Dyes & Pigments Market by Type (Dyes (Reactive, Disperse, Vat, Acid), Pigments (Titanium Dioxide, Inorganic, Organic)), Application (Textile, Leather, Paper, Paints & Coatings, Plastics, Construction) - Global Forecast to 2021

The dyes & pigments market is projected to reach 42.00 billion by 2021, at a CAGR of 5.0%. Dyes and pigments are colorants or substances that impart color to textiles, plastics, concrete, and paper. Dye is a soluble substance that has affinity to substances on which it is applied. Dyes can be classified as acid dyes, vat dyes, direct dyes, and basic dyes. Pigments are water and oil insoluble colorants that impart color to substances such as paper, plastics, paints, and concrete. In this report, 2015 is considered as the base year and the forecast period is from 2016 to 2021.

Dyes & Pigments Market Dynamics

Drivers

- Increase in per capita consumption of dyes & pigments in emerging economies

- Increasing demand from end-use industries

- High demand for HPP pigments

Restraints

- Volatile raw material prices

- Stringent environmental regulations

Opportunities

- Technological advancemnets in the market

Increasing demand from end-use industries

Dyes & pigments have many applications ranging from paints & coatings, textile construction, and printing inks to plastics. Growth in the dyes & pigments market is partly driven by a turnaround in these key industries and their increasing need in these applications. The paints & coatings industry is growing significantly because of rising infrastructure. Asia-Pacific is expected to be a major market for paints & coatings due to increasing population and infrastructure projects. Thus, dyes & pigments companies can gain profit margin by providing various types of dyes to cater the growth in the Asia-Pacific paints industry, thus increasing their revenue and market position.

The Objectives of Dyes & Pigments Market Study are:

- To define, describe, and analyze the global dyes & pigments market by type, application, and region

- To forecast and analyze the market size (in terms of value and volume) and different submarkets of five regions—Asia-Pacific, Europe, North America, South America and the Middle East & Africa

- To forecast and analyze the market at the country level for each region

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the global dye & pigment market

- To analyze opportunities in the market for the stakeholders by identifying high growth segments of the global dyes & pigments market

- To identify significant market trends and factors driving or inhibiting the growth of the market and its submarkets

- To analyze competitive developments, such as expansions, joint ventures, new products launches, and acquisitions, in the global dyes & pigments market

- To strategically profile the key market players and comprehensively analyze their growth strategies

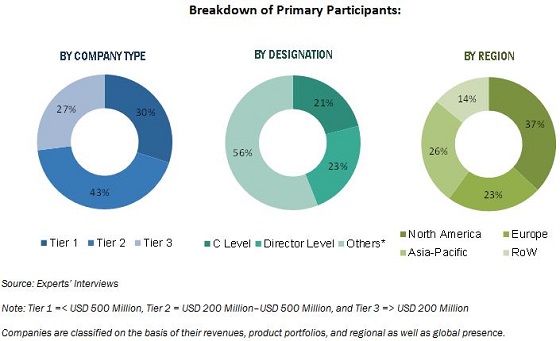

This technical, market oriented, and commercial research study of the global dyes & pigments market involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information. The primary sources mainly include several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industry’s supply chain. After arriving at the overall market size, the total market has been split into several segments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study:

To know about the assumptions considered for the study, download the pdf brochure

Raw material suppliers are the first stage of the value chain for dyes product. Different types of raw materials and technologies are used for the production of dyes including crude oil. Intermediates are derived from the reaction between aromatic hydrocarbon (obtained from crude oil distillation) and other chemicals. The final product obtained from the intermediates in the form of granules known as dyes. In case of pigments, some of the major raw materials used for producing pigments include illite, hematite, natural gas, and zincite. Pigments are obtained from their raw materials via a series of metallurgical or chemical processes. Some of the key manufacturers of pigments include BASF SE (Germany), E. I. du Pont de Nemours and Company (U.S.), Tronox Limited (U.S.). The manufactured pigments are used by the paint, ink, paper, and textile industries in conjugation with binders.

