Robot End Effector Market Size, Share & Industry Trends Growth Analysis Report by Type (Grippers, Welding Guns, Tool Changer, Clamps, Suction Cups, Deburring, Soldering, Milling, & Painting Tools), Robot Type (Traditional, Collaborative), Application, Industry & Region - Global Growth Driver and Industry Forecast to 2028

Updated on : Sep 16, 2024

Robot End Effector Market Size & Share

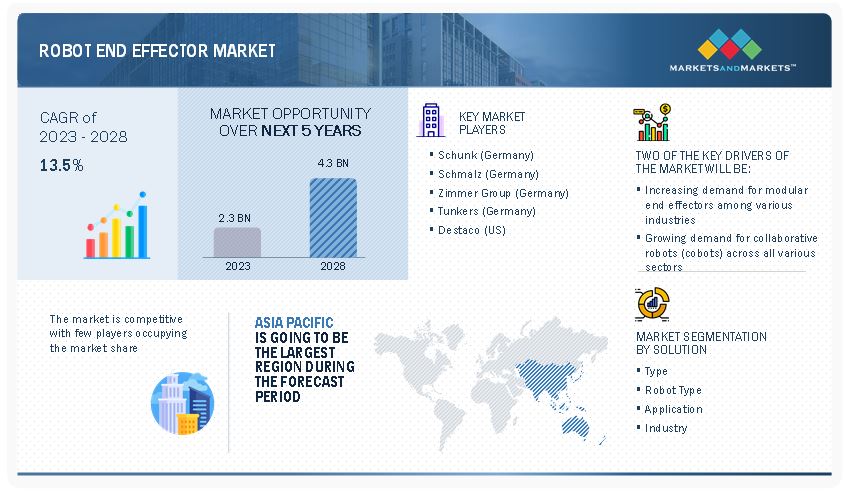

The global robot end effector market size is expected to grow from USD 2.3 billion in 2023 to USD 4.3 billion by 2028, registering a CAGR of 13.5%. Growing demand for modular end effectors, increasing adoption of cobots, penetration of automation in SMEs, and increasing adoption in the warehousing, pharmaceutical, and food industry are the main drivers for the growth of the robot end effector industry.

Robot End Effector Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

The robot end-effector market will grow significantly due to its various applications in several industries, such as automotive, electrical & electronics, food & beverage, and pharmaceutical. Various key players in the market adopt different strategies such as acquisitions, product launches, collaborations, and partnerships to grow in the robot end effector market.

Robot End Effector Market Analysis

The Robot End Effector Market is poised for significant growth driven by the escalating demand for automation across industries worldwide. Factors such as increasing labor costs, stringent quality standards, and the need for higher productivity are fueling the adoption of robotic systems equipped with advanced end effectors.

Additionally, technological advancements, such as the integration of sensors and artificial intelligence, are enhancing the capabilities and efficiency of end effectors, further driving market expansion. With the continuous evolution of manufacturing processes and the emergence of new applications in sectors such as automotive, electronics, healthcare, and logistics, the Robot End Effector Market is anticipated to experience robust growth in the coming years.

Robot End Effector Market Trends

Driver: Increasing demand for modular end effectors by various industries.

Due to the fast-changing nature of industries, the demand for modular end effectors is increasing. This scenario is observed in the consumer goods industry, specifically packaging, where the shape, size, surface, or weight of the packaging is constantly changing.

This shortens the life cycle of an end effector to 1 to 2 years and thereby increases the cost of replacement for the company. Modular end effectors have the capability to accommodate and handle a large variety of objects as required. A modular vacuum bar from Schmalz (Germany) can perfectly seal and lift objects regardless of their size; Zimmer Group (Germany) and Schunk (Germany) introduced a modular gripping system – MATCH with an unlimited range of uses from production and assembly to warehouse logistics, shipping, and even laboratory automation.

This modularity ensures that the grippers do not have to be changed from time to time, thereby reducing the cost of redesigning and downtime associated with its change and replacement. Modularity can be seen in other forms as well, where the end effector components such as mounts and accessories can be quickly swapped without drilling or welding. Destaco (US), for instance, offers their Bodybuilder end effector solution that allows modification to the end effector within minutes, keeping downtime to a minimum, and ensures that the alignment stays the same before and after the changes are made; Schunk (Germany) and Doosan Robotics (South Korea) introduced modular plug-and-work systems for cobots, which can quickly change jaw systems, pallet systems for milling machines, and gripping systems for robotics. Electrical finger grippers have the capability to be programmed precisely to handle objects of different sizes as well as tweak the clamping force accordingly, which provides modularity. The gripper system can be programmed easily and is modular by nature.

Restraint: High cost of deployment, especially for SMEs.

Small and medium-sized enterprises (SMEs) differ from large-scale industries such as automotive or electronics manufacturing in various ways. SMEs typically have a low threshold for capital expenditure, a low-risk appetite, and limited time to generate returns on their investment.

