Circuit Monitoring Market by Type (Modular Circuit Monitoring, Others (Branch Circuit & Multi Circuit)), End Use (Residential,Commercial, Industrial, Data Centers), & Region (North America, Europe, APAC, South America, MEA) - Global Forecast to 2028

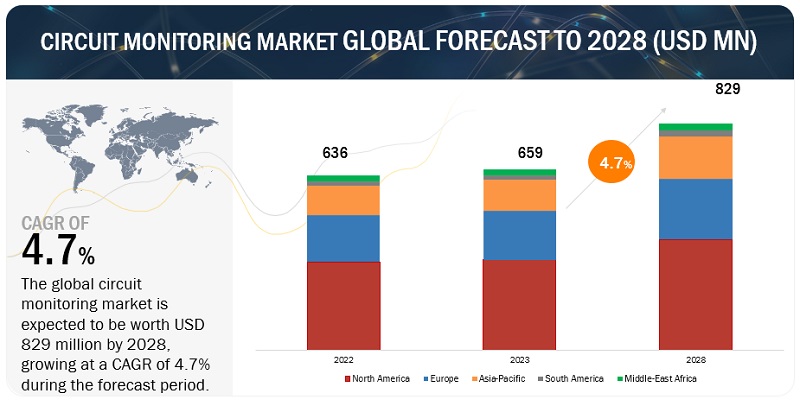

The Circuit Monitoring Market size was valued at USD 659 Million in 2023 and the total Circuit Monitoring Market is expected to grow at a CAGR of 4.7% from 2023 to 2028, nearly reaching USD 829 Million in 2028.

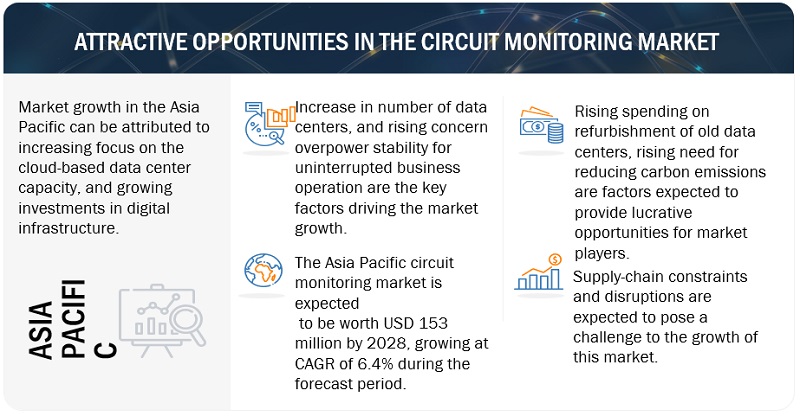

Increasing number of data centers, and rising concern overpower stability for uninterrupted business operation is driving the market for Circuit Monitoring Market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Circuit Monitoring Market Dynamics

Driver: Rising concerns over power stability for uninterrupted business operation

Electricity is a vital and fundamental need for economies and industries to operate, but many locations are deprived of stable power distribution infrastructure. As power density in modern industrial and commercial applications increases, more focus would shift toward improving efficiency in the power distribution infrastructure. Circuit monitoring units act as a backbone for the efficient monitoring of power to increase efficiency.

According to the Energy Information Administration (EIA), computers and related equipment were the major consumers of electricity in 2018. Other systems that used electricity in bulk were refrigeration, space cooling, ventilation, lighting, and space and water heating.

Currently, the IT & telecom sector individually accounts for 2–3% of global electricity consumption. With the introduction of the 5G network worldwide, electricity consumption from such sectors is expected to increase. Such energy-intensive industries require 24x7 power supply to run the operations, and power distribution units aid in reliable and stable power supply to the connected outlets. Similarly, the healthcare industry, which includes hospitals and dispensaries broadly, is another electricity-intensive sector as electricity is required every second for critical applications, such as medical machines, lighting and heating needs, and computer operations.

