Cheese Market by Type (Cheese Product and Cheese Powder), Product Type (Cheddar, Mozzarella, Parmesan, American Cheese, and Blue Cheese), Source (Animal and Plant), Nature, Distribution Channel, Application, and by Region - Global Forecast to 2026

The global cheese market is estimated to reach $105.9 billion by 2026, growing at a 3.6% compound annual growth rate (CAGR). The global market size was valued $88.7 billion in 2021. The base year for estimation is 2020, and the historical data spans from 2021 to 2026.

Various factors have played a major role in driving the cheese market growth across the globe. The effects of rapid westernization have led to the rising demand for cheese in countries other than Europe and the US. A sharp increase in consumer demand for packaged meals containing cheese and rising demand from the food processing industry is also propelling the market.

Cheese products are mainly derived from dairy-based sources. However, there is an increase in trends of consuming cheese products derived from plant sources. Owing to various health-related issues such as lactose intolerance, allergenic associated with dairy-based products, among other consumers are more inclined towards plant-based food products. Furthermore, an increase in consumer shift towards vegan products are also to drive the growth of plant-based food products such as cheese.

To know about the assumptions considered for the study, Request for Free Sample Report

Cheese Market Dynamics

Drivers: Rising influence of western cuisines across the world

The rising influence of western cuisines, inflating disposable incomes, and introduction of a number of flavored cheese products, including pepper, garlic, red chili flakes, and oregano pickle, drives the cheese market. Although cheese is a staple in Western countries such as Europe and the US, its versatility enables it to cater to the different tastes and preferences of consumers globally.

The cuisines of Western countries are diverse, although there are common characteristics that distinguish them from those of other regions. There are hundreds of varieties of cheese and other fermented milk products used in Western cuisines. The effects of rapid westernization have led to the rising demand for cheese in countries other than Europe and the US. A sharp increase in consumer demand for packaged meals containing cheese and rising demand from the food processing industry are also propelling the market. In Asian countries, imports contributed more than 40% of overall cheese consumed in 2020. The rising demand in Asian countries, driven by rapid urbanization will drive the growth of Asian cheese market.

Restraints: Rising concern over the adverse health effects of cheese consumption

The rising consumer awareness about the ill-health effects of cheese poses a great restrain to the growth of the global cheese market. Obesity, high cholesterol levels, and heart diseases are the major conditions associated with the consumption of processed cheese. Furthermore, studies suggest that the consumption of cheddar cheese may pose an increased risk of breast cancer by increasing the production of galactose from lactose. The ripening process of cheese includes the production of a toxic alkaloid and toxic amines that bring changes to the nervous system, thereby resulting in high blood pressure, headaches, palpitations, and migraines. Rennet, preservatives, emulsifiers, and other chemical agents used in the production process of cheese can have ill effects on the body. Dairy products— especially cheese, are a major source of saturated fat in the average American diet. Saturated fats tend to raise harmful LDL cholesterol, which can boost heart disease risk. Published in the August 2016 American Journal of Clinical Nutrition, a study looked at more than 220,000 women and men in the Health Professionals Follow-Up Study, the Nurses' Health Study, and the Nurses' Health Study II, all of which explore the role of risk factors (especially diet and lifestyle) in major chronic diseases. The participants filled out food questionnaires every four years for up to 26 years. The dairy products they tracked included skim and low-fat milk, whole milk, cream, ice cream, yogurt, cottage and ricotta cheeses, cream cheese, and other cheese.

In the US, certain kinds of cheese have resulted in outbreaks of food-borne gastroenteritis, food sensitivities, lactose intolerance, allergies, and high-calorie content. As per a February 2022 MDPi journal, a daily amount of 50 g of cheese (a standard serving of hard and semi-hard types) was associated with a statistically significant 10% to 14% of higher risk of Coronary Heart Disease (CHD). Consumers have now become aware of the association of these diseases with cheese. This factor is posing as a restrain for various cheese manufacturers to overcome and meet the customer demand for healthy food.

Challenges: Regulatory Influence

The stringent regulatory legislations regarding cheese are projected to be challenging for the growth of the cheese market. The demand for accurate labeling, listing the names of all the ingredients in the product, and specifying the details of the ingredients and their nutrient content is on the rise owing to the rising health concerns. Such information is especially important in the case of food products that contain various additives; for instance, cheese is prepared by adding various ingredients, such as whey, caseinate, and maltodextrin. Adhering to these labeling regulations may increase the cost of packaging and labeling, which, in turn, affects the price of the final products. This leads to low acceptance by consumers, which poses a challenge for the cheese market.

The US Government has stringent policies for the labeling of packages containing cheese products. While packaging cheese products, the label must contain the accurate process through which the cheese has been processed and manufactured, such as ‘pasteurized’, ‘processed’, or ‘blended.’ It is also necessary that any cheese made from vegetables,fruits,meat should be labeled by these items. The regulation states that there should also be a standard font size for these ingredients making it easily readable to the consumers. According to the FDA “Where the names of optional ingredients are required to appear on the label, the designations of all such ingredients should be given equal prominence. The names of the optional ingredients should appear prominently and conspicuously but should not be displayed with greater prominence than the name of the food. The word "contains" may precede the names of the optional ingredients, and when so used will not be considered as intervening printed matter between the name of food and name of optional ingredients required to be placed on the label.”

