Cloud Compliance Market by Component (Software (CSPM, CWPP, CASB, and CNAPP) and Services), Application, Cloud Model (IaaS, PaaS, and SaaS), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2027

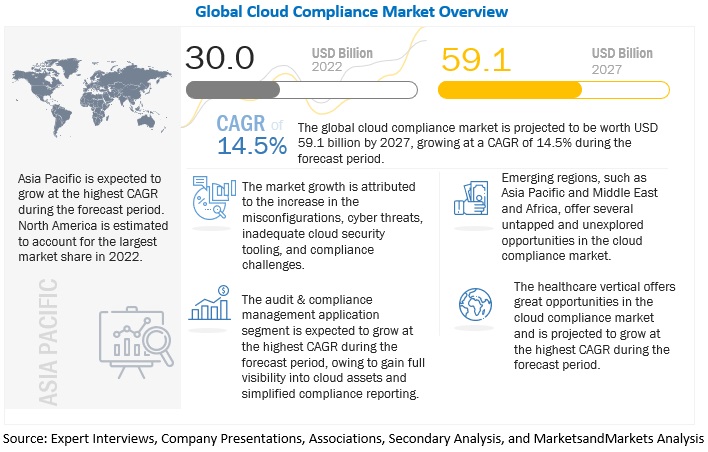

[307 Pages Report] The global cloud compliance market is projected to grow from USD 30.0 billion in 2022 to USD 59.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period. The increasing importance of web applications is one of the primary factors driving the market growth. Moreover, the technological proliferation and increasing penetration of IoT are driving the adoption of cloud compliance solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of COVID-19 on the cloud compliance market has affected large and small enterprises across various industry verticals.

- COVID-19 is persuading business leaders to adopt new operating models to ensure existential survival. The large-scale adoption of work-from-home technologies and exponentially greater use of cloud services encourage enterprises in Canada and the US to adopt cloud compliance software and services to avoid misconfiguration, improve security posture, and meet regulatory compliance standards in the cloud environment.

- Major North American cybersecurity vendors, such as IBM, Cisco, Fortinet, and Imperva, have responded to the COVID-19 crisis. For instance, FortiClient offers VPN solutions free of cost to ensure teleworkers have fast and secure network access.

- In March 2019, the Brno University Hospital in the Czech Republic was affected by a cyberattack on its computer servers with the ongoing COVID-19 outbreak. To secure the data on enterprise or cloud servers, organizations demand cloud compliance software and services for effective risk and compliance management in Europe.

- Internet penetration and smartphone users have increased drastically after the COVID-19 outbreak, leading to a rise in spear-phishing attacks. The NCSC, in the UK, has detected a surge in the number of COVID-19-related scams and phishing emails by malicious attackers targeting individuals, SMEs, and large organizations.

- With the lockdown imposed in the UK, organizations are experiencing data security breaches due to flexible working conditions. Moreover, there has been an increasing deployment of cloud collaboration tools. Hence, there is an urgent need to secure cloud storage and adhere to regulatory compliances set by the EU for a secure remote working office environment.

- The COVID-19 outbreak is posing challenges to industries in Germany. The German government has introduced a wide range of measures with strict adherence to GDPR. Such stringent regulations encourage the demand for cloud compliance software solutions nationwide.

- Adherence to regulatory compliance has tightened in France, with regulations such as GDPR and the French Data Protection Act (FDPA) to ensure cybersecurity. Thus, the growth of the cloud compliance market is expected to strengthen in France because of COVID-19.

Cloud Compliance Market Dynamics

Driver: Need to automate compliance among large enterprises

Most large enterprises have adopted a multi-cloud strategy to reap the benefits of migrating to cloud. However, this migration creates two major challenges, namely complexity and inefficient data management. This is especially true for large organizations that have their data centers spread across the world and need to be compliant with the regulatory standards of various countries. Cloud compliance automation helps enterprises manage hundreds of settings across regions and accounts and helps IT teams validate current security posture against best practices, policies, and compliance frameworks. Furthermore, adding automation capabilities improves efficiency by removing manual workload, which is time-intensive, eliminates human error, and reduces data complexity.

Restraint: Lack of technical knowledge and expertise

Organizations face the challenge of keeping up with the evolving cloud compliances due to the ever changing threat landscape. To ensure continuous visibility over their cloud assets and reduce the risk of cloud-based threats, they need a security team with the required technical skills and knowledge for implementing, processing, analyzing, and securing cloud solutions. Lack of proper knowledge can lead to misconfigurations and also prevents security teams from implementing solutions such as auto remediation. This is a major problem across the security industry. According to the State of Cloud Security Risk, Compliance, and Misconfigurations Report, 2021, 59% of the respondents considered lack of skills and expertise as the bggest barrier to resolving security issues. Thus, organizations need to hire security professionals with the right skills to analyze and identify advanced security gaps while implementing and managing operations.

