Chiral Chromatography Column Market by Technology (GC, LC, TLC, Flash Chromatography), Type (Empty, Prepacked, Analytical, Preparative), Material (Metal, Glass, Plastic), End User (Hospital, Food, Pharma-Biotech, Environmental) & Region - Global Forecasts to 2025

Market Growth Outlook Summary

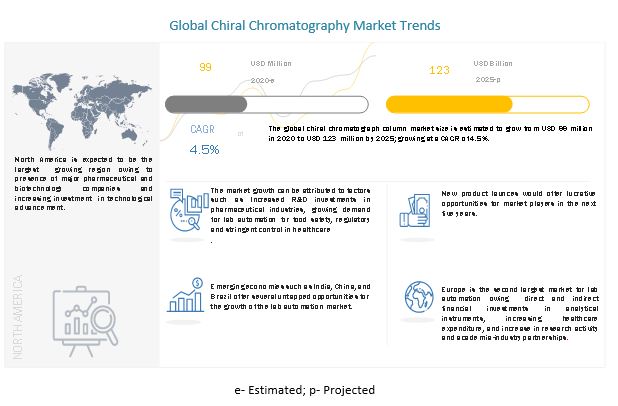

The global chiral chromatography column market growth forecasted to transform from $99 million in 2020 to $123 million by 2025, driven by a CAGR of 4.5%. Market growth is driven largely by factors, such as increasing R&D investments in the pharmaceutical and biotechnology industry, and increasing importance of chromatography tests for drug approvals. Moreover, growth opportunities in emerging countries as well as green chromatography are expected to present avenues of growth for market players.

To know about the assumptions considered for the study, download the pdf brochure

Chiral Chromatography Column Market Dynamics

Driver: Increasing R&D investments in the pharmaceutical and biotechnology industry

Chromatography is a versatile separation technique that is used across many industries such as biopharmaceutical & pharmaceutical, food & beverage, oil & petroleum, environmental testing, and agriculture & chemical. Pharmaceutical and biotechnology companies are investing significant amounts of their revenue in research to come up with breakthrough protein-related products to meet the growing needs of the healthcare sector. Chromatography, spectroscopy, PCR, flow cytometry, and NGS are common technologies used in proteomic research. Moreover, pharmaceutical and biotechnology companies are increasingly adopting these technologies for protein separation and identification during drug discovery and development.

Restraint: Lack of skilled professionals

The proper use of analytical technologies such as chromatography, PCR, and NGS requires expertise with relevant experience and knowledge. Various technological innovations in the chiral chromatography columns market are increasing the need for skilled professionals who can effectively operate chiral chromatography columns. For instance, an inconsistent column packing can result in low purity levels and product yield, which would, in turn, impact the quality of the final product. Moreover, the selection of the right chromatography technique (specific to a given task) plays a crucial role in the purification process. The lack of knowledge regarding the right choice of technique incurs several direct and indirect expenses and increases the time to market the drugs.

Opportunity: Growth opportunities in emerging countries

Many developing economies, such as India, China, Brazil, Russia, Taiwan, and South Korea, offer high-growth opportunities for major market players in the life science instrumentation market owing to the increasing growth opportunities for analytical instruments. Although the adoption of advanced technologies is low in developing countries, their huge population base and increasing research activities, especially in India and China, are expected to offer a sustainable market for life science instruments. Furthermore, with the increasing number of greenfield projects and rising capital expenditure on infrastructure development, these countries are offering potential growth avenues for market players

Challenge: Inadequate infrastructure for research in emerging countries

Adequate infrastructure for research, coupled with a skilled workforce, financial support, and basic research laboratories, are the key prerequisites for the use of chiral chromatography techniques for research. However, emerging countries in Asia (such as India, Indonesia, and the Philippines), the Middle East (such as Oman, Iraq, and UAE), and Africa lack the required infrastructure. For instance, in India, of the 4,168 private laboratories in the state of Kerala, only 7% have the National Accreditation Board for Testing and Calibration Laboratories (NABL) accreditation or ISO certification

By the end-user, the pharmaceutical & biotechnology companies segment is expected to make the most significant contribution to the chiral chromatography column market during the forecast period.

