Cheese Powder Market by Type (Cheddar, Mozzarella, American Cheese, Blue Cheese, Parmesan), Application (Bakery & Confectionery, Sweet & Savory Snacks, Sauces, Dressings, Dips, and Condiments, Ready Meals), Origin and Region - Global Forecast to 2028

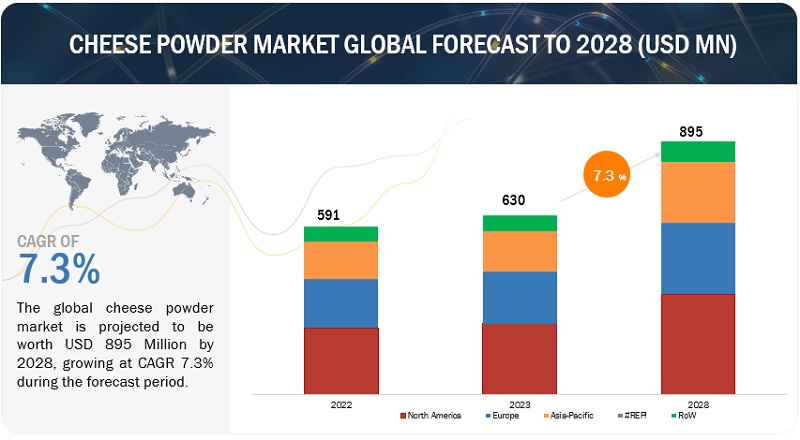

According to the MarketsandMarkets™, The cheese powder market is estimated at USD 630 million in 2023 and is projected to reach USD 895 million by 2028, at a CAGR of 7.3% from 2023 to 2028.

The cheese powder market is highly impacted by the increasing size of the convenience & fast-food industry and innovative offerings by cheese powder manufacturers. The growth rate of the fast-food industry is significant owing to the changing lifestyles of people around the globe. The US. is the dominant market in the fast-food industry and this trend is expected to continue. The emerging economies of the Asia Pacific region are the major markets for cheese powders and are increasingly contributing to their demand, owing to the rising disposable income, rapidly increasing population, and an increase in the demand for processed foods in these countries. The widespread impact of western cuisines on developing regions such as Asia Pacific and Latin America has led to a tremendous increase in demand for cheese-based fast-food products. Moreover, constant innovations offer investment opportunities to cheese powder manufacturers. On the other hand, rising awareness about the ill-health effects of cheese such as obesity, high cholesterol levels, and heart problems, and stringent government regulations for labelling cheese.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Expansive globalization of cuisines

The blending of modern methods and components with traditional tastes is a result of the global popularity of different cuisines. Within this rich culinary landscape, cheese powder has become a common ingredient, connecting various kitchens and cultures seamlessly.

As people's food preferences become more diverse and cultural exchange becomes easier, chefs and home cooks are increasingly combining flavors and techniques from different traditions. Cheese powder has emerged as a versatile seasoning that enhances the taste profiles of both traditional and innovative dishes, making it a valuable addition to the world of gastronomy. Cheese powder has become an emblem of culinary versatility and experimentation, spanning from the bustling streets of Asia to the quaint villages of Europe and the vibrant markets of the Americas. Its ubiquity has made it a staple ingredient in many dishes, and it continues to inspire chefs and food enthusiasts alike to push the boundaries of traditional cuisine. Its adaptability and versatility make it a valuable addition to any kitchen, offering a range of flavors and textures that can be incorporated into a variety of dishes, from savory to sweet. As such, it remains an important ingredient in the culinary industry, celebrated for its ability to enhance and elevate dishes across the globe. In traditional cuisines, cheese powder has breathed new life into time-honored recipes. Its ability to impart a concentrated burst of flavor allows chefs to recreate distant delicacies that might otherwise be challenging to source or reproduce authentically. In Asian cuisine, cheese powder might infuse a modern twist into classic noodle dishes, compellingly contrasting traditional ingredients. Similarly, Mediterranean fare could elevate a rustic dish with a touch of creamy richness, seamlessly blending cultures and flavors.

This growing demand for cheese powder on a global scale is attributed to chefs and home cooks continuing to explore the vast possibilities of culinary fusion. It has earned its place as a symbol of the modern culinary landscape, an ingredient that surpasses geographical constraints.

The ascendancy of artisanal cheese within the cheese powder market has been a remarkable phenomenon, driven by an increasing consumer yearning for authenticity, quality, and unique flavors. As mass-produced and standardized products dominated the market, a palpable desire emerged among discerning consumers for a more elevated and personalized culinary experience. Artisanal cheese, with its emphasis on traditional craftsmanship, locally sourced ingredients, and diverse aging techniques, answered this call to cheese enthusiasts worldwide. The rise of artisanal cheese in the cheese powder market has been facilitated by a renewed appreciation for regional flavors and heritage. As consumers seek to connect with their food more meaningfully, artisanal cheese offers a direct link to local culinary traditions and a sense of place. This appeal is not limited to a single region but extends globally, with enthusiasts worldwide eager to explore the nuances of cheese varieties.

Restraints: Quality and authenticity

Creating an authentic cheese flavor and ensuring consistent product quality in cheese powder is indeed a complex task that presents several challenges for food manufacturers. Cheese powder is a convenient and versatile ingredient used in various food products, such as snacks, sauces, and seasonings. The foundation of any cheese powder is the cheese itself. The specific type and quality of cheese used as the base ingredient greatly influence the final flavor, aroma, and texture of the powder. Different cheeses, such as cheddar, parmesan, or blue cheese, possess distinct and complex flavor profiles. Capturing and translating these nuances accurately into a powdered form is a complex task, and even slight variations in the source or type of cheese can lead to noticeable differences in the end product. Achieving consistency in flavor across batches becomes challenging, especially when using different sources or types of cheese.