The planning of circuit monitoring systems in buildings and infrastructure facilities is subject to electricity budgeting and maintaining operational expenditure for industries. Such industries drive the demand for circuit monitoring, which acts as an interface between power consumption and power management of industries. In a sustainability report for 2020, Facebook announced that it had used a total of 7.17 million megawatt-hours of electricity in 2020, out of which 6.966 million megawatt-hours were for data centers, and the rest was for its offices, which was ~39% increase over 2019.

Restraint: Decilne in adoption of circuit monitoring due to advancement in energy monitoring systems

An energy management system is installed by data centers and industries, as well as residential and commercial sectors. This system offers various benefits such as faster problem determination, increased safety, high productivity, improved power quality, and increased scalability. These systems also facilitate monitoring of various parameters, such as power quality, generator control, load forecasting, energy cost calculations, and automatic load shedding, for power distribution. Energy management systems have been widely adopted by industries for increasing energy efficiency, improving efficiency of equipment by decreasing power consumption, and reducing energy costs. Circuit monitoring systems only help in monitoring but, to some extent, also assist in measuring the power quality. Thus, energy management systems provide more features and advantages than circuit monitoring systems, and hence, are being implemented by commercial, data centers, residential, and industrial end users at large. The aforesaid is limiting the adoption of circuit monitoring systems.

Opportunities: Enforcement of stringent regulations to reduce carbon footprint of data centers

Data centers are intense consumers of water and electricity and are responsible for significant carbon emissions. Some regulatory bodies and governments, such as the International Organization for Standardization, American National Standards Institute, and European standards, are imposing sustainability standards on newly built data centers. For instance, in Singapore, the Infocomm Media Development Authority (IMDA) of the government managed the growth of data centers by imposing a moratorium on new data center projects since 2019 and announced a temporary pause in data center development in the country. However, in 2022, the three-year moratorium on new data centers officially ended, with the IMDA and Economic Development Board (EDB) launching a pilot scheme for new applications for calibrated and sustainable growth of data centers in Singapore. On February 16, 2022, the Netherlands' Ministry of the Interior made a preliminary decision on government regulations for hyperscale data centers that prohibit to change the use of grounds and buildings in such way that a hyperscale data center cannot be established until new national conditions for establishing hyperscale data centers have been determined. These developments give investors opportunities to secure data centers with carbon-free energy supplies.

The use of renewable energy is critical for hyperscale data centers. Hyperscale and colocation data center developers have committed themselves to using only carbon-free energy by 2030 to meet sustainability goals. Measurement and monitoring of data center energy consumption is also gaining traction to enhance achieving sustainability goals. Rack PDUs, PDUs, bus drops, busway end feeds, remote power panels, UPS, and building meters help monitor power consumption and improve energy efficiency. Circuit monitoring allows data centers to manage power usage, enabling them to identify areas where energy is being wasted and make adjustments to reduce energy consumption. By using circuit monitoring to optimize energy usage, data centers can reduce their carbon emissions and environmental impact. This is particularly important as the demand for data storage and processing continues to grow and data centers become an increasingly important part of the global technology infrastructure.

Challenges: Supply chain constraints and disruptions

The prices of raw materials used for making circuit monitoring components are unstable and raw material providers face multiple disruptions in the supply chain. Several components and parts of circuit monitoring systems come from China, the US, and Europe. Manufacturing disruptions in China and the US could contribute to the slow growth in the circuit monitoring market over the next few years. Due to the inflation and economic crisis, the local currencies of several countries have depreciated, affecting purchase prices of materials that are generally traded in US dollars. There is a misalignment of supply and demand, leading to financial losses to component/part manufacturers.

Post COVID-19, a bullwhip effect-recovery was seen in the market for raw materials owing to a sudden rise in demand for components and raw materials due to massive stimulus injections and federal reserve interventions. This negatively affected component manufacturers that had scaled-down their production due to the pandemic. The impact of the Russia–Ukraine war and COVID-19 reemerging in China has detrimentally affected raw materials and energy prices, which have significantly increased. Ukraine-related transportation restrictions and extended lead times have plagued the supply chain. Moreover, Ukraine and Russia are significant producers of aluminum, copper, and steel. Galvanized steel is a major component typically used to make panelboards. Steel prices are likely to increase significantly in the near future. Circuit breakers use steel or aluminum and copper. With recently moderating copper prices, a smaller price hike can be expected in circuit breakers. Switchgears are large and bulky items. Continuing shipping disruptions is anticipated to affect lead times. Furthermore, surging fuel prices might enhance transport costs, further driving price increases in the near term. Wires and cables use copper and aluminum. Their prices are slowly stabilizing after a huge increase, but are expected to remain high for a few years.

