Cognitive Security Market by Component (Solutions & Services), Application (Threat Intelligence, Anomaly Detection & Risk Mitigation, Automated Compliance Management), Security Type, Deployment, Enterprise Size, Vertical, & Region- Global Forecast to 2023

[181 Pages Report] The cognitive security market to grow from $2.77 Billion in 2017 to $17.09 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 36.4% during the forecast period. The base year considered for this study is 2017 and the forecast period considered is from 2018 to 2023.

The cognitive security industry to register a significant growth rate over the next 5 years, due to the increasing number of security breaches and cyber-attacks, and the rising adoption of the Internet of Things (IoT) and Bring Your Own Device (BYOD) trends across verticals.

The objective of the study is to define, describe, and forecast the cognitive security market on the basis of components (solutions and services), deployment modes (cloud and on-premises), applications (threat intelligence, anomaly detection and risk mitigation, automated compliance management, and others), enteprise size (large enteprises and SMEs), security types (physical security and cybersecurity), verticals (aerospace and defense; goverments; Banking, Financial Services, and Insurance (BFSI); IT and telecom; retail; manufacturing; energy and utilities; and others), and regions. Moreover, the report aims to provide detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

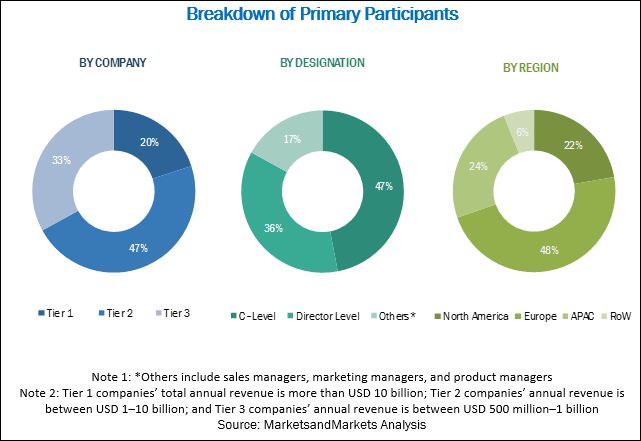

The research methodology used to estimate and forecast the global cognitive security market size initiated with the capturing of data on the key vendor revenues through secondary research, annual reports, Institute of Electrical and Electronics Engineers (IEEE), Factiva, Bloomberg, and press releases. Moreover, the vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenues of the key market players. Post arrival at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The major vendors in the global cognitive security market are IBM (US), Cisco (US), CA Technologies (US), Symantec (US), Check Point Software (US), DXC Technology (US), AWS (US), Expert System (Italy), Fortinet (US), Trend Micro (Japan), Google (US), Acalvio (US), Securonix (US), Sift Science (US), Feedzai (US), SparkCognition (US), Cybraics (US), Demisto (US), XTN (Italy), LogRhythm (US), ThreatMetrix (US), High-Tech Bridge (Switzerland), Deep Instinct (Israel), Darktrace (UK and US), Cylance (US), and McAfee (US).

Target Audience

- Cognitive security solution providers

- Government agencies

- Cybersecurity vendors

- Consulting firms

- Independent software vendors

- Information Technology (IT) governance directors/managers

- System integrators

- IT security agencies

- Managed Security Service Providers (MSSPs)

- Value-added resellers

Scope of the Report

The research report segments the cognitive security into the following segments and subsegments:

By Component

- Solutions

- Unified log manager and data catalog

- Real-time security analytics and visualization platform

- Biometric recognition

- Digital signature recognition

- Services

- Deployment and integration

- Support and maintenance

- Training and consulting

By Deployment Mode

- Cloud

- On-premises

Cognitive Security Market By Application

- Threat Intelligence

- Anomaly detection and risk mitigation

- Automated compliance management

- Others (Perimeter/border security automation, and fraud detection and prevention))

By Security Type

- Physical security

- Cybersecurity

- Network security

- Cloud security

- Application security

- Endpoint security

By Enterprise Size

- Large Enterprises

- SMEs

By Vertical

- Aerospace and defense

- Government

- BFSI

- IT and telecom

- Healthcare

- Retail

- Manufacturing

- Energy and utilities

- Others (Media and entertainment, education, and transportation)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC cognitive security market.