Opportunity: Rising demand for CNAPP solutions

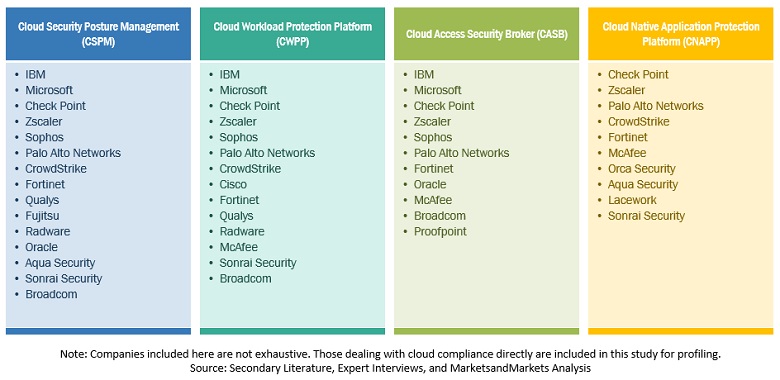

As organizations grow, they tend to adopt a mixture of tools with disoparate security controls in various cloud environments. Security teams deploy tools such as CSPM, CWPP, and CASB to secure cloud infrastructure. However, with this approach leaves gaps in visibility and integration complexities. The interconnected and interdependent nature of everything makes it difficult to identify and remediate security issues and vulnerabilities. Thus, the organizations are in need of a unified solution to address these issues and improve their overall security posture. CNAPP is a cloud security platform that combines the capabilities of various cloud security solutions such as CSPM, CWPP, and CASB. It is intended to replace multiple independent tool with a single holistic solution for modern enterprises with cloud native workloads. Thus, CNAPP helps to effectively manage risk, gain visibility, and define consistent security policies throughout the cloud infrastructure.

Challenge: Misunderstanding shared responsibility on cloud

The shared responsibility model states that both cloud and cloud service providers (CSPs) are responsible for maintaining appropriate and comprehensive security and compliance practices for services on the cloud. This however varies depending upon the CSPs. Typically, CSPs are responsible for ensuring that the cloud infrastructure is secure. The cloud users are meanwhile responsible for their data, networks, applications, and operating systems that exist on the cloud. However, it is a common misconception that compliance in the cloud is the sole responsibility of the cloud providers. Many new businesses that migrate to the cloud often assume that once their data is on the cloud, it is vendors responsibility to store it compliantly. This misunderstanding leads to significant gaps in cloud security and compliance coverage as some IT professionals dont recognize their obligation to manage their end of the shared responsibility. While public cloud services and SaaS products do offer compliance and security features, however, the security of data in the cloud is the legal responsibility of the cloud user. Thus, it is important for organizations to understand that the responsibility of data protection and compliance ultimately falls to their feet before investing in cloud services.

Cloud Compliance Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By services, the managed services subsegment is expected to account for the highest growth during the forecast period

The managed services subsegment is expected to account for the highest growth rate during the forecast period. Managed service providers provide consulting, tools, and solutions to maintain compliance and keep organizations cloud running efficiently. Managed services offer a way for businesses to offload daily-but critical-management activities, including security and compliance capabilities, to experts whose sole focus is ensuring the success and safety of managed cloud environments.

By cloud model, the SaaS segment is expected to account for a larger market size during the forecast period

By cloud model, the Software-as-a-Service (SaaS) segment is estimated to account for a larger market share. SaaS is a cloud subscription service that enables organizations to subscribe to applications without in-house staff support. Capabilities such as DLP, compliance and industry regulation solutions, and advanced malware prevention attract enterprises to use SaaS security solutions.

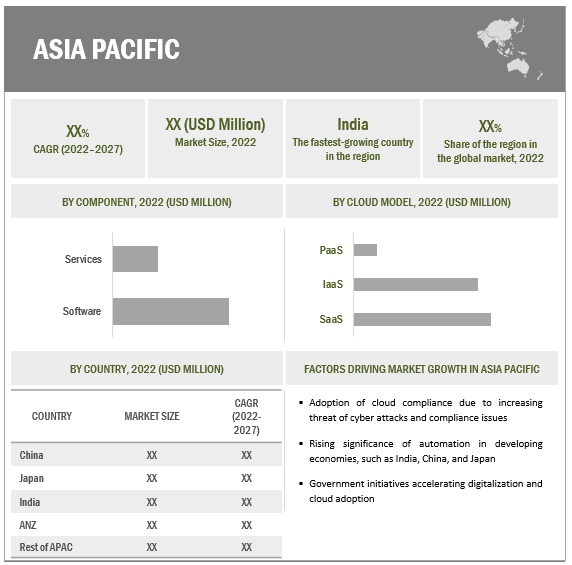

By region, Asia Pacific is expected to record the highest growth during the forecast period

Asia Pacific includes developed and developing economies, such as China, Japan, India, Singapore, and Australia. With effective government regulations and technological advancements, the cloud compliance market is witnessing tremendous growth opportunities in this region. Asia Pacific is the fastest-growing region in terms of the adoption of cloud compliance software and services. Moreover, with the rising intensity and complexity of cyberattacks, data security concerns of businesses in this region have been escalating. Increasing advancements in mobility and cloud adoption and growing mandatory compliances with government regulations to resolve data security issues have forced enterprises to adopt cloud compliance software and services.