Supply disruptions and increasing raw material costs are anticipated to drive the price increase, furthering the disruptions in the circuit monitoring market.

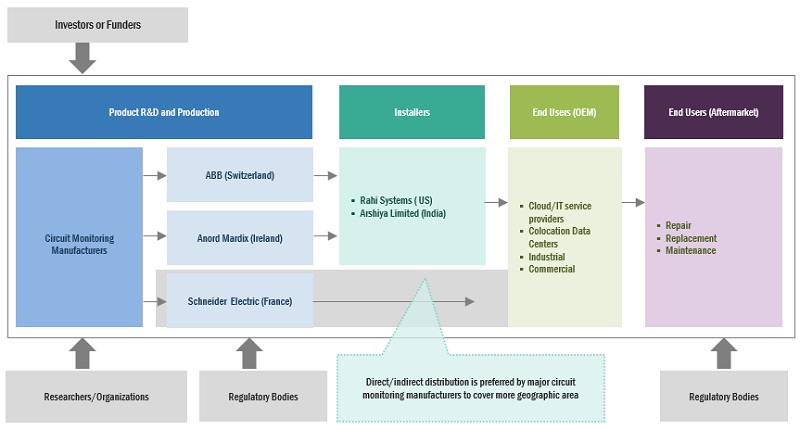

Circuit Monitoring Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Circuit Monitoring systems and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Toshiba International Corporation (Japan), and Legrand (Ireland).

The others segment, by type, is expected to be the largest market during the forecast period.

This report segments the circuit monitoring market based on type into two types: Modular circuit monitoring, and others. The others segment is expected to be the largest market during the forecast period. The others segment include branch circuit monitoring, and multi circuit monitoring. Both multi-circuit monitors and branch circuit monitors are compact and, hence, use lesser space as compared to traditional single-circuit energy meters. These are used by industries, data centers, and commercial and residential end users.

By End User, the data center segment is expected to be the largest during the forecast period

This report segments the circuit monitoring market based on end users into four segments: data centers, commercial, industrial, and residential. The data center segment is expected to be the largest segment during the forecast period. The data centers segment is driven by the heightened adoption of circuit monitoring in data centers for remote monitoring and the determination of power usage effectiveness.

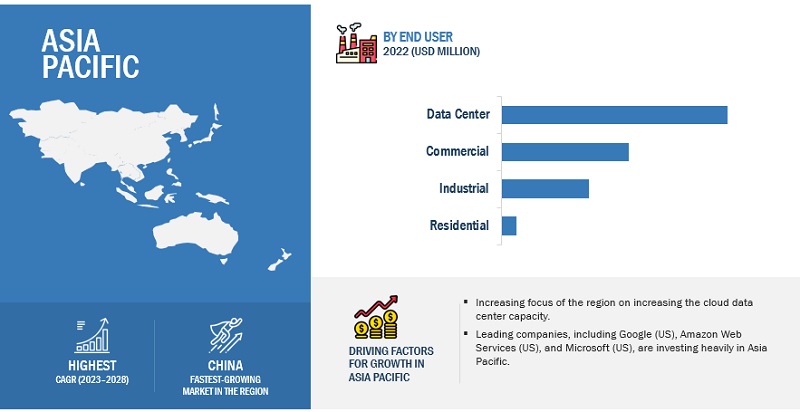

“Asia Pacific”: The fastest in the circuit monitoring market”

Asia Pacific is expected to fastest growing region in the circuit monitoring market between 2023–2028, followed by the Middle East and Africa, and South America America. Leading companies, including Google (US), Amazon Web Services (US), and Microsoft (US), are investing heavily in Asia Pacific and building regional data center facilities is one of the key factors fostering the growth of the circuit monitoring in the Asia Pacific.