Major Dyes & Pigments Market Developments

- In September 2016, Eckart launched its new pigment portfolio and a new “illoom” concept at the packaging innovations exhibitions in London, held in September 2016. The new products — TOPSTAR 06 3000 Brilliant Silver and LUXAN & SYMIC synthetic mica were launched for printing and arts applications. illoom provides designers opportunities to enhance their designs and sketches.

- In September 2016, Huntsman launched a new titanium dioxide pigment, HOMBITAN AFDC 101. This new pigment can be used alone or in combination with other color pigments. It is mainly used in cosmetics applications and provides better opacity to the products.

- In August 2016 HEUBACH GmbH expanded its inorganic pigments production capacity at its existing site in Germany. This expansion helped the company meet the increasing customer requirements.

The target audiences for the dyes & pigments market report are as follows:

- Dyes & pigments manufacturers

- Dyes & pigments suppliers

- Raw material suppliers

- Investment banks

- Government bodies

Dyes & Pigments Market Report Scope

This report categorizes the global market for dyes & pigments on the basis of type, application, and region.

Dyes & Pigments market, by type:

Dyes, by type-

- Reactive dyes

- Disperse dyes

- VAT dyes

- Direct dyes

- Acid dyes

- Others

Pigments, by type-

- Titanium dioxide

- Inorganic pigments

- Organic pigments

Dyes & Pigments market, by application:

- Textile

- Paints & coatings

- Plastics

- Leather

- Paper

- Construction

- Printing ink

- Others

Dyes & Pigments market, by region:

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

Critical questions which the report answers

- What new product dyes & pigments manufacturing companies are exploring?

- Which are the key players in the market and how intense is the competition?

Dyes & Pigments Market Report Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Dyes & Pigments Market Regional Analysis

- Further breakdown of a region with respect to a particular country, additional application, and/or type

Dyes & Pigments Market Country Information

- Additional country information (up to three)

Dyes & Pigments Market Company Information

- Detailed analysis and profiles of additional market players (up to five)

The global dyes & pigments market was USD 32.86 billion in 2016, and is projected to reach USD 42.00 billion by 2021, at a CAGR of 5.0% during the forecast period. Increase in per capita consumption of dyes & pigments in emerging economies and increasing demand from end-use industry is expected drive the market during the forecast period.

Dyes and pigments impart color to the substance by reflecting light of a particular wavelength. The shade of a color depends on the amount of light reflected/scattered. Hence, a substance reflecting more light appears to be darker. However, in case of pigments, light scattering also depends on the particle size and refractive index of pigments and its binders. Reactive dyes are commonly used for dyeing cellulosic fibers. The dye & pigment market is mainly driven by increasing demand from the end-use industries. High demand for high-performance pigments (HPPs) is also contributing to the growth of the market.

The global dyes market is classified on the basis of type, namely, reactive dyes, disperse dyes, VAT dyes, direct dyes, acid dyes, and others. Reactive dyes is expected to lead the global dyes market during the forecast period, followed by disperse dyes. Reactive dyes lead the market due to its growing use in the textile application. The market for acid dyes is expected to witness the highest CAGR from 2016 to 2021. On the other hand, global pigments market is classified on the basis of type, namely, titanium dioxide, inorganic pigments, and organic pigments. Titanium dioxide is expected to lead the global pigments market during the forecast period, followed by inorganic pigments. The growth is mainly due to capacity expansion and growing demand from emerging economies such as Brazil, China, and India.

The global dyes & pigments market is segmented on the basis of region, namely, Asia-Pacific, Europe, North America, Middle East & Africa, and South America. Currently, the Asia-Pacific region is the largest market for dyes & pigments. The increasing population coupled with rising disposable income in the region is expected to drive the increasing demand for dyes & pigments. South America is projected to be the second-fastest growing market from 2016 to 2021. This growth is attributed to the rapidly growing textile sector in the region.

