Clean Room Robot Market Size, Share, Industry Growth, Trends & Analysis by Type (Articulated, SCARA, Collaborative Robots), End User (Aerospace, Electrical & Electronics, Food & Beverage), Component (Robotic Arm, End Effector), and Region

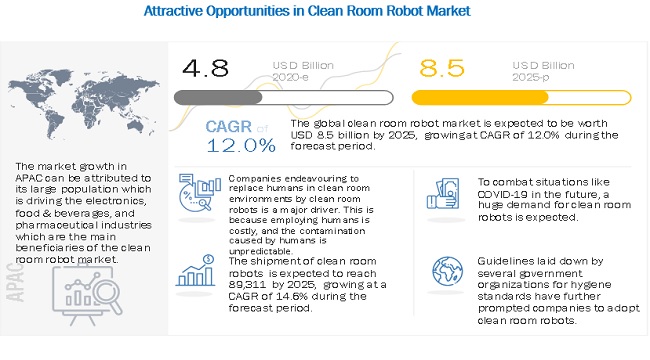

The global clean room robot market Size, Share, Industry Growth, Trends & Analysis is projected to grow from USD 4.8 billion in 2020 to USD 8.5 billion by 2025; it is expected to grow at a CAGR of 12.0% during 2020–2025.

The clean room robots are widely used in electronics industry. In the semiconductor industry, thin-film technology is used to manufacture microprocessors, sensors, and flash memory. A single particle finding its way into a hard drive or a CPU during manufacturing is enough to render the product useless.

Therefore, companies are eager to minimize the risk and are opting for clean rooms, which must be ISO Class 4 or cleaner. Computer processors start out as silicon wafers, which are subjected to intense vacuums, high energy plasmas, and ultraviolet light. These processes are not human friendly; therefore, the demand for clean room robots is increasing in the semiconductor industry to help in moving the wafers from one processing station to another.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on current clean room robot market size and forecast

The emergence of COVID-19, a deadly respiratory disease that originated in China, has now become a global pandemic and has affected the clean room robot market. The Q1 revenue of 2020 of clean room robot manufacturers such as FANUC (Japan), YASKAWA (Japan), ABB (Switzerland), KUKA (Germany), and Mitsubishi Electric (Japan) fell by 7%, 14%, 21%, 19%, and 9%, respectively, due to COVID-19.

The food & beverages and pharmaceuticals & cosmetics industries did not see much decline in demand; however, due to lack of workers, the industries faced challenges in meeting the demand. Therefore, to be ready for situations such as COVID-19 in the future, companies are expected to adopt more robots and become less dependent on humans. Other industries such as electrical & electronics and aerospace saw a decline in demand due to the financial crisis caused by COVID-19. For instance, Samsung Electronics (South Korea) saw a decline of 7.6% in its first-quarter revenue for 2020 as compared to the previous year. This decline was especially evident for luxury products, such as electronic equipment. Therefore, such industries are not expected to invest in industrial robots until they recuperate. In the long term, all industries are expected to adopt more robots to reduce their dependency on humans to cope with situations like COVID-19. Therefore, in the long term, demand for clean room robots is also expected to grow substantially.

In order to be future-ready for pandemics such as COVID-19, companies are moving toward automation and are reducing dependency on humans for operation. Articulated robots which have the maximum number of joints, and the highest degree of freedom, can be the most versatile and most autonomous. Due to this independency, articulated robots are expected to be adopted at the highest rate to cope with situations like COVID-19. Conversely, collaborative robots may see a decrease in demand due to their dependence on humans. But in the short term, the demand may not fall much as companies may prefer them due to their low cost during this economic crisis caused by COVID-19.

Clean Room Robot Market Dynamics

Driver: Need to pass goods and materials between areas of different environmental grades through material air locks (MAL)

In clean rooms, goods and materials need to be transferred between areas of different environmental grades through MAL. In this process, goods and materials need to be cleaned with isopropyl alcohol (IPA) to prevent the transfer of impurities.

When inhaled or absorbed by humans, IPA can have life-threatening effects, such as affecting the central nervous system, which controls the involuntary actions of the body, including heartbeat, breathing, and gag reflex. IPA causes blood’s thinning, which causes blood sugar levels to fall, which can eventually lead to seizures. Therefore, considering human safety, companies are moving toward clean room robots.

Also, production in a clean room environment reduces the requirement of IPA for cleaning. IPA has several other disadvantages apart from harming human health. For instance, IPA is not effective on non-polar contaminants. IPA also absorbs moisture from the environment and increases the risk of corrosion and electrical leakage when left on precision assemblies. When exposed to the air, IPA will absorb moisture rapidly until it reaches an equilibrium value of 65% IPA to 35% water. Plastic films used as anti-glare coatings on computer monitor screens can be especially sensitive to even mild alcohol dilutions. Therefore, clean room environments and robots are adopted by companies to reduce their dependency on IPA.