Key Market Players

The circuit monitoring market is dominated by a few major players that have a wide regional presence. The major players in the circuit monitoring market are ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Toshiba International Corporation (Japan), and Legrand (Ireland). Between 2019 and 2023, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the circuit monitoring market.

Scope of the Report

| Report Metrics |

Details |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Circuit monitoring market by type, end user, and region |

|

Region covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Toshiba International Corporation (Japan), Legrand (Ireland), NHP (Newzealand), Accuenergy (Canada), Circuitmeter Inc (Canada), Senva Inc (US), CET Inc (China), Socomec (France), Omron (Japan), Anord Mardix (Ireland), Packet Power (US), Daxten (UK), Nlyte Software (Georgia), Bay Power Inc (US), Acrel-Electric Co (China), Elmeasure (India), and MPL Technology (UK) |

This research report categorizes the circuit monitoring market by type, end user, and region.

On the basis of by type:

- Modular Circuit Monitoring

- Others

On the basis of end user:

- Residential

- Data Centers

- Industrial

- Commercial

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2023, Schneider Electric invested USD 42.85 million in a Hungarian factory of 25,000-meter sq. with 500 employees. The site would have 30 electric cars and 25 electric bicycles, Schneider electric charging stations, and Schneider electric sensors to reduce energy waste and airlocks.

- In September 2022, ABB invested USD 13 million for the expanision of facilities in Canada to increase production capacity and establish a research & development facility.

- In July 2022, Eaton acquired 50% circuit breaker business in Jiangsu Huineng Electric Co. Ltd. This would boost the growth strategy of Eaton and capitalize on opportunities in high-growth market segments.

- In March 2021, Eaton completed the acquisition of Tripp Lite, a supplier of power supply systems, rack power distribution units, surge protectors and enclosures for data centers and industrial, medical and communication markets. This acquisition would enhance the breadth offerings of Eaton.

Frequently Asked Questions (FAQ):

What is the current size of the circuit monitoring market?

The current market size of the circuit monitoring market is USD 636 million in 2022.

What are the major drivers for the circuit monitoring market?

Increasing number of data centers, and rising concern overpower stability for uninterrupted business operation is driving the market for Circuit Monitoring Market.

Which is the fastest growing region during the forecasted period in the circuit monitoring market?

Asia Pacific is expected to fastest growing region in the circuit monitoring market between 2023–2028, followed by the Middle East and Africa, and South America America. Leading companies, including Google (US), Amazon Web Services (US), and Microsoft (US), are investing heavily in Asia Pacific and building regional data center facilities is one of the key factors fostering the growth of the circuit monitoring in the Asia Pacific.

Which is the largest segment, by end user during the forecasted period in the circuit monitoring market?

The data center segment is expected to be the largest segment during the forecast period. The data centers segment is driven by the heightened adoption of circuit monitoring in data centers for remote monitoring and the determination of power usage effectiveness.

Which is the largest segment, by the type during the forecasted period in the circuit monitoring market?

The others segment is expected to be the largest market during the forecast period. The others segment include branch circuit monitoring, and multi circuit monitoring. Both multi-circuit monitors and branch circuit monitors are compact and, hence, use lesser space as compared to traditional single-circuit energy meters. These are used by industries, data centers, and commercial and residential end users.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising concerns over power stability for uninterrupted business operations- Increasing number of data centers- Intensifying need to monitor energy consumption to achieve carbon neutralityRESTRAINTS- Decline in adoption of circuit monitoring due to advancements in energy monitoring systemsOPPORTUNITIES- Enforcement of stringent regulations to reduce carbon footprint of data centers- Shift toward cloud-based data centersCHALLENGES- Supply chain constraints and disruptions- Complexities involved in integrating circuit monitoring systems into operational data centers

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR CIRCUIT MONITORING SYSTEM PROVIDERS