- Further breakdown of the North American market

- Further breakdown of the European market

- Further breakdown of the RoW market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The cognitive security market is expected to grow from USD 3.62 Billion in 2018 to USD 17.09 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 36.4% during the forecast period. The major driving factors for the cognitive security market growth are the increasing number of security breaches and cyber-attacks, and the rising adoption of the Internet of Things (IoT) and Bring Your Own Device (BYOD) trends across verticals.

The solutions segment is expected to account for the larger market size during the forecast period. The real-time security analytics and visualization platform plays a crucial role in detecting anomalies and preventing unusual behaviors or cyber-attacks. On the contrary, the services segment is expected to grow at a faster rate during the forecast period, owing to the growing need for the proper implementation of cognitive security solutions.

The cloud deployment mode is expected to account for the larger market size and is expected to grow at a higher CAGR during the forecast period, as the cloud deployment mode is more preferred for mobile and web application security.

The large enterprises segment is expected to account for the larger market size during the forecast period, whereas the Small and Medium-sized Enterprises (SMEs) segment is expected to register a higher CAGR during the forecast period, as attackers mainly target SMEs to penetrate their applications for accessing customer information, payment details, and other confidential data.

Among the security types, the cybersecurity segment is expected to have the larger market size and is projected to grow at a faster rate during the forecast period. The rapidly growing connected devices have made enterprise networks more prone to cyber threats. Therefore, the demand for cognitive solutions is expected to be more during the forecast period.

Among the applications, the threat intelligence application is expected to be the fastest growing application in the cognitive security market, whereas the anomaly detection and risk mitigation application is expected to have the largest market size during the forecast period. Anomaly detection and risk mitigation is a network security application that monitors networks to identify abnormal activities and report them.

Among the verticals, the Banking, Financial Services, and Insurance (BFSI) vertical is expected to be the highest contributor in terms of the market size and is projected to grow at the fastest rate during the forecast period, as this vertical holds large volumes of sensitive information related to employees, assets, offices, branches, operations, and customers. Therefore, the demand to protect sensitive information is always high in the BFSI vertical.

The healthcare, energy and utilities, manufacturing, retail, government, aerospace and defense, and IT and telecom verticals are also expected to contribute significantly to the growth of the cognitive security market to safeguard information and quickly identify and prevent cyber-attacks.

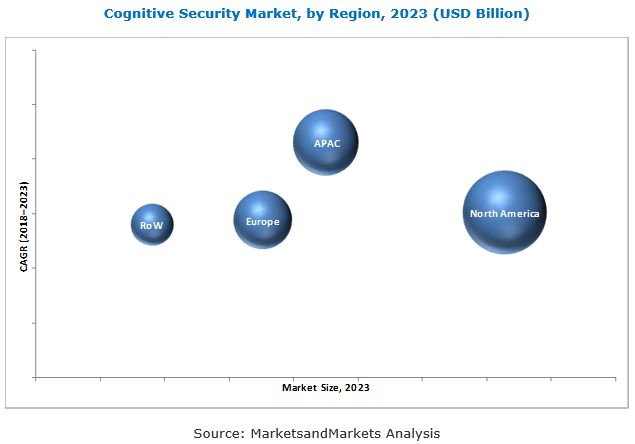

The global cognitive security market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). North America is expected to be the largest revenue generating region, due to the growing demand for cognitive security solutions to safeguard business data. These regions have the most competitive and rapidly changing market across the globe. APAC is expected to be the fastest growing region in the market during the forecast period. Moreover, the APAC region is expected to be a highly potential market, due to the growing digitalization rate and the surging government policies. These factors are expected to contribute to the growth of the market across the region.

Furthermore, concerns such as the rapidly increasing insider cyber threats and the lack of skilled security professionals may affect the growth of the cognitive security market. These factors increase the risk of failure for organizations, thereby necessitating the need for effective cognitive security solutions.

