Cloud Endpoint Protection Market by Component, Solution (Antivirus, Anti-spyware, Firewall, Endpoint Device Control, Anti-phishing, Endpoint Application Control), Service, Organization Size, Vertical, and Region - Global Forecast 2023

[137 Pages Report] The cloud endpoint protection market size was USD 910.0 million in 2017, and is expected to reach USD 1,819.0 million by 2023, at a Compound Annual Growth Rate (CAGR) of 12.4% during the forecast period. The growing need for effective protection against cyberattacks on endpoints is expected to drive the market. In this report, 2017 is considered as the base year and 20182023 is the forecast period.

Cloud Endpoint Protection Market Dynamics

Drivers

- Increase in the number of endpoint devices

- Growing number of breaches and attacks on endpoints

- Growing demand for cost-effective alternatives for on-premises security deployment

Restraints

- Use of free or pirated endpoint protection solutions

- Rise in demand for integrated endpoint security solutions

Opportunities

- Growing demand for securing IT infrastructure in the media and entertainment vertical

- Increasing digital traffic

Challenges

- Dynamic IT infrastructure and cyber threat landscape

Increasing number of endpoint devices drives the global cloud endpoint protection market

Organizations are increasingly adopting endpoint devices such as laptops, Internet of Things (IoT), tablets, smartphones, and other smart technologies. Rapid advancement in mobile computing has also led to the growing popularity of the BYOD trend in the corporate environments. This offers work flexibility and increased employee productivity as it allows employees to access organizational data from anywhere, anytime. Each of these devices is a potential entry point for an attacker that can exploit and gain access to the organizations network. Negligence such as a careless click on a malicious link, or an unpatched endpoint device can provide a vulnerability for the attackers to exploit. Moreover, most of the work performed in an organization is on these endpoint devices. Hence, it is necessary to safeguard organizational data against potential risks to ensure its confidentiality and integrity.

Objectives of the Study

The main objective of this report is to define, describe, and forecast the global cloud endpoint protection market based on components, solutions, services, organization size, verticals, and regions. The report provides detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth. It aims at strategically analyzing the micro markets with respect to the individual growth trends, prospects, and contributions to the global market. It attempts to forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments, such as joint ventures, mergers and acquisitions, new developments, and Research and Development (R&D) activities, in the global market.

Research Methodology

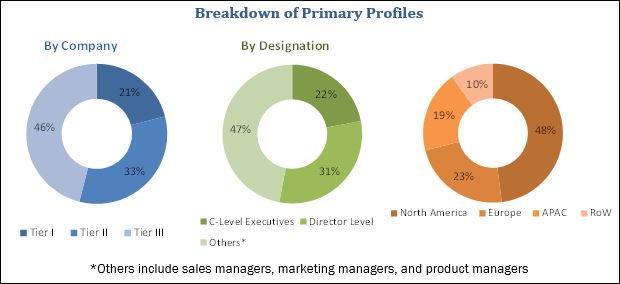

The research methodology used to estimate and forecast the cloud endpoint protection market started with capturing data on the key vendors revenue through secondary research using various sources, such as Cisco Cloud Index, Cloud Security Alliance, and Institute of Electrical and Electronic Engineers (IEEE). In addition to this, the vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenues of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The cloud endpoint protection market includes various vendors, including as Symantec (US), Sophos (UK), Trend Micro (Japan), ESET (Slovakia), Kaspersky Lab (Russia), Palo Alto Networks (US), McAfee (US), Fortinet (US), Cisco Systems (US), Panda Security (Spain), Avast (Czech Republic), SentinelOne (US), Bitdefender (Romania), Commvault (US), Carbon Black (US), FireEye (US), CoSoSys (Romania), Malwarebytes (US), K7 Computing (India), F-Secure Corporation (Finland), CrowdStrike (US), Comodo (US), Endgame (US), Webroot (US), and VIPRE Security (US).

Major Cloud Endpoint Protection Market Developments

- In December 2017, Symantec and British Telecom (BT) partnered to provide the best-in-class endpoint security protection. The partnership would help BT customers encounter the rapidly changing threat landscape with a consolidated, intelligent security infrastructure.

