Cloud Project Portfolio Management Market by Application (Portfolio Management, Resource Management, Demand Management, Financial Management, Project Management), Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2022

[126 Pages Report] The cloud Project Portfolio Management (PPM) market size is expected to grow from USD 2.97 Billion in 2017 to USD 5.79 Billion by 2022, at an estimated Compound Annual Growth Rate (CAGR) of 14.3%.

The cloud PPM report aims at estimating the market size and future growth potential of the market across different segments, such as application, deployment model, organization size, vertical, and region. The primary objective of the report is to provide a detailed analysis of the major factors influencing the growth of this market (drivers, restraints, opportunities, industry-specific challenges, and burning issues), analyze the opportunities in the market for stakeholders, and details of the competitive landscape for market leaders.

Market Dynamics

Drivers

-

Increasing use of BYOD and mobile devices drives the demand for cloud ppm

-

High adoption of cloud analytics

-

Increasing need for ROI in process manufacturing industries

Restraints

-

Rise in security and privacy concerns among enterprises

Opportunities

-

Increasing adoption of cloud-based ppm solutions among SMEs

-

Integration of project management with social platforms

Challenges

-

Lack of experienced professional for cloud PPM

Increasing use of BYOD and mobile devices is expected to drive the cloud PPM market in coming years

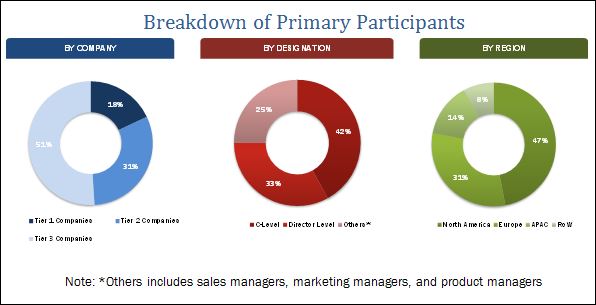

The cloud-based PPM platform offers more accessibility for the users through mobile devices, such as smartphones, tablets, and laptops to their personal data from anywhere at any time. Furthermore, the increasing use of Bring Your Own Device (BYOD) in the workforce has increased the use of personal smartphones, laptops, and tablets. This has created a challenge for IT to offer new applications and secure access to disparate platforms and mobile handsets used by the project managers and the team members across multiple locations. This unprecedented usage of BYOD has enabled workers to access data utilizing their own devices, such as smartphones and tablets. Further, various factors such as enterprise mobility, easy accessibility, and real-time collaboration of geographically dispersed business units have encouraged the growth of the BYOD trend. Mobile accessibility keeps the project team updated about the tasks and updates; hence, it is considered as one of the factors driving the growth of the cloud PPM market. The research methodology used to estimate and forecast the cloud project portfolio management market begins with capturing data on key vendor revenues through secondary literature, such as annual reports, company websites, public databases, and MarketsandMarkets data repository. This research study involved the extensive usage of secondary sources, directories, and databases, such as Cloud Computing Association (CCA), Hoovers, Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the cloud PPM market. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud PPM market from the revenue of key players in this market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud project portfolio management market comprises vendors, such as CA Technologies (New York, U.S.), HPE (California, U.S.), Changepoint Corporation (Richmond Hill, Ontario), Clarizen, Inc. (California, U.S.), Microsoft Corporation (Washington, U.S.), Mavenlink (California, U.S.), Oracle Corporation (California, U.S.), lanisware (California, U.S.), ServiceNow, Inc. (California, U.S.), SAP SE (Walldorf, Germany), Upland Software (Texas, U.S.), and Workfront, Inc. (Utah, U.S.).

Please visit 360Quadrants to see the vendor listing of Project Management Software

Key Target Audience Of Cloud Project Portfolio Management Market

- Cloud PPM vendors

- Cloud brokers

- Internet of Things (IoT) vendors

- Platform providers

- Consultancy firms/advisory firms

- Training and education service providers

- Managed service providers

The research study answers several questions for the stakeholders, primarily which market segments to focus in during the next two to five years for prioritizing the efforts and investments.

Scope of the Report:

The research report categorizes the cloud project portfolio management market to forecast the revenues and analyze the trends in each of the following submarkets:

By Application

- Project management

- Portfolio management

- Demand management

- Resource management

- Financial management

- Others (time and risk management)

Cloud Project Portfolio Management Market research report By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and life sciences

- Telecommunication and ITES

- Manufacturing

- Government and public sector

- Retail and consumer goods

- Others (travel & transportation, education, and aerospace & defense)

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Vendor Comparison Analysis

- Vendor comparison analysis provides information about the major players, who offer cloud PPM solutions and services and outlines the findings & analysis, on how well each cloud project portfolio management market vendor performs within our criteria.

