Cloud Native Applications Market by Component (Platforms and Services), Deployment Mode, Organization Size, Vertical (BFSI, Healthcare & Life Sciences, and IT & Telecom) and Region - Global Forecast to 2028

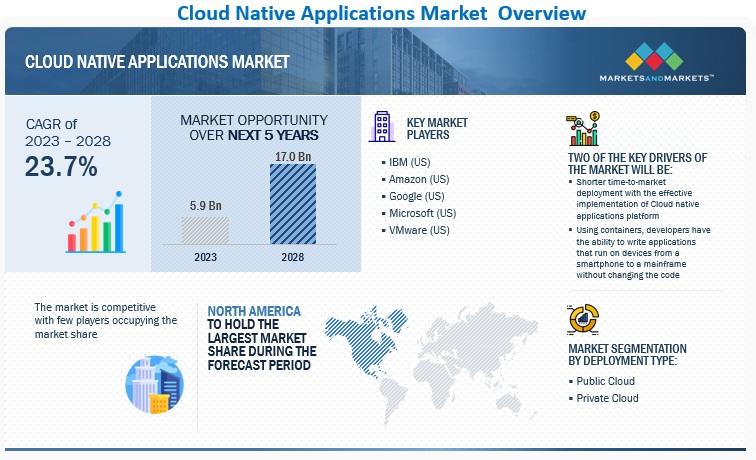

[219 Pages Report] The global Cloud Native Applications Market size is projected to expand at a CAGR of 23.7% during the forecast period to reach USD 17.0 billion by 2028, size was valued USD 5.9 billion in 2023. An analysis of market trends is part of the new research report. The latest research includes conference and webinar materials, patent analysis, important stakeholder information, and pricing analysis. Flexibility and speed being key factors for cloud native applications to scale as enterprises can achieve quicker development and rolling out their application enhancements/updates, convenient application management, and significant flexibility in scaling app resources upwards or downwards automatically in order to meet real-time changes in demand.

The increasing cloud computing demand and hike in cloud traffic require cloud native technologies to empower organizations in building and running applications over public, private, and hybrid clouds to scale. To succeed in fast-paced, software-driven markets, companies must change the way they design, build, and use applications. Cloud-native application development is an approach to building, running, and improving apps based on well-known techniques and technologies for cloud computing. These are programs that are designed for a cloud computing architecture. Cloud native applications offer several benefits such as independent building up of the applications, so they’re managed and deployed individually, resilient architecture aids survival and remaining online even in the event of an infrastructure outage, cloud native applications due to interoperability and workload portability are often based on open source and standards based technology (cloud native services) which aids reduce vendor lock-in and results in increased portability, business agility, automation using DevOps automation(s) features, and container orchestrators such as Kubernetes and Docker, enterprises can deploy a software update with nearly zero downtime, which are strong driving forces of the cloud native applications market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Cloud native development leverages getting apps to market swiftly

The cloud-native model helps enterprises to bring new features online so customers can use them instantly. According to an IBM survey, 73% of development executives, IT executives, and developers have reported that this model has resulted in quicker development and roll-out. As because the cloud-native approach encourages efficiency and flexibility, it directly stimulates and boosts business growth. Enterprises globally can scale resources to handle user demand and reach even more users quickly. By using this cloud platform, the company(ies) can be more responsive to and relevant to its application updates. This manner of continuous integration and continuous deployment (CI/CD) and self-service has gained popularity with customers, who, over recent times have become more likely to buy and use the app, as well as potentially share their experiences.

Restraint: Cost overrun as a limiting factor

Enterprises might find that the costs of cloud-native development can be dicey and potentially dangerous. Usage-based pricing can lead to unexpected costs if an application experiences a surge in traffic. Organizations need to carefully monitor their usage and plan accordingly, otherwise they are prone to face budget overruns. Several organizations have been charged USD 100,000 cloud bills in recent times when their calculation was USD 2,000. Cloud-native application development offers several advantages; however, organizations should be aware of these potential downsides and plan accordingly to fully experience the benefits of this approach.

