Coated Steel Market by Resin Type (Polyester, Fluoropolymer, Siliconized Polyester, Plastisol, and Others), by Application (Building & Construction, Appliances, Automotive, and Others) - Global Forecast to 2020

[167 Pages Report] The coated steel market is estimated to grow from USD 20.62 Billion in 2015 to USD 26.68 Billion by 2020, at a CAGR of 5.30% between 2015 and 2020. The coated steel industry is witnessing moderate growth because of demand from end-use industries. Coated steel is largely used in building & construction and appliances industries.

Years considered for this report

2013 – Historical Year

2014 – Base Year

2015 – Estimated Year

2020 – Projected Year

Research Methodology

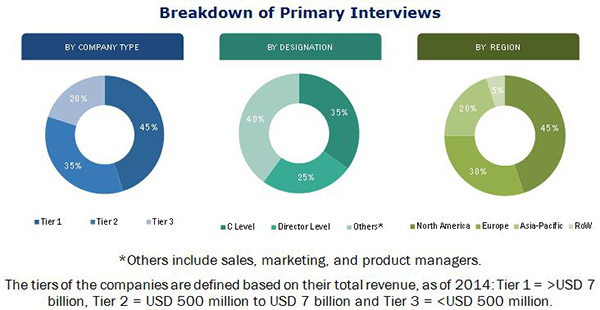

This study aims to estimate the coated steel market size for 2015 and project its demand till 2020. It also provides a detailed qualitative and quantitative analysis of the coated steel market. Various secondary sources such as directories, industry journals, and databases have been used to identify and collect information useful for this extensive commercial study of the coated steel market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the coated steel market. The breakdown of profiles of primaries is depicted in the figure below:

The coated steel value chain includes coil coatings manufacturers, coated steel manufacturers, and end-use industries. Maximum value addition is done during the manufacturing stage of coated steel.

Target audience:

- Manufacturers of coated steel, steel, and other raw material manufacturers

- Converters of coated steel for building & construction, appliances, automotive, and other applications such as furniture and packaging

- Traders, distributors, and suppliers of coated steel

- Regional manufacturers' associations and general coated steel associations

- Coil coating manufacturers

- Government and regional agencies and research organizations

“The study answers several questions for the stakeholders, primarily which market segments to focus in the next two-to-five years for prioritizing efforts and investments and competitive landscape of the market”.

Scope of the Report:

The coated steel market has been covered in detail in this report. To provide an all-round picture, the current market demand and forecasts have also been included. The coated steel market is segmented as follows:

On the basis of Resin Type:

- Polyester

- Fluoropolymer

- Siliconized Polyester

- Plastisol

- Others

On the Basis of Application:

- Building & Construction

- Appliances

- Automotive

- Others

On the Basis of Region:

- Asia-Pacific

- Europe

- North America

- RoW

The market is further analyzed for key countries in each of these regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Regional Analysis

- Further breakdown of the rest of Asia-Pacific coated steel market into Vietnam, Thailand, Taiwan, Singapore, and other Asian countries

- Further breakdown of the RoW coated steel market into the Middle East & Africa and Latin America

The coated steel market size, in terms of value, is estimated to reach USD 26.68 Billion by 2020, signifying a firm CAGR of over 5.30% between 2015 and 2020. The coated steel market registered a moderate growth in the past few years and is likely to continue the same growth in the coming years. This growth is driven by the growing of building & construction and appliances industries.

The coated steel industry finds its application majorly in building & construction, appliances, automotive, and other industries, which includes AHU, generator canopy, signage, solar heaters, lighting fixtures, furniture, metal doors & frames, and decking profilers. The growth of building & construction application is driven by increasing urbanization in Asia-Pacific and RoW, which resulted into increased demand for residential, commercial, and industrial infrastructure. Low interest rates on housing loans are also responsible for increase in the demand for new houses, eventually driving the market.

Paint is chosen by its resin type, which gives the film its gloss as well as resistance. The polyester coated steel is the major market and is mainly used in the building & construction industry. In siliconized polyester resin, silicone improves the gloss retention and weather resistance of polyester coatings. The other resins used in coated steel are fluoropolymer, plastisol, and others.

