Cloud Performance Management Market by Component (Solutions and Services), Deployment Type (Public Cloud and Private Cloud), Organization Size, Vertical (BFSI, IT & Telecom, Government & Public Sector) and Region - Global Forecast to 2027

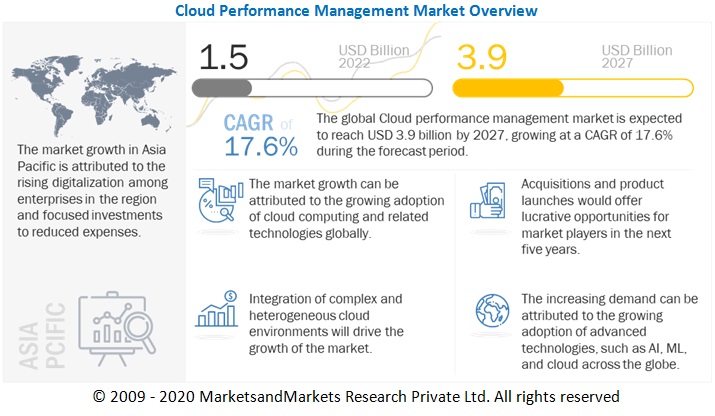

[225 Pages Report] The global cloud performance management market to grow from USD 1.5 billion in 2022 to USD 3.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.6% during the forecast period. Cloud Performance Management market helps in network performance. It helps in automatic performance upgrades, faster product development and deployment. With automatic scaling in the cloud, computing power can be scaled up to handle unexpected spikes in usage.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The cloud computing model is inherently designed to handle fluctuating demand and, if properly implemented, should be able to support increased requests like those caused by the COVID-19 crisis. However, few providers have reserved enough capacity to make the change. Those who can demonstrate their strength and adaptability can do so by offering collaboration and conferencing services at a reduced or no cost, demonstrating the power of new technologies like virtual reality to make virtual meetings feel more real, or forming new partnerships with telecom providers to expand their telco cloud offerings. By capitalising on these and other opportunities, cloud providers can have a significant impact on how much cloud-based digital work becomes the norm rather than the exception. Cloud service providers should be aware of the challenges that increased demand will bring. Aside from remote work, digital events in place of live meetings and streaming services will add to the already high demand. Operational support for cloud offerings will need to be maintained while working remotely or with fewer people, and supply chains will be impacted by short supplies due to manufacturing facilities in China and other areas impacted by current events. Cloud service offerings that haven't been stress-tested may be unprepared to deal with these threats.

In Cloud Performance Management Market Dynamics

Driver: Increasing need to efficiently manage the security and performance of the cloud

According to the Federal Bureau of Investigation (FBI), which is the leading federal agency for investigating cyber-attacks by criminals, overseas adversaries, and terrorists, cyber intrusions are becoming more of a commonplace, more dangerous, and more sophisticated. According to Symantec's 2018 Internet Security Threat Report (ISTR), the number of malware variants increased to 669,947,865 in 2017, more than doubling the number of variants in 2016. According to the Atlas VPN team, new malware samples decreased by 22% in February to 8.93 million. In March, they fell by 2% to 8.77 million people. However, the number of newly discovered malware threats in Q1 2022 remained at 29.11 million.5.65 million new malware samples have been discovered in April, bringing the total number of malware samples discovered in 2022 to 1,347.39 million. These growing security threats and vulnerabilities have increased the need to implement security measures efficient on the cloud platform.

Compromise in the cloud performance may lead to losses for businesses and also result in consumer dissatisfaction. Cloud monitoring proves to be a crucial aspect for managing the security and performance of the cloud. It enables the quick and easy identification of patterns to pinpoint potential threats and vulnerabilities that may compromise the security of the cloud infrastructure. Cloud monitoring supervises the cloud infrastructure to continuously assess and measure the application, data, and infrastructure behaviors for potential security threats. This assures that the cloud infrastructure and platforms function optimally while minimizing the risk of data breaches. Moreover, cloud monitoring helps in assessing the performance of the cloud infrastructure on a modular level. Monitoring helps in evaluating parameters such as uptime and response rate. This further aids in assessing the cloud performance for providing an enhanced customer experience .