Rising consumer spending drives dyes market in textile application

Textile

The textile industry is evolving; therefore, dyes used for textile applications are also undergoing changes to meet the rapidly changing demand from the fashion industry. For example, polyesters are a major consumer of disperse dyes. Cotton fabrics are more in demand during the summers, which increases the demand for vat, reactive, and direct dyes.

Construction and coatings applications to drive the growth of dyes & pigments market

Construction

In construction application, pigments are used in pavers, concrete masonry, floor tile, roof tile, pipe & panels, bridges, and precast walls. Inorganic pigments provide heat stability, chemical inertness, and weather & light fastness properties for construction material applications. Pigments used in construction application increase the durability of buildings and conserves wooden materials.

Paints & Coatings

In coatings application, pigments are used in architectural and industrial coating. Pigments are used in this application to provide whiteness & tone, aesthetic appeal, opacity, and durable protection. In architectural coatings, pigments are used in paints, stains, lacquers, primers, and clear coats applications. In industrial coatings, they are used in automotive, coil, powder, and marine coatings.

Critical Questions the Dyes & Pigments Market Report Answers

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming product type of dyes and pigments?

The major factors restraining the growth of the global dyes & pigments market is environmental regulations. Rigid restrictions have been made imperative for industries that produce dyes and pigments.

Key Players in Dyes & Pigments Market Industry

Some of the key players in the global dyes & pigments market are BASF SE (Germany), Clariant AG (Switzerland), Atul Limited (India), Sudharshan Chemicals Industries Limited (India), DIC Corporation (Japan), Huntsman Corporation (U.S.), Kiri Industries Ltd. (India), Kronos Worldwide, Inc. (U.S.), Lanxess AG (Germany), Tronox Limited (U.S.) among others.

Frequently Asked Questions (FAQ):

What is the Dyes and Pigments Market growth?

Growth of Dyes and Pigments Market - At a CAGR of 5.0% between 2016 and 2021.

Who leading market players in Dyes and Pigments industry?

BASF SE (Germany), Clariant AG (Switzerland), Atul Limited (India), Sudharshan Chemical Industries Limited (India), DIC Corporation (Japan), Huntsman Corporation (U.S.), Kiri Industries Ltd. (India), Kronos Worldwide, Inc. (U.S.), Lanxess AG (Germany), Tronox Limited (U.S.), among others are the key players operating in the global dyes & pigments market.

How big is the Dyes and Pigments Market?

The global Dyes and Pigments Market is projected to reach USD 42.00 Billion by 2021.

Which segments are covered in Dyes and Pigments Market report?

By Type (Dyes (Reactive, Disperse, Vat, Acid), Pigments (Titanium Dioxide, Inorganic, Organic)) & Application (Textile, Leather, Paper, Paints & Coatings, Plastics, Construction).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stake Holders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in Dyes & Pigments Market (2016–2021)