Currently, the Asia-Pacific region is the largest market of coated steel and is estimated to witness the highest CAGR. Countries such as China, India, Japan, and South Korea are expected to lead the Asia-Pacific coated steel market, with China accounting for the largest share in the regional demand for coated steel. Currently, the market size, in terms of volume, for coated steel is comparatively low in Mexico. However, Mexico is expected to grow at the highest rate in the North America region.

Transportation, the biggest challenge in the developing countries, demand-supply gap in Europe and the euro crisis are restraining the growth of coated steel market.

The coated steel market is highly competitive, with key market players, such as ArcelorMittal S.A. (Luxembourg), SSAB AB (Sweden), Salzgitter AG (Germany), OJSC Novolipetsk Steel (NLMK) (Russia), Voestalpine AG (Austria), OJSC Magnitogorsk Iron & Steel Works (MMK) (Russia), ThyssenKrupp AG (Germany), Nippon Steel & Sumitomo Metal Corporation (Japan), United States Steel (U.S.), Essar Steel Ltd. (India), Tata Steel Ltd. (India), Lysvenskii Metallurgicheskii Zavod Zao (Russia), and Jindal Steel & Power Ltd. (India), accounting for a sizable share in the global market. New product development/launches, investments & expansions, acquisitions, and partnerships, contracts & agreements are some of the key strategies adopted by the market players to expand their global presence and product portfolio. Maximum number of market activities took place in 2014. The leading players, such as ArcelorMittal S.A. (Luxembourg), SSAB AB (Sweden), OJSC Novolipetsk Steel (NLMK) (Russia), Voestalpine AG (Austria), OJSC Magnitogorsk Iron & Steel Works (MMK) (Russia), ThyssenKrupp AG (Germany), Essar Steel Ltd. (India), and Lysvenskii Metallurgicheskii Zavod Zao (Russia) contributed mainly in terms of number of developments.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Introduction

1.3 Scope of the Report

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered for the Report

1.4 Currency and Pricing

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Color Coated Steel Market

4.2 Color Coated Steel Market: Major Applications

4.3 Color Coated Steel Market in Asia-Pacific

4.4 Color Coated Steel Market Share, By Region

4.5 Color Coated Steel Market, By Resin Type (2014)

4.6 Color Coated Steel Market–Developed vs. Developing Nations

4.7 Color Coated Steel Market, Demand From RoW

4.8 Color Coated Steel Market Attractiveness, By Application (2020)

4.9 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Resin Type

5.2.2 By Application

5.2.3 By Region

5.2.4 Benefits of Color Coated Steel

5.2.4.1 Manufacturing Benefits

5.2.4.2 Product Quality and Environmental Benefits

5.2.4.3 Economic Benefits

5.2.5 Advantages of Coil Coatings Over Silicone Spray Systems

5.3 Market Evolution

5.3.1 History of Pre-Painted Steel

5.4 Color Coated Steel Manufacturing Process

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Growing Demand From End-User Industries

5.5.1.2 Stiff Competition in the Color Coated Steel Industry

5.5.1.3 High Growth in Construction, Automotive, and Appliance Industries

5.5.1.4 Inexpensive Than Electro Galvanizing Process

5.5.1.5 Product Quality and Differentiation

5.5.1.6 Durability of Cut Edges

5.5.1.7 Fluoropolymer Continues to Grow in the Building & Construction Industry

5.5.2 Restraints

5.5.2.1 Transportation: the Biggest Challenge for the Color Coated Steel Manufacturers

5.5.2.2 Demand-Supply Gap in Europe and the Euro Crisis Restraining the Color Coated Steel Market

5.5.3 Opportunities

5.5.3.1 Opportunities for Steel and Aluminum Protected Skyscrapers in the Middle East Countries

5.5.3.2 Major European Players are Shifting to Emerging Countries Such as India and Saudi Arabia

5.5.3.3 Price: Depends on Customer and Resin Required

5.5.4 Challenges

5.5.4.1 Cost Reduction in Order to Maintain Quality

5.5.4.2 Difficult to Convince End-Users in Developing Countries to Buy High-Cost Color Coated Steel

5.5.4.3 Imbalance in the Demand and Supply of Color Coated Steel

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Color Coated Steel Market, By Resin Type (Page No. - 59)