- 5.4 MARKET MAP

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSCOMPONENT MANUFACTURERSCIRCUIT MONITORING SYSTEM MANUFACTURERSDISTRIBUTORS AND END USERSPOST-SALES SERVICE PROVIDERS

- 5.6 AVERAGE SELLING PRICE (ASP) ANALYSIS

-

5.7 TARIFF AND REGULATORY LANDSCAPETARIFFS RELATED TO CIRCUIT MONITORINGREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODES AND REGULATIONS RELATED TO CIRCUIT MONITORING

-

5.8 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.10 PATENT ANALYSIS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 CASE STUDY ANALYSISPACKET POWER PROVIDED CUSTOMIZED POWER MONITORS FOR DATA REALTYNREL REDUCED DATA CENTER LOAD AT ITS FACILITY

-

5.14 TECHNOLOGY ANALYSISTECHNOLOGY TRENDS RELATED TO CIRCUIT MONITORING

- 5.15 TRENDS IN COLOCATION AND HYPERSCALE DATA CENTERS

- 6.1 INTRODUCTION

-

6.2 MODULAR CIRCUIT MONITORINGOFFERS ADVANTAGES OF ACCURACY AND EASY INSTALLATION

- 6.3 OTHERS

- 7.1 INTRODUCTION

-

7.2 RESIDENTIALUSE CIRCUIT MONITORING TO GAIN ACTUAL PICTURE OF POWER CONSUMPTION

-

7.3 COMMERCIALUSE CIRCUIT MONITORING TO IMPROVE CAPACITY PLANNING AND POWER CONSUMPTION

-

7.4 DATA CENTERSUSE CIRCUIT MONITORING TO TRACK POWER CONSUMPTION OF ALL IT DEVICES

-

7.5 INDUSTRIALDEPLOY CIRCUIT MONITORING TO MAXIMIZE MACHINE UPTIME, INCREASE EFFICIENCY, AND LOWER COSTS

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACT ON CIRCUIT MONITORING MARKET IN ASIA PACIFICBY TYPEBY END USERBY COUNTRY- China- Japan- India- South Korea- Rest of Asia Pacific

-

8.3 NORTH AMERICARECESSION IMPACT ON CIRCUIT MONITORING MARKET IN NORTH AMERICABY TYPEBY END USERBY COUNTRY- US- Canada

-

8.4 EUROPERECESSION IMPACT ON CIRCUIT MONITORING MARKET IN EUROPEBY TYPEBY END USERBY COUNTRY- UK- Germany- France- Italy- Rest of Europe

-

8.5 SOUTH AMERICARECESSION IMPACT ON CIRCUIT MONITORING MARKET IN SOUTH AMERICABY TYPEBY END USERBY COUNTRY- Brazil- Argentina- Rest of South America

-

8.6 MIDDLE EAST & AFRICARECESSION IMPACT ON CIRCUIT MONITORING MARKET IN MIDDLE EAST & AFRICABY TYPEBY END USERBY COUNTRY- South Africa- Saudi Arabia- UAE- Rest of Middle East & Africa

- 9.1 KEY PLAYERS STRATEGIES

- 9.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 9.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

9.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 9.5 CIRCUIT MONITORING MARKET: COMPANY FOOTPRINT

- 9.6 COMPETITIVE SCENARIOS AND TRENDS

-

10.1 KEY PLAYERSSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEATON- Business overview- Products/Solutions/Services offered- Deals- Others- MnM viewABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOSHIBA INTERNATIONAL CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewLEGRAND- Business overview- Products/Solutions/Services offered- MnM viewANORD MARDIX- Business overview- Products/Solutions/Services offered- Recent developmentsPACKET POWER- Business overview- Products/Solutions/Services offeredSENVA INC- Business overview- Products/Solutions/Services offeredSOCOMEC- Business overview- Products/Solutions/Services offered- Recent developmentsOMRON CORPORATION- Business overview- Products/Solutions/Services offeredACREL – ELECTRIC CO- Business overview- Products/Solutions/Services offeredMPL TECHNOLOGIES- Business overview- Products/Solutions/Services offeredDAXTEN- Business overview- Products/Solutions/Services offered- Recent developmentsNHP- Business overview- Products/Solutions/Services offeredACCUENERGY- Business overview- Products/Solutions/Services offered