Opportunities: Better reliability in accordance with IT infrastructure

With a microservices platform, there is no single point of failure. The independent services are fault-tolerant or fault-resistant (to a greater extent) and isolated from each other within their own runtime. This denotes that even when a failure occurs, developers can quickly isolate its impact, and one failure does not impact and take down the entire application. For instance, as Netflix’s streaming service grew, it realized that it needed a more reliable infrastructure with no single point of failure. The company decided to migrate the IT infrastructure from its data centers to a public cloud and replace monolithic programs with smaller manageable software components using a microservices architecture. Not only does this mean Netflix engineers can easily change any services, which leads to faster deployments, but it also enables them to track the performance of each service well and quickly troubleshoot any issues.

Another instance like Netflix is Education Horizons which designed a student information platform for small schools named Zunia (the student information platform), using AWS, which benefits from strong security isolation between the containers. AWS also provides the latest security updates and enables granular access permissions for every container. Zunia has been designed and built to tap into the scalability, elasticity, resiliency, and flexibility of the cloud.

Challenges: Managing and governing development workflow

Cloud native applications are built on many layers, and their development process is spread across multiple stages, which makes it difficult and complex to manage and govern the development workflow. There also is a large number of tools and technologies that function as enablers for cloud-native application development. The unique value proposition of cloud-native architectures also brings along many layers of complexity, such as the source code, third-party code, dependencies, software artifacts (observations/inferences) from the build process, and Infrastructure as Code, which results in the deployment of live infrastructure, and the cloud resources provisioning along with clusters. Therefore, one of the main challenges for cloud-native applications is security.

Based on organization size, large enterprises segment to hold a larger share in the cloud native applications market growth during the forecast period

Large enterprises have been early adopters of cloud native applications and associated professional and/or managed services. Large enterprises have increasingly started using cloud-based systems over traditional on-premises solutions. These enterprises have several departments or teams engaged with different operations. Large enterprises deploy cloud native solutions due to higher flexibility, scalability, and low maintenance costs. As businesses store information and data in the cloud, the requirement for security solutions is also increasing. Large enterprises have emphasized on the importance of innovating their customer experience quickly to see the value of adopting cloud-native development model. Over half of the new applications to be developed in 2023 will be cloud native. Among current adopters of the model, 53% of applications are cloud-native. Among enterprise applications, data analytics, business intelligence, and any application that uses a database are most commonly designed and built with the cloud-native model.

Based on vertical, the BFSI segment to hold the largest market share in the cloud native applications market during the forecast period

Cloud technology is increasingly being used by banking, financial services and insurance institutions to store data and applications. Cloud technology providers offer products and services that provide multiplied revenue generation, customer insights, with reduced costs. The deployment of cloud computing models provides control to financial institutions on how they pay for the technology deployed. Cloud deployment provides increased scalability, and organizations can respond more quickly to market shifts. The overall costs are reduced as the organizations do not need to pay for on-premises infrastructure costs. The COVID-19 outbreak has further accelerated data movement to the cloud environment. There is an increasing need for cybersecurity solutions and services in the BFSI vertical to fight against the growing number of physical and cyberattacks on critical infrastructures that are taking place due to the increasing adoption of BYOD and Work from Home (WFH) trends. Financial institutions need to be compliant with regulations such as the PIPEDA. This has led to the growing adoption of CNAPP and associated services. Financial institutes are always early adopters of advanced technologies. CNAPP is one of the essential security tools developed to secure deployed cloud resources and has significant applications in the BFSI vertical.

