Cloud IDS IPS Market by Component (Solution Type (Signature-Based, Anomaly-Based Detection), and Services), Deployment Model (Public, Private, and Hybrid Cloud), Organization Size, Industry, and Region - Global Forecast to 2022

[125 Pages] The cloud IDS IPS market accounted for USD 514.8 Million in 2016 and is projected to reach USD 1,764.7 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 24.04% during the forecast period. In this report, 2016 is considered as the base year, and 20172022 is the forecast period. The growing requirement for cost-effective and easily scalable security solutions is the major growth driver of the market.

Objectives of the Study

The main objective of this report is to define, describe, and forecast the global cloud IDS IPS market by components (solution type and services), deployment models, organization size, industry verticals, and regions. The report provides detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market. The report aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global market. The report also attempts to forecast the market size of the 5 main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, new developments, and Research and Development (R&D) activities, in this market.

Research Methodology

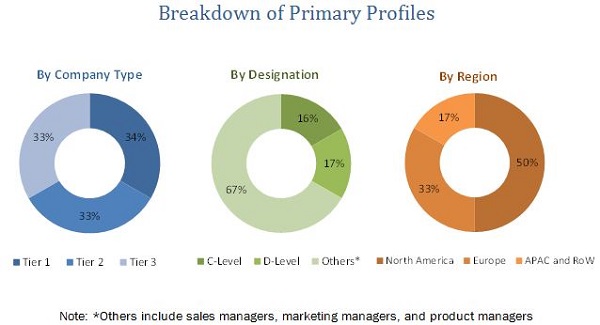

The research methodology used to estimate and forecast the cloud IDS IPS market began with capturing data on the key vendors revenues through secondary research using various sources, such as Cloud Security Alliance, Information Systems Security Association and Institute of Electrical and Electronic Engineers (IEEE) cloud computing journals. The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenues of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The target audience of the cloud IDS IPS market report includes the following:

- Government agencies

- Cybersecurity vendors

- Cloud security vendors

- Network solution providers

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Healthcare organizations

- Financial organizations

- Managed Security Service Providers (MSSPs)

- Monitoring service providers

The study answers several questions for the stakeholders, primarily which market segments to focus on over the next 25 years for prioritizing the efforts and investments.

Scope of the Cloud IDS IPS Market Report

|

Report Metrics |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component (Solution Type (Signature-Based, Anomaly-Based Detection), and Services), Deployment Model (Public, Private, and Hybrid Cloud), Organization Size, Industry, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Check Point (Israel), NTT Communications (Japan), Trend Micro (Japan), Century Link (US), Cisco (US), Intel (US), Fortinet (US), Imperva (US), Metaflows (US), Hillstone Networks (US), and Alert Logic (US). |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

Cloud IDS IPS Market By Components

- Solution Type

- Signature-based detection

- Anomaly-based detection

- Others (policy-based and protocol-based detection)

- Services

- Training and Consulting

- Integration

- Support and Maintenance

Market By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

Cloud IDS IPS Market By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Market By Industry:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Government and Defense

- Education

- Retail

- Manufacturing

- Healthcare

- Energy and utilities

- Others (Media and entertainment, and transportation and logistics)

Cloud IDS IPS Market By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players

Country Information

Country-specific information and market data as per feasibility

The global cloud IDS IPS market is expected to grow from USD 600.9 Million in 2017 to USD 1,764.7 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 24.04% during the forecast period. Cloud-based IDS IPS systems offer additional layer of protection to enterprise IT assets by monitoring and analyzing network traffic flows to detect suspicious activities based on pre-defined signatures or based on the malicious behaviour or anomalies. These solutions are witnessing a rise in demand as they are finding utility in cloud security from industry verticals, such as Banking, Financial Services, and Insurance (BFSI), IT and telecom, and retail.

This report provides detailed insights into the cloud IDS IPS market, split across various regions, segments, and industry verticals. The market is segmented on the basis of components into solution type and services. The solution type segment consists of signature-based detection, anomaly-based detection, and others (policy-based and protocol-based detection). Services considered for the market include training and consulting; integration; and support and maintenance. The deployment model for the market consists of public cloud, private cloud, and hybrid cloud deployments. The market is also segmented on the basis of organization sizes into Small and Medium-sized Enterprises (SMEs) and large enterprises. The large enterprises segment is expected to hold a larger market size, due to the high demand for enhanced cloud IDS IPS systems in their facilities. The growing security threats across the globe and the increasing usage of cloud-based solutions are expected to create significant demand for cloud IDS IPS solutions and fuel the market growth.

