Cognitive Assessment and Training Market by Component, Organization Size, Application (Clinical Trials, Learning, and Research), Vertical (Healthcare and Life Sciences, Education, and Corporate), and Region - Global Forecast to 2025

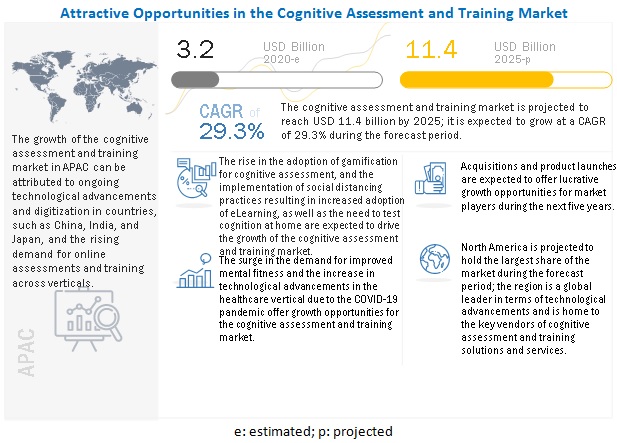

[256 Pages Report] The cognitive assessment and training market is projected to grow from USD 3.2 billion in 2020 to USD 11.4 billion by 2025, at a CAGR of 29.3% during the forecast period. Various factors such as the rising adoption of gamification for cognitive assessment, social distancing practices resulting in increased adoption of eLearning, and the COVID-19 pandemic leading to the increased need to test cognition at home are expected to drive the adoption of the cognitive assessment and training market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Cognitive Assessment and Training Market

Businesses providing cognitive assessment and training solutions and services are expected to witness a minor decline in their growth for a short span of time. However, the adoption of work from home initiatives, eLearning, and eHealth are expected to drive increased adoption of cognitive assessment and training solutions, and the market would witness a negligible decline in 2020, followed by positive growth. Tracking cognitive abilities is becoming an important activity, as a number of neurologic effects have been observed in people suffering from COVID-19.

Businesses in various verticals are planning to deploy a diverse array of cognitive assessment and training solutions to carry out assessments and track and improve brain health. With the growing focus on mental health and the ability of cognitive assessment and training solutions to be leveraged virtually, the market is witnessing significant growth.

Market Dynamics

Driver: Rising adoption of gamification for cognitive assessment

Gamification and serious gaming help people induce positive health behavioral changes. Gamification is a relatively new trend that focuses on applying game mechanics to non-game contexts for engaging audiences and adding a little fun into mundane activities besides generating motivational and cognitive benefits. Various fields, such as corporate and education, have taken advantage of the potential of gamification. The digital healthcare domain has also started to explore this concept as an emerging trend. Gamification intends to affect users’ behavior and motivation by means of experiences reminiscent of games. The healthcare domain has seen a rapid ascent in the adoption of gamification and serious games in health self-monitoring and management. The ability of serious games to motivate, engage, and entertain as well as offer numerous systematic reviews prove effective in promoting particular health behavioral changes and reducing a broad range of disorder-related symptoms. Corporate gamification is also gaining traction in the market. Gamification is used to enhance the digital experience, increase collaboration, or engage and motivate employees to participate in initiatives that are strategically important to companies.

Restraint: Time-constraints in developing clinically validated brain training solutions

Companies are trying to improve brain fitness by increasing the number of developing solutions and applications to enhance neuroplasticity. However, after developing brain training solutions, companies need to get clinical approvals for launching their products to be used on people. As it takes a year to develop a clinically-validated brain fitness solution, it restrains the faster growth of the cognitive assessment and training market. The time duration for developing these solutions is vast, as professionals focus on creating solutions for training that contain complex algorithms to provide appropriate exercises for the brain. Moreover, with the increasing cases of Alzheimer’s, Attention Deficit Hyperactivity Disorder (ADHD), and other cognitive dysfunctions have led to the need for effective solutions that use the latest technologies.