Restraint: High installation cost of industrial robots, especially for small and medium-sized enterprises

The high installation cost of industrial clean room robots, especially for small and medium-sized enterprises, is the main restraint for the adoption of industrial clean room robots.

Industrial robots, along with controllers and teach pendants, are priced in the range of USD 50,000 and USD 80,000. With the addition of application-specific peripherals, the robot system costs between USD 100,000 and USD 150,000. There are further costs in setting up the robot. Robots require heavy-duty, purpose-built pedestals, which can cost several thousand dollars. Unless the robot is collaborative, it requires a cage for the safety of the workers. The cage will need some safety equipment, such as an emergency stop button and safety sensors.

This further adds to the cost. Also, often, end effectors are not readily available and need to be customized according to the application, which increases the cost of the end effector. The robot needs to work with more than one end effector. This requires investments in a tool changer. Tool changers are expensive and add almost 30% more to the initial cost of the robot. The robot also requires fixtures and contraptions for holding the parts on which the robot is working.

These fixtures and contraptions also need to be specific to the manufacturing process. Additionally, the robot would need to be equipped with vision systems and lighting. In the final stage, the robot needs to be programmed, and programmable logic controllers (PLCs) or embedded computers need to be selected according to the application. Customers are often unaware of how to set up and integrate robots with the above-mentioned peripherals, so they hire integration companies. Hiring these companies costs twice the total of all the parts involved. This high cost makes the adoption of robots difficult in small and medium-sized companies.

Opportunity: Increasing adoption of collaborative robots for cleanroom applications

The air in a clean room is purified using high-efficiency particulate air (HEPA) filters to achieve the required environmental conditions. Air is forced through the filters, which remove particles as small as 0.5 micron. The filtration system depends on the required level of cleanliness.

Therefore, to maintain a clean room, space is required. As a result, companies try to optimize the use of space for clean room applications. As collaborative robots do not require cages around them and save space, they are preferred to traditional industrial robots. UR3, UR5, and UR10 are collaborative robots offered by Universal Robots (Denmark) for clean room applications and are ISO Class 5 certified. These robots are extensively being used in food, semiconductor, electrical, and optoelectronic industries. Therefore, the adoption of such collaborative robots for clean room applications is expected.

Challenge: Interoperability and integration issues with industrial robots

Interoperability is an important function in any factory or manufacturing unit. A modular framework is required for both hardware and software to connect and coordinate various automation systems. The focus here is on the software side, which is used for programming, diagnosing, and monitoring.

Companies often use robot arms from different manufacturers and may also need to reprogram robots due to a change in production and demand or to accommodate different parts, such as vision systems and end effectors. The integrator, rather than the manufacturer or end user, is responsible for deciding the implementation and set up or programming of the robot. Interoperability issues present a big challenge, especially to SMEs, due to their unique requirements and lack of personnel to set up a complex automation setup.

The integration of robots into existing facilities can be difficult and expensive. Due to the advent of IIoT, more and more heterogeneous systems need to be integrated on the manufacturing floor. In addition, because most industrial machines were not designed to connect to the Internet, they do not have the proper security in place to protect data from being stolen or equipment from being hacked. Many systems are also unable to talk to the cloud or support bidirectional communications. This adds to the challenge of the integration and interoperability of industrial robots.

Clean Room Robot Market Segment Overview

Market for end effectors is expected to grow at highest CAGR during forecast period

Market for end effectors is expected to grow at highest CAGR during forecast period, as end effectors are expected to be the key in expanding the scope of the applications performed by a robot. End effector manufacturers are developing grippers, soldering guns, and robotic screwdrivers for robots.

A robotic system costs anywhere from USD 150,000 to USD 200,000 when including the price of the robot, end effectors, peripherals, safety components, etc. Depending on the application, the price of end effectors ranges from USD 500 to USD 10,000. Hence, end effectors contribute anywhere from 0.3% to 17% of the overall cost of a robotic system.

Market for food & beverages industry is expected to grow at highest CAGR during forecast period

Food & beverages industry is expected to grow at highest CAGR during the forecast period. This is due to companies striving to be future ready for pandemics like COVID-19, by reducing contamination caused by humans.

In food and beverages industry robots are largely used for primary packaging (loading food products into their packaging). Therefore, robots generally have a payload capacity up to 10 Kg. SCARA (Selective Compliance Assembly Robot Arm) robots are being widely adopted for food processing. Their low cost, small footprint and high throughput rates make them attractive.

