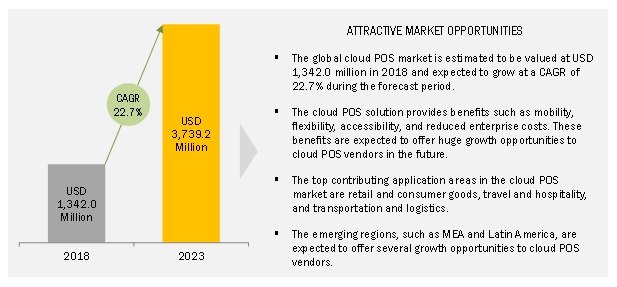

Cloud POS Market by Component, Organization Size, Application Area (Retail and Consumer Goods, Travel and Hospitality, Transportation and Logistics, Media and Entertainment, and Healthcare), and Region - Global Forecast to 2023

[111 Pages Report] The cloud POS solution enables efficient management of POS terminals across multiple locations. Moreover, this solution provides improved service delivery to its customers. These benefits are expected to drive the demand for the solution. The increasing adoption of eCommerce transactions in the retail and consumer goods application area and the rising number of cashless transactions have further propelled the demand for this solution across the globe. The cloud POS solution has witnessed technological advancements in the past few years, and this has made the solution more secure and easily manageable. Moreover, this solution is integrated with technologies, such as advanced machine learning and artificial intelligence. The solution analyzes the sales data to determine customer behavior. This crucial data can be used to provide exclusive advice on promotional and marketing initiatives.

The global cloud POS market was estimated to be USD 1.34 billion in 2018, and is expected to be worth USD 3.73 billion in 2023

By service, the support and maintenance segment is expected to grow at a higher CAGR during the forecast period

The POS software also safeguards against the threats related to the safety of sensitive cardholder/payment data, with the latest Point-to-Point Encryption (P2PE) technology. Services related to POS include payment services along with management services, gateway services, and maintenance services. These services help organizations in building successful client relationships by continuously supporting them throughout their business tenure. These services also benefit organizations by maximizing resource usage, enhancing the marketing project execution, and streamlining the marketing operations. Traditional POS systems generally charge a software license fee per register and then a yearly maintenance fee of 1820% for upgrades. SaaS, on the other hand, is more of a partnership model in which monthly fees are paid, and there are no up-front payments made as in the case of a traditional POS system. These monthly fees cover software, support, backups, and future upgrades.

The small and medium-sized enterprises segment is expected to register a higher CAGR during the forecast period

Cloud POS vendors have specific tools for individuals, small businesses, and freelancers. Cost-effectiveness is one of the important needs of small businesses; hence, there are specific vendors available to satisfy the requirements of SMEs. These vendors provide SMEs with simple tools that help them easily manage people, projects, and assets. These simple tools also help the SMEs in fully utilizing the deployed software. The adoption of the cloud POS solution is expected to accelerate in the coming years among SMEs and enable SMEs to have a considerable market size during the forecast period.

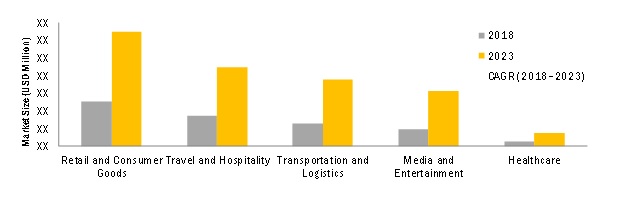

Media and entertainment application area is expected to register the highest CAGR during the forecast period

Cloud POS solutions are largely used in the media and entertainment application areas. In this sector, cloud POS is deployed in casinos, movie theaters, theme parks, museums, and sports arenas. It assures a flexible and transparent entertainment business. It also provides better customer service, which in turn, helps in enhancing sales.

Some of the players from the cloud POS market, such as First Data, have started investing in the sports and entertainment application area. First Data collaborated with Bypass in July 2016 to deliver a modern, comprehensive payment solution for sports arenas and concert venues. As part of this unique collaboration, the company blends its innovative Clover family of POS devices and business management tools with the revolutionary cloud-based software and back-office management tools offered by Bypass. The two companies have already collaborated to support major sporting events and concerts across the country.