Growth Opportunities: Growth of the cheese market in emerging economies

Emerging economies such as the Asia Pacific and South America are expected to witness a stalwart rise in the demand for cheese. Cheese consumption per capita has risen rapidly in East Asia, driven by rising incomes, changes in food habits, and the spread of restaurant chains that use cheese as a key ingredient. The process of rapid urbanization in Asia, combined with the rise in household incomes and the increasing popularity of the Western lifestyle amongst the middle and high-income population, promote the cheese market. The increasing consumption of pizza and other European-style fast-foods appears as a fundamental consumer trend, particularly amongst young people. Thus, the cheese market in Asia is concentrated in large cities, where the average-high income segment of the population mainly lives. A sharp increase has been observed in consumer demand for packaged meals containing cheese. Moreover, tariff reductions and increased tariff-rate quotas have lowered cheese prices, boosting imports.

Versatile Application of Cheddar Cheese to Drive its Market Growth

Cheddar is one of the many varieties of cheese, which is off-white and has a sharp taste with a relatively hard texture than any other variety. This category of cheese is most popular in European countries. Cheddar cheese was originated in a small town called Cheddar in the Somerset region, which is in southwest England. This type of cheese is made through a process typically called cheddaring, in which curd and whey are separated using rennet enzymes. Many multinational dairy cooperatives and companies now tend to add different flavors to cheddar by adding paprika, herbs, oregano, among others.

Cheddar cheese finds application across a multitude of industries, including bakery (melted, grated, shredded), soups, sauces, & dips, ready meals, snacks & cereals, and other food applications.

Growing Fast-Food Industry Promotes the Application of Cheese Powder in Sweet & Savory Snacks

Cheese powder is widely used in sweet & savory snacks to induce the cheesy flavor in them and provide a richer mouthfeel. In the savory snacks and sweets segment, cheese powder is majorly used in Mozzarella sticks, Nachos, popcorn, puffed snacks, and chips. The most popular brands that have cheese powder snacks are Cheetos, Burritos, McCain, and Venkys. Cheese powder offers better functionality and taste over other flavors and better convenience for use in a range of snack products. Consumers are now more inclined toward fast food and on-the-go products hence, led to an increase in the demand for snacks and fast foods, which has led the companies to think innovatively and proactively while making snacks products.

Demand for Cheese-Based on-the-Go Food Products to Drive the Ready Meals Market

Cheese powder is used in ready meals to add a specific cheese flavor to the meal or enhance the existing flavor in it. Application flexibility, flavor management, ambient storage, easy handling, and extended shelf-life are some of the key benefits associated with the use of cheese powders in ready meals.

Due to the hectic schedules and busy lifestyles of consumers, especially the millennial population, there has been an increased demand for on-the-go ready meals, which can be consumed immediately. Adding a specific cheese note or flavor to such ready meals gives it a Western taste and nature, enhancing the products’ value and appearance. Food manufacturers across the globe are capitalizing on this trend and investing in R&D to come up with innovative cheese-based ready meals that can cater to the growing demand.

Sauces, dressings, dips, and condiments are estimated to dominate the cheese market, with a value of USD 141.2 million in 2021; it is projected to reach USD 190.0 million by 2026, at a CAGR of 6.1% during the forecast period.

Cheese powder imparts an enhanced cheese flavor to sauces, dressings, dips, and condiments. This can be done with the use of a single flavor cheese or a mix of more than one cheese flavors. The use of cheese powder also offers better taste, convenience, and functionality in recipes where high-temperature cooking is required. Sauces made using cheese powder are widely consumed with pasta, vegetables, pizza, and casseroles. They are also used as dressings on salads, vegetables, fish, and other meat products. Dips and condiments made from cheese powder are normally consumed with vegetables, wings, and fried snacks.

With the rapidly rising demand for fast food in the Asia Pacific, the demand for cheese powder in sauces, dressings, dips, and condiments is likely to grow at the highest rate, in this region, during the forecasted period.

Cheese Market Key Companies

Key players in cheese market include Arla Foods (UK), Fonterra (New Zealand), Glanbia (Ireland), The Kraft Heinz Company (US), Saputo (Canada), BEL Group (France), and FrieslandCampina (Netherlands).