Additionally, their applications are often specific and on a case-by-case basis. For instance, Saint-Gobain, a glass manufacturing company in France, required automation of its glass polishing process that was previously carried out manually. Robotiq successfully automated the process by programming its torque sensor to replicate the hand movements and pressure applied by a human. Unlike large industries, many SMEs have not built their infrastructure around deploying robots, and must often integrate them into their existing floor space at a later stage.

Since the growth of end effector in SME applications is slowly outpacing the growth in the automotive sector, companies have started taking certain initiatives, such as Universal Robots (Denmark) and Robotiq (Canada), are now making use of advertising campaigns showcasing different use-cases and estimating payback period. Zimmer Group (Germany) has set up a division known as the Know-How Factory to solve challenging implementations of end effector and robot systems, reducing the hassle of integration for their client. However, industrial robots and automation still remain a cost-prohibitive investment for most SMEs.

Opportunity: Advancement in robotics has surged the demand for soft grippers.

Advances in soft robotics, coupled with the increasing need to handle delicate items, have enabled rapid progress in soft grippers. Unlike traditional grippers that are made of rigid materials, these end effectors are fabricated from soft and flexible components. Earlier, most end effectors were able to only manipulate objects of fixed size and shape.

However, industry requirements are slowly shifting toward the use of components that can grasp and manipulate a large variety of objects. Due to the material softness of the gripper arms, they can be used for sensitive applications such as in the food & beverage or glass manufacturing industries that can handle objects without damaging them.

Fruits or vegetables have varying sizes, making soft grippers ideal due to their consistent clamping force irrespective of slight differences in size and shape. Soft grippers are mainly adopted by the food & beverage industry, one of the fastest-growing clients for soft grippers. Hence, the high penetration rate of automation in the food & beverage industry is expected to stimulate the adoption of soft grippers in the next 4 to 5 years.

Challenge: Interoperability and integration issues related to end effectors with existing facilities.

Interoperability is a very important function in any factory or manufacturing unit. There must exist a modular framework for both hardware and software to connect and coordinate various end effector systems.

The focus is not only on the software side, which is used for programming, diagnosing, and monitoring but also the interchangeability of hardware between the end effector and robot arm. There have been cases in the robot end effector industry where a client has bought a robot arm and an end effector separately that were not fully compatible with each other, and the setup was a huge challenge from the onset.

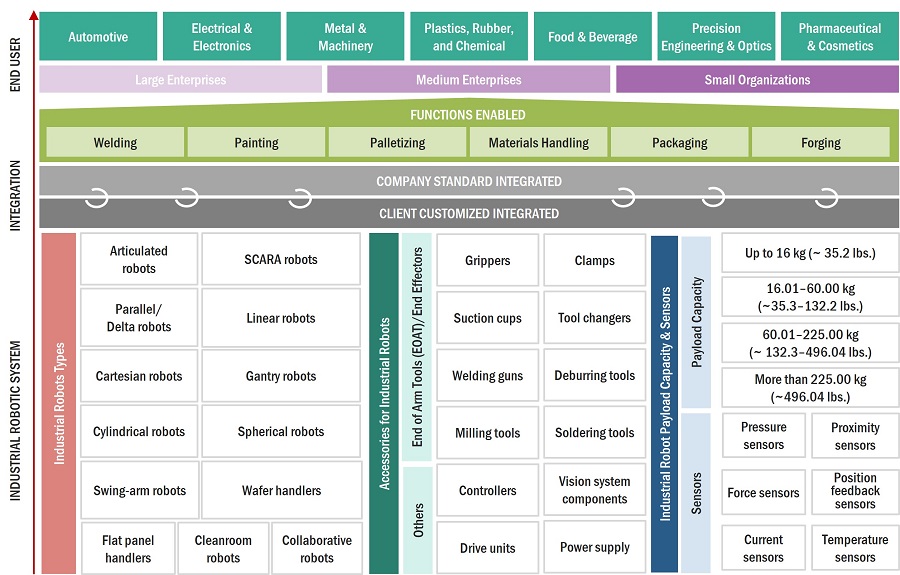

Robot End Effector Market Ecosystem

Component suppliers and system integrators have witnessed a decline in production activities. Consequently, OEMs have faced a shortage of essential components. The figure below shows the robot end effector ecosystem linked with industrial robots.

Robot End Effector Market Segment

The technology trends in end effectors for handling applications fueled the market for handling applications. The smart grippers can measure, identify, and monitor the target object in real time while handling them, whereas the 3D-oriented grippers can handle workpieces in harsh environments amid their constructions and anti-corrosion properties.

The continuous developments in dexterous robotic hands (human hand-shaped robotic hand with 3/4-fingers and thumb design provides a degree of freedom for better handling) further drive the end effector market for handling applications.