Opportunity: Growing need for technological advancements in the healthcare industry during COVID-19

The usage of smartphones and tablets to collect Clinician-Reported Outcome (ClinRO) measures are rapidly increasing worldwide. With the industry shifting toward electronic data collection, guidelines are being created on the recommended approach for establishing a similarity between the electronic version of a clinician-administered measure and the paper version. Moreover, the adoption of mobile technologies in cognitive assessment and clinical research for patient recruitment, data collection, symptom monitoring, and health management are in huge demand with the outbreak of the COVID-19 pandemic. Patients need better mental treatment, and to improve patient compliance, patient care, patient safety, and patient satisfaction, the adoption of mobile applications and IT systems is increasing in hospitals and healthcare centers. Also, the increasing demand from physicians and hospitals to access patient databases remotely is projected to support the growing adoption of mobile applications and IT systems in healthcare organizations.

Challenge: High dependency on traditional assessment methods

Assessment is central to learning: it shapes the learning experience yet is a critical and time-consuming function for teachers, doctors, and even coaches. Pen and paper-based assessment is the traditional approach for measuring the cognitive behavior of any individual. The approach involves a set of questions that an individual is asked to take. The responses are then analyzed, and based on their analysis, the cognitive quotient of an individual is achieved. Written assessments may not be testing the students’ knowledge but rather their writing skills and ability to express their learning. Still, organizations depend on pen and paper-based assessment methods as these prove helpful in collecting the samples of student work to assess individual progress and diagnose areas of misunderstandings. Standardized tests are now commonly administered on computers, but classroom assessment usually requires students to submit written responses on paper. In a classroom setting, paper-and-pencil assessment frequently refers to tests scored objectively, which are meant to measure memorized knowledge and lower levels of understanding, as compared to performance-based assessment, which is meant to measure deeper understanding through skills and ability. But with the increased use of technology, education institutions and healthcare providers need to start adopting computer-based testing that offers the opportunity to design more effective, interactive, and engaging formative assessment and feedback.

Among verticals, the healthcare and life sciences segment to hold the largest market size during the forecast period

The cognitive assessment and training market is segmented based on verticals. The verticals include healthcare and life sciences, education, corporate, and others (sports, government, and defense). The healthcare and life sciences vertical is expected to hold the largest market share during the forecast period. The healthcare and life sciences organizations use cognitive assessment to analyze people with mental or cognitive disabilities and is being used in the detection and therapy of dementia. Cognitive impairment can be caused in early childhood or late adulthood. Advanced age and conditions such as dementia, stroke, substance abuse, and alcohol consumption may also cause cognitive disorders. Brain/head injury and infections can cause impairment at any stage of life. The need to detect and assess such conditions is expected to drive the adoption of cognitive assessment and training solutions.

Clinical trials application to hold the largest market size during the forecast period

The cognitive assessment and training market is segmented based on applications into clinical trials, learning, research, and others (diagnostics, recruitment, and patient engagement). Easy assessment and identification of cognitive changes and the ability to detect, diagnose, and reduce the chance of developing the disease in patients would drive the adoption of the clinical trials application.

Asia Pacific to grow at the highest CAGR during the forecast period

North America is expected to hold the largest market size in the global cognitive assessment and training market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The growing awareness of mental health and cognitive skills in key countries, such as China, India, and Japan, is expected to fuel the adoption of cognitive assessment and training solutions and services. Technological advancements and digitization in these countries are also expected to increase the demand for cognitive assessment and training solutions from key verticals, such as healthcare and life sciences, education, and corporate.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The cognitive assessment and training vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global cognitive assessment and training market include Cambridge Cognition (UK), Cogstate (US), Quest Diagnostics (US), Signant Health (US), Total Brain (US), BrainWare (US), Pearson (UK), Philips (Netherlands), MedAvante-ProPhase (US), CogniFit (US), ERT (US), VeraSci (US), BrainCheck (US), MeritTrac (India), Berke (US), Neurotrack (US), Lumosity (US), The Brain Workshop (UAE), ImPACT Applications (US), Savonix (US), Winterlight Labs (Canada), Aural Analytics (US), Unmind (UK), Kernel (US), and Altoida (US). The study includes an in-depth competitive analysis of these key players in the Cognitive assessment and training market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Million |

