Clarifying Agents Market by Form (Powder, Granules, Liquid), Polymer (PP, PE, PET), Application (Packaging, Consumer Products, Electronics) and Region (Europe, North America, Asia Pacific, MEA, SA)- Global Forecast to 2027

Updated on : August 22, 2024

Clarifying Agents Market

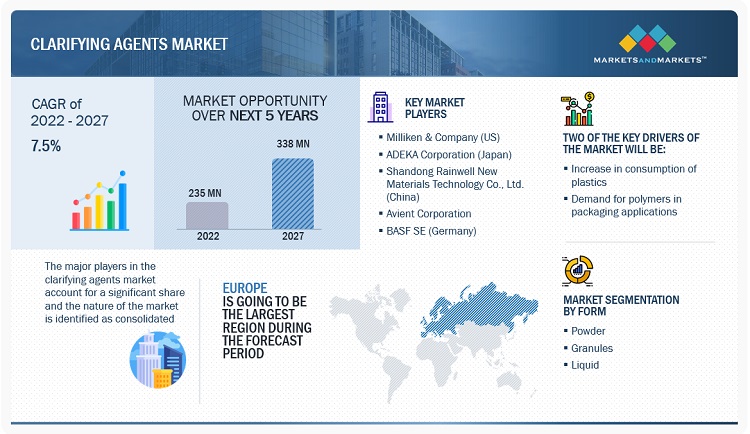

Clarifying Agents Market was valued at USD 235 million in 2022 and is projected to reach USD 338 million by 2027, growing at 7.5% cagr from 2022 to 2027. The market is mainly led by the significant usage of different polymers such as PP, PE, and PET in containers and packaging application in food & beverage industry. The retail sector in emerging countries such as India, Brazil, and China is becoming organized. This is expected to drive demand for better packaging of products to minimize damage during the transportation of goods.

Attractive Opportunities in the Clarifying Agents Market

To know about the assumptions considered for the study, Request for Free Sample Report

Clarifying Agents Market Dynamics

Driver: Demand for polymers in packaging applications

The packaging industry is expected to grow significantly due to the growing urban population and increasing demand for plastic packaging from the food & beverage industry. The packaging industry in emerging markets such as Asia Pacific and the Middle East & Africa is expected to grow due to the increase in disposable income of consumers and changing lifestyles. The increasing demand for packaged fruits and vegetables globally is also driving demand for clarifying agents, wherein packaging is intended to be transparent. The shift in consumer preference from rigid to flexible packaging due to advantages such as convenience in handling and disposal and savings in transportation costs, among others, are also expected to support the growth of the market.

Restraints: Stringent environmental regulations

There are rising concerns regarding GHG emissions and plastic waste entering oceans and other natural water sources. New acts and regulations have been implemented globally, mandating stringent rules against plastic waste. Stringent environmental regulations in Europe do not allow the use of certain plastic materials. Regulations have been passed against the use of non-biodegradable plastic bags in most countries in North America, Europe, and Asia Pacific. The table below lists a few regulations on the use of plastics in various countries.

Opportunities: Rise in pharmaceutical applications

The usage of clarifying agents in pharma industry and medical applications is rising due to the increase in demand for hard and see-through medical equipments. Plastic containers and other medical equipments should be transparent to confirm the accuracy of different medicinal dosages. Syringes and saline bottles are kept transparent to monitor and make sure that the appropriate dosage of medicine is given. Considering the latest advancements in science and healthcare industry, the intricacy and susceptibility of medical equipments and machines have increased significantly. This is projected to drive the global demand for clarifying agents in pharmaceutical packaging.

Challenges: Appropriate dosage of clarifying agents

These clarifying agents are required to be chosen depending on the end applications. If the end application is for direct food contact packaging, the clarifying agents used for the packaging materials should be compatible with the food items. Hence, using the correct dosage and selecting clarifying agents is a difficult task for various manufacturers of plastic products. This acts as a challenge for the market players.

Clarifying Agents Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

“Powder was the largest form for clarifying agents market in 2021, in terms of value”

Powder form accounted for the largest market share in the global clarifying agents industry, in terms of value, in 2021. The segment is projected to grow at second highest CAGR, in terms of value, during the forecast period. Clarifying agents in powder form are easily dispersed on surfaces providing smooth texture. Powder form is widely used across various applications such as packaging, consumer goods, and others.