Asia Pacific: Cloud Compliance Market Snapshot

Key Market Players

The report includes the study of key players offering cloud compliance solutions and services. The major vendors in the market include Microsoft (US), IBM (US), Check Point (Israel), AT&T (US), Broadcom (US), Qualys (US), Nutanix (US), Sophos (UK), Oracle (US), Palo Alto Networks (US).

The study includes an in-depth competitive analysis of these key players in the cloud compliance market, including their company profiles and strategies undertaken.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Component, Application, Cloud Model, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major vendors include Microsoft (US), IBM (US), Check Point (Israel), AT&T (US), Broadcom (US). |

This research report categorizes the cloud compliance market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Software

- Cloud Security Posture Management (CSPM)

- Cloud Workload Protection Platform (CWPP)

- Cloud Access Security Broker (CASB)

- Cloud-Native Application Protection Platform (CNAPP)

- Services

- Managed Services

- Professional Services

By Application:

- Audit and Compliance Management

- Threat Detection and Remediation

- Activity Monitoring and Analytics

- Visibility and Risk Assessment

- Other Applications

By Cloud Model:

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- IT and ITeS

- Retail and eCommerce

- Manufacturing

- Utilities

- Other Verticals

By Region:

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Rest of Asia Pacific

- Middle East and Africa

- United Arab Emirates

- South Africa

- Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022, IBM acquired Neudesic, a leading Microsoft Azure consultancy. This acquisition would boost IBM Consultings hybrid cloud services business. It would enhance IBMs ability to help clients meet their business needs with multi-cloud technologies.

- In December 2021, Broadcom announced its acquisition of privately held AppNeta Inc., headquartered in Boston, MA. AppNeta is a leading SaaS-based network performance monitoring solution for the distributed enterprise. It provides IT teams with precise, end-to-end visibility into network performance from the end user's point of view, independent of what network they use to access applications.

- In November 2021, Microsoft collaborated with Sonrai Security to make Sonrai Dig a preferred solution on Microsoft Azure Marketplace. Sonrai Security joined Microsoft Intelligent Security Association (MISA) for integrations with Microsoft Azure services. The integration with Azure Sentinel would let users monitor unused or unnecessary permissions in their cloud deployments using Sonrai and proactively remediates potential security risks within the Azure Sentinel console.

- In June 2021, AT&T, in collaboration with Palo Alto Networks, delivered a new managed SASE solution to drive innovation and transform user experiences at the edge. AT&T SASE, with Palo Alto Networks, would help businesses to optimize their network performance at the edge while securely connecting remote users directly to the internet.

- In November 2019, Check Point partnered the Microsoft to integrate CloudGuard with Microsoft Azure Security Center to deliver comprehensive Azure security posture management.

Frequently Asked Questions (FAQ):

How big is the cloud compliance market?

What is the cloud compliance market growth?

Which region has the largest market share in the cloud compliance market?

Which component is expected to account for a higher growth during the forecast period?

Which vertical is expected to account for the largest market size during the forecast period?

Who are the major vendors in the cloud compliance market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE, 20182021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 CLOUD COMPLIANCE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary interviews

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 CLOUD COMPLIANCE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE AND SERVICES FROM CLOUD COMPLIANCE VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CLOUD COMPLIANCE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY CLOUD COMPLIANCE VENDORS FROM EACH COMPONENT

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT APPLICATIONS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 GLOBAL CLOUD COMPLIANCE MARKET, 20192027 (USD MILLION)

FIGURE 10 FASTEST-GROWING SEGMENTS IN MARKET, 20222027

FIGURE 11 SOFTWARE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 PROFESSIONAL SERVICES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 AUDIT AND COMPLIANCE MANAGEMENT SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 SOFTWARE-AS-A-SERVICE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 15 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 16 TOP VERTICALS IN MARKET

FIGURE 17 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 OVERVIEW OF CLOUD COMPLIANCE MARKET

FIGURE 18 NEED FOR COMPLIANCE AND RISING INSTANCES OF CYBERATTACKS TO BOOST MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 19 SOFTWARE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

4.3 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 20 AUDIT AND COMPLIANCE MANAGEMENT SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY CLOUD MODEL, 2022 VS. 2027

FIGURE 21 SOFTWARE-AS-A-SERVICE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 22 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 23 BFSI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.7 MARKET: REGIONAL SCENARIO, 20222027

FIGURE 24 ASIA PACIFIC EXPECTED TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD COMPLIANCE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing need among organizations to meet cloud compliance standards

5.2.1.2 Need for large enterprises to automate compliance

FIGURE 26 TIME REQUIRED TO RESOLVE SECURITY ISSUES

5.2.1.3 Rising adoption of cloud-based solutions due to pandemic

FIGURE 27 CHANGE FROM PLANNED CLOUD USAGE DUE TO COVID-19

FIGURE 28 YEAR-ON-YEAR SPENDING OF OVER USD 1.2 MILLION FOR SMALL AND MEDIUM-SIZED BUSINESSES

5.2.2 RESTRAINTS

5.2.2.1 Lack of technical knowledge and expertise

FIGURE 29 BARRIERS TO RESOLVING SECURITY ISSUES

FIGURE 30 LACK OF KNOWLEDGE AND EXPERTISE AS BARRIER

5.2.2.2 Organizations failure to adhere to continuous changes in compliance frameworks

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing government initiatives to accelerate cloud adoption