To know about the assumptions considered for the study, download the pdf brochure

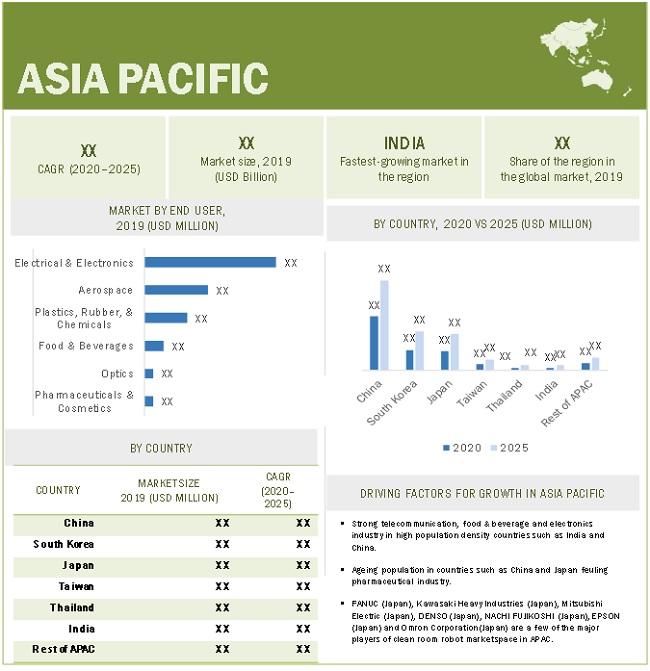

Clean room robot market in APAC expected to grow at highest CAGR during forecast period

The APAC market is also expected to grow at the fastest CAGR during the forecast period due to the presence of developing countries such as India and China, which are not yet saturated in terms of development and demand and therefore have scope for establishing new manufacturing plants.

Due to the aging population in countries such as China and Japan, there is a huge demand for clean room robots in the pharmaceutical industry. Also, APAC countries have a strong IT industry due to the availability of a cheap workforce. For instance, according to India’s Ministry of Commerce & Industry, in January 2020, Nippon Telegraph and Telephone, a Japanese tech announced its plans to invest a significant part of its USD-7-billion global commitment for a data center business in India over the next years.

This is expected to further increase the demand for clean room robots in the optics industry. Due to the large population, the food & beverage industry is also flourishing in APAC. According to the Population Reference Bureau, in 2019, China had the largest population, followed by India.

Clean Room Robot Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 4.8 billion |

| Revenue Forecast in 2025 | USD 8.5 billion |

| Growth Rate | 12.0% |

|

Market Size Available for Years |

2017-2025 |

|

Base year |

2019 |

|

Forecast Period |

2020-2025 |

|

Units |

Value (USD million/billion) and Volume (Units) |

|

Segments Covered |

Type, component, end user and geography. |

|

Geographic Regions Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

ABB (Switzerland), YASKAWA (Japan), FANUC (Japan), Kawasaki Heavy Industries (Japan), KUKA (Germany), Mitsubishi Electric (Japan), DENSO (Japan), NACHI-FUJIKOSHI (Japan), EPSON (Japan), OMRON Corporation (Japan), Universal Robots (Denmark), Aerotech (US), IAI (Japan), Staubli (Switzerland), Comau (Italy), Yamaha (Japan), Hirata (Japan), S T Robotics (US), Techman Robot (Taiwan) and Rethink Robotics (US) |

This report categorizes the clean room robot market based on type, component, industry and geography.

By Type:

-

Traditional industrial robots

- Articulated Robots

- SCARA Robots

- Parallel Robots

- Cartesian Robots

- Collaborative robots

- COVID-19 impact on various types of clean room robots

By Component:

- Robotic Arm

-

End Effectors

- Grippers

- Vacuum Cups

- Clamps

-

Drives

- Pneumatic

- Electric

- Controllers

- Sensors

- Power Supply

- Motors

- Others

- COVID-19 impact on various types of components

By End User:

- Aerospace

- Electrical and Electronics

- Plastics, Rubber, and Chemicals

- Food and Beverages

- Optics

- Pharmaceuticals and Cosmetics

- COVID-19 impact on various industries

By Geography:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- Italy

- Spain

- France

- UK

- Rest of Europe

-

APAC

- China

- South Korea

- Japan

- Taiwan

- Thailand

- India

- Rest of APAC

-

RoW

- South America

- Middle East and Africa

- COVID-19 impact on various regions

Cleanroom Robot Related Standards and Ratings (Qualitative)

- ISO Cleanroom Standards (ISO Class 1–ISO Class 9)