Geographic Analysis

- Further breakdown of the North American cloud PPM market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The cloud Project Portfolio Management (PPM) market size is expected to grow from USD 2.97 Billion in 2017 to USD 5.79 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 14.3% during the forecast period. The major drivers of this market include the increasing need for Bring Your Own Device (BYOD) & mobile devices, shift toward integrated cloud-based solutions, and increased need for Return on Investment (ROI) in process manufacturing industries.

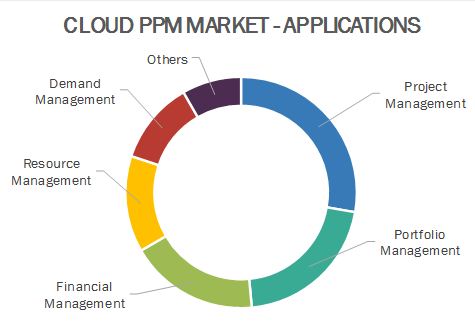

The cloud project portfolio management market report has been broadly classified on the basis of applications into project management, portfolio management, demand management, resource management, financial management, and others (time and risk management); on the basis of deployment models into public, private, and hybrid; on the basis of organization size into Small and Medium Enterprises (SMEs) and large enterprises; on the basis of verticals into Banking, Financial Services, and Insurance (BFSI), healthcare & life sciences, telecommunication & ITES, manufacturing, government & public sector, retail & consumer goods, and others (travel & transportation, education, and aerospace & defense); and on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America.

The project management application is projected to hold the largest market size and is expected to continue its dominance during the forecast period. The use of cloud in the PPM process facilitates consistent project execution, automated compliance with employee & industry regulations, improved resource utilization & reduced resource gaps, increased project visibility, workforce productivity, and operational effectiveness. These benefits are increasing the demand for cloud PPM solution for project management.

The public deployment model is projected to hold the largest market share in 2017 and is expected to grow during the forecast period. The main reason for the high adoption of public cloud is its ease of access and fast deployment. The public cloud deployment model offers various benefits to the enterprises, such as scalability, reliability, flexibility, and remote location access. The public cloud deployment model is more preferred by the enterprises that have less regulatory hurdles and are willing to outsource their storage facilities either fully or partially. The major concern with public cloud is its data security due to which many enterprises are shifting to private and hybrid cloud storage solutions.

The SMEs segment is moving toward the adoption of cloud PPM and growing rapidly at the highest CAGR during the forecast period. Cloud PPM has become a crucial part of the business processes in SMEs due to the ease of use and the flexibility it offers and is expected to grow in the coming years.

North America is expected to have the largest market share in 2017, whereas the APAC region is projected to grow at the highest CAGR from 2017 to 2022 in the cloud project portfolio management market. Remote accessibility, easy implementation, low cost, and immense scalability are some of the major driving factors responsible for the shift from traditional PPM software to cloud PPM in this region.

APAC is expected to be growing at a higher rate in the near future owing to the technological advancements, along with the mandatory regulations imposed by the government regulatory entities to adopt the best-in-class technology and standards. The growth of cloud PPM is primarily driven by the new users and growing awareness regarding the cloud-based solutions in enterprises.

Increasing need for BYOD & mobile devices, shift toward integrated cloud-based solutions, and increased need for ROI in process manufacturing industries are the drivers of the cloud project portfolio management market. Growing concerns regarding security and privacy are some of the major restraints and challenges in the market. The key vendors in the cloud PPM market are Oracle Corporation, SAP SE, Microsoft Corporation, HPE, CA Technologies, and ServiceNow, Inc. These players have adopted various strategies, such as new product developments, acquisitions, and partnerships to serve the cloud PPM market. Continuous technology innovation is an area of focus for these players to maintain its competitive position in the market and promote customer satisfaction.

The cloud PPM market is expected to grow significantly with the increasing need for compliance and collaboration to address industry standards and regulations across all regions. The rising demand for shifting toward integrated cloud-based solutions is one of the major drivers of this market. Organizations are deploying cloud PPM suite as the emergence of cloud-based PPM platform negated the issues related to the PPM. The cloud PPM market is diversified and competitive with many market players, such as Oracle, Microsoft, ServiceNow, and SAP. The cloud PPM market is segmented based on applications, deployment models, organization size, verticals, and regions. Some of the major players in the cloud PPM market include Oracle, SAP, ServiceNow, and Microsoft who have adopted different growth strategies, such as mergers & acquisitions, new product launches, and business expansions to increase their market shares. These players can be categorized into big players, who cater to all segments, and niche players, who focus on specific segments only.

Cloud Project Portfolio Management Market by Application type

Project Management

Project management process involves initiating, planning, executing, controlling, and closing the work of a team to achieve specific goals and meet specific business requirements. The management enables enterprises to plan and allocate resources and allows the organizations to view all the tasks that are competing for resources. Once the task is created, budgets and resources are allocated, and timelines are established. The demand for the project management application is increasing due to real-time communication, decision-making, and increased control over project related expenditures.