5.2.3.2 Rising demand for CNAPP solutions

5.2.4 CHALLENGES

5.2.4.1 Misunderstanding shared responsibility on cloud

5.2.4.2 Growing complexity due to adoption of multi-cloud model

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 31 CLOUD COMPLIANCE MARKET: VALUE CHAIN

5.5 ECOSYSTEM

FIGURE 32 MARKET: ECOSYSTEM

5.6 PRICING ANALYSIS

TABLE 3 MARKET: PRICING LEVELS

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 MACHINE LEARNING

5.7.3 DATA ANALYTICS

5.8 CASE STUDY ANALYSIS

5.8.1 CASE STUDY 1: ZSCALER HELPED GLOBAL MINING COMPANY AUTOMATE RISK MITIGATION

5.8.2 CASE STUDY 2: PALO ALTO PROVIDED VISIBILITY AND CONTROL TO SECURE FUNDING SOCIETIES CLOUD TRANSFORMATION

5.8.3 CASE STUDY 3: CHECK POINT CLOUDGUARD HELPED TO SECURE CLOUD AND DEVOPS FOR EAGERS AUTOMOTIVE

5.9 KEY CONFERENCES AND EVENTS, 2022

TABLE 4 CLOUD COMPLIANCE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.10 PATENT ANALYSIS

TABLE 5 MARKET: PATENTS

TABLE 6 TOP 10 PATENT OWNERS (US)

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

5.11 PORTERS FIVE FORCES ANALYSIS

TABLE 7 PORTERS FIVE FORCES ANALYSIS: MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY

FIGURE 34 PORTERS FIVE FORCES ANALYSIS: CLOUD COMPLIANCE MARKET

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 INTRODUCTION

5.12.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCIDSS)

5.12.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

5.12.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001

5.12.5 EUROPEAN UNION GENERAL DATA PROTECTION REGULATION (EU GDPR)

5.12.6 SERVICE ORGANIZATION CONTROL 2 (SOC 2) COMPLIANCE

5.12.7 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

5.12.8 SARBANES-OXLEY (SOX) ACT

5.12.9 GRAMM-LEACH-BLILEY ACT (GLBA)

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 35 CLOUD COMPLIANCE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

5.14.2 BUYING CRITERIA

FIGURE 37 KEY BUYING CRITERIA FOR END USERS

TABLE 9 KEY BUYING CRITERIA FOR END USERS

6 CLOUD COMPLIANCE MARKET, BY COMPONENT (Page No. - 86)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 38 SERVICES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 20222027 (USD MILLION)

6.2 SOFTWARE

TABLE 12 SOFTWARE: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 13 SOFTWARE: MARKET, BY REGION, 20222027 (USD MILLION)

6.2.1 CLOUD SECURITY POSTURE MANAGEMENT

6.2.1.1 Empowers companies to identify and remediate risks

6.2.2 CLOUD WORKLOAD PROTECTION PLATFORM

6.2.2.1 Enables organizations to monitor compliance posture with single dashboard

6.2.3 CLOUD ACCESS SECURITY BROKER

6.2.3.1 Secures cloud applications and delivers data and threat protection services

6.2.4 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM

6.2.4.1 Enables enterprises to proactively scan, detect, and remediate security and compliance risks

6.3 SERVICES

FIGURE 39 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 CLOUD COMPLIANCE MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 15 MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 16 SERVICES: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 17 SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Technicalities involved in implementing cloud compliance solutions to boost demand

TABLE 18 PROFESSIONAL SERVICES: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Growing deployment of cloud compliance solutions to keep organizations cloud running

TABLE 20 MANAGED SERVICES: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 21 MANAGED SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

7 CLOUD COMPLIANCE MARKET, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 40 AUDIT AND COMPLIANCE MANAGEMENT SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 20222027 (USD MILLION)

7.2 AUDIT AND COMPLIANCE MANAGEMENT

7.2.1 CLOUD COMPLIANCE SOLUTIONS SIMPLIFY RISK ASSESSMENT AND COMPLIANCE MANAGEMENT

TABLE 24 AUDIT AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 25 AUDIT AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 20222027 (USD MILLION)

7.3 THREAT DETECTION AND REMEDIATION

7.3.1 CLOUD COMPLIANCE SOLUTION OFFERS NETWORK VISIBILITY, NETWORK THREAT DETECTION, AND REMEDIATION

TABLE 26 THREAT DETECTION AND REMEDIATION: CLOUD COMPLIANCE MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 27 THREAT DETECTION AND REMEDIATION: MARKET, BY REGION, 20222027 (USD MILLION)

7.4 ACTIVITY MONITORING AND ANALYTICS

7.4.1 NEED TO DETECT SECURITY INCIDENTS AND NON-COMPLIANT BEHAVIOUR

TABLE 28 ACTIVITY MONITORING AND ANALYTICS: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 29 ACTIVITY MONITORING AND ANALYTICS: MARKET, BY REGION, 20222027 (USD MILLION)