4.2 Pigments Market to Register A High CAGR

4.3 Dyes Market in Asia-Pacific, By Country and Application

4.4 Dyes & Pigments Market Attractiveness, 2016–2021

4.5 Dyes Market Size, By Application, 2016 vs 2021

5 Market Overview (Page No. - 37)

5.1 Introduction

5.1.1 Overview of Dyes Industry

5.1.1.1 Importance of Product Innovation & R&D

5.1.1.2 Increasing Focus on Technical Services

5.1.1.3 Increasing Environmental Regulations

5.1.1.4 Shifting of Manufacturing Facilities to Developing Countries

5.1.1.5 Conclusion

5.1.2 Overview of Pigments Industry

5.1.2.1 New Technologies

5.1.2.2 Environmental Concerns

5.1.2.3 Initiatives for Developing Environment-Friendly Processes and Products

5.1.2.4 Conclusion

5.2 Market Segmentation

5.2.1 Dyes Market, By Type

5.2.2 Dyes Market, By Application

5.2.3 Pigments Market, By Type

5.2.4 Pigments Market, By Application

5.3 Market Dynamics

5.3.1 Impact Analysis for Short, Medium, and Long Term

5.3.2 Drivers

5.3.2.1 Increase in Per Capita Consumption of Dyes & Pigments in Emerging Economies

5.3.2.2 Increasing Demand From End-Use Industries

5.3.2.3 High Demand for Hpp

5.3.3 Restraints

5.3.3.1 Environmental Regulations

5.3.3.1.1 Environmental Considerations

5.3.3.2 Volatile Raw Material Prices

5.3.3.2.1 Pigments

5.3.3.2.2 Dyes

5.3.4 Opportunities

5.3.4.1 Technological Advancements

5.3.5 Challenges

5.3.5.1 Global Overcapacity of Dyestuffs

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Dyes

6.2.1.1 Raw Material Suppliers

6.2.1.2 Intermediates

6.2.1.3 Dye Products

6.2.1.4 Applications

6.2.2 Pigments

6.2.2.1 Raw Materials

6.2.2.2 Manufacturers

6.2.2.3 Application & End-Use

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Dyes & Pigments Market, By Type (Page No. - 55)