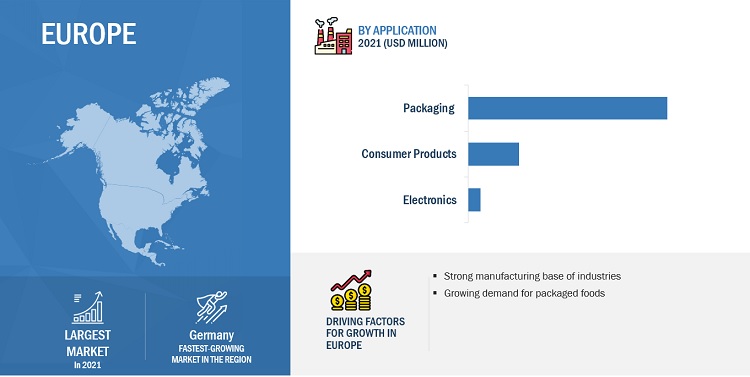

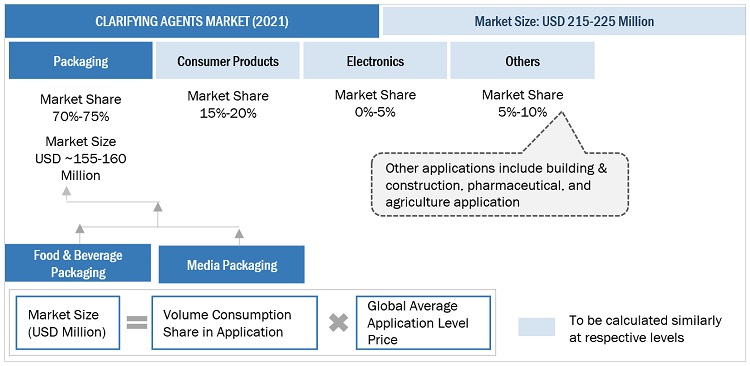

“Packaging was the largest application for clarifying agents market in 2021, in terms of value”

Packaging application accounted for the largest market share in the global clarifying agents market, in terms of value, in 2021. The segment is projected to grow at highest CAGR, in terms of value, during the forecast period. The significant growth related to packaging application is related to development of retail & e-commerce, rapid urbanization, increasing demand for cosmetics, and healthscience applications in emerging countries such as China, India, and Brazil.

“Europe was the largest market for clarifying agents in 2021, in terms of value.”

Europe was the largest market for global clarifying agents market, in terms of value, in 2021. Germany is the largest market in Europe. It is projected to witness highest growth during the forecast period considering of high usage of polymers in the region for packaging application. The major players operating in Europe include BASF SE, ALTANA AG and PALMAROLE AG, among others.

To know about the assumptions considered for the study, download the pdf brochure

Clarifying Agents Market Players

The key players in this market Milliken & Company (U.S.), ADEKA Corporation (Japan), Shandong Rainwell New Materials Technology Co., Ltd. (China), BASF SE (Germany), Avient Corporation (US), New Japan Chemical Co., Ltd. (Japan), GCH Technology Co., Ltd. (China). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of clarifying agents have opted for new product launches to sustain their market position.

Read More: Clarifying Agents Companies

Clarifying Agents Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 235 million |

|

Revenue Forecast in 2027 |

USD 338 million |

|

CAGR |

7.5% |

|

Years considered for the study |

2016-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (ton); Value (USD Million) |

|

Segments |

Form, Polymer, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa and South America |

|

Companies |

The key players in this market are as Milliken & Company (US), ADEKA Corporation (Japan), Shandong Rainwell New Materials Technology Co., Ltd. (China), Avient Corporation (US), BASF SE (Germany), New Japan Chemical Co., Ltd. (Japan), GCH Technology Co., Ltd. (China), Qingdao Jade New Material Technology (China), Guangzhou Bolong Chemical Co. Ltd. (China), and Ta Haw Enterprise Co. Ltd. (Taiwan) |

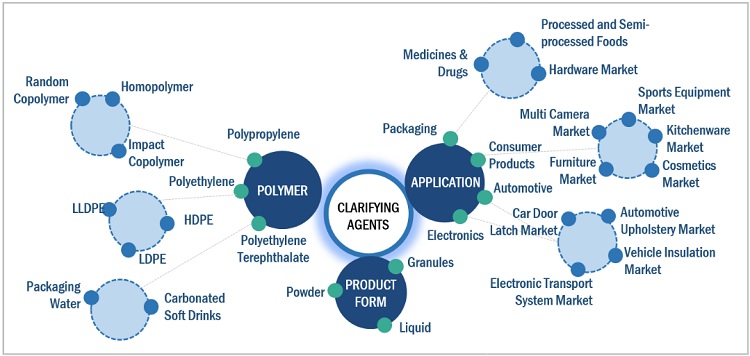

This report categorizes the global clarifying agents market based on form, polymer, application, and region.