To know about the assumptions considered for the study, download the pdf brochure

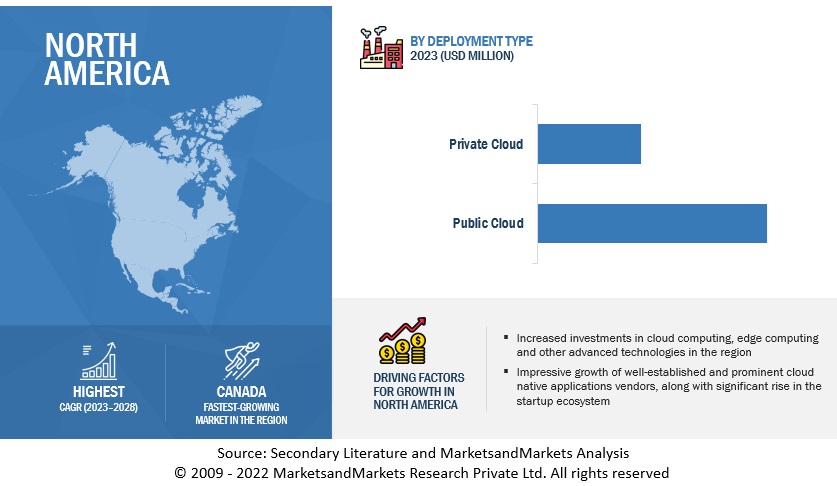

North America to hold the largest market share during the forecast period

North America is expected to be among the largest contributors to the global cloud native applications market in terms of market share. It is one of the most advanced regions regarding cloud and edge computing technology adoption and infrastructure, besides several other advanced technologies. The region has quite well experienced increasing digitalization and cloud technology adoption. IT spending on system infrastructure is drastically shifting upwards from traditional solutions to the cloud, with both public and private deployment types. Organizations are rapidly using cloud services for new initiatives or to replace existing systems. The regional presence of key industry players offering cloud native applications drives the market growth in North America.

Nearly 35% of the market’s growth will originate from North America during the forecast period, per studies/surveys from expert opinions. The US is the key market for the cloud native applications market in North America. Market growth in this region will be faster than the growth of the market in Europe. Additionally, the region’s growth is anticipated due to the presence of top vendors in the region, including Microsoft, AWS, IBM, VMware, and Google. According to Forrester, 14% of the professional developers in Canada significantly use containers on the public cloud, and 16% use a serverless architecture. Increased adoption across the region with the proliferation of containerized environments such as Kubernetes attracts impressive investment directed towards this market, and Kubernetes has become the container orchestration platform of choice among IT teams across the region. The countries analyzed in the North American region include the US and Canada.

Key Players

Several global as well as startup players in the cloud native applications market have been profiled in the report. Those include Amazon.com, Inc. (Amazon, US), Google LLC (Google, US), International Business Machines Corporation (IBM, US), Infosys Technologies Private Limited (Infosys, India), Larsen & Toubro Infotech (LTIMindtree, India), Microsoft Corporation (Microsoft, US), Oracle Corporation (Oracle, US), Red Hat (US), SAP SE (SAP, Germany), VMware (US), Alibaba Cloud (Singapore), Apexon (US), Bacancy Technology (India), Citrix Systems, Inc. (Citrix, US), Harness (US), Cognizant Technology Solutions Corp (Cognizant, US), Ekco (Ireland), Huawei Technologies Co. Ltd. (Huawei, China), R Systems (US), Scality (US), Sciencesoft (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 5.9 billion |

|

Revenue forecast for 2028 |

USD 17.0 billion |

|

Growth Rate |

23.7% CAGR |

|

Market size available for years |

2019–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Billion (USD) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Component, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

|

Companies covered |

Amazon.com, Inc. (Amazon, US), Google LLC (Google, US), International Business Machines Corporation (IBM, US), Infosys Technologies Private Limited (Infosys, India), Larsen & Toubro Infotech (LTI, India), Microsoft Corporation (Microsoft, US), Oracle Corporation (Oracle, US), Red Hat (US), SAP SE (SAP, Germany), VMware (US), Alibaba Cloud (Singapore), Apexon (US), Bacancy Technology (India), Citrix Systems, Inc. (Citrix, US), Harness (US), Cognizant Technology Solutions Corp (Cognizant, US), Ekco (Ireland), Huawei Technologies Co. Ltd. (Huawei, China), R Systems (US), Scality (US), Sciencesoft (US) |

This research report categorizes the cloud native applications market based on solution, deployment mode, organization size, vertical, and region.