The transformation of cheese into powder involves several processing steps, including drying and milling. These steps are essential to ensure the product’s stability and shelf life. However, if not executed properly, they can adversely affect the final flavor and texture. Over-processing, inadequate drying, or incorrect processing conditions can cause the degradation of delicate flavor compounds present in cheese, resulting in an inauthentic or muted taste. Achieving the right balance between processing efficiency and flavor preservation is crucial. The cheese flavor is a complex interplay of volatile compounds that can be sensitive to external factors such as temperature, humidity, and light. Over time, exposure to these environmental conditions can lead to the breakdown and degradation of these volatile compounds. This can result in flavor loss or changes that deviate from the desired authentic cheese profile. Manufacturers must carefully formulate their products to mitigate the impact of these factors and select appropriate packaging materials to maintain flavor stability throughout the product’s shelf life.

Opportunities: Rapidly growing market of processed and packaged food in developing countries

With favorably changing economic conditions and developments, there is an increase in the disposable income of consumers. This rise in disposable income has resulted in higher purchasing power of consumers, which in turn has increased the household expenditure, wherein the consumers are increasingly spending on processed & packaged foods. Cheese powder is extensively used in packaged and processed food as a flavorant. The increasing disposable income in emerging economies can be analyzed by the growth in GDP (PPP) of leading countries in 2015.

The rise in urbanization in developing countries is expected to create opportunities for the global cheese powder market. Urbanization often leads to changes in lifestyle and dietary habits. With fast-paced urban lives, people are seeking convenient and time-saving food options that do not compromise on taste and nutritional value. Cheese powder, known for its long shelf life and versatility, aligns perfectly with this need. It can be easily incorporated into a variety of dishes, ranging from instant pasta meals to ready-to-eat snacks, catering to the on-the-go urban lifestyle. According to the FAO, rapid economic development, income growth, and urbanization are leading to changes in dietary patterns of people in Asia. A shift is observed from staple food towards including processed & packaged food products in their food intake. Moreover, growth in retail channels such as supermarkets and hypermarkets in urban areas is expected to increase the availability of processed & packaged food. With the rising demand for packaged foods such as snacks, bakery & confectionery products, and ready to eat meals, the demand for cheese powder is likely to grow in the future.

Furthermore, urbanization tends to foster exposure to diverse cuisines and flavors due to increased cultural exchange and international migration. Cheese powder, with its ability to enhance the taste profile of a wide range of dishes, can contribute to the creation of fusion foods that appeal to cosmopolitan urban palates. This opens up avenues for innovative culinary creations and cross-cultural gastronomic experiences, further driving the demand for cheese powder.

Challenges: Allergen and dietary restrictions

Many cheese powders contain allergens, such as milk, which can pose challenges for individuals with allergies or dietary restrictions. Meeting the demands of consumers seeking allergen-free or plant-based options while maintaining the desired taste and texture can be complex. As stated in the report “Lactose Intolerance by Country - 2023” by the World Population Review, lactose intolerance tends to be more prevalent among individuals in the United States with familial or ancestral ties to regions where lactose malabsorption is more frequent. Specifically, those with African American, American Indian, Asian American, or Hispanic/Latino heritage are more prone to lactose malabsorption, according to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK).

Lactose intolerance is most notably widespread in Asian nations, particularly in East Asian countries, where a substantial 70-100% of the population exhibits lactose intolerance. Conversely, it is notably less prevalent in Northern and Central European regions, where only around 5% of the populace experiences lactose intolerance. Given the higher likelihood of lactose intolerance among specific ethnic groups in the US, manufacturers may tailor their marketing efforts and product formulations to cater to these segments. This could involve creating lactose-free or dairy-free cheese powder options to accommodate those more susceptible to lactose malabsorption.

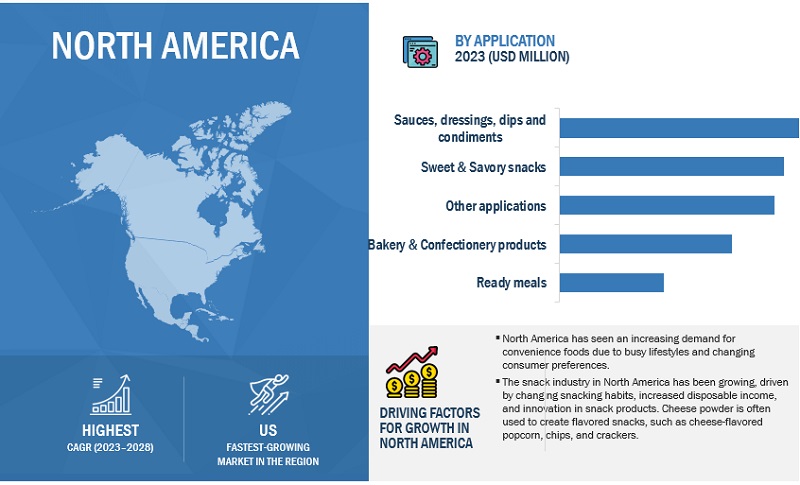

Based on application, Sauces, dressings, dips, and condiments products is estimated to account for the largest market share of the cheese powder market.