On the basis of form, the clarifying agents market has been segmented as follows:

- Powder

- Granules

- Liquid

On the basis of polymer, the clarifying agents market has been segmented as follows:

-

PP

- Homopolymer

- Random Copolymer

- Impact Copolymer

- PE

- PET

- Others

On the basis of application, the clarifying agents market has been segmented as follows:

- Packaging

- Consumer Products

- Electronics

- Others

On the basis of region, the clarifying agents market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- Others

Recent Developments

- In September 2022, Milliken launched its new clarifier plant in Blacksburg, South Carolina, US and is planning to increase Millad NX 8000 production by 50%.

- In March 2022, BASF increased the production capacity for plastic additives in Europe.

- In December 2021, Clariant AG and PolyOne Corporation entered into an agreement with Clariant to purchase its global color and additive masterbatch business.

- In March 2019, Milliken & Company increased the production capacity of its clarifiers by 50% in the US. This expansion is expected to meet the increase in demand and reduce the carbon footprint during the manufacture of PP products. This expansion is also expected to help the company strengthen its market share in the US.

Frequently Asked Questions (FAQ):

What is the expected growth rate of clarifying agents market?

The forecast period for clarifying agents market in this study is 2022-2027. The clarifying agents market is expected to grow at CAGR of 7.5%, in terms of value, during the forecast period.

Who are the major key players in clarifying agents market?

Milliken & Company (US), ADEKA Corporation (Japan), Shandong Rainwell New Materials Technology Co., Ltd. (China), Avient Corporation (US), BASF SE (Germany), New Japan Chemical Co., Ltd. (Japan), GCH Technology Co., Ltd. (China), Qingdao Jade New Material Technology (China), Guangzhou Bolong Chemical Co. Ltd. (China), and Ta Haw Enterprise Co. Ltd. (Taiwan) are the leading manufacturers of clarifying agents.

Who are the major regulations the clarifying agents market in various countries?

ECHA-Industrial use of processing aids in processes and products, not becoming part of articles. Industrial use of processing aids in continuous processes or batch processes applying dedicated or multi-purpose equipment, either technically controlled or operated by manual interventions.

What are the drivers and opportunities for the clarifying agents market?

The increased consumption of plastics, and the increased demand for plastics from packaging application is driving the market during forecast period. Growing usage of clarifying agents in pharmaceutical end-use industry acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the clarifying agents market?

The addition of clarifying agents to semicrystalline polymer influences the crystallization kinetics and also the final properties of the material. Clarifying agents can significantly increase the range of utilizing semicrystalline polymers because they are able to adjust the properties of materials. In packaging, clarity is a desired property. However, polypropylene, which is suitable for this application, shows relatively high haze. With the addition of clarifying agent, the opacity can be significantly decreased. As clarifying agents increase the rate of crystallization, the processing cycles are shorter. In the case of polymorphic polymers (for example, isotactic polypropylene), a specific clarifying agent can induce crystallization into the preferred crystalline form. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in consumption of plastics- Demand for polymers in packaging applicationsRESTRAINTS- Awareness of adverse effects of plastics- Stringent environmental regulationsOPPORTUNITIES- Growing usage in pharmaceutical applicationsCHALLENGES- Complexity in selecting appropriate product type and dosage

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSCLARIFYING AGENT MANUFACTURERSDISTRIBUTIONAPPLICATION

-

6.2 CLARIFYING AGENTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOSNON-COVID-19 SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSESREVENUE SHIFT AND REVENUE POCKETS FOR CLARIFYING AGENTS

-

6.4 CONNECTED MARKETS: ECOSYSTEM

- 6.5 TECHNOLOGY ANALYSIS

-

6.6 CASE STUDY ANALYSISCASE STUDY ON MILLAD NX 8000 IN POLYPROPYLENE PACKAGING INDUSTRY

-

6.7 TRADE DATA STATISTICSIMPORT SCENARIOEXPORT SCENARIO

-

6.8 PRICING ANALYSISAVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TRENDS

- 6.9 KEY CONFERENCES AND EVENTS IN 2023

- 6.10 GLOBAL REGULATORY FRAMEWORK ON CLARIFYING AGENTS MARKET

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 POLYPROPYLENE (PP)INCREASING DEMAND FOR PP IN PACKAGING AND CONSUMER GOODS TO FUEL MARKET