Based on component, the cloud native applications market has been segmented as follows:

- Platforms

- Services

Based on deployment type, the cloud native applications market has been segmented as follows

- Public cloud

- Private cloud

Based on organization size, the cloud native applications market has been segmented as follows

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on vertical, the cloud native applications market has been segmented as follows

- BFSI

- IT & telecommunication

- Government & public sector

- Retail & eCommerce

- Healthcare & life sciences

- Manufacturing

- Other verticals (education, media & entertainment, and energy & utilities)

Based on region, the cloud native applications market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2022, IBM SaaS (on IBM Cloud) signed an agreement with AWS (Amazon), that will provide clients with access to IBM software that runs cloud-native on AWS. This collaboration will provide clients with quick and easy access to IBM software that spans automation, data and AI, security and sustainability capabilities, which is built on Red Hat OpenShift Service on AWS (ROSA – Red Hat OpenShift service) and runs cloud-native on AWS. The mutually agreed companies are also committing to a wide range of joint investments for hassle-free clients’ experience to consume IBM software on AWS, including integrated go-to-market (GTM) activities/strategies across sales and marketing, channel incentives, developer enablement and training, and solution development. This is targeted across key verticals such as Oil and Gas, Travel and Transportation.

- In April 2022, developers and IT operations professionals at Google built containers and APIs on Google Cloud in order to create modern, cloud-first and cloud-native applications. Products and services include Google Cloud on application development, containers, Kubernetes, DevOps, serverless and open source as well.

- In February 2022, IBM acquired Neudesic, which provides services consultancy specializing primarily in the Microsoft Azure platform, along with getting skills in multi-cloud. The ability to accelerate digital transformation through application development, modernization and data capabilities, powered by the cloud, plays a significant role in achieving the company’s operational goals. Yet enterprises are facing an acute cloud-native skills shortage, owing to which IBM is strictly looking at and enhancing its cloud-native capability and capacity significantly.

Frequently Asked Questions (FAQ):

What is the projected market value of the global cloud native applications market?

The global market of cloud native applications is projected to reach USD 17.8 billion

What is the estimated growth rate (CAGR) of the global cloud native applications market for the next five years?

The global cloud native applications market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.7% from 2023 to 2028.

What are the major revenue pockets in the cloud native applications market currently?

North America is expected to have the largest market size in the CNA market, and the trend is expected to continue till 2028. With the new Cloud Native and Orchestration Center in North America, Ericsson is doubling down on cloud native. Cloud native is a modern approach to developing and running software applications that takes advantage of cloud computing’s flexibility, scalability, and resilience.

Who are the key vendors in the cloud native applications market?

Amazon (US), Google (US), IBM (US), Infosys (India), LTI Mindtree (India), Microsoft (US), Oracle (US), Red Hat (US), SAP (Germany), VMware (US), Alibaba Cloud (Singapore), Apexon (US), Citrix (US), Cloudhelix (Sussex), and Cognizant (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Cloud native development helps get apps to market swiftly- Ease in carrying out business globally with aid of cloud native applications- Significant reduction in vendor lock-ins- Real-time analytics and guidelines complianceRESTRAINTS- Cost overrun to be limiting factor- Replacing new developments with traditional practices- Organizational shift required across teamsOPPORTUNITIES- Better reliability in terms of IT infrastructure- Proliferation of Kubernetes and containerizationCHALLENGES- Managing and governing development workflow- Security threats vis-a-vis data breach

-

5.3 USE CASESCASE STUDY 1: CLOUD NATIVE DEPLOYMENT IMPROVING DAVINCI’S QUALITY OF OFFERINGS ALONG WITH ENHANCED FEATURESCASE STUDY 2: COST AND TIME TO BE EFFECTIVE ADVANTAGES OF GOOGLE CLOUD PLATFORM FOR RESCUING DRONEDEPLOYCASE STUDY 3: OCI BOOSTED WORKING MECHANISM OF FORMULA ONE RACING TEAMCASE STUDY 4: RAPID ACTION DEVELOPMENT BY RED HAT DIRECTED TOWARD CITIZEN-FACING SERVICES IN GREAT LAKES STATECASE STUDY 5: COST-EFFECTIVE MIGRATION USING VMWARE TANZU OFFERED RELIABLE AND SCALABLE DEPLOYMENT OF DELIVERABLES