Scope of the Cheese Market Report

|

Report Metric |

Details |

|

Base Year |

2020 |

|

Cheese Market Size in 2021 |

$88.7 billion |

|

Forecast Period 2021 to 2026 CAGR |

3.6% |

|

2026 Value Projection |

$105.9 |

|

Tables, Figures, & No. of Pages |

161 market data Tables and 57 Figures spread through 196 Pages |

|

Growth Drivers: |

|

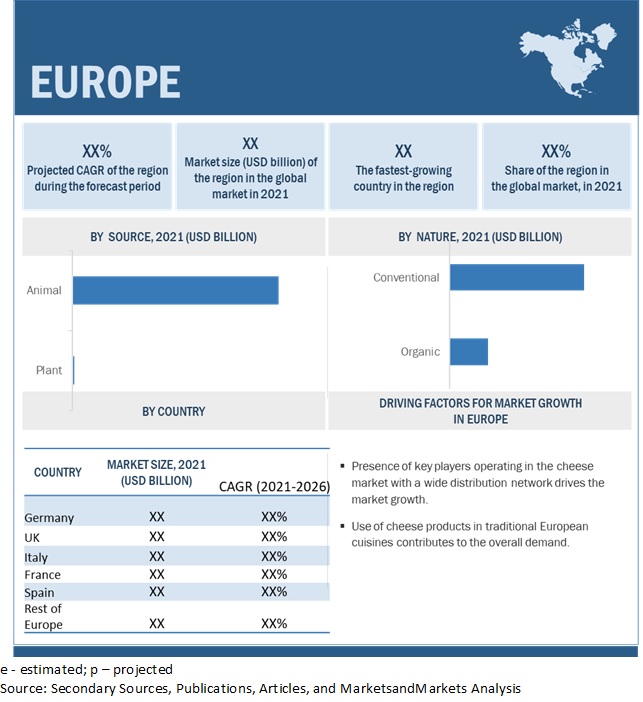

Europe is projected to account for the largest market during the forecast period

The European cheese market is the largest in the world, and despite very high per capita consumption levels, market growth has remained attractive and stable. Cheese has provided better export opportunities than any other dairy product, as the willingness to pay for quality European cheese has always been high, and the impact of higher raw-material costs is less problematic. Due to the maturity of the cheese market, the strategic focus of key players is to consolidate current market positions by acquiring add-ons and facilitating new and innovative product development to stay ahead in the industry.

Cheese Market Report Highlights

This research report categorizes the cheese market based on type, application, product type, nature, distribution channel, source, and region.

|

By Type |

By Source |

By Product Type |

By Region |

|

|

|

|

Key Trends Shaping the Global Cheese Market:

- Global Cheese Explosion: Appetite for cheese is on the rise around the world, driven by factors like increasing disposable income, the influence of western cuisine, and a wider variety of cheese products available. This is especially true in Asia, where cheese consumption is growing rapidly.

- Natural and Authentic Flavors: Consumers are seeking out high-quality, authentic cheeses. Natural cheeses boast a wider range of flavors and textures than processed varieties, and manufacturers are responding with an ever-growing selection.

- Bold and Convenient Formats: People want cheese that's easy to incorporate into their lives. This means shredded or cubed cheese for quick meals, along with innovative packaging for on-the-go snacking. Zesty flavors are also a growing trend, appealing to those who enjoy a bit of a kick.

- Online Cheese Shopping: The cheese market is embracing e-commerce. With more people shopping online, cheese vendors are finding new ways to reach customers and deliver fresh cheese directly to their doors.

- Health and Wellness: Cheese is a good source of protein, calcium and other nutrients, and this is a factor for some consumers. While some may be concerned about fat content, cheese can still be part of a healthy diet.

Cheese Market Recent Developments

- In March 2021, Dalter Alimentari Spa introduced a new product in terms of cheese cuts: new cheese matchsticks, a unique cut on the market designed to guarantee the best results. This product caters to the needs of food manufacturing and food service industries. It is particularly used as an ingredient in ready meals, ready-made salads, soups, sauces, as well as for fillings and stuffing.

- In August 2020, Glanbia completed the acquisition of Foodarom (Germany). The acquisition strengthened Glanbia’s capability in the area of flavors and nutritional solutions.

- In 2020, Land O’Lakes developed an organic cheese powder formulated using different types of cheeses such as American, Parmesan, Blue, and Swiss cheese.

Frequently Asked Questions (FAQ):

How big is the cheese market?

What is the future growth potential of cheese market?

What are the key trends affecting the global Cheese Market?

- Increased demand for organic cheese

- Natural cheese

- Artisanal cheeses

- Specialty cheeses

Which players are involved in the manufacturing of the cheese market?

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for cheese market?

What is the outlook of the cheese market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON CHEESE TYPES, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATION AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON THE CHEESE MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD BILLION)

FIGURE 10 MARKET SIZE FOR CHEESE, BY TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 11 MARKET SIZE FOR CHEESE, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD BILLION)

FIGURE 12 MARKET SIZE FOR CHEESE, BY NATURE, 2021 VS. 2026 (USD BILLION)

FIGURE 13 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THIS MARKET

FIGURE 14 GROWTH IN THE FAST-FOOD INDUSTRY AND RISE IN INFLUENCE OF WESTERN CUISINES ACROSS THE GLOBE TO PROPEL THE MARKET

4.2 EUROPE: CHEESE MARKET, BY KEY DISTRIBUTION CHANNEL & COUNTRY

FIGURE 15 RETAIL SEGMENT AND GERMANY ACCOUNT FOR THE LARGE SHARES IN THE EUROPEAN MARKET IN 2020

4.3 MARKET FOR CHEESE, BY PRODUCT TYPE

FIGURE 16 CHEDDAR SEGMENT TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.4 MARKET FOR CHEESE, BY DISTRIBUTION CHANNEL & REGION

FIGURE 17 EUROPE TO DOMINATE THE MARKET FOR CHEESE DURING THE FORECAST PERIOD

4.5 MARKET FOR CHEESE, BY TYPE

FIGURE 18 CHEESE PRODUCT TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.6 MARKET FOR CHEESE, BY SOURCE

FIGURE 19 ANIMAL SEGMENT TO DOMINATE THE CHEESE MARKET DURING THE FORECAST PERIOD

FIGURE 20 COVID-19 IMPACT ON THE CHEESE MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS, SUCH AS ASIA PACIFIC AND SOUTH AMERICA