Pharmaceutical and biotechnology companies are among the key end users of chiral chromatography columns. They use analytical instrumentation during various stages of biopharmaceutical and pharmaceutical drug discovery, drug research and development, pharmacokinetics, toxicology, and clinical studies.

Increasing R&D for therapeutic areas, such as cancer, HIV/AIDS, and immunodeficiency disorders, technological innovations in biotechnology research, increasing focus of pharmaceutical and biotechnology companies on extending their product pipeline, rising number of drug discovery and clinical trial projects, and patent expiry of blockbuster drugs and biomolecules are some of the key factors driving the growth of this segment during the forecast period. Additionally, the availability of government and corporate funding for biotechnology and pharmaceutical research, growth of the pharmaceutical industry, and the presence of stringent regulatory guidelines for drug development and safety are other key factors driving the growth of this segment.

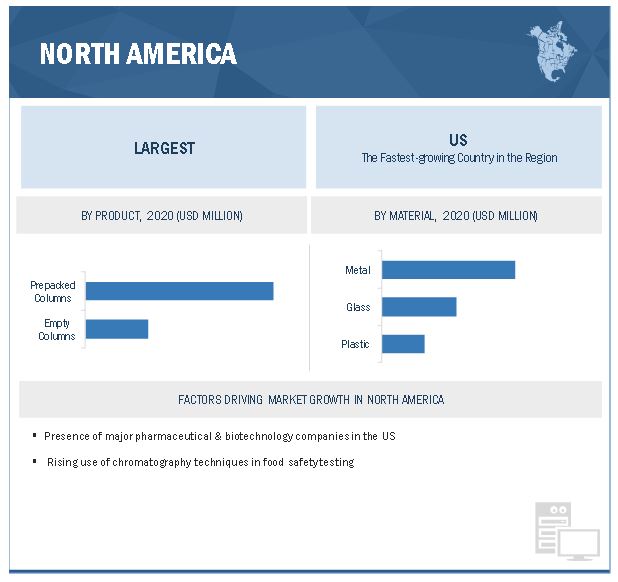

By product type, the prepacked columns segment is expected to grow at the fastest rate during the forecast period.

Prepacked/ready-to-use columns are prefilled with the stationary phase and can directly be attached to chromatographic systems. Prepacked columns exhibit minimal variations and are uniform in nature. These columns are used for early method development for optimizing column packing. These columns are widely used in industries due to their ability to run large amounts of samples on a daily basis. Due to this, prepacked columns dominate the chiral chromatography columns market.

Chromatography columns are critical factors to the successful separation of valuable molecules. Pharmaceutical and biotechnology companies are extending their offering of standard, custom, and prepacked columns from lab-scale to pilot and process-scale. Prepacked large-scale columns meet the needs of manufacturing with single-use technologies.

North America is expected to be the largest market during the forecast period.

US and Canada are the major countries considered for the study of the chiral chromatography column market. North America has a diverse and well-established R&D infrastructure, with rapid adoption of chromatography techniques among end-user industries. North America accounted for the largest share of 37.3% of the chiral chromatography columns market in 2019. A number of factors, such as increasing drug development activities, the availability of government funding for life science R&D, high adoption of technologically advanced solutions, and a large number of ongoing clinical research studies are driving the growth of the North American chiral chromatography columns market.

The major players in the chiral chromatography market Agilent Technologies (US), Thermo Fisher Scientific (US), Waters Corporation (US), Daicel Corporation (Japan), Bio-Rad Laboratories (US), W.R.Grace & Co. (US), Merk Group (Germany), GL Sciencies (Japan), Perkin Elmer (US), Shimadzu Corporation (Japan), Sartorious Group (Germany), Cytiva (US), ES Industruies (US), and Phenomenex (US)

Scope of the Chiral Chromatography Column Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$99 million |

|

Projected Revenue Size by 2025 |

$123 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 4.5% |

|

Market Driver |

Increasing R&D investments in the pharmaceutical and biotechnology industry |

|

Market Opportunity |

Growth opportunities in emerging countries |

This research report categorizes the chiral chromatography column market based on product type, material type, technology, end user, and region