-

5.4 ECOSYSTEM MAPPING

-

5.5 SUPPLY CHAIN ANALYSISPLATFORM PROVIDERSSERVICE PROVIDERSRETAILERS & DISTRIBUTORSEND USERS

-

5.6 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGEDGE COMPUTINGCLOUD COMPUTINGSERVICE MESH WITH MICROSERVICES

-

5.7 PATENT ANALYSIS

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSRIVALRY AMONG EXISTING COMPETITORS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & South Africa- Latin America

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.1 INTRODUCTIONCOMPONENTS: MARKET DRIVERS

-

6.2 PLATFORMSINCREASE IN SWIFT DELIVERIES OF APPLICATIONS

-

6.3 SERVICESRAPID INTEGRATION AND DEPLOYMENT TO DRIVE MARKET

-

7.1 INTRODUCTIONDEPLOYMENT TYPES: MARKET DRIVERS

-

7.2 PUBLIC CLOUDOFFERED WORKLOAD MAINTENANCE AND EFFICIENT IT INFRASTRUCTURE FOR INCESSANT SERVICE

-

7.3 PRIVATE CLOUDENTERPRISES GET EDGE IN TERMS OF SECURITY, MAINTENANCE, AND UPGRADES DEPLOYED OVER PRIVATE CLOUD

-

8.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISESBETTER RISK MITIGATION AND IMPROVED BUSINESS EFFICIENCY BOOSTS ADOPTION

-

8.3 LARGE ENTERPRISESINCREASING ADOPTION OF KUBERNETES PLATFORM PROVIDES SUPPORT DURING DISASTER RECOVERY AND BACKUP

-

9.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCEDATA MANAGEMENT TO BE KEY FACTOR FOR GROWTH

-

9.3 IT & TELECOMMUNICATIONARCHITECTURE OF CLOUD NATIVE APPLICATIONS TO HELP RESOLVE TROUBLES OF OPERATORS

-

9.4 GOVERNMENT & PUBLIC SECTORIMMENSE GROWTH OPPORTUNITY AT SCALE WITH CLOUD NATIVE APPLICATIONS FOR GOVERNMENT AGENCIES

-

9.5 RETAIL & ECOMMERCERISING DEMAND AMONG CUSTOMERS FOR ACTIVE APPLICATIONS WITH ZERO DOWNTIME

-

9.6 HEALTHCARE & LIFE SCIENCESINCREASING AUTOMATION AND DATA INTEGRITY WITH COMPLIANCE TO BE FORERUNNER IN HEALTHCARE

-

9.7 MANUFACTURINGINNOVATION AND ZERO DOWNTIME TO RESCUE SEVERAL GIANT VENDORS GLOBALLY

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSUNITED STATES- Growing need to upgrade customer experience to reduce operational costsCANADA- Organizations to deploy cloud native applications to maximize revenue and reduce operating cost

-

10.3 EUROPEEUROPE: MARKET DRIVERSUNITED KINGDOM- Growing need for streamlined application development to boost marketGERMANY- Increasing digitalization and effective app management to fuel market growthFRANCE- France to be major market for adopting cloud native applicationsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: CLOUD NATIVE APPLICATIONS MARKET DRIVERSCHINA- Growing need among verticals to adopt cloud native applicationsJAPAN- Organizations prefer cloud native technologies to reduce production costsINDIA- Government initiatives and schemes to fuel marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSKINGDOM OF SAUDI ARABIA- Substantial shift in implementing cloud native technologies to fuel demandUNITED ARAB EMIRATES- Advanced technologies used with cloud native applications empower government entities to improve uptimeREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: CLOUD NATIVE APPLICATIONS MARKET DRIVERSBRAZIL- Increasing awareness of organizations about cloud native technologies to drive marketMEXICO- Increasing awareness for containerization, CI/CD, and APIs to boost marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE OF TOP VENDORS