Sauces, dressings, dips, and condiments are commonly used to enhance the flavor of various dishes. When combined with cheese powder, they can create a rich and savory taste profile that appeals to consumers. The combination of different flavors can lead to unique culinary experiences, driving demand for cheese powder in both the consumer and food service sectors. The food service sector, including restaurants and cafes, often uses cheese powder as a cost-effective and flavor-boosting ingredient. By incorporating cheese powder into sauces, dressings, and dips, foodservice establishments can offer unique menu items that stand out to customers.

Based on origin, processed cheese is anticipated to dominate the market.

Processed cheese powder products are favored for their convenience and longer shelf life compared to traditional cheeses. They are easy to store, have a longer shelf life, and require minimal preparation. This convenience factor appeals to busy consumers seeking quick and easy meal solutions. Processed cheese powder can be stored for longer periods without the risk of spoilage or mold growth. This makes them ideal for food manufacturers and consumers who require longer-lasting dairy products.

Cheddar cheese of the cheese powder market by type segment is projected to witness the largest share during the forecast period.

Cheddar cheese has been a popular and versatile cheese variety, enjoyed for its sharp and tangy flavor. It is widely used in various culinary applications, including snacks, sauces, dips, and ready-to-eat meals. The global snack industry has been expanding, driven by changing consumer preferences, on-the-go snacking, and the introduction of innovative snack products. Cheddar cheese powder finds application in the seasoning of various snack items, aligning with the growth of the snack market.

The North America market is projected to contribute the largest share for the cheese powder market.

North America, especially the United States, has been a significant consumer of processed and convenience foods, which often include cheese-flavored snacks and products. This has contributed to the demand for cheese powder as an ingredient. Consumers have shown a growing preference for convenient, ready-to-eat, and portable snack options. Cheese powder is often used to add flavor to such products, aligning with this trend. Cheese powder is a versatile ingredient that provides a concentrated cheese flavor. Its use in various food items helps enhance taste profiles and can make products more appealing to consumers.

Key Market Players

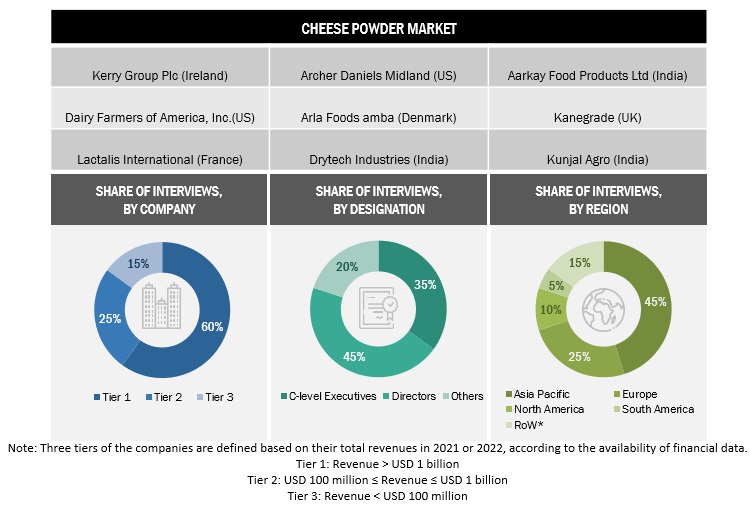

Land O'Lakes, Inc. (US), Kerry Group Plc (Ireland), Fonterra Co-operative Group Limited (New Zealand), Archer Daniels Midland (US), and Lactosan A/S (Denmark) are among the key players in the global cheese powder market. These players in this market are focusing on increasing their presence through partnership and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (tons) |

|

Segments Covered |

By Type, By Application, By Milk Source (qualitative), By origin, and By Region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and Rest of the World |

|

Companies studied |

|

Cheese powder Market Report Scope:

By Type

- Cheddar

- Mozzarella

- Parmesan

- American Cheese

- Blue Cheese

- Other Types

By Origin

- Natural

- Processed

By Application

- Bakery & Confectionery products

- Sweet & Savory snacks

- Sauces, dressings, dips & condiments

- Ready Meals

- Other Applications

By Milk Source (Qualitative)

- Cow milk

- Buffalo milk

- Sheep milk

- Goat milk

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In September 2022, Kerry Group plc (Ireland) significantly bolstered its position in the cheese powder market by acquiring The Kraft Heinz Company's powdered cheese business and related assets. This strategic move not only elevates Kerry's scale and manufacturing capacity but also expands its customer base in the vital snacking category. Through this acquisition, Kerry gains access to Kraft Heinz's B2B powdered cheese business, reinforcing its foothold in the cheese powder market. Moreover, with the acquisition, Kerry further extends its presence and influence in emerging markets, solidifying its position as a prominent player in the cheese powder industry.

- In March 2023, Kerry Group plc (Ireland) has inaugurated the Southern Europe Innovation Centre in Barcelona, Spain, showcasing their commitment to expanding their presence in the region, catering to customers in Spain, Portugal, Italy, and France. By leveraging the facility's cutting-edge labs and technology expertise, Kerry can accelerate the development of novel and tailored cheese powder solutions for the region. This enhanced product portfolio and the ability to cater to diverse consumer tastes are likely to position Kerry as a dominant player in the South European cheese powder market.

