Cloud Advertising Market by Component, Application (Customer Management, Campaign Management), Organization Size, Deployment Model, Vertical (Retail & Consumer Goods, Travel & Hospitality), and Region - Global Forecast to 2026

Cloud Advertising Market - Industry Trends & Forecast

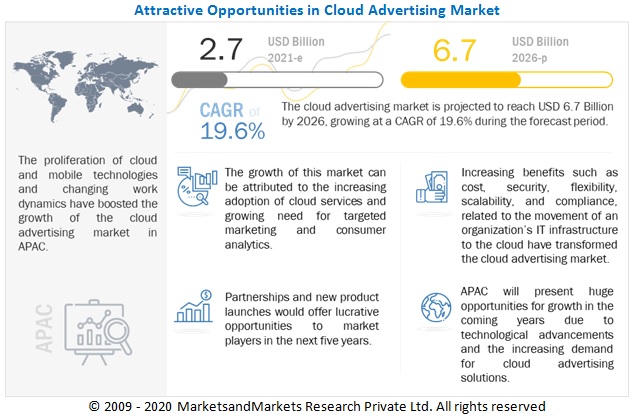

The global Cloud Advertising Market is estimated to be worth USD 2.7 billion in 2021. It is projected to reach USD 6.7 billion by 2026 at a CAGR of 19.6% during the forecast period. An analysis of market trends is part of the new research report. The latest research study includes market purchasing patterns, conference and webinar materials, patent analysis, important stakeholder information, and pricing analysis. Major factors that are expected to drive the growth cloud advertising market include increasing adoption of cloud services, growing need for targeted marketing and consumer analytics, and better return on investment and cost optimization.

To know about the assumptions considered for the study, Request for Free Sample Report

Cloud Advertising Market Growth Dynamics

Drivers: Growing need for targeted marketing and consumer analytics

Marketing has evolved to a great extent in the past decade; new forms of marketing have taken over with continuously upgrading tools. Marketers can target the specific customer they want from the comfort of their homes. Outdoor marketing is no longer the only medium to reach the targeted audience; nowadays, marketers can market their products and services to the target audience they like. Different forms of marketing can help end users reach the exact kind of customer they want. Different types of marketing, such as social media marketing, email marketing, etc., help end users analyze the target audience. Data analytics provide marketers accurate details of their target audience so that advertising can be optimized and lead to efficient results. This increasing demand for targeted marketing and consumer analytics bolsters the growth of the cloud advertising market.

Restraints: Data security concerns and stringent cloud regulations

The demand for digital advertising is rising, which will eventually fuel the demand for cloud advertising. However, with the increasing demand for cloud advertising, there would be increased data collection from customers via various sources. To ensure an optimum level of security, various regulatory bodies set norms for cloud advertising. However, these norms are served as safety measures, whose rigidity has led to strangulating the growth and adoption of cloud advertising. Various regulatory bodies, such as NIST, FISMA, FedRAMP, ISO, and HMG, set strict rules and regulations, which have to be adhered to by cloud advertising solution providers. This will reduce the concerns adhering to Payment Card Industry Data Security Standard (PCI DSS) and Health Insurance Portability and Accountability Act (HIPAA) compliance supporting security and encryption and protection of individual’s private data.

Challenges: Efficient use of data

The data available for consumer analytics is collected from different sources and is transferred to different departments of an organization, such as marketing, sales, and R&D. Data is collected from different touchpoints, and businesses have to categorize it based on customer needs and expectations. Data collected from different touchpoints, such as company websites, web, mobiles, social media, and emails, differ from one another, making it difficult for organizations to combine them since they have to be structured in different forms. Customer analytics is not helpful when organizational data is not synchronized. A large amount of structured and unstructured data requires significant resources, such as money, time, and expertise, for analysis. Thus, it is difficult to synchronize the customer data in general format from each touchpoint.

Opportunities: Growing impact of internet users and consumption of digital media

The growing number of smartphone users and increasing internet penetration, and increasing consumption of digital media have led to a significant rise in online users. This creates a new window for dynamic advertising, which will create more opportunities for the cloud advertising market in the future. According to a report by Statista, the number of smartphone users is expected to grow to 7.5 billion by 2026. These smartphone users will have access to the internet and will consume more digital content, which eventually will create more opportunities for the cloud advertising market in the future.