By Industry, Food & beverage industry is expected to register highest CAGR during the forecast period.

The growth of processed and packaged foods in developing countries presents a huge opportunity for the growth of end effectors. The food & beverage industry requires end effectors mainly for handling applications as the end products are edibles, and they need a precise system for handling the workpieces that are delicate and prone to spillage and damage very easily. Increased automation and the introduction of soft grippers and human-robot collaborative (HRC) grippers in developing countries also contribute to the projected growth. Increased automation across various stages of the supply chain in the food & beverage industry is contributing to the high growth.

Robot End Effector Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Robot End Effector Market Regional Analysis

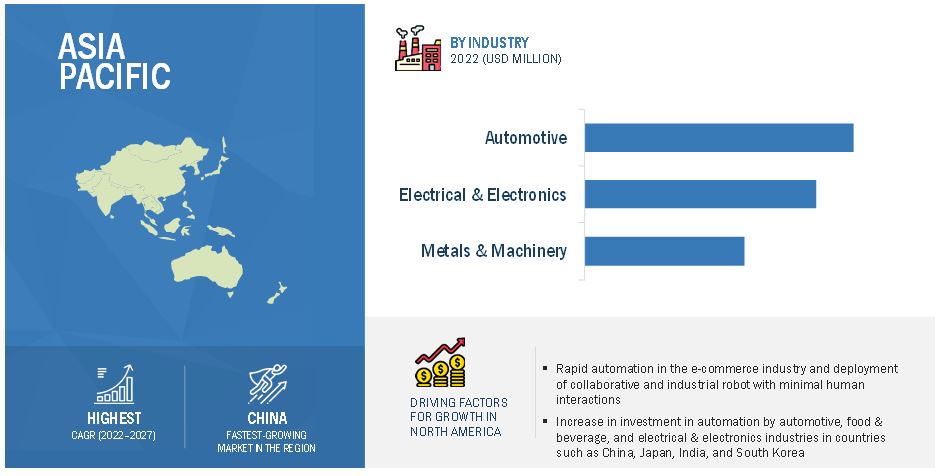

By Region, Asia Pacific to grow at highest CAGR during the forecast period.

The robot end effector market in Asia Pacific has witnessed greater growth in the past 10 years than the fully grown markets in Europe and the Americas due to low production costs, easy access to affordable labor, lenient emission and safety norms, and government initiatives for foreign direct investments (FDIs).

Top Robot End Effector Companies - Key Market Players

The robot end effector companies have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are

- Schunk (Germany),

- Schmalz (Germany),

- Zimmer Group (Germany),

- Tünkers (Germany),

- cDestaco (US),

- Festo (Germany),

- ABB (Switzerland),

- ATI Industrial Automation (US),

- Piab AB (Sweden), and

- Robotiq (Canada).

The study includes an in-depth competitive analysis of these key players in the robot end effector market with their company profiles, recent developments, and key market strategies.

Robot End Effector Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 2.3 billion in 2023 |

| Projected Market Size | USD 4.3 billion by 2028 |

| Growth Rate | CAGR of 13.5%. |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Robot Type, Application, Industry, and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies Covered |

Schunk (Germany), Schmalz (Germany), Zimmer Group (Germany), Tünkers (Germany), and Destaco (US) |

Robot End Effector Market Highlights

This report has segmented the overall robot end effector market based on type, robot type, application, industry, and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Robot Type |

|

|

By Application |

|

|

By Industry |

|

|

By Region |

|

Recent Developments in Robot End Effector Industry

- In October 2022, ABB (Switzerland) acquired Codian Robotics B.V. (Netherlands), which provided delta robots used for high-precision pick and place applications. With this acquisition, ABB is accelerating its engagement in the growing field of delta robots.

- In August 2022, Piab AB (Sweden) and AVAC Vakuumteknik AB (Sweden) strengthened their position as leading automation companies. AVAC complements Paib with a solid portfolio of products and solutions covering a wide range of applications and a highly skilled and experienced team, as well as many new customers to Piab.

- In November 2022, Schunk (Germany) developed an intelligent EGK gripper for small components for handling delegates and fragile workpieces. EGK offers maximum process safety in the handling process, ensuring a constant gripping force over the entire finger length and allowing permanent re-gripping.

Frequently Asked Questions (FAQ):

What will be the robot end effector market size in 2023?

The robot end effector market is expected to be valued at USD 2.3 billion in 2023.

What CAGR will be recorded for the robot end effector market from 2023 to 2028?

The global robot end effector market is expected to record a CAGR of 13.5% from 2023–2028.

Who are the top players in the robot end effector market?

The major vendors operating in the robot end effector market include Schunk (Germany), Schmalz (Germany), Zimmer Group (Germany), Tünkers (Germany), and Destaco (US).

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, Mexico, and the rest of North America.

Which robot type has been considered under the robot end effector market?