FIGURE 21 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020-2021

5.2.2 INCREASING POPULATION DENSITY

TABLE 3 GLOBAL POPULATION DENSITY, 2019

FIGURE 22 POPULATION GROWTH TREND, 1950–2050

5.2.3 EFFECTS OF RAPID URBANIZATION AND WESTERNIZATION

FIGURE 23 MOST URBANIZED COUNTRIES, 2020

5.3 MARKET DYNAMICS

FIGURE 24 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Growing fast-food industry

FIGURE 25 RESTAURANT & FOODSERVICE INDUSTRY SALES, 2019–2021

5.3.1.2 Rising influence of western cuisines across the world

5.3.2 RESTRAINTS

5.3.2.1 Rising concern over the adverse health effects of cheese consumption

FIGURE 26 PERCENTAGE OF THE US POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2017

5.3.3 OPPORTUNITIES

5.3.3.1 Emergence of plant-based cheese alternatives

5.3.3.2 Growth of the market in emerging economies

FIGURE 27 EU CHEESE EXPORTS TO JAPAN (‘000 TONS)

FIGURE 28 PER CAPITA GDP (USD), BY COUNTRY, 2019

FIGURE 29 PER CAPITA CONSUMPTION OF CHEESE IN ASIAN AND SOUTH AMERICAN COUNTRIES, 2018–2020 (KILOGRAMS)

5.3.4 CHALLENGES

5.3.4.1 Regulatory influence

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 IMPACT ON THE CHEESE SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RAW MATERIAL SOURCING

6.2.2 MANUFACTURING OF CHEESE

6.2.3 QUALITY AND SAFETY CONTROLLERS

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 30 VALUE CHAIN ANALYSIS OF THE MARKET: MANUFACTURING AND QUALITY & SAFETY CONTROLLERS KEY CONTRIBUTORS

6.3 TRADE DATA: MARKET FOR CHEESE

6.3.1 PROCESSED CHEESE

TABLE 4 TOP 10 IMPORTERS AND EXPORTERS OF PROCESSED CHEESE, 2018 (KG)

6.3.2 PROCESSED CHEESE

TABLE 5 TOP 10 IMPORTERS AND EXPORTERS OF PROCESSED CHEESE, 2019 (KG)

6.3.3 PROCESSED CHEESE

TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF PROCESSED CHEESE, 2020 (KG)

6.4 PRICING ANALYSIS: MARKET FOR CHEESE

TABLE 7 GLOBAL CHEESE AVERAGE SELLING PRICE (ASP), BY TYPE, 2019–2021 (USD/TONS)

TABLE 8 GLOBAL CHEESE AVERAGE SELLING PRICE (ASP), BY REGION, 2019–2021 (USD/TONS)

6.5 MARKET MAP AND ECOSYSTEM CHEESE MARKET

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

FIGURE 31 CHEESE: MARKET MAP

TABLE 9 MARKET FOR CHEESE: SUPPLY CHAIN (ECOSYSTEM)

6.6 TRENDS IMPACTING BUYERS

FIGURE 32 CHEESE MARKET: TRENDS IMPACTING BUYERS

6.7 REGULATORY FRAMEWORK

6.7.1 NORTH AMERICA: REGULATORY FRAMEWORK

6.7.2 EUROPE: REGULATORY FRAMEWORK

6.7.3 ASIA PACIFIC: REGULATORY FRAMEWORK

6.7.4 SOUTH AMERICA: REGULATORY FRAMEWORK

6.8 PATENT ANALYSIS

FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 34 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 35 TOP 10 APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 10 SOME OF THE PATENTS PERTAINING TO CHEESE, 2020–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MARKET FOR CHEESE: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 GROWING DEMAND FOR PLANT-BASED CHEESE PRODUCTS

6.10.2 INCREASE IN CONCERN REGARDING HUMAN HEALTH AND WELLNESS

7 CHEESE MARKET, BY PRODUCT TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 36 MARKET SIZE FOR CHEESE, BY PRODUCT TYPE, 2021 VS. 2026 (USD BILLION)

TABLE 12 MARKET SIZE FOR CHEESE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

7.2 CHEDDAR

7.2.1 VERSATILE APPLICATION OF CHEDDAR CHEESE TO DRIVE ITS MARKET GROWTH

TABLE 13 CHEDDAR: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

7.3 MOZZARELLA

7.3.1 MOZZARELLA CHEESE FINDS MAJOR APPLICATION IN ITALIAN CUISINE

TABLE 14 MOZZARELLA: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

7.4 PARMESAN

7.4.1 HARD TEXTURE OF PARMESAN CHEESE TO OFFER EASE IN STORAGE AND DISTRIBUTION

TABLE 15 PARMESAN: CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

7.5 AMERICAN CHEESE

7.5.1 LONGER SHELF LIFE OF AMERICAN CHEESE TO FUEL ITS DEMAND

TABLE 16 AMERICAN CHEESE: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

7.6 BLUE CHEESE

7.6.1 MULTIFUNCTIONAL HEALTH BENEFITS OF BLUE CHEESE TO DRIVE THE DEMAND

TABLE 17 BLUE CHEESE: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

7.7 OTHER PRODUCT TYPES

TABLE 18 OTHER PRODUCT TYPES: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

8 CHEESE MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 37 CHEESE POWDER MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 19 CHEESE POWDER MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 SAUCES, DRESSINGS, DIPS, AND CONDIMENTS