- Ingress Protection (IP XX) Ratings

Key Market Players in Clean Room Robot Industry

Major companies in the clean room robot market are ABB (Switzerland), YASKAWA (Japan), FANUC (Japan), Kawasaki Heavy Industries (Japan), KUKA (Germany), Mitsubishi Electric (Japan), DENSO (Japan), NACHI-FUJIKOSHI (Japan), EPSON (Japan), OMRON Corporation (Japan), Universal Robots (Denmark), Aerotech (US), IAI (Japan), Staubli (Switzerland), Comau (Italy), Yamaha (Japan), Hirata (Japan), S T Robotics (US), Techman Robot (Taiwan) and Rethink Robotics (US)

ABB is one of the market leaders in the industrial robotics segment and plans to focus more on the industrial automation business in the future. In December 2018, ABB announced that it had sold off its Power Grid business to Hitachi (Japan). The divestment is expected to be completed by 2020. This enabled ABB to offload its least profitable business division and focus more on industrial automation. The company has a significant presence across China and has invested in a new robotics factory in the country to further increase its market share and presence in the coming years. The company can make its clean room robots more cost effective by providing the option to make only certain parts of the robot clean room compliant instead of the whole robot.

Recent Developments in Clean Room Robot

- In December 2019, ABB (Switzerland) launched the clean room version of IRB 1100 with the entire body being certified with IP67 rating. The robot is suitable for applications generating substantial dust, water, and debris, including 3C polishing, wet grinding, buffing, and deburring.

- In August 2019, KUKA (Germany) launched a mobile clean room robot for the manufacture of semiconductor wafers. The mobile robot helps in the transfer of wafers from one step to another. The mobile manipulation application consists of a standardized automated guided vehicle (AGV) and the proven LBR iiwa lightweight robot. Mobility is provided by the KMR 200 CR mobile platform.

- In January 2019, NACHI-FUJUKOSHI (Japan) launched the ultracompact robot model MZ01 designed to meet space-saving demands in the electric machinery, electronics, and EMS fields for applications that involve the handling of small component workpieces weighing around 100 g. MZ01 is ISO Class 5 certified and is suitable for clean room applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

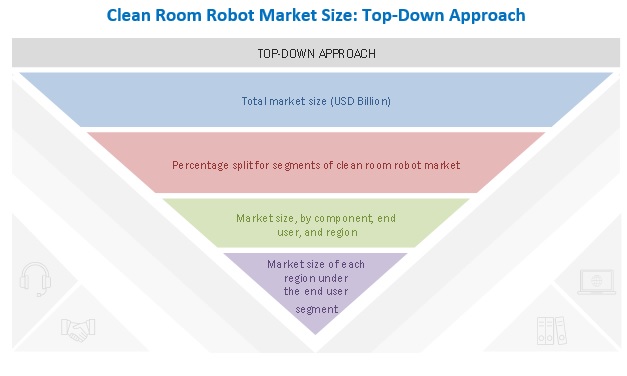

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN CLEAN ROOM ROBOT MARKET

4.2 CLEANROOM ROBOT MARKET, BY COMPONENT

4.3 CLEAN ROOM ROBOT MARKET IN APAC, BY END USER VS. BY COUNTRY

4.4 CLEAN ROOM ROBOT MARKET, BY TYPE

4.5 CLEAN ROOM ROBOT MARKET, BY END USER

4.6 CLEAN ROOM ROBOT MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand for contaminant-free machines and equipment in clean rooms

5.2.1.2 Need to pass goods and materials between areas of different environmental grades through material airlocks (MAL)

5.2.1.3 Anticipated shortage of skilled workforce in manufacturing industries due to restrictions on migration due to COVID-19

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of industrial robots, especially for small and medium-sized enterprises

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of collaborative robots for clean room applications

5.2.3.2 Accelerating spread of COVID-19 prompting several end users to adopt automation technologies

5.2.4 CHALLENGES

5.2.4.1 Interoperability and integration issues with industrial robots

5.2.4.2 Difficulties faced by start-up companies to demonstrate their products virtually

5.3 USE CASES

5.3.1 VS-087 CLEAN ROOM ROBOT MANUFACTURED BY DENSO (JAPAN) USED BY FRAUNHOFER INSTITUTE FOR PRODUCTION TECHNOLOGY IPT (GERMANY) FOR STEM CELL RESEARCH

5.3.2 GLOBALFOUNDARIES (SINGAPORE) ADOPTED OMRON CORPORATION’S (JAPAN) LD-90 MOBILE ROBOTS FOR MANUFACTURING SEMICONDUCTOR WAFERS