7.5 VISIBILITY AND RISK ASSESSMENT

7.5.1 CLOUD COMPLIANCE SOLUTIONS ENABLE ORGANIZATIONS TO ASSESS RISK AND GAIN VISIBILITY

TABLE 30 VISIBILITY AND RISK ASSESSMENT: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 31 VISIBILITY AND RISK ASSESSMENT: MARKET, BY REGION, 20222027 (USD MILLION)

7.6 OTHER APPLICATIONS

TABLE 32 OTHER APPLICATIONS: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 33 OTHER APPLICATIONS: MARKET, BY REGION, 20222027 (USD MILLION)

8 CLOUD COMPLIANCE MARKET, BY CLOUD MODEL (Page No. - 106)

8.1 INTRODUCTION

FIGURE 41 CLOUD-SHARED RESPONSIBILITY MODEL

8.1.1 CLOUD MODEL: MARKET DRIVERS

8.1.2 CLOUD MODEL: COVID-19 IMPACT

FIGURE 42 SOFTWARE-AS-A-SERVICE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 34 MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 35 MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

8.2 INFRASTRUCTURE-AS-A-SERVICE (IAAS)

8.2.1 IAAS CLOUD MODEL INCREASES REGULATORY COMPLIANCE REPORTING RESPONSIBILITIES

TABLE 36 INFRASTRUCTURE-AS-A-SERVICE: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 37 INFRASTRUCTURE-AS-A-SERVICE: MARKET, BY REGION, 20222027 (USD MILLION)

8.3 PLATFORM-AS-A-SERVICE (PAAS)

8.3.1 RAPID SOFTWARE DEVELOPMENT AND SIMPLIFIED DEPLOYMENT TO BOOST ADOPTION

TABLE 38 PLATFORM-AS-A-SERVICE: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 39 PLATFORM-AS-A-SERVICE: MARKET, BY REGION, 20222027 (USD MILLION)

8.4 SOFTWARE-AS-A-SERVICE (SAAS)

8.4.1 DLP, COMPLIANCE, AND INDUSTRY REGULATION SOLUTIONS AND MALWARE PREVENTION TO BOOST DEMAND

TABLE 40 SOFTWARE-AS-A-SERVICE: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 41 SOFTWARE-AS-A-SERVICE: MARKET, BY REGION, 20222027 (USD MILLION)

9 CLOUD COMPLIANCE MARKET, BY ORGANIZATION SIZE (Page No. - 115)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 43 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 42 MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 43 MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 GROWING NEED TO MANAGE SECURITY AND COMPLIANCE ON SEVERAL APPLICATIONS

TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

9.3 SMALL AND MEDIUM ENTERPRISES

9.3.1 NEED FOR COST-EFFECTIVE SOLUTIONS TO DRIVE ADOPTION OF CLOUD COMPLIANCE SOFTWARE AND SERVICES

TABLE 46 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 47 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

10 CLOUD COMPLIANCE MARKET, BY VERTICAL (Page No. - 120)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 44 HEALTHCARE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 49 MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.2.1 RISING NEED FOR CLOUD SECURITY AND COMPLIANCE PRACTICES AND REGULATORY BENCHMARKS

TABLE 50 BFSI: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 51 BFSI: MARKET, BY REGION, 20222027 (USD MILLION)

10.3 HEALTHCARE

10.3.1 HIGH DEMAND FOR SAFEGUARDING PATIENTS DATA AND COMPLYING WITH DATA SECURITY REQUIREMENTS

TABLE 52 HEALTHCARE: CLOUD COMPLIANCE MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET, BY REGION, 20222027 (USD MILLION)

10.4 RETAIL AND ECOMMERCE

10.4.1 SURGING DEMAND TO MAINTAIN REGULATORY COMPLIANCE AND MANAGE CYBER RISKS

TABLE 54 RETAIL AND ECOMMERCE: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 55 RETAIL AND ECOMMERCE: MARKET, BY REGION, 20222027 (USD MILLION)

10.5 EDUCATION

10.5.1 NEED FOR ADHERENCE TO INDUSTRY COMPLIANCE STANDARDS

TABLE 56 EDUCATION: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 57 EDUCATION: MARKET, BY REGION, 20222027 (USD MILLION)

10.6 IT AND ITES

10.6.1 GROWING NECESSITY TO ENSURE CLOUD CONFIGURATIONS AND MAINTAIN POLICY AND STANDARDS

TABLE 58 IT AND ITES: CLOUD COMPLIANCE MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 59 IT AND ITES: MARKET, BY REGION, 20222027 (USD MILLION)

10.7 GOVERNMENT

10.7.1 RISING ADOPTION OF CLOUD SERVICES AGAINST CYBERATTACKS AND OTHER SECURITY CONCERNS

TABLE 60 GOVERNMENT: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 61 GOVERNMENT: MARKET, BY REGION, 20222027 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 62 OTHER VERTICALS: MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 63 OTHER VERTICALS: MARKET, BY REGION, 20222027 (USD MILLION)

11 CLOUD COMPLIANCE MARKET, BY REGION (Page No. - 133)

11.1 INTRODUCTION

11.1.1 MARKET: COVID-19 IMPACT

FIGURE 45 NORTH AMERICA EXPECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 46 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 65 MARKET, BY REGION, 20222027 (USD MILLION)