7.1 Introduction

7.1.1 Difference Between Dyes and Pigments

7.1.2 Pigments Hold A Major Share in the Overall Market

7.2 Dyes

7.2.1 Acid Dyes to Be the Fastest-Growing Segment in Dyes Market

7.2.2 Reactive Dyes

7.2.2.1 India is the Major Exporter of Reactive Dyes

7.2.2.2 China is the Major Importer of Reactive Dyes

7.2.3 Disperse Dyes

7.2.3.1 China is the Largest Exporter of Disperse Dyes

7.2.3.2 Germany is the Largest Importer of Disperse Dyes

7.2.4 Vat Dyes

7.2.5 Direct Dyes

7.2.5.1 India is the Largest Exporter of Direct Dyes

7.2.5.2 Germany is the Major Importer of Direct Dyes

7.2.6 Acid Dyes

7.2.6.1 India Was the Largest Exporter of Acid Dyes

7.2.6.2 China Overtook Italy in Import of Acid Dyes

7.2.7 Other Dyes

7.2.7.1 Sulfur Dyes

7.2.7.2 Basic Dyes

7.2.7.3 Solvent Dyes

7.3 Pigments

7.3.1 Better Tinting Strength Offered By Organic Pigmnets

7.3.2 Titanium Dioxide Accounts for the Maximum Share in Pigments Market

7.3.3 Organic Pigments

7.3.3.1 Natural Organic Pigments

7.3.3.2 Synthetic Organic Pigments

7.3.3.2.1 Azo Pigments

7.3.3.2.2 Phthalocyanine Pigments

7.3.3.2.3 High-Performance Pigments

7.3.4 Inorganic Pigments

7.3.5 Consistent Properties and Tinting Strength Drive Synthetic Iron Oxide Pigments

7.3.5.1 Iron Oxide Pigments

7.3.5.1.1 Natural Iron Oxide Pigments

7.3.5.1.2 Synthetic Iron Oxide Pigments

7.3.5.1.2.1 Carbon Black Pigments

7.3.5.1.2.2 Chromium Oxide Pigments

7.3.5.1.2.3 Cadmium Pigments

7.3.6 Titanium Dioxide

7.3.7 Chloride Process is More Prefered Over Sulfate Process

7.3.7.1 Chloride Process

7.3.7.2 Sulfate Process

8 Dyes & Pigments Market, By Application (Page No. - 76)

8.1 Introduction

8.2 Dyes

8.2.1 Rising Consumer Spending Drives Dyes Market in Textile Application

8.2.2 Revenue Pocket Matrix, By Application for Dyes

8.2.3 Textile

8.2.4 Leather

8.2.5 Paper

8.2.6 Paints

8.2.7 Plastics

8.2.8 Others

8.3 Pigments

8.3.1 Organic Pigment, By Application

8.3.2 Inorganic Pigment, By Application

8.3.2.1 Synthetic Iron Oxide Pigment, By Application

8.3.3 Titanium Dioxide Pigment, By Application

8.3.3.1 Nano Titanium Dioxide Pigment, By Application

8.3.4 Applications of Organic and Inorganic Pigments

8.3.4.1 Paints & Coatings

8.3.4.2 Plastics

8.3.4.3 Paper

8.3.4.4 Printing Ink

8.3.4.5 Construction

8.3.4.6 Others

9 Dyes & Pigments Market, By Region (Page No. - 87)

9.1 Introduction

9.1.1 Asia-Pacific to Drive Dyes Market

9.1.2 Asia-Pacific is One of the Key Markets for Pigment

9.2 Asia-Pacific

9.2.1 Asia-Pacific Dyes Market, By Type

9.2.2 Asia-Pacific Dyes Market, By Application

9.2.3 Asia-Pacific Dyes Market, By Country

9.2.4 Asia-Pacific Pigments Market, By Type

9.2.5 Asia-Pacific Pigments Market, By Country

9.2.5.1 China

9.2.5.2 India

9.2.5.3 Japan

9.2.5.4 South Korea

9.2.5.5 Indonesia

9.2.5.6 Vietnam

9.2.5.7 Thailand

9.3 Europe

9.3.1 European Dyes Market, By Type

9.3.2 European Dyes Market, By Application

9.3.3 European Dyes Market, By Country

9.3.4 European Pigments Market, By Type

9.3.5 European Pigments Market, By Country

9.3.5.1 Germany

9.3.5.2 France

9.3.5.3 U.K.

9.3.5.4 Italy

9.3.5.5 Spain

9.3.5.6 Russia

9.4 North America

9.4.1 North American Dyes Market, By Type

9.4.2 North American Dyes Market, By Application

9.4.3 North American Dyes Market, By Country

9.4.4 North American Pigments Market, By Type

9.4.5 North American Pigments Market, By Country

9.4.5.1 U.S.

9.4.5.2 Mexico

9.4.5.3 Canada

9.5 South America

9.5.1 South American Dyes Market, By Type

9.5.2 South American Dyes Market, By Application

9.5.3 South American Dyes Market, By Country

9.5.4 South American Pigments Market, By Type

9.5.5 South American Pigments Market, By Country

9.5.5.1 Brazil

9.5.5.2 Argentina

9.5.5.3 Chile

9.6 Middle East & Africa

9.6.1 Middle East & Africa Dyes Market, By Type

9.6.2 Middle East & Africa Dyes Market, By Application

9.6.3 Middle East & Africa Dyes Market, By Country

9.6.4 Middle East & Africa Pigments Market, By Type

9.6.5 Middle East & Africa Pigments Market, By Country

9.6.5.1 Saudi Arabia

9.6.5.2 UAE

9.6.5.3 Egypt

9.6.5.4 Iran

9.6.5.5 South Africa

10 Competitive Landscape (Page No. - 139)

10.1 Overview

10.2 Market Share of Major Players

10.2.1 Dyes Market

10.2.1.1 Dystar Singapore Pte Ltd.

10.2.1.2 Huntsman Corporation

10.2.2 Titanium Dioxide Pigments Market

10.2.2.1 E. I. Du Pont De Nemours & Co.

10.2.3 Dyes & Organic Pigments Market

10.2.3.1 BASF SE

10.3 Competitive Benchmarking

10.4 Competitive Situations and Trends

10.4.1 New Product Launches

10.4.2 Expansions

10.4.3 Mergers & Acquisitions

10.4.4 Contracts & Agreements

11 Company Profiles (Page No. - 153)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 DIC Corporation

11.3 Clariant AG

11.4 Sudarshan Chemical Industries Limited

11.5 Huntsman Coporation

11.6 Atul Ltd.

11.7 Cabot Corp.

11.8 E.I. Dupont De Nemours & Co.

11.9 Kiri Industries Ltd.

11.10 Kronos Worldwide, Inc.

11.11 Lanxess AG

11.12 National Industrialization Co. (Tasnee)

11.13 Tronox Limited

11.14 CPS Color AG

11.15 Eckart GmbH

11.16 Flint Group

11.17 Heubach GmbH

11.18 The Shepherd Color Company

11.19 Tinting Systems Company

11.20 Zhejiang Longsheng Group Co. Ltd.

11.21 Other Key Market Players

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 197)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (107 Tables)