7.1 Introduction

7.2 Polyester Color Coated Steel

7.3 Fluoropolymer Color Coated Steel

7.4 Siliconized Polyester Color Coated Steel

7.5 Plastisol Color Coated Steel

7.6 Other Color Coated Steel

8 Color Coated Steel Market, By Application (Page No. - 72)

8.1 Introduction

8.2 Building & Construction

8.3 Appliances

8.4 Automotive

8.5 Others

9 Color Coated Steel Market, By Region (Page No. - 84)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 South Korea

9.2.3 Japan

9.2.4 India

9.2.5 Others

9.3 Europe

9.3.1 Turkey

9.3.2 Germany

9.3.3 Italy

9.3.4 Czech Republic

9.3.5 Romania

9.3.6 Hungary

9.3.7 Slovakia

9.3.8 Poland

9.3.9 Ukraine

9.3.10 Russia

9.3.11 Others

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 RoW

9.5.1 Brazil

9.5.2 Others

10 Competitive Landscape (Page No. - 121)

10.1 Overview

10.2 Investments & Expansions

10.3 New Product Development/Launches

10.4 Partnerships, Contracts & Agreements

10.5 Acquisitions

11 Company Profiles (Page No. - 127)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Arcelormittal S.A.

11.3 SSAB AB

11.4 Salzgitter AG

11.5 OJSC Novolipetsk Steel

11.6 Voestalpine AG

11.7 OJSC Magnitogorsk Iron and Steel Works

11.8 Thyssenkrupp AG

11.9 Nippon Steel & Sumitomo Metal Corporation

11.10 United States Steel

11.11 Essar Steel Ltd.

11.12 Tata Steel Limited

11.13 Lysvenskii Metallurgicheskii Zavod ZAO

11.14 Jindal Steel & Power Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 160)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (79 Tables)

Table 1 Market for Building & Construction Application to Register High Growth Between 2015 and 2020

Table 2 Advantages of Color Coated Steel

Table 3 Resins for Color Coated Steel and Their Use

Table 4 Color Coated Steel Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 5 Market Size, By Resin Type, 2013–2020 (USD Million)

Table 6 Polyester Color Coated Steel Market Size, By Region,2013–2020 (Kiloton)

Table 7 Polyester Color Coated Steel Market Size, By Region,2013–2020 (USD Million)

Table 8 Fluoropolymer Color Coated Steel Market Size, By Region,2013–2020 (Kiloton)

Table 9 Fluoropolymer Color Coated Steel Market Size, By Region,2013–2020 (USD Million)

Table 10 Siliconized Polyester Color Coated Steel Market Size, By Region,2013–2020 (Kiloton)

Table 11 Siliconized Polyester Color Coated Steel Market Size, By Region,2013–2020 (USD Million)

Table 12 Plastisol Color Coated Steel Market Size, By Region,2013–2020 (Kiloton)

Table 13 Plastisol Color Coated Steel Market Size, By Region,2013–2020 (USD Million)

Table 14 Other Color Coated Steel Market Size, By Region, 2013–2020 (Kiloton)

Table 15 Other Color Coated Steel Market Size, By Region,2013–2020 (USD Million)

Table 16 Market Size, By Application, 2013–2020 (Kiloton)

Table 17 Market Size, By Application,2013–2020 (USD Million)

Table 18 Market Size for Building & Construction Application, By Region, 2013–2020 (Kiloton)

Table 19 Market Size for Building & Construction Application, By Region, 2013–2020 (USD Million)

Table 20 Market Size for Appliances Application, By Region, 2013–2020 (Kiloton)

Table 21 Market Size for Appliances Application, By Region, 2013–2020 (USD Million)

Table 22 Market Size for Automotive Application, By Region, 2013–2020 (Kiloton)

Table 23 Market Size for Automotive Application, By Region, 2013–2020 (USD Million)

Table 24 Market Size for Other Applications, By Region, 2013–2020 (Kiloton)

Table 25 Market Size for Other Applications, By Region, 2013–2020 (USD Million)

Table 26 Market Size, By Region, 2013–2020 (Kiloton)

Table 27 Market Size, By Region, 2013–2020 (USD Million)

Table 28 Asia-Pacific: Market Size, By Country,2013–2020 (Kiloton)

Table 29 Asia-Pacific: Market Size, By Country,2013–2020 (USD Million)

Table 30 Asia-Pacific: Market Size, By Application,2013–2020 (Kiloton)

Table 31 Asia-Pacific: Market Size, By Application,2013–2020 (USD Million)