5.3.3 NASA USING CLEAN ROOM ROBOTS FOR RESEARCHING SAMPLES OBTAINED FROM MARS

5.4 CLEAN ROOM ROBOT-RELATED REGULATIONS AND STANDARDS

5.4.1 ISO CLEAN ROOM STANDARDS (ISO CLASS 1–ISO CLASS 9)

TABLE 2 PARTICLES (TAKING SIZE IN CONSIDERATION) PER METER CUBE FOR ISO 14644-1 AND FED 209E STANDARDS

5.4.2 INGRESS PROTECTION (IP XX) RATINGS

TABLE 3 INTERPRETATION OF FIRST DIGIT IN IP RATING

TABLE 4 INTERPRETATION OF SECOND DIGIT IN IP RATING

6 INDUSTRY TRENDS (Page No. - 64)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.3 ECOSYSTEM AND MARKET MAP

6.4 TECHNOLOGY TRENDS

6.4.1 INTEGRATION WITH IIOT, CLOUD TECHNOLOGY, AND PREDICTIVE MAINTENANCE

6.4.2 INTEGRATION WITH AI

6.4.3 INTEGRATION WITH 5G NETWORKS

6.5 PATENT ANALYSIS

TABLE 5 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS

6.5.1 PUBLICATION TRENDS

7 CLEANROOM ROBOT MARKET, BY TYPE (Page No. - 71)

7.1 INTRODUCTION

TABLE 6 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY TYPE, 2017–2025 (USD MILLION)

TABLE 7 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY TYPE, 2017–2025 (USD MILLION)

TABLE 8 CLEAN ROOM ROBOT MARKET, BY TYPE, 2017–2025 (UNITS)

7.2 TRADITIONAL INDUSTRIAL ROBOTS

TABLE 9 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR TRADITIONAL INDUSTRIAL ROBOTS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 10 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR TRADITIONAL INDUSTRIAL ROBOTS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 11 CLEAN ROOM ROBOT MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY TYPE, 2017–2025 (UNITS)

TABLE 12 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (USD MILLION)

TABLE 13 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (USD MILLION)

TABLE 14 CLEAN ROOM ROBOT MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 15 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR TRADITIONAL INDUSTRIAL ROBOTS, BY COMPONENT, 2017–2025 (USD MILLION)

7.2.1 ARTICULATED ROBOTS

7.2.1.1 Articulated robots have highest payload capacity among other types of robots and can exceed 1,000 kg

7.2.1.2 Average selling price of articulated robots

TABLE 16 ARTICULATED ROBOTS: SUMMARY TABLE

TABLE 17 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ARTICULATED ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 18 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ARTICULATED ROBOTS, BY END USER, 2017–2025 (USD MILLION)

TABLE 19 CLEAN ROOM ROBOT MARKET FOR ARTICULATED ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 20 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ARTICULATED ROBOTS, BY COMPONENT, 2017–2025 (USD MILLION)

7.2.2 SCARA ROBOTS

7.2.2.1 SCARA robots popularly used in assembly and material handling applications

7.2.2.2 Average selling price of SCARA robots

TABLE 21 SCARA ROBOTS: SUMMARY TABLE

TABLE 22 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR SCARA ROBOTS, BY END USER, 2017–2025 (USD MILLION)

TABLE 23 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR SCARA ROBOTS, BY END USER, 2017–2025 (USD MILLION)

TABLE 24 CLEAN ROOM ROBOT MARKET FOR SCARA ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 25 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR SCARA ROBOTS, BY COMPONENT, 2017–2025 (USD MILLION)

7.2.3 PARALLEL ROBOTS

7.2.3.1 Parallel robots move faster than SCARA robots

7.2.3.2 Average selling price of parallel robots

TABLE 26 PARALLEL ROBOTS: SUMMARY TABLE

TABLE 27 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PARALLEL ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 28 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PARALLEL ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 29 CLEAN ROOM ROBOT MARKET FOR PARALLEL ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 30 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PARALLEL ROBOTS, BY COMPONENT, 2017–2025 (USD THOUSAND)

7.2.4 CARTESIAN ROBOTS

7.2.4.1 Cartesian robots can easily handle payload of 100 kg or more

7.2.4.2 Average selling price of cartesian robots

TABLE 31 CARTESIAN ROBOTS: SUMMARY TABLE

TABLE 32 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING FOR CARTESIAN ROBOTS), BY END USER, 2017–2025 (USD THOUSAND)

TABLE 33 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR CARTESIAN ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 34 CLEAN ROOM ROBOT MARKET FOR CARTESIAN ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 35 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR CARTESIAN ROBOTS, BY COMPONENT, 2017–2025 (USD THOUSAND)

7.3 COLLABORATIVE ROBOTS

7.3.1 COLLABORATIVE ROBOTS OCCUPY LESS SPACE DUE TO ABSENCE OF SAFETY FENCE

7.3.2 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS

TABLE 36 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 37 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (USD THOUSAND)