Table 1 India: Specialty Chemical Industry Market Revenue, 2015 (USD Million)

Table 2 Dyes and Their Applications

Table 3 Raw Materials and Corresponding Pigments

Table 4 Dyes & Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 5 Dye & Pigment Market Size, By Type, 2014–2021 (USD Million)

Table 6 Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 7 Dyes Market Size, By Type, 2014–2021 (USD Million)

Table 8 Reactive Dyes: Exports By Country, 2013–2015 (USD Million)

Table 9 Reactive Dyes: Imports By Country, 2013–2015 (USD Million)

Table 10 Disperse Dyes: Exports By Country, 2013–2015 (USD Million)

Table 11 Disperse Dyes: Imports By Country, 2013–2015 (USD Million)

Table 12 Direct Dyes: Exports By Country, 2013–2015 (USD Million)

Table 13 Direct Dyes: Imports By Country, 2013–2015 (USD Million)

Table 14 Acid Dyes: Exports By Country, 2013–2015 (USD Million)

Table 15 Acid Dyes: Imports By Country, 2013–2015 (USD Million)

Table 16 Difference Between Organic and Inorganic Pigments

Table 17 Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 18 Pigments Market Size, By Type, 2014–2021 (USD Million)

Table 19 Organic Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 20 Inorganic Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 21 Synthetic Iron Oxide Pigments Market Size, By Colors, 2014–2021 (Kiloton)

Table 22 Titanium Dioxide Pigments Market Size, By Production Process, 2014–2021 (Kiloton)

Table 23 Dyes Market Size, By Application, 2014–2021 (Kiloton)

Table 24 Organic Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 25 Inorganic Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 26 Synthetic Iron Oxide Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 27 Titanium Dioxide Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 28 Nano Titanium Dioxide Pigments Market Size, By Application, 2014–2021 (Kiloton)

Table 29 Dyes & Pigments Market Size, By Region, 2014–2021 (Kiloton)

Table 30 Dye & Pigment Market Size, By Region, 2014–2021 (USD Million)

Table 31 Dyes Market Size, By Region, 2014–2021 (Kiloton)

Table 32 Dye Market Size, By Region, 2014–2021 (USD Million)

Table 33 Pigments Market Size, By Region, 2014–2021 (Kiloton)

Table 34 Pigments Market Size, By Region, 2014–2021 (USD Million)

Table 35 Asia-Pacific: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 36 Asia-Pacific: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 37 Asia-Pacific: Dyes Market Size, By Country, 2014–2021 (Kiloton)

Table 38 Asia-Pacific: Dye Market Size, By Country, 2014–2021 (USD Million)

Table 39 Asia-Pacific: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 40 Asia-Pacific: Pigment Market Size, By Country, 2014–2021 (Kiloton)

Table 41 Asia-Pacific: Pigments Market Size, By Country, 2014–2021 (USD Million)

Table 42 China: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 43 China: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 44 China: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 45 India: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 46 India: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 47 India: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 48 Europe: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 49 Europe: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 50 Europe: Dyes Market Size, By Country, 2014–2021 (Kiloton)

Table 51 Europe: Dye Market Size, By Country, 2014–2021 (USD Million)

Table 52 Europe: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 53 Europe: Pigment Market Size, By Country, 2014–2021 (Kiloton)

Table 54 Europe: Pigments Market Size, By Country, 2014–2021 (USD Million)

Table 55 Germany: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 56 Germany: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 57 Germany: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 58 France: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 59 France: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 60 France: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 61 North America: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 62 North America: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 63 North America: Dyes Market Size, By Country, 2014–2021 (Kiloton)

Table 64 North America: Dye Market Size, By Country, 2014–2021 (USD Million)

Table 65 North America: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 66 North America: Pigment Market Size, By Country, 2014–2021 (Kiloton)

Table 67 North America: Pigments Market Size, By Country, 2014–2021 (USD Million)