Based on organization size, the large enterprises to hold a larger market size during the forecast period

The organization size segment includes large enterprises and SMEs. The cloud advertising market is booming, and cloud advertising solutions are being adopted by various end users for numerous applications. These solutions are witnessing massive adoption trends among large enterprises and SMEs. The cloud advertising market has been segmented, by organization size, into large enterprises and SMEs. The organization size section has been segmented based on the total number of employees in an organization. Both large enterprises and SMEs are adopting cloud-based data warehouse solutions across the world, owing to the growth of big data across all industries. The large enterprises hold a larger market share during the forecast period. Large enterprises are defined as business entities with more than 1,000 employees. These enterprises invest in enhancing the customer experience to have a leading edge in the market. In comparison to SMEs, large enterprises are mostly publicly traded companies, and hence, are compelled to adopt cloud-based data warehouse solutions due to the vast amount of structured and unstructured data the enterprises generate. Large enterprises are major adopters of the private cloud, owing to the criticality of the stored data that is visible to enterprises. The integration of private cloud solutions manages enterprise data more effectively and automatically archives inactive primary data from traditional deployment models to clouds, thereby creating effortless capacity expansion. Large enterprises demand data warehouse services to speed up campaign management and decisions with innovative, rapid data movement from on-premises to the cloud.

Based on verticals, retail and consumer goods segment to hold larger market size during the forecast period

The retail and eCommerce vertical is becoming more customer-centric with its continual focus on leveraging internet technologies. It is expected to be one of the fastest-growing verticals due to the rising consumers’ purchasing power. The retail and eCommerce vertical has gone far beyond the goods that were displayed on shopping windows to the availability of goods on mobile devices through the internet. The buyers are checking prices, reading product reviews, and browsing competitor websites before buying the products. According to Salesforce, 82% of marketers begin their customer journey online before committing to any purchase in a store. To be competitive in the market, retailers are adopting various marketing strategies to attract customers to the physical store for buying goods over the online eCommerce platform.

Organizations from this vertical deal with a large amount of customer data, through which it provides personalized experiences to its customers. Cloud advertising helps marketers create influencing content and enhance customer engagement. This, in turn, assists consumer goods providers to improve their brand loyalty and make consumers purchase their products. Moreover, the use of content analytics plays a major role in determining the customers’ shopping patterns by coordinating with all the omnichannel brand interactions and intensifying customer relationships. Cloud advertising plays an unprecedented role in the retail and eCommerce vertical and helps marketers drive their business’ operational efficiency.

To know about the assumptions considered for the study, download the pdf brochure

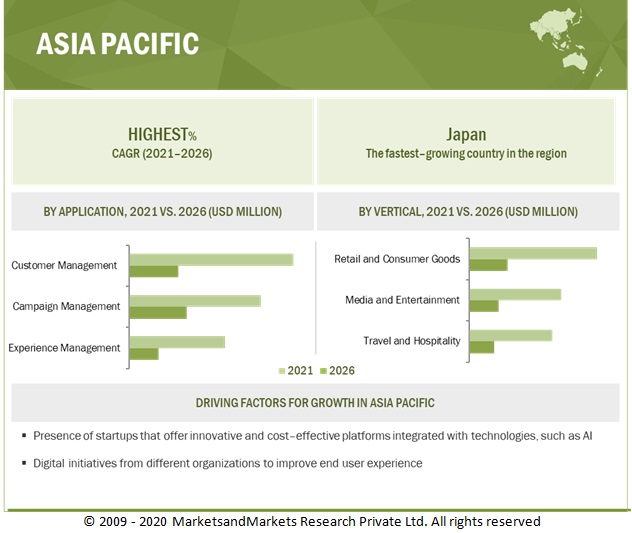

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

The APAC region is expected to experience extensive growth opportunities in the next few years. There is an increasing demand for cloud advertising, which is cloud-driven and cloud-supported, in the APAC region, thereby resulting in increasing investments and technological advancements across various industries. The region is expected to provide significant growth opportunities during the forecast period. Untapped potential markets, high penetration of advanced technologies, and application development in various verticals are expected to drive the APAC cloud advertising market during the forecast period. The increasing adoption of cloud computing among enterprises, coupled with the intense competition, is expected to drive the market in APAC. APAC enterprises are transforming their strategies from customer acquisition to customer experience. Hence, the region is expected to grow at the highest CAGR during the forecast period.