- In November 2017, Trend Micro acquired the application security firm, Immunio. The acquisition would help Trend Micro increase the automated protection that Trend Micro provides to its customers throughout the DevOps lifecycle.

- In February 2017, Sophos acquired Invincea, an innovative provider of next-generation malware protection. The company added the capabilities of advanced machine learning to its next-generation endpoint protection portfolio.

The target audience of the cloud endpoint protection market report includes the following:

- Security solution providers

- Security service providers

- System integrators

- Consulting firms

- Research organizations

- Resellers and distributors

The study answers several questions for stakeholders, primarily which market segments to focus on in the next 25 years for prioritizing their efforts and investments.

Scope of the Cloud Endpoint Protection Market Report

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

Cloud Endpoint Protection Market By Component

- Solutions

- Services

Cloud Endpoint Protection Market By Solution:

- Antivirus

- Anti-spyware

- Firewall

- Endpoint Device Control

- Anti-phishing

- Endpoint Application Control

- Others (intrusion protection and data loss prevention)

Cloud Endpoint Protection Market By Service:

- Managed Services

- Training and Consulting

- Maintenance and Support

Cloud Endpoint Protection Market By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Cloud Endpoint Protection Market By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare

- Manufacturing

- Education

- Retail

- Media and Entertainment

- Government and Defense

- Others (travel and hospitality, and transportation and logistics)

Cloud Endpoint Protection Market By region:

- North America

- US

- Canada

- Europe

- UK

- France

- Germany

- Rest of Europe

- APAC

- China

- Japan

- Australia

- India

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Critical questions which the report answers

- What are new verticals which the cloud endpoint protection companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs and on the best effort basis.

The global cloud endpoint protection market is expected to grow from USD 1,014.4 million in 2018 to USD 1,819.0 million by 2023, at a Compound Annual Growth Rate (CAGR) of 12.4% during the forecast period. Cloud endpoint protection solutions are easy to use SaaS-based security solutions that protect and manage mobile devices and servers from a single console. The advancement in technologies and hacking methods has increased the need for endpoint security system that can learn quickly and defend against security threats in real time. Moreover, benefits such as cost-effectiveness and scalability have propelled the demand for cloud endpoint protection solutions across verticals.

This report provides detailed insights into the cloud endpoint protection market by region, segment, and vertical. The market has been segmented on the basis of components (solutions and services). The solutions considered for the market include anti-virus, anti-spyware, firewall, endpoint device control, anti-phishing, and endpoint application control. The services considered for the market include managed services, training and consulting, and maintenance and support.

The market has been segmented by organization size into Small and Medium-sized Enterprises (SMEs) and large enterprises. The growing investments in cloud-based technologies across the globe are fueling the demand for cloud endpoint protection solutions and services, and increasing the growth of the cloud endpoint protection market.

Regulatory compliance is a key driver to the growth of the cloud endpoint protection market in BFSI and government and defense verticals

Banking, Financial Services, and Insurance

This vertical deals with huge volumes of sensitive data, which include investment portfolio performance statements, outbound investor communications, competitive market research, payment information, money transaction details, credit/debit card details, account numbers, trading transactions, and other critical information. Large volumes of transactions are conducted every minute in BFSI organizations, and the identification of suspicious and abnormal activities can help prevent major security attacks. The BFSI vertical is prone to attacks directed toward its IT infrastructure as well as customers. The most common form of attack seen within the BFSI vertical is the use of scam emails to distribute Trojans. Therefore, to mitigate security threats, BFSI organizations need to have effective security measures to strengthen their infrastructure and back-end systems by adopting cloud endpoint protection solutions and related services.

IT and Telecom

Information and Communications Technology (ICT) has become an essential part of the daily activities of industries, governments, families, and consumers. It has also become a major driver for economic and social growth over decades. The growing number of data breach incidents reported worldwide, coupled with the rising number of web attacks, has compelled organizations to adopt effective security strategies. IT and telecom organizations face threats from encrypted malware that can exploit data storage vulnerabilities to steal or hack critical information. Moreover, these encrypted malware utilize advanced codes to bypass signature-based detection systems; this has further added to the demand for advanced detection in the IT and telecom vertical.

