Wireless POS Terminal Market by Component (Hardware, Software & Services), Type (Portable Countertop & PIN Pad, mPOS, Smart POS), Industry (Retail, Hospitality, Healthcare, Transportation, Sports & Entertainment), and Geography - Global Forecast to 2035

Wireless POS Terminal Market Overview

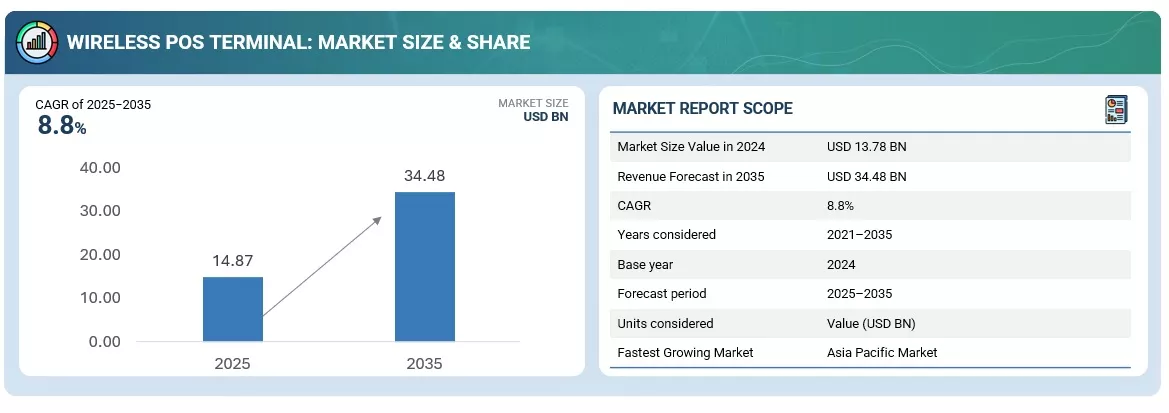

The global wireless POS terminal market was valued at USD 13.78 billion in 2024 and is estimated to reach USD 34.48 billion by 2035, at a CAGR of 8.8% between 2025 and 2035.

The wireless POS terminal market is undergoing rapid transformation as merchants and service providers seek faster, more secure, and more flexible payment acceptance solutions. Wireless POS terminals combine hardware devices with software platforms and supportive services to enable card based payments, mobile wallets, contactless transactions, and integrated point of sale capabilities. Growth is being driven by the expanding use of mobile payments, the rise of e commerce, the demand for unattended and on the go payment acceptance, and the need for better customer experiences across retail and service industries. This report examines the market by component, by type, by industry vertical, and by geography and provides a forecast from 2025 to 2035.

Market Drivers

Broad consumer adoption of digital payments and a rising preference for contactless transactions are among the primary drivers. Small and medium merchants are increasingly adopting wireless solutions because they reduce the cost and complexity of installing traditional wired terminals. Improved cellular networks and ubiquitous Wi Fi coverage allow terminals to operate reliably across locations including pop up stores, delivery vehicles, outdoor events, and remote service sites. The growth of omnichannel retailing and the need to accept payments outside of fixed counters is also increasing demand for wireless terminal form factors that can be customized to merchant workflows.

Market Restraints

Despite strong demand, the market faces headwinds. Security and regulatory compliance remain critical concerns. Merchants must adhere to payment industry standards and invest in software updates and services to maintain compliance. Integration challenges with existing back end systems and enterprise resource planning platforms can slow adoption among larger retailers. Power management and battery life issues in portable devices create operational constraints for some use cases. Lastly, intense price competition and a fragmented vendor landscape put pressure on margins for hardware manufacturers.

Market Opportunities

There are significant opportunities in emerging markets where digital payments are still gaining traction. Contactless transit ticketing, in field service payments, and hospitality use cases such as table side ordering are growing. The integration of value added services like loyalty programs, gift cards, and analytics into terminal software creates new revenue streams for vendors. Advances in secure element technology and tokenization improve security and open up new use cases such as tap to phone where a merchant smartphone becomes a payment acceptance device. Partnerships between payment processors and telecom operators also present distribution and scale opportunities.