-

7.3 POLYETHYLENE (PE)PACKAGING INDUSTRY IN EUROPE TO DRIVE DEMAND FOR CLARIFYING AGENTS FOR PEHDPELDPELLDPE

-

7.4 POLYETHYLENE TEREPHTHALATE (PET)RISING DEMAND FOR BEVERAGE PACKAGING TO FUEL MARKET IN PET SEGMENT

-

7.5 OTHERSPOLYAMIDEPOLYSTYRENEACRYLONITRILE BUTADIENE STYRENE

- 8.1 INTRODUCTION

-

8.2 POWDERABILITY OF POWDER CLARIFYING AGENTS TO IMPART SMOOTH TEXTURES TO DRIVE DEMAND

-

8.3 GRANULESCOMPATIBILITY WITH CONVENTIONAL FEEDERS AND EFFICIENCY IN MATERIAL HANDLING TO DRIVE MARKET

-

8.4 LIQUIDASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR LIQUID CLARIFYING AGENTS

- 9.1 INTRODUCTION

-

9.2 PACKAGINGDEMAND FOR INCREASED SHELF LIFE OF PRODUCTSFOOD & BEVERAGE PACKAGINGMEDIA PACKAGING

-

9.3 CONSUMER PRODUCTSGROWING DEMAND DUE TO REDUCED PROCESSING CYCLE TIME AND HIGHER PRODUCTIVITYPERSONAL CARE PRODUCTSHOUSEHOLD PRODUCTS

-

9.4 ELECTRONICSCLARIFYING AGENTS OFFER CONTROLLED SHRINKAGE AND INCREASED IMPACT RESISTANCE

-

9.5 OTHERSBUILDING & CONSTRUCTIONPHARMACEUTICALSAGRICULTURE

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICASIA PACIFIC: CLARIFYING AGENTS MARKET, BY FORMASIA PACIFIC: CLARIFYING AGENT MARKET, BY POLYMERASIA PACIFIC: CLARIFYING AGENTS MARKET, BY APPLICATIONASIA PACIFIC: CLARIFYING AGENT MARKET, BY COUNTRY- China- South Korea- Japan- India

-

10.3 EUROPEEUROPE: CLARIFYING AGENTS MARKET, BY FORMEUROPE: CLARIFYING AGENT MARKET, BY POLYMEREUROPE: CLARIFYING AGENTS MARKET, BY APPLICATIONEUROPE: CLARIFYING AGENT MARKET, BY COUNTRY- Germany- Italy- France- UK

-

10.4 NORTH AMERICANORTH AMERICA: CLARIFYING AGENTS MARKET, BY FORMNORTH AMERICA: CLARIFYING AGENT MARKET, BY POLYMERNORTH AMERICA: CLARIFYING AGENTS MARKET, BY APPLICATIONNORTH AMERICA: CLARIFYING AGENT MARKET, BY COUNTRY- US- Mexico- Canada

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CLARIFYING AGENTS MARKET, BY FORMMIDDLE EAST & AFRICA: CLARIFYING AGENT MARKET, BY POLYMERMIDDLE EAST & AFRICA: CLARIFYING AGENTS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: CLARIFYING AGENT MARKET, BY COUNTRY- Iran- South Africa

-

10.6 SOUTH AMERICASOUTH AMERICA: CLARIFYING AGENTS MARKET, BY FORMSOUTH AMERICA: CLARIFYING AGENT MARKET, BY POLYMERSOUTH AMERICA: CLARIFYING AGENTS MARKET, BY APPLICATIONSOUTH AMERICA: CLARIFYING AGENT MARKET, BY COUNTRY- Brazil- Argentina