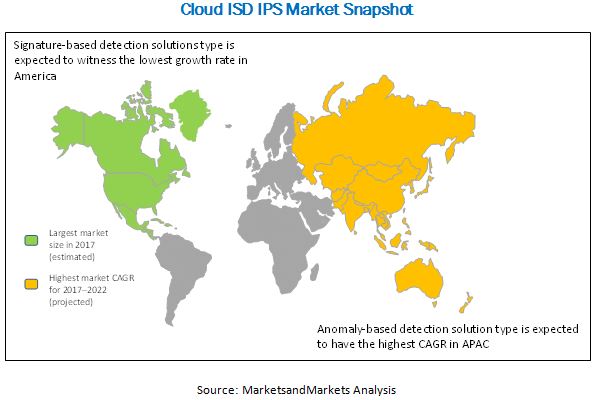

The report covers all the major aspects of the cloud IDS IPS market and provides an in-depth analysis across North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to hold the largest market share, due to the presence of major vendors, and increasing adoption of associated services. The APAC region is expected to provide several growth opportunities in the market and is projected to grow at the highest CAGR during the forecast period.

Difficulties pertaining to cloud IDS IPS implementation on hybrid cloud systems may restrain the market growth. Various vendors provide cloud IDS IPS solutions to help enterprises reduce their Capital Expenditure (CAPEX). NTT Communications is one of the major vendors of cloud IDS IPS solutions. The company offers managed cloud-based IPS through its wholly owned subsidiary, Virtela Technology Services Incorporated. Other vendors in the cloud IDS IPS market include Check Point (Israel), Trend Micro (Japan), Century Link (US), Cisco (US), Intel (US), Fortinet (US), Imperva (US), Metaflows (US), Hillstone Networks (US), and Alert Logic (US). These market players have adopted various strategies, such as partnerships, collaborations, and expansions, to remain competitive in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Cloud IDS IPS Market

4.2 Market, By Industry and Region

4.3 Life Cycle Analysis, By Region

5 Cloud IDS IPS Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Data Storage Compliance Requirements

5.2.1.2 Growing Threat From Attacks and Data Breaches

5.2.1.3 Increasing Adoption of Multi-Cloud Strategy

5.2.2 Restraints

5.2.2.1 Difficulty in Providing Hybrid Cloud Security

5.2.3 Opportunities

5.2.3.1 Increased Adoption of Cloud-Based Security Solutions

5.2.3.2 Growing Demand for Securing IT Infrastructure

5.2.4 Challenges

5.2.4.1 Fluid Design of Cloud Systems Prone to Intrusions

5.2.4.2 Need for Highly Knowledgeable and Skilled Staff

5.3 Technology Trends and Standards

5.3.1 Standards and Guidelines for the Cloud IDS IPS Market

5.3.1.1 Payment Card Industry Data Security Standard (PCI DSS)

5.3.1.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.1.3 Federal Information Security Management Act (FISMA)

5.3.1.4 Gramm-Leach-Bliley Act

5.3.1.5 Sarbanes-Oxley Act

5.4 Industry Trends and Applications

5.4.1 Introduction

5.4.1.1 Address Compliance Needs

5.4.1.2 Managing Risk and Complexity

5.4.1.3 Real-Time Threat Monitoring

5.4.1.4 Detects and Mitigates Vulnerabilities

6 Cloud IDS IPS Market By Component (Page No. - 35)

6.1 Introduction

6.2 Solution Type

6.2.1 Signature-Based Detection

6.2.2 Anomaly-Based Detection

6.2.2.1 Network Behaviour Anomaly Detection (NBAD)

6.2.2.2 User Behaviour Anomaly Detection

6.2.3 Others

6.3 Services

6.3.1 Training and Consulting

6.3.2 Integration

6.3.3 Support and Maintenance

7 Cloud IDS IPS Market By Deployment Model (Page No. - 44)

7.1 Introduction

7.2 Public Cloud

7.3 Private Cloud

7.4 Hybrid Cloud

8 Cloud IDS IPS Market By Organization Size (Page No. - 49)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Cloud IDS IPS Market By Industry (Page No. - 53)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 IT and Telecom

9.4 Government and Defense

9.5 Education

9.6 Retail

9.7 Manufacturing

9.8 Healthcare

9.9 Energy and Utilities

9.10 Others

10 Cloud IDS IPS Market By Region (Page No. - 63)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 83)

11.1 Overview

11.1.1 Market Ranking

11.1.2 New Product/Technology Launches

11.1.3 Partnerships, Agreements, and Collaborations

11.1.4 Mergers and Acquisitions

12 Company Profiles (Page No. - 87)

(Business Overview, Products/Services Offered, Recent Developments, MnM View, Key Strategies, and SWOT Analysis)*

12.1 Introduction

12.2 Check Point Software Technologies

12.3 NTT Communications

12.4 Trend Micro

12.5 Cisco Systems

12.6 Intel

12.7 Fortinet

12.8 Imperva

12.9 Centurylink

12.10 Metaflows

12.11 Hillstone Networks

12.12 Alert Logic

*Details on Business Overview, Products/Services Offered, Recent Developments, MnM View, Key Strategies, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12.13 Key Innovators