Component Analysis

Hardware, software and services are the core components of the wireless POS terminal market. Hardware encompasses portable countertop devices, PIN pad units, handheld mPOS readers, and full scale smart POS terminals that combine computing and payment functions. Software includes payment applications, terminal operating systems, middleware for integration, value added services such as loyalty and inventory management, and security software for encryption and tokenization. Services cover installation, maintenance, software as a service subscriptions, certification and compliance services, and managed services.

Hardware revenues continue to account for a sizable share of current market value because devices must be purchased or leased. However software and services are the fastest growing segments in terms of recurring revenue. Vendors are shifting business models toward subscription offerings and platform driven monetization. This trend allows vendors to capture long term value and justify ongoing investments in software updates and cybersecurity. Services play a crucial role in post sale support and in enabling seamless deployments across distributed merchant networks.

Type Analysis

The market can be segmented by terminal type into portable countertop and PIN pad devices, mPOS solutions, and smart POS systems. Portable countertop and PIN pad devices are often used at fixed payment points but connect wirelessly for transaction routing. These devices appeal to retailers that require counter based terminals with cable free connectivity. The mPOS segment includes small card readers that attach to a merchant smartphone or tablet or connect via Bluetooth. Mobile POS solutions are popular with small merchants, market vendors, delivery services, and field based businesses because they are low cost and easy to deploy.

Smart POS terminals provide an integrated solution with a full touch screen interface, application support, peripheral connectivity for scanners and receipt printers, and built in payment acceptance. Smart POS systems are rapidly gaining traction in hospitality, restaurant, and large retail chains that require integrated order management, inventory control, and advanced reporting. The smart POS segment is expected to capture increasing market share as merchants replace legacy terminals and pursue digital transformation.

Industry Vertical Analysis

Adoption rates vary across industries. Retail remains the largest end user by revenue share due to high transaction volumes and the diverse range of store formats from small independent shops to large chains. Wireless POS solutions help retailers serve customers across multiple channels and geographic locations. Hospitality is another key vertical where table side ordering, mobile payments for room service, and event based acceptance drive demand. Wireless terminals enhance guest experiences by speeding up checkout and enabling personalized offers.

Healthcare providers are adopting wireless POS terminals for patient payments at bedside, in clinic lobbies, and for mobile service units. The ability to securely accept payments while integrating with patient billing systems is an important requirement. Transportation providers use wireless terminals for ticketing and onboard payments, especially in buses, taxis, and ride hail services. Sports and entertainment venues deploy wireless terminals to support concessions, merchandise sales, and entry validation.

Other niche verticals such as field services, home delivery, and professional services also contribute to market growth. Each industry places unique demands on device ruggedness, battery life, integration options, and compliance requirements which vendors must address through tailored hardware and software offerings.

Regional Analysis

Geography plays a central role in shaping market dynamics. North America has historically led adoption because of high smartphone penetration, strong card infrastructure, and a mature ecosystem of payments players. Europe follows closely with robust contactless adoption and regulatory frameworks that encourage innovation. Asia Pacific is projected to be the fastest growing region due to rapid digital payment adoption in countries with large unbanked or underbanked populations and strong uptake of mobile wallets and QR code based payments.

Latin America and the Middle East and Africa are emerging markets where wireless POS adoption is increasing as merchants seek low cost and flexible payment acceptance options. In these regions partnerships between local acquirers, fintech startups, and global terminal vendors are accelerating deployments. Vendors that can provide localized software, multi language support, and rugged hardware suited to local conditions will find success.

Security and Compliance Considerations

Security remains a top priority across the market. Payment terminals must comply with global and regional standards for data protection and secure transaction processing. Certifications such as PCI point to point encryption and device level certifications are critical for merchant trust. Tokenization, end to end encryption, and secure boot processes are key technologies that vendors implement. Regular software updates and the availability of remote management tools are also necessary to quickly address vulnerabilities and maintain compliance with evolving regulations.

Regulatory frameworks for consumer data protection and financial services influence product roadmaps. Vendors must be proactive in designing privacy by default features and in providing transparency around data usage. Compliance services and audits are an important revenue stream for service providers and a critical support offering for merchants in regulated industries such as healthcare.

