Chicory Market by Product Type (Extracts, Roasted, Instant Powder, Flour), Form (Powder, Cubes, Liquid), Plant Part, Application (Food & Beverage, Dietary Supplement, Feed & Pet food, Cosmetics & Personal Care), and Region - (2020 - 2025)

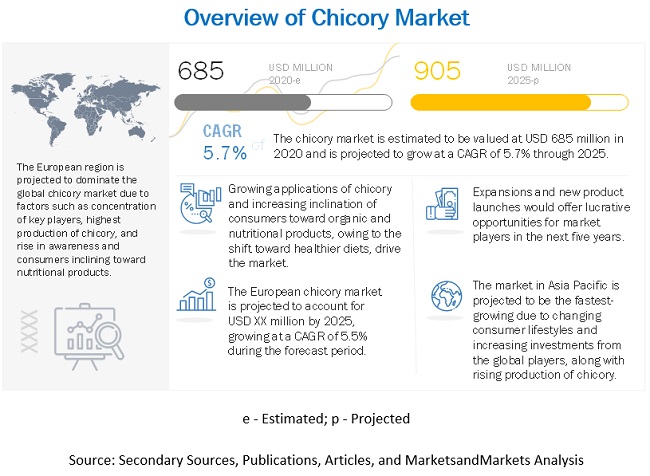

The global chicory market size was estimated at USD 685 million in 2020 and is expected to reach USD 905 million by 2025, recording a compound annual growth rate (CAGR) of 5.7% during the forecast period.

Chicory Market Size, Share and Insights

Chicory offers various health benefits and is offer anti-inflammatory benefits for the heart and osteoarthritis. Besides, chicory also contain inulin which promotes the growth of beneficial bacteria in the gut and helps in improving digestive health. Due to this, the demand for chicory is rising across the globe from health aware consumers. Moreover, chicory being a natural ingredient is being widely used in various industries as it can be used in clean-label products in industries such as cosmetic & personal care industry.

Chicory and chicory-based products are witnessing an increase in demand from various countries in Asia Pacific as it is a cheaper substitute for coffee and is also free from caffeine. Major players in market are increasing their operation scalability and increasing storage space to meet the rising demand from consumers. These players are also planning to enter into emerging markets in Asia Pacific and Middle East.

To know about the assumptions considered for the study, Request for Free Sample Report

Chicory, or Cichorium intybus, is a woody, herbaceous plant in the dandelion family. It usually has bright blue flowers, though they can sometimes be white or pink. Chicory is cultivated for its leaves and its roots. Chicory root is also a good source of inulin, a type of prebiotic fiber that has been linked to support weight loss and improved gut health. Several studies have shown that supplementing diets with inulin could increase the concentration of certain strains of healthy bacteria in the colon and manage blood sugar levels. Hence, all these beneficial qualities make chicory a healthier alternative to various ingredients across various applications, including food & beverages, dietary supplement, feed & pet food, and cosmetics & personal care, exhibiting a good market potential across the globe in the few coming years.

Market Dynamics

Drivers: Preference for chicory as a cheaper substitute for coffee

Chicory is currently ten times cheaper than coffee. Coffee is one of the premium food products. The prices of coffee powder have further increased due to an increase in global prices, making it impossible for companies to absorb the higher cost of raw material. Coffee companies are now blending in chicory to protect their margin. Large coffee companies that hold a couple of bestselling brands have increased their chicory content in their branded sachets to 49% from 30%. According to Mr. S Jagdeesh Gupta, the managing director of Jyothi Chicory, India’s leading chicory manufacturer that supplies to all the leading coffee companies, “Earlier most coffee producers were offering blends with up to 30% chicory. Now virtually all my customers have raised it to 47%–49%.” This has highly increased the cultivation of chicory roots and hence the production of instant chicory powder across major countries. Direct consumer products made from chicory, such as the roasted chicory powder that is an absolute coffee substitute, are also cheap; therefore, people now prefer more chicory because of its lower price, accompanied by significant health benefits and also is caffeine-free.

Restraints: High dependency on mainstream products such as coffee

Chicory, though popularly known to be a caffeine-free substitute to coffee, does not offer the same organoleptic characteristics. The dark coffee flavor and aroma are unique to the coffee bean. Chicory coffee, on the other hand, has a slightly woody bitter taste with a nutty, and sometimes, herbal flavor. Some roasts of chicory even have traces of slightly tart fruits such as cherries. Coffee is enjoyed for many reasons by people across the globe for its flavor, ritual, memories, emotion, and of course, the stimulation it delivers.