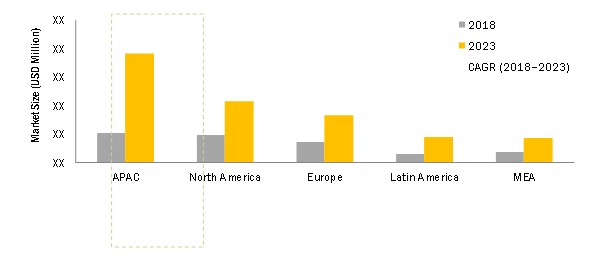

APAC is expected to be the fastest-growing region during the forecast period

The cloud POS market in APAC has been sub-segmented into China, Japan, India, and Rest of APAC. Rapidly growing customer base, owing to the increasing prominence of SMEs, coupled with the reduction in TCO, is expected to drive the cloud POS market growth in APAC. Benefits associated with cloud POS systems, such as low queue time, a high degree of security, paper-free receipt option, decrease in check-out space requirement, and increase in floor space, would help fuel the growth of the cloud POS market in APAC. The booming retail sector and emerging infrastructures in the region would further facilitate the growth of the cloud POS market in APAC. Moreover, the economic growth in APAC is attracting increased investments from cloud POS suppliers.

The APAC region is one of the potential markets for the growth of the cloud POS market; therefore, many companies are expanding their reach in this region.

Market Dynamics

Driver: Increased business mobility and flexibility

A cloud-based POS system can be accessed from any device with an internet connection. This provides the flexibility for real-time viewing of labor usage percentages, inventory counts, and productivity reports. The information can be instantly updated and accessed round-the-clock from any remote location. This advantage of cloud POS increases the flexibility in business operations. Moreover, cloud POS can be configured on a portable device, which enables users to move around along with the equipment. It also provides the advantage of adding more mobile devices to your existing system for enhanced mobility. This advantage enables customers to leverage the functionality of a mobile POS (mPOS) system. The increased mobility advantage provided by cloud POS deployments is expected to fuel the demand for cloud POS systems in the future.

Restraint: Skepticism regarding cloud-based offerings

In the complex IT security environment today, the frequency of cyber-attacks is growing exponentially. Many organizations are skeptical about the overall competence of cloud-based offerings regarding security challenges. IT experts who are comfortable with interacting with on-premises POS deployments often experience concern when moving to cloud-based POS, as they fear the loss of ownership and control. There is also a belief that cloud-based POS is not yet mature to handle IT security demands. Furthermore, even though there is an increase in the adoption of cloud-based POS among regions, such as APAC and MEA, the awareness about potential risks, such as cloud security and threats, is low among organizations.

Opportunity: Growing demand for eCommerce transactions in retail and consumer goods applications

The need to adopt cloud POS is increasing due to the increase in the number of eCommerce transactions worldwide. In countries, such as India, consumers prefer paying after receiving the products through the card-on-delivery payment mode. This augments the need for mPOS terminals that can accept payments through cards. As a result, several eCommerce companies are deploying mPOS terminals. Therefore, the upsurge in the number of eCommerce transactions across the world fuels the demand for cloud POS terminals.

Challenge: Lack of standardization and awareness

The main challenge of the cloud POS market is the lack of global standardization of the systems and low consumer awareness about the same. Bringing the consumers onboard and the effective development of vertical markets are the major challenges for cloud POS technology vendors. Consumers are in need of a viable alternative to cash for making payments but are generally not aware of the options available in the market. In developing countries, the consumers are mostly unaware of the wireless payment technologies, while in developed countries, they avoid using wireless payment cards due to the issues related to security. Financial regulators have to make huge efforts to educate the public about the cloud POS systems available to them, which are more scalable and secure.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

USD million |

|

Segments covered |

Component, Service, Organization Size, Application Area, and Region |

|

Geographies covered |

North America, Europe, MEA, APAC, and Latin America |

|

Companies covered |

Square Inc (US), Cegid (France), UTC RETAIL (US), Shop Keep (US), PAR Technology (US), Shopify (Canada), B2B Soft (US), Intuit (US), Lightspeed (Canada), Oracle (US), SalonTarget (US), RetailOps (US), Celerant Technology (US), TouchSuite (US), Clover (US), Revel Systems (US), ERPLY (US), Omnico Group (UK), Diaspark (US), Teamwork Retail (US), Jesta I.S. (Canada), One Step Retail Solutions (US), Phorest (Ireland), Poster POS (Poland), and iiko(Russia) |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub segments:

By Component:

- Solution

- Services

By Service:

- Training, Consulting, and Integration

- Support and Maintenance

By Organization Size:

- SMEs

- Large Enterprises

By Application Areas:

- Retail and Consumer Goods

- Travel and Hospitality

- Media and Entertainment

- Transport and Logistics

- Healthcare

By Region:

- North America

- US

- Canada

- Europe

- UK

- France

- Germany

- Other European Countries

- APAC

- China

- Japan

- India

- Other APAC Countries

- MEA

- KSA

- South Africa

- Other MEA Countries

- Latin America

- Brazil

- Mexico

- Other Latin American Countries

Key Market Players

Square Inc, Shopify, Oracle, Clover, Lightspeed

Recent Developments

- In September 2018, Shopify announced the launch of the new Shopify App Store. App Store is a collection of free and premium apps that extend the functionality of Shopifys merchants online stores.