Technology Trends

Several technology trends are shaping the wireless POS terminal market. Contactless NFC payments and EMV contactless chips are standard features on modern terminals. The rise of mobile wallets and wearable payments requires terminals to support multiple contactless protocols. Cloud native platforms are enabling faster deployments and easier integration with value added services. Edge computing on smart POS terminals enables local processing and offline transaction capabilities which are crucial for uninterrupted service in areas with unstable connectivity.

Bluetooth low energy and improved Wi Fi protocols enhance device connectivity and extend battery life. The adoption of 5G networks will further improve transaction throughput and enable new use cases such as high definition video based services on smart POS devices. Artificial intelligence and machine learning are being embedded in terminal software for fraud detection, sales optimization, and personalized offers. These capabilities increase the utility of terminals beyond payments and position them as central nodes in the merchant technology stack.

Competitive Landscape

The market is competitive and comprises device manufacturers, payment processors, software platform providers, and value added service companies. Large players offer end to end solutions while a rich ecosystem of startups focuses on niche innovations such as tap to phone solutions and integrated loyalty platforms. Strategic partnerships and acquisitions are common as companies seek to expand their product portfolios and geographic reach. Differentiation is achieved through a mix of hardware design, software features, security offerings, pricing models, and service level agreements.

Vendors that emphasize open APIs and developer ecosystems gain traction among merchants who require custom integrations. Providers offering bundled solutions that include payments processing, software subscriptions, and managed services are attractive to merchants seeking to limit vendor complexity.

Market Forecast

From 2025 to 2035, the wireless POS terminal market is expected to grow at a steady compound annual growth rate driven by continued digital payment adoption and merchant modernization programs. Smart POS and software driven offerings will register the fastest revenue growth due to demand for integrated business applications and recurring subscription models. The mPOS segment will continue to capture share among small merchants and micro merchants in emerging markets because of low upfront costs and simple onboarding.

Hardware unit shipments will remain significant but average selling prices may decline slightly as competition intensifies and as software and services become the primary vehicles for monetization. Services including remote device management, software updates, certification, and merchant support will grow in importance and contribute a larger share of total market revenues. Regional shifts will see strong growth in Asia Pacific and Latin America as digital payment ecosystems expand and regulatory frameworks mature.

Strategic Recommendations for Vendors

Vendors should invest in modular hardware platforms that can be configured for different industries and use cases. Building secure cloud native platforms and offering flexible pricing including subscriptions, leasing, and revenue share models will help capture a broader merchant base. Strong focus on developer tools and open APIs will enable third party integrations and foster a partner ecosystem.

Localized product variants, language support, and regional certification will be key to entering new markets. Offering bundled solutions that combine payments processing, analytics, loyalty, and compliance services will increase customer stickiness. Vendors should also prioritize sustainability by designing energy efficient devices and supporting refurbishment programs to meet corporate responsibility goals.

Strategic Recommendations for Merchants and Acquirers

Merchants should evaluate wireless POS options not only on hardware cost but on software capabilities, security posture, and service support. Selecting vendors that offer easy integration with existing inventory and accounting systems reduces operational friction. Acquirers and payment processors should collaborate with terminal vendors to provide seamless onboarding, value added services, and transparent pricing to merchant customers.

Investing in staff training and device management systems ensures smooth operations and reduces downtime. Merchants in regulated industries should work closely with providers who offer compliance support and regular software updates.

Future Outlook

The wireless POS terminal market will continue to evolve from a hardware centric model toward platform centric ecosystems. Terminals will become smarter and more connected, serving as hubs for payments, customer engagement, and business insights. Cross industry convergence and the expansion of digital payment rails will create new opportunities for innovation. As contactless and mobile payments become ubiquitous, wireless POS solutions will be essential for businesses seeking to deliver seamless, secure, and personalized customer experiences.

Target Audience:

- Original device manufacturers (ODMs)

- System integrators

- Wireless POS terminal original equipment manufacturers (OEMs)

- Raw material suppliers

- Assembly and packaging vendors

- Technical universities

- Government research agencies and private research organizations

- Research institutes and organizations

- Market research and consulting firms

Scope of the Report:

In this research report, the wireless POS terminal market has been segmented on the basis of component, type, industry, and geography.