8.2.1 CHEESE POWDER VIEWED AS A STABLE AND FLAVORFUL INGREDIENT IN SAUCES, DRESSINGS, DIPS, AND CONDIMENTS

TABLE 20 SAUCES, DRESSINGS, DIPS, AND CONDIMENTS: CHEESE POWDER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 SWEET & SAVORY SNACKS

8.3.1 GROWING FAST-FOOD INDUSTRY PROMOTES THE APPLICATION OF CHEESE POWDER IN SWEET & SAVORY SNACKS

TABLE 21 SWEET & SAVORY SNACKS: CHEESE POWDER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 BAKERY & CONFECTIONERY

8.4.1 CHEESE POWDER HELPS ENHANCE THE TEXTURE AND FLAVOR OF BAKERY PRODUCTS

TABLE 22 BAKERY & CONFECTIONERY: CHEESE POWDER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.5 READY MEALS

8.5.1 DEMAND FOR CHEESE-BASED ON-THE-GO FOOD PRODUCTS TO DRIVE THE MARKET

TABLE 23 READY MEALS: CHEESE POWDER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.6 OTHER APPLICATIONS

TABLE 24 OTHER APPLICATIONS: CHEESE POWDER MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 CHEESE MARKET, BY NATURE (Page No. - 86)

9.1 INTRODUCTION

FIGURE 38 MARKET SIZE FOR CHEESE, BY NATURE, 2021 VS. 2026 (USD BILLION)

TABLE 25 MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 26 ANIMAL SOURCE: MARKET SIZE FOR CHEESE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 27 PLANT SOURCE: MARKET SIZE FOR CHEESE, BY NATURE, 2019–2026 (USD MILLION)

9.2 CONVENTIONAL

9.2.1 LOWER PRICES OF CONVENTIONAL CHEESE TO BOOST THE GLOBAL DEMAND

TABLE 28 CONVENTIONAL: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

TABLE 29 CONVENTIONAL: ANIMAL SOURCE CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 30 CONVENTIONAL: PLANT SOURCE CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 ORGANIC

9.3.1 RISING AWARENESS ABOUT THE BENEFITS OF ORGANIC CHEESE TO ACCELERATE ITS DEMAND

TABLE 31 ORGANIC: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

TABLE 32 ORGANIC: ANIMAL SOURCE CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 33 ORGANIC: PLANT SOURCE CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 CHEESE MARKET, BY TYPE (Page No. - 92)

10.1 INTRODUCTION

FIGURE 39 MARKET SIZE FOR CHEESE, BY TYPE, 2021 VS. 2026 (USD BILLION)

TABLE 34 MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 35 MARKET SIZE, BY TYPE, 2019–2026 (KT)

10.2 COVID-19 IMPACT ON THE CHEESE MARKET, BY TYPE

10.2.1 REALISTIC SCENARIO

TABLE 36 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2019–2022 (USD BILLION)

10.2.2 PESSIMISTIC SCENARIO

TABLE 37 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE CHEESE MARKET SIZE, BY TYPE, 2019–2022 (USD BILLION)

10.2.3 OPTIMISTIC SCENARIO

TABLE 38 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2019–2022 (USD BILLION)

10.3 CHEESE PRODUCTS

10.3.1 VARIOUS FORMS OF CHEESE PRODUCTS AND LONGER SHELF LIFE TO AUGMENT THE DEMAND FOR CHEESE PRODUCTS

TABLE 39 CHEESE PRODUCTS: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

TABLE 40 CHEESE PRODUCTS: MARKET SIZE, BY REGION, 2019–2026 (KT)

TABLE 41 CHEESE PRODUCTS: MARKET SIZE, BY SUB-SEGMENT, 2019–2026 (USD BILLION)

10.3.2 SOLID

TABLE 42 SOLID CHEESE PRODUCTS: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

10.3.3 SEMI-LIQUID

TABLE 43 SEMI-LIQUID CHEESE PRODUCTS: MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

10.4 CHEESE POWDER

10.4.1 ESCALATED POPULARITY OF NOVEL CHEESE FORMULATIONS TO PROPEL THE CHEESE POWDER MARKET

TABLE 44 CHEESE POWDER: CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 CHEESE POWDER: MARKET SIZE, BY REGION, 2019–2026 (KT)

11 CHEESE MARKET, BY DISTRIBUTION CHANNEL (Page No. - 99)

11.1 INTRODUCTION

FIGURE 40 CHEESE MARKET SIZE, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD BILLION)

TABLE 46 MARKET SIZE FOR CHEESE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD BILLION)

11.2 COVID-19 IMPACT ON THE CHEESE MARKET, BY DISTRIBUTION CHANNEL

11.2.1 REALISTIC SCENARIO

TABLE 47 REALISTIC SCENARIO: COVID-19 IMPACT ON THE CHEESE MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

11.2.2 PESSIMISTIC SCENARIO

TABLE 48 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

11.2.3 OPTIMISTIC SCENARIO

TABLE 49 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOABL MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2022 (USD BILLION)