11.2 NORTH AMERICA

TABLE 66 NORTH AMERICA: PESTLE ANALYSIS

11.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

11.2.2 US

11.2.2.1 Presence of cloud compliance software and service providers to drive market growth

TABLE 81 US: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 82 US: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 83 US: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 84 US: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 85 US: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 86 US: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Government initiatives and technological advancements to fuel adoption of cloud compliance software solutions

TABLE 87 CANADA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 88 CANADA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 89 CANADA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 90 CANADA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 91 CANADA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 92 CANADA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.3 EUROPE

TABLE 93 EUROPE: PESTLE ANALYSIS

11.3.1 EUROPE: CLOUD COMPLIANCE MARKET DRIVERS

TABLE 94 EUROPE: MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY COUNTRY, 20222027 (USD MILLION)

11.3.2 UK

11.3.2.1 Need for efficient management of compliance standards in cloud environment

TABLE 108 UK: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 109 UK: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 110 UK: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 111 UK: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 112 UK: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 113 UK: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Focus of smaller enterprises in providing enhanced cloud compliance services to drive growth

TABLE 114 GERMANY: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 119 GERMANY: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Growing need to reduce compliance and security issues

TABLE 120 FRANCE: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 121 FRANCE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 122 FRANCE: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 123 FRANCE: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 126 REST OF EUROPE: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 127 REST OF EUROPE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 128 REST OF EUROPE: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 132 ASIA PACIFIC: PESTLE ANALYSIS

11.4.1 ASIA PACIFIC: CLOUD COMPLIANCE MARKET DRIVERS

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 133 ASIA PACIFIC: MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 20222027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Need to ensure data security in cloud platforms to boost demand

TABLE 147 CHINA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 148 CHINA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 149 CHINA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 150 CHINA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 151 CHINA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 152 CHINA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Growing investments in new technologies to drive demand

TABLE 153 JAPAN: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 154 JAPAN: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 155 JAPAN: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 156 JAPAN: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Rising focus of government and organizations on improving performance, security, and compliance requirements

TABLE 159 INDIA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 160 INDIA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 161 INDIA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 162 INDIA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 163 INDIA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 164 INDIA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.4.5 AUSTRALIA AND NEW ZEALAND

11.4.5.1 Need to prevent data breaches, cybercrimes, targeted attacks, and compliance issues in cloud

TABLE 165 AUSTRALIA AND NEW ZEALAND: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 166 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 167 AUSTRALIA AND NEW ZEALAND: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 168 AUSTRALIA AND NEW ZEALAND: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 169 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 170 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 171 REST OF ASIA PACIFIC: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

TABLE 177 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

11.5.1 MIDDLE EAST AND AFRICA: CLOUD COMPLIANCE MARKET DRIVERS

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

11.5.2 UAE

11.5.2.1 Growing need for efficient security and posture management in cloud environment among enterprises

TABLE 192 UAE: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 193 UAE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 194 UAE: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 195 UAE: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 196 UAE: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 197 UAE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.5.3 SOUTH AFRICA

11.5.3.1 Increased use of advanced technologies, increased cyberattacks, and compliance issues

TABLE 198 SOUTH AFRICA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 199 SOUTH AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 202 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 203 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.5.4 REST OF MIDDLE EAST AND AFRICA

TABLE 204 REST OF MIDDLE EAST AND AFRICA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST AND AFRICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 207 REST OF MIDDLE EAST AND AFRICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 208 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 209 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.6 LATIN AMERICA

TABLE 210 LATIN AMERICA: PESTLE ANALYSIS

11.6.1 LATIN AMERICA: CLOUD COMPLIANCE MARKET DRIVERS

TABLE 211 LATIN AMERICA: MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY SERVICES, 20182021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY SERVICES, 20222027 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET, BY APPLICATION, 20182021 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY VERTICAL, 20182021 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Growing instances of cyberattacks to drive implementation and spending on cloud compliance

TABLE 225 BRAZIL: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 226 BRAZIL: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 227 BRAZIL: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 228 BRAZIL: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 229 BRAZIL: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 230 BRAZIL: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Growing cyber threat environment and compliance issues in cloud infrastructure

TABLE 231 MEXICO: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 232 MEXICO: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 233 MEXICO: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 234 MEXICO: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 235 MEXICO: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 236 MEXICO: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

11.6.4 REST OF LATIN AMERICA

TABLE 237 REST OF LATIN AMERICA: CLOUD COMPLIANCE MARKET, BY COMPONENT, 20182021 (USD MILLION)

TABLE 238 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 239 REST OF LATIN AMERICA: MARKET, BY CLOUD MODEL, 20182021 (USD MILLION)

TABLE 240 REST OF LATIN AMERICA: MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

TABLE 241 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20182021 (USD MILLION)

TABLE 242 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 203)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 MARKET EVALUATION FRAMEWORK, 20192021

12.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 243 OVERVIEW OF STRATEGIES ADOPTED BY KEY CLOUD COMPLIANCE VENDORS

12.4 REVENUE ANALYSIS

FIGURE 50 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 20192021 (USD BILLION)