Government and Defense

Government organizations are increasingly opting for cloud storage to store important public documents that can be accessed by citizens. The defense sector is targeted by cybercriminals with the purpose to extract highly confidential and sensitive data. Attackers have developed innovative techniques to bypass security systems and access confidential data. Moreover, satellites and drones are quickly emerging as efficient surveillance systems and are being widely adopted in the defense sector. The data gathered from surveillance systems needs to be secured to prevent it from going into the wrong hands. Cloud endpoint protection systems facilitate the deployment of advanced prevention solutions to provide effective security to enterprises in the government and defense vertical.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry trends for cloud endpoint protection?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

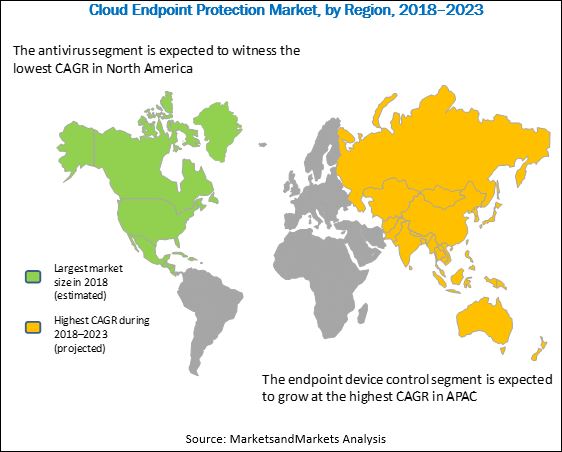

The report covers all the major aspects of the cloud endpoint protection market and provides an in-depth analysis across North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to hold the largest market size, due to the presence of major vendors and adoption of cloud associated services. APAC is expected to provide several opportunities for cloud endpoint protection vendors and projected to grow at the highest CAGR during the forecast period. The growing use of free or pirated endpoint protection solutions may restrain the market growth.

In todays complex organizational infrastructure, there are multiple endpoints such as smartphones, tablets, desktops, and laptops through which end-users access the organizational data. This creates difficulty for cloud-based security solutions to maintain efficiency, security, and compliance over such complex organizational infrastructure.

Various vendors provide cloud endpoint protection solutions for helping enterprises reduce their Capital Expenditure (CAPEX). Sophos is a leading provider of security solutions. The company offers security solutions for network security, end-user security, and server security. It has been following various organic as well as inorganic business growth strategies, such as mergers and acquisitions, new product launches, and product enhancements. Other vendors in the cloud endpoint protection market include Symantec (US), Trend Micro (Japan), ESET (Slovakia), Kaspersky Lab (Russia), Palo Alto Networks (US), McAfee (US), Fortinet (US), Cisco Systems (US), Panda Security (Spain), Avast (Czech Republic), SentinelOne (US), Bitdefender (Romania), Commvault (US), Carbon Black (US), FireEye (US), CoSoSys (Romania), Malwarebytes (US), K7 Computing (India), F-Secure Corporation (Finland), CrowdStrike (US), Comodo (US), Endgame (US), Webroot (US), and VIPRE Security (US). These market players have adopted various strategies, such as partnerships, collaborations, and expansions, to remain competitive in the market.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Cloud Endpoint Protection Market

4.2 Market Top 3 Verticals and Regions

4.3 Life Cycle Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in the Number of Endpoint Devices

5.2.1.2 Growing Number of Breaches and Attacks on Endpoints

5.2.1.3 Growing Demand for Cost-Effective Alternatives for On-Premises Security Deployment

5.2.2 Restraints

5.2.2.1 Use of Free Or Pirated Endpoint Protection Solutions

5.2.2.2 Skepticism Regarding Cloud-Based Security

5.2.3 Opportunities

5.2.3.1 Growing Demand for Securing It Infrastructure in the Media and Entertainment Vertical

5.2.3.2 Rise in Demand for Integrated Endpoint Security Solutions

5.2.4 Challenges

5.2.4.1 Dynamic It Infrastructure and Cyber Threat Landscape

5.3 Technology Trends and Standards

5.3.1 Standards and Guidelines for the Cloud Endpoint Protection Market

5.3.1.1 Payment Card Industry Data Security Standard (PCI DSS)

5.3.1.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.1.3 Federal Information Security Management Act (FISMA)

