Casino Management Systems Market by Component (Solutions and Services), Application (Accounting, Security and Surveillance, Player Tracking, Hotel and Hospitality, Analytics, and Digital Content Management), End User, and Region - Global Forecast to 2025

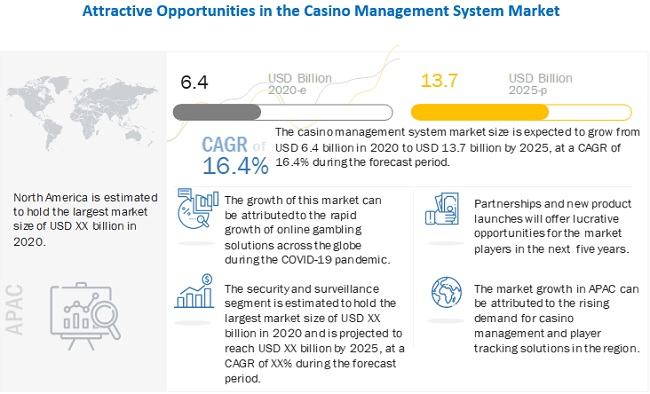

The global Casino Management Systems Market size was valued at $6.4 billion in 2020 and it is projected to reach $13.7 billion by the end of 2025 at a CAGR of 16.4% during the forecast period. The evolving lifestyle and societal concerns and increasing use of cashless slot machines and server-based gaming to drive the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has affected every segment of society including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. The casinos and gambling industry is one of the most severely hit industry during the COVID-19 pandemic. Due to the COVID-19 pandemic, the dependency on player tracking and security and surveillance systems has increased significantly. Casinos and resorts are leveraging the casino management solutions to provide necessary services to end users.

Security and surveillance application to grow at the highest CAGR during the forecast Period

Today’s demanding business environments require proficient handling of processes by implementing CMS solutions across casinos. Over the time, video surveillance has been proved to be an effective tool to create a secure and healthy environment in the gambling industry. Most of the casinos are deploying new generation of cameras and networking equipment, security and surveillance systems not only captures a player’s actions, but it also helps to store it for future references. CCTV cameras are now being replaced by IP cameras, since IP cameras require less hardware. Security and surveillance software would have more deployments in future. Therefore, the security and surveillance segment holds the highest growth rate during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

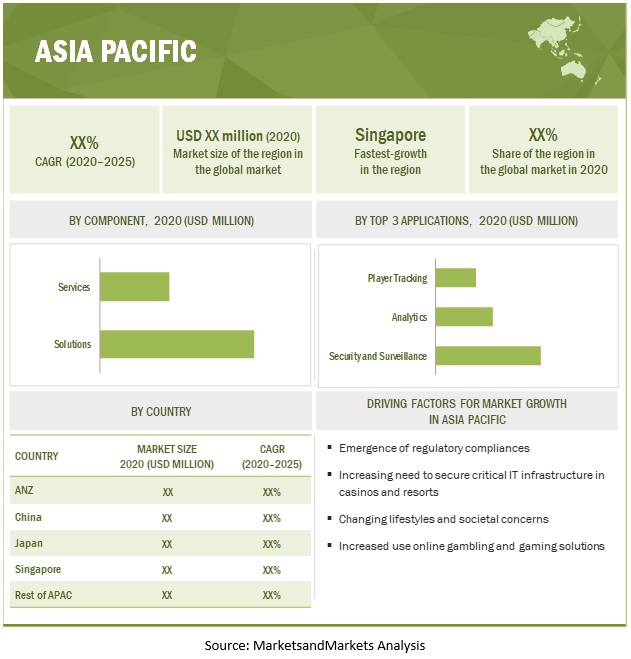

APAC to account for the highest CAGR during the forecast period

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR in the global Casino management systems market during the forecast period. APAC constitutes major economies, such as China, Japan, Singapore, and Australia and New Zealand, which are expected to register high growth rates in the casino management system market. In recent years, the APAC region has undergone tremendous economic growth, political transformations, and social changes. India, Japan, and Singapore, and Australia are the new casino heavens for gamblers and are attracting new casinos in the region. These new casinos are attracting installations of more deployment of IT solution and systems. Post-pandemic the APAC has become new revenue generating regional market and will lead in next couple of years in terms of revenues. China is the largest manufacturer and exporter of security components such as video surveillance cameras, biometric devices, and communication equipment. Companies operating in APAC would benefit from the flexible economic conditions, industrialization-motivated policies of the governments, as well as from the growing digitalization, which is expected to have a significant impact on the business community.

