHASSIS & SAFETY REVENUE SHARE OVER THE YEARS

TABLE 117 APTIV: PRODUCT OFFERINGS

TABLE 118 APTIV: ADVANCED SAFETY AND USER EXPERIENCE REVENUE SHARE OVER THE YEARS

TABLE 119 DENSO CORPORATION: PRODUCT OFFERINGS

TABLE 120 DENSO CORPORATION: MOBILITY SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 121 INFINEON TECHNOLOGIES AG: PRODUCT OFFERINGS

TABLE 122 INFINEON TECHNOLOGIES AG: MOBILITY SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 123 NXP SEMICONDUCTORS N.V.: PRODUCT OFFERINGS

TABLE 124 NXP SEMICONDUCTORS N.V.: MOBILITY SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 125 ANALOG DEVICES, INC..: PRODUCT OFFERINGS

TABLE 126 ANALOG DEVICES, INC.: MOBILITY SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 127 HELLA KGAA HUECK & CO: PRODUCT OFFERINGS

TABLE 128 HELLA KGAA HUECK & CO: MOBILITY SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 129 VALEO: PRODUCT OFFERINGS

TABLE 130 VALEO: COMFORT & DRIVING ASSISTANCE SYSTEMS REVENUE SHARE OVER THE YEARS

TABLE 131 TEXAS INSTRUMENTS INCORPORATED: PRODUCT OFFERINGS

TABLE 132 TEXAS INSTRUMENTS INCORPORATED: EMBEDDED PROCESSING REVENUE SHARE OVER THE YEARS

TABLE 133 ZF FRIEDRICHSHAFEN AG: PRODUCT OFFERINGS

TABLE 134 ZF FRIEDRICHSHAFEN AG: ACTIVE & PASSIVE SAFETY TECHNOLOGY REVENUE SHARE OVER THE YEARS

TABLE 135 MAGNA INTERNATIONAL INC.: PRODUCT OFFERINGS

TABLE 136 MAGNA INTERNATIONAL INC.: POWER & VISION REVENUE SHARE OVER THE YEARS

LIST OF FIGURES (52 Figures)

FIGURE 1 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET: MARKET SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 DATA TRIANGULATION

FIGURE 6 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR: MARKET OUTLOOK

FIGURE 7 REVENUE SHIFT DUE TO ADVANCED TECHNOLOGIES DRIVING THE RADAR MARKET GROWTH

FIGURE 8 COMMERCIAL VEHICLE RADAR MARKET, BY APPLICATION, 2020 VS. 2027 (USD MILLION)

FIGURE 9 COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2020 VS. 2027 (USD MILLION)

FIGURE 10 INCREASING DEMAND FOR EFFICIENT SAFETY SYSTEMS IS LIKELY TO BOOST GROWTH

FIGURE 11 COMMERCIAL VEHICLE RADAR MARKET SHARE, BY REGION, 2020 (USD MILLION)

FIGURE 12 COMMERCIAL VEHICLE AND 77–81 GHZ ACCOUNT FOR THE LARGEST SHARES OF THE COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET IN 2020 (USD MILLION)

FIGURE 13 LONG RANGE RADAR IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (USD MILLION)

FIGURE 14 AEB IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (USD MILLION)

FIGURE 15 COMMERCIAL VEHICLE IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (USD MILLION)

FIGURE 16 77–81 GHZ RADAR IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (USD MILLION)

FIGURE 17 MARKET : MARKET DYNAMICS

FIGURE 18 VALUE CHAIN ANALYSIS OF MARKET

FIGURE 19 VOLKSWAGEN GROUP PERFORMANCE IN CHINA DURING JAN–FEB 2020

FIGURE 20 PASSENGER CAR SALES AND PRODUCTION IN CHINA

FIGURE 21 COMMERCIAL VEHICLE SALES AND PRODUCTION IN CHINA

FIGURE 22 COMMERCIAL VEHICLE RADAR MARKET, BY COMPONENT, 2020 VS. 2027

FIGURE 23 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET, BY VEHICLE TYPE, 2020 VS. 2027