By Product Type

- Prepacked Column

- Empty Column

By Material Type

- Metal Based

- Glass Based

- Plastic Based

By Technology

- Liquid Chromatography (LC)

- Gas Chromatography (GC)

- Supercritical Fluid Chromatography (SFC)

- Thin Layer Chromatography

- Flash Chromatography

- Other technologies (other technologies include paper chromatography)

By End User

- Pharmaceutical Biotechnology Companies

- Academic Institutes

- Food & Beverage Manufacturers

- Hospital & Diagnostic Clinics

- Environmental Testing Laboratories

- Cosmoceutical Companies

- Neutraceutical Companies

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In January 2020, Thermo Fisher entered into an agreement with Astrea Bioseparations to supply EvolveD columns, which include proprietary CaptureSelect and POROS chromatography resins that have been manufactured by Astrea. The columns and resins are used as a part of the molecule purification process to develop biotherapeutics.

- In March 2019, the company introduced the new Thermo Scientific TriPlus 500 Gas Chromatography Headspace Autosampler that provides a scalable, compact design that is reliable, efficient, and capable of handling samples at high-throughput for pharmaceutical, food safety, and environmental scientists performing regulatory-compliant volatile organic compound (VOC) analysis.

- In January 2018, the company introduced FAME GC columns. Agilent J&W DB-FastFAME GC columns feature a mid-content cyanopropyl phase (USP G48). They are engineered for rapid, selective analysis of saturated and polyunsaturated FAMEs, including challenging cis-trans isomers cis-trans isomers.

Frequently Asked Questions (FAQs):

What is the size of Chiral Chromatography Column Market ?

The global chiral chromatography column market size is projected to reach USD 123 million by 2025, growing at a CAGR of 4.5%.

What are the major growth factors of Chiral Chromatography Column Market ?

Market growth is driven largely by factors, such as increasing R&D investments in the pharmaceutical and biotechnology industry, and increasing importance of chromatography tests for drug approvals. Moreover, growth opportunities in emerging countries as well as green chromatography are expected to present avenues of growth for market players.

Who all are the prominent players of Chiral Chromatography Column Market ?

The major players in the chiral chromatography market Agilent Technologies (US), Thermo Fisher Scientific (US), Waters Corporation (US), Daicel Corporation (Japan), Bio-Rad Laboratories (US), W.R.Grace & Co. (US), Merk Group (Germany), GL Sciencies (Japan), Perkin Elmer (US), Shimadzu Corporation (Japan), Sartorious Group (Germany), Cytiva (US), ES Industruies (US), and Phenomenex (US) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CHIRAL CHROMATOGRAPHY COLUMNS MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 END USER-BASED MARKET ESTIMATION

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 CHIRAL CHROMATOGRAPHY COLUMNS MARKET OVERVIEW

4.2 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

4.3 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2020 VS. 2025 (USD MILLION)

4.4 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL & COUNTRY (2019)

4.5 CHIRAL CHROMATOGRAPHY COLUMNS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing R&D investments in the pharmaceutical and biotechnology industry

5.2.1.2 Increasing importance of chromatography tests for drug approvals

5.2.1.3 Technological advancements in chromatography instruments

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled professionals

5.2.2.2 High instrumentation costs

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging countries

5.2.3.2 Green chromatography

5.2.4 CHALLENGES

5.2.4.1 Inadequate infrastructure for research in emerging countries

5.3 KEY INDUSTRY TRENDS

5.3.1 RISING FOCUS ON MINIATURIZED CHIRAL SEPARATION TECHNIQUES

5.4 GLOBAL REGULATORY GUIDELINES

5.5 COVID-19 IMPACT TRENDS ON THE GLOBAL MARKET

6 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL (Page No. - 41)