The major vendors in the global cognitive security market are IBM (US), Cisco (US), CA Technologies (US), Symantec (US), Check Point Software (US), DXC Technology (US), AWS (US), Expert System (Italy), Fortinet (US), Trend Micro (Japan), Google (US), Acalvio (US), Securonix (US), Sift Science (US), Feedzai (US), SparkCognition (US), Cybraics (US), Demisto (US), XTN (Italy), LogRhythm (US), ThreatMetrix (US), High-Tech Bridge (Switzerland), Deep Instinct (Israel), Darktrace (UK and US), Cylance (US), and McAfee (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Cognitive Security Market Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Cognitive Security Market

4.2 Market Top 3 Verticals

4.3 Market Analysis, By Region, 2018

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 to Assist Security Analysts in Taking Proactive Security Measures

5.2.1.2 Increasing Number of Security Breaches and Cyber-Attacks

5.2.1.3 Rising Adoption of IoT and Increasing Trend of Byod Across Verticals

5.2.2 Restraints

5.2.2.1 Restricted Security Budgets

5.2.3 Opportunities

5.2.3.1 Regulatory and Compliance Mandates

5.2.3.2 Growing Market for Cloud-Based Businesses

5.2.3.3 Rising Adoption of Social Media Platforms in Various Business Functions

5.2.4 Challenges

5.2.4.1 Lack of Skilled Security Professionals

5.2.4.2 Rapidly Increasing Insider Cyber Threats

5.3 Industry Trends

5.3.1 Regulatory Implications

5.3.1.1 Introduction

5.3.2 Cognitive Security Market: Case Studies

5.3.2.1 Case Study: Healthcare

5.3.2.2 Case Study: Retail

5.3.2.3 Use Case: Government

5.3.2.4 Use Case: BFSI

5.3.2.5 Use Case: Education

6 Cognitive Security Market, By Component (Page No. - 49)

6.1 Introduction

6.2 Solutions

6.2.1 Unified Log Manager and Data Catalog

6.2.2 Real-Time Security Analytics and Visualization Platform

6.2.3 Biometric Recognition

6.2.4 Digital Signature Recognition

6.3 Services

6.3.1 Deployment and Integration

6.3.2 Support and Maintenance

6.3.3 Training and Consulting

7 Market, By Application (Page No. - 59)

7.1 Introduction

7.2 Threat Intelligence

7.3 Anomaly Detection and Risk Mitigation

7.4 Automated Compliance Management

7.5 Others

8 Cognitive Security Market, By Security Type (Page No. - 64)

8.1 Introduction

8.2 Physical Security

8.3 Cybersecurity

8.3.1 Network Security

8.3.2 Cloud Security

8.3.3 Application Security

8.3.4 Endpoint Security

9 Market By Deployment Mode (Page No. - 69)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Cognitive Security Market By Enterprise Size (Page No. - 72)

10.1 Introduction

10.2 Large Enterprises

10.3 Small and Medium-Sized Enterprises

11 Market, By Vertical (Page No. - 75)

11.1 Introduction

11.2 Aerospace and Defense

11.3 Government

11.4 Banking, Financial Services, and Insurance

11.5 IT and Telecom

11.6 Healthcare

11.7 Retail

11.8 Manufacturing

11.9 Energy and Utilities

11.10 Others

12 Geographic Analysis (Page No. - 84)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Rest of APAC

12.5 Rest of the World

12.5.1 Israel

12.5.2 United Arab Emirates

12.5.3 Mexico

12.5.4 Rest of RoW

13 Competitive Landscape (Page No. - 111)

13.1 Overview

13.2 Top Players in the Cognitive Security Market

13.3 Competitive Scenario

13.3.1 New Product Launches/Product Upgradations

13.3.2 Partnerships/Collaborations/Agreements

13.3.3 Mergers and Acquisitions

14 Company Profiles (Page No. - 117)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 IBM

14.3 Cisco

14.4 CA Technologies

14.5 Symantec

14.6 Check Point Software

14.7 DXC Technology

14.8 AWS

14.9 Expert System

14.10 Fortinet

14.11 Trend Micro

14.12 Google

14.13 Acalvio

14.14 Securonix

14.15 Sift Science

14.16 Feedzai

14.17 SparkCognition

14.18 Cybraics

14.19 Demisto

14.20 XTN

14.21 ThreatMetrix

14.22 LogRhythm

14.23 High-Tech Bridge

14.24 Deep Instinct

14.25 DarKTrace

14.26 Cylance

14.27 McAfee

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 170)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (78 Tables)

Table 1 Global Cognitive Security Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 2 Cybersecurity Workforce Shortage, By Country and Skillset

Table 3 Inadvertent Insider Cloud Service Misconfiguration Incidents

Table 4 Cognitive Security Market Size, By Component, 20162023 (USD Million)

