Cloud Enterprise Content Management Market by Solution (Document Management, Case Management, Workflow Management, Record Management, and E-Discovery), Service, Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2022

[136 Pages Report] The cloud Enterprise Content Management (ECM) market size is projected to grow from USD 9.77 Billion in 2017 to USD 34.42 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 28.6%. Factors such as growth in the digital content across enterprises, easier access from remote end-points, and need for regulatory compliances are fueling the growth of the cloud ECM market, across the globe. The base year considered for this study is 2016 and the forecast period considered is 20172022.

Objectives of the Cloud Enterprise Content Management Market Study

- To describe and forecast the global cloud ECM market on the basis of solutions, services, deployment models, organization sizes, industry verticals, and regions

- To forecast the market size of the five main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze subsegments, with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and to provide details of competitive landscape for major players

- To strategically profile key players and comprehensively analyze their core competencies and positioning

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships, agreements and collaborations in the market

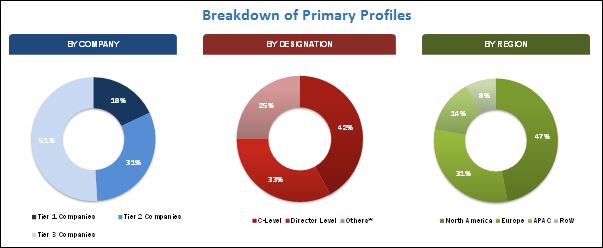

The research methodology used to estimate and forecast the cloud ECM market begins with capturing data on key vendor revenues through secondary research, such as cloud computing association, associations of a financial professional, and information system security association. Vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud ECM market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud ECM ecosystem comprises service providers, such as OpenText Corporation (Ontario, Canada), Newgen Software, Inc. (McLean, Virginia), Xerox Corporation (Connecticut, US), Hyland Software, Inc. (Ohio, US), Microsoft Corporation (Washington, US), M-Files Corporation ( Dallas, US), Oracle Corporation (California, US), IBM Corporation (New York, US), Everteam (Paris, France), Box, Inc. (California, US), Alfresco Software, Inc. (California, US), and Docuware GmbH (Germering, Germany). Other stakeholders of the cloud ECM market include ECM vendors, cloud brokers, and managed service providers.

Key Target Audience for Cloud Enterprise Content Management Market

- Cloud ECM vendors

- Cloud brokers

- Platform providers

- Consultancy firms/advisory firms

- Training and education service providers

- Managed service providers

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast unit |

Value (USD Billion) |

|

Segments covered |

Solution, Service, Deployment Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Alfresco Software, Inc. (California, US), ASG Technologies (Florida, US), Box, Inc. (California, US), Docuware (Germering, Germany), Epicor Software Corporation (Texas, US), Everteam((Paris, France), Fabsoft Software, Inc. (New Jersey, US), Hewlett Packard Enterprise (California, US), Hyland Software, Inc. (Ohio, US), IBM Corporation (New York, US), Laserfiche (California, US), Lexmark International, Inc. (Kentucky, US), MaxxVault LLC (New York, US), M-Files Corporation(Texas, US), Microsoft Corporation (Washington, US), Micro Strategies Inc. (New Jersey, US), Newgen Software Inc.(New Delhi, India), Nuxeo (New York, US), Objective Corporation (New South Wales, Australia), OpenText orporation (Ontario, Canada), Oracle Corporation (California, US), SER Group (Bonn, Germany), and Xerox Corporation (Connecticut, US) |

The research report categorizes the cloud ECM market to forecast the revenues and analyze the trends in each of the following submarkets:

By Solution

- Document Management

- Content Management

- Case Management

- Workflow Management

- Record Management

- Digital Asset Management

- EDiscovery

- Others

By Service

- Professional Services

- Managed services

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Vertical

- BFSI

- Education

- Energy and Power

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Media and Entertainment

- Retail and Consumer Goods

- Telecommunications and ITES

- Others

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC cloud ECM market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American cloud ECM market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European cloud ECM market into countries contributing 75% to the regional market size

Company Information

Detailed analysis and profiling of additional market players (up to 5).

