Clickstream Analytics Market by Application (Click Path and Website Optimization, Customer Analysis, Basket Analysis and Personalization, Traffic Analysis), Type, Organization Size, Deployment Model, and Vertical - Global Forecast to 2022

[165 Pages Report] The global clickstream analytics market is expected to grow from USD 750.3 Million in 2017 to USD 1,560.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 15.8% from 2017 to 2022. Clickstream analytics can manage large volumes of clickstream data that might be structured, unstructured, or semi-structured. Companies deploy clickstream analytics solutions to get hold of clickstream data sets with higher volume and variety. These data sets, when managed properly using clickstream analytics solutions, can provide actionable insights to organizations. These insights help organizations to take quick decision and provide customer-centric solutions. In the past few years, web analytics has become a big thing in the technological landscape. Moreover, cost-effectiveness of clickstream analytics solutions and their secure data assurance have led the clickstream analytics market toward the higher side of the market graph. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Clickstream Analytics Market Dynamics

Drivers

- Rise in ecommerce leading to unprecedented growth in consumer data

- Predictive analytics for businesses rapid adoption of mobile technology providing multiple digital touchpoints

Restraints

- Data privacy laws and regulations

- Presence of open source clickstream analytics vendors

Opportunities

- Multichannel marketing

- Emerging trend of predictive marketing

Challenges

- Data Collection and Identifying Business Requirements

- Real-Time Clickstream Data Analysis

Increasing adoption of clickstream analytics across retail and eCommerce organizations would drive the market growth

Clickstream analytics solutions have been deployed across various verticals, including retail and eCommerce; media and entertainment; telecommunications and IT; travel and hospitality; Banking, Financial Services, and Insurance (BFSI); transportation and logistics; government; energy and utilities; and others (manufacturing, healthcare and life sciences, and education). The retail and eCommerce vertical is expected to witness the growth at the highest CAGR during the forecast period, because of the rise in eCommerce across all regions and increasing need for managing real-time data coming from various eCommerce activities. Further, clickstream analytics also helps to predict demand for resources, supplies, inventory, and equipment with a user-friendly interface

Following are the objectives of the report:

- To define, describe, and forecast the clickstream analytics market on the basis of types, services, applications, organization size, deployment models, verticals, and regions

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze subsegments with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and to provide the details of a competitive landscape for the major players

- To forecast the revenue of market segments with respect to all the major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To profile key players and comprehensively analyze their recent developments and positioning

- To analyze competitive developments, such as acquisitions, new product launches, and research and development activities in the market

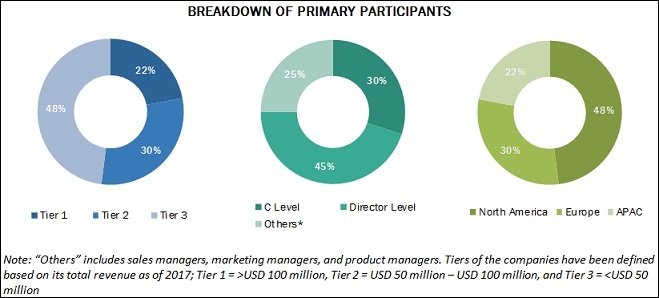

During this research study, major players operating in the clickstream analytics market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The clickstream analytics ecosystem comprises key vendors, such as Adobe Systems (US), AT Internet (US), Google (US), IBM Corporation (US), Microsoft Corporation (US), Oracle Corporation (US), SAP SE (Germany), Connexity (US), Hewlett Packard Enterprise (US), Jumpshot (US), Splunk (US), Talend (US), Verto Analytics (Finland), Webtrends Corporation (US), and Vlocity, Inc (US). Other stakeholders of the clickstream analytics market include analytics service providers, consulting service providers, Information Technology (IT) service providers, resellers, enterprise users, and technology providers. These Clickstream Analytics Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Clickstream Analytics Software.

Major Clickstream Analytics Market Developments

-

In May 2017, Adobe formed a partnership with Idea Cellular in order to help the mobile operator deliver personalized customer experiences to its customers. The partnership incorporates deployment of Adobe experience cloud including Adobe Analytics Cloud, Adobe Advertising Cloud, and Adobe Marketing Cloud.

-

In May 2017, Google added Google Analytics Settings Variables settings to Universal Analytics tags in the Web and Mobile containers. A Google Analytics Settings Variable acts as a central location to configure sets of Google Analytics settings for use across multiple tags. With this addition, users can focus on their core task, rather than on configuring settings.

-

In September 2016, IBM introduced new features and enhancements into its Digital Analytics platform including improvements in clickstream reports. Clickstream reports can now show correct numeric formats, and sessions can expand up to 5 nodes of depth.