Table 5 Solutions: Market Size By Type, 20162023 (USD Million)

Table 6 Solutions: Market Size By Region, 20162023 (USD Million)

Table 7 Unified Log Manager and Data Catalog Market Size, By Region, 20162023 (USD Million)

Table 8 Real-Time Security Analytics and Visualization Platform Market Size, By Region, 20162023 (USD Million)

Table 9 Biometric Recognition Market Size, By Region, 20162023 (USD Million)

Table 10 Digital Signature Recognition Market Size, By Region, 20162023 (USD Million)

Table 11 Services: Cognitive Security Market Size By Type, 20162023 (USD Million)

Table 12 Services: Market Size By Region, 20162023 (USD Million)

Table 13 Deployment and Integration Market Size, By Region, 20162023 (USD Million)

Table 14 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 15 Training and Consulting Market Size, By Region, 20162023 (USD Million)

Table 16 Cognitive Security Market Size, By Application, 20162023 (USD Million)

Table 17 Threat Intelligence: Market Size By Region, 20162023 (USD Million)

Table 18 Anomaly Detection and Risk Mitigation: Market Size By Region, 20162023 (USD Million)

Table 19 Automated Compliance Management: Market Size By Region, 20162023 (USD Million)

Table 20 Others: Market Size By Region, 20162023 (USD Million)

Table 21 Cognitive Security Market Size, By Security Type, 20162023 (USD Million)

Table 22 Cybersecurity: Market Size By Type, 20162023 (USD Million)

Table 23 Market Size By Deployment Mode, 20162023 (USD Million)

Table 24 Cognitive Security Market Size By Enterprise Size, 20162023 (USD Million)

Table 25 Market Size By Vertical, 20162023 (USD Million)

Table 26 Aerospace and Defense: Market Size By Region, 20162023 (USD Million)

Table 27 Government: Market Size By Region, 20162023 (USD Million)

Table 28 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 29 IT and Telecom: Cognitive Security Market Size By Region, 20162023 (USD Million)

Table 30 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 31 Retail: Market Size By Region, 20162023 (USD Million)

Table 32 Manufacturing: Cognitive Security Market Size By Region, 20162023 (USD Million)

Table 33 Energy and Utilities: Market Size By Region, 20162023 (USD Million)

Table 34 Others: Market Size By Region, 20162023 (USD Million)

Table 35 Cognitive Security Market Size, By Region, 20162023 (USD Million)

Table 36 North America: Market Size By Country, 20162023 (USD Million)

Table 37 North America: Market Size By Component, 20162023 (USD Million)

Table 38 North America: Cognitive Security Market Size By Solution, 20162023 (USD Million)

Table 39 North America: Market Size By Service, 20162023 (USD Million)

Table 40 North America: Market Size By Application, 20162023 (USD Million)

Table 41 North America: Cognitive Security Market Size By Security Type, 20162023 (USD Million)

Table 42 North America: Market Size By Cybersecurity Type, 20162023 (USD Million)

Table 43 North America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 44 North America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 45 North America: Market Size By Vertical, 20162023 (USD Million)

Table 46 Europe: Cognitive Security Market Size, By Country, 20162023 (USD Million)

Table 47 Europe: Market Size By Component, 20162023 (USD Million)

Table 48 Europe: Market Size By Solution, 20162023 (USD Million)

Table 49 Europe: Market Size By Service, 20162023 (USD Million)

Table 50 Europe: Cognitive Security Market Size By Application, 20162023 (USD Million)

Table 51 Europe: Market Size By Security Type, 20162023 (USD Million)

Table 52 Europe: Market Size By Cybersecurity Type, 20162023 (USD Million)

Table 53 Europe: Cognitive Security Market Size By Deployment Mode, 20162023 (USD Million)

Table 54 Europe: Market SizeBy Enterprise Size, 20162023 (USD Million)

Table 55 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 56 Asia Pacific: Cognitive Security Market Size, By Country, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 58 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 59 Asia Pacific: Cognitive Security Market Size By Service, 20162023 (USD Million)

Table 60 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 61 Asia Pacific: Market Size By Security Type, 20162023 (USD Million)

Table 62 Asia Pacific: Cognitive Security Market Size By Cybersecurity Type, 20162023 (USD Million)

