Cell Harvesting Market by Type (Manual, Automated), Application (Biopharmaceutical, Stem Cell Research), End User (Biotechnology, Biopharmaceutical Companies, Research Institute), and Region (North America, Europe, APAC, Row) - Global Forecasts to 2023

The global cell harvesting market is expected to reach USD 324.5 Million by 2023, at a CAGR of 8.7%. Factors such as rising investments in Regenerative Medicine and cell-based research, growth of the biotechnology and biopharmaceutical industry, and increasing incidence of chronic and infectious diseases are contributing to the growth of this market.

Years considered in this report:

2017 – Base Year

2018 – Estimated Year

2023 – Projected Year

The objectives of this study are as follows:

- To define, describe, and forecast the market for cell harvesting, on the basis of type, application, end user, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, opportunities, and restrains)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market development and growth strategies

- To track and analyze competitive developments such as product launches, expansions, acquisitions, and collaborations in the market for cell harvesting

Research Methodology

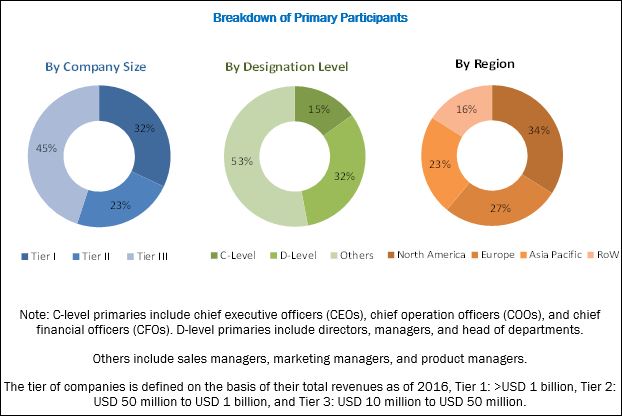

Top-down and bottom-up approaches were used to estimate and validate the size of the cell harvesting industry and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation by type, application, end user, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources referred to for this research study include publications from government sources such as the International Society for Stem Cell Research, World Health Organization, National Institutes of Health, American Society for Cell Biology, International Cell Research Organization; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements have been used to identify and collect information useful for this extensive commercial study of this market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the cell harvesting market include PerkinElmer (US), Brandel (US), TOMTEC (US), Cox Scientific (UK), Connectorate (Switzerland), Scinomix (US), ADSTEC (Japan), and Terumo BCT (a part of Terumo Corporation) (Japan).

Target Audience for this Report:

- Cell harvester manufacturers and vendors

- Distributors of cell harvesters

- Research and development companies

- Market research and consulting companies

- Biopharmaceutical and biotechnology companies

- Academic research institutes

Value Addition for the Buyer:

This report aims to provide insights into the global market for cell harvesting. It provides valuable information on cell harvesting type, application, and end user. Details on regional markets for these segments are also presented in this report. In addition, leading players in the market are profiled to understand the strategies undertaken by them to be competitive in this market.

Cell Harvesting Market Scope

This report categorizes the cell harvesting market into the following segments:

By Type

- Manual Cell Harvesters

- Automated Cell Harvesters

By Application

- Biopharmaceutical Application

- Stem Cell Research

- Other Applications

By End User

- Biotechnology & Biopharmaceutical Companies

- Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Customization Options:

- Detailed analysis and profiling of additional market players (up to 5)

Cell harvesting is the process of harvesting cells from the culture media during upstream and downstream bioprocessing. Rising investments in regenerative medicine and cell-based research, growth of the biopharmaceutical and biotechnology industry, and increasing incidence of chronic and infectious diseases are the major driving factors for this market.

The cell harvesting market is segmented on the basis of type, application, and end user. The market based on application is segmented into research institutes, biotechnology & biopharmaceutical companies, and other end users. The biotechnology & biopharmaceutical companies segment is expected to account for the largest share of the market in 2018. The growth in this segment is primarily attributed to high prevalence of chronic diseases worldwide and the increasing R&D activities to develop new products across the globe.

Based on type, the market for cell harvesting is segmented into manual and automated cell harvesters. The manual cell harvesters segment is expected to register the highest CAGR during the forecast period. This growth can be attributed to their ease of use and low price as compared to automated harvesters.

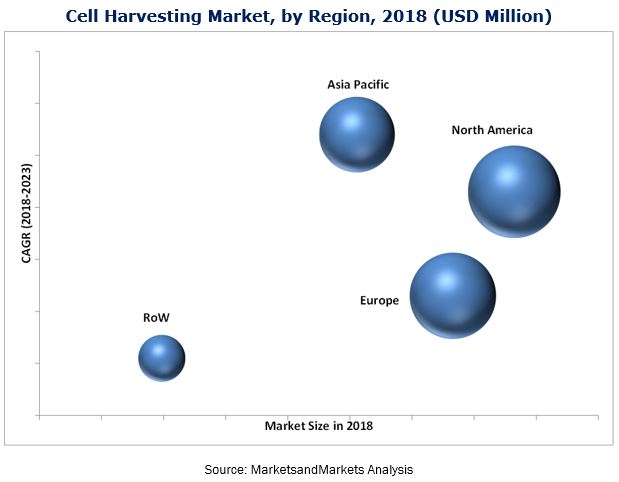

By region, the cell harvesting market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). The market is dominated by North America, followed by Europe; however, the APAC region is expected to witness the highest growth rate during the forecast period. Increasing private and government funding for stem cell research in this region and growing expansion of key market players in emerging Asian countries are some of the factors driving the APAC market.