Traditional industrial and collaborative industrial robots are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for modular end effectors among various industries- Growing demand for collaborative robots (cobots) across various sectorsRESTRAINTS- High requirement of deployment costs, especially for SMEsOPPORTUNITIES- Surging demand for soft grippers- Rising adoption of additive manufacturing across industries- Growing adoption of electric grippersCHALLENGES- Interoperability and integration issues related to end effectors with existing facilities

-

5.3 VALUE CHAIN ANALYSISMANUFACTURINGASSEMBLY, DISTRIBUTION, AND AFTER-SALES SERVICE

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISASP ANALYSIS OF KEY PLAYERSASP TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Use of 3D printing technology for EOAT manufacturing- Increase in demand for HRC end effectors- Development of combination grippers- Launch of bionic grippers- Increase in demand for soft and flexible grippersCOMPLEMENTARY TECHNOLOGIES- Integration of Industrial Internet of Things (IIoT) and AI to design systems aligned with Industry 4.0- Smart and intelligent grippersADJACENT TECHNOLOGIES- Grippers in research and conceptual phases- Innovative components

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDIESCANADIAN BAKERY BOULANGERIE LA FABRIQUE AUTOMATES USING MGRIP WITH REVTECH SYSTEMS’ ROBOTIC PACKAGING SOLUTIONSENNHEISER INCREASED NUMBER OF QUALITY TESTS BY 33% WITH ROBOTIQ 2F-85 AND INSIGHTSSAPHO INCREASED PRODUCTION PACE WITH PIAB’S BAG GRIPPERS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.14 REGULATORY LANDSCAPEREGULATIONS- North AmericaSTANDARDS- ISO standards and key regulatory bodies worldwide (excluding North America)- ISO standards for handling using robots (ISO 14539)

- 6.1 INTRODUCTION

-

6.2 WELDING GUNSWELDING GUNS TO ACCOUNT FOR SECOND-LARGEST SHARE OF MARKET DURING FORECAST PERIOD

-

6.3 GRIPPERSMECHANICAL GRIPPERS- Mechanical grippers offer advantages such as simplicity and low operating costELECTRIC GRIPPERS- Electric grippers preferred in applications that require high operational speedMAGNETIC GRIPPERS- Magnetic grippers widely used in gripping objects with holes or nets

-

6.4 TOOL CHANGERSTOOL CHANGERS CREATE STRUCTURED INTERFACE BETWEEN ROBOT FLANGE AND TOOL BASE

-

6.5 CLAMPSCLAMPS USED TO POSITION AND HOLD PRODUCTS WITH LOW GRIP FORCE

-

6.6 SUCTION CUPSVACUUM CLAMPS USED FOR VARIOUS MACHINING AND ASSEMBLY OPERATIONS

- 6.7 OTHERS

- 7.1 INTRODUCTION

-

7.2 TRADITIONAL INDUSTRIAL ROBOTSTRADITIONAL INDUSTRIAL ROBOTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

-

7.3 COLLABORATIVE INDUSTRIAL ROBOTSCOLLABORATIVE INDUSTRIAL ROBOTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1 INTRODUCTION

-

8.2 HANDLINGUSE OF ROBOT END EFFECTORS IN MATERIAL HANDLING IMPROVES SPEED AND PRECISION

-

8.3 ASSEMBLYAUTOMATION TO IMPROVE SPEED AND ACCURACY ACROSS ASSEMBLY LINES

-

8.4 WELDINGROBOT END EFFECTORS USED EXCLUSIVELY IN SPOT AND ARC WELDING

-

8.5 DISPENSINGAUTOMOTIVE AND ELECTRONICS INDUSTRIES REQUIRE HIGHLY PRECISE ADHESIVE DISPENSERS

-

8.6 PROCESSINGGRINDING AND POLISHING TO IMPROVE CONSISTENCY OF FINISHED PRODUCTS

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVESUBSTANTIAL USE OF ROBOT END EFFECTORS IN MANUFACTURING AND ASSEMBLY STAGES

-

9.3 ELECTRICAL & ELECTRONICSROBOT END EFFECTORS MAINLY USED IN HANDLING AND ASSEMBLY

-

9.4 METALS & MACHINERYROBOT END EFFECTORS TO ACHIEVE COST-EFFECTIVE PRODUCTION OF MACHINING METAL COMPONENTS

-

9.5 PLASTIC, RUBBER, & CHEMICALMULTITASKING END EFFECTORS TO FIND SIGNIFICANT USE IN PLASTIC AND RUBBER INDUSTRIES

-

9.6 FOOD & BEVERAGESOFT GRIPPERS MAJORLY USED IN FOOD & BEVERAGE INDUSTRY DUE TO HIGH DEGREE OF SANITATION

-

9.7 PRECISION ENGINEERING & OPTICSROBOT END EFFECTORS USED FOR ERROR PROOFING AND VALIDATION

-

9.8 PHARMACEUTICAL & COSMETICSROBOT END EFFECTORS MAINLY USED IN PACKAGING AND SORTING IN PHARMACEUTICAL & COSMETICS INDUSTRIES