Emergence of new content management tools and growing inclinations towards cloud solutions to drive the global cloud ECM market to USD 34.42 billion by 2022

Cloud ECM is a set of defined processes to securely procure, store, monitor, and manage enterprise data to deliver crucial information by moving paper documents and electronic files into an organized electronic format. It is a Software as a Service (SaaS) based approach designed for organizations to eradicate ad hoc processes that can lay open an organization to regulatory compliance risks. Cloud ECM includes features such as document management, content management, workflow management, and record management.

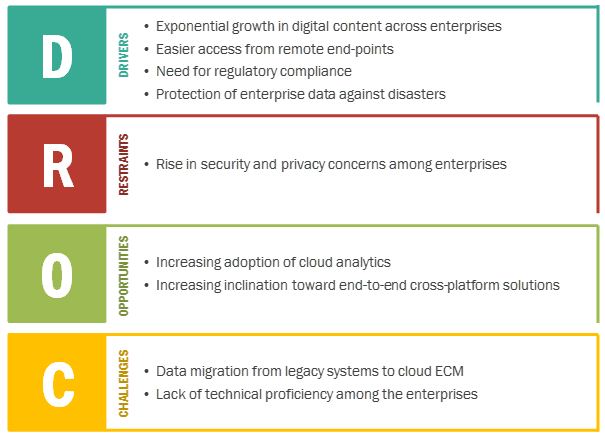

Cloud ECM serves the needs of geographically dispersed business units by providing one consolidated solution. In order to leverage the full benefits of this technology, organizations are shifting from on-premises ECM solutions to cloud. The major factors that have been driving the adoption of cloud ECM are the exponential growth of digital content across all types of enterprises, easier access from remote end-points, need for regulatory compliance, and protection of enterprise data against disaster. However, the risks associated with data security and privacy of enterprises data is hindering the growth of the cloud ECM market globally. Moreover, increasing adoption of cloud analytics and growing inclination toward data integration are some of the factors driving the market, while the lack of technical proficiency among enterprises and intense competition among vendors are the challenges faced by the vendors in this market.

Several mergers & acquisitions and inclination toward end-to-end cross-platform solutions provide huge opportunities in cloud ECM market

OpenText acquiring Dell EMCs Enterprise Content Division, Documentum and Hyland completed acquisition of the Perceptive business unit which was part of the enterprise content management business unit of Lexmark International that Hyland acquired in 2016 were some of the major acquisitions in the ECM market. Enterprises need solutions that fit snugly with their current systems, to not overhaul technologies that are already in place and working well. A truly comprehensive solution offers a suite of integration capabilities that enable enterprises to collaborate data to help staff makes informed decisions. However, the demand for single-source and cross-platform solutions is on the rise.

Market Dynamics

The cloud Enterprise Content Management (ECM) market size is expected to grow from USD 9.77 Billion in 2017 to USD 34.42 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 28.6%. The major drivers of this cloud ECM market include the growth in the digital content across enterprises, easier access from remote end-points, need for protection of enterprise data against the disaster, and need for regulatory compliances.

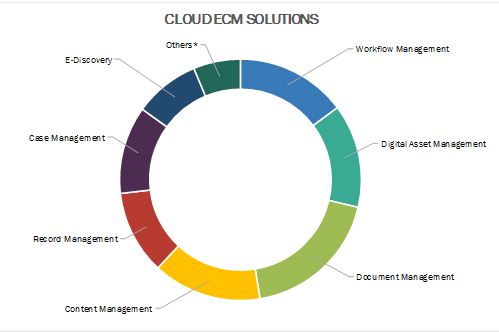

The cloud ECM market report has been broadly classified on the basis of solutions into document management, content management, case management, workflow management, record management, digital asset management, eDiscovery, and others; on the basis of services into professional services, and managed services; on the basis of deployment models into public, private, and hybrid; on the basis of organization sizes into Small and Medium Enterprises (SMEs) and large enterprises; on the basis of verticals into BFSI, education, energy and power, government and public sector, healthcare and life sciences, manufacturing, media and entertainment, retail and consumer goods, telecommunications and ITES, and others; and on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

The document management solution is projected to hold the largest market size and is expected to continue its dominance during the forecast period. There has been a tremendous increase in the volume of documents generated in an enterprise on a daily basis; thus, this increases the need to manage and store the generated data. Moreover, the need to maintain metadata files is increasing due to tremendous rise in organizational content, generated on a daily basis. Metadata files can be instrumental in defining the control and access mechanism of the documents.