11.3 RETAIL

11.3.1 HOME COOKING AND STOCKING OF FOODSTUFF TO BOOST THE MARKET GROWTH OF THE RETAIL SECTOR

TABLE 50 RETAIL: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

11.4 FOODSERVICE

11.4.1 CHEESE-BASED FOOD ITEMS OFFERED BY QUICK-SERVICE RESTAURANTS TO DRIVE THE MARKET

TABLE 51 FOODSERVICE: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

11.5 FOOD MANUFACTURERS

11.5.1 MANUFACTURE OF FOOD PRODUCTS INFUSED WITH CHEESE INVOLVES EXTENSIVE R&D AND INNOVATION

TABLE 52 FOOD MANUFACTURERS: CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

12 CHEESE MARKET, BY SOURCE (Page No. - 105)

12.1 INTRODUCTION

FIGURE 41 MARKET SIZE FOR CHEESE, BY SOURCE, 2021 VS. 2026 (USD BILLION)

TABLE 53 MARKET SIZE, BY SOURCE, 2019–2026 (USD BILLION)

12.2 COVID-19 IMPACT ON THE CHEESE MARKET, BY SOURCE

12.2.1 REALISTIC SCENARIO

TABLE 54 REALISTIC SCENARIO: COVID-19 IMPACT ON THE CHEESE MARKET SIZE, BY SOURCE, 2019–2022 (USD BILLION)

12.2.2 PESSIMISTIC SCENARIO

TABLE 55 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE CHEESE MARKET SIZE, BY SOURCE, 2019–2022 (USD BILLION)

12.2.3 OPTIMISTIC SCENARIO

TABLE 56 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY SOURCE, 2019–2022 (USD BILLION)

12.3 ANIMAL

12.3.1 OVERALL NUTRIENT CONTENT OF ANIMAL-BASED CHEESE TO DRIVE THE MARKET

TABLE 57 ANIMAL SOURCE: MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

12.4 PLANT

12.4.1 THE FAST-GROWING TREND OF VEGANISM TO FUEL THE MARKET FOR PLANT-BASED CHEESE

TABLE 58 PLANT SOURCE: CHEESE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

13 CHEESE MARKET, BY REGION (Page No. - 110)

13.1 INTRODUCTION

FIGURE 42 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN THE ASIA PACIFIC, 2021–2026

TABLE 59 MARKET SIZE FOR CHEESE, BY REGION, 2019–2026 (USD BILLION)

TABLE 60 MARKET SIZE, BY REGION, 2019–2026 (KT)

13.2 COVID-19 IMPACT ON THE CHEESE MARKET, BY REGION

13.2.1 OPTIMISTIC SCENARIO

TABLE 61 OPTIMISTIC SCENARIO: CHEESE MARKET SIZE, BY REGION, 2019–2022 (USD BILLION)

13.2.2 REALISTIC SCENARIO

TABLE 62 REALISTIC SCENARIO: MARKET SIZE FOR CHEESE, BY REGION, 2019–2022 (USD BILLION)

13.2.3 PESSIMISTIC SCENARIO

TABLE 63 PESSIMISTIC SCENARIO: MARKET SIZE FOR CHEESE, BY REGION, 2019–2022 (USD BILLION)

13.3 NORTH AMERICA

TABLE 64 NORTH AMERICA CHEESE MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD BILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD BILLION)

TABLE 67 NORTH AMERICA:MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 69 NORTH AMERICA PLANT-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA ANIMAL-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 71 NORTH AMERICA MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 72 NORTH AMERICA CHEESE PRODUCT MARKET SIZE, BY SUB-TYPE, 2019–2026 (USD BILLION)

TABLE 73 NORTH AMERICA CHEESE POWDER MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

13.3.1 UNITED STATES

13.3.1.1 Demand for Italian and Mexican food preparation in the US to fuel the demand for cheese

TABLE 74 UNITED STATES: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.3.2 CANADA

13.3.2.1 Rise in demand for cheese in processed food products to drive the demand

TABLE 75 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.3.3 MEXICO

13.3.3.1 Consumer preference for soft and mild flavor cheese than strong flavor cheese to drive the demand

TABLE 76 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.4 EUROPE

FIGURE 43 EUROPE: CHEESE MARKET SNAPSHOT

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 78 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD BILLION)

TABLE 79 EUROPE: MARKET SIZE, BY SOURCE, 2019–2026 (USD BILLION)

TABLE 80 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 81 EUROPE: MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 82 EUROPE: PLANT-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: ANIMAL-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 84 EUROPE: MARKET SIZE FOR CHEESE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: CHEESE PRODUCT MARKET SIZE, BY SUB-TYPE, 2019–2026 (USD BILLION)

TABLE 86 EUROPE: CHEESE POWDER MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

13.4.1 GERMANY

13.4.1.1 Locally produced cheeses to attract significant demand from German consumers

TABLE 87 GERMANY: CHEESE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.4.2 UNITED KINGDOM

13.4.2.1 Large-scale employment in dairy and cheese production sites to spur the cheese market in the UK

TABLE 88 UNITED KINGDOM: MARKET SIZE FOR CHEESE, BY TYPE, 2019–2026 (USD MILLION)

13.4.3 FRANCE

13.4.3.1 Significant steps taken by the French government to uphold the market for cheese

TABLE 89 FRANCE: MARKET SIZE FOR CHEESE, BY TYPE, 2019–2026 (USD MILLION)

13.4.4 ITALY

13.4.4.1 Traditional Italian cuisine and the presence of PDO cheeses to boost the French cheese market

TABLE 90 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.4.5 SPAIN

13.4.5.1 Prominence of the dairy sector to drive the Spanish cheese market

TABLE 91 SPAIN: MARKET SIZE FOR CHEESE, BY TYPE, 2019–2026 (USD MILLION)