Most coffee enthusiasts find it difficult to replace coffee with any other beverage. Over time, the coffee drinker begins to associate the taste and smell of coffee with positive mood changes and energy, enhancing their brain function on consumption.; this includes improved memory, mood, rise in energy levels, and improves general cognitive functions. Green tea is associated with enhancing body metabolism and, consequently, weight loss; black tea is associated with physical and mental robustness. Tea and coffee are also widely grown and harvested in several countries in large amounts. According to FAOSTAT, more the 100 million tonnes (~112 million tons) of coffee and 6.4 million tonnes (7.05 million tons) of tea were produced globally in 2018. The coffee and tea industries witness the easy availability of raw materials and cheaper products from the local and regional players. All these factors restrain the growth of the chicory product market across the world as their substitute.

Opportunities: Growth in applications of chicory across various industries

A variety of trends have driven the use of chicory root fiber not only in food & beverage applications but also in other areas like in dietary supplements, pet food, cosmetics, and pharmaceutical industries. In the food and beverage industry, one of the present significant trends is in sugar reduction. Chicory root fiber can assist with sugar reduction by helping with flavor and texture. Chicory leaves and roots have been used for salads and in the preparation of various innovative and tasty recipes. Chicory is a nutritional powerhouse, containing vitamin K, A, C, and a long list of the B group vitamins. It is an excellent source of minerals like manganese, copper, iron, and potassium. The roots of chicory contain inulin fiber, a type of prebiotic that promotes the growth of beneficial bacteria in the gut; this is used widely as a dietary supplement.

According to the data provided by a study published in the British Journal of Nutrition and The National Center for Biotechnology Information, in 2017, chicory caused the colon environment to be less favorable for cancer development. In more recent times, dog food manufacturers have picked up on the potential benefits of chicory root and have started to include it in dog food, which further extends its potential in the pet food industry. However, the portion or quantity of chicory root used in dog food is quite minimal. A number of the popular and prominent dog food brands make use of chicory root. Examples include Acana, Orijen, Nature’s Logic, Fromm, Solid Gold, and Farmina. However, since the amount used in these products are too small, it is clear that it is not being used to provide significant nutrition in the animal. This points toward it being used for its probiotic properties or as a digestive aid. Many cosmetic companies are now using chicory ingredients in their products. The chicory root oligosaccharides work to boost the skin’s collagen while smoothing the appearance of fine lines and wrinkles. All these application areas increase the demand for chicory, hence bolstering the chicory production and growth potential in various countries.

Challenges: Higher technical expertise required for producing certain chicory-based products

The chicory root is used to produce many varieties of chicory products; hence, a lot of expertise is required to extract each product one after the other while processing. For manufacturing chicory inulin, hydrolysates, and derivatives of inulin by conventional manufacturing techniques from roots of chicory, they are required to be grown in appropriate regions and also have to be processed under proper climatological temperature conditions. Selection of said proper conditions enables to provide a growing and/or processing period for the chicory roots, which may partly or extend beyond the conventional periods.

The preparation of instant chicory coffee requires a high amount of energy and is a continuous ongoing process. Temperature conditions are the most vital factor for chicory production. If the production by any chance suddenly gets interrupted, the entire mass of chicory solidifies inside the processing units causing huge damage to the machinery and a large amount of material gets wasted; this caused companies to incur huge amounts of losses. For this reason, it is necessary for manufacturers to evaluate the whole process (while main attention should be brought to the most energy-consuming processes) and techniques used to achieve the most efficient result. Different production plants and countries assume that the energy consumed in the two processes of drying and roasting mostly defines the price of the chicory coffee. Thus, the difficult and high technical expertise required for the production of chicory-based products hinders the market growth potential.

Chicory Market Segmentation

Based on type, the instant powder segment is projected to account for the largest share in the chicory market during the forecast period

The instant powder segment dominated the global chicory market, on the basis of type, in 2019. This is due to the widespread acceptability and availability of the instant powder across the globe. Also, the majority key players prevailing in the market, offer a wide range of instant powders of chicory to the players of various application industry. Apart from that, the ease of consumption is one of the majority factor, that results in the largest consumption of instant powder type of chicory, across the globe.