6.1 INTRODUCTION

6.2 METAL-BASED COLUMNS

6.2.1 INCREASING DEMAND FOR UNIQUE SELECTIVITY AND RETENTION PROPERTIES HAVE DRIVEN THE ADOPTION OF METAL-BASED COLUMNS

6.3 GLASS-BASED COLUMNS

6.3.1 GLASS-BASED COLUMNS ARE SUITABLE FOR LOW-PRESSURE CHROMATOGRAPHY TECHNIQUES

6.4 PLASTIC-BASED COLUMNS

6.4.1 PLASTIC-BASED COLUMNS ARE MORE SUITABLE FOR GRAVITY FLOW PURIFICATION

7 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT (Page No. - 45)

7.1 INTRODUCTION

7.2 PREPACKED COLUMNS

7.2.1 ANALYTICAL COLUMNS

7.2.1.1 Increasing demand for qualitative analysis is driving the growth of this segment

7.2.2 PREPARATIVE COLUMNS

7.2.2.1 High cost of preparative columns is expected to restrain the market growth

7.3 EMPTY COLUMNS

7.3.1 LOW COST & EASE OF AVAILABILITY ARE SOME OF THE ADVANTAGES ASSOCIATED WITH EMPTY COLUMNS

8 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY (Page No. - 50)

8.1 INTRODUCTION

8.2 LIQUID CHROMATOGRAPHY

8.2.1 INCREASING DEMAND FOR QUICK AND EFFICIENT SEPARATION OF CHEMICAL COMPOUNDS TO DRIVE MARKET GROWTH

8.3 GAS CHROMATOGRAPHY

8.3.1 HIGH REQUIREMENT OF GC SYSTEMS IN AIRPORTS, LABORATORIES, & FORENSIC LABORATORIES TO SUPPORT MARKET GROWTH

8.4 SUPERCRITICAL FLUID CHROMATOGRAPHY (SFC)

8.4.1 SFC COLUMNS EXHIBIT PROPERTIES SUCH AS LOW VISCOSITY AND HIGH DIFFUSIVITY

8.5 THIN-LAYER CHROMATOGRAPHY (TLC)

8.5.1 TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

8.6 FLASH CHROMATOGRAPHY

8.6.1 RISING DEMAND FOR THE SEPARATION OF COMPOUNDS UP TO GRAM QUANTITIES IS DRIVING THE GROWTH OF THIS MARKET

8.7 OTHER TECHNOLOGIES

9 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER (Page No. - 56)

9.1 INTRODUCTION

9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

9.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ARE THE LARGEST END USERS OF CHIRAL CHROMATOGRAPHY COLUMNS

9.3 ACADEMIC INSTITUTES

9.3.1 INCREASED EMPHASIS ON PRACTICAL APPLICATION AS COMPARED TO THEORETICAL KNOWLEDGE HAS INCREASED THE USE OF HIGH-END CHROMATOGRAPHY TOOLS IN ACADEMIC & RESEARCH LABORATORIES

9.4 FOOD & BEVERAGE MANUFACTURERS

9.4.1 INCREASING NEED FOR QUALITY CONTROL IN THE FOOD INDUSTRY IS DRIVING THE ADOPTION OF CHIRAL CHROMATOGRAPHY COLUMNS AMONG THESE END USERS

9.5 HOSPITALS & DIAGNOSTIC CLINICS

9.5.1 GROWING NUMBER OF DIAGNOSTIC TESTS TO SUPPORT MARKET GROWTH

9.6 ENVIRONMENTAL TESTING LABORATORIES

9.6.1 IMPLEMENTATION OF STRINGENT REGULATIONS TO DRIVE THE DEMAND FOR CHROMATOGRAPHY TECHNIQUES

9.7 COSMECEUTICAL COMPANIES

9.7.1 DEVELOPMENT OF ADVANCED ANALYTICAL METHODS IN COSMETIC INDUSTRIES TO PROPEL MARKET GROWTH

9.8 NUTRACEUTICAL COMPANIES

9.8.1 INCREASING DEMAND FOR DIETARY SUPPLEMENTS TO DRIVE THE ADOPTION OF CHIRAL CHROMATOGRAPHY COLUMNS

10 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION (Page No. - 63)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 Increased government investments and funding in biomedical research to support market growth