Target Audience

- Solution vendors

- Original equipment manufacturers

- System integrators

- Advisory firms

- National regulatory authorities

- Venture capitalists

- Private equity groups

- Investment houses

- Equity research firms

Scope of the Report

The research report categorizes the clickstream analytics market to forecast the revenues and analyze the trends in each of the following sub segments:

By type

- Software

- Services

By service

- Managed services

- Professional services

- Consulting services

- Deployment and integration

- Support and maintenance

By application

- Click path optimization

- Website/application optimization

- Customer analysis

- Basket analysis and personalization

- Traffic analysis

- Others

By organization size

- Small and medium-sized enterprises

- Large enterprises

By deployment model

- On-premises

- On-demand

By industry vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and IT

- Travel and hospitality

- Retail and eCommerce

- Government

- Energy and utilities

- Media and entertainment

- Transportation and logistics

- Others

By region

- North America

- Europe

- APAC

- Latin America

- MEA

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American clickstream analytics market

- Further breakdown of the European clickstream analytics market

- Further breakdown of the APAC clickstream analytics market

- Further breakdown of the MEA clickstream analytics market

- Further breakdown of the Latin American clickstream analytics market

Company Information

The overall clickstream analytics market is expected to grow from USD 750.3 Million in 2017 to USD 1,560.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 15.8% from 2017 to 2022. The major growth drivers of the clickstream analytics market include rise in eCommerce leading to unprecedented growth in consumer data and rapid adoption of mobile technology providing multiple digital touchpoints.

The increasing volume and variety of clickstream data has created new opportunities for organizations to transform the way they manage their businesses. It results in enhanced customer satisfaction, increased revenue, and reduced costs. Clickstream analytics solutions and services offer crucial benefits to enterprises, such as cutting inevitable losses, creating new opportunities, saving costs by ensuring uninterrupted operations, and increasing efficiency by analyzing clickstream data in real-time. Major drivers of the clickstream analytics market are rise in eCommerce leading to unprecedented growth in consumer data and rapid adoption of mobile technology providing multiple digital touchpoints. The clickstream analytics market faces challenges such as data collection and identification of business requirements and real-time clickstream analytics. Major factors that are restraining the growth of the clickstream analytics market are data privacy laws and regulations, and presence of several open source clickstream analytics solutions in the market. The various opportunities present in this market include multi-channel marketing and emerging trend of predictive marketing.

The clickstream analytics market is segmented by software and services. The services segment is expected to grow at the highest CAGR during the forecast period, out of which the consulting services subsegment in the professional services segment is projected to witness the highest demand due to the growing need of clickstream analytics solutions across organizations.

The retail and eCommerce vertical is estimated to hold the largest share of the clickstream analytics market in 2017. The market growth in the retail and eCommerce vertical is fueled by the growing need for eCommerce across all regions. Clickstream analytics solutions and services offer crucial benefits to the retail and eCommerce vertical, such as cutting inevitable losses, creating new opportunities, saving costs by ensuring uninterrupted operations, and increasing efficiency by analyzing clickstream data in real time.The retail and eCommerce vertical is also expected to grow at the highest CAGR during the forecast period.

The clickstream analytics market is segmented by application into click path optimization, website/application optimization, customer analysis, basket analysis and personalization, traffic analysis, and others (competition benchmarking and next best product analysis). The click path optimization application is expected to hold the largest share of the market during the forecast period. The basket analysis and personalization application is expected to grow at the highest CAGR during the forecast period.

The North American region, followed by Europe, is expected to continue as the largest revenue-generating region for clickstream analytics vendors over the next five years, as enterprises in the U.S. and Canada have a high focus on innovations obtained from research and development, and technology. The APAC region is expected to be the fastest-growing region in the global clickstream analytics market because of the increasing adoption of eCommerce and smart technologies, and various government initiatives, such as smart cities across the APAC countries, including China and India.