APAC is expected to record robust growth in the coming years as enterprises in the region are rapidly adopting various digital marketing channels to reach the target customers. Companies in APAC are demanding marketing solutions and services that can help them in expanding their market reach. Furthermore, SMEs in the region need cloud-based marketing solutions that can assist them in accelerating their marketing activities, creating marketing content, and tracking and reporting marketing campaigns. Vendors are looking toward APAC as a high-growth area for offering cloud marketing technologies. Additionally, the adoption of emerging technologies and the enhancement in the economy of several countries in APAC, such as India and other ASEAN countries, are driving the market and have encouraged solution providers to offer their cloud advertising and services in the region.

Key Market Players

The cloud advertising market is dominated by companies such as Adobe (US), Oracle (US), Salesforce (US), Google (US), IBM (US), SAP (Germany), Acquia (US), Demandbase (US), Experian (US), Kubient (US), FICO (US), HubSpot (US), Imagine Communications (US), InMobi (India), Marin Software (US), Sitecore (US), MediaMath (US), Nielsen (US), PEGA (US), and Sailthru (US). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (Billion USD) |

|

Market size value in 2021 |

USD 2.7 billion |

|

Revenue forecast for 2026 |

USD 6.7 billion |

|

Growth Rate |

19.6% CAGR |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Component, Application, Organization Size, Deployment Model, Verticals, and Region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Adobe (US), Oracle (US), Salesforce (US), Google (US), IBM (US), SAP (Germany), Acquia (US), Demandbase (US), Experian (US), Kubient (US), FICO (US), HubSpot (US), Imagine Communications (US), InMobi (India), Marin Software (US), Sitecore (US), MediaMath (US), Nielsen (US), PEGA (US), and Sailthru (US). |

This research report categorizes the cloud advertising market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Platforms

- Services

Based on the Application:

- Campaign Management

- Customer Management

- Experience Management

- Analytics and Insights

- Real-Time Engagement

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Deployment Model:

- Public Cloud

- Private Cloud

Based on verticals:

- Retail and Consumer Goods

- Media and Entertainment

- Travel and Hospitality

- BFSI

- Telecommunications

- Manufacturing

- Education

- Others

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zeland

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2021, Salesforce introduced new AI-powered innovations for Marketing Cloud that help companies to humanize every interaction; make trusted, first-party data the foundation of their digital strategy; and optimize marketing impact with unified analytics.

- In September 2021, IBM announced the launch of new AI and automation capabilities in IBM Watson Assistant designed to make it easier for businesses to create enhanced customer service experiences across any channel – phone, web, SMS, and any messaging platform.

Frequently Asked Questions (FAQ):

How big is the cloud advertising market?

What is growth rate of the cloud advertising market?

What are the applications in cloud advertising market?

Who are the key players in cloud advertising market?

Who will be the leading hub for cloud advertising market?

What is the cloud advertising market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 CLOUD ADVERTISING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

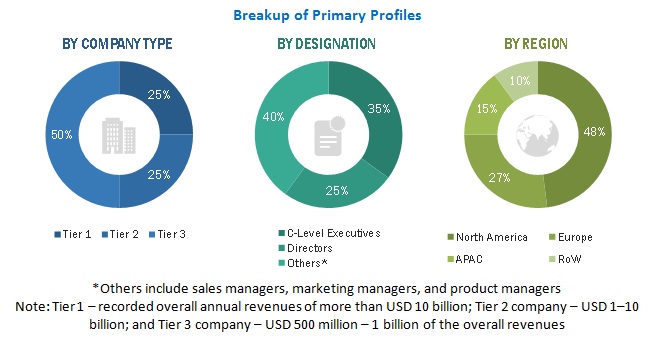

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY PARTICIPANTS

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 CLOUD ADVERTISING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF CLOUD ADVERTISING FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CLOUD ADVERTISING VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – SUPPLY SIDE: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – SUPPLY SIDE: CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM APPLICATIONS (1/2)

FIGURE 15 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 16 CLOUD ADVERTISING MARKET: GLOBAL SNAPSHOT

FIGURE 17 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 18 PLATFORMS SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 CUSTOMER MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 PUBLIC CLOUD SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 21 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 22 TOP VERTICALS IN THE MARKET, 2019–2026 (USD MILLION)

FIGURE 23 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 BRIEF OVERVIEW OF THE CLOUD ADVERTISING MARKET

FIGURE 24 SHIFT FROM TRADITIONAL ADVERTISING TO ONLINE ADVERTISING, THE GROWING IMPACT OF INTERNET USERS, AND CONSUMPTION OF DIGITAL MEDIA TO DRIVE THE DEMAND FOR CLOUD ADVERTISING