Wireless POS Terminal Market, by Component

- Hardware

- POS Software & Services

Wireless POS Terminal Market, by Type

- Portable Countertop & PIN Pad

- mPOS

- Smart POS

- Other Types (Mini POS and Smart Mobile Dongle)

Wireless POS Terminal Market, by Industry

- Retail

- Hospitality

- Healthcare

- Transportation

- Sports & Entertainment

- Other Industries (Home Delivery & Service Delivery)

Wireless POS Terminal Market, by Geography

- North America

- Europe

- APAC

- RoW

Available Customizations:

With the given wireless POS terminal market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

FAQ

1. What is a Wireless POS Terminal?

Answer:

A wireless POS terminal is a portable device that enables card and digital payments using Wi-Fi, Bluetooth, or cellular networks.

2. What drives the growth of the Wireless POS Terminal Market?

Answer:

Rising adoption of contactless payments and the shift toward cashless, digital transactions drive market growth.

3. Which industries use Wireless POS Terminals the most?

Answer:

Retail, hospitality, healthcare, transportation, and e-commerce are the primary end-users.

4. What are the key trends in the Wireless POS Terminal Market?

Answer:

Cloud-based payment integration, NFC technology, 5G connectivity, and enhanced security are key trends.

5. Who are the major players in the Wireless POS Terminal Market?

Answer:

Leading players include Ingenico, Verifone, PAX Technology, Newland, and Castles Technology.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of Study

1.2 Definition

1.3 Scope of The Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary & Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Major Opportunities in Market

4.2 Market, By Type

4.3 Market in APAC

4.4 Market, By Industry

4.5 Market, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Wide Adoption of Wireless Payment Terminal By Retailers

5.2.1.2 Growing Use of Europay, Mastercard, and Visa(EMV) Cards

5.2.1.3 Increasing E-Commerce Transactions Leading to Rise in Demand for Wireless POS Terminals

5.2.1.4 Increase in Cashless Transactions in Different Countries

5.2.1.5 Growing Adoption of Wireless Technology in Mobile Handsets and Wearables

5.2.2 Restraints

5.2.2.1 Security Issues Related to Wireless Technology

5.2.2.2 High Maintenance Cost of Wireless POS Systems

5.2.3 Opportunities

5.2.3.1 Reduction in Cost of Wireless Technology and Increase in Their Reliability

5.2.3.2 Mass Adoption of Dual-Interface Chip Technology and Multi-Application Support By NFC and Hce

5.2.4 Challenges

5.2.4.1 Lack of Standardization and Consumer Awareness Regarding Wireless POS Technology

5.2.4.2 Slow Rate of Adoption of Wireless POS Terminals

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Regulatory Standards

7 Wireless POS Terminal Market, By Component (Page No. - 47)

7.1 Introduction

7.2 Hardware

7.2.1 Monitor

7.2.2 Receipt Printer

7.2.3 Card Reader

7.2.4 Other Hardware

7.3 POS Software and Services

8 Market, By Type (Page No. - 52)

8.1 Introduction

8.2 Portable Countertop & Pin Pad

8.3 MPOS

8.4 Smart POS

8.5 Other Types

9 Market, By Industry (Page No. - 74)

9.1 Introduction

9.2 Retail

9.3 Hospitality

9.4 Healthcare

9.5 Transportation

9.6 Sports & Entertainment

9.7 Other Industries

10 Geographic Analysis (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC

10.5 RoW

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.2 Ranking Analysis of Wireless POS Terminal

11.3 Competitive Scenario

11.3.1 Product Launches & Developments

11.3.2 Partnerships, Agreements, Joint Ventures, & Collaborations

11.3.3 Mergers & Acquisitions

12 Company Profiles (Page No. - 111)

12.1 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.1.1 Ingenico

12.1.2 Verifone

12.1.3 First Data

12.1.4 PAX Global Technology

12.1.5 NCR Corporation

12.1.6 Diebold Nixdorf

12.1.7 BBPOS

12.1.8 Elavon

12.1.9 Castles Technology

12.1.10 Winpos

12.1.11 Bitel

12.1.12 Cegid Group

12.1.13 Squirrel Systems

12.1.14 Newland Payment Technology

12.1.15 Citixsys Americas

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12.2 Start-Up Ecosystem

12.2.1 Izettle

12.2.2 Revel Systems

12.2.3 Shopkeep

12.2.4 Touchbistro

12.2.5 Vend

13 Appendix (Page No. - 153)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (62 Figures)

Table 1 Wireless POS Terminal Market, By Component, 2014–2023 (USD Billion)