CLICKSTREAM ANALYTICS MARKET, BY REGION, 2022 (USD BILLION)

Clickstream Analytics applications in retail and eCommerce, media and entertainment, telecommunications and IT, and travel and hospitality drive the market growth

Retail and eCommerce

Retail and eCommerce customers use different platforms for online shopping, and collect information regarding their products of interest among various others. In doing so, they leave behind large trails of digital footprints while engaging in eCommerce interactions. Clickstream analytics can be used to generate valuable business insights from these digital footprints or data logs of customers collected from the online platforms. The clickstream data including data logs captured from online platforms when integrated with structured ERP and CRM data, web media, geo-location, and POS transactional data, specific outbound actions such as customized coupons, promotions, and email campaigns can be created according to predicted customers interests. Clickstream data gives retailers and marketers a 360° view of its customers, based on multiple dimensions including shopping basket analysis, preferences expressed on social media platforms, and feedback from marketing campaigns. With

Media and entertainment

The media comprises news channels, radio, magazines, newspapers, direct mail, billboards, telephone, fax, and internet. The data collected through these channels is in the form of large amount which needs to be analyzed. Clickstream analytics solutions allow to analyze all the data generated through customers clicks and follow their path to connect with the customers. Additionally, the clickstream analytics solution expected to generate large revenues from devices such as desktop PCs, smartphones, tablets, e-readers, TVs, games consoles, and wearable gadgets. The media and entertainment industry has been implementing the advanced technologies to analyze its data, in which clickstream data has the largest share.

Telecommunications and IT

By tracking and analyzing their customers clicks, Communication Service Providers (CSPs) can understand their preferences and buying behavior. Combining this data with customer call logs, usage and customer satisfaction data, and social media data, CSPs can have better understanding of their customer preferences and behavior, and they can make adequate recommendations including cross-selling new services, pricing plans, or make targeted offers. Further, CSPs can use clickstream data to calculate the speed of downloaded data. Analysis of this data provides the CSP the opportunity to understand throughput speeds at the tower level, as well as handset speeds.

Travel and hospitality

Clickstream analytics can prove to be an effective tool for travel and hospitality companies by enabling them to measure the performance of their online marketing campaigns; track their existing customers and target potential customers on different social media platforms; and effectively optimize the content and user interface of their websites to provide an enhanced customer experience. Further, combining the customer data captured as clickstream data with the CRM processes and ERP, companies in these industries can optimize their marketing efforts, business operations, provide innovative services to their customers and build on their customer experiences.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for clickstream analytics?

With many compelling features over the restrictions of proprietary solutions, open source clickstream analytics solutions have a noticeable impact on these solutions. A leading market research organizations recent publication revealed that open source solutions are influencing the technology domain, with their key advantages over the challenges of proprietary solutions, including low satisfaction, implementation challenges, high prices, and user concerns about the lack of transparency in the pricing of proprietary solutions. Many open source clickstream analytics solutions have observed a significant growth in interest, in terms of search volumes and growth rates far exceeding those of the proprietary vendors.

Major vendors that offer clickstream analytics software and services globally are Adobe Systems (US), AT Internet (US), Google (US), IBM Corporation (US), Microsoft Corporation (US), Oracle Corporation (US), SAP SE (Germany), Connexity (US), Hewlett Packard Enterprise (US), Jumpshot (US), Splunk (US), Talend (US), Verto Analytics (Finland), Webtrends Corporation (US), and Vlocity, Inc (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Clickstream Analytics Market

4.2 Market Share Across Various Regions

4.3 Market Verticals and Regions

4.4 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Market Overview

5.1.1 Introduction

5.1.2 Market Dynamics

5.1.2.1 Drivers

5.1.2.1.1 Rise in Ecommerce Leading to; Unprecedented Growth in Consumer Data

5.1.2.1.2 Rapid Adoption of Mobile Technology Providing Multiple Digital Touchpoints

5.1.2.2 Restraints

5.1.2.2.1 Data Privacy Laws and Regulations

5.1.2.2.2 Presence of Open Source Clickstream Analytics Vendors

5.1.2.3 Opportunities

5.1.2.3.1 Multichannel Marketing

5.1.2.3.2 Emerging Trend of Predictive Marketing

5.1.2.4 Challenges

5.1.2.4.1 Data Collection and Identifying Business Requirements

5.1.2.4.2 Real-Time Clickstream Data Analysis

5.2 Industry Trends

5.2.1 Introduction

5.2.2 Clickstream Analytics USE Cases

5.2.2.1 Introduction

5.2.2.2 USE Case #1: Traffic Analysis

5.2.2.3 USE Case #2: Website Optimization

5.2.2.4 USE Case #3: Basket Analysis and Personalization

5.2.2.5 USE Case #4: Customer Analysis

5.2.3 Clickstream Analytics, By Architecture

6 Clickstream Analytics Market Analysis, By Type (Page No. - 48)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Professional Services