- In August 2018, Square, Inc. announced an update on its chip card reader to enable faster processing of card payments.

- In July 2018, Lightspeed launched an integrated iOS solution for retailers and restaurants. The solution supports better business management, right from planning finances and organizing work schedules to simplifying merchant-to-customer transactions.

- In July 2018, ShopKeep announced a partnership with the credit card processing company, Gravity Payments, to offer its POS software for Gravitys transparent payment processing service.

- In April 2018, Square, Inc. acquired Zesty to strengthen and scale its growing corporate ordering business.

Critical questions the report answers:

- What is the competitive landscape scenario of this market?

- Which region is expected to dominate the market during the forecast period?

- Which are the key players operating in the market, and what are the factors contributing to their domination over other players?

- What are the future hot bets in this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Regional Scope

1.5 Years Considered for the Study

1.6 Currency

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Cloud POS Market

4.2 Market, Top 3 Application Areas and Regions

4.3 Life Cycle Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Business Mobility and Flexibility

5.2.1.2 Efficient Management of POS Terminals Across Multiple Locations

5.2.1.3 Improved Service Delivery

5.2.2 Restraints

5.2.2.1 Skepticism Regarding Cloud-Based Offerings

5.2.3 Opportunities

5.2.3.1 Growing Demand for Ecommerce Transactions in Retail and Consumer Goods Applications

5.2.3.2 Increase in Cashless Transactions in Different Countries

5.2.4 Challenges

5.2.4.1 Lack of Standardization and Awareness

5.3 Technology Trends and Standards

5.3.1 Introduction

5.3.2 Standards and Guidelines for Cloud POS Market

5.3.2.1 Payment Card Industry Data Security Standard (PCI DSS)

5.3.2.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.2.3 Federal Information Security Management Act (FISMA)

5.3.2.4 PCI Pin Transaction Security (PCI PTS) Requirements

5.3.2.5 International Organization for Standardization (Iso) 10536

5.3.2.6 Iso 14443

5.3.2.7 Distributed Management Task Force (Dmtf) Standards

5.3.2.8 Organization for the Advancement of Structured Information Standards (OASIS)

6 Cloud POS Market, By Component (Page No. - 34)

6.1 Introduction

7 Market By Service (Page No. - 37)

7.1 Introduction

7.2 Training, Consulting, and Integration

7.3 Support and Maintenance

8 Cloud POS Market, By Organization Size (Page No. - 41)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Market By Application Area (Page No. - 44)

9.1 Introduction

9.2 Retail and Consumer Goods

9.2.1 Inventory Management

9.2.2 Cash Management and Checkout

9.2.3 Labour Scheduling

9.2.4 Shelf Space Management

9.2.5 Scale Management

9.3 Travel and Hospitality

9.3.1 Restaurant and Table Management

9.3.2 Staff Management

9.3.3 Kitchen Management

9.3.4 Reporting

9.4 Media and Entertainment

9.4.1 Cinema Operations Management

9.4.2 In-Theatre Dining Management

9.4.3 Cash Desk Management

9.4.4 Digital Signage Management

9.5 Transportation and Logistics

9.5.1 Vehicle Inventory Management

9.5.2 Operations Management

9.5.3 Warehouse Management

9.5.4 Payroll Management

9.6 Healthcare

9.6.1 Inventory Management

9.6.2 Invoicing

9.6.3 Reporting and Analytics

10 Cloud POS Market, By Region (Page No. - 52)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 France

10.3.3 Germany

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.2 South Africa

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 68)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product Launches/Product Upgradations

11.2.2 Partnerships, Agreements, and Collaborations

11.2.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 71)

12.1 Introduction

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Square, Inc.