- In October 2022, Fonterra Co-operative Group Limited (New Zealand) has embarked on a collaborative initiative to enhance its US Foodservice business by partnering with Land O'Lakes, Inc. (US), a prominent dairy cooperative in the United States. This strategic sales and marketing agreement is aimed at unlocking new avenues for Fonterra's Foodservice offerings within the expansive US market. Considering the implications for the cheese powder market, while the immediate scope of this partnership centers on cooking creams, cream cheese, and potentially other categories, the broader collaboration with Land O’Lakes could influence Fonterra's overall presence and capabilities in the US market. This enhanced market access and distribution network could indirectly impact the availability and distribution of various dairy products, including cheese powder, as Fonterra further establishes its foothold in the competitive US Foodservice landscape.

Key Questions Addressed by the Report

What is the Cheese Powder market?

The cheese powder market refers to the global industry involved in the production, distribution, and sale of dehydrated cheese in powdered form. Cheese powder is used as a flavoring ingredient in snacks, sauces, dressings, ready-to-eat meals, bakery products, and more due to its long shelf life, convenience, and rich taste profile.

What is the current size and forecast of the global cheese powder market?

In 2023, the cheese powder market was valued at USD 630 million and is anticipated to rise to USD 895 million by 2028, registering a CAGR of 7.3%.

What are the key drivers of the Cheese Powder market?

The market is primarily driven by the growing demand for convenience foods, increased consumption of packaged snacks, and the rising popularity of cheese-flavored products. Additionally, innovations in food processing technology, urbanization, and changing dietary habits have boosted cheese powder usage in both household and industrial applications.

Which types of cheese powder are most popular?

Common types include cheddar, parmesan, mozzarella, cream cheese, blue cheese, and specialty blends. Cheddar cheese powder dominates due to its versatile flavor profile and widespread use in snacks and processed foods.

What are the major applications of cheese powder?

Cheese powder is widely used in: Snacks, Bakery & confectionery, Ready meals & instant food, Dressings & dips, and Prepared meat products.

Which regions lead the Cheese Powder market?

North America and Europe currently lead due to high consumption of cheese-based products and strong food processing industries. Asia-Pacific is the fastest-growing region, driven by increasing Western food adoption, urbanization, and rising disposable incomes.

What are the key challenges in the Cheese Powder market?

Challenges include fluctuating raw material prices (especially milk), strict food safety regulations, potential health concerns related to high sodium and fat content, and competition from plant-based cheese alternatives.

How is the market impacted by the rise of plant-based and vegan products?

While traditional dairy-based cheese powder faces competition from plant-based alternatives, the trend has also opened opportunities for vegan cheese powder made from nuts, soy, or nutritional yeast, catering to health-conscious and lactose-intolerant consumers.

What is the growth outlook for the Cheese Powder market?

The market is expected to grow steadily due to increasing snack consumption, rising demand in emerging economies, and innovations in flavor and formulation. Manufacturers focusing on low-fat, organic, and clean-label cheese powders are likely to gain a competitive edge.

Who are the major players in the Cheese Powder market?

Key players include Land O'Lakes, Inc. (US), Kerry Group Plc (Ireland), Fonterra Co-operative Group Limited (New Zealand), ADM (US), Commercial Creamery Company (US). These companies compete through product innovation, expansion in emerging markets, and partnerships with food brands.

What trends are shaping the future of the cheese powder market?

Trends such as the development of organic and clean-label cheese powders, plant-based alternatives, and innovative flavor blends are shaping the future of the market. Manufacturers are also focusing on reducing sodium content, using natural ingredients, and improving powder solubility to cater to health-conscious consumers and evolving dietary preferences.

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN GLOBAL POPULATION AND DIVERSE FOOD CONSUMPTION

-

5.3 MARKET DYNAMICSDRIVERS- Increase in demand for convenience food- Growth of fast-food industry- Expansive globalization of cuisinesRESTRAINTS- Rise in awareness regarding ill health effects of cheese- Quality and authenticityOPPORTUNITIES- Growth in recognition of powdered cheese- Rapidly growing market of processed and packaged food in emerging economiesCHALLENGES- Labeling regulations- Allergen and dietary restrictions

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SOURCINGMANUFACTURING CHEESE POWDERQUALITY & SAFETY CONTROLLERSPACKAGINGMARKETING & DISTRIBUTIONEND-USE INDUSTRY

- 6.3 TRADE ANALYSIS

- 6.4 PRICING ANALYSIS

-

6.5 MARKET MAP AND ECOSYSTEMDEMAND SIDESUPPLY SIDE

- 6.6 TRENDS IMPACTING BUYERS

-

6.7 TECHNOLOGY ANALYSISCHEESE POWDER AND INTERNET OF THINGS (IOT)CHEESE POWDER AND ENCAPSULATION TECHNOLOGY

-

6.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 REGULATORY FRAMEWORK, TARIFF, AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORKS- North America- Europe- Asia Pacific- South America

-

6.12 CASE STUDY ANALYSISKERRY’S INNOVATIVE CHEESE-FLAVORED SNACK SPARKED SALES SURGE AND PREMIUM APPEAL FOR LEADING BRANDHRS EVAPORATION TECHNOLOGY BOOSTED CHEESE PROCESSOR’S DRYING CAPACITY AND EFFICIENCY