The public deployment model is projected to hold the largest market share in 2017 and is expected to grow during the forecast period. The main reason for the high adoption of public cloud is its ease to access and fast deployment. The public cloud deployment model offers various benefits to the enterprises, such as scalability, reliability, flexibility, and remote location access. The public cloud deployment model is more preferred by the enterprises that have less regulatory hurdles and are willing to outsource their storage facilities either fully or partially. The major concern with public cloud is its data security due to which, many enterprises are shifting to private and hybrid cloud storage solutions.

The SMEs segment is moving toward the adoption of cloud ECM and growing rapidly at the highest CAGR during the forecast period. Cloud ECM has become a crucial part of the business processes in SMEs, due to the ease of use and the flexibility it offers and is expected to grow in the coming years.

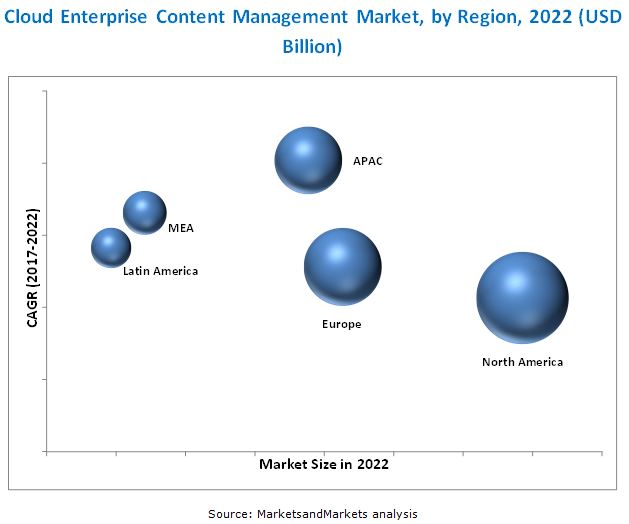

APAC is expected to be growing at a higher rate in the near future. The increased need to manage consistent data and prompt control and visibility mechanisms has led to a wider demand among enterprises for ECM solutions in the APAC region. Moreover, the sale of ECM solutions is increased due to the rising need for implementing security and accessibility controls; enhanced decision-making has led the APAC region to become a highly potential market.

Growing concerns regarding security and privacy are some of the major restraints and challenges in the cloud ECM market. Some of the key vendors in the cloud Enterprise Content Management market are OpenText Corporation (Ontario, Canada), Newgen Software( New Delhi, India), Xerox Corporation(Connecticut, US), Hyland Software, Inc.(Ohio, US), M-Files Corporation(Texas, US), IBM Corporation (New York, US), Oracle Corporation (California, US), Everteam (Paris, France), Box, Inc.(California, US), Alfresco Software (California, US), Microsoft Corporation (Washington, US), and DocuWare (Germering, Germany). These players have adopted various strategies, such as new product developments, acquisitions, and partnerships to serve the cloud ECM market. Continuous technology innovation is an area of focus for these players to maintain its competitive position in the market and promote customer satisfaction.

The cloud ECM market is expected to grow significantly with the increasing need for regulatory compliance to address industry standards and regulations across all regions. The exponential growth in digital content across enterprises is one of the major drivers of this market. Enterprises are deploying cloud ECM as it eases the accessibility of enterprise data for employees working at remote locations. The cloud ECM market is diversified and competitive with many market players, such as Oracle, Microsoft, OpenText, and Hyland.

Document Management

There has been a tremendous increase in the volume of documents generated in an enterprise on a daily basis; thus, this increases the need to manage and store the generated data. Microscopic analysis of the organizational content is necessary to establish relationships between heterogeneous variables and accordingly, frame organizational strategies. Moreover, the need to maintain metadata files is increasing due to the tremendous rise in organizational content. Metadata files can be instrumental in defining control and access mechanism of the documents.Content Management

The content management solution comprises web content management, social content management, and mobile content management. The web content management is a set of tools that enables an enterprise with a way to manage digital information on a website through creating and maintaining content. Social content management solution helps to manage, publish, and monitor the workflow of multiple social media channel from a single tool. Mobile content management solutions provide capabilities to store and secure content. It also provides services to devices, such as smartphones, tablets, and PDAs.