5.3.1.4 Gramm-Leach-Bliley Act

5.3.1.5 SarbanesOxley Act

5.3.1.6 Underwriters Laboratory

5.3.1.7 Distributed Management Task Force Standards

5.3.1.8 Organization for the Advancement of Structured Information Standards (OASIS)

6 Cloud Endpoint Protection Market By Component (Page No. - 38)

6.1 Introduction

7 Market By Solution (Page No. - 41)

7.1 Introduction

7.2 Antivirus

7.3 Anti-Spyware

7.4 Firewall

7.5 Endpoint Device Control

7.6 Anti-Phishing

7.7 Endpoint Application Control

7.8 Others

8 Cloud Endpoint Protection Market By Service (Page No. - 50)

8.1 Introduction

8.2 Managed Services

8.3 Training, Consulting and Integration

8.4 Maintenance and Support

9 Market By Organization Size (Page No. - 55)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Cloud Endpoint Protection Market By Vertical (Page No. - 59)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 It and Telecom

10.4 Healthcare

10.5 Manufacturing

10.6 Education

10.7 Retail

10.8 Media and Entertainment

10.9 Government and Defense

10.10 Others

11 Cloud Endpoint Protection Market By Region (Page No. - 69)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 86)

12.1 Overview

12.2 Competitive Scenario

12.2.1 New Product Launches/Product Upgradations

12.2.2 Partnerships, Agreements, and Collaborations

12.2.3 Mergers and Acquisitions

12.2.4 Business Expansions

13 Company Profiles (Page No. - 90)

13.1 Introduction

(Business Overview, Solutions And, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Symantec

13.3 Sophos

13.4 Trend Micro

13.5 Eset

13.6 Kaspersky Lab

13.7 Palo Alto Networks

13.8 Mcafee

13.9 Fortinet

13.10 Cisco Systems

13.11 Panda Security

13.12 Avast

13.13 Sentinelone

13.14 Bitdefender

13.15 Commvault

13.16 Carbon Black

13.17 Fireeye

13.18 Cososys

13.19 Malwarebytes

13.20 K7 Computing

13.21 F-Secure Corporation

13.22 Crowdstrike

13.23 Comodo

13.24 Endgame

13.25 Webroot

13.26 Vipre Security

*Details on Business Overview, Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 130)

14.1 Insight of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (66 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Global Market Assumptions

Table 3 Global Market Size, 20162023 (USD Million)

Table 4 Cloud Endpoint Protection Market Size, By Component, 20162023 (USD Million)

Table 5 Solutions: Market Size By Region, 20162023 (USD Million)

Table 6 Services: Market Size By Region, 20162023 (USD Million)

Table 7 Market Size By Solution, 20162023 (USD Million)

Table 8 Antivirus: Market Size By Region, 20162023 (USD Million)

Table 9 Anti-Spyware: Market Size By Region, 20162023 (USD Million)

Table 10 Firewall: Market Size By Region, 20162023 (USD Million)

Table 11 Endpoint Device Control: Market Size By Region, 20162023 (USD Million)

Table 12 Anti-Phishing: Market Size By Region, 20162023 (USD Million)

Table 13 Endpoint Application Control: Market Size By Region, 20162023 (USD Million)

Table 14 Others: Market Size By Region, 20162023 (USD Million)

Table 15 Cloud Endpoint Protection Market Size, By Service, 20162023 (USD Million)

Table 16 Managed Services: Market Size By Region, 20162023 (USD Million)

Table 17 Training, Consulting and Integration: Market Size By Region, 20162023 (USD Million)

Table 18 Maintenance and Support: Market Size By Region, 20162023 (USD Million)

Table 19 Market Size By Organization Size, 20162023 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 22 Cloud Endpoint Protection Market Size, By Vertical, 20162023 (USD Million)