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 7.1 INTRODUCTION

-

7.2 BAKERY & CONFECTIONERY PRODUCTSCONSUMER DESIRE FOR NOVEL TASTE EXPERIENCES IN BAKED GOODS AND CONFECTIONERY

-

7.3 SWEET & SAVORY SNACKSDEMAND FOR CONVENIENT SNACKS DRIVEN BY BUSY LIFESTYLES

-

7.4 SAUCES, DRESSINGS, DIPS, AND CONDIMENTSDEMAND FOR CONVENIENCE, COST-EFFECTIVENESS, AND ENHANCED FLAVOR PROFILE

-

7.5 READY MEALSDECLINE IN EXTENSIVE FOOD PREPARATION, COUPLED WITH DEMAND FOR CHEESE FLAVORS IN FROZEN PRODUCTS

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 NATURALCULINARY HERITAGE AND HEALTH ADVANTAGES OF NATURAL CHEESE

-

8.3 PROCESSEDDEMAND FOR PROCESSED CHEESE POWDER WITHIN REALM OF GLOBAL FAST-FOOD CHAINS

- 9.1 INTRODUCTION

-

9.2 COW MILKNUTRITIONAL PROFILE OF COW’S MILK TO APPEAL TO HEALTH-CONSCIOUS CONSUMERS

-

9.3 BUFFALO MILKBUFFALO MILK CHEESE TO OFFER UNIQUE HARD, RUBBER-LIKE, DRY TEXTURES

-

9.4 SHEEP MILKSHEEP MILK’S SUSTAINABILITY AND NUTRITIONAL ADVANTAGES TO RESHAPE PREMIUM CHEESE POWDER MARKET

-

9.5 GOAT MILKGOAT MILK TO GAIN MARKET FOR DIVERSE BENEFITS AND CULINARY USES

- 10.1 INTRODUCTION

-

10.2 CHEDDARCONSISTENTLY STABLE CHEDDAR CHEESE PRODUCTION TO REINFORCE DEPENDABLE SUPPLY CHAIN FOR CHEESE POWDER

-

10.3 MOZZARELLAADAPTABILITY TO INTERNATIONAL FUSION DISHES—MEETING DEMAND FOR DIVERSE AND DISTINCTIVE FLAVOR COMBINATIONS

-

10.4 PARMESANPARMESAN’S FAMILIARITY AND ACCEPTANCE ACROSS VARIOUS CUISINES TO APPEAL TO CONSUMERS WORLDWIDE

-

10.5 AMERICAN CHEESEAMERICAN CHEESE’S CONVENIENCE AND FLAVOR CONSISTENCY

-

10.6 BLUE CHEESEBLUE CHEESE TO OFFER GOURMET OPTIONS FOR PREMIUM, INDULGENT CULINARY EXPERIENCES

- 10.7 OTHER TYPES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Strong presence of key market players in USCANADA- Increase in processed food consumption in CanadaMEXICO- Country's culinary traditions to shape market demand

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- High demand encouraged major imports despite rich cheese-making historyFRANCE- Cheese powder market unaffected by decline in cheese consumption during pandemic owing to shelf-stabilityITALY- Prominent global exporter of cheese powdersUK- Increased preference for convenience food in UKSPAIN- Boost in Spanish dairy exportsREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Major importer of cheese products in Asia PacificINDIA- Dairy-rich history and evolving lifestyles in IndiaJAPAN- Surge in inbound visitors to Japan opens potential avenues for market growthAUSTRALIA & NEW ZEALAND- Despite decrease in milk production, cheese powder market to remain stableREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Fluctuating dairy trends set to reshape market dynamics in BrazilARGENTINA- Culinary shifts and growing appetite for convenience foodsREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Rise in Urbanization and Western InfluenceAFRICA- Consumer preference to drive bakery & confectionery industry

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 KEY PLAYER STRATEGIES

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIO AND TRENDSDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSLAND O’LAKES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFONTERRA CO-OPERATIVE GROUP LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARCHER DANIELS MIDLAND COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLACTOSAN A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBLUEGRASS INGREDIENTS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMMERCIAL CREAMERY COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALL AMERICAN FOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAARKAY FOOD PRODUCTS LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDAIRY FARMERS OF AMERICA, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGIVAUDAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARLA FOODS AMBA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKANEGRADE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLACTALIS INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDRYTECH INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.3 STARTUPS/SMES/OTHER PLAYERSKUNJAL AGRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUHRENHOLT A/S- Business overview- Products/Solutions/Services offered- MNM viewCHHATARIYA FOODS PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHANDONG BIGTREE DREYFUS SPECIAL MEALS FOOD CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVANI FOOD PRODUCTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNZAC FOODSVISHAL ESSENTIAL OILS & CHEMICALSXI’AN HAOZE BIOTECHNOLOGY CO., LTD.ROGERS & COMPANY FOODS PTY LTDBALLANTYNE

-

14.1 INTRODUCTIONADJACENT MARKETS

- 14.2 RESEARCH LIMITATIONS

-

14.3 CHEESE MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 CHEESE INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 STUDY ASSUMPTIONS

- TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- TABLE 4 RECESSION INDICATORS AND THEIR IMPACT ON CHEESE POWDER MARKET

- TABLE 5 CHEESE POWDER MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF GRATED OR POWDERED CHEESE, 2020 (KG)

- TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF GRATED OR POWDERED CHEESE, 2021 (KG)

- TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF GRATED OR POWDERED CHEESE, 2022 (KG)

- TABLE 9 NORTH AMERICA: AVERAGE SELLING PRICE OF CHEESE POWDER, BY TYPE, 2019–2022 (USD/KG)

- TABLE 10 EUROPE: AVERAGE SELLING PRICE OF CHEESE POWDER, BY TYPE, 2019–2022 (USD/KG)

- TABLE 11 ASIA PACIFIC: AVERAGE SELLING PRICE OF CHEESE POWDER, BY TYPE, 2019–2022 (USD/KG)

- TABLE 12 SOUTH AMERICA: AVERAGE SELLING PRICE OF CHEESE POWDER, BY TYPE, 2019–2022 (USD/KG)