6.3.1.1 Deployment and Integration

6.3.1.2 Support and Maintenance

6.3.1.3 Consulting Services

6.3.2 Managed Services

7 Clickstream Analytics Market Analysis, By Business Application (Page No. - 57)

7.1 Introduction

7.2 Click Path Optimization

7.3 Customer Analysis

7.4 Website/Application Optimization

7.5 Basket Analysis and Personalization

7.6 Traffic Analysis

7.7 Others

8 Clickstream Analytics Market Analysis, By Deployment Model (Page No. - 64)

8.1 Introduction

8.2 On-Premises

8.3 On-Demand

9 Clickstream Analytics Market Analysis, By Organization Size (Page No. - 68)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Clickstream Analytics Market Analysis, By Vertical (Page No. - 72)

10.1 Introduction

10.2 Retail and Ecommerce

10.3 Media and Entertainment

10.4 Telecommunications and It

10.5 Travel and Hospitality

10.6 Banking, Financial Services, and Insurance

10.7 Transportation and Logistics

10.8 Government

10.9 Energy and Utilities

10.10 Others

11 Geographic Analysis (Page No. - 82)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Latin America

11.6 Middle East and Africa

12 Competitive Landscape (Page No. - 102)

12.1 Microquadrant Overview

12.1.1 Innovators

12.1.2 Vanguards

12.1.3 Emerging

12.1.4 Dynamics

12.2 Microquadrant

12.3 Clickstream Analytics Market: Product Offering

12.4 Clickstream Analytics Market: Business Strategy

13 Company Profiles (Page No. - 106)

13.1 Adobe

13.2 AT Internet

13.3 Google

13.4 IBM

13.5 Microsoft

13.6 Oracle

13.7 SAP

13.8 Connexity

13.9 HPE

13.10 Jumpshot

13.11 Splunk

13.12 Talend

13.13 Verto Analytics

13.14 Webtrends

13.15 Vlocity

14 Appendix (Page No. - 156)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 Clickstream Analytics Market Size, By Type, 20152022 (USD Million)

Table 2 Software: Market Size, By Region, 20152022 (USD Million)

Table 3 Clickstream Analytics Market Size, By Service, 20152022 (USD Million)

Table 4 Services: Market Size, By Region, 20152022 (USD Million)

Table 5 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 6 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 7 Deployment and Integration Market Size, By Region, 20152022 (USD Million)

Table 8 Support and Maintenance Services Market Size, By Region, 20152022 (USD Million)

Table 9 Consulting Services Market Size, By Region, 20152022 (USD Million)

Table 10 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 11 Clickstream Analytics Market Size, By Business Application, 20152022 (USD Million)

Table 12 Click Path Optimization Market Size, By Region, 20152022 (USD Million)

Table 13 Customer Analysis Market Size, By Region, 20152022 (USD Million)

Table 14 Website/Application Optimization Market Size, By Region, 20152022 (USD Million)

Table 15 Basket Analysis and Personalization Market Size, By Region, 20152022 (USD Million)

Table 16 Traffic Analysis Market Size, By Region, 20152022 (USD Million)

Table 17 Other Business Applications Market Size, By Region, 20152022 (USD Million)

Table 18 Clickstream Analytics Market Size, By Deployment Model, 20152022 (USD Million)

Table 19 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 20 On-Demand: Market Size, By Region, 20152022 (USD Million)

Table 21 Clickstream Analytics Market Size, By Organization Size, 20152022 (USD Million)

Table 22 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 23 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 24 Clickstream Analytics Market Size, By Vertical, 20152022 (USD Million)

Table 25 Retail and Ecommerce: Market Size, By Region, 20152022 (USD Million)

Table 26 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 27 Telecommunications and It: Market Size, By Region, 20152022 (USD Million)

Table 28 Travel and Hospitality: Market Size, By Region, 20152022 (USD Million)

Table 29 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 30 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 31 Government: Market Size, By Region, 20152022 (USD Million)

Table 32 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 33 Others: Market Size, By Region, 20152022 (USD Million)

Table 34 Clickstream Analytics Market Size, By Region, 20152022 (USD Million)

Table 35 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 36 North America: Market Size, By Type, 20152022 (USD Million)

Table 37 North America: Market Size, By Service, 20152022 (USD Million)

Table 38 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 39 North America: Market Size, By Business Application, 20152022 (USD Million)

Table 40 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 41 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 42 Europe: Clickstream Analytics Market Size, By Vertical, 20152022 (USD Million)

Table 43 Europe: Market Size, By Type, 20152022 (USD Million)

Table 44 Europe: Market Size, By Service, 20152022 (USD Million)

Table 45 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 46 Europe: Market Size, By Business Application, 20152022 (USD Million)

Table 47 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 48 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 49 Asia Pacific: Clickstream Analytics Market Size, By Vertical, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size, By Business Application, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 55 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 56 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 57 Latin America: Clickstream Analytics Market Size, By Type, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Business Application, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 63 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 64 Middle East and Africa: Market Size, By Type, 20152022 (USD Million)