13.4.6 REST OF EUROPE

13.4.6.1 Favorable government initiatives fuel the cheese market

TABLE 92 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.5 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: CHEESE MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD BILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2019–2026 (USD BILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 98 ASIA PACIFIC: PLANT-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: ANIMAL-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 101 ASIA PACIFIC: CHEESE PRODUCT MARKET SIZE, BY SUB-TYPE, 2019–2026 (USD BILLION)

TABLE 102 ASIA PACIFIC: CHEESE POWDER MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

13.5.1 CHINA

13.5.1.1 Government initiatives and extensive import operations to augment the cheese market in China

TABLE 103 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.5.2 INDIA

13.5.2.1 Well-established dairy industry in India to support the growth of the market

TABLE 104 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.5.3 JAPAN

13.5.3.1 Global partnerships and agreements to influence the Japanese cheese market

TABLE 105 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.5.4 AUSTRALIA & NEW ZEALAND

13.5.4.1 Hefty export activities drive the market

TABLE 106 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.5.5 REST OF ASIA PACIFIC

13.5.5.1 Rapid westernization to augment the market

TABLE 107 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.6 REST OF THE WORLD

TABLE 108 ROW: CHEESE MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 109 ROW: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD BILLION)

TABLE 110 ROW: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 111 ROW: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

TABLE 112 ROW: MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 113 ROW: PLANT-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD MILLION)

TABLE 114 ROW: ANIMAL-BASED CHEESE MARKET SIZE, BY NATURE, 2019–2026 (USD BILLION)

TABLE 115 ROW: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 ROW: CHEESE PRODUCT MARKET SIZE, BY SUB-TYPE, 2019–2026 (USD BILLION)

TABLE 117 ROW: CHEESE POWDER MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

13.6.1 SOUTH AMERICA

13.6.1.1 Favorable import-export regulations to fuel the demand for cheese

TABLE 118 SOUTH AMERICA: CHEESE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.6.2 MIDDLE EAST

13.6.2.1 Health & wellness trends to drive the Middle Eastern cheese market

TABLE 119 MIDDLE EAST: CHEESE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

13.6.3 AFRICA

13.6.3.1 Growing cheese market to improve the health of consumers and help combat malnutrition

TABLE 120 AFRICA: CHEESE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 141)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2020

TABLE 121 CHEESE MARKET SHARE ANALYSIS, 2020

14.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN THE CHEESE MARKET, 2018–2020 (USD BILLION)

14.4 COVID-19 SPECIFIC COMPANY RESPONSE

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STARS

14.5.2 PERVASIVE PLAYERS

14.5.3 EMERGING LEADERS

14.5.4 PARTICIPANTS

FIGURE 46 CHEESE MARKET, COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

14.5.5 PRODUCT FOOTPRINT

TABLE 122 COMPANY FOOTPRINT, BY DISTRIBUTION CHANNEL

TABLE 123 COMPANY FOOTPRINT, BY PRODUCT TYPE

TABLE 124 COMPANY FOOTPRINT, BY REGION

TABLE 125 OVERALL COMPANY FOOTPRINT

14.6 CHEESE MARKET, STARTUP/SME EVALUATION QUADRANT, 2020

14.6.1 PROGRESSIVE COMPANIES

14.6.2 STARTING BLOCKS

14.6.3 RESPONSIVE COMPANIES

14.6.4 DYNAMIC COMPANIES

FIGURE 47 CHEESE MARKET: COMPANY EVALUATION QUADRANT, 2020 (STARTUP/SMES)