12.5 MARKET SHARE ANALYSIS

FIGURE 51 CLOUD COMPLIANCE MARKET: MARKET SHARE ANALYSIS, 2021

TABLE 244 MARKET: DEGREE OF COMPETITION

12.6 COMPANY EVALUATION QUADRANT

TABLE 245 COMPANY EVALUATION QUADRANT: CRITERIA

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 52 MARKET, KEY COMPANY EVALUATION MATRIX, 2022

12.6.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 246 COMPANY PRODUCT FOOTPRINT

TABLE 247 COMPANY COMPONENT FOOTPRINT

TABLE 248 COMPANY VERTICAL FOOTPRINT

TABLE 249 COMPANY REGION FOOTPRINT

12.7 RANKING OF KEY PLAYERS

FIGURE 53 RANKING OF KEY PLAYERS IN CLOUD COMPLIANCE MARKET, 2021

12.8 STARTUP/SME EVALUATION MATRIX

FIGURE 54 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 55 MARKET (GLOBAL) STARTUP/SME COMPANY EVALUATION MATRIX, 2022

12.8.5 COMPETITIVE BENCHMARKING

TABLE 250 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 251 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

12.9 KEY MARKET DEVELOPMENTS

12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 PRODUCT LAUNCHES AND ENHANCEMENTS, 20192022

12.9.2 DEALS

TABLE 253 DEALS, 20192022

12.9.3 OTHERS

TABLE 254 OTHERS, 20202021

13 COMPANY PROFILES (Page No. - 228)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products, Solution & Services offered, Recent Developments, Response to COVID-19, MnM View)*

13.2.1 MICROSOFT

TABLE 255 MICROSOFT: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

TABLE 256 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 257 MICROSOFT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 258 MICROSOFT: DEALS

13.2.2 IBM

TABLE 259 IBM: BUSINESS OVERVIEW

FIGURE 57 IBM: COMPANY SNAPSHOT

TABLE 260 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 261 IBM: NEW SOLUTION/SERVICE LAUNCHES

TABLE 262 IBM: DEALS

13.2.3 CHECK POINT

TABLE 263 CHECK POINT: BUSINESS OVERVIEW

FIGURE 58 CHECK POINT: COMPANY SNAPSHOT

TABLE 264 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 CHECK POINT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 266 CHECK POINT: DEALS

13.2.4 AT&T

TABLE 267 AT&T: BUSINESS OVERVIEW

FIGURE 59 AT&T: COMPANY SNAPSHOT

TABLE 268 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 269 AT&T: NEW SOLUTION/SERVICE LAUNCHES

TABLE 270 AT&T: DEALS

13.2.5 BROADCOM

TABLE 271 BROADCOM: BUSINESS OVERVIEW

FIGURE 60 BROADCOM: COMPANY SNAPSHOT

TABLE 272 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 273 BROADCOM: DEALS

13.2.6 QUALYS

TABLE 274 QUALYS: BUSINESS OVERVIEW

FIGURE 61 QUALYS: COMPANY SNAPSHOT

TABLE 275 QUALYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 QUALYS: NEW SOLUTION/SERVICE LAUNCHES

TABLE 277 QUALYS: DEALS

TABLE 278 QUALYS: OTHERS

13.2.7 NUTANIX

TABLE 279 NUTANIX: BUSINESS OVERVIEW

FIGURE 62 NUTANIX: COMPANY SNAPSHOT

TABLE 280 NUTANIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 281 NUTANIX: NEW SOLUTION/SERVICE LAUNCHES

TABLE 282 NUTANIX: DEALS

13.2.8 SOPHOS

TABLE 283 SOPHOS: BUSINESS OVERVIEW

TABLE 284 SOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 285 SOPHOS: NEW SOLUTION/SERVICE LAUNCHES

TABLE 286 SOPHOS: DEALS

TABLE 287 SOPHOS: OTHERS

13.2.9 ORACLE

TABLE 288 ORACLE: BUSINESS OVERVIEW

FIGURE 63 ORACLE: COMPANY SNAPSHOT

TABLE 289 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 290 ORACLE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 291 ORACLE: DEALS

13.2.10 PALO ALTO NETWORKS

TABLE 292 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 64 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 293 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 294 PALO ALTO NETWORKS: NEW SOLUTION/SERVICE LAUNCHES

TABLE 295 PALO ALTO NETWORKS: DEALS

13.3 OTHER PLAYERS

13.3.1 AWS

13.3.2 LACEWORK

13.3.3 ZSCALER

13.3.4 MCAFEE

13.3.5 FIDELIS CYBERSECURITY

13.3.6 FORTINET

13.3.7 ATOS

13.3.8 RADWARE

13.3.9 PROOFPOINT

13.3.10 CROWDSTRIKE

13.4 SMES/STARTUPS

13.4.1 ORCA SECURITY

13.4.2 AQUA SECURITY

13.4.3 SECUREFRAME

13.4.4 CAVIRIN

13.4.5 VANTA

13.4.6 HORANGI CYBER SECURITY

13.4.7 CLOUDCHECKR

13.4.8 THREAT STACK

13.4.9 FUGUE

13.4.10 SONRAI SECURITY

*Details on Business Overview, Products, Solutions & Services offered, Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 287)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 296 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 CLOUD COMPLIANCE MARKET ECOSYSTEM AND ADJACENT MARKETS