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021MARKET SHARE OF KEY PLAYERS- Milliken & Company- ADEKA Corporation- Shandong Rainwell New Materials Technology Co., Ltd.REVENUE ANALYSIS OF TOP THREE PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSMILLIKEN & COMPANY- Business overview- Products offered- Recent developments- MnM viewADEKA CORPORATION- Business overview- Products offered- MnM viewBASF SE- Business overview- Products offered- Recent developments- MnM viewAVIENT CORPORATION- Business overview- Products offered- MnM viewNEW JAPAN CHEMICAL CO., LTD.- Business overview- Products offered- MnM viewSHANDONG RAINWELL NEW MATERIALS TECHNOLOGY CO., LTD.- Business overview- Products offeredGCH TECHNOLOGY CO., LTD.- Business overview- Products offered- Recent developmentsQINGDAO JADE NEW MATERIAL TECHNOLOGY- Business overview- Products offeredGUANGZHOU BOLONG CHEMICAL CO. LTD.- Business overview- Products offeredTA HAW ENTERPRISE CO. LTD.- Business overview- Products offered

-

12.2 OTHER KEY PLAYERSRIANLON CORPORATIONALTANA AGPOLYVEL INC.SYNCHEMER CO., LIMITEDLIBERTY CHEMICALSHPL ADDITIVES LIMITEDRICH YU CHEMICAL CO., LTD.EVERSPRING CHEMICAL CO., LTD.INTEGRATED COLOUR SYSTEM SDN BHD (ICS)SRI VASAVI PIGMENTS PVT. LTD.PRIMEX PLASTICS CORPORATIONSUNRISE COLOURS VIETNAM CO., LTD.PALMAROLE AGTIANJIN BEST GAIN SCIENCE & TECHNOLOGY CO., LTD.BLEND COLOURS PVT. LTD.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 PLASTIC ADDITIVES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 PLASTIC ADDITIVES MARKET, BY REGIONASIA PACIFIC- By country- By applicationEUROPE- By country- By applicationNORTH AMERICA- By country- By applicationMIDDLE EAST & AFRICA- By country- By applicationSOUTH AMERICA- By country- By application

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 PLASTIC CONSUMPTION, BY COUNTRY, 2014–2020 (KILOTON)

- TABLE 2 COMMON USAGE AND ADVERSE HEALTH EFFECTS OF PLASTICS

- TABLE 3 REGULATIONS ON USAGE OF PLASTICS

- TABLE 4 CLARIFYING AGENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 8 CLARIFYING AGENTS MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

- TABLE 9 CLARIFYING AGENT MARKET: ECOSYSTEM

- TABLE 10 IMPORTS OF CLARIFYING AGENTS, BY REGION, 2012–2020 (USD MILLION)

- TABLE 11 EXPORTS OF CLARIFYING AGENTS, BY REGION, 2012–2020 (USD MILLION)

- TABLE 12 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE OF CLARIFYING AGENTS, BY REGION, 2020–2027 (USD/KG)

- TABLE 14 CLARIFYING AGENTS MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 15 REGULATIONS RELATED TO CLARIFYING AGENTS

- TABLE 16 GRANTED PATENTS ACCOUNT FOR ~64% OF TOTAL COUNT

- TABLE 17 LIST OF RECENT PATENTS BY UNIVERSITY OF CALIFORNIA

- TABLE 18 LIST OF RECENT PATENTS BY BRISTOL MYERS SQUIBB

- TABLE 19 LIST OF RECENT PATENTS BY CORNING INC.

- TABLE 20 TOP 10 PATENT OWNERS IN US, 2011–2021

- TABLE 21 CLARIFYING AGENTS MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 22 CLARIFYING AGENT MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 23 CLARIFYING AGENTS MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 24 CLARIFYING AGENT MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 25 PP: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 26 PP: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 27 PP: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 28 PP: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 PE: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 30 PE: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 31 PE: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 32 PE: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 33 PET: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 34 PET: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 35 PET: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 36 PET: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 37 OTHER POLYMERS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 38 OTHER POLYMERS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 39 OTHER POLYMERS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 40 OTHER POLYMERS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 41 CLARIFYING AGENTS MARKET, BY FORM, 2016–2020 (TON)

- TABLE 42 CLARIFYING AGENT MARKET, BY FORM, 2021–2027 (TON)

- TABLE 43 CLARIFYING AGENTS MARKET, BY FORM, 2016–2020 (USD MILLION)

- TABLE 44 CLARIFYING AGENT MARKET, BY FORM, 2021–2027 (USD MILLION)

- TABLE 45 POWDER: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (TON)

- TABLE 46 POWDER: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (TON)

- TABLE 47 POWDER: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 48 POWDER: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 49 GRANULES: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (TON)

- TABLE 50 GRANULES: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (TON)

- TABLE 51 GRANULES: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 52 GRANULES: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 53 LIQUID: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (TON)