12.3 Cegid

12.4 UTC Retail

12.5 Shopkeep

12.6 PAR Technology

12.7 Shopify

12.8 B2B Soft

12.9 Intuit

12.10 Lightspeed

12.11 Oracle

12.12 Salontarget

12.13 Retailops

12.14 Celerant Technology

12.15 Touchsuite

12.16 Clover

12.17 Revel Systems

12.18 Erply

12.19 Omnico Group

12.20 Diaspark

12.21 Teamwork Retail

12.22 Jesta I.S.

12.23 One Stop Retail Solutions

12.24 Phorest

12.25 POSter POS

12.26 Iiko

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 105)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (46 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Market: Assumptions

Table 3 Cloud POS Market Size, By Component, 20162023 (USD Million)

Table 4 Solution: Market Size By Region, 20162023 (USD Million)

Table 5 Services: Market Size By Region, 20162023 (USD Million)

Table 6 Cloud POS Market Size, By Service, 20162023 (USD Million)

Table 7 Training, Consulting, and Integration: Market Size By Region, 20162023 (USD Million)

Table 8 Support and Maintenance: Market Size By Region, 20162023 (USD Million)

Table 9 Cloud POS Market Size, By Organization Size, 20162023 (USD Million)

Table 10 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 11 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 12 Cloud POS Market Size, By Application Area, 20162023 (USD Million)

Table 13 Retail and Consumer Goods: Market Size By Region, 20162023 (USD Million)

Table 14 Travel and Hospitality: Market Size By Region, 20162023 (USD Million)

Table 15 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 16 Transportation and Logistics: Market Size By Region, 20162023 (USD Million)

Table 17 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 18 Cloud POS Market Size, By Region, 20162023 (USD Million)

Table 19 North America: Market Size By Component, 20162023 (USD Million)

Table 20 North America: Market Size By Service, 20162023 (USD Million)

Table 21 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 22 North America: Market Size By Application Area, 20162023 (USD Million)

Table 23 North America: Market Size By Country, 20162023 (USD Million)

Table 24 Europe: Cloud POS Market Size, By Component, 20162023 (USD Million)

Table 25 Europe: Market Size By Service, 20162023 (USD Million)

Table 26 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 27 Europe: Market Size By Application Area, 20162023 (USD Million)

Table 28 Europe: Market Size By Country, 20162023 (USD Million)

Table 29 Asia Pacific: Cloud POS Market Size, By Component, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 31 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 32 Asia Pacific: Market Size By Application Area, 20162023 (USD Million)

Table 33 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 34 Middle East and Africa: Cloud POS Market Size, By Component, 20162023 (USD Million)

Table 35 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 36 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 37 Middle East and Africa: Market Size By Application Area, 20162023 (USD Million)

Table 38 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 39 Latin America: Cloud POS Market Size, By Component, 20162023 (USD Million)

Table 40 Latin America: Market Size By Service, 20162023 (USD Million)

Table 41 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 42 Latin America: Market Size By Application Area, 20162023 (USD Million)

Table 43 Latin America: Market Size By Country, 20162023 (USD Million)

Table 44 New Product Launches/Product Upgradations, 2018

Table 45 Partnerships, Agreements, and Collaborations, 2018

Table 46 Mergers and Acquisitions, 2018

List of Figures (33 Figures)

Figure 1 Global Cloud POS Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Asia Pacific is Estimated to Account for the Largest Market Share in 2018

Figure 8 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 9 Media and Entertainment Application Area is Expected to Register the Highest CAGR During the Forecast Period

Figure 10 Increased Business Mobility and Flexibility is Expected to Fuel the Growth of the Cloud POS Market During the Forecast Period

Figure 11 Retail and Consumer Goods Application Area and Asia Pacific are Estimated to Account for the Largest Market Shares in 2018

Figure 12 Cloud POS Market is Expected to Register Immense Growth Opportunities in Asia Pacific

Figure 13 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Support and Maintenance Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment is Expected to Register A Higher CAGR During the Forecast Period

Figure 17 Media and Entertainment Application Area is Expected to Register the Highest CAGR During the Forecast Period

Figure 18 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 North America: Market Snapshot

Figure 20 Asia Pacific: Market Snapshot

Figure 21 Key Developments By the Leading Players in the Cloud POS Market During 20162018

Figure 22 Geographic Revenue Mix of the Top Market Players

Figure 23 Square, Inc.: Company Snapshot

Figure 24 Square, Inc.: SWOT Analysis

Figure 25 Cegid: Company Snapshot

Figure 26 PAR Technology: Company Snapshot

Figure 27 PAR Technology: SWOT Analysis

Figure 28 Shopify: Company Snapshot

Figure 29 Shopify: SWOT Analysis

Figure 30 Intuit: Company Snapshot

Figure 31 Intuit: SWOT Analysis

Figure 32 Oracle: Company Snapshot

Figure 33 Oracle: SWOT Analysis

Growth opportunities and latent adjacency in Cloud POS Market