|

Segments covered |

Component, organization size, application, vertical, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Cambridge Cognition (UK), Cogstate (US), Quest Diagnostics (US), Signant Health (US), Total Brain (US), BrainWare (US), Pearson (UK), Philips (Netherlands), MedAvante-ProPhase (US), CogniFit (US), ERT (US), VeraSci (US), BrainCheck (US), MeritTrac (India), Berke (US), Neurotrack (US), Lumosity (US), The Brain Workshop (UAE), ImPACT Applications (US), Savonix (US), Winterlight Labs (Canada), Aural Analytics (US), Unmind (UK), Kernel (US), and Altoida (US) |

This research report categorizes the Cognitive assessment and training market based on components, deployment modes, organization size, business functions, verticals, and regions.

By Component:

-

Solutions

- Assessment

- Data Management

- Data Analysis and Reporting

- Cognitive Training

- Others (Rater Training, Concussion Management, and Screening Solutions)

-

Services

- Training and Support

- Consulting

By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application:

- Clinical Trials

- Learning

- Research

- Others (Diagnostics, Recruitment and Patient Engagement)

By Vertical:

- Healthcare and Life Sciences

- Education

- Corporate

- Others (Sports. and Government And Defense)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2020, ERT acquired APDM Wearable Technologies to reinvent endpoint measurement in clinical trials. Both companies will generate higher-fidelity and more powerful data to enable clinical trials to be more predictable, cost-effective, and efficient.

- In May 2020, Total Brain partnered with the Center for Adolescent Research and Education (CARE), a national collaborative of institutions and organizations committed to increasing favorable youth outcomes and reducing risk. The partnership will promote positive youth development by offering CARE collaborative teen beneficiary access to Total Brain’s neuroscience-based mental health and wellness assessment and screening tools.

- In December 2019, Philips extended its AI portfolio with the launch of IntelliSpace AI Workflow Suite to seamlessly integrate applications across imaging workflows. The comprehensive AI workflow platform provides a full suite of applications for integration and centralized workflow management of AI algorithms, delivering structured results wherever they are needed across healthcare enterprises.

- In November 2019, Cambridge Cognition expanded the eCOA offering and bagged a contract with the top 10 pharmaceutical companies. The aim of this solution enhancement was to include complex forms, alerting, interview recording, and playback. With the launch of enhanced functionalities, the Company is pleased to announce a new clinical trial contract worth over USD 225,000.

- In Janurary 2019, Total Brain partnered with the Center for Adolescent Research and Education (CARE), a national collaborative of institutions and organizations committed to increasing favorable youth outcomes and reducing risk. The partnership will promote positive youth development by offering CARE collaborative teen beneficiary access to Total Brain’s neuroscience-based mental health and wellness assessment and screening tools.

Frequently Asked Questions (FAQ):

What is cognitive assessment and training?

According to Copeman Healthcare, cognitive assessment evaluates important areas of brain function. These areas include memory, concentration, processing speed, language, and reasoning capabilities. Cognitive assessments are critical to complete wellness because they have set a personalized benchmark of brain health for future comparison. A baseline cognitive assessment provides a reference point to measure against in case of problems or concerns (major illness or brain injury).

According to BrainTrain, cognitive training or brain training is a tool, which can be utilized by educators and healthcare professionals to supplement and help enhance the therapeutic interactions with clients.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are key verticals adopting cognitive assessment and training solutions and services?

Key verticals adopting cognitive assessment and training solutions and services include healthcare and life sciences, education, and corporate.

Which are the key opportunities supporting the growth of the cognitive assessment and training market?

The growing need for technological advancements in the healthcare industry during COVID-19, the rising demand for improved brain and mental fitness, and the increasing need for remote patient care in the COVID-19 pandemic scenario are the key opportunities supporting the market growth.

Who are the key vendors in the cognitive assessment and training market?