14.4 CLOUD SECURITY MARKET

14.4.1 CLOUD SECURITY MARKET, BY SECURITY TYPE

TABLE 297 CLOUD SECURITY MARKET, BY SECURITY TYPE, 20152020 (USD MILLION)

TABLE 298 CLOUD SECURITY MARKET, BY SECURITY TYPE, 20202026 (USD MILLION)

14.4.2 CLOUD SECURITY MARKET, BY APPLICATION

TABLE 299 CLOUD SECURITY MARKET, BY APPLICATION, 20152020 (USD MILLION)

TABLE 300 CLOUD SECURITY MARKET, BY APPLICATION, 20202026 (USD MILLION)

14.4.3 CLOUD SECURITY MARKET, BY SERVICE MODEL

TABLE 301 CLOUD SECURITY MARKET, BY SERVICE MODEL, 20152020 (USD MILLION)

TABLE 302 CLOUD SECURITY MARKET, BY SERVICE MODEL, 20202026 (USD MILLION)

14.4.4 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE

TABLE 303 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 20152020 (USD MILLION)

TABLE 304 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 20202026 (USD MILLION)

14.4.5 CLOUD SECURITY MARKET, BY VERTICAL

TABLE 305 CLOUD SECURITY MARKET, BY VERTICAL, 20152020 (USD MILLION)

TABLE 306 CLOUD SECURITY MARKET, BY VERTICAL, 20202026 (USD MILLION)

14.4.6 CLOUD SECURITY MARKET, BY REGION

TABLE 307 CLOUD SECURITY MARKET, BY REGION, 20152020 (USD MILLION)

TABLE 308 CLOUD SECURITY MARKET, BY REGION, 20202026 (USD MILLION)

14.5 CLOUD SECURITY POSTURE MANAGEMENT MARKET

14.5.1 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT

TABLE 309 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 20162021 (USD MILLION)

TABLE 310 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 20222027 (USD MILLION)

14.5.2 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL

TABLE 311 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 20162021 (USD MILLION)

TABLE 312 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 20222027 (USD MILLION)

14.5.3 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 313 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 314 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

14.5.4 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL

TABLE 315 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 20162021 (USD MILLION)

TABLE 316 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 20222027 (USD MILLION)

14.5.5 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION

TABLE 317 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 318 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 20222027 (USD MILLION)

15 APPENDIX (Page No. - 299)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

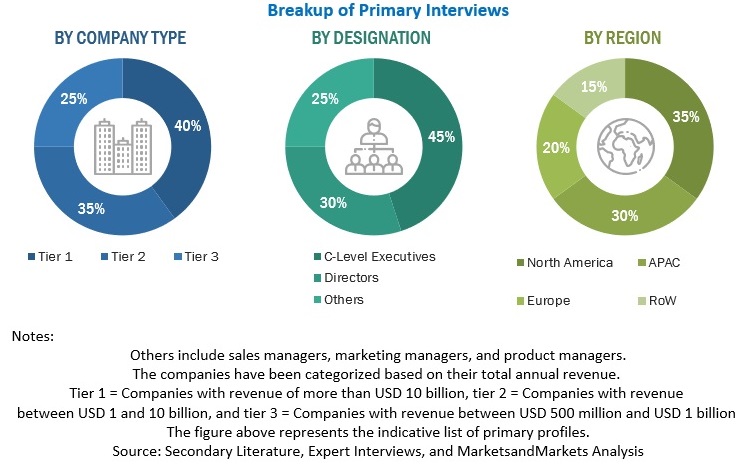

The study involves four major activities in estimating the current size of the cloud compliance market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the cloud compliance market.

Secondary Research

The market size of companies offering cloud compliance software and services was arrived at based on the secondary data available through paid and unpaid sources, by analyzing the product portfolios of major companies in the ecosystem, and by rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, and product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industrys supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cloud compliance market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using cloud compliance software and services; and digital initiatives project teams, were interviewed to understand the buyers perspective on suppliers, products, service providers, and their current use of software solutions affecting the overall cloud compliance market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the cloud compliance market and various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the bottom-up approach, the adoption trend of cloud compliance software and services among industry verticals in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of cloud compliance software and services, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different solution areas for the calculation. An exhaustive list of all vendors offering software and services in the cloud compliance market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with cloud compliance software and service offerings were considered to evaluate the market size. Each vendor was evaluated based on its software and service offerings across verticals. The aggregate of all companies revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the region split was determined by primary and secondary sources.

In the top-down approach, an exhaustive list of all vendors in the cloud compliance market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The market size was estimated from revenues generated by vendors from different cloud compliance software and service offerings. Revenue generated from each component (software and services) from different vendors was identified with the help of secondary and primary sources and combined to arrive at market size. Further, the procedure included an analysis of the markets regional penetration. With the data triangulation procedure and data validation through primaries, the exact values of the overall cloud compliance market size and its segments market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global cloud compliance market on the basis of component (software and services), application, cloud model, organization size, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the cloud compliance market

- To analyze the impact of COVID-19 on component, application, cloud model, organization size, vertical, and region across the globe

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

1. Micromarkets are defined as the further segments and subsegments of the cloud compliance market included in the report.

2. The core competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the market

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Compliance Market