Table 68 U.S.: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 69 U.S.: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 70 U.S.: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 71 Mexico: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 72 Mexico: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 73 Mexico: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 74 Canada: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 75 Canada: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 76 Canada: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 77 South America: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 78 South America: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 79 South America: Dyes Market Size, By Country, 2014–2021 (Kiloton)

Table 80 South America: Dye Market Size, By Country, 2014–2021 (USD Million)

Table 81 South America: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 82 South America: Pigment Market Size, By Country, 2014–2021 (Kiloton)

Table 83 South America: Pigments Market Size, By Country, 2014–2021 (USD Million)

Table 84 Brazil: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 85 Brazil: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 86 Brazil: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 87 Argentina: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 88 Argentina: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 89 Argentina: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 90 Middle East & Africa: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 91 Middle East & Africa: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 92 Middle East & Africa: Dyes Market Size, By Country, 2014–2021 (Kiloton)

Table 93 Middle East & Africa: Dye Market Size, By Country, 2014–2021 (USD Million)

Table 94 Middle East & Africa: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 95 Middle East & Africa: Pigment Market Size, By Country, 2014–2021 (Kiloton)

Table 96 Middle East & Africa: Pigments Market Size, By Country, 2014–2021 (USD Million)

Table 97 Saudi Arabia: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 98 Saudi Arabia: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 99 Saudi Arabia: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 100 UAE: Dyes Market Size, By Type, 2014–2021 (Kiloton)

Table 101 UAE: Dye Market Size, By Application, 2014–2021 (Kiloton)

Table 102 UAE: Pigments Market Size, By Type, 2014–2021 (Kiloton)

Table 103 Major Dyes & Pigments Producers

Table 104 New Product Launches, 2012–2016

Table 105 Expansions, 2012–2016

Table 106 Mergers & Acquisitions, 2011–2014

Table 107 Contracts & Agreements, 2012–2016

List of Figures (67 Figures)

Figure 1 Dyes & Pigments: Market Segmentation

Figure 2 Dye & Pigment Market, Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Dyes & Pigments Market: Data Triangulation

Figure 6 Reactive Dyes to Dominate the Dyes Market Between 2016 and 2021

Figure 7 Titanium Dioxide to Dominate the Pigments Market Between 2016 and 2021

Figure 8 Asia-Pacific to Register the Highest CAGR in Dyes & Pigments Market, 2016–2021

Figure 9 Dyes & Pigments Market to Register High Growth Between 2016 and 2021

Figure 10 Asia-Pacific to Be the Key Market for Pigments Between 2016 and 2021

Figure 11 Asia-Pacific Dyes Market: Textile Application Accounted for the Largest Share in 2015

Figure 12 Asia-Pacific to Be the Fastest-Growing Market for Dyes & Pigments Between 2016 and 2021

Figure 13 Textile Application Accounts for the Largest Share in Dyes Market

Figure 14 Overview of Forces Governing Dyes & Pigments Market

Figure 15 Value Chain of Dyes Market

Figure 16 Value Chain of Pigments Market

Figure 17 Porter’s Five Forces Analysis

Figure 18 Reactive Dyes to Dominate the Dyes Market Between 2016 and 2021

Figure 19 Titanium Dioxide to Be the Largest Type in Pigments During the Forecast Period

Figure 20 Textile Application to Dominate Dyes Market Between 2016 and 2021

Figure 21 Textile: the Largest Application for Dyes

Figure 22 Dyes Market Size in Textile Application, 2014–2021

Figure 23 Dyes Market Size in Leather Application, 2014–2021

Figure 24 Dyes Market Size in Paper Application, 2014–2021

Figure 25 Dyes Market Size in Paints Application, 2014–2021

Figure 26 Dyes Market Size in Plastics Application, 2014–2021

Figure 27 Dyes Market Size in Other Applications, 2014–2021

Figure 28 Regional Snapshot: India Emerging as Strategic Location for Pigments Market