- 11.3 REVENUE ANALYSIS OF TOP FIVE VENDORS

-

11.4 EVALUATION QUADRANT FOR KEY PLAYERS, 2022DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022DEFINITION AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.6 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY COMPANIESIBM- Business overview- Products offered- Recent developments- MnM viewAMAZON- Business overview- Products offered- MnM viewGOOGLE- Business overview- Products offered- Recent developments- MnM viewMICROSOFT- Business overview- Products offered- Recent developments- MnM viewLTIMINDTREE- Business overview- Products offered- Recent developmentsINFOSYS- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsVMWARE- Business overview- Products offered- Recent developmentsRED HAT- Business overview- Products offered- Recent developmentsSAP- Business overview- Products offered- Recent developments

-

12.3 OTHER COMPANIESALIBABA CLOUDAPEXON (FORMERLY INFOSTRETCH)BACANCY TECHNOLOGYCITRIXHARNESSCOGNIZANTEKCOHUAWEIR SYSTEMSSCALITYSCIENCESOFT

- 13.1 INTRODUCTION

- 13.2 CLOUD NATIVE STORAGE MARKET

- 13.3 CLOUD NATIVE APPLICATION PROTECTION PLATFORM MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2022

- TABLE 2 MARKET GROWTH FORECAST

- TABLE 3 CLOUD NATIVE APPLICATIONS MARKET: ECOSYSTEM

- TABLE 4 TOP 10 PATENT APPLICANTS

- TABLE 5 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 14 MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 15 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 PLATFORMS: CLOUD NATIVE APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 17 PLATFORMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 21 MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 22 PUBLIC CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 PUBLIC CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 PRIVATE CLOUD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 PRIVATE CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 27 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 33 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD NATIVE APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 IT & TELECOMMUNICATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 IT & TELECOMMUNICATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 RETAIL & ECOMMERCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 OTHER VERTICALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: CLOUD NATIVE APPLICATIONS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 61 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 62 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 63 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 64 CANADA: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 65 CANADA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 66 CANADA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 67 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 71 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 74 EUROPE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 UNITED KINGDOM: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 79 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 80 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 81 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 82 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 83 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 87 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 88 FRANCE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 89 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 91 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 92 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 93 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 CHINA: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 CHINA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 108 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 109 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 110 JAPAN: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 111 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 112 INDIA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 113 INDIA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 114 INDIA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 115 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: CLOUD NATIVE APPLICATIONS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 KSA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 131 KSA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 132 KSA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 133 KSA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 134 UAE: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 135 UAE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 136 UAE: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 137 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 143 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 145 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 149 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 BRAZIL: CLOUD NATIVE APPLICATIONS MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 153 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 155 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 156 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 157 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 158 MEXICO: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 159 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 160 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2019–2022 (USD MILLION)

- TABLE 163 REST OF LATIN AMERICA: CLOUD NATIVE APPLICATIONS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 165 COMPANY FOOTPRINT

- TABLE 166 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 167 LIST OF KEY STARTUPS/SMES