-

9.9 E-COMMERCEVACUUM GRIPPERS, PALLETIZERS, AND LARGE CLAMPS SIGNIFICANTLY USED IN WAREHOUSES

- 9.10 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- US to account for largest market share in North AmericaCANADA- Increased foreign investments in manufacturing sector to drive marketMEXICO- Increasing deployment of industrial robots in automotive industry to foster market growth

-

10.3 EUROPEUK- Strong manufacturing industry to boost demand for robot end effectorsGERMANY- Automotive industry to significantly contribute to market growthFRANCE- Government funding to boost automation and demand for robotsREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- High-tech manufacturing industries to foster market growthJAPAN- Growing production of electric vehicles to drive marketSOUTH KOREA- Rise in industrial robots deployed in automotive & electronics industries to drive marketINDIA- Flourishing automotive and electronic industries to boost demand for robot end effectorsREST OF ASIA PACIFIC

-

10.5 ROWMIDDLE EAST- Growing adoption of automation in several manufacturing industries to strengthen marketAFRICA- Growing FDI to support market growthSOUTH AMERICA- Rapid urbanization and increasing focus on manufacturing to boost market

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2022

-

11.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.6 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

-

11.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSSCHUNK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZIMMER GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHMALZ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDESTACO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFESTO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewABB- Business overview- Products/Solutions/Services offered- Recent developmentsATI INDUSTRIAL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developmentsPIAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsROBOTIQ- Business overview- Products/Solutions/Services offered- Recent developmentsTÜNKERS- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER KEY PLAYERSJH ROBOTICSEMI CORPSOFT ROBOTICSWEISS ROBOTICSINTELLIGENT ACTUATOR INC.BASTIAN SOLUTIONSFIPAIPRSMCRADKUKAAPPLIED ROBOTICSONROBOTMILLIBAR ROBOTICSWYZO

- 13.1 INDUSTRIAL ROBOTICS MARKET

- 13.2 INTRODUCTION

-

13.3 UP TO 16.00 KGROBOTS WITH PAYLOAD UP TO 16.00 KG TO HOLD LARGEST MARKET SHARE IN 2022

-

13.4 16.01–60.00 KGFASTEST GROWTH RATE EXPECTED DURING FORECAST PERIOD

-

13.5 60.01–225.00 KGAUTOMOTIVE AND FOOD & BEVERAGES INDUSTRIES TO DRIVE MARKET

-

13.6 MORE THAN 225.00 KGINCREASING ADOPTION ACROSS INDUSTRIES EXPECTED TO DRIVE MARKET

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 LIST OF COMPANIES AND THEIR ROLE IN ROBOT END EFFECTOR ECOSYSTEM

- TABLE 2 KEY PLAYERS: AVERAGE SELLING PRICE OF GRIPPERS BASED ON PAYLOAD (USD)

- TABLE 3 CONTRIBUTION OF VARIOUS END EFFECTORS TO OVERALL COST OF ROBOTIC SYSTEM

- TABLE 4 ROBOT END EFFECTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 7 PATENTS FILED FOR VARIOUS TYPES OF ROBOT END EFFECTORS, 2020–2022

- TABLE 8 ROBOT END EFFECTOR MARKET: CONFERENCES AND EVENTS

- TABLE 9 ISO AND ANSI STANDARDS FOR INDUSTRIAL ROBOTS, END EFFECTORS, AND COBOTS

- TABLE 10 ROBOT END EFFECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 11 ROBOT END EFFECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 12 PLAYERS MANUFACTURING ROBOTIC WELDING GUNS

- TABLE 13 WELDING GUNS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 14 WELDING GUNS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 15 GRIPPERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 16 GRIPPERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 17 GRIPPERS: ROBOT END EFFECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 18 GRIPPERS: ROBOT END EFFECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 PLAYERS MANUFACTURING MECHANICAL GRIPPERS

- TABLE 20 PLAYERS MANUFACTURING ELECTRIC GRIPPERS

- TABLE 21 PLAYERS MANUFACTURING DEXTEROUS ROBOTIC HANDS

- TABLE 22 PLAYERS MANUFACTURING MAGNETIC GRIPPERS

- TABLE 23 COMPARISON BETWEEN MECHANICAL, ELECTRIC, AND MAGNETIC GRIPPERS

- TABLE 24 PLAYERS MANUFACTURING TOOL CHANGERS

- TABLE 25 TOOL CHANGERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 26 TOOL CHANGERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 27 PLAYERS MANUFACTURING CLAMPS

- TABLE 28 CLAMPS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 29 CLAMPS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 30 PLAYERS MANUFACTURING VACUUM TECHNOLOGY