Restraint: Concerns about cyber attacks and data breaches

Cloud performance management has grown in popularity in recent years, thanks to major players such as Microsoft, Oracle, HPE which all provide cloud performance platforms. The technology, which began as a backup storage option, cloud tracking, has evolved into an all-encompassing computing platform that has fundamentally changed the way businesses use, store, and share data. However, as cybersecurity professionals are well aware, anything that gains popularity in the digital world will inevitably become a target of malicious cyber actors—and cloud computing platforms are no exception. The number of attacks on these platforms has risen dramatically in recent years. Cloud cyber attacks, incidentally, accounted for 20% of all cyber attacks in 2020, making cloud computing platforms the third most-targeted cyber environment.

Microsoft announced on January 22, 2020, that one of their cloud databases had been breached in December 2019, exposing 250 million entries, including email addresses, IP addresses, and support case details. The cause of this data breach, according to the computing giant, was a misconfigured network server that was hosting the critical information. While not the largest cyber attack, it was one of the most shocking due to the high-profile nature of the target. McAfee believes that data in the cloud may be more vulnerable than data on on-premises servers. These flaws are exacerbated by lapses on the part of both Cloud Service Providers (CSPs) and end users.

Opportunity: Emergence of hybrid cloud infrastructure

Using a hybrid cloud setup, it is easier to add more computational power and run more complex and resource-demanding applications with public cloud options. However, in a hybrid cloud environment, it is relatively simple to use encryption methods to ensure data security throughout this process. The IT team has several options for making data transfer and storage safer with a hybrid cloud. Hybrid clouds frequently help lower long-term costs, freeing up some budgetary space in an organisation. The company saves money during the growth process because scaling a hybrid cloud upward is easier and less expensive. Furthermore, because scaling is more accessible, the organisation can grow faster and generate more revenue sooner. Growth can be hampered by purely on-site storage, resulting in higher opportunity costs due to the company missing out on potential income. One of the primary advantages of a hybrid cloud environment is control. Instead of entrusting all aspects of your IT infrastructure to a third-party provider, users can tailor the private side of their cloud model to their specific needs. Other sectors of the user's hybrid cloud could be assigned to less critical or time-sensitive tasks. When properly protected, hybrid cloud infrastructure is not only safe, but it can also help boost the overall security profile of the company.

Challenge: Complexity in designing the network brought on by cloud and security concerns

User data is stored on cloud service provider (CSP) data centres due to security and privacy concerns. A CSP should follow the rules of not sharing confidential data or any data that is important to users. A CSP must ensure that data centres are secure and that data privacy is maintained. Cloud security is a collection of control-based technologies and policies designed to adhere to regulatory compliances and rules while also protecting data applications and cloud technology infrastructure. Because the cloud's nature is to share resources, cloud security places a premium on identity management, privacy, and access control. As a result, data stored in the cloud should be encrypted. With the increased use of cloud technology for data operations, proper security and other potentially vulnerable areas became a priority for organisations contracting with cloud providers. Cloud computing security manages security controls in the cloud and ensures customer data security, privacy, and compliance with applicable regulations. Many organisations are concerned about data privacy and confidentiality. Data protection regulations such as the EU's General Data Protection Regulation (GDPR), the Health Insurance Portability and Accessibility Act (HIPAA), the Payment Card Industry Data Security Standard (PCI DSS), and others require the protection of customer data and impose harsh penalties for security violations. Organizations also have a large amount of internal data that is critical to maintaining a competitive advantage. While storing this data in the cloud has its benefits, it has also raised major security concerns for 66 percent of organisations. Many businesses have embraced cloud computing but lack the knowledge to ensure that they and their employees are using it safely. Complexity in designing the cloud platform hinders the growth of the cloud performance management market.

Based on organization size, SMEs segment is to be a larger dominator to the Cloud Performance Management market during the forecast period.

SMEs is the fastest-growing segment in the cloud performance management market as cloud-based solutions and services help SMEs to improve business performance, cloud performance, and enhance productivity, whereas the large enterprises segment is expected to hold a larger share due to affordability and its acceptance for emerging technologies. The major driving factors favoring the adoption of cloud system management solutions among SMEs include reliability, scalability, integration, flexibility, and improved productivity. Organizations with employee numbers ranging between 1 and 1,000 are categorized as SMEs. The cloud performance management market for SMEs is expected to gain traction as it provides flexibility and scalability, along with reduced costs. Small and medium-sized businesses can benefit greatly from understanding business cloud solutions. Cloud computing technology enables SMEs to compete in a cloud monster-controlled environment and provides the level playing field required to succeed in business.