Portfolio Management

Portfolio management in cloud PPM refers to an organizations group of projects and process which are selected and managed to offer better returns on project investments. The portfolio is strategically selected to fulfill the organizations goals. The selection of projects maximizes the profit while complying with the budgetary restrictions. Further, the portfolio management application allows the project team to manage the overall risk of the portfolio while ensuring that cash flow and other organizational requirements are achieved.

Demand Management

The demand management centralizes strategic business and project requests, streamlines investment decision process for new products, services, and enhancements. The application provides holistic visibility into project health, cost, and portfolio performance, along with the ability to centralize, collect, and prioritize all demand. Demand management possesses the ability to assess, manage, and accurately forecast demand for products and services. The enterprises stretch its limited resources to satisfy the ever-increasing demand from project portfolios.

Resource Management

Resource management deals with the efficient and effective deployment and allocation of enterprise resources based on the business requirements. The resources mainly comprise financial resources, inventory, employees, production resources, or information technology. Resource management consists of planning, allocating, and scheduling of resources to tasks that include manpower, systems, money, and materials. The enterprise resource can be managed effectively with the help of data of about how much resources are required, which is timely forecasted.

Financial Management

The financial management provides capabilities to support project and portfolio budgeting and planning. The application tracks portfolio budgets, aggregated project budgets at the portfolio level to assess any shortfalls, and compare actual spending with total budget projections. The application analyzes the individual projects and showcases the impact of new projects on the current budget.

Others

The others application section mainly includes time management and risk management. Time management of projects includes measuring and reporting the status of project goals, tasks, and activities required in achieving the pre-defined project results. It also provides tracking of tasks, assignments, events, and activities related to the project.

Key Questions answered in Cloud Project Portfolio Management Market Report

- What are the latest innovations happening in the market?

- What are different use cases of the cloud PPM solutions?

- Various strategies adopted by the leading vendors in the market?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud Project Portfolio Management Market

4.2 Market Share of the Top Three Applications and Regions, 2017

4.3 Market Investment Scenario

4.4 Market Top Three Verticals, 20172022

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Ecosystem

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Use of Byod and Mobile Devices Drives the Demand for Cloud PPM

5.3.1.2 High Adoption of Cloud Analytics

5.3.1.3 Increasing Need for Roi in Process Manufacturing Industries

5.3.2 Restraints

5.3.2.1 Rise in Security and Privacy Concerns Among Enterprises

5.3.3 Opportunities

5.3.3.1 Increasing Adoption of Cloud-Based PPM Solutions Among SMES

5.3.3.2 Integration of Project Management With Social Platforms

5.3.4 Challenges

5.3.4.1 Lack of Experienced Professional for Cloud PPM

6 Cloud Project Portfolio Management Market Analysis, By Application (Page No. - 37)

6.1 Introduction

6.2 Project Management

6.3 Portfolio Management

6.4 Demand Management

6.5 Resource Management

6.6 Financial Management

6.7 Others

7 Cloud Project Portfolio Management Market Analysis, By Deployment Model (Page No. - 43)

7.1 Introduction

7.2 Public Cloud

7.3 Private Cloud

7.4 Hybrid Cloud

8 Market Analysis, By Organization Size (Page No. - 47)

8.1 Introduction

8.2 Small and Medium Enterprises

8.3 Large Enterprises

9 Cloud Project Portfolio Management Market Analysis, By Vertical (Page No. - 51)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 Healthcare and Life Sciences

9.4 Telecommunication and Ites

9.5 Manufacturing

9.6 Government and Public Sector

9.7 Retail and Consumer Goods

9.8 Others

10 Geographic Analysis (Page No. - 58)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Others

10.4 Asia-Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 82)

11.1 Microquadrant Overview

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

11.2.1 Strength of Product Portfolio in Cloud Project Portfolio Management Market (For 25 Players)

11.2.2 Business Strategy Excellence Adopted in Market (For 25 Players)

12 Company Profiles (Page No. - 86)

12.1 CA Technologies

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)

12.2 Changepoint

12.3 Clarizen

12.4 HPE

12.5 Microsoft

12.6 Mavenlink

12.7 Oracle

12.8 Planisware

12.9 Planview

12.10 Servicenow

12.11 SAP

12.12 Upland

12.13 Workfront

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 119)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (62 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Cloud Project Portfolio Management Market Size, By Application, 20152022 (USD Million)

Table 3 Project Management: Market Size, By Region, 20152022 (USD Million)

Table 4 Portfolio Management: Market Size, By Region, 20152022 (USD Million)

Table 5 Demand Management: Market Size, By Region, 20152022 (USD Million)