-

10.2 OTHER PLAYERSCET INC.BAY POWER INC.NLYTE SOFTWAREELMEASURECIRCUITMETER

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS

- TABLE 1 CIRCUIT MONITORING MARKET SNAPSHOT

- TABLE 2 MAJOR COUNTRIES WITH COLOCATION DATA CENTERS, 2022

- TABLE 3 DATA CENTER SUSTAINABILITY TARGETS AND INVESTMENTS BY MAJOR COMPANIES

- TABLE 4 CIRCUIT MONITORING MARKET: ECOSYSTEM ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF CIRCUIT MONITORING SYSTEMS, BY TYPE, 2021

- TABLE 6 PRICING ANALYSIS OF CIRCUIT MONITORING SYSTEMS, BY REGION, 2021

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 13 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 14 EUROPE: CODES AND REGULATIONS

- TABLE 15 GLOBAL: CODES AND REGULATIONS

- TABLE 16 EXPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 17 IMPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 18 CIRCUIT MONITORING MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 19 CIRCUIT MONITORING MARKET: INNOVATIONS AND PATENT REGISTRATION

- TABLE 20 CIRCUIT MONITORING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 22 KEY BUYING CRITERIA, BY END USER

- TABLE 23 CIRCUIT MONITORING MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 24 CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 MODULAR CIRCUIT MONITORING: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 OTHERS: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 CIRCUIT MONITORING MARKET, BY END USER, 2016–2020 (USD MILLION)

- TABLE 28 CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2016–2020 (USD MILLION)

- TABLE 29 CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 30 CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 31 RESIDENTIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 COMMERCIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 DATA CENTERS: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 INDUSTRIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 CIRCUIT MONITORING MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 36 CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 CIRCUIT MONITORING MARKET, BY REGION, 2021–2028 (MILLION UNITS)

- TABLE 38 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MODULAR CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 CHINA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 47 CHINA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 48 JAPAN: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 JAPAN: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 50 INDIA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 INDIA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 52 SOUTH KOREA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 SOUTH KOREA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 US: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 US: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 66 CANADA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 UK: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 UK: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 78 GERMANY: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 GERMANY: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 80 FRANCE: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 FRANCE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 82 ITALY: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 ITALY: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 86 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 89 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 91 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 93 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 BRAZIL: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 BRAZIL: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 96 ARGENTINA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 ARGENTINA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 98 REST OF SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 REST OF SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER, 2021–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 SOUTH AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 109 SOUTH AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 110 SAUDI ARABIA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 SAUDI ARABIA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 112 UAE: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 113 UAE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 114 REST OF MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021–2028 (USD MILLION)

- TABLE 116 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2019–2023

- TABLE 117 CIRCUIT MONITORING MARKET: DEGREE OF COMPETITION

- TABLE 118 COMPANY TYPE FOOTPRINT

- TABLE 119 COMPANY END USER FOOTPRINT

- TABLE 120 COMPANY REGION FOOTPRINT

- TABLE 121 COMPANY FOOTPRINT

- TABLE 122 CIRCUIT MONITORING MARKET: DEALS, 2019–2023

- TABLE 123 CIRCUIT MONITORING MARKET: OTHERS, 2019–2023

- TABLE 124 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 125 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 SCHNEIDER ELECTRIC: OTHERS

- TABLE 127 EATON: BUSINESS OVERVIEW

- TABLE 128 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 EATON: DEALS

- TABLE 130 EATON: OTHERS

- TABLE 131 ABB: BUSINESS OVERVIEW

- TABLE 132 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 TOSHIBA INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 134 TOSHIBA INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 LEGRAND: BUSINESS OVERVIEW

- TABLE 136 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 ANORD MARDIX: BUSINESS OVERVIEW

- TABLE 138 ANORD MARDIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ANORD MARDIX: DEALS