Some small and medium-sized businesses have yet to fully grasp the benefits that cloud solutions can provide. Meanwhile, many cloud sellers are preparing for the expected significant increase in popularity among cloud services for SMEs and private buyers. Another important preferred viewpoint is versatility. Given today's global and focused business environment, it is critical for SMEs to have the versatility and adaptability to respond quickly to market changes. Cloud computing services are adaptable in terms of demand and are priced on a pay-per-use basis, in which organisations pay for the IT services they consume. The compensation, per-utilize model implies that organisations pay for the services that they require and can easily scale up by paying for more clients or modules when the business requirement emerges, without having to invest heavily in hardware, applications, or IT faculty. Cloud operation and orchestration, governance, and compliance across large as well as small and mid-sized enterprises are cloud performance-intensive.

Based on vertical retail and consumer goods segment to grow at the highest CAGR during the forecast period

The effects of cloud computing on the retail industry are obvious. Power has shifted from retailers to consumers in today's world. To keep the attention of customers from all over the world, the retail industry has undergone a digital transformation. Cloud migration is a promising investment for retailers who want to attract new customers while also retaining their existing customer base. One of the most important aspects of the retail industry is cost efficiency. The cloud infrastructure can be scaled up or down based on the needs of the business. Certainly, shopping trends change with the seasons. Cloud computing enables the organisation to scale up for peak periods such as the holidays while scaling down for slower periods in the retail calendar. Cloud computing provides users with the same high-quality user experience as brick-and-mortar stores. For example, from the availability of artificial intelligence-powered chatbots to Buy-Online-Pick-Up-In-Store (BOPUS), the cloud helps power a unified customer experience from store to online. To summarise, an industry-wide unified platform for seamless communication. The cloud has made it possible to have access to the entire inventory at one's fingertips. The power of cloud computing allows businesses to securely store confidential information no matter where their employees are. Furthermore, storing inventory in the cloud allows employees to access inventory information from anywhere and make decisions accordingly.

To know about the assumptions considered for the study, download the pdf brochure

