Cloud Database and DBaaS Market by Database Type (SQL and NoSQL), Component (Solutions & Services), Deployment Mode, Organization Size, Vertical (BFSI, IT & Telecom, Manufacturing, Healthcare & Life Sciences) and Region - Global Forecast to 2028

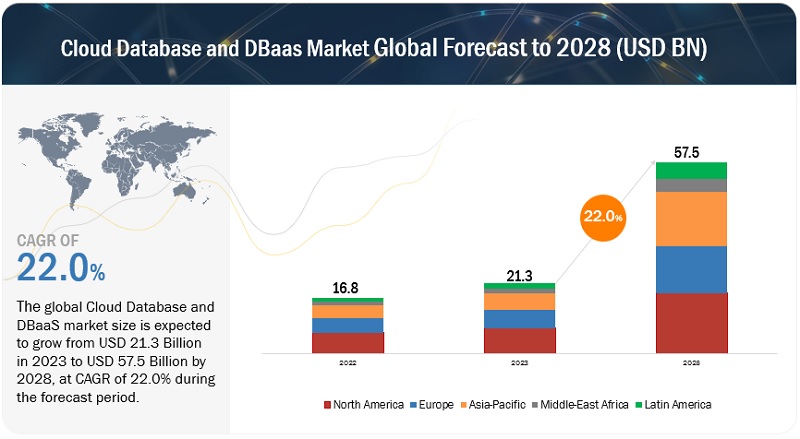

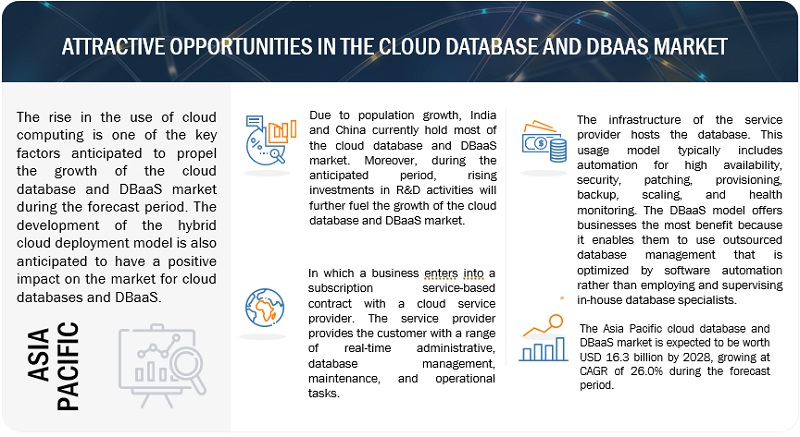

[284 Pages Report] The global Cloud Database and DBaaS market size is expected to grow from USD 21.3 billion in 2023 to USD 57.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 22.0% during the forecast period. The growing need for continuous innovation, digitalization, and rising demand for smartphones, tablets, and social media are the major factors fueling the growth of the Cloud Database and DBaaS market. Further, the increasing adoption of Cloud Databases and DBaaS by medium businesses and small businesses, with limited resources available to optimize their operations, has significantly contributed to the growth in the market in terms of the user base.

A database-as-a-service provided on a cloud computing platform is referred to as a cloud database or DBaaS. The rental of databases with enormous storage capacities by cloud database service providers enables effective management and analysis of large amounts of data. Additionally, these services give businesses access to a cloud database system, saving them the time it would take them to set up the necessary hardware, install the necessary software, and configure the system. The software's upkeep and any necessary upgrades are also handled by the service providers. The cost-effectiveness and effective time management of cloud databases and DBaaS services are some additional advantages.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: The growing demand for structured data in various enterprises

Quantitative data, also known as structured data, is organized in a way that machine learning algorithms can easily understand. Structured query language (SQL) is a programming language created by IBM in 1974 that enables business users to input, search, and manipulate structured data using a relational database. Structured data is ideal for machine learning algorithms due to its organized architecture, which simplifies data manipulation and querying. Even users with basic knowledge of the data's topic can access and interpret structured data without requiring an in-depth understanding of various data types. Structured data has more tools available for its usage and analysis than unstructured data since it predates it. For instance, CRM software utilizes analytical tools to process structured data and produce datasets that reveal customer behavior patterns and trends. Data from online bookings of hotel and ticket reservations adhere to a pre-defined data model’s ‘rows and columns’ format. Accounting firms or departments use structured data to process and record financial transactions. Nowadays, many technology companies utilize cloud databases to cater to various industries. Barracuda Networks, for example, provides a cloud-based Advanced Threat Protection (ATP) network that safeguards businesses worldwide from malware, ransomware, targeted attacks, and zero-day threats. The ATP network relies on Apache Cassandra as the underlying database and Astra DB, a Cassandra-based DBaaS, to simplify operation and management. This drives the enterprise cloud database and DBaaS market.