- TABLE 13 ROW: AVERAGE SELLING PRICE OF CHEESE POWDER, BY TYPE, 2019–2022 (USD/KG)

- TABLE 14 SUPPLY CHAIN (ECOSYSTEM)

- TABLE 15 PORTER’S FIVE FORCES: IMPACT ANALYSIS

- TABLE 16 LIST OF MAJOR PATENTS PERTAINING TO CHEESE POWDER MARKET, 2017–2022

- TABLE 17 KEY CONFERENCES AND EVENTS FOR CHEESE POWDER, 2022–2023

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF CHEESE POWDER

- TABLE 24 KEY CRITERIA FOR BUYING POWDERED CHEESE

- TABLE 25 CHEESE POWDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 CHEESE POWDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 CHEESE POWDER MARKET IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 CHEESE POWDER MARKET IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 CHEESE POWDER MARKET IN SWEET & SAVORY SNACKS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 CHEESE POWDER MARKET IN SWEET & SAVORY SNACKS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 CHEESE POWDER MARKET IN SAUCES, DRESSINGS, DIPS, AND CONDIMENTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 CHEESE POWDER MARKET IN SAUCES, DRESSINGS, DIPS, AND CONDIMENTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 CHEESE POWDER MARKET IN READY MEALS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 CHEESE POWDER MARKET IN READY MEALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CHEESE POWDER MARKET IN OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 CHEESE POWDER MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CHEESE POWDER MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 38 CHEESE POWDER MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 39 NATURAL CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 NATURAL CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PROCESSED CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 PROCESSED CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 CHEESE POWDER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 CHEESE POWDER MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 46 CHEESE POWDER MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 47 CHEDDAR CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 CHEDDAR CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 CHEDDAR CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 50 CHEDDAR CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 51 MOZZARELLA CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 MOZZARELLA CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MOZZARELLA CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 54 MOZZARELLA CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 55 PARMESAN CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 PARMESAN CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 PARMESAN CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 58 PARMESAN CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 59 AMERICAN CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 AMERICAN CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 AMERICAN CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 62 AMERICAN CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 63 BLUE CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 BLUE CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 BLUE CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 66 BLUE CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 67 OTHER TYPES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 OTHER TYPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 OTHER TYPES MARKET, BY REGION, 2019–2022 (TON)

- TABLE 70 OTHER TYPES MARKET, BY REGION, 2023–2028 (TON)

- TABLE 71 CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 CHEESE POWDER MARKET, BY REGION, 2019–2022 (TON)

- TABLE 74 CHEESE POWDER MARKET, BY REGION, 2023–2028 (TON)

- TABLE 75 NORTH AMERICA: CHEESE POWDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 80 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 81 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 85 US: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 CANADA: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 MEXICO: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 90 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: CHEESE POWDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 96 EUROPE: MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 97 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 101 GERMANY: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 102 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 FRANCE: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 ITALY: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 106 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 UK: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 SPAIN: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 SPAIN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: CHEESE POWDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 118 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 119 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 123 CHINA: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 JAPAN: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 128 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 AUSTRALIA & NEW ZEALAND: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 130 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: CHEESE POWDER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: CHEESE POWDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 138 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 139 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 140 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 143 BRAZIL: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 ARGENTINA: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 ARGENTINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 REST OF SOUTH AMERICA: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 ROW: CHEESE POWDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 150 ROW: CHEESE POWDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 151 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 ROW: MARKET, BY TYPE, 2019–2022 (TON)

- TABLE 154 ROW: MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 155 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 ROW: MARKET, BY ORIGIN, 2019–2022 (USD MILLION)

- TABLE 158 ROW: MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 AFRICA: CHEESE POWDER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 162 AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 CHEESE POWDER MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 164 COMPANY FOOTPRINT, BY TYPE

- TABLE 165 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 166 COMPANY FOOTPRINT, BY REGION

- TABLE 167 OVERALL COMPANY FOOTPRINT

- TABLE 168 CHEESE POWDER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 169 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 170 MARKET: DEALS, 2020–2022

- TABLE 171 CHEESE POWDER MARKET: OTHERS, 2021–2023

- TABLE 172 LAND O’LAKES, INC.: BUSINESS OVERVIEW

- TABLE 173 LAND O’LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 LAND O’LAKES, INC.: DEALS

- TABLE 175 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 176 KERRY GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 KERRY GROUP PLC: DEALS

- TABLE 178 KERRY GROUP PLC: OTHERS

- TABLE 179 FONTERRA CO-OPERATIVE GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 180 FONTERRA CO-OPERATIVE GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 FONTERRA CO-OPERATIVE GROUP LIMITED: DEALS

- TABLE 182 FONTERRA CO-OPERATIVE GROUP LIMITED: OTHERS

- TABLE 183 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

- TABLE 184 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 LACTOSAN A/S: BUSINESS OVERVIEW

- TABLE 186 LACTOSAN A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 BLUEGRASS INGREDIENTS, INC.: BUSINESS OVERVIEW

- TABLE 188 BLUEGRASS INGREDIENTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 COMMERCIAL CREAMERY COMPANY: BUSINESS OVERVIEW

- TABLE 190 COMMERCIAL CREAMERY COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 ALL AMERICAN FOODS: BUSINESS OVERVIEW

- TABLE 192 ALL AMERICAN FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 AARKAY FOOD PRODUCTS LTD: BUSINESS OVERVIEW