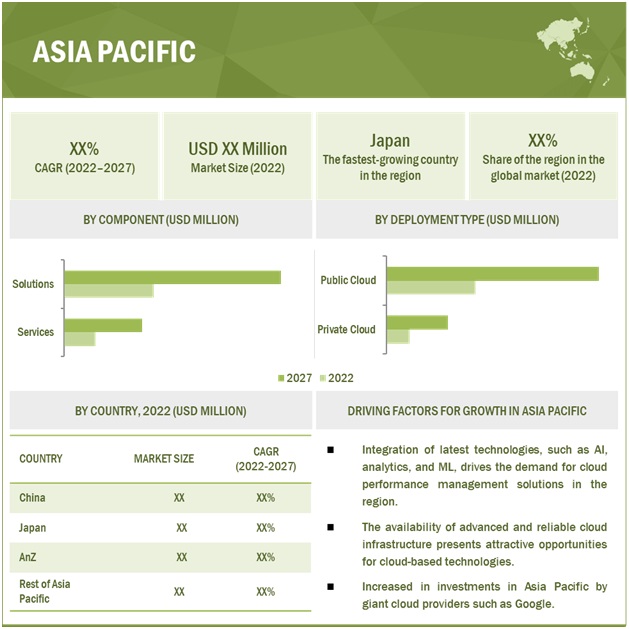

Asia Pacific to grow at the highest CAGR during the forecast period

In the past few decades, China is home to one of the largest online companies in the world. The country plays a key role in the technological landscape of the Asia Pacific region. According to an intelligence report by the Global System for Mobile Communications (GSMA) 2019, China is one of the world’s largest IoT markets and holds 64% of the global cellular connections. China’s technology market is the transformation of traditional industries through the internet and Chinese enterprises' participation in “Belt and Road” initiatives to enter foreign markets. China-based software and outsourcing companies are shifting toward adopting cloud-based technologies to compete efficiently in the market due to the factors of low costs and enhanced business efficiencies, which boost the demand for cloud performance management solutions. For instance, in November 2016, China enacted its first-ever Cybersecurity Law, effective from June 1, 2017, which established the regulatory framework for promoting cybersecurity as a function of national security. Japan is one of the major countries in Asia Pacific to adopt cloud, with continuous development in cloud services. It was ranked as the top market for adopting cloud-based solutions and services for the third consecutive year by the Asia Cloud Computing Association (ACCA). SMEs are moving toward cloud adoption, which is leading to the increasing growth of the cloud performance management market in this country. Furthermore, large cloud players are showing interest in driving the cloud adoption rate in Japan. These factors are leading to the adoption of cloud performance management solutions at a faster rate. The country has been ranked second by the Software Alliance in its 2018 Global Cloud Computing Scoreboard. Japanese companies are the main actors promoting R&D investments for technological advancements. Moreover, Japanese corporations are taking a keen interest in moving to cloud-based B2B services. This is likely to boost the demand for cloud-based management solutions.

Cloud Performance Management Companies

The Cloud Performance Management market is dominated by companies such as, Microsoft (US), IBM (US), HPE (US), Oracle (US), VMware (US), CA Technologies (US), Riverbed (US), Dynatrace (US), App Dynamics (US), BMC Software (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2021–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Component, deployment type, organization size, vertical and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa and Latin America |

|

List of Companies in Cloud Performance Management |

Microsoft (US), IBM (US), HPE (US), Oracle (US), VMware (US), CA Technologies (US), Riverbed (US), Dynatrace (US), App Dynamics (US), BMC Software (US). |

This research report categorizes the Cloud Performance Management market based on Component, deployment type, organization size, vertical and region

Based on Component:

- Solutions

- Services

Based on Deployment Type:

- Public Cloud

- Private Cloud

Based on Organization Size:

- SMEs

- Large Enterprises

Based on Vertical:

- Banking, Financial Services, and insurance

- IT and telecom

- Government and Public Sector

- Manufacturing

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Energy and Utilities

- Other Verticals

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In October 2020, Oracle launched Oracle Cloud Observability and Management Platform, which platform will provide a new level of visibility and control for software deployed on Oracle Cloud Infrastructure, multi-cloud environments, and on-premises systems.

- In June 2021, VMware partnered with Cohere Technologies. Cohere Technologies and VMware announced the development of an O-RAN solution. The RAN is by far the most expensive and complicated component of a CSP network, as the workloads that run there necessitate ultra-low latency and high performance.

- In May 2022, Riverbed partnered with Ghabbour Auto to improve the performance of its 54 subsidiaries spread across four countries' hybrid networks and mission-critical applications within Riverbed Acceleration Portfolio. This partnership has enabled GB Auto to deliver secure, optimized performance and improve digital experiences for all employees as well as customers who are increasingly using the company's website and mobile app to access services quickly and conveniently.

Frequently Asked Questions (FAQ):

What is the projected market value of the Cloud Performance Management market?

The global EdTech and smart classrooms market to grow from USD 1.5 billion in 2022 to USD 3.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.6% during the forecast period.

Which region has the highest market share in the Cloud Performance Management market?

North America region has the higher market share in the Cloud Performance Management market.

Which are the major vendors in the Cloud Performance Management market?

Microsoft (US), IBM (US), HPE (US), Oracle (US), VMware (US)

What are some of the drivers in the Cloud Performance Management market?

The increased usage of mobile, internet penetration, usage of AI, ML, Big Data are the key drivers of Cloud Performance Management market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 CLOUD PERFORMANCE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF CLOUD PERFORMANCE MANAGEMENT FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF CLOUD PERFORMANCE MANAGEMENT VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND-SIDE): CLOUD PERFORMANCE MANAGEMENT MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): VENDOR-REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 START-UP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 10 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 11 CLOUD PERFORMANCE MANAGEMENT MARKET: GLOBAL SNAPSHOT, 2019-2027

FIGURE 12 TOP-GROWING SEGMENTS IN MARKET

FIGURE 13 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET

FIGURE 14 PUBLIC CLOUD TO ACCOUNT FOR LARGER MARKET

FIGURE 15 SMES TO GROW AT HIGHER CAGR

FIGURE 16 RETAIL AND CONSUMER GOODS TO GROW AT HIGHEST CAGR

FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BRIEF OVERVIEW OF CLOUD PERFORMANCE MANAGEMENT MARKET

FIGURE 18 SHIFTING WORKLOADS OF ENTERPRISES TOWARD CLOUD ENVIRONMENTS TO DRIVE MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 19 SOLUTIONS TO ACCOUNT FOR LARGER SHARE BY 2027