Restraint: Lack of technical knowledge and expertise

When it comes to using cloud databases and DBaaS, it's essential that experts or staff have the necessary technical skills and knowledge to implement, process, analyze, and secure cloud solutions. Unfortunately, many organizations are losing out on market share and money due to a lack of cloud expertise, which prevents them from taking advantage of emerging technologies. This is largely due to a severe shortage of technical skills among IT workers, particularly in the realm of cloud databases and DBaaS. Companies are struggling with various talent-related issues, including the need for rapid hiring processes, high wages for seasoned cloud workers, and difficulties finding candidates who are a good fit for their organizational culture. Ultimately, the growth engines of these companies could sputter if there aren't enough skilled cloud workers available. While 80% of IT leaders acknowledge that a lack of skilled workers is preventing companies from expanding their modern software engineering and cloud environments, more than 90% of them are actively working to address this issue.

Opportunities: Adoption of IoT and connected devices

It's no secret that technological advancements are being made every day. A couple of these technologies that have gained much attention are IoT and cloud computing, which are closely related. IoT has experienced remarkable growth, with over 10 billion active devices currently in use and an expected growth of 25.4 billion by 2030. Meanwhile, cloud services are being used by 94% of businesses, with 83% of enterprise workloads being hosted in the cloud. IoT devices generate a lot of data that requires collection and processing, either locally or remotely. While remote hosting and analytics are more practical and cost-effective in many IoT applications, edge computing has emerged as a promising alternative. Edge computing can filter data and send only some of it to distant servers, reducing the demand for cloud storage. It has enormous potential for real-time data analytics and is expected to work alongside IoT devices and cloud computing in the future. However, it's impractical for most businesses to move all their data processing and storage back to the edge.

Challenges: Risk of vendor lock-in

Cloud database and DBaaS adoption face a significant obstacle in the form of vendor lock-in, as there are no industry standards in place. While there are technologically-based solutions and initiatives being developed to address this issue, the complexity of the problem in the cloud context is not fully understood due to limited research. Consequently, many clients are unaware of proprietary standards that hinder application portability and interoperability when using vendor services. For example, migrating data from one data center to another can be challenging due to compatibility issues resulting from changes made in the original provider’s system. In this highly competitive environment, companies cannot rely on just one provider to maintain their edge over rivals, and they are constantly looking for improvements and better cloud databases and DBaaS services. Vendor lock-in can be caused by incompatible technologies, high initial costs for switching vendors, poor business practices, and contractual restrictions. These factors are holding back the adoption of cloud databases and DBaaS services and making it difficult for vendors to keep up with the competition in the market.

Ecosystem

Based on organization size, large enterprises segment to be the largest contributor to the Cloud Database and DBaaS market growth during the forecast period.

Based on organization sizes, the large enterprise segment is expected to hold a higher market share. The global business practices of organizations have undergone a significant change because of the cloud database and DBaaS market. Enterprise-scale businesses are abandoning dated on-premises database solutions in favor of adaptable, cloud-based alternatives. During the forecast period, the market growth for cloud databases is anticipated to be aided by the rising demand from large-scale businesses for digital database management and storage. Large businesses are increasingly choosing private cloud databases built on No SQL-implemented storage, which ensures security and offers additional advantages like less complicated infrastructure configuration and administrative burdens. To create their cloud-based applications and solutions, businesses can use cloud virtualization solutions, tools, and databases.

The market will be further stimulated by the expanding use of databases as virtual image machines. Small and Medium-sized Enterprises (SMEs) are expected to grow at a higher CAGR during the forecast period. By reimagining entire industries, the Internet of Things promises to connect the world in truly revolutionary ways. Small businesses will be able to make better decisions thanks to the business intelligence generated by cloud-based analytics. Expensive offices will make way for effective, on-demand workplaces that don't require commuting time or expensive IT teams and can adapt to a worker's specific needs. Teams will all have access to up-to-the-minute, reliable data, breaking down silos and making fragmented data easily accessible. This information will aid SMEs in creating distinctive customer journeys and enhancing their employee experiences, in addition to serving as a foundation for better decision-making.

Based on vertical, the retail & consumer goods segment is to be a larger dominator in the Cloud Database and DBaaS market during the forecast period.

Notably, cloud-based technology transformation can benefit retailers greatly in terms of sustainability. By making the best use of the hardware, a cloud migration can have numerous positive direct environmental effects. However, cloud journeys also give retailers the opportunity to make the next step towards responsibility by promoting sustainable customer experiences, circular business models, and traceable and improved supply chains. Many retailers had started shifting operations to the cloud even before the pandemic. The pandemic has also oftentimes accelerated those plans. Although the current environment is extremely difficult for retailers, things will eventually improve. And when it does, retailers who haven't benefited from this opportunity to transform their company will be at a disadvantage to those who have. And doing so entails more than just transferring more current systems and applications to the cloud. Retailers that have used the cloud to quickly reimagine their businesses on a cloud-enabled, sustainable technology platform will transform into true digital retailers, able to keep up with the pace of change and cost-effectively and continuously evolve and innovate to deliver the experiences customers want. Due to the rising demand for online shopping as well as the fiercer competition, retail companies must make full use of the most cutting-edge technologies available to them in order to survive and thrive.