The key vendors operating in the cognitive assessment and training market include Cambridge Cognition, Cogstate, Quest Diagnostics, Total Brain, Signant Health, Philips, and Pearson. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 6 COGNITIVE ASSESSMENT AND TRAINING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 COGNITIVE ASSESSMENT AND TRAINING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SHARE OF COGNITIVE ASSESSMENT AND TRAINING THROUGH OVERALL COGNITIVE ASSESSMENT AND TRAINING SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON MARKET

FIGURE 14 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 4 GLOBAL COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y%)

FIGURE 15 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 16 ASSESSMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2020

FIGURE 17 TRAINING AND SUPPORT SERVICES SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2020

FIGURE 19 CLINICAL TRIALS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2020

FIGURE 20 HEALTHCARE AND LIFE SCIENCES VERTICAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2020

FIGURE 21 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN COGNITIVE ASSESSMENT AND TRAINING MARKET

FIGURE 22 ONGOING GLOBAL DIGITAL TRANSFORMATION AND GROWING FOCUS ON MENTAL HEALTH AND TESTING COGNITION AT HOME CONTRIBUTE TO MARKET GROWTH

4.2 MARKET, BY APPLICATION

FIGURE 23 LEARNING SEGMENT TO GROW AT HIGHEST CAGR OF MARKET FROM 2020 TO 2025

4.3 MARKET, BY REGION

FIGURE 24 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET, TOP THREE SOLUTIONS AND VERTICALS

FIGURE 25 ASSESSMENT SOLUTION AND HEALTHCARE AND LIFE SCIENCES VERTICAL TO HOLD LARGE SHARES OF MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

5.2 COGNITIVE ASSESSMENT: TYPES

5.3 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: COGNITIVE ASSESSMENT AND TRAINING MARKET

5.3.1 DRIVERS

5.3.1.1 Rising adoption of gamification for cognitive assessment

5.3.1.2 Social distancing practices resulting in increased adoption of eLearning solutions

5.3.1.3 COVID-19 pandemic to drive the need for testing cognition at home

5.3.2 RESTRAINTS

5.3.2.1 Time-constraints in developing clinically validated brain training solutions

5.3.2.2 Negative publicity in the media about brain training efficiency

5.3.3 OPPORTUNITIES

5.3.3.1 Growing need for technological advancements in the healthcare industry during COVID-19

5.3.3.2 Rising demand for improved brain and mental fitness

5.3.4 CHALLENGES

5.3.4.1 High dependency on traditional assessment methods

5.3.4.2 Lack of awareness about brain fitness among the current population

5.3.5 CUMULATIVE GROWTH ANALYSIS

5.4 COGNITIVE ASSESSMENT AND TRAINING: ECOSYSTEM

FIGURE 27 MARKET ECOSYSTEM

5.5 MARKET: COVID-19 IMPACT

FIGURE 28 COGNITIVE ASSESSMENT AND TRAINING MARKET TO WITNESS NEGLIGIBLE/MINOR DECLINE IN GROWTH IN 2020

5.6 CASE STUDY ANALYSIS

5.6.1 US-BASED HUMAN RESOURCES SERVICE PROVIDER COMPANY, AZILEN’S END-USER ORIENTED SOLUTION

5.6.2 BAYER ADOPTED SAVONIX MOBILE TESTS TO MEASURE SMALL IMPROVEMENTS IN COGNITION

5.6.3 LEANDER ISD USED AN IMPACT SOLUTION FOR MANAGING A STUDENT’S HEAD INJURY

5.6.4 METRO RAIL CORPORATION SIGNED A CONTRACT WITH MERITTRAC FOR ESTABLISHMENT OF A RECRUITMENT PROCESS

5.6.5 GIET’S MANAGEMENT SELECTED MERITTRAC TO IMPROVE THE PLACEMENT PERCENTAGE OF ENGINEERING STUDENTS

5.7 PATENT ANALYSIS

5.7.1 TOP PATENT APPLICANTS BY ARTIFICIAL INTELLIGENCE APPLICATION FIELD

5.8 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.9.1 INTERNET OF THINGS AND COGNITIVE ASSESSMENT AND TRAINING

5.9.2 BLOCKCHAIN AND COGNITIVE ASSESSMENT AND TRAINING

5.9.3 NATURAL LANGUAGE PROCESSING AND COGNITIVE ASSESSMENT AND TRAINING

5.10 PRICING ANALYSIS

6 COGNITIVE ASSESSMENT AND TRAINING MARKET, BY COMPONENT (Page No. - 74)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 30 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