4.2 MARKET, BY APPLICATION (2021 VS. 2026)

FIGURE 25 CAMPAIGN MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

4.3 MARKET, BY DEPLOYMENT MODEL (2021 VS. 2026)

FIGURE 26 PUBLIC CLOUD TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET, BY VERTICAL (2021 VS. 2026)

FIGURE 27 RETAIL AND CONSUMER GOODS VERTICAL TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 CLOUD ADVERTISING MARKET INVESTMENT SCENARIO

FIGURE 28 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of cloud services

5.2.1.2 Growing need for targeted marketing and consumer analytics

5.2.1.3 Better return on investment (RoI) and cost optimization

5.2.2 RESTRAINTS

5.2.2.1 Data security concerns and stringent cloud regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Shift from traditional advertising to online advertising

5.2.3.2 Growing impact of internet users and consumption of digital media

FIGURE 30 GROWING INTERNET USERS AROUND THE WORLD

5.2.4 CHALLENGES

5.2.4.1 Efficient use of data

5.2.4.2 Poor infrastructure in few developing and underdeveloped countries

5.3 CASE STUDY ANALYSIS

5.3.1 USE CASE 1: SITECORE

5.3.2 USE CASE 2: SALESFORCE

5.3.3 USE CASE 3: SITECORE

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 31 CLOUD ADVERTISING MARKET: SUPPLY CHAIN

5.5 ECOSYSTEM

FIGURE 32 MARKET: ECOSYSTEM

5.6 PATENT ANALYSIS

FIGURE 33 TOP PATENT APPLICATIONS AROUND THE GLOBE, 2010 - PRESENT

TABLE 4 TOP PATENT APPLICANTS

5.7 COVID-19-DRIVEN MARKET DYNAMICS

5.7.1 DRIVERS AND OPPORTUNITIES

5.7.2 RESTRAINTS AND CHALLENGES

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 CLOUD ADVERTISING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 CLOUD ADVERTISING: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 TECHNOLOGICAL ANALYSIS

5.9.1 BIG DATA AND ANALYTICS

5.9.2 BLOCKCHAIN

5.9.3 MACHINE LEARNING

5.9.4 ARTIFICIAL INTELLIGENCE

5.10 REGULATIONS

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.10.3 ASIA PACIFIC

5.10.4 MIDDLE EAST & AFRICA

5.10.5 LATIN AMERICA

5.11 PRICING ANALYSIS

TABLE 6 PRICING ANALYSIS OF CLOUD ADVERTISING VENDORS

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 35 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 CLOUD ADVERTISING MARKET, BY APPLICATION (Page No. - 78)

6.1 INTRODUCTION

FIGURE 36 CUSTOMER MANAGEMENT SEGMENT EXPECTED TO REGISTER THE LARGEST MARKET SIZE IN 2026

6.1.1 APPLICATION: MARKET DRIVERS

6.1.2 APPLICATION: COVID-19 IMPACT

TABLE 7 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 8 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2 CAMPAIGN MANAGEMENT

TABLE 9 CAMPAIGN MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 CAMPAIGN MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 CUSTOMER MANAGEMENT

TABLE 11 CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 CUSTOMER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 EXPERIENCE MANAGEMENT

TABLE 13 EXPERIENCE MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 EXPERIENCE MANAGEMENT: CLOUD ADVERTISING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 ANALYTICS AND INSIGHTS

TABLE 15 ANALYTICS AND INSIGHTS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 ANALYTICS AND INSIGHTS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 REAL-TIME ENGAGEMENT

TABLE 17 REAL-TIME ENGAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 REAL-TIME ENGAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 CLOUD ADVERTISING MARKET, BY COMPONENT (Page No. - 86)

7.1 INTRODUCTION

FIGURE 37 SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 COMPONENT: MARKET DRIVERS

7.1.2 COMPONENT: COVID-19 IMPACT

TABLE 19 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 PLATFORMS

TABLE 21 PLATFORMS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 PLATFORMS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SERVICES

TABLE 23 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 CLOUD ADVERTISING MARKET, BY DEPLOYMENT MODEL (Page No. - 91)

8.1 INTRODUCTION

FIGURE 38 PUBLIC CLOUD DEPLOYMENT MODEL TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