- TABLE 140 ANORD MARDIX: OTHERS

- TABLE 141 PACKET POWER: BUSINESS OVERVIEW

- TABLE 142 PACKET POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SENVA INC: BUSINESS OVERVIEW

- TABLE 144 SENVA INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 SOCOMEC: BUSINESS OVERVIEW

- TABLE 146 SOCOMEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 SOCOMEC: DEALS

- TABLE 148 SOCOMEC: OTHERS

- TABLE 149 OMRON CORPORATION: BUSINESS OVERVIEW

- TABLE 150 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 ACREL – ELECTRIC CO: BUSINESS OVERVIEW

- TABLE 152 ACREL – ELECTRIC CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 ACREL – ELECTRIC CO: DEALS

- TABLE 154 MPL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 155 MPL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 DAXTEN: BUSINESS OVERVIEW

- TABLE 157 DAXTEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 DAXTEN: DEALS

- TABLE 159 NHP: BUSINESS OVERVIEW

- TABLE 160 NHP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 ACCUENERGY: BUSINESS OVERVIEW

- TABLE 162 ACCUENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 CIRCUIT MONITORING MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR CIRCUIT MONITORING

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF CIRCUIT MONITORING

- FIGURE 7 CIRCUIT MONITORING MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2021

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CIRCUIT MONITORING MARKET DURING 2023–2028

- FIGURE 10 OTHERS SEGMENT TO LEAD CIRCUIT MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 11 DATA CENTERS SEGMENT TO LEAD CIRCUIT MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING ADOPTION OF POWER DISTRIBUTION SOURCES TO DRIVE CIRCUIT MONITORING MARKET

- FIGURE 13 CIRCUIT MONITORING MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 DATA CENTERS AND US WERE LARGEST SHAREHOLDERS OF CIRCUIT MONITORING MARKET IN NORTH AMERICA IN 2022

- FIGURE 15 OTHERS SEGMENT TO ACCOUNT FOR LARGER SHARE OF CIRCUIT MONITORING MARKET IN 2028

- FIGURE 16 DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF CIRCUIT MONITORING MARKET IN 2028

- FIGURE 17 CIRCUIT MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL ELECTRICITY CONSUMPTION, BY END USER

- FIGURE 19 GLOBAL DATA CENTER CAPACITY GROWTH

- FIGURE 20 GLOBAL DATA CENTER CAPACITY GROWTH, IN TERMS OF CLOUD INFRASTRUCTURE SERVICES AND DATA CENTER HARDWARE & SOFTWARE, 2009–2020

- FIGURE 21 GLOBAL NOMINAL PRICES FOR ALUMINUM AND COPPER, 2020–2023

- FIGURE 22 COST OF CIRCUIT MONITORING SYSTEM PER CABINET

- FIGURE 23 REVENUE SHIFTS FOR CIRCUIT MONITORING SYSTEM MANUFACTURERS

- FIGURE 24 MARKET MAP/ECOSYSTEM ANALYSIS

- FIGURE 25 CIRCUIT MONITORING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE OF CIRCUIT MONITORING SYSTEMS, BY TYPE, 2021

- FIGURE 27 PRICING ANALYSIS OF CIRCUIT MONITORING SYSTEMS, BY REGION, 2021

- FIGURE 28 CIRCUIT MONITORING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 30 KEY BUYING CRITERIA, BY END USER

- FIGURE 31 CIRCUIT MONITORING MARKET, BY TYPE, 2022 (%)

- FIGURE 32 CIRCUIT MONITORING MARKET, BY END USER, 2022 (%)

- FIGURE 33 ASIA PACIFIC CIRCUIT MONITORING MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 34 CIRCUIT MONITORING MARKET, BY REGION, 2022

- FIGURE 35 ASIA PACIFIC: SNAPSHOT OF CIRCUIT MONITORING MARKET

- FIGURE 36 NORTH AMERICA: CIRCUIT MONITORING MARKET SNAPSHOT

- FIGURE 37 CIRCUIT MONITORING MARKET SHARE ANALYSIS, 2021

- FIGURE 38 TOP PLAYERS IN CIRCUIT MONITORING MARKET, 2017–2021

- FIGURE 39 CIRCUIT MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 40 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 41 EATON: COMPANY SNAPSHOT