One such technology that makes workflows simpler lowers IT costs, and enhances customer experience is cloud computing. One of the key elements influencing a consumer's purchase decision is the product's price. Because of this, it's crucial for sellers to monitor competitor pricing, examine historical sales trends and margin implications, and use this data to establish reasonable prices for their goods both in-person and online. However, performing all of this manually takes a lot of time and can result in unreliable data. Although it can take data from numerous sources and prepare it for pricing analysis, cloud computing in retail offers accurate data and can save a significant amount of time for data specialists. Cloud-based retail solutions can also automatically update prices in-store and online. One of the hardest jobs in the retail sector is managing, monitoring, and maintaining inventory. Businesses with numerous store locations will find it even harder to track and keep an eye on their inventory in real-time. However, real-time data is offered by retail cloud services, allowing for inventory tracking and monitoring in real time. Retail businesses with multiple stores no longer need to manually sync their various store inventories thanks to cloud computing.

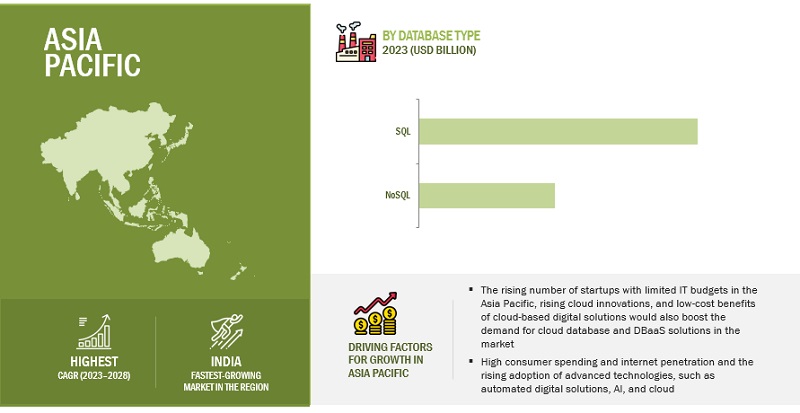

Asia Pacific to grow at the highest CAGR during the forecast period.

In Australia, Newcastle Council's Smart City Strategy focuses on how Big Data, the Internet of Things, and cloud connectivity can contribute to the development of more livable and forward-thinking urban environments. Cloud computing was widely regarded as the cornerstone of Malaysia's digital transformation during the endemic phase of COVID-19. Primary vendors like Alibaba Cloud have made it possible for small businesses to trade as successfully as large corporations. This has made it possible for these companies to fully utilize the services. The two main market leaders for data centers in the Asia-Pacific region are China and Australia. The largest optical fiber network, 4G, and 5G independent networking networks are all found in China. 916,000 base stations have been constructed for 5G at this time, which accounts for more than 365 million of the 70% to 80% of 5G connections worldwide. Significantly more data is being consumed as a result of the rising demand for OTT services and online streaming content on large display formats. Although there is no Netflix in China, there are local OTT services like Yuoku, Tencent Video, Mango TV, and Bilibili. With an estimated 34 billion USD in revenue in 2021, the online streaming market is anticipated to grow in value. Around 10-12% of data is currently created and processed outside of a centralized data center or cloud in Australia, but this percentage is predicted to rise to 65-70% by 2025, following a global trend that is also present in Australia. The COVID-19 crisis made clear how urgently Australia needs digital infrastructure to boost connectivity. Because of the growing demand for high-speed Internet services and the government's emphasis on aggressive fiber to the x (FTTx) network expansions across the country as part of the National Broadband Network (NBN) project, fiber lines are predicted to continue to be the dominant fixed broadband technology through 2025. In August 2022, the Australian operator Telstra chose new partners for the rollout of its transport network infrastructure and purchased Mad Max-style equipment that can lay two fiber cables at once as it accelerated the construction of its high-capacity data transport networks across a nation known for its unique environmental difficulties.

Key Players

Google (US), Microsoft (US), AWS (US), IBM (US), Oracle v (US), Alibaba Cloud (China), SAP (Germany), MongoDB (US), EnterpriseDB (US), Redis Labs (US), Tencent (China), Rackspace (US), Teradata (US), CenturyLink (US), Neo4J (US), Datastax (US), Tigergraph (US), MariaDB (US), RDX (US), SingleStore (US) are the key players in the Cloud Database and DBaaS market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments Covered |

Database Type, Component, Service, Deployment Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

|

Companies covered |

Google (US), Microsoft (US), AWS (US), IBM (US), Oraclev (US), Alibaba Cloud (China), SAP (Germany), MongoDB (US), EnterpriseDB (US), Redis Labs (US), Tencent (China), Rackspace (US), Teradata (US), CenturyLink (US), Neo4J (US), Datastax (US), Tigergraph (US), MariaDB (US), RDX (US), SingleStore (US). |

This research report categorizes the Cloud Database and DBaaS market based on database type component, service, deployment model, organization size, vertical, and region.