The growing use of single-use bioprocessing containers is expected to hinder the growth of this market in the coming years.

PerkinElmer (US), Brandel (US), TOMTEC (US), Cox Scientific (UK), Connectorate (Switzerland), ADSTEC (Japan), and Terumo BCT (a part of Terumo Corporation) (Japan) are the major players in this market.

Frequently Asked Questions (FAQs):

What is the size of Cell Harvesting Market?

The global cell harvesting market is expected to reach USD 324.5 Million by 2023, at a CAGR of 8.7%.

What are the major growth factors of Cell Harvesting Market?

Factors such as rising investments in Regenerative Medicine and cell-based research, growth of the biotechnology and biopharmaceutical industry, and increasing incidence of chronic and infectious diseases are contributing to the growth of this market.

Who all are the prominent players of Cell Harvesting Market?

Key players operating in the cell harvesting market include PerkinElmer (US), Brandel (US), TOMTEC (US), Cox Scientific (UK), Connectorate (Switzerland), Scinomix (US), ADSTEC (Japan), and Terumo BCT (a part of Terumo Corporation) (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Research Approach

2.2 Research Data

2.2.1 Secondary Sources

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Sources

2.2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 20)

4 Premium Insights (Page No. - 23)

4.1 Cell Harvesting Market: Overview

4.2 Asia Pacific Market for Cell Harvesting, By Application and Country

4.3 Geographic Snapshot of the Market for Cell Harvesting

4.4 Market, By Type

5 Cell Harvesting Market: Overview (Page No. - 26)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Investments in Regenerative Medicine and Cell-Based Research

5.2.1.2 Growth of the Biotechnology and Biopharmaceutical Industry

5.2.1.3 Increasing Incidence of Chronic and Infectious Diseases

5.2.2 Restraints

5.2.2.1 Growing Use of Single-Use Bioprocessing Containers

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Emerging Economies

6 Cell Harvesting Market, By Type (Page No. - 30)

6.1 Introduction

6.2 Manual Cell Harvesters

6.3 Automated Cell Harvesters

7 Cell Harvesting Market, By Application (Page No. - 34)

7.1 Introduction

7.2 Biopharmaceutical Application

7.3 Stem Cell Research

7.4 Other Applications

8 Cell Harvesting Market, By End User (Page No. - 39)

8.1 Introduction

8.2 Biotechnology & Biopharmaceutical Companies

8.3 Research Institutes

8.4 Other End Users

9 Cell Harvesting Market, By Region (Page No. - 44)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 RoAPAC

9.5 Rest of the World

10 Cell Harvesting Market: Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 Acquisitions

10.3.3 Product Launches

10.3.4 Collaborations

11 Company Profiles (Page No. - 80)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Perkinelmer

11.2 Tomtec

11.3 Brandel (Biomedical Research and Development Laboratories)

11.4 COX Scientific

11.5 Connectorate

11.6 Scinomix

11.7 Sartorius

11.8 ADS Biotec (A Subsidiary of Adstec)

11.9 General Electric

11.10 Terumo Bct (A Subsidiary of Terumo Corporation)

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 93)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (67 Tables)

Table 1 Cell Harvesting Market, By Type, 2016–2023 (USD Million)

Table 2 Manual Market, By Region, 2016–2023 (USD Million)

Table 3 Automated Market, By Region, 2016–2023 (USD Million)

Table 4 Global Market, By Application, 2016–2023 (USD Million)

Table 5 Market for Biopharmaceutical Applications, By Region, 2016–2023 (USD Million)

Table 6 Market for Stem Cell Research, By Region, 2016–2023 (USD Million)

Table 7 Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 8 Market, By End User, 2016–2023 (USD Million)

Table 9 Market for Biotechnology & Biopharmaceutical Companies, By Region, 2016–2023 (USD Million)

Table 10 Cell Harvesting Market for Research Institutes, By Region, 2016–2023 (USD Million)

Table 11 Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 12 Market, By Region, 2016–2023 (USD Million)

Table 13 North America: Market, By Country, 2016–2023 (USD Million)

Table 14 North America: Market, By Type, 2016–2023 (USD Million)

Table 15 North America: Market, By Application, 2016–2023 (USD Million)

Table 16 North America: Market, By End User, 2016–2023 (USD Million)

Table 17 US: Market, By Type, 2016–2023 (USD Million)

Table 18 US: Cell Harvesting Market, By Application, 2016–2023 (USD Million)

Table 19 US: Market, By End User, 2016–2023 (USD Million)