4.3 MARKET, BY DEPLOYMENT TYPE, 2022 VS. 2027

FIGURE 20 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2027

4.4 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 21 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2027

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE TO ACCOUNT FOR LARGEST SHARE BY 2027

4.6 MARKET - INVESTMENT SCENARIO

FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD PERFORMANCE MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Growing adoption of hybrid cloud and multi-cloud strategies across enterprises from different industry verticals

5.2.1.2 Emergence of AI-enabled tools in IT operations

5.2.1.3 Shifting workloads of enterprises toward cloud environment

5.2.1.4 Increasing need to efficiently manage security and performance of cloud

5.2.2 RESTRAINTS

5.2.2.1 Concerns about cyber-attacks and data breaches

5.2.2.2 Difficulties involved in application portability

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of hybrid cloud infrastructure

5.2.3.2 Proactive investments by enterprises in cloud-based models

5.2.3.3 COVID-19 outbreak to foster adoption of cloud-based solutions

5.2.4 CHALLENGES

5.2.4.1 Complexity in network design brought on by cloud and security concerns

5.2.4.2 Increasing and changing business demand

5.2.4.3 Increasing number of changes in IT operations

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: IMPROVING PERFORMANCE WITH CISCO WORKLOAD OPTIMIZATION MANAGER

5.4.2 CASE STUDY 2: COGNIZANT REALIZED POWER OF HYBRID CLOUD MANAGEMENT USING VMWARE ENTERPRISE SOLUTION

5.4.3 CASE STUDY 3: ROYAL BANK OF CANADA ACHIEVED CENTRAL MANAGEMENT OF ITS CLOUD APPS AND DATABASE USING AZURE

5.5 ECOSYSTEM

FIGURE 25 CLOUD PERFORMANCE MANAGEMENT MARKET: ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN

5.7 PRICING ANALYSIS

TABLE 3 DYNATRACE: PRICING ANALYSIS OF VENDORS IN MARKET

TABLE 4 BMC SOFTWARE: PRICING ANALYSIS OF VENDORS IN MARKET

TABLE 5 VMWARE: PRICING ANALYSIS OF VENDORS IN MARKET

5.8 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENT DOCUMENTS PUBLISHED OVER LAST 10 YEARS

FIGURE 28 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 6 TOP TEN PATENT APPLICANTS

TABLE 7 PATENTS GRANTED TO VENDORS IN MARKET

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 CLOUD PERFORMANCE MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 30 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 TECHNOLOGICAL ANALYSIS

5.12.1 ARTIFICIAL INTELLIGENCE

5.12.2 DATA ANALYTICS

5.12.3 BIG DATA

5.13 REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 REGULATIONS

5.13.2.1 North America

5.13.2.2 Europe

5.13.2.3 Asia Pacific

5.13.2.4 Middle East and South Africa

5.13.2.5 Latin America

6 CLOUD PERFORMANCE MANAGEMENT MARKET, BY COMPONENT (Page No. - 71)

6.1 INTRODUCTION

FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 15 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 SOLUTIONS

TABLE 16 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

TABLE 18 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 32 PRIVATE CLOUD TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 20 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 21 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

7.2 PUBLIC CLOUD

TABLE 22 PUBLIC CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PRIVATE CLOUD

TABLE 24 PRIVATE CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 PRIVATE CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CLOUD PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 81)

8.1 INTRODUCTION

FIGURE 33 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT HIGHER CAGR

TABLE 26 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 27 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 28 SMES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CLOUD PERFORMANCE MANAGEMENT MARKET, BY VERTICAL (Page No. - 86)

9.1 INTRODUCTION

FIGURE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE TO ACCOUNT FOR LARGEST MARKET SIZE

TABLE 32 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 33 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 IT AND TELECOM

TABLE 36 IT AND TELECOM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 IT AND TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 GOVERNMENT AND PUBLIC SECTOR

TABLE 38 GOVERNMENT AND PUBLIC SECTOR: CLOUD PERFORMANCE MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 MANUFACTURING