Based on Database Type, the Cloud Database and DBaaS market has been segmented as follows:

- Structured Query Language

- Not Only Structured Query Language

Based on Components, the Cloud Database and DBaaS market has been segmented as follows:

- Solutions

- Services

Based on Service, the Cloud Database and DBaaS market has been segmented as follows:

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

Based on the Deployment Model, the Cloud Database and DBaaS market has been segmented as follows:

- Private Cloud

- Public Cloud

- Hybrid Cloud

Based on Organization Size, the Cloud Database and DBaaS market has been segmented as follows:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Based on vertical, the Cloud Database and DBaaS market has been segmented as follows:

- BFSI

- IT & Telecom

- Government

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals (Education, Travel & Hospitality, and Transportation)

Based on regions, the Cloud Database and DBaaS market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2022, Google launched Manufacturing Data Engine and Manufacturing Connect. These two new solutions allowed manufacturers to connect previously siloed assets, process and standardize data, and improve visibility from the factory floor to the cloud. Once the data is unified, the solutions enable three critical AI and analytics-based use cases: manufacturing analytics and insights, predictive maintenance, and machine-level anomaly detection.

- In October 2022, Microsoft partnered with LSEG. LSEG and Microsoft announced a 10-year strategic partnership for next-generation data and analytics solutions, as well as cloud infrastructure solutions; Microsoft will make an equity investment in LSEG through share acquisition. New collaboration with Microsoft Azure, AI, and Microsoft Teams to architect LSEG's data infrastructure and build intuitive next-generation productivity, data and analytics, and modeling solutions.

- In May 2023, IBM acquired Polar Security. Polar Security, a technology innovator that helps businesses discover, continuously monitor, and secure the cloud, has been acquired by IBM. Polar Security’s DSPM technology will be integrated into IBM's Guardium family of leading data security products. With the addition of Polar Security's DSPM technology, IBM Security® Guardium will provide security teams with a data security platform that spans all data types and storage locations: SaaS, on-premises, and public cloud infrastructure.

Frequently Asked Questions (FAQ):

What is the projected market value of the Cloud Database and DBaaS Market?

The global Cloud Database and DBaaS market size is expected to grow from USD 21.3 Billion in 2023 to USD 57.5 Billion by 2028 at a Compound Annual Growth Rate (CAGR) of 22.0% during the forecast period.

Which region has the highest market share in the Cloud Database and DBaaS Market?

North America has the highest market share in the Cloud Database and DBaaS Market.

Which are the major vendors in the Cloud Database and DBaaS Market?

Google (US), Microsoft (US), AWS (US), IBM (US), Oraclev (US), Alibaba Cloud (China), SAP (Germany), MongoDB (US), EnterpriseDB (US), Redis Labs (US), Tencent (China), Rackspace (US), Teradata (US), CenturyLink (US), Neo4J (US), Datastax (US), Tigergraph (US), MariaDB (US), RDX (US), SingleStore (US) are the key vendors in the Cloud Database and DBaaS market.

What are the drivers in the Cloud Database and DBaaS Market?

The rising need for self-driving cloud databases, growing demand to process low latency queries, need for disaster recovery, and contingency plans are the major factors fueling the growth of the Cloud Database and DBaaS market.

What are some challenges in the Cloud Database and DBaaS Market?

The growing need to manage regulatory and compliance policy needs and the risk of vendor lock-in are the common challenges in the Cloud Database and DBaaS Market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for self-driving cloud databases- Growing demand to process low-latency queries- Need for structured data in various enterprises- Increase in amount of data generatedRESTRAINTS- Privacy and security concerns- Shortage of technical knowledge and expertise- Downtime or data inaccessibilityOPPORTUNITIES- Increase in production of database workload- Growing adoption of NoSQL database- Popularity of IoT and connected devicesCHALLENGES- Need for strict adherence to regulatory and compliance policies- Vendor lock-in risks

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: HOLIDAYME ADOPTED REDIS LABS’ SOLUTIONS TO ACHIEVE HIGH-SPEED FRAMEWORK WITH LOW LATENCYCASE STUDY 2: KINCARD ADOPTED NEO4J’S SOLUTIONS TO AUTOMATE AND MANAGE COMPLEX WORKFLOWSCASE STUDY 3: LOCSTAT ADOPTED INTEGRATED MODULES TO ACHIEVE EFFECTIVE MANAGEMENTCASE STUDY 4: SUPERCAT OUTPERFORMED AMAZON AURORA AND SAVED DATABASE COSTS BY UPGRADING TO MARIADB XPANDCASE STUDY 5: APERVITA ADOPTED MONGODB’S ATLAS SOLUTION TO IMPROVE INTEROPERABILITY

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 TECHNOLOGICAL ANALYSISARTIFICIAL INTELLIGENCEBIG DATAINTERNET OF THINGSDATA ANALYTICSMACHINE LEARNING

-

5.7 PATENT ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.9 AVERAGE SELLING PRICE TREND

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY IMPLICATIONS AND INDUSTRY STANDARDSGENERAL DATA PROTECTION REGULATIONSEC RULE 17A-4ISO/IEC 27001SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCEFINANCIAL INDUSTRY REGULATORY AUTHORITYFREEDOM OF INFORMATION ACTHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.14 KEY CONFERENCES & EVENTS, 2023