Based on form, the powder segment is projected to have the highest growth in the chicory market during the forecast period

Powder form is the most popular form in which chicory is used for various applications. It is widely used as a mixture by key players in the coffee manufacturing industry to enhance its flavor and aroma. Additionally, the powdered form of chicory can be easily mixed in other products like bakery items. Due to wide availability and popularity the powder segment is projected to have the highest growth in the global chicory market during the forecast period. It also has the largest share in the market by form in 2019.

Based on plant-part, the root segment is projected to account for the largest share in the chicory market during the forecast period

The root of the chicory plant has the most beneficial nutrients, required by majority of the manufacturing players of various industries. The chicory-root consists of high inulin content, which is used as a fiber ingredient in various food & beverage products, also its other essential nutrients are consumed in other industry applications, such as dietary supplements. Thus, the root plant-part segment dominates the majority market share.

Based on application, the food & beverage segment is projected to account for the largest share in the chicory market during the forecast period

The chicory market, on the basis of application, was dominated by the food & beverage segment in 2019. Chicory is popular as an alternative to coffee. Also, its leaves are consumed in various salads across the globe. Owing to its inulin and other essential nutrient contents, the food & beverage manufacturers prefer adopting to this ingredients. Furthermore, its lower price points make it suitable for majority of the organic and all-natural food & beverage product manufacturers. All these factors result into the dominance of this segment, in the global market.

To know about the assumptions considered for the study, download the pdf brochure

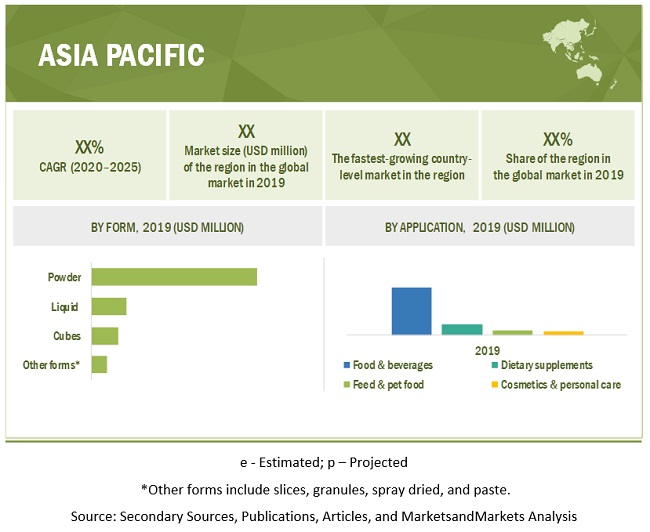

Asia Pacific is projected to grow at the highest growth rate during the forecast period

Asia Pacific is projected to witness a higher growth rate during the forecast period. This is attributed to factors such as untapped potential, growing awareness among the population, rising investments from the global key players, and increasing economic developments, among others. The densely populated countries in the region with higher risks of chronic diseases such as obesity and heart-related issues are expected to bolster the growth in demand for chicory. The growing food & beverage industry, along with the rising cultivation and production of chicory, is further driving the demand and growth prospects for the chicory market in Asia Pacific.

Key Market Players in Chicory Market:

Cosucra Groupe Warcoing (Belgium), Delecto Foods Pvt Ltd (India), BENEO GmbH (Germany), Sensus (Netherlands), Leroux (France), Cargill Incorporated (US), Reily Foods Company (US), Pioneer Chicory (India), PMV Nutrient Products Pvt Ltd (India), Farmvilla Food Industries Pvt Ltd (India), Murlikrishna Foods Pvt Ltd (India), Starwest Botanicals (US), STOKROS Company Ltd (Russia), Nature’s Gold Production (Netherlands), Organic Herb Trading Co (UK), Narasu’s Coffee Company (India), NP Nutra (US), Shaanxi Sciphar Natural Product Co Ltd. (China), Jamnagar Chicory Industries (India), and Herbs & Crops Overseas (India).

COVID-19 Impact Analysis

Owing to the COVID-19 pandemic, the consumption of ready-to-mix and ready-to-drink beverages has witnessed a substantial increase. This includes drinks such as coffee, juices, and flavored milks. Due to the lockdowns and curfews imposed by various regional and national governments, the work-from-home culture experienced a boost. Due to the increased work-life stress and busier lifestyles, the population across the globe started increasingly consuming coffee in order to have increased concentration and focus on work. To cater to this growing demand, the coffee manufacturers boosted/enhanced their production capabilities and volumes. Owing to this, the consumption of chicory has increased simultaneously, as it is used as a blend in the majority of the ready-to-mix and ready-to-drink coffee products. As it is a caffeine-free, healthier, and low-cost substitute to coffee, manufacturers have started including it in the coffee processing process. Consumers are also leaning toward chicory blends to minimize health risks associated with caffeine. Thus, the pandemic has bolstered the growth prospects for chicory, not only being a cheaper substitute for coffee, but also due to its health benefits offerings.