Table 32 Asia-Pacific: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 33 Asia-Pacific: Market Size, By Resin Type,2013–2020 (USD Million)

Table 34 China: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 35 China: Market Size, By Resin Type,2013–2020 (USD Million)

Table 36 South Korea: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 37 South Korea: Market Size, By Resin Type,2013–2020 (USD Million)

Table 38 Japan: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 39 Japan: Market Size, By Resin Type,2013–2020 (USD Million)

Table 40 India: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 41 India: Market Size, By Resin Type,2013–2020 (USD Million)

Table 42 Others: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 43 Others: Market Size, By Resin Type,2013–2020 (USD Million)

Table 44 Europe: Market Size, By Country,2013–2020 (Kiloton)

Table 45 Europe: Market Size, By Country,2013–2020 (USD Million)

Table 46 Europe: Market Size, By Application,2013–2020 (Kiloton)

Table 47 Europe: Market Size, By Application,2013–2020 (USD Million)

Table 48 Europe: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 49 Europe: Market Size, By Resin Type,2013–2020 (USD Million)

Table 50 Turkey: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 51 Turkey: Market Size, By Resin Type,2013–2020 (USD Million)

Table 52 Germany: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 53 Germany: Market Size, By Resin Type,2013–2020 (USD Million)

Table 54 Russia: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 55 Russia: Market Size, By Resin Type,2013–2020 (USD Million)

Table 56 Others: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 57 Others: Market Size, By Resin Type,2013–2020 (USD Million)

Table 58 North America: Market Size, By Country,2013–2020 (Kiloton)

Table 59 North America: Market Size, By Country,2013–2020 (USD Million)

Table 60 North America: Market Size, By Application,2013–2020 (Kiloton)

Table 61 North America: Market Size, By Application,2013–2020 (USD Million)

Table 62 North America: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 63 North America: Market Size, By Resin Type,2013–2020 (USD Million)

Table 64 U.S.: Market Size, By Resin Type, 2013–2020 (Kiloton)

Table 65 U.S.: Market Size, By Resin Type,2013–2020 (USD Million)

Table 66 Canada: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 67 Canada: Market Size, By Resin Type,2013–2020 (USD Million)

Table 68 Mexico: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 69 Mexico: Market Size, By Resin Type,2013–2020 (USD Million)

Table 70 RoW: Market Size, By Country, 2013–2020 (Kiloton)

Table 71 RoW: Market Size, By Country,2013–2020 (USD Million)

Table 72 RoW: Market Size, By Application,2013–2020 (Kiloton)

Table 73 RoW: Market Size, By Application,2013–2020 (USD Million)

Table 74 RoW: Market Size, By Resin Type,2013–2020 (Kiloton)

Table 75 RoW: Market Size, By Resin Type,2013–2020 (USD Million)

Table 76 Investments & Expansions, 2010-2015

Table 77 New Product Development/Launches, 2010–2015

Table 78 Partnerships, Contracts & Agreements, 2010–2015

Table 79 Acquisitions, 2010–2015

List of Figures (72 Figures)

Figure 1 Color Coated Steel: Market Segmentation

Figure 2 Color Coated Steel: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Color Coated Steel Market: Bottom-Up Approach

Figure 5 Color Coated Steel Market: Top-Down Approach

Figure 6 Color Coated Steel Market: Data Triangulation

Figure 7 Market for Color Coated Steel in the Building & Construction to Register the Highest Growth Between 2015 and 2020

Figure 8 Market for Polyester to Register the Highest Growth Between2015 and 2020

Figure 9 Asia-Pacific Dominated the Color Coated Steel Market By VolumeIn 2014

Figure 10 Color Coated Steel Market to Register A CAGR of 5.30% Between2015 and 2020

Figure 11 Building & Construction to Register the Highest Growth Rate Between 2015 and 2020

Figure 12 China Dominates the Color Coated Steel Market in Asia-Pacific

Figure 13 Asia-Pacific Leads the Color Coated Steel Market in 2014

Figure 14 Polyester Leads the Global Color Coated Steel Market With the Largest Share in Terms of Volume

Figure 15 Market in Developing Nations to Grow at A Moderate Rate Than in Developed Nations Between 2015 and 2020