Table 2 Market, By Type, 2014–2023 (USD Million)

Table 3 Market for Portable Countertop and Pin Pad, By Industry, 2014–2023 (USD Million)

Table 4 Market for Portable Countertop and Pin Pad, By Region, 2014–2023 (USD Million)

Table 5 Portable Countertop and Pin Pad Market for Retail, By Region, 2014–2023 (USD Million)

Table 6 Portable Countertop and Pin Pad Market for Hospitality, By Region, 2014–2023 (USD Million)

Table 7 Portable Countertop and Pin Pad Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 8 Portable Countertop and Pin Pad Market for Transportation, By Region, 2014–2023 (USD Million)

Table 9 Portable Countertop and Pin Pad Market for Sports and Entertainment, By Region, 2014–2023 (USD Million)

Table 10 Portable Countertop and Pin Pad Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 11 Market for MPOS, By Industry, 2014–2023 (USD Million)

Table 12 Market for MPOS, By Region, 2014–2023 (USD Million)

Table 13 MPOS Market for Retail, By Region, 2014–2023 (USD Million)

Table 14 MPOS Market for Hospitality, By Region, 2014–2023 (USD Million)

Table 15 MPOS Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 16 MPOS Market for Transportation, By Region, 2014–2023 (USD Million)

Table 17 MPOS Market for Sports & Entertainment, By Region, 2014–2023 (USD Million)

Table 18 MPOS Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 19 Market for Smart POS, By Industry, 2014–2023 (USD Million)

Table 20 Market for Smart POS, By Region, 2014–2023 (USD Million)

Table 21 Smart POS Market for Retail, By Region, 2014–2023 (USD Million)

Table 22 Smart POS Market for Hospitality, By Region, 2014–2023 (USD Million)

Table 23 Smart POS Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 24 Smart POS Market for Transportation, By Region, 2014–2023 (USD Million)

Table 25 Smart POS Market for Sports and Entertainment, By Region, 2014–2023 (USD Million)

Table 26 Smart POS Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 27 Market for Other Types, By Industry, 2014–2023 (USD Million)

Table 28 Market for Other Types, By Region, 2014–2023 (USD Million)

Table 29 Other Type Market for Retail, By Region, 2014–2023 (USD Million)

Table 30 Other Types Market for Hospitality, By Region, 2014–2023 (USD Million)

Table 31 Other Types Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 32 Other Types Market for Transportation, By Region, 2014–2023 (USD Million)

Table 33 Other Types Market for Sports and Entertainment, By Region, 2014–2023 (USD Million)

Table 34 Other Types Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 35 Market, By Industry, 2014–2023 (USD Million)

Table 36 Market for Retail, By Type, 2014–2023 (USD Million)

Table 37 Market for Retail, By Region, 2014–2023 (USD Million)

Table 38 Market for Hospitality, By Type, 2014–2023 (USD Million)

Table 39 Market for Hospitality, By Region, 2014–2023 (USD Million)

Table 40 Market for Healthcare, By Type, 2014–2023 (USD Million)

Table 41 Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 42 Market for Transportation, By Type, 2014–2023 (USD Million)

Table 43 Market for Transportation, By Region, 2014–2023 (USD Million)

Table 44 Market for Sports and Entertainment, By Type, 2014–2023 (USD Million)

Table 45 Market for Sports and Entertainment, By Region, 2014–2023 (USD Million)

Table 46 Market for Other Industries, By Type, 2014–2023 (USD Million)

Table 47 Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 48 Market, By Region, 2014–2023 (USD Billion)

Table 49 Market, By Region, 2014–2023 (Million Units)

Table 50 Market in North America, By Country, 2014–2023 (USD Million)

Table 51 Market in North America, By Type, 2014–2023 (USD Million)

Table 52 Market in North America, By Industry, 2014—2023 (USD Million)