8.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

8.1.2 DEPLOYMENT MODEL: COVID-19 IMPACT

TABLE 25 MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 26 MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

8.2 PUBLIC CLOUD

TABLE 27 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 PRIVATE CLOUD

TABLE 29 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 CLOUD ADVERTISING MARKET, BY ORGANIZATION SIZE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 39 LARGE ENTERPRISES ARE EXPECTED TO RECORD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.2 LARGE ENTERPRISES

TABLE 33 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 CLOUD ADVERTISING MARKET, BY VERTICAL (Page No. - 101)

10.1 INTRODUCTION

FIGURE 40 RETAIL AND CONSUMER GOODS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

TABLE 37 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 RETAIL AND CONSUMER GOODS

TABLE 39 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 MEDIA AND ENTERTAINMENT

TABLE 41 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 TRAVEL AND HOSPITALITY

TABLE 43 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 TRAVEL AND HOSPITALITY: CLOUD ADVERTISING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 BFSI

TABLE 45 BFSI: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 BFSI: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 TELECOMMUNICATIONS

TABLE 47 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 MANUFACTURING

TABLE 49 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 EDUCATION

TABLE 51 EDUCATION: CLOUD ADVERTISING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.9 OTHERS

TABLE 53 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 CLOUD ADVERTISING MARKET, BY REGION (Page No. - 113)

11.1 INTRODUCTION

FIGURE 41 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 55 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: CLOUD ADVERTISING MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Health Information Technology for Economic and Clinical Health Act

11.2.3.5 Sarbanes-Oxley Act

11.2.3.6 Federal Information Security Management Act

11.2.3.7 Payment Card Industry Data Security Standard

11.2.3.8 Federal Information Processing Standards

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 57 NORTH AMERICA: CLOUD ADVERTISING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 69 UNITED STATES: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 73 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: CLOUD ADVERTISING MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 77 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 84 EUROPE: CLOUD ADVERTISING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 93 GERMANY: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 95 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.6 FRANCE

TABLE 97 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 98 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 99 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 100 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 101 REST OF EUROPE: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 International Organization for Standardization 27001

11.4.3.2 Personal Data Protection Act

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 105 ASIA PACIFIC: CLOUD ADVERTISING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 117 CHINA: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 118 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 121 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 122 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 123 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 124 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 125 AUSTRALIA AND NEW ZEALAND: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 126 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 127 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 128 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 129 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: CLOUD ADVERTISING MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in KSA

11.5.3.4 Protection of Personal Information Act

11.5.3.5 TRA’s IoT Regulatory Policy

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 SAUDI ARABIA

TABLE 145 SAUDI ARABIA: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 146 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 147 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 148 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

TABLE 149 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 150 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 151 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.6 SOUTH AFRICA

TABLE 153 SOUTH AFRICA: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 154 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 155 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 156 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5.7 REST OF MIDDLE EAST AND AFRICA

TABLE 157 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CLOUD ADVERTISING MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 161 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 167 LATIN AMERICA: CLOUD ADVERTISING MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 173 BRAZIL: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 174 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 175 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 176 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 177 MEXICO: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 178 MEXICO: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 179 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 180 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 181 REST OF LATIN AMERICA: CLOUD ADVERTISING MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 182 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 183 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 184 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 173)

12.1 INTRODUCTION

FIGURE 44 MARKET EVALUATION FRAMEWORK

12.2 MARKET RANKING

FIGURE 45 MARKET RANKING IN 2021

12.3 MARKET SHARE OF TOP VENDORS

TABLE 185 CLOUD ADVERTISING MARKET: DEGREE OF COMPETITION

FIGURE 46 MARKET: VENDOR SHARE ANALYSIS

12.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 47 HISTORICAL REVENUE ANALYSIS

12.5 COMPANY EVALUATION QUADRANT

12.5.1 DEFINITIONS AND METHODOLOGY

TABLE 186 COMPANY EVALUATION QUADRANT: CRITERIA

12.5.2 STAR

12.5.3 EMERGING LEADER

12.5.4 PERVASIVE

12.5.5 PARTICIPANT

FIGURE 48 CLOUD ADVERTISING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 187 COMPANY FOOTPRINT

TABLE 188 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 189 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 190 COMPANY REGION FOOTPRINT