Table 20 Canada: Market, By Type, 2016–2023 (USD Million)

Table 21 Canada: Market, By Application, 2016–2023 (USD Million)

Table 22 US: Market, By End User, 2016–2023 (USD Million)

Table 23 Europe: Market, By Country, 2016–2023 (USD Million)

Table 24 Europe: Market, By Type, 2016–2023 (USD Million)

Table 25 Europe: Market, By Application, 2016–2023 (USD Million)

Table 26 Europe: Market, By End User, 2016–2023 (USD Million)

Table 27 Germany: Market, By Type, 2016–2023 (USD Million)

Table 28 Germany: Market, By Application, 2016–2023 (USD Million)

Table 29 Germany: Market, By End User, 2016–2023 (USD Million)

Table 30 UK: Cell Harvesting Market, By Type, 2016–2023 (USD Million)

Table 31 UK: Market, By Application, 2016–2023 (USD Million)

Table 32 UK: Market, By End User, 2016–2023 (USD Million)

Table 33 France: Market, By Type, 2016–2023 (USD Million)

Table 34 France: Market, By Application, 2016–2023 (USD Million)

Table 35 France: Market, By End User, 2016–2023 (USD Million)

Table 36 Italy: Market, By Type, 2016–2023 (USD Million)

Table 37 Italy: Market, By Application, 2016–2023 (USD Million)

Table 38 Italy: Cell Harvesting Market, By End User, 2016–2023 (USD Million)

Table 39 Spain: Market, By Type, 2016–2023 (USD Million)

Table 40 Spain: Market, By Application, 2016–2023 (USD Million)

Table 41 Spain: Market, By End User, 2016–2023 (USD Million)

Table 42 RoE: Market, By Type, 2016–2023 (USD Million)

Table 43 RoE: Market, By Application, 2016–2023 (USD Million)

Table 44 RoE: Market, By End User, 2016–2023 (USD Million)

Table 45 APAC: Market, By Type, 2016–2023 (USD Million)

Table 46 APAC: Cell Harvesting Market, By Application, 2016–2023 (USD Million)

Table 47 APAC: Market, By End User, 2016–2023 (USD Million)

Table 48 China: Market, By Type, 2016–2023 (USD Million)

Table 49 China: Market, By Application, 2016–2023 (USD Million)

Table 50 China: Market, By End User, 2016–2023 (USD Million)

Table 51 Japan: Cell Harvesting Market, By Type, 2016–2023 (USD Million)

Table 52 Japan: Market, By Application, 2016–2023 (USD Million)

Table 53 Japan: Market, By End User, 2016–2023 (USD Million)

Table 54 India: Market, By Type, 2016–2023 (USD Million)

Table 55 India: Market, By Application, 2016–2023 (USD Million)

Table 56 India: Market, By End User, 2016–2023 (USD Million)

Table 57 RoAPAC: Cell Harvesting Market, By Type, 2016–2023 (USD Million)

Table 58 RoAPAC: Market, By Application, 2016–2023 (USD Million)

Table 59 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 60 RoW: Market, By Type, 2016–2023 (USD Million)

Table 61 RoW: Market, By Application, 2016–2023 (USD Million)

Table 62 RoW: Market, By End User, 2016–2023 (USD Million)

Table 63 Ranking of Companies in the Global Market 2016

Table 64 Expansions, 2014–2017

Table 65 Acquisitions, 2014–2017

Table 66 Product Launches, 2014–2017

Table 67 Collaborations, 2014–2017

List of Figures (27 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Manual Cell Harvesters to Continue to Dominate the Global Market, By Type, in 2023

Figure 7 Biopharmaceutical Application to Account for the Largest Share of the Cell Harvesting Market, By Application, During the Forecast Period

Figure 8 Biotechnology & Biopharmaceutical Companies to Dominate the Market in 2018

Figure 9 APAC to Witness the Highest Growth Rate of the Market During the Forecast Period

Figure 10 Rising Investments in Regenerative Medicine and Cell-Based Research to Drive Market Growth

Figure 11 Biopharmaceutical Applications Dominated the Asia Pacific Cell Harvesting Market in 2017

Figure 12 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 13 Manual Cell Harvesters Will Continue to Register the Highest Growth Rate During the Forecast Period

Figure 14 Market: Drivers, Restraints, & Opportunities

Figure 15 Manual Cell Harvesters, the Largest Type Segment in the Market

Figure 16 Biopharmaceutical Applications, the Largest Application Segment in the Market

Figure 17 Biotechnology & Biopharmaceutical Companies to Continue to Dominate the Cell Harvesting Market in 2023

Figure 18 North America to Continue to Dominate the Market in 2023

Figure 19 North America: Market Snapshot

Figure 20 Europe: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 RoW: Market Snapshot

Figure 23 Acquisitions and Expansions Were the Key Strategies Adopted By Players Between 2014 and 2017

Figure 24 Perkinelmer: Company Snapshot

Figure 25 Sartorius: Company Snapshot

Figure 26 GE: Company Snapshot

Figure 27 Terumo Corporation: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Harvesting Market