- TABLE 31 SUCTION CUPS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 32 SUCTION CUPS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 33 PLAYERS MANUFACTURING DEBURRING TOOLS

- TABLE 34 PLAYERS MANUFACTURING MILLING TOOLS

- TABLE 35 PLAYERS MANUFACTURING SOLDERING TOOLS

- TABLE 36 PLAYERS MANUFACTURING PAINTING TOOLS

- TABLE 37 PLAYERS MANUFACTURING DISPENSING TOOLS

- TABLE 38 OTHERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 39 OTHERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 40 ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 41 ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 42 TRADITIONAL INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 43 TRADITIONAL INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 44 TRADITIONAL INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 TRADITIONAL INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 COLLABORATIVE INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 47 COLLABORATIVE INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 COLLABORATIVE INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 COLLABORATIVE INDUSTRIAL ROBOTS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 51 ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 52 AUTOMOTIVE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 53 AUTOMOTIVE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 54 AUTOMOTIVE: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 AUTOMOTIVE: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 ELECTRICAL & ELECTRONICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 57 ELECTRICAL & ELECTRONICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 58 ELECTRICAL & ELECTRONICS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 ELECTRICAL & ELECTRONICS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 METALS & MACHINERY: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 61 METALS & MACHINERY: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 62 METALS & MACHINERY: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 METALS & MACHINERY: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 PLASTIC, RUBBER, & CHEMICAL: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 65 PLASTIC, RUBBER, & CHEMICAL: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 66 PLASTIC, RUBBER, & CHEMICAL: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 PLASTIC, RUBBER, & CHEMICAL: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 FOOD & BEVERAGE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 69 FOOD & BEVERAGE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 70 FOOD & BEVERAGE: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 FOOD & BEVERAGE: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 PRECISION ENGINEERING & OPTICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 73 PRECISION ENGINEERING & OPTICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 74 PRECISION ENGINEERING & OPTICS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 PRECISION ENGINEERING & OPTICS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 PHARMACEUTICAL & COSMETICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 77 PHARMACEUTICAL & COSMETICS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 78 PHARMACEUTICAL & COSMETICS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 PHARMACEUTICAL & COSMETICS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 E-COMMERCE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 81 E-COMMERCE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 82 E-COMMERCE: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 E-COMMERCE: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 OTHERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 85 OTHERS: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 86 OTHERS: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 OTHERS: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ROBOT END EFFECTOR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 ROW: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 109 ROW: ROBOT END EFFECTOR MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 ROW: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 111 ROW: ROBOT END EFFECTOR MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ROW: ROBOT END EFFECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 ROW: ROBOT END EFFECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 OVERVIEW OF STRATEGIES DEPLOYED BY ROBOT END EFFECTOR COMPANIES

- TABLE 115 DEGREE OF COMPETITION: ROBOT END EFFECTOR MARKET, 2022

- TABLE 116 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 117 END EFFECTOR TYPE FOOTPRINT OF COMPANIES

- TABLE 118 INDUSTRY FOOTPRINT OF COMPANIES (36 COMPANIES)

- TABLE 119 REGIONAL FOOTPRINT OF COMPANIES (36 COMPANIES)