TABLE 191 COMPANY APPLICATION FOOTPRINT

12.6 COMPETITIVE SCENARIO

TABLE 192 MARKET: NEW LAUNCHES, SEPTEMBER 2021–MARCH 2019

TABLE 193 CLOUD ADVERTISING MARKET: DEALS, AUGUST 2021-MARCH 2019

13 COMPANY PROFILES (Page No. - 191)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

13.2.1 ADOBE

TABLE 194 ADOBE: BUSINESS OVERVIEW

FIGURE 49 ADOBE: COMPANY SNAPSHOT

TABLE 195 ADOBE: NEW LAUNCHES

TABLE 196 ADOBE: DEALS

13.2.2 ORACLE

TABLE 197 ORACLE: BUSINESS OVERVIEW

FIGURE 50 ORACLE: COMPANY SNAPSHOT

TABLE 198 ORACLE: NEW LAUNCHES

TABLE 199 ORACLE: DEALS

13.2.3 SALESFORCE

TABLE 200 SALESFORCE: BUSINESS OVERVIEW

FIGURE 51 SALESFORCE: COMPANY SNAPSHOT

TABLE 201 SALESFORCE: NEW LAUNCHES

TABLE 202 SALESFORCE: DEALS

13.2.4 GOOGLE

TABLE 203 GOOGLE: BUSINESS OVERVIEW

FIGURE 52 GOOGLE: COMPANY SNAPSHOT

TABLE 204 GOOGLE: NEW LAUNCHES

TABLE 205 GOOGLE: DEALS

13.2.5 IBM

TABLE 206 IBM: BUSINESS OVERVIEW

FIGURE 53 IBM: COMPANY SNAPSHOT

TABLE 207 IBM: NEW LAUNCHES

TABLE 208 IBM: DEALS

13.2.6 SAP

TABLE 209 SAP: BUSINESS OVERVIEW

FIGURE 54 SAP: COMPANY SNAPSHOT

TABLE 210 SAP: NEW LAUNCHES

TABLE 211 SAP: DEALS

13.2.7 ACQUIA

TABLE 212 ACQUIA: BUSINESS OVERVIEW

TABLE 213 ACQUIA: NEW LAUNCHES

TABLE 214 ACQUIA: DEALS

13.2.8 DEMANDBASE

TABLE 215 DEMANDBASE: BUSINESS OVERVIEW

TABLE 216 DEMANDBASE: NEW LAUNCHES

TABLE 217 DEMANDBASE: DEALS

13.2.9 EXPERIAN

TABLE 218 EXPERIAN: BUSINESS OVERVIEW

FIGURE 55 EXPERIAN: COMPANY SNAPSHOT

TABLE 219 EXPERIAN: NEW LAUNCHES

TABLE 220 EXPERIAN: DEALS

13.2.10 KUBIENT

TABLE 221 KUBIENT: BUSINESS OVERVIEW

FIGURE 56 KUBIENT: COMPANY SNAPSHOT

TABLE 222 KUBIENT: DEALS

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.3 OTHER PLAYERS

13.3.1 FICO

13.3.2 HUBSPOT

13.3.3 IMAGINE COMMUNICATIONS

13.3.4 INMOBI

13.3.5 MARIN SOFTWARE

13.3.6 SITECORE

13.3.7 MEDIAMATH

13.3.8 NIELSEN

13.3.9 PEGA

13.3.10 SAILTHRU

14 ADJACENT MARKETS (Page No. - 235)

14.1 MOBILE ADVERTISING MARKET

TABLE 223 MOBILE MARKETING MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 224 MOBILE MARKETING MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 225 MOBILE MARKETING MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 226 MOBILE MARKETING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.2 MARKETING CLOUD PLATFORM MARKET

TABLE 227 MARKETING CLOUD PLATFORM MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

TABLE 228 MARKETING CLOUD PLATFORM MARKET SIZE, BY MARKETING FUNCTION, 2016–2023 (USD MILLION)

TABLE 229 MARKETING CLOUD PLATFORM MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 238)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, data center associations, vendor data sheets, product demos, Cloud Computing Association (CCA), Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the cloud advertising market. The primary sources were mainly several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering cloud advertising solutions and services was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from cloud advertising vendors, industry associations, and independent consultants; and key opinion leaders.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Cloud Advertising Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cloud advertising market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the cloud system market.

Report Objectives

- To define, segment, and project the global market size of the cloud advertising market

- To understand the structure of the cloud advertising market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the cloud advertising market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Advertising Market