Web Content Management

The content generated in enterprises can be used to streamline organizations business processes and reduce the overall cost of ownership. The increase in the eCommerce applications on a global scale has led to an increase in awareness, regarding the need to avail right data at the right time along with content management to achieve sustainable development.

Social Content Management

Social media is considered as one of the most effective platforms for the enterprises to create new leads and get more traffic. Social content management is one of the types of content management that helps enterprises to successfully implement product campaigns over various social networking sites such as Facebook, LinkedIn, Twitter, and Google+.

Mobile Content Management

Mobile content management enables enterprises to store data on a centralized server in a raw format, which is later delivered to various types of mobile devices in a format they are compatible with. The solution enables employees to simply reach for their smartphones and tablets to share, review, approve, write, read, edit, present, and perform countless other work-oriented activities in seconds.

Case Management

Case management can be defined as the technique of processing a business case. A case here refers to a collection of files, digital documents, and business workflow activities by knowledge workers or case workers. A case can be defined as a business entity that an organization possesses and that needs to be processed. Advanced case management is a process to manage, update, monitor, interpret, and understand every bit of a business work as it is processed.

Workflow Management

There has been an increasing demand for tools, which supports content workflow management, specifically for website data management. Additionally, with growing use of Internet, mobile devices, and social media among customers, the demand for content workflow management has grown exponentially. Moreover, the time spent by users online has increased tremendously, and websites have become a major way to connect with the enterprise business and other prospective customers. Websites also provide a platform to promote enterprise products and furthermore boost their marketing strategy.

Record Management

Records management is essential as most of the enterprises are hampered due to the mismanagement of records such as missing values, non-conformance to business semantics, repetitive records, and incorrect entries. Therefore, to ensure business continuity, it is necessary to put in place a proper records management framework. Every enterprise business, government agencies, and other sectors such as BFSI, telecommunication, and healthcare, need record-keeping for various purposes. Records management is a cyclical process which enables continuous analysis, observation, and enhancement of enterprise records.

Digital Asset Management

Digital asset management creates a centralized storage for digital files and programs to archive, retrieve, and search the digital content. Digital asset management systems provide a centralized repository for archiving, integrating, managing, and accessing digital assets: both the documents and the related metadata. Digital assets consist of images, graphics, logos, animations, audio/video clips, presentations, web pages, documents, and a number of other digital file formats. Digital asset management is considered significant in terms of managing the asset lifecycle of an enterprise.

Ediscovery

Electronic Discovery (eDiscovery) can be defined as the process in which identification, collection, and production of Electronically Stored Information (ESI) is performed for a particular civil litigation or investigation. ESI can be documents, emails, databases, voicemails, presentations, audio and video files, websites, and social media. The eDiscovery solutions mainly comprise prominent solutions for legal hold (legal hold prevents addition, modification, and deletion of data), early case assessment, data processing, and data production.

Others

The other solutions include enterprise portal management, enterprise archive solution, and enterprise performance management, which simplify content management across varied platforms to enhance business decisions and resolve business complexities in a quick manner. Enterprise portal management is a process of integration and aggregation of the information, processes, and people across the enterprises. It can be used in monitoring and managing crucial website content and can also provide transparency, control, and visibility in website content management.

Key Questions

- What are the latest innovations happening in the cloud ECM market?

- What are different use cases of the cloud ECM solutions?