Casino Management Systems Market Dynamics

Driver: Demand for better management of security and surveillance operations in casinos

The risk landscape for modern-day casinos is evolving consistently due to growing concerns over thefts and frauds. Casinos witness large number of monetary transactions every day in wide-open environments that have multiple entry and exit points, making it challenging to secure them comprehensively. For the security personnel, it becomes difficult to monitor each person’s actions as large number of people walk through the entrances and exits on busy nights. In a recent case of casino theft fraud, in July 2020, a federal judge in Miami (U.S.) sentenced two workers at a Florida casino for stealing USD 5 million from the casino by tampering with the gambling machines to generate credit vouchers. Every year, such scams and thefts cost millions of dollars to the casino operators. In the light of growing security and surveillance concerns, the demand for advanced security solutions is growing rapidly in the casino industry.

Technological advancements such as facial recognition and automated number plate recognition have improved the utility of security solutions to facilitate securing large casinos handling heavy footfall. As casinos start to operate normally after the uplifting of restrictions on public gatherings due to the COVID-19 pandemic, casino operators are expected to increase their investment in procuring modern security solutions for their establishments.

Restraint: Growing popularity of online casinos/gambling

The growing interest among gamblers towards online casinos/gambling is expected to certainly impact the revenues of brick and mortar casinos over the forecast timeline. The availability of online platforms makes gambling extremely accessible to the customers who can login and play anytime they want from the comfort of their homes. These platforms offer all the games that are typically available at any casino from blackjack and poker to the slot machines. Another advantage of online gambling is the access to hundreds of online casinos that the customers can switch between for different games and bonuses. With a simple cellular device such as a smartphone or a tablet and an internet connection, one can avoid the hassle of travelling to a casino for gambling.

With growing penetration of smartphones, accessing online casinos from anywhere has become extremely convenient for the users. According to a recent study, smartphones account for nearly 75% of all the mobile handsets in use worldwide. The growing popularity of the app-based delivery models is likely to generate more interest in online casinos among the young adults who prefer better accessibility and user experience. As most of the casinos worldwide are still inoperable due to lockdowns and reluctance from people to visit public places, online gambling is expected to gain consistent popularity which will in turn, affect the brick and mortar casino revenues adversely.

Opportunity: Use of advanced analytics technologies for improving the solution capabilities

Casino operators have access to large volumes of data about their customers and their gaming behavior which can be leveraged for improving their operational procedures and their performance analysis/reporting using advanced AI-driven casino management solutions. By implementing advanced analytics, casinos can use statistical analysis and determine the most favorable rates for hotel rooms and segment customer profiles to target the right customer with the right marketing campaigns. These tools help casinos in gaining and analyzing demographic information about their customers and track their spending behavior, gaming patterns, visiting patters, and other such parameters to build comprehensive customer profiles.

High performance video analytics and storage solutions offer critical operational insights that assist the owners/operators in sustaining revenues and driving efficiency. The systems are equipped with high-resolution cameras, low-light technology, and wide coverage to improve visibility. Analytics solutions such as object recognition and heat mapping allow operators to identify which areas in the casinos are visited more by the customers. These insights can be used to maximize the revenues by targeting customers with offers and bonuses while they indulge in their favorite games. Considering the social distancing norms required and/or mandated during and post the COVID-19 pandemic, such technology can be used to effectively ensure social distancing and prohibit crowding on the casino floors.

Challenge: Steep decline in casino revenues and operations due to the COVID-19 pandemic

The COVID-19 pandemic has had a devastating impact on the land-based gambling/casino industry. The stay-at-home restrictions imposed by governments across many countries led to the closure of casinos, lottery outlets, and other gambling venues. Closures forced the casinos to go for weeks and months without revenues, and even when they started functioning, restrictions were put in place to limit the number of visitors preventing them from operating at full capacity. As they struggle to restart and maintain operations, the significant losses and revenues are expected to deter the largely affected casino owners from investing significantly in procuring new management systems.