TABLE 38 CLEAN ROOM ROBOT MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY END USER, 2017–2025 (UNITS)

TABLE 39 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY COMPONENT, 2017–2025 (USD THOUSAND)

7.4 COVID-19 IMPACT ON VARIOUS TYPES OF CLEAN ROOM ROBOTS

8 CLEANROOM ROBOT MARKET, BY COMPONENT (Page No. - 96)

8.1 INTRODUCTION

TABLE 40 CLEAN ROOM ROBOT MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

8.2 ROBOTIC ARMS

8.2.1 ROBOTIC ARMS HELD LARGEST SHARE OF CLEAN ROOM ROBOT MARKET IN 2019

8.3 END EFFECTORS

8.3.1 GRIPPERS

8.3.1.1 Mechanical

8.3.1.1.1 Mechanical grippers—strongest type of grippers

8.3.1.2 Electric

8.3.1.2.1 Electric grippers being fully programmable enables them to have partially open and partially closed states

8.3.2 VACUUM CUPS

8.3.2.1 Vacuum cups—most versatile robot end effectors due to their modularity

8.3.3 CLAMPS

8.3.3.1 Clamps more economical and portable for short-run jobs compared to grippers in many applications

8.4 DRIVES

8.4.1 PNEUMATIC

8.4.1.1 Good for lightweight pick-and-place applications that require both speed and accuracy

8.4.2 ELECTRIC

8.4.2.1 Electric drives preferred over pneumatic drives in clean room application as electric drives do not leak air

8.5 CONTROLLERS

8.5.1 CONTROLLERS CAPABLE OF SUPPORTING MULTIPLE ROBOTS

8.6 SENSORS

8.6.1 SOME SENSORS USED IN CLEAN ROOM APPLICATION: TEMPERATURE SENSORS, PRESSURE SENSORS, PROXIMITY SENSORS, NAVIGATION/POSITIONING SENSORS, VIBRATION SENSORS, AND CURRENT SENSORS

8.7 POWER SUPPLY

8.7.1 INDUSTRIAL ROBOTS POWERED BY INDUSTRIAL 400 V, 3-PHASE CURRENT SUPPLIED FROM 4-PIN OUTLETS

8.8 MOTORS

8.8.1 BRUSHLESS AC SERVO MOTORS PREFERRED OVER DC SERVO MOTORS, AS THEY SUPPORT HIGHER TORQUES AND PAYLOADS

8.9 OTHERS

8.9.1 END-POSITION SWITCHES, SINGLE ACTING CYLINDERS, VACUUM GENERATORS, AND VALVES—SOME OTHER COMPONENTS USED IN CLEAN ROOMS

9 CLEAN ROOM ROBOT MARKET, BY END USER (Page No. - 104)

9.1 INTRODUCTION

TABLE 41 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY END USER, 2017–2025 (USD MILLION)

TABLE 42 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY END USER, 2017–2025 (USD MILLION)

TABLE 43 CLEAN ROOM ROBOT MARKET, BY END USER, 2017–2025 (UNITS)

9.2 AEROSPACE

9.2.1 REQUIREMENT OF ISO CLASS 7 FOR CLEAN ROOMS DRIVING DEMAND

TABLE 44 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR AEROSPACE INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 45 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY, BY TYPE, 2017–2025 (UNITS)

TABLE 46 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR AEROSPACE INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 47 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 48 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR AEROSPACE INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 49 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 50 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 51 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 52 CLEAN ROOM ROBOT MARKET FOR AEROSPACE INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.3 ELECTRICAL & ELECTRONICS

9.3.1 MANUFACTURING OF SEMICONDUCTOR DEVICES, HARD DISKS, FLAT PANEL DISPLAYS, AND SOLAR PANELS TO BOOST DEMAND

TABLE 53 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 54 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS, BY TYPE, 2017–2025 (UNITS)

TABLE 55 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 56 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 57 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 58 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 59 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 60 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 61 CLEAN ROOM ROBOT MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.4 PLASTICS, RUBBER, & CHEMICALS

9.4.1 SOME PLASTIC PRODUCTS CANNOT WITHSTAND STERILIZATION METHODS EFFECTIVELY AND MUST BE PRODUCED IN CLEAN ENVIRONMENTS

TABLE 62 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 63 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY, BY TYPE, 2017–2025 (UNITS)

TABLE 64 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 65 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 66 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 67 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 68 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 69 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 70 CLEAN ROOM ROBOT MARKET FOR PLASTICS, RUBBER, & CHEMICALS INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.5 FOOD & BEVERAGES

9.5.1 ROBOTS USED IN THIS INDUSTRY GENERALLY POSSESS PAYLOAD CAPACITY—UP TO 10 KG

TABLE 71 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 72 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2017–2025 (UNITS)