TABLE 40 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 RETAIL AND CONSUMER GOODS

TABLE 42 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 HEALTHCARE AND LIFE SCIENCES

TABLE 44 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 ENERGY AND UTILITIES

TABLE 46 ENERGY AND UTILITIES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 48 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CLOUD PERFORMANCE MANAGEMENT MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR

TABLE 50 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

TABLE 52 NORTH AMERICA: CLOUD PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

TABLE 62 US: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 63 US: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 64 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 65 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

TABLE 66 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 67 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 69 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: CLOUD PERFORMANCE MANAGEMENT MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 70 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

TABLE 80 UK: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 81 UK: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 82 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 83 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

TABLE 84 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

TABLE 88 FRANCE: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 92 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: CLOUD PERFORMANCE MANAGEMENT MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

TABLE 106 CHINA: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 107 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 108 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 109 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.4 JAPAN

TABLE 110 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 111 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 112 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 114 AUSTRALIA AND NEW ZEALAND: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 115 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 116 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 117 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: CLOUD PERFORMANCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: CLOUD PERFORMANCE MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 122 MIDDLE EAST & AFRICA: CLOUD PERFORMANCE MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 132 KINGDOM OF SAUDI ARABIA: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 133 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 134 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 135 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 136 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 137 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 138 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 139 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 140 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 141 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 142 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 143 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: CLOUD PERFORMANCE MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 144 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

TABLE 154 BRAZIL: CLOUD PERFORMANCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 155 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 157 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 158 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 159 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 160 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 161 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 142)

11.1 INTRODUCTION

FIGURE 38 MARKET EVALUATION FRAMEWORK, 2019-2022

11.2 MARKET SHARE OF TOP VENDORS

FIGURE 39 CLOUD PERFORMANCE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS

FIGURE 40 HISTORICAL REVENUE ANALYSIS, 2017–2021

11.4 KEY MARKET DEVELOPMENTS

11.4.1 NEW LAUNCHES

TABLE 162 NEW LAUNCHES, 2019-2022

11.4.2 DEALS

TABLE 163 DEALS, 2019-2022

11.4.3 OTHERS

TABLE 164 OTHERS, 2020-2022

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 41 CLOUD PERFORMANCE MANAGEMENT MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 165 COMPANY COMPONENT FOOTPRINT

TABLE 166 COMPANY VERTICAL FOOTPRINT

TABLE 167 COMPANY REGIONAL FOOTPRINT

TABLE 168 COMPANY FOOTPRINT

11.6 COMPETITIVE BENCHMARKING

TABLE 169 CLOUD PERFORMANCE MANAGEMENT MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 170 SME/START-UP COMPONENT FOOTPRINT

TABLE 171 SME/START-UP VERTICAL FOOTPRINT

TABLE 172 SME/START-UP REGION FOOTPRINT

TABLE 173 SME/START-UP FOOTPRINT

12 COMPANY PROFILES (Page No. - 159)

12.1 INTRODUCTION

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

12.2 KEY PLAYERS

12.2.1 IBM

TABLE 174 IBM: BUSINESS OVERVIEW

FIGURE 42 IBM: COMPANY SNAPSHOT

TABLE 175 IBM: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 176 IBM: PRODUCT LAUNCH

TABLE 177 IBM: DEALS

TABLE 178 IBM: OTHERS

12.2.2 MICROSOFT

TABLE 179 MICROSOFT: BUSINESS OVERVIEW

FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

TABLE 180 MICROSOFT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 181 MICROSOFT: PRODUCT LAUNCHES

TABLE 182 MICROSOFT: DEALS

TABLE 183 MICROSOFT: OTHERS

12.2.3 HPE

TABLE 184 HPE: BUSINESS OVERVIEW

FIGURE 44 HPE: COMPANY SNAPSHOT

TABLE 185 HPE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 186 HPE: PRODUCT LAUNCHES

TABLE 187 HPE: DEALS

TABLE 188 HPE: OTHERS

12.2.4 ORACLE

TABLE 189 ORACLE: BUSINESS OVERVIEW

FIGURE 45 ORACLE: COMPANY SNAPSHOT

TABLE 190 ORACLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 191 ORACLE: PRODUCT LAUNCHES