- TABLE 194 AARKAY FOOD PRODUCTS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 DAIRY FARMERS OF AMERICA, INC.: BUSINESS OVERVIEW

- TABLE 196 DAIRY FARMERS OF AMERICA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 GIVAUDAN: BUSINESS OVERVIEW

- TABLE 198 GIVAUDAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 GIVAUDAN: DEALS

- TABLE 200 ARLA FOODS AMBA: BUSINESS OVERVIEW

- TABLE 201 ARLA FOODS AMBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 KANEGRADE: BUSINESS OVERVIEW

- TABLE 203 KANEGRADE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LACTALIS INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 205 LACTALIS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 DRYTECH INDUSTRIES: BUSINESS OVERVIEW

- TABLE 207 DRYTECH INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 KUNJAL AGRO: BUSINESS OVERVIEW

- TABLE 209 KUNJAL AGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 UHRENHOLT A/S: BUSINESS OVERVIEW

- TABLE 211 UHRENHOLT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 CHHATARIYA FOODS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 213 CHHATARIYA FOODS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SHANDONG BIGTREE DREYFUS SPECIAL MEALS FOOD CO., LTD: BUSINESS OVERVIEW

- TABLE 215 SHANDONG BIGTREE DREYFUS SPECIAL MEALS FOOD CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 AVANI FOOD PRODUCTS: BUSINESS OVERVIEW

- TABLE 217 AVANI FOOD PRODUCTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 NZAC FOODS: BUSINESS OVERVIEW

- TABLE 219 VISHAL ESSENTIAL OILS & CHEMICALS: BUSINESS OVERVIEW

- TABLE 220 XI’AN HAOZE BIOTECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 221 ROGERS & COMPANY FOODS PTY LTD: BUSINESS OVERVIEW

- TABLE 222 BALLANTYNE: BUSINESS OVERVIEW

- TABLE 223 CHEESE MARKET, BY PRODUCT TYPE, 2019–2026 (USD BILLION)

- TABLE 224 CHEESE INGREDIENTS MARKET, BY CHEESE TYPE, 2015–2022 (USD MILLION)

- FIGURE 1 CHEESE POWDER MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 3 CHEESE POWDER MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 CHEESE POWDER MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 CHEESE POWDER MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 6 CHEESE POWDER MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 INDICATORS OF RECESSION

- FIGURE 9 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 10 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 11 CHEESE POWDER MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 12 CHEESE POWDER MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CHEESE POWDER MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 CHEESE POWDER MARKET, BY ORIGIN, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 CHEESE POWDER MARKET SHARE (VALUE), BY REGION, 2023

- FIGURE 16 INCREASE IN DEMAND FOR CONVENIENCE FOOD TO DRIVE MARKET FOR CHEESE POWDER

- FIGURE 17 INDIA TO WITNESS HIGHEST CAGR AMONG KEY MARKETS DURING FORECAST PERIOD

- FIGURE 18 CHEDDAR CHEESE POWDER AND US ACCOUNTED FOR SIGNIFICANT RESPECTIVE SEGMENTAL SHARES IN 2022

- FIGURE 19 SAUCES, DRESSING, DIPS, AND CONDIMENTS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 20 PROCESSED CHEESE POWDER PROJECTED TO LEAD OVER NATURAL CHEESE POWDER MARKET DURING FORECAST DEMAND

- FIGURE 21 POPULATION GROWTH TREND, 1950–2050 (MILLION)

- FIGURE 22 CHEESE POWDER MARKET DYNAMICS

- FIGURE 23 TEN COUNTRIES WITH HIGHEST PREVALENCE OF LACTOSE INTOLERANCE, 2023

- FIGURE 24 KEY COUNTRIES WITH LOWEST PREVALENCE OF LACTOSE INTOLERANCE, 2023

- FIGURE 25 CHEESE POWDER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 CHEESE POWDER MARKET MAP

- FIGURE 27 CHEESE MARKET: TRENDS IMPACTING BUYERS

- FIGURE 28 LIST OF TOP PATENTS PERTAINING TO MARKET, 2012–2022

- FIGURE 29 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 30 CHEESE POWDER MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 US: ANNUAL BAKED GOODS EXPORTS, 2017–2022 (USD BILLION)

- FIGURE 32 TOP 10 MARKETS FOR BAKED GOODS, 2022 (USD MILLION)

- FIGURE 33 CHEESE POWDER MARKET, BY ORIGIN, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 COW MILK PRODUCTION, BY KEY REGION, 2013–2021 (‘000 TONS)

- FIGURE 35 US: PER CAPITA CONSUMPTION OF SELECTED CHEESE, 2016–2021 (POUNDS)

- FIGURE 36 CHEESE POWDER MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 US: CHEDDAR CHEESE PRODUCTION, 2019–2023 (MILLION POUNDS)

- FIGURE 38 TOP 10 COUNTRIES IN TERMS OF PER CAPITA CHEESE CONSUMPTION (POUNDS/YEAR)

- FIGURE 39 CHEESE POWDER MARKET: GEOGRAPHICAL SNAPSHOT, 2022

- FIGURE 40 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 41 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 42 NORTH AMERICA CHEESE POWDER MARKET SNAPSHOT

- FIGURE 43 US: PER CAPITA CONSUMPTION OF SELECTED CHEESE, 2016–2021 (POUNDS)

- FIGURE 44 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 45 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 46 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 47 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 48 ASIA PACIFIC: CHEESE POWDER MARKET SNAPSHOT

- FIGURE 49 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 50 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 ROW: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 52 ROW: RECESSION IMPACT ANALYSIS, 2022–2023