- 5.15 CLOUD DATABASE AND DBAAS MARKET: BUSINESS MODEL ANALYSIS

-

6.1 INTRODUCTIONDATABASE TYPES: MARKET DRIVERS

-

6.2 STRUCTURED QUERY LANGUAGE (SQL)NEED FOR ON-DEMAND ACCESS TO MANAGED RELATIONAL DATABASES TO DRIVE GROWTH

-

6.3 NOT ONLY STRUCTURED QUERY LANGUAGE (NOSQL)INCREASE IN DATA AND NEED FOR DYNAMIC SCALABLE DATABASE TO BOOST MARKET GROWTH

-

7.1 INTRODUCTIONCOMPONENTS: MARKET DRIVERS

-

7.2 SOLUTIONSINCREASING ADOPTION OF ADVANCED TECHNOLOGIES TO ENCOURAGE USE OF CLOUD DATABASE AND DBAAS SOLUTIONS

-

7.3 SERVICESGROWING DEMAND TO STRENGTHEN GEOGRAPHICAL REACH OF SOLUTION VENDORS TO BOOST ADOPTION OF CLOUD DATABASE AND DBAAS SERVICES

-

8.1 INTRODUCTIONSERVICES: MARKET DRIVERS

-

8.2 PROFESSIONAL SERVICESNEED FOR SPECIALIZED CLOUD DATABASE AND DBAAS SOLUTIONS TO DRIVE MARKETCONSULTINGIMPLEMENTATIONSUPPORT & MAINTENANCE

-

8.3 MANAGED SERVICESINCREASING NEED TO CONCENTRATE ON CORE BUSINESS PROCESSES TO PROPEL MARKET GROWTH

-

9.1 INTRODUCTIONDEPLOYMENT MODELS: MARKET DRIVERS

-

9.2 PUBLIC CLOUDNEED FOR SIMPLE AND EASY-TO-DEPLOY CLOUD SOLUTIONS TO DRIVE MARKET GROWTH

-

9.3 PRIVATE CLOUDDEMAND TO ACHIEVE BETTER CONTROL OVER DEPLOYMENT MODELS AND REDUCE RISKS TO DRIVE USE OF PRIVATE CLOUD SOLUTIONS

-

9.4 HYBRID CLOUDNEED FOR SOLUTIONS TO MANAGE WORKLOADS DISTRIBUTED ACROSS ENVIRONMENTS TO BOOST MARKET

-

10.1 INTRODUCTIONORGANIZATION SIZES: MARKET DRIVERS

-

10.2 LARGE ENTERPRISESRISING TREND OF DIGITALIZATION AMONG LARGE ENTERPRISES TO BOOST ADOPTION OF CLOUD DATABASE AND DBAAS SOLUTIONS

-

10.3 SMESNEED FOR COST-EFFECTIVE DATABASE SOLUTIONS IN SMES TO DRIVE MARKET

-

11.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)USE OF LARGE VOLUMES OF DATABASES TO ENCOURAGE ADOPTION OF CLOUD SOLUTIONS

-

11.3 IT & TELECOMINCREASING USE OF SMARTPHONES AND ADVANCEMENTS IN TECHNOLOGY TO BOOST MARKET GROWTH

-

11.4 GOVERNMENTVAST AMOUNTS OF DATA GENERATED BY GOVERNMENT AGENCIES TO PROPEL ADOPTION OF CLOUD SOLUTIONS

-

11.5 RETAIL & CONSUMER GOODSNEED TO SUPPORT BUSINESS CONTINUITY AND ENHANCE COMPETITIVENESS TO ENCOURAGE USE OF CLOUD SOLUTIONS AND SERVICES

-

11.6 MANUFACTURINGDEMAND TO IMPROVE PRODUCTION PROCESSES BY IDENTIFYING DEFECTS TO BOOST MARKET

-

11.7 ENERGY & UTILITIESGROWING USE OF CONSUMPTION AND SALES DATA TO DRIVE POPULARITY OF CLOUD DATABASE AND DBAAS SOLUTIONS

-

11.8 MEDIA & ENTERTAINMENTDEMAND FOR SOLUTIONS TO MANAGE COMPLEX BUSINESS DATA TO DRIVE GROWTH

-

11.9 HEALTHCARE & LIFE SCIENCESRAPID DIGITAL TRANSFORMATION AND EXTENSIVE EMPLOYMENT OF EHRS TO DRIVE ADOPTION OF CLOUD SOLUTIONS

- 11.10 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- High level of technology awareness and presence of large number of cloud vendors to drive demandCANADA- High internet penetration to drive market growth

-

12.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Need for businesses to transform traditional database into cloud-based database to drive growthGERMANY- Rising exports of high-tech products to boost growth of cloud database and DBaaS services and solutionsFRANCE- Demand to cut IT budgets to improve returns on investment to boost market growthITALY- Growth in smart city initiatives to drive adoption of cloud database and DBaaS solutionsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: CLOUD DATABASE AND DBAAS MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Robust government support and growing youth population to boost use of cloud database and DBaaS solutionsINDIA- Growth in initiatives to regulate cloud-based laws to drive marketJAPAN- Increasing adoption of advanced technologies, such as IoT, LTE, SDN, and AI, to boost growthREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Expansion of 5G fiber network and software-defined networks, and data centers to drive market growthUAE- Rising government initiatives to create effective integrated business environment to boost market growthREST OF MIDDLE EAST & AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Presence of major cloud players, such as AWS, IBM, Microsoft, and Oracle, and spread of data centers to encourage market growthMEXICO- Steady rise in digitalization and internet penetration to propel spread of cloud database and DBaaS solutionsREST OF LATIN AMERICA