10.2.2 CANADA

10.2.2.1 Rising use of chromatography techniques in food safety testing to drive market growth in Canada

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Growing biotechnology sector and a large number of ongoing drug research projects to drive market growth in Germany

10.3.2 FRANCE

10.3.2.1 Increasing investments in infrastructure development will drive market growth

10.3.3 UK

10.3.3.1 Rising number of academia-industry partnerships and research activities will drive the growth of the UK market

10.3.4 SPAIN

10.3.4.1 Availability of research funds and grants in Spain to boost the chiral chromatography columns market

10.3.5 ITALY

10.3.5.1 Growing number of biotechnology firms to aid the market growth

10.3.6 REST OF EUROPE (ROE)

10.4 ASIA PACIFIC

10.4.1 JAPAN

10.4.1.1 Japan is the largest market for chiral chromatography columns in the APAC

10.4.2 CHINA

10.4.2.1 Increasing investment in R&D to aid market growth

10.4.3 INDIA

10.4.3.1 Increasing healthcare expenditure is expected to drive the chiral chromatography columns market

10.4.4 AUSTRALIA

10.4.4.1 Growing public and private initiatives to support the adoption and development of chiral technologies

10.4.5 SOUTH KOREA

10.4.5.1 Growing awareness to drive the adoption of chiral chromatography columns in the country

10.4.6 REST OF ASIA PACIFIC (ROAPAC)

10.5 LATIN AMERICA

10.5.1 BRAZIL

10.5.1.1 Minimum trade barriers for laboratory equipment and medical devices to boost the market growth

10.5.2 MEXICO

10.5.2.1 Investments in the country’s healthcare systems to aid market growth

10.5.3 REST OF LATIN AMERICA (ROLA)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EAST & AFRICA ACCOUNTS FOR A S SIGNIFICANTLY SMALLER SHARE OF THE GLOBAL CHIRAL CHROMATOGRAPHY COLUMNS MARKET