14.7 COMPETITIVE SCENARIO

14.7.1 NEW PRODUCT LAUNCHES

TABLE 126 CHEESE MARKET: NEW PRODUCT LAUNCHES, 2019–2021

14.7.2 DEALS

TABLE 127 CHEESE MARKET: DEALS, 2019–2021

15 COMPANY PROFILES (Page No. - 151)

(Business overview, Products offered, Recent developments & MnM View)*

15.1 KEY PLAYERS

15.1.1 ARLA FOODS

TABLE 128 ARLA FOODS: BUSINESS OVERVIEW

FIGURE 48 ARLA FOODS: COMPANY SNAPSHOT

TABLE 129 ARLA FOODS: PRODUCTS OFFERED

15.1.2 GLANBIA

TABLE 130 GLANBIA: BUSINESS OVERVIEW

FIGURE 49 GLANBIA: COMPANY SNAPSHOT

TABLE 131 GLANBIA: PRODUCTS OFFERED

TABLE 132 GLANBIA: DEALS

15.1.3 FONTERRA

TABLE 133 FONTERRA: BUSINESS OVERVIEW

FIGURE 50 FONTERRA: COMPANY SNAPSHOT

TABLE 134 FONTERRA: PRODUCTS OFFERED

15.1.4 THE KRAFT HEINZ COMPANY

TABLE 135 THE KRAFT HEINZ COMPANY: BUSINESS OVERVIEW

FIGURE 51 THE KRAFT HEINZ COMPANY: COMPANY SNAPSHOT

TABLE 136 THE KRAFT HEINZ COMPANY: PRODUCTS OFFERED

15.1.5 SAPUTO

TABLE 137 SAPUTO: BUSINESS OVERVIEW

FIGURE 52 SAPUTO: COMPANY SNAPSHOT

TABLE 138 SAPUTO: PRODUCTS OFFERED

15.1.6 BEL GROUP

TABLE 139 BEL GROUP: BUSINESS OVERVIEW

TABLE 140 BEL GROUP: PRODUCTS OFFERED

15.1.7 DALTER ALIMENTARI SPA

TABLE 141 DALTER ALIMENTARI SPA: BUSINESS OVERVIEW

TABLE 142 DALTER ALIMENTARI SPA: PRODUCTS OFFERED

TABLE 143 DALTER ALIMENTARI SPA: PRODUCT LAUNCHES

15.1.8 FRIESLANDCAMPINA

TABLE 144 FRIESLANDCAMPINA: BUSINESS OVERVIEW

FIGURE 53 FRIESLANDCAMPINA: COMPANY SNAPSHOT

TABLE 145 FRIESLANDCAMPINA: PRODUCTS OFFERED

TABLE 146 FRIESLANDCAMPINA: DEALS

15.1.9 DMK DEUTSCHES MILCHKONTOR GMBH

TABLE 147 DMK DEUTSCHES MILCHKONTOR GMBH: BUSINESS OVERVIEW

TABLE 148 DMK DEUTSCHES MILCHKONTOR GMBH: PRODUCTS OFFERED

15.1.10 LACTALIS INTERNATIONAL

TABLE 149 LACTALIS INTERNATIONAL: BUSINESS OVERVIEW

TABLE 150 LACTALIS INTERNATIONAL: PRODUCTS OFFERED

15.1.11 MEIJI HOLDINGS

TABLE 151 MEIJI HOLDINGS: BUSINESS OVERVIEW

FIGURE 54 MEIJI HOLDINGS: COMPANY SNAPSHOT

TABLE 152 MAIJI HOLDINGS: PRODUCTS OFFERED

15.1.12 AMUL

TABLE 153 AMUL: BUSINESS OVERVIEW

FIGURE 55 AMUL: COMPANY SNAPSHOT

TABLE 154 AMUL: PRODUCTS OFFERED

15.1.13 SAVENCIA SA

TABLE 155 SAVENCIA SA: BUSINESS OVERVIEW

FIGURE 56 SAVENCIA SA: COMPANY SNAPSHOT

TABLE 156 SAVENCIA SA: PRODUCTS OFFERED

15.1.14 LAND O’LAKES

TABLE 157 LAND O’LAKES: BUSINESS OVERVIEW

TABLE 158 LAND O’LAKES: PRODUCTS OFFERED

TABLE 159 LAND O’LAKES: PRODUCT LAUNCHES

15.1.15 KERRY GROUP

TABLE 160 KERRY GROUP: BUSINESS OVERVIEW

FIGURE 57 KERRY GROUP: COMPANY SNAPSHOT

TABLE 161 KERRY GROUP: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 OTHER KEY PLAYERS

15.2.1 ADM

15.2.2 GOOD PLANET FOODS (GPF)

15.2.3 DANONE

15.2.4 VIOLIFE

15.2.5 MIYOKO'S CREAMERY

15.2.6 DAIYA

15.2.7 FOLLOW YOUR HEART

16 APPENDIX (Page No. - 188)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

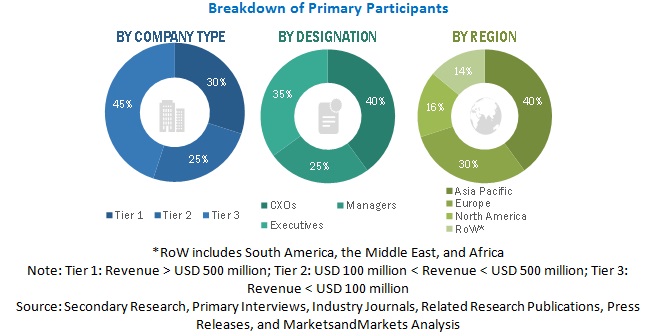

The process of estimating the size of the cheese market was a comprehensive one, involving four major activities. Firstly, an exhaustive secondary research phase was conducted to collect information on the market, peer market, and parent market. This phase was aimed at gathering as much information as possible about the cheese market and the broader industry within which it operates. The next step was to validate the findings, assumptions, and sizing obtained from the secondary research with industry experts across the value chain through primary research. This phase involved reaching out to experts in the industry to get their opinions and insights, which helped to verify the accuracy and reliability of the information gathered. Both the top-down and bottom-up approaches were employed to estimate the complete market size. The top-down approach involved analyzing the overall market size and then breaking it down into sub-segments, while the bottom-up approach involved estimating the market size of individual segments and then adding them up to arrive at the total market size. Finally, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments. This involved analyzing the data obtained from the primary and secondary research and cross-checking it to ensure consistency and accuracy. By using these techniques, the size of the cheese market was estimated with a high level of confidence, providing valuable insights into the industry's current and future prospects.

Cheese Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Cheese Market Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service-providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Cheese Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of cheese was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the market, with respect to type, application, product type, nature, distribution channel, source, and regional markets, over a period, ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on cheese supply chain and its impact on various stakeholders such as suppliers, manufacturers, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the cheese market and impact of COVID-19 on the key vendors.

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the cheese market.

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe cheese market, by key country

- Further breakdown of the Rest of Asia Pacific cheese market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cheese Market