Recent Developments

- In July 2020, BENEO GmbH announced a significant expansion for its chicory root fiber production facility in Chile by 2022, funded by an investment of more than EUR 50 million. This was done as a result of rising interest in chicory root fibers from food and drink manufacturers around the globe, creating a high market demand for BENEO’s inulin and oligofructose ingredients.

- In July 2020, Approval was granted exclusively to Sensus’ Frutafit inulin and Frutalose fructooligosaccharides made from chicory roots by the Thailand FDA. This development would allow the company to penetrate the Thailand local market and thereby expand the consumer base in the digestive health market.

- In November 2018, Cargill’s food ingredients and applications business chose six North American distribution partners—Univar Inc., Gillco Ingredients, International Food Products Corporation, Batory Foods, Pearson Sales Company, and St. Charles Trading, Inc. This would benefit the company in optimizing the customer experience, streamlining the supply chain, and creating a platform to generate sustainable growth through a select group of committed channel partners.

Frequently Asked Questions (FAQ):

What are the upcoming trends or opportunities that a start-up company can look at, in the chicory market?

Start-up companies can invest in R&D activities to innovate and formulate chicory for newer application areas. This is causing the various researches and studies are going on, to introduce potential use of chicory if different application areas.

Which region witnesses to have a lucrative market?

Asia Pacific regional market exhibits lucrative opportunities. A number of food & beverage and dietary supplement manufacturers have started investing in the region, owing to the market been at a nascent stage and the potential of high growth due to a rise in awareness and consumption.

Does the report provide bifurcation of the region into countries and provide insights?

Yes, the report provides further bifurcation of regions into countries. The data and insights have been provided for individual countries, which will help the companies or manufacturers understand country-level insights.

Can you provide company profiling for additional or customized companies?

Yes, we can provide additional profiling of companies.

Does the report provide COVID-19 impact analysis?

Yes, the report includes COVID-19 impact analysis. Also, it is further extended into every individual segment of the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2016–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 CHICORY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 CHICORY MARKET SIZE ESTIMATION: METHOD 1

2.2.2 MARKET SIZE ESTIMATION: METHOD 2

2.2.3 MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 2 MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 4 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 5 MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 6 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 7 MARKET SIZE, BY PLANT PART, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET SHARE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BRIEF OVERVIEW OF THE CHICORY MARKET

FIGURE 9 CHICORY: AN EMERGING MARKET WITH IMMENSE GROWTH POTENTIAL

4.2 CHICORY MARKET, BY REGION

FIGURE 10 ASIA PACIFIC TO GROW AT THE HIGHEST RATE IN THE CHICORY MARKET FROM 2020 TO 2025

4.3 MARKET, BY TYPE

FIGURE 11 INSTANT POWDER TO DOMINATE THE MARKET IN 2020

4.4 MARKET, BY FORM

FIGURE 12 POWDER TO DOMINATE THE MARKET AMONG FORMS FROM 2020 TO 2025

4.5 MARKET, BY PLANT PART

FIGURE 13 THE ROOT SEGMENT TO DOMINATE THE MARKET FROM 2020 TO 2025

4.6 MARKET, BY APPLICATION

FIGURE 14 THE FOOD & BEVERAGE SEGMENT TO DOMINATE THE MARKET FROM 2020 TO 2025

4.7 EUROPE: MARKET, BY TYPE & COUNTRY

FIGURE 15 THE INSTANT POWDER SEGMENT, BY TYPE, ACCOUNTED FOR THE LARGEST SHARE IN THE EUROPEAN CHICORY MARKET IN 2019

4.8 MARKET, BY KEY COUNTRIES

FIGURE 16 THE US OCCUPIED A MAJOR SHARE IN THE GLOBAL MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

FIGURE 17 CHICORY PROCESSING TO OBTAIN INSTANT CHICORY AND INULIN: PROCESS FLOW DIAGRAM

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: CHICORY MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in concern regarding negative effects due to high intake of caffeine