- TABLE 168 PRODUCT LAUNCHES/ENHANCEMENTS, 2020–2023

- TABLE 169 DEALS, 2020–2022

- TABLE 170 IBM: BUSINESS OVERVIEW

- TABLE 171 IBM: PRODUCTS OFFERED

- TABLE 172 IBM: NEW PRODUCT LAUNCHES

- TABLE 173 IBM: DEALS

- TABLE 174 AMAZON: BUSINESS OVERVIEW

- TABLE 175 AMAZON: PRODUCTS OFFERED

- TABLE 176 AMAZON: DEALS

- TABLE 177 GOOGLE: BUSINESS OVERVIEW

- TABLE 178 GOOGLE: PRODUCTS OFFERED

- TABLE 179 GOOGLE: PRODUCT LAUNCHES

- TABLE 180 GOOGLE: DEALS

- TABLE 181 MICROSOFT: BUSINESS OVERVIEW

- TABLE 182 MICROSOFT: PRODUCTS OFFERED

- TABLE 183 MICROSOFT: PRODUCT LAUNCHES

- TABLE 184 MICROSOFT: DEALS

- TABLE 185 LTIMINDTREE: BUSINESS OVERVIEW

- TABLE 186 LTIMINDTREE: PRODUCTS OFFERED

- TABLE 187 LTIMINDTREE: PRODUCT LAUNCHES

- TABLE 188 LTIMINDTREE: DEALS

- TABLE 189 INFOSYS: BUSINESS OVERVIEW

- TABLE 190 INFOSYS: PRODUCTS OFFERED

- TABLE 191 INFOSYS: PRODUCT LAUNCHES

- TABLE 192 ORACLE: BUSINESS OVERVIEW

- TABLE 193 ORACLE: PRODUCTS OFFERED

- TABLE 194 ORACLE: PRODUCT LAUNCHES

- TABLE 195 ORACLE: DEALS

- TABLE 196 VMWARE: BUSINESS OVERVIEW

- TABLE 197 VMWARE: PRODUCTS OFFERED

- TABLE 198 VMWARE: PRODUCT LAUNCHES

- TABLE 199 VMWARE: DEALS

- TABLE 200 RED HAT: BUSINESS OVERVIEW

- TABLE 201 RED HAT: PRODUCTS OFFERED

- TABLE 202 RED HAT: PRODUCT LAUNCHES

- TABLE 203 RED HAT: DEALS

- TABLE 204 SAP: BUSINESS OVERVIEW

- TABLE 205 SAP: PRODUCTS OFFERED

- TABLE 206 SAP: PRODUCT LAUNCHES

- TABLE 207 CLOUD NATIVE STORAGE MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 208 CLOUD NATIVE STORAGE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 209 CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 210 CLOUD NATIVE STORAGE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 211 CLOUD NATIVE STORAGE MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 212 CLOUD NATIVE STORAGE MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 213 CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 214 CLOUD NATIVE STORAGE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 215 CLOUD NATIVE STORAGE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 216 CLOUD NATIVE STORAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 217 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

- TABLE 218 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY OFFERING, 2020–2027 (USD MILLION)

- TABLE 219 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY CLOUD TYPE, 2020–2027 (USD MILLION)

- TABLE 220 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

- TABLE 221 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY REGION, 2020–2027 (USD MILLION)

- FIGURE 1 CLOUD NATIVE APPLICATIONS MARKET: RESEARCH DESIGN

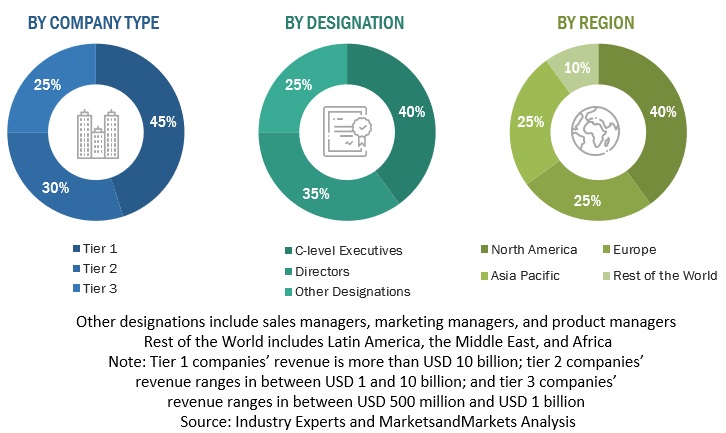

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF CLOUD NATIVE APPLICATIONS FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE) - COLLECTIVE REVENUE OF CLOUD NATIVE APPLICATION PLATFORM AND SERVICE VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (BOTTOM-UP), REVENUE GENERATED BY VENDORS FROM EACH COMPONENT