TABLE 73 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR FOOD & BEVERAGES INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 74 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 75 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 76 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 77 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 78 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 79 CLEAN ROOM ROBOT MARKET FOR FOOD & BEVERAGES INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.6 OPTICS

9.6.1 OPTICAL COMPONENTS REQUIRING EXTREMELY HIGH PRECISION TO DRIVE DEMAND

TABLE 80 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR OPTICS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 81 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY, BY TYPE, 2017–2025 (UNITS)

TABLE 82 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR OPTICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 83 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 84 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR OPTICS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 85 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 86 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 87 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 88 CLEAN ROOM ROBOT MARKET FOR OPTICS INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.7 PHARMACEUTICALS & COSMETICS

9.7.1 STRICT CLEANING AND HIGH IP RATINGS REQUIREMENTS TO SPUR MARKET GROWTH

TABLE 89 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY TYPE, 2017–2025 (USD MILLION)

TABLE 90 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY TYPE, 2017–2025 (UNITS)

TABLE 91 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (USD MILLION)

TABLE 92 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY TRADITIONAL INDUSTRIAL ROBOTS, 2017–2025 (UNITS)

TABLE 93 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY REGION, 2017–2025 (USD MILLION)

TABLE 94 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN APAC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 95 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 96 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN EUROPE, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 97 CLEAN ROOM ROBOT MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

9.8 COVID-19 IMPACT ON VARIOUS END USERS

10 GEOGRAPHIC ANALYSIS (Page No. - 136)

10.1 INTRODUCTION

TABLE 98 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY REGION, 2017–2025 (USD MILLION)

TABLE 99 CLEAN ROOM ROBOT MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING), BY REGION, 2017–2025 (USD MILLION)

TABLE 100 CLEAN ROOM ROBOT MARKET, BY REGION, 2017–2025 (UNITS)

10.2 NORTH AMERICA

TABLE 101 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 102 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN NORTH AMERICA, BY END USER, 2017–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Low cost of natural gas and oil reduced operating costs

10.2.2 CANADA

10.2.2.1 Aerospace and pharmaceutical industries hold huge market growth opportunities

10.2.3 MEXICO

10.2.3.1 Mexico engaged in various free trade agreements

10.3 EUROPE

TABLE 103 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 104 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN EUROPE, BY END USER, 2017–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Pharmaceutical, aerospace, automotive, and chemical industries to create demand for clean room robots

10.3.2 ITALY

10.3.2.1 Chemical expected to create demand for clean room robots

10.3.3 SPAIN

10.3.3.1 Chemical, including pharmaceutical (but excluding plastics and rubber products), became second-largest industry

10.3.4 FRANCE

10.3.4.1 Clean room robots to have huge demand from optics industry

10.3.5 UK

10.3.5.1 Manufacture of electronic components of electric vehicles to boost demand

10.3.6 REST OF EUROPE

10.4 APAC

TABLE 105 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 106 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN APAC, BY END USER, 2017–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 World’s second-largest pharmaceutical market, following US

10.4.2 SOUTH KOREA

10.4.2.1 In 2018, electronics industry ranked third, in terms of production, globally

10.4.3 JAPAN

10.4.3.1 Several clean room robot OEMs headquartered in Japan

10.4.4 TAIWAN

10.4.4.1 Home to TSMC, world’s largest independent semiconductor foundry

10.4.5 THAILAND

10.4.5.1 Boost in industrialization and automation due to government initiatives

10.4.6 INDIA

10.4.6.1 Second-largest mobile phone manufacturing hub globally in 2020

10.4.7 REST OF APAC

10.5 ROW

TABLE 107 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 108 CLEAN ROOM ROBOT MARKET (INCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING) IN ROW, BY END USER, 2017–2025 (USD THOUSAND)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Chemical industry—important industry in Middle East

10.5.2 SOUTH AMERICA

10.5.2.1 Brazil and Argentina steadily increasing use of robotics for electronics and food & beverages industries

10.6 COVID-19 IMPACT ON VARIOUS REGIONS

10.6.1 NORTH AMERICA

10.6.2 EUROPE

10.6.3 APAC

11 COMPETITIVE LANDSCAPE (Page No. - 155)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

11.3 STARTUP AND SME EVALUATION

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADERS

11.4.4 EMERGING COMPANIES

11.5 STRENGTH OF PRODUCT PORTFOLIO (25 PLAYERS)

11.6 BUSINESS STRATEGY EXCELLENCE (25 PLAYERS)

11.7 COMPETITIVE SITUATIONS AND TRENDS

11.7.1 PRODUCT LAUNCHES

TABLE 109 PRODUCT LAUNCHES, 2019

11.7.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 110 PARTNERSHIPS AND COLLABORATIONS, 2018–2019