FIGURE 31 DATA MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.1 ASSESSMENT

TABLE 12 ASSESSMENT: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 13 ASSESSMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.2 DATA MANAGEMENT

TABLE 14 DATA MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 DATA MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.3 COGNITIVE TRAINING

TABLE 16 COGNITIVE TRAINING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 COGNITIVE TRAINING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.4 DATA ANALYSIS AND REPORTING

TABLE 18 DATA ANALYSIS AND REPORTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 DATA ANALYSIS AND REPORTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.5 OTHER SOLUTIONS

TABLE 20 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 SERVICES

FIGURE 32 CONSULTING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 23 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 25 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1 TRAINING AND SUPPORT

TABLE 26 TRAINING AND SUPPORT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 27 TRAINING AND SUPPORT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2 CONSULTING

TABLE 28 CONSULTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 CONSULTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 COGNITIVE ASSESSMENT AND TRAINING MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: MARKET DRIVERS

7.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 33 LEARNING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 31 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

7.2 CLINICAL TRIALS

TABLE 32 CLINICAL TRAILS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 CLINICAL TRIALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 LEARNING

TABLE 34 LEARNING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 35 LEARNING: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 RESEARCH

TABLE 36 RESEARCH: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 37 RESEARCH: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 38 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 COGNITIVE ASSESSMENT AND TRAINING MARKET, BY ORGANIZATION SIZE (Page No. - 97)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 42 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 COGNITIVE ASSESSMENT AND TRAINING MARKET, BY VERTICAL (Page No. - 102)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 35 EDUCATION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

9.2 EDUCATION

TABLE 48 EDUCATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 49 EDUCATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 HEALTHCARE AND LIFE SCIENCES

TABLE 50 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 51 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4 CORPORATE

TABLE 52 CORPORATE: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 CORPORATE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.5 OTHER VERTICALS

TABLE 54 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 COGNITIVE ASSESSMENT AND TRAINING MARKET, BY REGION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 36 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 56 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 57 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

10.2.3.1 Health Insurance Portability and Accountability Act of 1996

10.2.3.2 California Consumer Privacy Act

10.2.3.3 Gramm–Leach–Bliley Act

10.2.3.4 Health Information Technology for Economic and Clinical Health Act

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.2.4 UNITED STATES

TABLE 72 UNITED STATES: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.2.5 CANADA

TABLE 76 CANADA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

10.3.3.1 General Data Protection Regulation

10.3.3.2 European Committee for Standardization

10.3.3.3 European Technical Standards Institute

TABLE 80 EUROPE: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 94 UNITED KINGDOM: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3.5 GERMANY

TABLE 98 GERMANY: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 101 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3.6 FRANCE

TABLE 102 FRANCE: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 105 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

10.4.3.1 International Organization for Standardization 27001

10.4.3.2 Personal Data Protection Act

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.4.4 CHINA

TABLE 120 CHINA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4.5 JAPAN

TABLE 124 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 125 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 126 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 127 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4.6 INDIA

TABLE 128 INDIA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 129 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 130 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 131 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 EFFECT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.3.2 Cloud Computing Framework

10.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia

10.5.3.4 Protection of Personal Information Act

TABLE 132 MIDDLE EAST AND AFRICA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 146 KINGDOM OF SAUDI ARABIA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 147 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 148 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 149 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.5 UNITED ARAB EMIRATES

TABLE 150 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 151 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 153 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.6 SOUTH AFRICA

TABLE 154 SOUTH AFRICA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 155 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 156 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 157 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.7 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