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 13.3 REVENUE ANALYSIS FOR TOP FIVE VENDORS

-

13.4 COMPANY EVALUATION MATRIX, 2023DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.5 COMPANY FOOTPRINT FOR KEY PLAYERS

-

13.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 13.7 COMPANY FOOTPRINT FOR STARTUPS/SMES

- 13.8 COMPANY FINANCIAL METRICS

- 13.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

13.10 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSGOOGLE- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Platforms/Solutions/Services offered- Recent developments- MnM viewALIBABA CLOUD- Business overview- Platforms/Solutions/Services offered- Recent developmentsSAP- Business overview- Platforms/Solutions/Services offered- Recent developmentsMONGODB- Business overview- Platforms/Solutions/Services offered- Recent developmentsENTERPRISEDB- Business overview- Platforms/Solutions/Services offered- Recent developmentsREDIS LABS- Business overview- Platforms/Solutions/Services offered- Recent developments

-

14.3 OTHER COMPANIESTENCENTRACKSPACETERADATACENTURYLINKNEO4JDATASTAXTIGERGRAPHMARIADBRDXSINGLESTORE (MEMSQL)FAIRCOMCOCKROACH LABSARANGODBPINGCAP

-

15.1 INTRODUCTIONRELATED MARKETS

- 15.2 CLOUD COMPUTING MARKET

- 15.3 CLOUD STORAGE MARKET

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 PRIMARY RESPONDENTS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 COMPANIES AND THEIR ROLES IN MARKET ECOSYSTEM

- TABLE 5 TOP 10 PATENT APPLICANTS

- TABLE 6 PRICING ANALYSIS

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- TABLE 9 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR KEY END USERS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LIST OF CONFERENCES & EVENTS, 2023

- TABLE 16 CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 17 MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 18 SQL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 SQL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 NOSQL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 NOSQL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 23 CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 24 SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 29 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 30 MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 31 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 32 MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 33 CLOUD DATABASE AND DBAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 34 PUBLIC CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 PUBLIC CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 PRIVATE CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 PRIVATE CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 HYBRID CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 HYBRID CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 41 CLOUD DATABASE AND DBAAS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 42 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SMES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 SMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 47 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 48 BFSI: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 IT & TELECOM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 IT & TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 GOVERNMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 MANUFACTURING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 ENERGY & UTILITIES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 OTHER VERTICALS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CLOUD DATABASE AND DBAAS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: CLOUD DATABASE AND DBAAS SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: CLOUD DATABASE AND DBAAS SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: CLOUD DATABASE AND DBAAS SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: CLOUD DATABASE AND DBAAS SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: PUBLIC CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: PUBLIC CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: PRIVATE CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: PRIVATE CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: HYBRID CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: HYBRID CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET FOR LARGE ENTERPRISES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET FOR LARGE ENTERPRISES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET FOR SMES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET FOR SMES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET FOR SQL, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET FOR SQL, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET FOR NOSQL, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET FOR NOSQL, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 US: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 103 US: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 104 US: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 105 US: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 106 US: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 107 US: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 108 US: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 109 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 110 CANADA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 111 CANADA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 112 CANADA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 113 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 114 CANADA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 115 CANADA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 116 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 117 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 119 EUROPE: CLOUD DATABASE AND DBAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 133 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 UK: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 135 UK: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 136 UK: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 137 UK: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 138 UK: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 139 UK: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 140 UK: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 141 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 GERMANY: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 143 GERMANY: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 144 GERMANY: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 145 GERMANY: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 147 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 149 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 150 FRANCE: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 151 FRANCE: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 152 FRANCE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 153 FRANCE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 154 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 155 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 156 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 157 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 158 ITALY: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 159 ITALY: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 160 ITALY: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 161 ITALY: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 162 ITALY: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 163 ITALY: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 164 ITALY: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 165 ITALY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 167 REST OF EUROPE: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 168 REST OF EUROPE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 169 REST OF EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 171 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 172 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 173 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 190 CHINA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 191 CHINA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 192 CHINA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 197 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 198 INDIA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 199 INDIA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 200 INDIA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 201 INDIA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 202 INDIA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 203 INDIA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 204 INDIA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 205 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 206 JAPAN: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 207 JAPAN: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 208 JAPAN: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 209 JAPAN: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 210 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 211 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 212 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 213 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 238 SAUDI ARABIA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 239 SAUDI ARABIA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 240 SAUDI ARABIA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 241 SAUDI ARABIA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 242 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 243 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 244 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 245 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 246 UAE: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 247 UAE: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 248 UAE: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 249 UAE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 250 UAE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 251 UAE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 252 UAE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 253 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 263 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 265 LATIN AMERICA: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 267 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 269 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 278 BRAZIL: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 279 BRAZIL: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 280 BRAZIL: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 281 BRAZIL: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 282 BRAZIL: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 283 BRAZIL: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 284 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 285 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 286 MEXICO: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 287 MEXICO: MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 288 MEXICO: CLOUD DATABASE AND DBAAS MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 289 MEXICO: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 290 MEXICO: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 291 MEXICO: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 292 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 293 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 294 REST OF LATIN AMERICA: MARKET, BY DATABASE TYPE, 2018–2022 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: CLOUD DATABASE AND DBAAS MARKET, BY DATABASE TYPE, 2023–2028 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 302 GLOBAL COMPANY FOOTPRINT, BY DATABASE TYPE, COMPONENT, DEPLOYMENT MODE, AND REGION