Figure 29 Asia-Pacific Market Snapshot: China to Dominate Dyes & Pigments Market

Figure 30 Japan Dyes & Pigments Market Size, 2014–2021

Figure 31 South Korea Dye & Pigment Market Size, 2014–2021

Figure 32 Indonesia Dyes & Pigments Market Size, 2014–2021

Figure 33 Vietnam Dye & Pigment Market Size, 2014–2021

Figure 34 Thailand Dyes & Pigments Market Size, 2014–2021

Figure 35 Europe Market Snapshot: Germany to Lead Dye & Pigment Market

Figure 36 U.K. Dyes & Pigments Market Size, 2014–2021

Figure 37 Italy Dye & Pigment Market Size, 2014–2021

Figure 38 Spain Dyes & Pigments Market Size, 2014–2021

Figure 39 Russia Dye & Pigment Market Size, 2014–2021

Figure 40 Snapshot of Dyes & Pigments Market in North America

Figure 41 Chile Dye & Pigment Market Size, 2014–2021

Figure 42 Egypt Dyes & Pigments Market Size, 2014–2021

Figure 43 Iran Dye & Pigment Market Size, 2014–2021

Figure 44 South Africa Dyes & Pigments Market Size, 2014–2021

Figure 45 New Product Launches Was the Most Preferred Growth Strategy Adopted By Major Players Between 2012 and 2016

Figure 46 Key Growth Strategies in Dye & Pigment Market, 2012–2016

Figure 47 Dystar: the Leading Player in Dyes Market in 2015

Figure 48 E. I. Du Pont De Nemours & Co. Accounted for the Largest Share in Titanium Dioxide Pigments Market

Figure 49 BASF SE is the Largest Player in Dyes & Organic Pigments Market

Figure 50 BASF SE: Company Snapshot

Figure 51 BASF SE: SWOT Analysis

Figure 52 DIC Corporation: Company Snapshot

Figure 53 DIC Coporation: SWOT Analysis

Figure 54 Clariant AG: Company Snapshot

Figure 55 Clariant AG: SWOT Analysis

Figure 56 Sudarshan Chemical Industries Limited: Company Snapshot

Figure 57 Sudarshan Chemical Industries Limited: SWOT Analysis

Figure 58 Huntsman Corporation: Company Snapshot

Figure 59 Huntsman Corporation: SWOT Analysis

Figure 60 Atul Ltd.: Company Snapshot

Figure 61 Cabot Corp.: Company Snapshot

Figure 62 E.I. Dupont De Nemours & Co.: Company Snapshot

Figure 63 Kiri Industries Ltd.: Company Snapshot

Figure 64 Kronos Worldwide, Inc.: Company Snapshot

Figure 65 Lanxess AG: Company Snapshot

Figure 66 National Industrialization Co. (Tasnee): Company Snapshot

Figure 67 Tronox Limited: Company Snapshot

Growth opportunities and latent adjacency in Dyes & Pigments Market

size of the market and growth of the dye industry. uses of the azo dyes, bans and effect on the environment.

Interested in global market of dyes and intermediate market

Information on dyes and pigments for publishing

Information on inorganic pigments market

potencial market of producing carminic acid in argentina. We are specially focus in sales forecast.

Dyes and pigments Global & Colombia Market

Data on Dyes market, in particular Acid,Direct,Reactive,Disperse,Vat, Basic dyes. and highly purified reactive dyes, (MCT types) for DTP ink production.

Specifc information on imports of leather acid dyes

information on global size of dyes and pigments, region, end use industries and Market size in India

Need information on dyes and pigments for yarn application

General information on global and European market of pigments by application area

Interested in dyestuff and intermediates data in export market

Global and german development of dyes industry, pigments and pigment dispersion.

Information on market dynamics and list of key manufacturers of waterproofing systems present in the market

Interested in water proofing systems and 1st level of connected markets

Interested in US market for Azo pigments such as production and US imports and sales

Looking for specific information on dyes and pigments market

Dyes and Pigments based on type and application, YoY forecast and India value chain analysis

General information on Dyes and Pigments Market

Need market study on Organic pigment and players production capacity

Report requirement for natural dyes