- TABLE 54 LIQUID: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (TON)

- TABLE 55 LIQUID: CLARIFYING AGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 56 LIQUID: CLARIFYING AGENT MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 57 CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 58 CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 59 CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 60 CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 61 PACKAGING: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 62 PACKAGING: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 63 PACKAGING: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 64 PACKAGING: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 65 CONSUMER PRODUCTS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 66 CONSUMER PRODUCTS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 67 CONSUMER PRODUCTS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 68 CONSUMER PRODUCTS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 69 ELECTRONICS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 70 ELECTRONICS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 71 ELECTRONICS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 72 ELECTRONICS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 73 OTHERS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 74 OTHERS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 75 OTHERS: CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 76 OTHERS: CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 77 CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (TON)

- TABLE 78 CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 79 CLARIFYING AGENTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

- TABLE 80 CLARIFYING AGENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CLARIFYING AGENTS MARKET SIZE, BY FORM, 2016–2020 (TON)

- TABLE 82 ASIA PACIFIC: CLARIFYING AGENT MARKET SIZE, BY FORM, 2021–2027 (TON)

- TABLE 83 ASIA PACIFIC: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 86 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 87 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 90 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 91 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (TON)

- TABLE 94 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 95 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 97 CHINA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 98 CHINA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 99 CHINA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 100 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 101 SOUTH KOREA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 102 SOUTH KOREA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 103 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 104 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 105 JAPAN: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 106 JAPAN: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 107 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 108 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 109 INDIA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 110 INDIA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 111 INDIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 112 INDIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 113 EUROPE: CLARIFYING AGENTS MARKET SIZE, BY FORM, 2016–2020 (TON)

- TABLE 114 EUROPE: CLARIFYING AGENT MARKET SIZE, BY FORM, 2021–2027 (TON)

- TABLE 115 EUROPE: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

- TABLE 116 EUROPE: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

- TABLE 117 EUROPE: MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 118 EUROPE: MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 119 EUROPE: MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 120 EUROPE: MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 122 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 123 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 124 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 125 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (TON)

- TABLE 126 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 127 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 128 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 129 GERMANY: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 130 GERMANY: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 131 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 132 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 133 ITALY: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 134 ITALY: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 135 ITALY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 136 ITALY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 137 FRANCE: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 138 FRANCE: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 139 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 140 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 141 UK: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 142 UK: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 143 UK: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 144 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 145 NORTH AMERICA: CLARIFYING AGENTS MARKET SIZE, BY FORM, 2016–2020 (TON)

- TABLE 146 NORTH AMERICA: CLARIFYING AGENT MARKET SIZE, BY FORM, 2021–2027 (TON)

- TABLE 147 NORTH AMERICA: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

- TABLE 148 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

- TABLE 149 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 150 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 151 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 152 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 153 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 154 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 155 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 156 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 157 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (TON)

- TABLE 158 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 159 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 160 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 161 US: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 162 US: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 163 US: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 164 US: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 165 MEXICO: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 166 MEXICO: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 167 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 168 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 169 CANADA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 170 CANADA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 171 CANADA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 172 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: CLARIFYING AGENTS MARKET SIZE, BY FORM, 2016–2020 (TON)

- TABLE 174 MIDDLE EAST & AFRICA: CLARIFYING AGENT MARKET SIZE, BY FORM, 2021–2027 (TON)

- TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 178 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (TON)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 189 IRAN: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 190 IRAN: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 191 IRAN: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 192 IRAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 193 SOUTH AFRICA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 194 SOUTH AFRICA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 195 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 196 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 197 SOUTH AMERICA: CLARIFYING AGENTS MARKET SIZE, BY FORM, 2016–2020 (TON)

- TABLE 198 SOUTH AMERICA: CLARIFYING AGENT MARKET SIZE, BY FORM, 2021–2027 (TON)

- TABLE 199 SOUTH AMERICA: MARKET SIZE, BY FORM, 2016–2020 (USD MILLION)

- TABLE 200 SOUTH AMERICA: MARKET SIZE, BY FORM, 2021–2027 (USD MILLION)

- TABLE 201 SOUTH AMERICA: MARKET SIZE, BY POLYMER, 2016–2020 (TON)

- TABLE 202 SOUTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2027 (TON)

- TABLE 203 SOUTH AMERICA: MARKET SIZE, BY POLYMER, 2016–2020 (USD MILLION)

- TABLE 204 SOUTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2027 (USD MILLION)