- TABLE 303 GLOBAL COMPANY FOOTPRINT, BY VERTICAL

- TABLE 304 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 305 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY DATABASE TYPE, COMPONENT, DEPLOYMENT MODE, AND REGION

- TABLE 306 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY VERTICAL

- TABLE 307 PRODUCT LAUNCHES AND ENHANCEMENTS, 2022–2023

- TABLE 308 DEALS, 2022–2023

- TABLE 309 GOOGLE: BUSINESS OVERVIEW

- TABLE 310 GOOGLE: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 312 GOOGLE: DEALS

- TABLE 313 MICROSOFT: BUSINESS OVERVIEW

- TABLE 314 MICROSOFT: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 MICROSOFT: DEALS

- TABLE 316 AWS: BUSINESS OVERVIEW

- TABLE 317 AWS: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 319 AWS: DEALS

- TABLE 320 IBM: BUSINESS OVERVIEW

- TABLE 321 IBM: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 323 IBM: DEALS

- TABLE 324 ORACLE: BUSINESS OVERVIEW

- TABLE 325 ORACLE: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 327 ORACLE: DEALS

- TABLE 328 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 329 ALIBABA CLOUD: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 ALIBABA CLOUD: DEALS

- TABLE 331 ALIBABA CLOUD: OTHERS

- TABLE 332 SAP: BUSINESS OVERVIEW

- TABLE 333 SAP: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 335 SAP: DEALS

- TABLE 336 MONGODB: BUSINESS OVERVIEW

- TABLE 337 MONGODB: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 MONGODB: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 339 MONGODB: DEALS

- TABLE 340 ENTERPRISEDB: BUSINESS OVERVIEW

- TABLE 341 ENTERPRISEDB: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 ENTERPRISEDB: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 343 ENTERPRISEDB: DEALS

- TABLE 344 REDIS LABS: BUSINESS OVERVIEW

- TABLE 345 REDIS LABS: PLATFORMS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 REDIS LABS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 347 REDIS LABS: DEALS

- TABLE 348 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 349 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 350 CLOUD COMPUTING MARKET, BY IAAS, 2017–2021 (USD BILLION)

- TABLE 351 CLOUD COMPUTING MARKET, BY IAAS, 2022–2027 (USD BILLION)

- TABLE 352 CLOUD COMPUTING MARKET, BY PAAS, 2017–2021 (USD BILLION)

- TABLE 353 CLOUD COMPUTING MARKET, BY PAAS, 2022–2027 (USD BILLION)

- TABLE 354 CLOUD COMPUTING MARKET, BY SAAS, 2017–2021 (USD BILLION)

- TABLE 355 CLOUD COMPUTING MARKET, BY SAAS, 2022–2027 (USD BILLION)

- TABLE 356 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD BILLION)

- TABLE 357 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD BILLION)

- TABLE 358 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 359 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 360 CLOUD COMPUTING MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 361 CLOUD COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 362 CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 363 CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 364 CLOUD STORAGE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 365 CLOUD STORAGE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 366 CLOUD STORAGE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 367 CLOUD STORAGE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 368 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 369 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 370 CLOUD STORAGE MARKET, BY DEPLOYMENT MODEL, 2018–2021 (USD MILLION)

- TABLE 371 CLOUD STORAGE MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

- TABLE 372 CLOUD STORAGE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 373 CLOUD STORAGE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 374 CLOUD STORAGE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 375 CLOUD STORAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF SERVICES OFFERED BY CLOUD DATABASE AND DBAAS VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF CLOUD DATABASE AND DBAAS VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE)

- FIGURE 8 CLOUD DATABASE AND DBAAS MARKET: GLOBAL SNAPSHOT

- FIGURE 9 MAJOR SEGMENTS OF CLOUD DATABASE AND DBAAS MARKET

- FIGURE 10 SQL SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 11 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 12 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 13 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 IT & TELECOM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 16 RISING DEMAND FOR DATABASES IN CORPORATES TO DRIVE GROWTH OF CLOUD DATABASE AND DBAAS SERVICES AND SOLUTIONS

- FIGURE 17 SQL SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 18 SOLUTIONS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 19 PUBLIC CLOUD SEGMENT TO BE DOMINANT MARKET IN 2023