- Various strategies adopted by the leading vendors in the market?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Cloud ECM Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Cloud ECM Market Size Estimation

2.3 Microquadrant Research Methodology

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud ECM Market

4.2 Cloud Enterprise Content Management Market: Market Share of the Top Four Solutions and Regions, 2017

4.3 Market Investment Scenario

4.4 Cloud Enterprise Content Management Market: Top Three Verticals, 20172022

5 Cloud ECM Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Ecosystem

5.3 Cloud ECM Market Dynamics

5.3.1 Drivers

5.3.1.1 Exponential Growth in Digital Content Across Enterprises

5.3.1.2 Easier Access From Remote End-Points

5.3.1.3 Need for Regulatory Compliance

5.3.1.4 Protection of Enterprise Data Against Disaster

5.3.2 Restraints

5.3.2.1 Rise in Security and Privacy Concerns Among Enterprises

5.3.3 Opportunities

5.3.3.1 Increasing Adoption of Cloud Analytics

5.3.3.2 Increased Inclination Toward End-To-End Cross-Platform Solutions

5.3.4 Challenges

5.3.4.1 Data Migration From Legacy Systems to Cloud-Based Ecm

5.3.4.2 Lack of Technical Proficiency Among the Enterprises

6 Cloud ECM Market Analysis, By Type (Page No. - 40)

6.1 Introduction

7 Cloud ECM Market Analysis, By Solution (Page No. - 42)

7.1 Introduction

7.2 Document Management

7.3 Content Management

7.3.1 Web Content Management

7.3.2 Social Content Management

7.3.3 Mobile Content Management

7.4 Case Management

7.5 Workflow Management

7.6 Record Management

7.7 Digital Asset Management

7.8 Ediscovery

7.9 Others

8 Cloud ECM Market Analysis, By Service (Page No. - 52)

8.1 Introduction

8.2 Professional Services

8.3 Managed Services

9 Cloud ECM Market Analysis, By Deployment Model (Page No. - 56)

9.1 Introduction

9.2 Public Cloud

9.3 Private Cloud

9.4 Hybrid Cloud

10 Cloud ECM Market Analysis, By Organization Size (Page No. - 60)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Cloud ECM Market Analysis, By Vertical (Page No. - 64)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Education

11.4 Energy and Power

11.5 Government and Public Sector

11.6 Healthcare and Life Sciences

11.7 Manufacturing

11.8 Media and Entertainment

11.9 Retail and Consumer Goods

11.10 Telecommunication and Ites

11.11 Others

12 Geographic Analysis (Page No. - 75)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 95)

13.1 Introduction

13.2 Competitive Leadership Mapping

13.2.1 Visionary Leaders

13.2.2 Innovators

13.2.3 Dynamic Differentiators

13.2.4 Emerging Companies

13.3 Competitive Benchmarking

13.3.1 Strength of Product Portfolio (For 25 Players)

13.3.2 Business Strategy Excellence (For 25 Players)

14 Company Profiles (Page No. - 99)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

14.1 Opentext

14.2 Newgen Software

14.3 Xerox

14.4 Hyland

14.5 M-Files

14.6 IBM

14.7 Oracle

14.8 Everteam

14.9 Box

14.10 Alfresco

14.11 Microsoft

14.12 Docuware

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 127)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (63 Tables)

Table 1 US Dollar Exchange Rate, 20142016

Table 2 Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 3 Cloud Enterprise Content Management Market Size, By Solution, 20152022 (USD Million)

Table 4 Document Management: Market Size, By Region, 20152022 (USD Million)

Table 5 Content Management: Market Size, By Region, 20152022 (USD Million)

Table 6 Case Management: Cloud Enterprise Content Management Market Size, By Region, 20162022 (USD Million)

Table 7 Workflow Management: Market Size, By Region, 20152022 (USD Million)

Table 8 Record Management: Market Size, By Region, 20152022 (USD Million)

Table 9 Digital Asset Management: Market Size, By Region, 20152022 (USD Million)

Table 10 Ediscovery: Cloud Enterprise Content Management Market Size, By Region, 20152022 (USD Million)

Table 11 Others: Market Size, By Region, 20152022 (USD Million)

Table 12 Cloud ECM Market Size, By Service, 20152022 (USD Million)

Table 13 Professional Services: Market Size, By Region, 20152022 (USD Million)

Table 14 Managed Services: Market Size, By Region, 20152022(USD Million)

Table 15 Cloud ECM Market Size, By Deployment Model, 20152022 (USD Million)

Table 16 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 17 Private Cloud: Cloud Enterprise Content Management Market Size, By Region, 20152022 (USD Million)