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE), REGIONAL LEVEL

- FIGURE 10 RESEARCH LIMITATIONS

- FIGURE 11 MARKET: GLOBAL SNAPSHOT

- FIGURE 12 FASTEST-GROWING SEGMENTS OF MARKET

- FIGURE 13 PLATFORMS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 MARKET: REGIONAL SNAPSHOT

- FIGURE 15 CONTINUOUS INTEGRATION AND CONTINUOUS DEPLOYMENT/DELIVERY SYSTEM TO DRIVE MARKET

- FIGURE 16 PLATFORMS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

- FIGURE 17 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

- FIGURE 19 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS OVER NEXT FIVE YEARS

- FIGURE 21 INDIA TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 23 MARKET: ECOSYSTEM

- FIGURE 24 SUPPLY CHAIN ANALYSIS: CLOUD NATIVE APPLICATIONS MARKET

- FIGURE 25 NUMBER OF PATENT DOCUMENTS PUBLISHED, 2012–2022

- FIGURE 26 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 27 CLOUD-NATIVE APPLICATIONS MARKET: PORTER’S FIVE FORCE ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 PRIVATE CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 BFSI VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: CLOUD NATIVE APPLICATIONS MARKET SNAPSHOT

- FIGURE 38 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 REVENUE ANALYSIS OF TOP FIVE VENDORS, 2018–2022 (USD BILLION)

- FIGURE 40 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 41 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 42 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 43 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 44 IBM: COMPANY SNAPSHOT

- FIGURE 45 AMAZON: COMPANY SNAPSHOT

- FIGURE 46 GOOGLE: COMPANY SNAPSHOT

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 48 LTIMINDTREE: COMPANY SNAPSHOT

- FIGURE 49 INFOSYS: COMPANY SNAPSHOT

- FIGURE 50 ORACLE: COMPANY SNAPSHOT

- FIGURE 51 VMWARE: COMPANY SNAPSHOT

- FIGURE 52 SAP: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for cloud native applications and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering quality and lifecycle management software was derived based on the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from quality and lifecycle management software vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, components, deployments, and regional trends. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using quality and lifecycle management software, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall quality and lifecycle management software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the market and various other dependent subsegments.

The research methodology used to estimate the market size includes the following details:

- The key players in the market have been identified through secondary research, and their revenue contributions in the respective countries have been determined through primary and secondary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups have been determined using secondary sources and verified through primary sources.

All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets.

In the bottom-up approach, the adoption trend of cloud native applications among different industry verticals in key countries, with respect to regions that contribute to most of the market share, has been identified. For cross-validation, the adoption trend of cloud native applications, along with different use cases with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in different solution areas for calculation. An exhaustive list of all vendors offering solutions and services in the quality and lifecycle management software market has been prepared. The revenue contribution of all vendors in the market has been estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with offerings have been considered to evaluate the market size. Each vendor has been evaluated based on its solution and service offerings across verticals. The aggregate of all companies' revenue has been extrapolated to reach the overall market size. Each subsegment has been studied and analyzed for its market size and regional penetration. Based on these numbers, primary and secondary sources have determined the region split.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Cloud-native application development is an approach to building, running, and improving apps based on well-known techniques and technologies for cloud computing. These are programs that are designed for a cloud computing architecture. Cloud native applications offer several benefits such as independent building up of the applications, so they’re managed and deployed individually. Cloud native applications due to interoperability and workload portability are often based on open source and standards-based technology (cloud native services) which reduce vendor lock-in(s).

Key Stakeholders of the Market Include:

- Cloud native application platform providers

- Cloud native application service providers

- Consultants/Consultancies/Advisory firms

- Governments and standardization bodies

- Independent Software Vendors (ISVs)

- Information Technology (IT) infrastructure providers

- Regional associations

- Resellers and distributors

- System Integrators (SIs)

- Third-party providers

- Value-added resellers and distributors

- Retailers

Report Objectives

- To describe and forecast the global cloud native applications (CNA) software market based on component, deployment mode, organization size, vertical, and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To track and analyze competitive developments, such as product developments, product enhancements, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Native Applications Market