11 COMPETITIVE LANDSCAPE (Page No. - 91)

11.1 OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

11.3 INDUSTRY CONCENTRATION, 2019

11.4 COMPETITIVE SCENARIO

11.4.1 KEY PRODUCT LAUNCHES

11.4.2 KEY AGREEMENTS

12 COMPANY PROFILES (Page No. - 97)

12.1 AGILENT TECHNOLOGIES

12.1.1 BUSINESS OVERVIEW

12.1.2 PRODUCTS OFFERED

12.1.3 RECENT DEVELOPMENTS

12.1.4 MNM VIEW

12.2 THERMO FISHER SCIENTIFIC

12.2.1 BUSINESS OVERVIEW

12.2.2 PRODUCTS OFFERED

12.2.3 RECENT DEVELOPMENTS

12.2.4 MNM VIEW

12.3 WATERS CORPORATION

12.3.1 BUSINESS OVERVIEW

12.3.2 PRODUCTS OFFERED

12.3.3 RECENT DEVELOPMENTS

12.3.4 MNM VIEW

12.4 MERCK KGAA

12.4.1 BUSINESS OVERVIEW

12.4.2 PRODUCTS OFFERED

12.4.3 RECENT DEVELOPMENTS

12.4.4 MNM VIEW

12.5 DAICEL CORPORATION

12.5.1 BUSINESS OVERVIEW

12.5.2 PRODUCTS OFFERED

12.5.3 RECENT DEVELOPMENTS

12.5.4 MNM VIEW

12.6 GL SCIENCES, INC.

12.6.1 BUSINESS OVERVIEW

12.6.2 PRODUCTS OFFERED

12.6.3 RECENT DEVELOPMENTS

12.7 PERKINELMER

12.7.1 BUSINESS OVERVIEW

12.7.2 PRODUCTS OFFERED

12.7.3 RECENT DEVELOPMENTS

12.8 SHIMADZU CORPORATION

12.8.1 BUSINESS OVERVIEW

12.8.2 PRODUCTS OFFERED

12.8.3 RECENT DEVELOPMENTS

12.9 SARTORIUS GROUP

12.9.1 BUSINESS OVERVIEW

12.9.2 PRODUCTS OFFERED

12.9.3 RECENT DEVELOPMENTS

12.10 BIO-RAD LABORATORIES

12.10.1 BUSINESS OVERVIEW

12.10.2 PRODUCTS OFFERED

12.10.3 RECENT DEVELOPMENTS

12.11 W. R. GRACE & CO.

12.11.1 BUSINESS OVERVIEW

12.11.2 PRODUCTS OFFERED

12.11.3 RECENT DEVELOPMENTS

12.12 CYTIVA

12.12.1 BUSINESS OVERVIEW

12.12.2 PRODUCTS OFFERED

12.12.3 RECENT DEVELOPMENTS

12.13 ES INDUSTRIES

12.13.1 BUSINESS OVERVIEW

12.13.2 PRODUCTS OFFERED

12.14 REGIS TECHNOLOGIES

12.14.1 BUSINESS OVERVIEW

12.14.2 PRODUCTS & SERVICES OFFERED

12.14.3 RECENT DEVELOPMENTS

12.15 PHENOMENEX

12.15.1 BUSINESS OVERVIEW

12.15.2 PRODUCTS OFFERED

12.15.3 RECENT DEVELOPMENTS

12.16 JASCO

12.16.1 BUSINESS OVERVIEW

12.16.2 PRODUCTS OFFERED

12.16.3 RECENT DEVELOPMENTS

12.17 FORTIS TECHNOLOGIES

12.17.1 BUSINESS OVERVIEW

12.17.2 PRODUCTS OFFERED

12.17.3 RECENT DEVELOPMENTS

12.18 HAMILTON COMPANY

12.19 YMC

12.2 HICHROM LIMITED

13 APPENDIX (Page No. - 136)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (70 Tables)

TABLE 1 R&D INVESTMENTS, BY COUNTRY (2017–2019)

TABLE 2 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 3 METAL-BASED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 4 GLASS-BASED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 PLASTIC-BASED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 7 PREPACKED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 8 PREPACKED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 ANALYTICAL PREPACKED CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 PREPARATIVE PREPACKED CHIRAL CHROMATOGRAPHY COLUMNS MARKET,BY REGION, 2018–2025 (USD MILLION)

TABLE 11 EMPTY CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 13 DIFFERENTIATION OF LIQUID CHROMATOGRAPHY SYSTEMS

TABLE 14 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR LIQUID CHROMATOGRAPHY, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR GAS CHROMATOGRAPHY, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 16 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR SUPERCRITICAL FLUID CHROMATOGRAPHY, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR THIN-LAYER CHROMATOGRAPHY, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR FLASH CHROMATOGRAPHY, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER,2018–2025 (USD MILLION)

TABLE 21 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR ACADEMIC, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR FOOD & BEVERAGE MANUFACTURERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR HOSPITALS & DIAGNOSTIC CLINICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR COSMECEUTICAL COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 CHIRAL CHROMATOGRAPHY COLUMNS MARKET FOR NUTRACEUTICAL COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 34 US: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 35 CANADA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 36 EUROPE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 EUROPE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 38 EUROPE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 41 GERMANY: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 42 FRANCE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 43 UK: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 44 SPAIN: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 45 ITALY: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 46 ROE: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 47 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 49 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 50 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 51 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 52 JAPAN: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 53 CHINA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 54 INDIA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 55 AUSTRALIA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 56 SOUTH KOREA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 57 ROAPAC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 58 LATIN AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 LATIN AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 60 LATIN AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 61 LATIN AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 62 LATIN AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 63 BRAZIL: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 64 MEXICO: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 65 ROLA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 66 MEA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 67 MEA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 68 MEA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 69 MEA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 70 DEVELOPMENTS OF KEY PLAYERS IN THE MARKET, JANUARY 2017-SEPTEMBER 2020

LIST OF FIGURES (32 Figures)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 BREAKDOWN OF PRIMARIES: CHIRAL CHROMATOGRAPHY COLUMNS MARKET

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 4 MARKET SIZE ESTIMATION: CHIRAL CHROMATOGRAPHY COLUMNS MARKET

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 CHIRAL CHROMATOGRAPHY COLUMNS MARKET SHARE, BY TECHNOLOGY, 2020 VS. 2025