Table 63 Asia Pacific: Market Size By Deployment Mode, 20162023 (USD Million)

Table 64 Asia Pacific: Market Size By Enterprise Size, 20162023 (USD Million)

Table 65 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 66 Rest of the World: Cognitive Security Market Size, By Country, 20162023 (USD Million)

Table 67 Rest of the World: Market Size By Component, 20162023 (USD Million)

Table 68 Rest of the World: Market Size By Solution, 20162023 (USD Million)

Table 69 Rest of the World: Cognitive Security Market Size By Service, 20162023 (USD Million)

Table 70 Rest of the World: Market Size By Application, 20162023 (USD Million)

Table 71 Rest of the World: Market Size By Security Type, 20162023 (USD Million)

Table 72 Rest of the World: Cognitive Security Market Size By Cybersecurity Type, 20162023 (USD Million)

Table 73 Rest of the World: Market Size By Deployment Mode, 20162023 (USD Million)

Table 74 Rest of the World: Market Size By Enterprise Size, 20162023 (USD Million)

Table 75 Rest of the World: Market Size By Vertical, 20162023 (USD Million)

Table 76 New Product Launches/Product Upgradations, 20162018

Table 77 Partnerships/Collaborations/Agreements, 20172018

Table 78 Mergers and Acquisitions, 20162018

List of Figures (54 Figures)

Figure 1 Global Cognitive Security Market Segmentation

Figure 2 Global Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cognitive Security Market: Assumption

Figure 8 Market Share By Component, 2017

Figure 9 Market Share By Solution, 2017

Figure 10 Market Share By Service, 2017

Figure 11 Market Share By Application, 2017

Figure 12 Market Share By Security Type, 2017

Figure 13 Cognitive Security Market Share By Cybersecurity Type, 2017

Figure 14 Market Share By Deployment Mode, 2017

Figure 15 Market Share By Enterprise Size, 2017

Figure 16 Market Share By Vertical, 2017

Figure 17 Market Snapshot, By Region

Figure 18 Rise in Insider and Outsider Threats Targeting Enterprises is One of the Major Factors Expected to Drive the Overall Growth of the Cognitive Security Market During the Forecast Period

Figure 19 Banking, Financial Security, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Asia Pacific is Estimated to Register the Highest Growth Potential in 2018

Figure 21 Market Investment Scenario: Asia Pacific is Expected to Emerge as the Best Opportunity Market for Investments in the Next 5 Years

Figure 22 Cognitive Security Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Hackmageddon Cyber Attacks Statistics: January 2018

Figure 24 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Real-Time Security Analytics and Visualization Platform Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Training and Consulting Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Threat Intelligence Application is Expected to Register the Highest CAGR During the Forecast Period

Figure 28 Cybersecurity Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 29 Cloud Security Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 30 Cloud Deployment Mode is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 31 Small and Medium-Sized Enterprises Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 32 Banking, Financial Services, and Insurance Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 33 North America is Expected to Account for the Largest Market Size in the Cognitive Security Market During the Forecast Period

Figure 34 Asia Pacific is Expected to Register the Fastest Growth Rate in the Cognitive Security Market During the Forecast Period

Figure 35 North America: Cognitive Security Market Snapshot

Figure 36 Asia Pacific: Market Snapshot

Figure 37 Key Developments By the Major Players in the Cognitive Security Market, 20162018

Figure 38 Geographic Revenue Mix of the Top 5 Market Players

Figure 39 IBM: Company Snapshot

Figure 40 IBM: SWOT Analysis

Figure 41 Cisco: Company Snapshot

Figure 42 Cisco: SWOT Analysis

Figure 43 CA Technologies: Company Snapshot

Figure 44 CA Technologies: SWOT Analysis

Figure 45 Symantec: Company Snapshot

Figure 46 Symantec: SWOT Analysis

Figure 47 Check Point Software Technologies: Company Snapshot

Figure 48 Check Point Software Technologies: SWOT Analysis

Figure 49 DXC Technology: Company Snapshot

Figure 50 AWS: Company Snapshot

Figure 51 Expert System: Company Snapshot

Figure 52 Fortinet: Company Snapshot

Figure 53 Trend Micro: Company Snapshot

Figure 54 Google: Company Snapshot

Growth opportunities and latent adjacency in Cognitive Security Market

Understanding cyber security market size and growth