11.7.3 EXPANSIONS

TABLE 111 EXPANSIONS, 2019

11.7.4 ACQUISITIONS

TABLE 112 ACQUISITIONS, 2017–2019

11.7.5 CONTRACTS AND AGREEMENTS

TABLE 113 CONTRACTS AND AGREEMENTS, 2017

12 COMPANY PROFILES (Page No. - 168)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-related Developments, SWOT Analysis, and MnM View)*

12.2.1 ABB

12.2.2 YASKAWA

12.2.3 FANUC

12.2.4 KUKA

12.2.5 KAWASAKI HEAVY INDUSTRIES

12.2.6 MITSUBISHI ELECTRIC

12.2.7 DENSO

12.2.8 NACHI-FUJIKOSHI

12.2.9 SEIKO EPSON

12.2.10 OMRON CORPORATION

*Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-related Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12.3 RIGHT-TO-WIN

12.3.1 ABB

12.3.2 YASKAWA

12.3.3 FANUC

12.3.4 KUKA

12.3.5 KAWASAKI HEAVY INDUSTRIES

12.4 OTHER KEY PLAYERS

12.4.1 UNIVERSAL ROBOTS

12.4.2 AEROTECH

12.4.3 IAI

12.4.4 STÄUBLI

12.4.5 COMAU

12.4.6 YAMAHA

12.4.7 HIRATA

12.4.8 ST ROBOTICS

12.4.9 TECHMAN ROBOT

12.4.10 RETHINK ROBOTICS

13 APPENDIX (Page No. - 208)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

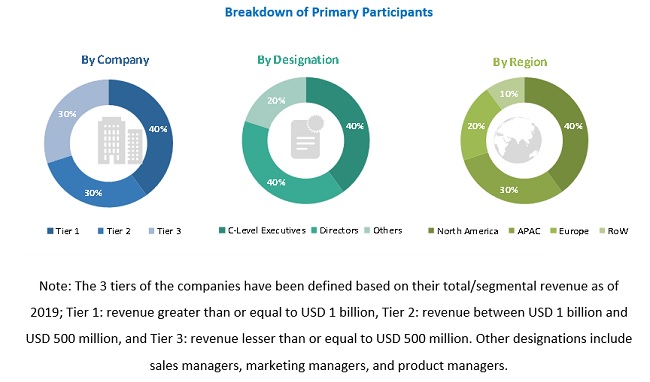

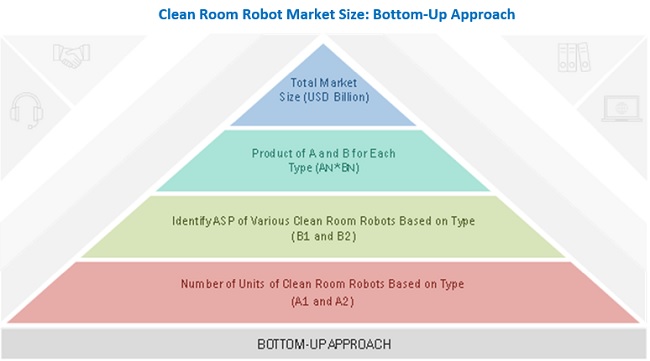

The study involved the estimation of the current size of the global clean room robot market. Exhaustive secondary research was carried out to collect information about the market and its peer markets. It was followed by the validation of findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete size of the market. It was followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the clean room robot market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the supply chain of the industry, value chain of the market, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering (which included calculations for the market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information, as well as to verify and validate the critical numbers obtained for the clean room robot market.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the clean room robot market through secondary research. Several primary interviews were conducted with the market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across 4 major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Approximately 20% and 80% of primary interviews were conducted with parties from the demand side and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the clean room robot market.

- In these approaches, statistics for clean room robots have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of clean room robots used in various industries.

- Several primary interviews have been conducted with key opinion leaders related to clean room robots, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the estimation processes explained above, the clean room robot market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides for clean room robots.

Report Objectives

- To describe and forecast the clean room robot market, in terms of value, based on type, component, and end user

- To describe and forecast the market, in terms of value for clean room robots with regard to 4 main regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the clean room robot ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the clean room robot market

- To benchmark players operating in the market using proprietary, competitive leadership mapping framework, which analyzes the market players on various parameters within broad categories of business and product strategies

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with the detailed competitive landscape for the market leaders

- To analyze competitive developments such as expansions, partnerships, contracts, acquisitions, product launches, and research and developments undertaken in the clean room robot market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix that gives a detailed comparison of the product portfolio of each company

- Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Clean Room Robot Market