Table 6 Resource Management: Market Size, By Region, 20152022 (USD Million)

Table 7 Financial Management: Market Size, By Region, 20152022 (USD Million)

Table 8 Others: Market Size, By Region, 20152022 (USD Million)

Table 9 Cloud Project Portfolio Management Market Size, By Deployment Model, 20152022 (USD Million)

Table 10 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 11 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 12 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 13 Market Size, By Organization Size, 20152022 (USD Million)

Table 14 Small and Medium Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 15 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 16 Cloud Project Portfolio Management Market Size, By Vertical, 20152022 (USD Million)

Table 17 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 18 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 19 Telecommunication and ITes: Market Size, By Region, 20152022 (USD Million)

Table 20 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 21 Government and Public Sector: Market Size, By Region, 20152022 (USD Million)

Table 22 Retail and Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 23 Others: Market Size, By Region, 20152022 (USD Million)

Table 24 Cloud Project Portfolio Management Market Size, By Region, 20152022 (USD Million)

Table 25 North America: Market Size, By Application, 20152022 (USD Million)

Table 26 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 27 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 28 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 29 North America: Market Size, By Country, 20152022 (USD Million)

Table 30 United States: Market Size, By Application, 20152022 (USD Million)

Table 31 United States: Market Size, By Deployment Model, 20152022 (USD Million)

Table 32 United States: Market Size, By Organization Size, 20152022 (USD Million)

Table 33 United States: Market Size, By Vertical, 20152022 (USD Million)

Table 34 Canada: Cloud Project Portfolio Management Market Size, By Application, 20152022 (USD Million)

Table 35 Canada: Market Size, By Deployment Model, 20152022 (USD Million)

Table 36 Canada: Market Size, By Organization Size, 20152022 (USD Million)

Table 37 Canada: Market Size, By Vertical, 20152022 (USD Million)

Table 38 Europe: Market Size, By Application, 20152022 (USD Million)

Table 39 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 40 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 41 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 42 Europe: Market Size, By Country, 20152022 (USD Million)

Table 43 United Kingdom: Cloud Project Portfolio Management Market Size, By Application, 20152022 (USD Million)

Table 44 United Kingdom: Market Size, By Deployment Model, 20152022 (USD Million)

Table 45 United Kingdom: Market Size, By Organization Size, 20152022 (USD Million)

Table 46 United Kingdom: Market Size, By Vertical, 20152022 (USD Million)

Table 47 Others: Market Size, By Application, 20152022 (USD Million)

Table 48 Others: Market Size, By Deployment Model, 20152022 (USD Million)

Table 49 Others: Market Size, By Organization Size, 20152022 (USD Million)

Table 50 Others: Market Size, By Vertical, 20152022 (USD Million)

Table 51 Asia-Pacific: Cloud Project Portfolio Management Market Size, By Application, 20152022 (USD Million)

Table 52 Asia-Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 53 Asia-Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 54 Asia-Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 59 Latin America: Cloud Project Portfolio Management Market Size, By Application, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Vertical, 20152022 (USD Million)

List of Figures (31 Figures)

Figure 1 Cloud Project Portfolio Management Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Assumptions

Figure 9 North America is Expected to Hold the Largest Market Share in 2017

Figure 10 Market Top 3 Segments, 2017

Figure 11 Increasing Need for BYOD and Mobile Devices is the Factor Contributing to the Growth of the Cloud Project Portfolio Management Market

Figure 12 Project Management Application and North America to Have the Largest Market Share in 2017

Figure 13 Market Investment Scenario: Asia-Pacific Would Emerge as the Best Market for Investments in the Next Five Years

Figure 14 Banking, Financial Services and Insurance is Expected to Have the Largest Market Size in 2017

Figure 15 Cloud Project Portfolio Management Ecosystem

Figure 16 Cloud Project Portfolio Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Project Management Application is Estimated to Have the Largest Market Size in 2017

Figure 18 Public Cloud Model is Estimated to Hold the Largest Market Size in 2017

Figure 19 Large Enterprises Segment is Estimated to Hold the Largest Market Size in 2017

Figure 20 Banking, Financial Services, and Insurance Vertical is Expected to Have the Largest Market Size in 2017

Figure 21 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 North America is Expected to Dominate the Market During the Forecast Period

Figure 23 Asia-Pacific Market Snapshot

Figure 24 Cloud Project Portfolio Management Market (Global), Competitive Leadership Mapping, 2017

Figure 25 CA Technologies: Company Snapshot

Figure 26 HPE: Company Snapshot

Figure 27 Microsoft: Company Snapshot

Figure 28 Oracle: Company Snapshot

Figure 29 Servicenow: Company Snapshot

Figure 30 SAP: Company Snapshot

Figure 31 Upland: Company Snapshot

Growth opportunities and latent adjacency in Cloud Project Portfolio Management Market