10.6.3.1 Brazil Data Protection Law

10.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 158 LATIN AMERICA: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.6.4 BRAZIL

TABLE 172 BRAZIL: COGNITIVE ASSESSMENT AND TRAINING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 173 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 174 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 175 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.6.5 MEXICO

TABLE 176 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 177 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 178 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 179 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 173)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS AND EXPANSIONS FROM 2018 AND 2020

11.3 MARKET SHARE, 2020

FIGURE 41 CAMBRIDGE COGNITION TO LEAD COGNITIVE ASSESSMENT AND TRAINING MARKET IN 2020

11.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 42 REVENUE ANALYSIS OF KEY MARKET PLAYERS

11.5 KEY MARKET DEVELOPMENTS

11.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 180 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2020

11.5.2 BUSINESS EXPANSIONS

TABLE 181 BUSINESS EXPANSIONS, 2018–2020

11.5.3 MERGERS AND ACQUISITIONS

TABLE 182 MERGERS AND ACQUISITIONS, 2017–2020

11.5.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 183 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2019–2020

11.6 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

FIGURE 43 RANKING OF KEY PLAYERS, 2020

11.7 COMPANY EVALUATION MATRIX, 2020

11.7.1 STAR

11.7.2 EMERGING LEADER

11.7.3 PERVASIVE

11.7.4 PARTICIPANT

FIGURE 44 COGNITIVE ASSESSMENT AND TRAINING MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.8 STARTUP/SME COMPANY EVALUATION MATRIX, 2020

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 45 COGNITIVE ASSESSMENT AND TRAINING MARKET (GLOBAL), STARTUP/SME COMPANY EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 185)

12.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 CAMBRIDGE COGNITION

FIGURE 46 CAMBRIDGE COGNITION: COMPANY SNAPSHOT

12.3 COGSTATE

FIGURE 47 COGSTATE: COMPANY SNAPSHOT

12.4 QUEST DIAGNOSTICS

FIGURE 48 QUEST DIAGNOSTICS: COMPANY SNAPSHOT

12.5 TOTAL BRAIN

FIGURE 49 TOTAL BRAIN: COMPANY SNAPSHOT

12.6 SIGNANT HEALTH

12.7 PEARSON

FIGURE 50 PEARSON: COMPANY SNAPSHOT

12.8 PHILIPS

FIGURE 51 PHILIPS: COMPANY SNAPSHOT

12.9 MEDAVANTE-PROPHASE

12.10 COGNIFIT

12.11 ERT

12.12 VERASCI

12.13 BRAINCHECK

12.14 MERITTRAC

12.15 BERKE

12.16 NEUROTRACK

12.17 BRAINWARE

12.18 LUMOSITY

12.19 THE BRAIN WORKSHOP

12.20 IMPACT APPLICATIONS

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.21 STARTUP/SME PROFILES

12.21.1 SAVONIX

12.21.2 WINTERLIGHT LABS

12.21.3 AURAL ANALYTICS

12.21.4 UNMIND

12.21.5 KERNEL

12.21.6 ALTOIDA

13 APPENDIX (Page No. - 233)

13.1 ADJACENT AND RELATED MARKETS

13.1.1 INTRODUCTION

13.1.2 COGNITIVE COMPUTING MARKET—GLOBAL FORECAST 2025

13.1.2.1 Market definition

13.1.2.2 Market overview

TABLE 184 GLOBAL COGNITIVE COMPUTING MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION AND Y-O-Y %)

13.1.2.2.1 Cognitive computing market, by component

TABLE 185 COGNITIVE COMPUTING MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

13.1.2.2.2 Cognitive computing market, by business function

TABLE 186 COGNITIVE COMPUTING MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

13.1.2.2.3 Cognitive computing market, by application

TABLE 187 COGNITIVE COMPUTING MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13.1.2.2.4 Cognitive computing market, by technology

TABLE 188 COGNITIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

13.1.2.2.5 Cognitive computing market, by deployment mode

TABLE 189 COGNITIVE COMPUTING MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