Figure 16 RoW to Witness Moderate Growth Rate Between 2015 and 2020

Figure 17 Building & Construction to Witness High Growth Between2015 and 2020

Figure 18 RoW Market to Register A Significant Growth, Between 2015 and 2020

Figure 19 Color Coated Steel, By Region

Figure 20 Advantages of Coil Coatings Over Silicone Spray Systems

Figure 21 Technology Innovations

Figure 22 Color Coated Steel Manufacturing Process

Figure 23 Drivers, Restraints, Opportunities, and Challenges in the Color Coated Steel Industry

Figure 24 Color Coated Steel Industry: Value-Chain Analysis

Figure 25 Polyester to Dominate the Color Coated Steel Market Size, By Type, 2015 vs. 2020 (Kiloton)

Figure 26 Asia-Pacific to Register the Highest CAGR for Polyester Color Coated Steel Market (Kiloton)

Figure 27 RoW Region to Emerge as A Growing Region for Fluoropolymer Color Coated Steel Market (Kiloton)

Figure 28 Siliconized Polyester Color Coated Steel Market Size (Kiloton)

Figure 29 Plastisol Color Coated Steel Market Size (Kiloton)

Figure 30 Other Color Coated Steel Market Size (Kiloton)

Figure 31 Key Drivers for End-Use Industries

Figure 32 Major Color Coated Steel End-Use Applications

Figure 33 Building & Construction Industry to Drive the Demand for Color Coated Steel in Asia-Pacific

Figure 34 Appliances Industry Will Drive the Color Coated Steel Market InAsia-Pacific

Figure 35 Automotive Industry to Witness Moderate Growth Rate in the Color Coated Steel Market

Figure 36 High Demand for Color Coated Steel From Emerging End-Use Industries

Figure 37 Regional Snapshot (2015-2020): India and China are Emerging as New Hotspots

Figure 38 Future Growth for Color Coated Steel Applications Centered InAsia-Pacific

Figure 39 Asia-Pacific Market Snapshot — India to Witness the Highest Growth Between 2015 and 2020

Figure 40 Europe Market Snapshot: Russia Was the Largest Market for Color Coated Steel in the Region in 2014

Figure 41 North American Market Snapshot: Demand to Be Driven By Building& Construction Segment

Figure 42 RoW Market Snapshot: Other Countries to Drive the Color Coated Steel Market in the Region

Figure 43 Companies Adopted New Product Development/Launches as the Key Growth Strategy Between 2010 and 2015

Figure 44 Market Evaluation Framework: Significant Number of Investments and Expansions Fueled Growth & Innovation, 2010 – 2015

Figure 45 Battle for Market Share: New Product Development/Launches Was the Key Strategy

Figure 46 Regional Revenue Mix of Top 5 Market Players

Figure 47 Arcelormittal S.A.: Company Snapshot

Figure 48 Arcelormittal S.A.: SWOT Analysis

Figure 49 SSAB AB: Company Snapshot

Figure 50 SSAB AB: SWOT Analysis

Figure 51 Salzgitter AG: Company Snapshot

Figure 52 Salzgitter AG: SWOT Analysis

Figure 53 OJSC Novolipetsk Steel: Company Snapshot

Figure 54 OJSC Novolipetsk Steel: SWOT Analysis

Figure 55 Voestalpine AG: Company Snapshot

Figure 56 Voestalpine AG: SWOT Analysis

Figure 57 OJSC Magnitogorsk Iron and Steel Works: Company Snapshot

Figure 58 OJSC Magnitogorsk Iron and Steel Works: SWOT Analysis

Figure 59 Thyssenkrupp AG: Company Snapshot

Figure 60 Thyssenkrupp AG: SWOT Analysis

Figure 61 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 62 Nippon Steel & Sumitomo Metal Corporation: SWOT Analysis

Figure 63 United States Steel: Company Snapshot

Figure 64 United States Steel: SWOT Analysis

Figure 65 Essar Steel Ltd.: Company Snapshot

Figure 66 Essar Steel Ltd.: SWOT Analysis

Figure 67 Tata Steel Limited: Company Snapshot

Figure 68 Tata Steel Limited: SWOT Analysis

Figure 69 Lysvenskii Metallurgicheskii Zavod ZAO: Company Snapshot

Figure 70 Lysvenskii Metallurgicheskii Zavod ZAO: SWOT Analysis

Figure 71 Jindal Steel & Power Ltd.: Company Snapshot

Figure 72 Jindal Steel & Power Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Coated Steel Market