5.2.1.2 Preference for chicory as a cheaper substitute for coffee

5.2.1.3 High medicinal values and health benefits associated with the consumption of chicory

5.2.1.4 Easy cultivation process of the chicory crop

5.2.1.5 Recent government regulations upholding the dietary fiber status for chicory roots

TABLE 3 TOP TEN COUNTRIES EXPORTING CHICORY, 2018 (MT & USD MILLION)

5.2.2 RESTRAINTS

5.2.2.1 High dependency on mainstream products such as coffee

5.2.2.2 Health risks associated with heavy consumption of chicory

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for chicory and chicory-based products across several emerging markets

5.2.3.2 Growth in applications of chicory across various industries

5.2.4 CHALLENGES

5.2.4.1 Higher technical expertise required for producing certain chicory-based products

5.2.4.2 Limited consumer awareness about chicory products

5.2.5 IMPACT OF COVID-19 ON CHICORY

5.3 PATENT ANALYSIS

FIGURE 19 GEOGRAPHICAL ANALYSIS: PATENT APPROVAL FOR THE CHICORY MARKET, 2015-2020

TABLE 4 LIST OF IMPORTANT PATENTS FOR CHICORY, 2015-2020

5.4 PRICING ANALYSIS

5.5 TRADE ANALYSIS

5.6 ECOSYSTEM

FIGURE 20 ECOSYSTEM: CHICORY MARKET

5.7 YC-YCC SHIFT

FIGURE 21 YC-YCC SHIFT: CHICORY MARKET

6 REGULATIONS (Page No. - 62)

6.1 FOOD SAFETY AUTHORITY OF IRELAND

6.2 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

6.3 EUROPEAN COMMISSION

6.4 CHICORY AS SOLUBLE DIETARY FIBER AND ITS REGULATIONS

6.5 PROSKY METHOD

6.6 MCCLEARY METHOD

6.7 RAPID INTEGRATED TOTAL DIETARY FIBER

7 CASE STUDY ANALYSIS (Page No. - 65)

7.1 CASE STUDIES ON TOP INDUSTRY INNOVATIONS AND BEST PRACTICES

7.1.1 INNOVATIONS AND DEVELOPMENTS IN CHICORY APPLICATIONS AND PRODUCTS TO CATER TO THE DYNAMIC CONSUMER NEEDS: A POSITIVE OUTLOOK

7.1.2 HIGHER DEMAND FOR CHICORY AS A CHEAPER AND HEALTHIER SUBSTITUTE TO VARIOUS INGREDIENTS DRIVES INVESTMENTS AND EXPANSIONS BY KEY PLAYERS

7.1.3 CHICORY INGREDIENTS PLAY AN ESSENTIAL ROLE IN SKINCARE

8 CHICORY MARKET, BY TYPE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 22 CHICORY MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.2 COVID-19 IMPACT ANALYSIS

TABLE 6 OPTIMISTIC SCENARIO: CHICORY MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 7 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 8 PESSIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.3 EXTRACTS

8.3.1 MULTIPLE APPLICATION AREAS FOR EXTRACTS INCLUDING FOOD & BEVERAGES AND DIETARY SUPPLEMENTS

TABLE 9 CHICORY EXTRACTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 ROASTED CHICORY

8.4.1 GROWING DEMAND FOR COFFEE EXPANDS THE GROWTH POTENTIAL FOR ROASTED CHICORY

TABLE 10 ROASTED CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.5 INSTANT POWDER

8.5.1 DEMAND FOR CAFFEINE-FREE READY-TO-DRINK BEVERAGES TO BOOST THE DEMAND FOR INSTANT POWDER

TABLE 11 INSTANT CHICORY POWDER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.6 CHICORY FLOUR

8.6.1 INCREASE IN NUMBER OF APPLICATIONS AREAS AND RISE IN DEMAND FROM BAKERY INDUSTRY

TABLE 12 CHICORY FLOUR MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.7 OTHER TYPES

8.7.1 AVAILABILITY OF OTHER TYPES AT A CHEAPER PRICE POINTS FOR FOOD & BEVERAGE PRODUCT MANUFACTURES

TABLE 13 OTHER CHICORY TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 CHICORY MARKET, BY FORM (Page No. - 74)

9.1 INTRODUCTION

FIGURE 23 CHICORY MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 14 MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