Table 18 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 19 Cloud ECM Market Size, By Organization Size, 20152022 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 21 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 22 Cloud ECM Market Size, By Vertical, 20152022 (USD Million)

Table 23 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 24 Education: Market Size, By Region, 20152022 (USD Million)

Table 25 Energy and Power: Market Size, By Region, 20152022 (USD Million)

Table 26 Government and Public Sector: Cloud Enterprise Content Management Market Size, By Region, 20152022 (USD Million)

Table 27 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 28 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 29 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 30 Retail and Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 31 Telecommunication and Ites: Market Size, By Region, 20152022 (USD Million)

Table 32 Others: Market Size, By Region, 20152022 (USD Million)

Table 33 Cloud ECM Market Size, By Region, 20152022 (USD Million)

Table 34 North America: Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 35 North America: Market Size, By Solution, 20152022 (USD Million)

Table 36 North America: Market Size, By Service, 20152022 (USD Million)

Table 37 North America: Market Size, By Deployment Model, 20152022(USD Million)

Table 38 North America: Cloud Enterprise Content Management Market Size, By Organization Size, 20152022 (USD Million)

Table 39 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 40 Europe: Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 41 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 42 Europe: Market Size, By Service, 20152022 (USD Million)

Table 43 Europe: Cloud Enterprise Content Management Market Size, By Deployment Model, 20152022 (USD Million)

Table 44 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 46 Asia Pacific: Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Deployment Model, 20152022(USD Million)

Table 50 Asia Pacific: Cloud Enterprise Content Management Market Size, By Organization Size, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 52 Middle East and Africa: Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Deployment Model, 20152022(USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 58 Latin America: Cloud ECM Market Size, By Type, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 61 Latin America: Cloud Enterprise Content Management Market Size, By Deployment Model, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Organization Size, 20152022(USD Million)

Table 63 Latin America: Market Size, By Vertical, 20152022 (USD Million)

List of Figures (34 Figures)

Figure 1 Cloud ECM Market: Market Segmentation

Figure 2 Cloud Enterprise Content Management Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Competitive Leadership Mapping: Criteria Weightage

Figure 8 Cloud Enterprise Content Management Market: Assumptions

Figure 9 North America is Expected to Hold the Largest Market Share in 2017

Figure 10 Top Three Revenue Segments in the Cloud Enterprise Content Management Market, 20172022

Figure 11 Exponential Growth in Digital Content Across Enterprises is Contributing to the Growth of the Cloud Enterprise Content Management Market in the Forecast Period

Figure 12 Document Management Solution and North America to Have the Largest Market Shares in 2017

Figure 13 Market Investment Scenario: Asia Pacific Would Emerge as the Best Market for Investments in the Next 5 Years

Figure 14 Banking, Financial Services, and Insurance Vertical is Expected to Have the Largest Market Size in 2017

Figure 15 Cloud Enterprise Content Management Ecosystem

Figure 16 Cloud ECM Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Market: Latest Trends Related to Digital Content

Figure 18 Market: Estimated Deployment of Byod

Figure 19 Cloud ECM Market: Estimated Percentage of Organizations, By Usage of Big Data and Analytics

Figure 20 Document Management Solution is Expected to Have the Largest Market Size in 2017

Figure 21 Professional Services Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Public Cloud Model is Expected to Hold the Largest Market Size in 2017

Figure 23 Large Enterprises Segment is Expected to Hold the Largest Market Size in 2017

Figure 24 Banking, Financial Services, and Insurance Vertical is Expected to Have the Largest Market Size in 2017

Figure 25 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 North America is Expected to Dominate the Cloud Enterprise Content Management Market During the Forecast Period

Figure 27 Asia Pacific Market Snapshot

Figure 28 Cloud ECM Market (Global), Competitive Leadership Mapping, 2017

Figure 29 Opentext: Company Snapshot

Figure 30 Xerox: Company Snapshot

Figure 31 IBM: Company Snapshot

Figure 32 Oracle: Company Snapshot

Figure 33 Box: Company Snapshot

Figure 34 Microsoft: Company Snapshot

Growth opportunities and latent adjacency in Cloud Enterprise Content Management Market