Table 53 Market in Europe, By Country, 2014–2023 (USD Million)

Table 54 Market in Europe, By Type, 2014–2023 (USD Million)

Table 55 Market in Europe, By Industry, 2014–2023 (USD Million)

Table 56 Market in APAC, By Country, 2014–2023 (USD Million)

Table 57 Market in APAC, By Type, 2014–2023 (USD Million)

Table 58 Market in APAC, By Industry, 2014–2023 (USD Million)

Table 59 Market in RoW, By Region, 2014–2023 (USD Million)

Table 60 Market in RoW, By Type, 2014–2023 (USD Million)

Table 61 Market in RoW, By Industry, 2014–2023 (USD Million)

Table 62 Market Ranking for Market, 2016

List of Figures (49 Figures)

Figure 1 Research Design

Figure 2 Wireless POS Terminal Market, 2014–2023

Figure 3 Market for POS Software and Services to Growth at Higher CAGR During Forecast Period

Figure 4 Portable Countertop and Pin Pad to Hold Largest Size of Market in 2017

Figure 5 Retail to Hold Largest Size of Market in 2017

Figure 6 North America Held Largest Share of Market in 2016

Figure 7 Increase in Cashless Transactions in Different Countries is Expected to Drive The Market

Figure 8 Market for MPOS to Grow at Highest CAGR During Forecast Period

Figure 9 Retail Held Largest Share of Market in APAC in 2016

Figure 10 Market for Sports & Entertainment Industry to Grow at The Highest CAGR During The Forecast Period

Figure 11 US Held Largest Share of Market in 2016

Figure 12 Increasing E-Commerce Transactions Spur Demand for Wireless POS Terminals and Drive Growth of The Market

Figure 13 Percentage of Transactions Enabled With EMV Cards

Figure 14 Increased Adoption of E-Commerce Transactions, 2011–2015

Figure 15 Global Number of Cyber Attack Incidents

Figure 16 Assembly and Manufacturing, and Software Development Add Major Value to Wireless POS Terminals

Figure 17 Market, By Component

Figure 18 POS Software and Services to Dominate Market During Forecast Period

Figure 19 Hardware Components of Wireless POS Terminals

Figure 20 Market, By Type

Figure 21 Portable Countertop and Pin Pad to Hold Largest Size of Market in 2017

Figure 22 Retail to Hold Largest Size of Market for Portable Countertop and Pin Pad in 2017

Figure 23 Market for MPOS in APAC to Grow at Highest CAGR During Forecast Period

Figure 24 Smart POS Market for Sports and Entertainment to Grow at Highest CAGR During Forecast Period

Figure 25 North America to Hold Largest Size of Market for Other Types in 2017

Figure 26 Market, By Industry

Figure 27 Retail to Hold Largest Size of Market in 2017

Figure 28 Market for Retail in APAC to Grow at Highest CAGR During Forecast Period

Figure 29 Portable Countertop and Pin Pad to Hold Largest Size of Market for Healthcare By 2017

Figure 30 North America to Hold Largest Size of Market for Sports and Entertainment By 2017

Figure 31 Market, By Region

Figure 32 Geographic Snapshot: Market

Figure 33 Market in North America

Figure 34 Market Snapshot: North America

Figure 35 Market in Europe

Figure 36 Market Snapshot: Europe

Figure 37 Market in APAC

Figure 38 Market Snapshot: APAC

Figure 39 Market in RoW

Figure 40 Companies Adopted Contracts, Agreements, and Partnerships as Key Growth Strategies

Figure 41 Market Evaluation Framework: Contracts, Agreements, and Partnerships Fuelled Growth and Innovation Between 2014 and 2016

Figure 42 Geographic Revenue Mix of Key Players

Figure 43 Ingenico: Company Snapshot

Figure 44 Verifone: Company Snapshot

Figure 45 First Data: Company Snapshot

Figure 46 PAX Global Technology: Company Snapshot

Figure 47 NCR Corporation: Company Snapshot

Figure 48 Diebold Nixdorf: Company Snapshot

Figure 49 Cegid Group: Company Snapshot

Growth opportunities and latent adjacency in Wireless POS Terminal Market