9.2 COVID-19 IMPACT ANALYSIS

TABLE 15 OPTIMISTIC SCENARIO: CHICORY MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 16 REALISTIC SCENARIO: MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 17 PESSIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

9.3 POWDER

9.3.1 WIDESPREAD AVAILABILITY AND ACCEPTABILITY OF THE POWDER FORM OF CHICORY

TABLE 18 CHICORY POWDER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 CUBES

9.4.1 GROWTH AWARENESS REGARDING THE USABILITY OF CHICORY CUBES ACROSS AN ARRAY OF INDUSTRIES

TABLE 19 CHICORY CUBES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.5 LIQUID

9.5.1 RISE IN INNOVATIONS AND DEVELOPMENTS IN APPLICATION OF LIQUID FORM OF CHICORY

TABLE 20 CHICORY LIQUID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.6 OTHER FORMS

9.6.1 DIVERSE USAGE OF THESE FORMS OF CHICORY ACROSS AN ARRAY OF INDUSTRIES

TABLE 21 OTHER FORMS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 CHICORY MARKET, BY PLANT PART (Page No. - 81)

10.1 INTRODUCTION

FIGURE 24 CHICORY MARKET SIZE, BY PLANT PART, 2020 VS. 2025 (USD MILLION)

TABLE 22 CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

10.2 COVID-19 IMPACT ANALYSIS

TABLE 23 OPTIMISTIC SCENARIO: CHICORY MARKET SIZE, BY PLANT PART, 2018–2021 (USD MILLION)

TABLE 24 REALISTIC SCENARIO: MARKET SIZE, BY PLANT PART, 2018–2021 (USD MILLION)

TABLE 25 PESSIMISTIC SCENARIO: CHICORY MARKET SIZE, BY PLANT PART, 2018–2021 (USD MILLION)

10.3 LEAF

10.3.1 RISE IN NUMBER OF CONSUMERS PREFERING HEALTHIER FOOD OPTIONS SUCH AS SALADS

TABLE 26 CHICORY LEAF MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 ROOTS

10.4.1 GROWTH IN AREAS OF APPLICATIONS OF CHICORY ROOTS ACROSS VARIOUS INDUSTRY APPLICATIONS

TABLE 27 CHICORY ROOT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 OTHER PLANT PARTS

10.5.1 INCREASE IN NUMBER OF INNOVATIONS AND DEVELOPMENTS INTRODUCED WITH THE USE OF OTHER PLANT PARTS OF CHICORY

TABLE 28 OTHER CHICORY PLANT PARTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 CHICORY MARKET, BY APPLICATION (Page No. - 87)

11.1 INTRODUCTION

FIGURE 25 CHICORY MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 29 CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11.2 COVID-19 IMPACT ANALYSIS

TABLE 30 OPTIMISTIC SCENARIO: CHICORY MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 31 REALISTIC SCENARIO: CHICORY MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 PESSIMISTIC SCENARIO: CHICORY MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

11.3 FOOD & BEVERAGES

11.3.1 WIDESPREAD ACCEPTABILITY AND USAGE ACROSS REGIONS BY SEVERAL PLAYERS IN AN ARRAY OF FOOD APPLICATIONS

TABLE 33 CHICORY MARKET SIZE IN FOOD & BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

11.4 DIETARY SUPPLEMENTS

11.4.1 RISE IN DEMAND AND AWARENESS FOR NATURAL AND ORGANICALLY SOURCED HEALTH SUPPLEMENTS

TABLE 34 CHICORY MARKET SIZE IN DIETARY SUPPLEMENTS, BY REGION, 2018–2025 (USD MILLION)

11.5 FEED & PET FOOD

11.5.1 INCREASE IN DEVELOPMENTS AND INNOVATIONS IN THE FEED & PET FOOD INDUSTRY

TABLE 35 CHICORY MARKET SIZE IN FEED & PET FOOD, BY REGION, 2018–2025 (USD MILLION)

11.6 COSMETICS & PERSONAL CARE

11.6.1 DEVELOPING APPLICATIONS OF CHICORY IN THE SKINCARE INDUSTRY WITH CONSUMERS SHIFTING TOWARD ALL-NATURAL PRODUCTS

TABLE 36 CHICORY MARKET SIZE IN COSMETICS & PERSONAL CARE, BY REGION, 2018–2025 (USD MILLION)