FIGURE 24 COMMERCIAL VEHICLE RADAR MARKET, BY FREQUENCY, 2020 VS. 2027

FIGURE 25 COMMERCIAL VEHICLE RADAR MARKET, BY APPLICATION, 2020 VS. 2027

FIGURE 26 COMMERCIAL VEHICLE RADAR MARKET, BY REGION, 2020 VS. 2027

FIGURE 27 EUROPE: COMMERCIAL VEHICLE RADAR MARKET SNAPSHOT

FIGURE 28 NORTH AMERICA: COMMERCIAL VEHICLE RADAR MARKET SNAPSHOT

FIGURE 29 ASIA PACIFIC: COMMERCIAL VEHICLE RADAR MARKET SNAPSHOT

FIGURE 30 ROW: COMMERCIAL VEHICLE RADAR MARKET SNAPSHOT

FIGURE 31 MARKET: MARKET RANKING ANALYSIS

FIGURE 32 COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COMMERCIAL VEHICLE & OFF-HIGHWAY RADAR MARKET

FIGURE 35 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2016–2019

FIGURE 36 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

FIGURE 37 ROBERT BOSCH GMBH: SWOT ANALYSIS

FIGURE 38 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 39 CONTINENTAL AG: SWOT ANALYSIS

FIGURE 40 APTIV: COMPANY SNAPSHOT

FIGURE 41 APTIV: SWOT ANALYSIS

FIGURE 42 DENSO CORPORATION: COMPANY SNAPSHOT

FIGURE 43 DENSO CORPORATION: SWOT ANALYSIS

FIGURE 44 INFINEON TECHN0LOGIES AG: COMPANY SNAPSHOT

FIGURE 45 INFINEON TECHNOLOGIES AG: SWOT ANALYSIS

FIGURE 46 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

FIGURE 47 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

FIGURE 48 HELLA KGAA HUECK & CO: COMPANY SNAPSHOT

FIGURE 49 VALEO: COMPANY SNAPSHOT

FIGURE 50 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FIGURE 51 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

FIGURE 52 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

The study involves four main activities to estimate the current size of the commercial vehicle & off-highway radar market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size of different segments considered in this study. After that, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, commercial vehicle & off-highway radar-related journals; certified publications; articles from recognized authors; directories; and databases among others. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the commercial vehicle & off-highway radar market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (Radar technology providers) across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 30% and 70% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this repor

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the commercial vehicle & off-highway radar market. The market size, by vehicle type, in terms of volume and value, is derived by applying the penetration of vehicles equipped with radar technology in the total sales of commercial and off-highway vehicles in a country. This gives the volume of market by country. Further, the summation of all countries leads to the regional-level market in terms of size. Then multiplying the ASP of the radar technology on the country level with the volume market gives the country-level market by value.

The top-down methodology has been followed for market by component and frequency. For deriving the market of commercial vehicle and off-highway radar, by the element, in terms of volume and value, the total volume of market is multiplied with the penetration percentage of component (long-range radar and short-range radar at regional level). This gives the market by component in terms of volume. A similar approach has been used for calculating the market by frequency.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To segment and forecast the Commercial Vehicle and Off-Highway Radar market size, in terms of value (USD million) and volume (thousand units)

- To define, describe, and forecast the commercial vehicle & off-highway radar market based on application, frequency, component, vehicle, and region.

- To segment and forecast the market size based on application (Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System, Intelligent Park Assist, and Autonomous Emergency Braking (AEB))

- To segment and forecast the market size based on frequency (24-GHz, and 77-81 GHz )

- To segment and forecast the market size based on component type (Long Range Radar (LRR), Short & Medium Range Radar (S&MRR), Mono Camera, and Stereo Camera)

- To segment and forecast the market size based on vehicle type (Commercial Vehicle, and Off-Highway Vehicle)

- To predict the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Commercial Vehicle Radar Market, By Application at country level (For countries covered in the report)

- Commercial Vehicle Radar Market, By Frequency at country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Commercial Vehicle & Off-Highway Radar Market