- TABLE 120 PRODUCT LAUNCHES, 2020–2022

- TABLE 121 DEALS, 2020–2022

- TABLE 122 EXPANSIONS, 2020–2022

- TABLE 123 SCHUNK: BUSINESS OVERVIEW

- TABLE 124 SCHUNK: PRODUCTS OFFERED

- TABLE 125 SCHUNK: PRODUCT LAUNCHES

- TABLE 126 SCHUNK: DEALS

- TABLE 127 SCHUNK: OTHERS

- TABLE 128 ZIMMER GROUP: BUSINESS OVERVIEW

- TABLE 129 ZIMMER GROUP: PRODUCTS OFFERED

- TABLE 130 ZIMMER GROUP: PRODUCT LAUNCHES

- TABLE 131 ZIMMER GROUP: DEALS

- TABLE 132 SCHMALZ: BUSINESS OVERVIEW

- TABLE 133 SCHMALZ: PRODUCTS OFFERED

- TABLE 134 SCHMALZ: PRODUCT LAUNCHES

- TABLE 135 SCHMALZ: DEALS

- TABLE 136 SCHMALZ: OTHERS

- TABLE 137 DESTACO: BUSINESS OVERVIEW

- TABLE 138 DESTACO: PRODUCTS OFFERED

- TABLE 139 DESTACO: PRODUCT LAUNCHES

- TABLE 140 FESTO: BUSINESS OVERVIEW

- TABLE 141 FESTO: PRODUCTS OFFERED

- TABLE 142 FESTO: PRODUCT LAUNCHES

- TABLE 143 FESTO: DEALS

- TABLE 144 ABB: BUSINESS OVERVIEW

- TABLE 145 ABB: PRODUCTS OFFERED

- TABLE 146 ABB: PRODUCT LAUNCHES

- TABLE 147 ABB: DEALS

- TABLE 148 ATI INDUSTRIAL AUTOMATION: BUSINESS OVERVIEW

- TABLE 149 ATI INDUSTRIAL AUTOMATION: PRODUCTS OFFERED

- TABLE 150 ATI INDUSTRIAL AUTOMATION: PRODUCT LAUNCHES

- TABLE 151 ATI INDUSTRIAL AUTOMATION: DEALS

- TABLE 152 PIAB AB: BUSINESS OVERVIEW

- TABLE 153 PIAB AB: PRODUCTS OFFERED

- TABLE 154 PIAB AB: PRODUCT LAUNCHES

- TABLE 155 PIAB AB: DEALS

- TABLE 156 ROBOTIQ: BUSINESS OVERVIEW

- TABLE 157 ROBOTIQ: PRODUCTS OFFERED

- TABLE 158 ROBOTIQ: PRODUCT LAUNCHES

- TABLE 159 ROBOTIQ: DEALS

- TABLE 160 ROBOTIQ: OTHERS

- TABLE 161 TÜNKERS: BUSINESS OVERVIEW

- TABLE 162 TÜNKERS: PRODUCTS OFFERED

- TABLE 163 TÜNKERS: PRODUCT LAUNCHES

- TABLE 164 TÜNKERS: DEALS

- TABLE 165 JH ROBOTICS: COMPANY OVERVIEW

- TABLE 166 EMI CORP: COMPANY OVERVIEW

- TABLE 167 SOFT ROBOTICS: COMPANY OVERVIEW

- TABLE 168 WEISS ROBOTICS: COMPANY OVERVIEW

- TABLE 169 IAI: COMPANY OVERVIEW

- TABLE 170 BASTIAN SOLUTIONS: COMPANY OVERVIEW

- TABLE 171 FIPA: COMPANY OVERVIEW

- TABLE 172 IPR: COMPANY OVERVIEW

- TABLE 173 SMC: COMPANY OVERVIEW

- TABLE 174 RAD: COMPANY OVERVIEW

- TABLE 175 KUKA: COMPANY OVERVIEW

- TABLE 176 APPLIED ROBOTICS: COMPANY OVERVIEW

- TABLE 177 ONROBOT: COMPANY OVERVIEW

- TABLE 178 MILLIBAR ROBOTICS: BUSINESS OVERVIEW

- TABLE 179 WYZO: COMPANY OVERVIEW

- TABLE 180 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2018–2021 (USD MILLION)

- TABLE 181 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2022–2027 (USD MILLION)

- TABLE 182 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2018–2021 (THOUSAND UNITS)

- TABLE 183 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2022–2027 (THOUSAND UNITS)

- TABLE 184 TYPES OF INDUSTRIAL ROBOTS WITH UP TO 16.00 KG PAYLOAD CAPACITY

- TABLE 185 TYPES OF INDUSTRIAL ROBOTS WITH 16.01–60.00 KG PAYLOAD CAPACITY

- TABLE 186 TYPES OF INDUSTRIAL ROBOTS WITH 60.01–225.00 KG PAYLOAD CAPACITY

- TABLE 187 TYPES OF INDUSTRIAL ROBOTS WITH MORE THAN 225.00 KG PAYLOAD CAPACITY

- FIGURE 1 ROBOT END EFFECTOR MARKET SEGMENTATION

- FIGURE 2 ROBOT END EFFECTOR MARKET: RESEARCH DESIGN

- FIGURE 3 ROBOT END EFFECTOR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 2 FOR MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE GENERATED FROM PRODUCTS IN ROBOT END EFFECTOR MARKET

- FIGURE 5 ROBOT END EFFECTOR MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

- FIGURE 8 GRIPPERS TO ACCOUNT FOR LARGEST SHARE OF ROBOT END EFFECTOR MARKET IN 2023

- FIGURE 9 TRADITIONAL INDUSTRIAL ROBOTS EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 10 AUTOMOTIVE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 13 ROBOT END EFFECTOR MARKET SCENARIO: BEFORE RECESSION AND WITH RECESSION

- FIGURE 14 INCREASING ADOPTION OF COLLABORATIVE ROBOTS (COBOTS) EXPECTED TO FUEL MARKET GROWTH

- FIGURE 15 TRADITIONAL INDUSTRIAL ROBOTS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 GRIPPERS HELD LARGEST SHARE OF ROBOT END EFFECTOR MARKET IN 2022

- FIGURE 17 AUTOMOTIVE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 ROBOT END EFFECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES ON ROBOT END EFFECTOR MARKET

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES ON ROBOT END EFFECTOR MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS

- FIGURE 23 ROBOT END EFFECTOR ECOSYSTEM LINKED WITH INDUSTRIAL ROBOTS

- FIGURE 24 ASP OF GRIPPERS BASED ON PAYLOAD

- FIGURE 25 ASP TREND FOR VARIOUS ROBOT END EFFECTORS

- FIGURE 26 REVENUE SHIFT IN ROBOT END EFFECTOR MARKET

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 30 IMPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 31 EXPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS DURING 2013–2022

- FIGURE 33 NO. OF PATENTS GRANTED PER YEAR OVER LAST 10 YEARS

- FIGURE 34 ISO VS ANSI/RIA STANDARDS

- FIGURE 35 ILLUSTRATION OF VARIOUS STATES AND ACTIONS INVOLVED IN HANDLING APPLICATION

- FIGURE 36 GRIPPERS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 WELDING GUNS: COLLABORATIVE INDUSTRIAL ROBOTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 GRIPPERS: COLLABORATIVE INDUSTRIAL ROBOTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 TOOL CHANGERS: TRADITIONAL INDUSTRIAL ROBOTS TO ACCOUNT FOR LARGEST SHARE

- FIGURE 40 COLLABORATIVE INDUSTRIAL ROBOTS MARKET TO GROW AT HIGHER CAGR

- FIGURE 41 GRIPPERS TO DOMINATE COLLABORATIVE INDUSTRIAL ROBOT END EFFECTOR MARKET DURING FORECAST PERIOD

- FIGURE 42 ROBOT END EFFECTORS HAVE SUBSTANTIAL APPLICATIONS IN HANDLING OPERATIONS

- FIGURE 43 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 44 AUTOMOTIVE: EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 METALS & MACHINERY: ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 46 FOOD & BEVERAGE: ASIA PACIFIC EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 PHARMACEUTICAL & COSMETICS: ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: SNAPSHOT OF ROBOT END EFFECTOR MARKET

- FIGURE 50 EUROPE: SNAPSHOT OF ROBOT END EFFECTOR MARKET

- FIGURE 51 ASIA PACIFIC: SNAPSHOT OF ROBOT END EFFECTOR MARKET

- FIGURE 52 SHARE OF MAJOR PLAYERS IN ROBOT END EFFECTOR MARKET, 2022

- FIGURE 53 ROBOT END EFFECTOR MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 54 ROBOT END EFFECTOR MARKET: STARTUP/SME EVALUATION MATRIX, 2020

- FIGURE 55 ABB: COMPANY SNAPSHOT

- FIGURE 56 TÜNKERS: COMPANY SNAPSHOT

- FIGURE 57 INDUSTRIAL ROBOTS WITH PAYLOAD RANGE OF 16.01 KG–60.00 KG TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

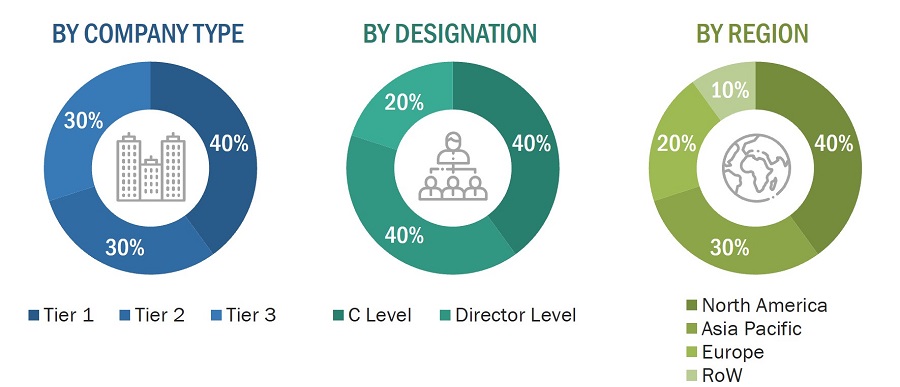

The study involves four major activities for estimating the size of the robot end effector market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the robot end effector market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the robot end-effector market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—Americas, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the robot end effector market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Robot End Effector Market: Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of the robot end effector market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which has then been later confirmed with the primary respondents across different regions.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

- The market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primaries, the size of the overall robot end effector and each individual markets have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data has then been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

An accessory device or tool, specifically designed to be attached to the wrist of an industrial robot or tool mounting plate which enables the robot to perform the intended task, is referred to as a robot end effector. Robot end effectors are also known as robotic peripherals, robotic accessories, robot tools, robotic tools, end-of-arm tooling (EOAT), or end-of-arm devices. Robot end effectors are designed to perform different industrial tasks, such as handling, assembly, welding, dispensing, processing, and others, including cutting and soldering in a defined pattern to automate the production process.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to robot end effectors

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives:

- To describe and forecast the robot end effector market in terms of value based on type, robot type, application, and industry

- To describe and forecast the robot end effector market size in terms of value with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the robot end-effector market

- To provide a detailed overview of the supply chain of the robot end-effector ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the robot end-effector market.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robot End Effector Market