13.1.2.2.6 Cognitive computing market, by organization size

TABLE 190 COGNITIVE COMPUTING MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13.1.2.2.7 Cognitive computing market, by industry vertical

TABLE 191 COGNITIVE COMPUTING MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

13.1.2.2.8 Cognitive computing market, by region

TABLE 192 COGNITIVE COMPUTING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3 GAMIFICATION IN EDUCATION MARKET– GLOBAL FORECAST TO 2023

13.1.3.1 Market definition

13.1.3.2 Market overview

TABLE 193 GLOBAL GAMIFICATION IN EDUCATION MARKET SIZE AND GROWTH RATE, 2016–2023 (USD MILLION AND Y-O-Y %)

13.1.3.2.1 Gamification in Education market, by offering

TABLE 194 GAMIFICATION IN EDUCATION MARKET SIZE, BY OFFERING, 2016–2023 (USD MILLION)

13.1.3.2.2 Gamification in Education market, by deployment mode

TABLE 195 GAMIFICATION IN EDUCATION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

13.1.3.2.3 Gamification in Education market, by region

TABLE 196 GAMIFICATION IN EDUCATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.1.4 COGNITIVE SERVICES MARKET– GLOBAL FORECAST TO 2023

13.1.4.1 Market definition

13.1.4.2 Market overview

TABLE 197 GLOBAL COGNITIVE SERVICES MARKET SIZE AND GROWTH RATE, 2016–2023 (USD MILLION AND Y-O-Y %)

13.1.4.2.1 Cognitive services market, by technology

TABLE 198 COGNITIVE SERVICES MARKET SIZE, BY TECHNOLOGY, 2016–2023 (USD MILLION)

13.1.4.2.2 Cognitive services market, by service type

TABLE 199 COGNITIVE SERVICES MARKET SIZE, BY SERVICE TYPE, 2016–2023 (USD MILLION)

13.1.4.2.3 Cognitive services market, by deployment mode

TABLE 200 COGNITIVE SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

13.1.4.2.4 Cognitive services market, by application

TABLE 201 COGNITIVE SERVICES MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

13.1.4.2.5 Cognitive services market, by end-user

TABLE 202 COGNITIVE SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

13.1.4.2.6 Cognitive services market, by vertical

TABLE 203 COGNITIVE SERVICES MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

13.1.4.2.7 Cognitive services market, by region

TABLE 204 COGNITIVE SERVICES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 245)

14.1 INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the cognitive assessment and training market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the cognitive assessment and training market.

Secondary Research

In the secondary research process, various secondary sources, such as Data Science and Artificial Intelligence for Communications, Journal of Medical Virology, Becoming Human: Artificial Intelligence Magazine and other related magazines, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

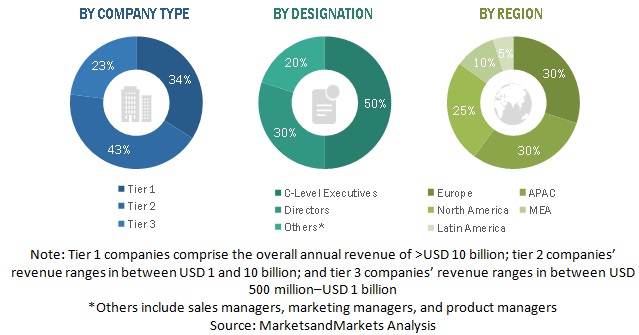

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from cognitive assessment and training solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cognitive assessment and training market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the cognitive assessment and training market by component (solutions and services), organization size, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the cognitive assessment and training market

- To analyze the impact of the COVID-19 pandemic on the cognitive assessment and training market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American cognitive assessment and training market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Cognitive Assessment and Training Market

Interested in neurosciences market

Interested in market sizing and segmentation of the assessment and monitoring solution part

Interested in Cognitive Assessment and Training market

Interested in Cognitive Assessment and Training market

Interested in cognitive training device market

Interested in Cognitive Assessment and Training market

Interested in Deep Learning Network.