- TABLE 205 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 206 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 207 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 208 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 209 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (TON)

- TABLE 210 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 211 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

- TABLE 212 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 213 BRAZIL: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 214 BRAZIL: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 215 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 216 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 217 ARGENTINA: CLARIFYING AGENTS MARKET SIZE, BY APPLICATION, 2016–2020 (TON)

- TABLE 218 ARGENTINA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 219 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 220 ARGENTINA: CLARIFYING AGENT MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 221 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 222 CLARIFYING AGENTS MARKET: DEGREE OF COMPETITION

- TABLE 223 CLARIFYING AGENT MARKET: FORM FOOTPRINT

- TABLE 224 CLARIFYING AGENTS MARKET: POLYMER TYPE FOOTPRINT

- TABLE 225 CLARIFYING AGENT MARKET: APPLICATION FOOTPRINT

- TABLE 226 CLARIFYING AGENTS MARKET: COMPANY REGION FOOTPRINT

- TABLE 227 CLARIFYING AGENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 228 CLARIFYING AGENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 229 CLARIFYING AGENT MARKET: NEW PRODUCT LAUNCHES (2019–2022)

- TABLE 230 CLARIFYING AGENTS MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 231 MILLIKEN & COMPANY: COMPANY OVERVIEW

- TABLE 232 MILLIKEN & COMPANY: PRODUCT LAUNCHES

- TABLE 233 MILLIKEN & COMPANY: OTHER DEVELOPMENTS

- TABLE 234 ADEKA CORPORATION: COMPANY OVERVIEW

- TABLE 235 BASF SE: COMPANY OVERVIEW

- TABLE 236 BASF SE: OTHER DEVELOPMENTS

- TABLE 237 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 238 NEW JAPAN CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 239 SHANDONG RAINWELL NEW MATERIALS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 240 GCH TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 241 GCH TECHNOLOGY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 242 QINGDAO JADE NEW MATERIAL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 243 GUANGZHOU BOLONG CHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 244 TA HAW ENTERPRISE CO. LTD.: COMPANY OVERVIEW

- TABLE 245 RIANLON CORPORATION: COMPANY OVERVIEW

- TABLE 246 ALTANA AG: COMPANY OVERVIEW

- TABLE 247 POLYVEL INC.: COMPANY OVERVIEW

- TABLE 248 SYNCHEMER CO., LIMITED: COMPANY OVERVIEW

- TABLE 249 LIBERTY CHEMICALS: COMPANY OVERVIEW

- TABLE 250 HPL ADDITIVES LIMITED: COMPANY OVERVIEW

- TABLE 251 RICH YU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 252 EVERSPRING CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 253 INTEGRATED COLOUR SYSTEM SDN BHD (ICS): COMPANY OVERVIEW

- TABLE 254 SRI VASAVI PIGMENTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 255 PRIMEX PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 256 SUNRISE COLOURS VIETNAM CO., LTD.: COMPANY OVERVIEW

- TABLE 257 PALMAROLE AG: COMPANY OVERVIEW

- TABLE 258 TIANJIN BEST GAIN SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 259 BLEND COLOURS PVT. LTD.: COMPANY OVERVIEW

- TABLE 260 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

- TABLE 261 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

- TABLE 262 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

- TABLE 263 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

- TABLE 264 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

- TABLE 265 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 266 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 267 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 268 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

- TABLE 269 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

- TABLE 270 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 271 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 272 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

- TABLE 273 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 274 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 275 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 276 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

- TABLE 277 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

- TABLE 278 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 279 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 280 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

- TABLE 281 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 282 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 283 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 284 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

- TABLE 285 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

- TABLE 286 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 287 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

- TABLE 289 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 290 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

- TABLE 293 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

- TABLE 294 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 296 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

- TABLE 297 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 298 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 299 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 300 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

- TABLE 301 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

- TABLE 302 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

- TABLE 303 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

- FIGURE 1 CLARIFYING AGENTS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION - SUPPLY SIDE: COMBINED SHARE OF MAJOR PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION - SUPPLY SIDE ( BOTTOM-UP): REVENUE FROM SALE OF CLARIFYING AGENTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (TOP-DOWN)

- FIGURE 6 CLARIFYING AGENTS MARKET: DATA TRIANGULATION

- FIGURE 7 CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 9 PACKAGING APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 PET SEGMENT PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER CAGR DURING FORECAST PERIOD