- FIGURE 42 ABB: COMPANY SNAPSHOT

- FIGURE 43 TOSHIBA INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 LEGRAND: COMPANY SNAPSHOT

- FIGURE 45 OMRON CORPORATION: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the circuit monitoring market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the circuit monitoring market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

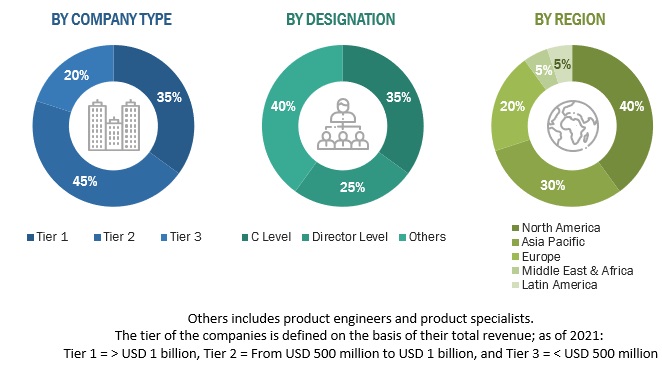

The circuit monitoring market comprises several stakeholders such as circuit monitoring manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for circuit monitoring in, data centers, industrial, residential, and commercial sector. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

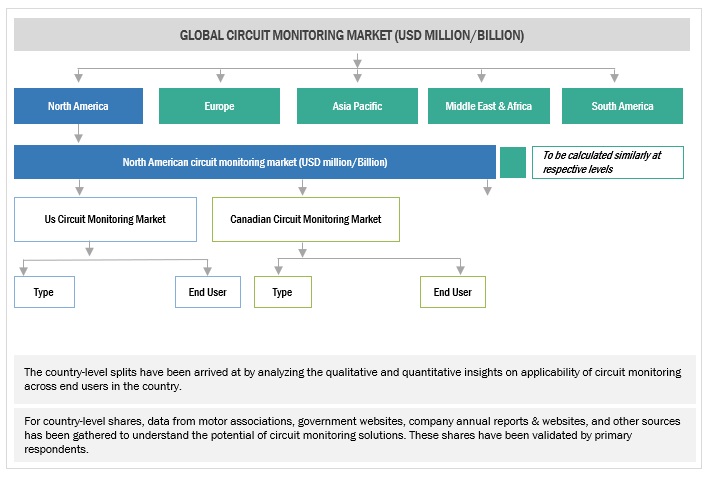

Both top-down and bottom-up approaches were used to estimate and validate the total size of the circuit monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Circuit Monitoring Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

Circuit monitoring is the process of measuring and analyzing the electrical performance of circuits in order to identify potential issues, optimize circuit operation, and prevent equipment downtime. It involves the use of specialized hardware and software to collect data on voltage, current, power consumption, and other key metric over time. Circuit monitoring is commonly used in industrial and commercial settings where even small disruptions in power supply can have significant consequences for productivity and safety.

The growth of the circuit monitoring market during the forecast period can be attributed to the planned rollout of green corridor programs across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- IEEE Power & Energy Society

- National Electrical Manufacturers Association

- America Public Power Association

- European Distribution Systems Operators (EDSO)

- Electrical Power Supply Association (EPSA)

- Data Center Coalition (DCC)

- Government and research organizations

- Power distribution infrastructure installation service providers

- Power solution providers

- IT infrastructure equipment providers

- Support infrastructure equipment providers

Objectives of the Study

- To define, describe, segment, and forecast the circuit monitoring market size, by type, end user, and region, in terms of value, and volume.

- To provide detailed information on the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the main regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market ranking and core competencies* along with value chain analysis involved in the market.

- To track and analyze competitive developments in the circuit monitoring market, such as contracts & agreements, investments & expansions, new product developments, and mergers & acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Circuit Monitoring Market