12.13.1 Cloud Connectiv

12.13.2 Microintegration

13 Appendix (Page No. - 114)

13.1 Insights of Industry Experts

13.2 Recent Developments

13.2.1 New Product Launches 2015

13.2.2 Agreements, Partnerships, Collaborations, and Joint Ventures 2015

13.3 Discussion Guide

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (65 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Global Cloud IDS IPS Market: Assumptions

Table 3 Market Size, By Component, 20152022 (USD Million)

Table 4 Solution Type: Market Size, By Region, 20152022 (USD Million)

Table 5 Services: Market Size, By Region , 20152022 (USD Million)

Table 6 Cloud IDS IPS Market Size, By Solution Type, 20152022 (USD Million)

Table 7 Signature-Based Detection: Market Size, By Region, 20152022 (USD Million)

Table 8 Anomaly-Based Detection: Market Size, By Region, 20152022 (USD Million)

Table 9 Others: Market Size, By Region, 20152022 (USD Million)

Table 10 Cloud IDS IPS Market Size, By Service, 20152022 (USD Million)

Table 11 Training and Consulting: Market Size, By Region, 20152022 (USD Million)

Table 12 Integration: Market Size, By Region, 20152022 (USD Million)

Table 13 Support and Maintenance: Market Size, By Region, 20152022 (USD Million)

Table 14 Cloud IDS IPS Market Size, By Deployment Model, 20152022 (USD Million)

Table 15 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 16 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 17 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 18 Market Size, By Organization Size, 20152022 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 20 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 21 Market Size, By Industry, 20152022 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 23 IT and Telecom: Market Size, By Region, 20152022 (USD Million)

Table 24 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 25 Education: Market Size, By Region, 20152022 (USD Million)

Table 26 Retail: Market Size, By Region, 20152022 (USD Million)

Table 27 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 28 Healthcare: Market Size, By Region, 20152022 (USD Million)

Table 29 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 30 Others: Market Size, By Region, 20152022 (USD Million)

Table 31 Cloud IDS IPS Market Size, By Region, 20152022 (USD Million)

Table 32 North America: Market Size, By Component, 20152022 (USD Million)

Table 33 North America: Market Size, By Solution Type, 20152022 (USD Million)

Table 34 North America: Market Size, By Service, 20152022 (USD Million)

Table 35 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 36 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 37 North America: Market Size, By Industry, 20152022 (USD Million)

Table 38 Europe: Cloud IDS IPS Market Size, By Component, 20152022 (USD Million)

Table 39 Europe: Market Size, By Solution Type, 20152022 (USD Million)

Table 40 Europe: Market Size, By Service, 20152022 (USD Million)

Table 41 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 42 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 43 Europe: Market Size, By Industry, 20152022 (USD Million)

Table 44 Asia Pacific: Cloud IDS IPS Market Size, By Component, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Solution Type, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Industry, 20152022 (USD Million)

Table 50 Middle East and Africa: Cloud IDS IPS Market Size, By Component, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Solution Type, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Industry, 20152022 (USD Million)

Table 56 Latin America: Cloud IDS IPS Market Size, By Component, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Solution Type, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Industry, 20152022 (USD Million)

Table 62 Market Ranking for the Cloud IDS IPS Market, 2017

Table 63 New Product/Technology Launches, 20162017

Table 64 Partnerships, Agreements, and Collaborations, 20152016

Table 65 Mergers and Acquisitions, 20132016

List of Figures (33 Figures)

Figure 1 Global Cloud IDS IPS Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 North America is Estimated to Hold the Largest Market Share in 2017

Figure 7 Cloud IDS IPS Market Size, By Solution Type

Figure 8 Market Size By Industry

Figure 9 Increasing Requirement for Regulatory Compliance is Expected to Fuel the Growth of the Market

Figure 10 Banking, Financial Services, and Insurance Industry, and North America Region are Estimated to Hold the Largest Market Shares in 2017

Figure 11 Asia Pacific Region is Expected to Have Immense Growth Opportunities in the Market

Figure 12 Cloud IDS IPS Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Cloud IDS IPS Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Support and Maintenance Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Hybrid Cloud Deployment Model is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 Retail Industry is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Regional Snapshot (20172022): North America is Expected to Hold the Largest Market Share in 2022

Figure 19 North America: Cloud IDS IPS Market Snapshot

Figure 20 North America Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Europe Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Asia Pacific: Cloud IDS IPS Market Snapshot

Figure 23 Asia Pacific Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Middle East and Africa Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Latin America Services Component is Expected to Grow at Higher CAGR During the Forecast Period

Figure 26 Geographic Revenue Mix of Key Market Players

Figure 27 Check Point Software Technologies: Company Snapshot

Figure 28 Trend Micro: Company Snapshot

Figure 29 Cisco Systems: Company Snapshot

Figure 30 Intel: Company Snapshot

Figure 31 Fortinet: Company Snapshot

Figure 32 Imperva: Company Snapshot

Figure 33 Centurylink: Company Snapshot

Growth opportunities and latent adjacency in Cloud IDS IPS Market