12 CHICORY MARKET, BY REGION (Page No. - 95)

12.1 INTRODUCTION

FIGURE 26 CHINA AND INDIA TO ACCOUNT FOR THE HIGHEST GROWTH RATE IN THE CHICORY MARKET

TABLE 37 CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 CHICORY MARKET SIZE, BY REGION, 2018–2025 (KT)

12.2 COVID-19 IMPACT ANALYSIS

TABLE 39 OPTIMISTIC SCENARIO: CHICORY MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.3 NORTH AMERICA

TABLE 42 NORTH AMERICA: CHICORY MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

12.3.1 US

12.3.1.1 Rise in awareness and consumption of chicory ingredient-based products

FIGURE 27 US: SURVEY OF CONSUMERS REGARDING ASSOCIATION OF CONSUMPTION OF PROTEIN AND FIBER WITH FEELING FULL FOR LONGER

FIGURE 28 US: SURVEY OF CONSUMERS REGARDING READING OF PRODUCT INFORMATION ON THE PACKING OF FOOD PRODUCTS

TABLE 47 US: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Increased potential usage in food & beverage and dietary supplement applications in Canada

FIGURE 29 CANADA: COMMONLY CONSUMED BEVERAGES BETWEEN AGES 18& 79

TABLE 50 CANADA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 51 CANADA: CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 52 CANADA: CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Increase in support from government initiatives and public health campaigns

TABLE 53 MEXICO: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 54 MEXICO: CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 55 MEXICO: CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4 EUROPE

FIGURE 30 EUROPE: CHICORY MARKET SNAPSHOT

TABLE 56 EUROPE: CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 57 EUROPE: CHICORY MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

12.4.1 UK

12.4.1.1 Growth in trend of buying organic products offers growth potential for chicory market

TABLE 61 UK: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 62 UK: CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 63 UK: CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.2 GERMANY

12.4.2.1 Increase in demand for chicory from the German food & feed industries

TABLE 64 GERMANY: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 65 GERMANY: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 66 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.3 SPAIN

12.4.3.1 Rise in consumer awareness toward consumption of organic ingredients in Spain

TABLE 67 SPAIN: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 68 SPAIN: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 69 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.4 FRANCE

12.4.4.1 Presence of major players in the chicory market in France

TABLE 70 FRANCE: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 71 FRANCE: CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 72 FRANCE: CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.5 ITALY

12.4.5.1 Rise in demand among consumers for health-enriching beverages significantly drives the market

TABLE 73 ITALY: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 74 ITALY: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 75 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.6 REST OF EUROPE

12.4.6.1 Rise in demand from confectionery and other food application industry players

TABLE 76 REST OF EUROPE: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 77 REST OF EUROPE: CHICORY MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 78 REST OF EUROPE: CHICORY MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: CHICORY MARKET SNAPSHOT

TABLE 79 ASIA PACIFIC: CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Significant changes in consumer lifestyle in urban areas to drive the growth of the chicory market in China

TABLE 84 CHINA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 86 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.2 INDIA

12.5.2.1 Demand for naturally-sourced ingredients in food products to drive the growth of the chicory market

TABLE 87 INDIA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 88 INDIA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.3 JAPAN

12.5.3.1 Demand for naturally-sourced/organic ingredients in dairy products to drive the growth of the chicory market

TABLE 90 JAPAN: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 91 JAPAN: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 92 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.4 AUSTRALIA

12.5.4.1 Subsequent growth of chicory in the pharmaceutical industry drives the market in the country

TABLE 93 AUSTRALIA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 94 AUSTRALIA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 95 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.5 NEW ZEALAND

12.5.5.1 Demand for chicory as a substitute for coffee drives the market growth

TABLE 96 NEW ZEALAND: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 97 NEW ZEALAND: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 98 NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.6 REST OF ASIA PACIFIC

12.5.6.1 Growth of dairy and beverage industries in these countries create a potential for substantial growth

TABLE 99 REST OF ASIA PACIFIC: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 102 SOUTH AMERICA: CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: CHICORY MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 106 SOUTH AMERICA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 Demand from diverse manufacturers to cater to the dynamic consumer demands

TABLE 107 BRAZIL: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 108 BRAZIL: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 109 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Gradual growth in demand from an array of industry players

TABLE 110 ARGENTINA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 111 ARGENTINA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 112 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.6.3 REST OF SOUTH AMERICA

12.6.3.1 Introduction of newer application areas and increase in awareness for healthier lifestyles

TABLE 113 REST OF SOUTH AMERICA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 114 REST OF SOUTH AMERICA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 115 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.7 REST OF WORLD