- FIGURE 12 MARKET EXPECTED TO WITNESS HIGH GROWTH BETWEEN 2022 AND 2027

- FIGURE 13 GERMANY ACCOUNTED FOR LARGEST SHARE OF CLARIFYING AGENTS MARKET IN EUROPE

- FIGURE 14 POWDER FORM TO DOMINATE CLARIFYING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC MARKET TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PACKAGING SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CLARIFYING AGENTS MARKET

- FIGURE 19 CLARIFYING AGENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 22 CLARIFYING AGENTS MARKET: SUPPLY CHAIN

- FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 24 CLARIFYING AGENTS MARKET: CHANGING REVENUE MIX

- FIGURE 25 CLARIFYING AGENT MARKET: ECOSYSTEM

- FIGURE 26 IMPORTS OF CLARIFYING AGENTS, BY KEY COUNTRIES

- FIGURE 27 EXPORTS OF CLARIFYING AGENTS, BY KEY COUNTRIES

- FIGURE 28 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 29 AVERAGE SELLING PRICE OF CLARIFYING AGENTS, BY REGION, 2020–2027

- FIGURE 30 PATENT PUBLICATION TRENDS, 2011–2021

- FIGURE 31 LEGAL STATUS OF PATENTS

- FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN US

- FIGURE 33 UNIVERSITY OF CALIFORNIA REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- FIGURE 34 PP TO BE DOMINANT SEGMENT FOR CLARIFYING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 35 POWDER PROJECTED TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- FIGURE 36 PACKAGING APPLICATION TO DOMINATE CLARIFYING AGENT MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO BE FASTEST-GROWING CLARIFYING AGENTS MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: CLARIFYING AGENTS MARKET SNAPSHOT

- FIGURE 39 EUROPE: CLARIFYING AGENT MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: CLARIFYING AGENTS MARKET SNAPSHOT

- FIGURE 41 RANKING OF TOP THREE PLAYERS, 2021

- FIGURE 42 MILLIKEN & COMPANY LED CLARIFYING AGENTS MARKET IN 2021

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- FIGURE 44 CLARIFYING AGENTS MARKET: COMPANY FOOTPRINT

- FIGURE 45 COMPANY EVALUATION QUADRANT FOR CLARIFYING AGENTS MARKET (TIER 1)

- FIGURE 46 STARTUP/SME EVALUATION QUADRANT FOR CLARIFYING AGENT MARKET

- FIGURE 47 ADEKA CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 BASF SE: COMPANY SNAPSHOT

- FIGURE 49 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 NEW JAPAN CHEMICAL CO., LTD.: COMPANY SNAPSHOT

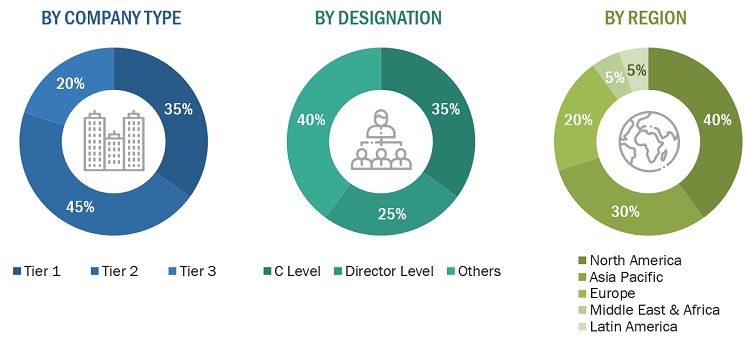

The study involved four major activities to estimate the market size for clarifying agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The clarifying agents market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the clarifying agents industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the clarifying agents industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using C4ISR were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of clarifying agents and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Milliken & Company |

Individual Industry Expert |

|

ADEKA Corporation |

Sales Manager |

|

Shandong Rainwell New Materials Technology Co., Ltd. |

Director |

|

Avient Corporation |

Marketing Manager |

|

New Japan Chemical Co., Ltd. |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the clarifying agents market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Clarifying Agents Market: Bottom-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Clarifying Agents Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

According to the European Plastic Joint Stock Company, a clarifying agent is an additive that improves the transparency of plastic products. It is used as an additive to increase transparency to help products achieve high aesthetics and improve quality. Clarifiers, in contrast to nucleating agents, are transparent, which helps minimize haze values and makes them easier to see through.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the clarifying agents market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on form, polymer, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clarifying Agents Market