- FIGURE 53 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 54 CHEESE POWDER MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 55 CHEESE POWDER MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 56 LAND O’LAKES, INC.: COMPANY SNAPSHOT

- FIGURE 57 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 58 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY SNAPSHOT

- FIGURE 59 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- FIGURE 60 GIVAUDAN: COMPANY SNAPSHOT

- FIGURE 61 ARLA FOODS AMBA: COMPANY SNAPSHOT

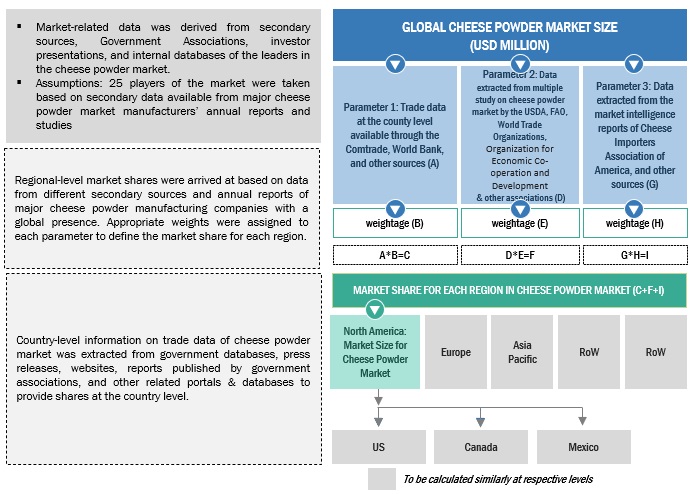

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the cheese powder market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to so as to identify and collect information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases. They were used to identify and collect information. The secondary research was used mainly to obtain key information about the industry’s supply chain, distribution channels, total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The cheese powder market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of the cheese powder market is characterized by the presence of key cheese and food & beverage manufacturers. The supply side is characterized by the presence of cheese manufacturers and key technology providers for the production of cheese powder. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the cheese and food & beverage industries. The primary sources from the supply side include research institutions involved in R&D to introduce technologies, key opinion leaders, distributors, and cheese powder manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

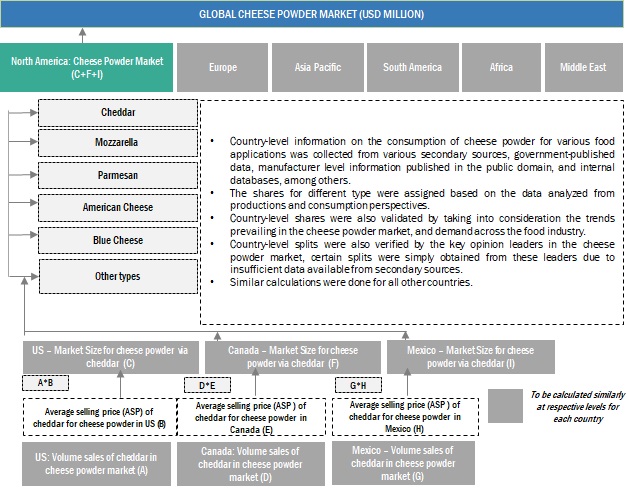

Cheese Powder Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the cheese powder market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major cheese powder manufacturing were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the cheese powder market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market size estimation: Top-Down approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research. For the calculation of each specific market segment, the most appropriate immediate parent market size was used to implement the top-down approach. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each market size were determined and confirmed. The data triangulation procedure in this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology: Bottom-Up Approach

In the bottom-up approach, each country's market size for cheese powder and the types was arrived at through secondary sources, such as annual reports, investor presentations, journals, and government publications. The bottom-up procedure was also implemented on the data extracted from secondary research to validate the market segment sizes obtained.

The penetration rate of each type of cheese powder in each country was calculated from secondary sources. Country-level data for cheese powder were estimated based on the adoption rate of each type of cheese powder within each food application. The origin of each product type was tracked via product mapping and studied for its penetration level to estimate the market size at a regional level. Each product type was studied for its commercially available form. The market size arrived at was further validated by primary respondents.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, there are three approaches: first is the top-down approach, second is the bottom-up approach, with the third being expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Market Definition

Cheese is a dairy-based product available in a variety of flavors, colors, textures, and forms. Cheese powder is dried/dehydrated cheese in powdered form which has numerous applications in the manufacturing of food products such as sweet & savory snacks, sauces, dressings, dips, and ready-to-eat meals. It helps in enhancing the texture, taste, and aesthetic appeal of food products.

Key Stakeholders

- Regulatory and research organizations

- Food additive associations and organizations such as the FDA, EFSA, USDA, and FSANZ

- Associations and industry bodies [World Health Organization (WHO), Institute of Food and Agricultural Sciences (IFAS)]

- Government agencies and NGOs

- Food safety agencies

- Dairy associations and industrial bodies

- Raw material suppliers and distributors

- Dairy traders, distributors, and dealers

- Food manufacturers

- Biotechnology-based organizations

- Cheese powder manufacturers

- Research and consulting firms

Report Objectives

Market Intelligence

- Determining and projecting the size of the cheese powder market based on type, application, origin, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the cheese powder market.

Competitive Intelligence

- Identifying and profiling the key market players in the cheese powder market.

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players.

- Providing insights into the key investments and product innovations and technology in the cheese powder market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European cheese powder market, by key country

- Further breakdown of the Rest of the South American cheese powder market, by key country

- Further breakdown of the Rest of Asia Pacific cheese powder market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Cheese Powder Market