Table 23 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 24 It and Telecom: Market Size By Region, 20162023 (USD Million)

Table 25 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 26 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 27 Education: Market Size By Region, 20162023 (USD Million)

Table 28 Retail: Market Size By Region, 20162023 (USD Million)

Table 29 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 30 Government and Defense: Market Size By Region, 20162023 (USD Million)

Table 31 Others: Market Size By Region, 20162023 (USD Million)

Table 32 Cloud Endpoint Protection Market Size, By Region, 20162023 (USD Million)

Table 33 North America: Market Size By Component, 20162023 (USD Million)

Table 34 North America: Market Size By Solution, 20162023 (USD Million)

Table 35 North America: Market Size By Service, 20162023 (USD Million)

Table 36 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 37 North America: Market Size By Vertical, 20162023 (USD Million)

Table 38 North America: Market Size By Country, 20162023 (USD Million)

Table 39 Europe: Cloud Endpoint Protection Market Size, By Component, 20162023 (USD Million)

Table 40 Europe: Market Size By Solution, 20162023 (USD Million)

Table 41 Europe: Market Size By Service, 20162023 (USD Million)

Table 42 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 43 Europe: Market Size By Vertical, 20162023 (USD Million)

Table 44 Europe: Market Size By Country, 20162023 (USD Million)

Table 45 Asia Pacific: Cloud Endpoint Protection Market Size, By Component, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 51 Middle East and Africa: Cloud Endpoint Protection Market Size, By Component, 20162023 (USD Million)

Table 52 Middle East and Africa: Market Size By Solution, 20162023 (USD Million)

Table 53 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size By Vertical, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size By Subregion, 20162023 (USD Million)

Table 57 Latin America: Cloud Endpoint Protection Market Size, By Component, 20162023 (USD Million)

Table 58 Latin America: Market Size By Solution, 20162023 (USD Million)

Table 59 Latin America: Market Size By Service, 20162023 (USD Million)

Table 60 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 61 Latin America: Market Size By Vertical, 20162023 (USD Million)

Table 62 Latin America: Market Size By Country, 20162023 (USD Million)

Table 63 New Product Launches/Product Upgradations, 20172018

Table 64 Partnerships, Agreements, and Collaborations, 2017-2018

Table 65 Mergers and Acquisitions, 20172018

Table 66 Business Expansions, 20172018

List of Figures (37 Figures)

Figure 1 Global Cloud Endpoint Protection Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 North America is Estimated to Account for the Largest Market Share in 2018

Figure 8 Endpoint Device Control Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Media and Entertainment Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 10 The Increasing Number of Endpoint Devices is Expected to Fuel the Growth of the Cloud Endpoint Protection Market During the Forecast Period

Figure 11 Banking, Financial Services, and Insurance Vertical, and North America are Estimated to Account for the Largest Market Shares in 2018

Figure 12 Market is Expected to Register Immense Growth Opportunities in Asia Pacific

Figure 13 Cloud Endpoint Protection Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Endpoint Device Control Solution is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Maintenance and Support Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises Segment is Expected to Register A Higher CAGR During the Forecast Period

Figure 18 Media and Entertainment Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Developments By the Leading Players in the Cloud Endpoint Protection Market During 20162018

Figure 23 Geographic Revenue Mix of the Top Market Players

Figure 24 Symantec: Company Snapshot

Figure 25 Symantec: SWOT Analysis

Figure 26 Sophos: Company Snapshot

Figure 27 Sophos: SWOT Analysis

Figure 28 Trend Micro: Company Snapshot

Figure 29 Trend Micro: SWOT Analysis

Figure 30 Eset: SWOT Analysis

Figure 31 Kaspersky Lab: SWOT Analysis

Figure 32 Palo Alto Networks: Company Snapshot

Figure 33 Fortinet: Company Snapshot

Figure 34 Cisco Systems: Company Snapshot

Figure 35 Commvault: Company Snapshot

Figure 36 Fireeye: Company Snapshot

Figure 37 F-Secure Corporation: Company Snapshot

Growth opportunities and latent adjacency in Cloud Endpoint Protection Market