FIGURE 7 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY MATERIAL, 2020 VS. 2025 (USD MILLION)

FIGURE 8 CHIRAL CHROMATOGRAPHY COLUMNS MARKET SHARE, BY PRODUCT, 2020 VS. 2025

FIGURE 9 CHIRAL CHROMATOGRAPHY COLUMNS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE CHIRAL CHROMATOGRAPHY COLUMNS MARKET

FIGURE 11 INCREASING R&D INVESTMENTS IN THE PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRY TO DRIVE MARKET GROWTH

FIGURE 12 LIQUID CHROMATOGRAPHY SEGMENT TO REGISTER THE HIGHEST GROWTH RATE IN THE FORECAST PERIOD

FIGURE 13 METAL-BASED COLUMNS WILL CONTINUE TO DOMINATE THE CHIRAL CHROMATOGRAPHY COLUMNS MARKET IN 2025

FIGURE 14 METAL-BASED COLUMNS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

FIGURE 15 NORTH AMERICA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 CHIRAL CHROMATOGRAPHY COLUMNS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17 NORTH AMERICA: CHIRAL CHROMATOGRAPHY COLUMNS MARKET SNAPSHOT

FIGURE 18 ASIA PACIFIC: CHIRAL CHROMATOGRAPHY COLUMNS MARKET SNAPSHOT

FIGURE 19 KEY DEVELOPMENTS IN THE CHIRAL CHROMATOGRAPHY COLUMNS MARKET

FIGURE 20 CHIRAL CHROMATOGRAPHY COLUMNS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 21 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

FIGURE 22 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2019)

FIGURE 23 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2019)

FIGURE 24 WATERS CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 25 MERCK KGAA: COMPANY SNAPSHOT (2019)

FIGURE 26 DAICEL CORPORATION: COMPANY SNAPSHOT (2020)

FIGURE 27 GL SCIENCES: COMPANY SNAPSHOT (2019)

FIGURE 28 PERKINELMER: COMPANY SNAPSHOT (2019)

FIGURE 29 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 30 SARTORIUS GROUP: COMPANY SNAPSHOT (2019)

FIGURE 31 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2019)

FIGURE 32 W. R. GRACE & CO.: COMPANY SNAPSHOT (2019)

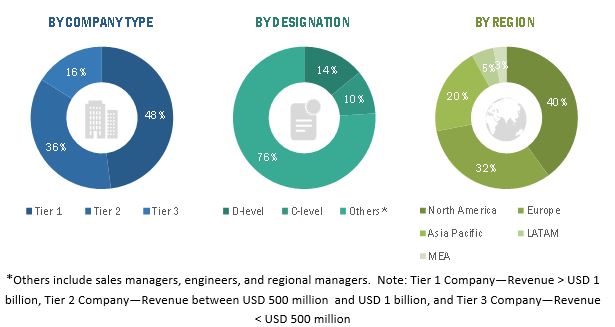

This study involved four major activities in estimating the current size of the chiral chromatography column market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to determine the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the chiral chromatography column market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The chiral chromatography column market comprises several stakeholders, such as end-product manufacturers, raw material providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as pharmaceutical and biotechnology companies, academic institutes, food & beverage manufacturers, hospital & disgnostic clinics, and environmental testing laboratories among others. The supply-side is characterized by raw material providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents are given below:

To know about the assumptions considered for the study, download the pdf brochure

Chiral Chromatography Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the chiral chromatography column market and its dependent submarkets. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market share has been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the end-use industries.

Report Objectives

- To define, describe, segment, and forecast the chiral chromatography column market based on the product type, material type, technology, end user, and region.

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the chiral chromatography column market with respect to individual growth trends, future expansions, and contributions of each segment to the market.

- To analyze opportunities in the market for stakeholders and describe the competitive landscape of the market

- To forecast the growth of the chiral chromatography column market with respect to region such as North America, Europe, Latin America, Asia Pacific, and Middle East & Africa.

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments in the chiral chromatography column market, such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the chiral chromatography column market report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chiral Chromatography Column Market