TABLE 192 ORACLE: DEALS

TABLE 193 ORACLE: OTHERS

12.2.5 VMWARE

TABLE 194 VMWARE: BUSINESS OVERVIEW

FIGURE 46 VMWARE: COMPANY SNAPSHOT

TABLE 195 VMWARE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 196 VMWARE: PRODUCT LAUNCHES

TABLE 197 VMWARE: DEALS

TABLE 198 VMWARE: OTHERS

12.2.6 CA TECHNOLOGIES

TABLE 199 CA TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 200 CA TECHNOLOGIES: SOLUTIONS/SERVICES/PLATFORMS OFFERED

12.2.7 RIVERBED

TABLE 201 RIVERBED: BUSINESS OVERVIEW

TABLE 202 RIVERBED: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 203 RIVERBED: PRODUCT LAUNCHES

TABLE 204 RIVERBED: DEALS

12.2.8 DYNATRACE

TABLE 205 DYNATRACE: BUSINESS OVERVIEW

FIGURE 47 DYNATRACE: COMPANY SNAPSHOT

TABLE 206 DYNATRACE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 207 DYNATRACE: PRODUCT LAUNCHES

TABLE 208 DYNATRACE: DEALS

12.2.9 APPDYNAMICS

TABLE 209 APPDYNAMICS: BUSINESS OVERVIEW

TABLE 210 APPDYNAMICS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 211 APPDYNAMICS: PRODUCT LAUNCHES

TABLE 212 APPDYNAMICS: DEALS

TABLE 213 APPDYNAMICS: OTHERS

12.2.10 BMC SOFTWARE

TABLE 214 BMC SOFTWARE: BUSINESS OVERVIEW

TABLE 215 BMC SOFTWARE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 216 BMC SOFTWARE: PRODUCT LAUNCHES

TABLE 217 BMC SOFTWARE: DEALS

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.3 OTHER COMPANIES

12.3.1 NEW RELIC

12.3.2 NASTEL TECHNOLOGIES

12.3.3 SNOW SOFTWARE

12.3.4 MICRO FOCUS

12.3.5 COGNIZANT

12.3.6 LUMEN TECHNOLOGIES

12.3.7 NETAPP

12.3.8 NUTANIX

12.3.9 DATADOG

12.3.10 SPLUNK

12.3.11 ATATUS

12.3.12 CITRIX

12.3.13 RACKWARE

12.3.14 CORESTACK

12.3.15 MORPHEUS DATA

12.3.16 HYPERGRID

13 ADJACENT AND RELATED MARKETS (Page No. - 211)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COMPONENT

TABLE 218 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 219 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 220 COMPONENT: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 221 COMPONENT: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2021–2027 (USD MILLION)

13.2.4 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE

TABLE 222 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 223 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

13.2.5 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY VERTICAL

TABLE 224 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 225 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

13.2.6 GEOGRAPHIC ANALYSIS

13.2.6.1 North America

TABLE 226 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 227 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 228 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 229 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 230 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 231 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 232 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 233 NORTH AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14 APPENDIX (Page No. - 219)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORT

14.5 AUTHOR DETAILS

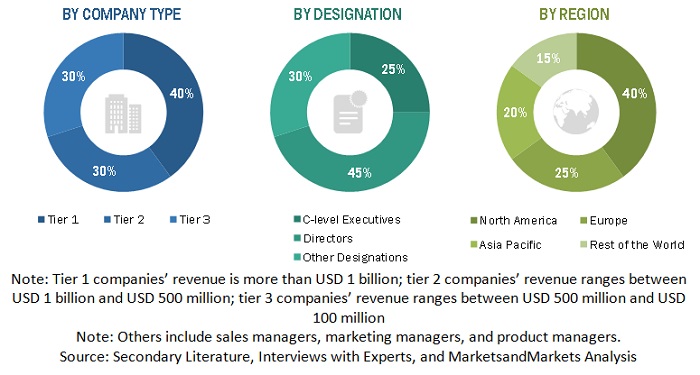

The study involved 4 major activities in estimating the current size of the Cloud Performance Management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering cloud performance management was derived based on the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from cloud performance management vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using cloud performance management solutions, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall cloud performance management market.

All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the cloud performance management market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall Cloud Performance Management market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the global cloud performance management market based on component (solutions and services), deployment type, organization size, vertical, and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19-related and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Performance Management Market