- FIGURE 20 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 21 IT & TELECOM VERTICAL TO LEAD MARKET IN 2023

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 23 CLOUD DATABASE AND DBAAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 27 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP INDUSTRIES

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 32 NOSQL SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 35 HYBRID CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 SMES SEGMENT TO RECORD HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 37 RETAIL & CONSUMER GOODS SEGMENT TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- FIGURE 42 REVENUE ANALYSIS FOR TOP FIVE VENDORS, 2018–2022 (USD BILLION)

- FIGURE 43 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 45 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 46 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 47 COMPANY FINANCIAL METRICS, 2022

- FIGURE 48 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 49 GOOGLE: COMPANY SNAPSHOT

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 51 AWS: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT

- FIGURE 53 ORACLE: COMPANY SNAPSHOT

- FIGURE 54 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 55 SAP: COMPANY SNAPSHOT

- FIGURE 56 MONGODB: COMPANY SNAPSHOT

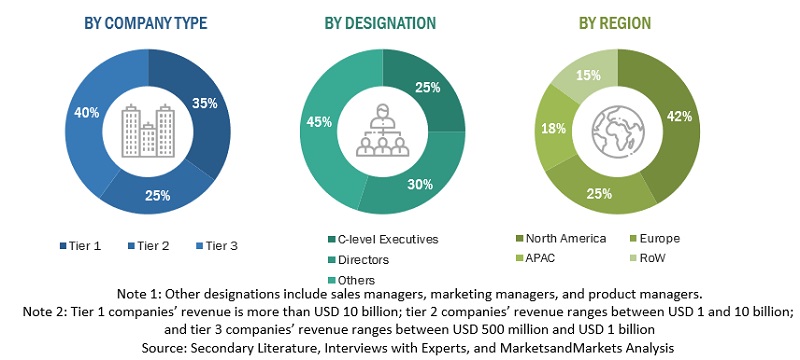

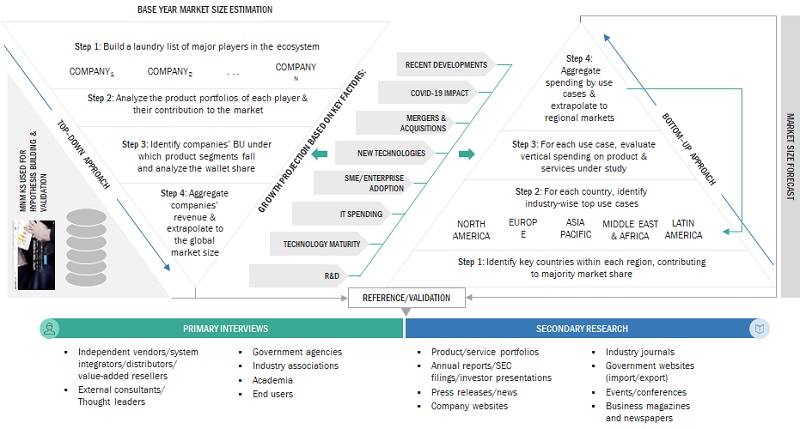

The study involved four major activities in estimating the current market size for Cloud Database and DBaaS solutions and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering cloud databases and DBaaS was derived based on the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development; related key executives from cloud database and DBaaS vendors and industry associations; independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, revenue data collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, service types, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation team of governments/end users using cloud database and DBaaS solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall cloud database and DBaaS market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the cloud database and DBaaS market size and other dependent subsegments. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets. In the bottom-up approach, the adoption trend of cloud database and DBaaS solutions among different services in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of cloud database and DBaaS solutions, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different service areas for the calculation. An exhaustive list of all the vendors offering solutions in the cloud database and DBaaS market was prepared. The revenue contribution of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with cloud databases and DBaaS offerings were considered to evaluate the market size. Each vendor was evaluated based on its product/solution offerings and services across industries. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the regional split was determined by primary and secondary sources.

Top-down and bottom-up Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

A research technique called data triangulation uses two or more methods to confirm findings and outcomes. It is employed to verify the veracity of findings and make sure that the hypothesis is supported by the data. Utilised frequently in qualitative research, data triangulation entails the confirmation of data by those who collected and analysed it. With the data triangulation procedure and validation of data through primaries, the exact values of the overall Cloud Database and DBaaS market size and its segments’ market size were determined and confirmed using the study.

Market Definition

Cloud database and DBaaS is a cloud computing service model that enables end users to create, access, and manage their databases on the cloud. These databases can be accessed through a web browser or through a vendor-provided Application Programming Interface (API). Some of the major features of cloud databases and DBaaS are automating administrative tasks, dynamic scaling, high-data availability, data backup, and recovery.

Key Stakeholders

- Cloud database providers

- Technology providers

- Internet Service Providers (ISPs)

- Telecom network operators

- Database software vendors

- System Integrators (SIs)

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the cloud database and Database as a Service (DBaaS) market by database type, component, service, deployment model, organization size, vertical, and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze recession impact and competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Cloud Database and DBaaS Market

Looking for the market share of cloud database and DBaaS in the U.S. including deployment and growth