Table 65 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 66 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 67 Middle East and Africa: Market Size, By Business Application, 20152022 (USD Million)

Table 68 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 69 Middle East and Africa: Clickstream Analytics Market Size, By Organization Size, 20152022 (USD Million)

List of Figures (73 Figures)

Figure 1 Clickstream Analytics Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Evaluation Criteria

Figure 9 Clickstream Analytics Market: Assumptions

Figure 10 Market is Poised to Witness Growth in the Global Market During 20172022

Figure 11 Market Snapshot on the Basis of Types (2017 vs. 2022)

Figure 12 Market Snapshot on the Basis of Service (20172022)

Figure 13 Market Snapshot on the Basis of Professional Service (20172022)

Figure 14 Market Snapshot on the Basis of Business Application (20172022)

Figure 15 Market Snapshot on the Basis of Deployment Model (20172022)

Figure 16 Market Snapshot on the Basis of Organization Size (20172022)

Figure 17 Market Snapshot on the Basis of Vertical (2017 vs. 2022)

Figure 18 Increasing Volume and Variety of Business Data is the Major Factor Contributing to the Growth of the Clickstream Analytics Market

Figure 19 North America is Expected to Hold the Largest Market Share in 2017

Figure 20 Retail and Ecommerce Vertical is Expected to Have the Largest Market Size in 2017

Figure 21 North America and Europe to Enter Maturity Phase During 20172022

Figure 22 Clickstream Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Clickstream Analytics Architecture

Figure 24 Services Segment is Expected to Have A Larger CAGR During the Forecast Period

Figure 25 Managed Services Segment is Expected to Have A Higher CAGR During the Forecast Period

Figure 26 Consulting Services Segment is Expected to Have the Highest CAGR During the Forecast Period

Figure 27 Basket Analysis and Personalization Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 On-Demand Deployment Model is Expected to Have A Higher CAGR During the Forecast Period

Figure 29 Small and Medium-Sized Enterprises Segment is Expected to Have the Higher CAGR During the Forecast Period

Figure 30 Retail and Ecommerce Vertical is Expected to Have the Largest Market Share and the Highest CAGR During the Forecast Period

Figure 31 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia Pacific is Expected to Have the Highest CAGR in the Clickstream Analytics Market During the Forecast Period

Figure 33 North America Market Snapshot

Figure 34 Asia Pacific Market Snapshot

Figure 35 Adobe: Company Snapshot

Figure 36 Adobe: Product Offering Scorecard

Figure 37 Adobe: Business Strategy Scorecard

Figure 38 AT Internet: Product Offering Scorecard

Figure 39 AT Internet: Business Strategy Scorecard

Figure 40 Google: Company Snapshot

Figure 41 Google: Product Offering Scorecard

Figure 42 Google: Business Strategy Scorecard

Figure 43 IBM: Company Snapshot

Figure 44 IBM: Product Offering Scorecard

Figure 45 IBM: Business Strategy Scorecard

Figure 46 Microsoft Corporation: Company Snapshot

Figure 47 Microsoft: Product Offering Scorecard

Figure 48 Microsoft: Business Strategy Scorecard

Figure 49 Oracle Corporation: Company Snapshot

Figure 50 Oracle: Product Offering Scorecard

Figure 51 Oracle: Business Strategy Scorecard

Figure 52 SAP: Company Snapshot

Figure 53 SAP: Product Offering Scorecard

Figure 54 SAP: Business Strategy Scorecard

Figure 55 Connexity: Product Offering Scorecard

Figure 56 Connexity: Business Strategy Scorecard

Figure 57 HPE: Company Snapshot

Figure 58 HPE: Product Offering Scorecard

Figure 59 HPE: Business Strategy Scorecard

Figure 60 Jumpshot: Product Offering Scorecard

Figure 61 Jumpshot: Business Strategy Scorecard

Figure 62 Splunk: Company Snapshot

Figure 63 Splunk: Product Offering Scorecard

Figure 64 Splunk: Business Strategy Scorecard

Figure 65 Talend S.A.: Company Snapshot

Figure 66 Talend: Product Offering Scorecard

Figure 67 Talend: Business Strategy Scorecard

Figure 68 Verto Analytics: Product Offering Scorecard

Figure 69 Verto Analytics: Business Strategy Scorecard

Figure 70 Webtrends: Product Offering Scorecard

Figure 71 Webtrends: Business Strategy Scorecard

Figure 72 Vlocity: Product Offering Scorecard

Figure 73 Vlocity: Business Strategy Scorecard

Growth opportunities and latent adjacency in Clickstream Analytics Market