TABLE 116 ROW: CHICORY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 117 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 ROW: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 119 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 120 ROW: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

12.7.1 MIDDLE EAST

12.7.1.1 Increase in the personal incomes and inclination toward food products with value-added health benefits

TABLE 121 MIDDLE EAST: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 122 MIDDLE EAST: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 123 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.7.2 AFRICA

12.7.2.1 Increase in support from government initiatives

TABLE 124 AFRICA: CHICORY MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 125 AFRICA: MARKET SIZE, BY PLANT PART, 2018–2025 (USD MILLION)

TABLE 126 AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 143)

13.1 OVERVIEW

13.2 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE CHICORY MARKET, 2018–2020

13.3 MARKET SHARE ANALYSIS, 2020

FIGURE 32 BENEO & CORSUCRA LED THE CHICORY MARKET IN 2019

13.4 COMPETITIVE SCENARIO

TABLE 127 EXPANSIONS & INVESTMENTS, 2018–2020

TABLE 128 NEW PRODUCT LAUNCHES, 2019–2020

TABLE 129 AGREEMENTS, JOINT VENTURES, AND PARTNERSHIPS, 2018

14 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 148)

14.1 COMPETITIVE LEADERSHIP MAPPING

FIGURE 33 CHICORY MARKET COMPETITIVE LEADERSHIP MAPPING, 2020 (TOP 20)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

14.2 COSUCRA GROUPE WARCOING

14.3 DELECTO FOODS PVT LTD

14.4 BENEO GHMB

14.5 SENSUS

14.6 LEROUX

14.7 CARGILL INCORPORATED

FIGURE 34 CARGILL INCORPORATED: COMPANY SNAPSHOT

14.8 REILY FOODS COMPANY

14.9 PIONEER CHICORY

14.10 PMV NUTRIENT PRODUCTS PVT LTD

14.11 FARMVILLA FOOD INDUSTRIES PVT LTD

14.12 MURLIKRISHNA FOODS PVT LTD

14.13 STARWEST BOTANICALS

14.14 STOKROS COMPANY LTD

14.15 NATURE’S GOLD PRODUCTION

14.16 ORGANIC HERB TRADING CO

14.17 NARASU’S COFFEE COMPANY

14.18 NP NUTRA

14.19 SHAANXI SCIPHAR NATURAL PRODUCT CO LTD

14.20 JAMNAGAR CHICORY INDUSTRIES

14.21 HERBS & CROPS OVERSEAS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 178)

15.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.2 AVAILABLE CUSTOMIZATIONS

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

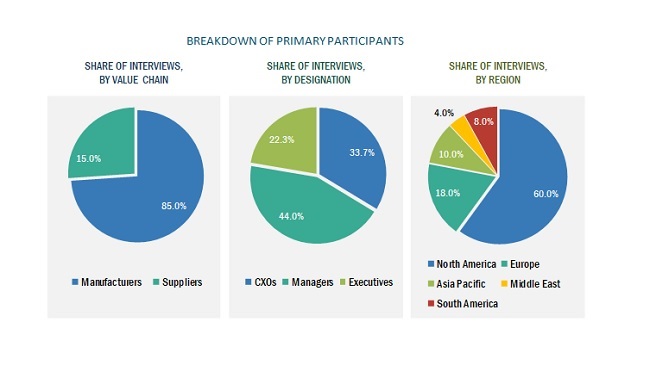

The study involved four major activities in estimating the chicory market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of various application-industry manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Chicory Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the chicory market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the chicory market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Chicory Market Report Objectives

- To describe and forecast the chicory market, in terms of type, form, plant-part, application, and region

- To describe and forecast the chicory market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the chicory market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the chicory market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the chicory market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of the World chicory market into Middle East & Africa.

- Further breakdown of the Rest of European chicory market into Sweden, Poland, and Norway, among other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific includes Indonesia, Vietnam, South Korea, Singapore, and Malaysia.

- Further breakdown of the Rest of South America includes Chile, Colombia, Peru, Venezuela, Ecuador, Guatemala, and the Dominican Republic.

SEGMENT ANALYSIS

- Further breakdown of the type segment into raw form and seeds.

- Further breakdown of the form segment into slices, granules, spray dried, and paste.

- Further breakdown of the plant-part segment into flower and stem.

Growth opportunities and latent adjacency in Chicory Market