This research study outlines the market potential, market dynamics, and major vendors operating in the Casino management system market. Key and innovative vendors in the Casino management systems market Novomatic (Austria), Konami Gaming (Japan), Agilysys (US), Scientific Games (US), Oracle (US), Winsystems (Spain), Panasonic (Japan), Ensico Gaming (Slovenia), Apex Pro Gaming (Czechia), Amatic Industries (Austria), Honeywell (US), Dallmeier (Germany), HCL (India), Playtech (UK), Cyrun (US), IGT (UK), LGS (US), Wavestore (UK), Tangam Systems (US), Advansys (Slovenia), Avigilon (Canada), Casinfo Systems (US), RNGplay (India), FunFair (Ireland), Gaming Analytics (US), Delta Casino Systems (US), DAObet (Singapore), CasinoFlex Systems (Bulgaria), Omnigo (US), NtechLab (Russia), Nelysis (US), and Bateleur Systems (India). The study includes an in-depth competitive analysis of these key players in the Casino management system market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

component, application, end user, and region |

|

Geographies covered |

North America, Europe, APAC, MEA and Latin America. |

|

Major companies covered |

Novomatic (Austria), Konami Gaming (Japan), Agilysys (US), Scientific Games (US), Oracle (US), Winsystems (Spain), Panasonic (Japan), Ensico Gaming (Slovenia), Apex Pro Gaming (Czechia), Amatic Industries (Austria), Honeywell (US), Dallmeier (Germany), HCL (India), Playtech (UK), Cyrun (US), IGT (UK), LGS (US), Wavestore (UK), Tangam Systems (US), Advansys (Slovenia), Avigilon (Canada), Casinfo Systems (US), RNGplay (India), FunFair (Ireland), Gaming Analytics (US), Delta Casino Systems (US), DAObet (Singapore), CasinoFlex Systems (Bulgaria), Omnigo (US), NtechLab (Russia), Nelysis (US), and Bateleur Systems (India). |

This research report categorizes the casino management systems market to forecast revenues and analyze trends in each of the following submarkets:

Based on component:

- Solution

-

Service

- Consulting

- Deployment and Integration

- Support and Maintenance

Based on Application:

- Accounting

- Security and Surveillance

- Hotel and Hospitality Management

- Analytics

- Player Tracking

- Digital content Management

- Marketing and Promotions

Based on End User:

- Small and Medium Casinos

- Large Casinos

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Spain

- Rest of Europe (other EU and non-EU countries)

-

APAC

- China

- Japan

- Australia and New Zealand

- Singapore

- Rest of APAC (India, Indonesia, Taiwan and South Korea)

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (Chile, Argentina, Colombia and Peru)

Recent Developments:

- In November 2020, Scientific Games and Menominee Casino Resort announced an agreement to install system solutions across 791 gaming machines. The solutions would include e iVIEW4 with Web Content Manager (WCM), Beverage Ordering Software System (BOSS), Business Intelligence, Elite Bonusing Suite (EBS), Promotional Kiosk, Servizio, and the Social Distancing and Automated Game Sanitization Modules.

- In October 2020, Novomatic extended its reach in Germany after receiving sports betting license by the Darmstadt Regional Council and has also become the first private providers to be granted a sports betting license.

- In October 2020, Agilysys and Shift4 Payments extended the partnership to offer seamless guest journey for hospitality operators. Shift4 Payments is a leading integrated payment processing provider. Agilysys can now offer an integrated payment experience which include online reservations, check in and checkout, on-premise dining, spa services and more to the hospitality operators.

- In September 2018, Novomatic and Monte-Carlo Société des Bains de Mer partnered to open the Novo Zone at Sun Casino. This is a live area on the casino floor where NOVOMATIC rolls out new releases and technology

- In September 2020, Konami launched slot cleaning systems which are linked to its Casino Management System Synkros. During COVID-19 Konami offered a new feature to its Synkros customer at no additional cost, where the slot machine is optimized and clear the machine between use. The new feature includes a mix of real time communications, alerts and report analytics.

- In August 2020, Konami and Gulfstream Park & Casino partnered to replace the previous casino management system. Gulfstream Park & Casino is the first land-based casino to launch Konami’s Synkros casino management system in Florida. Konami’s Synkros would help the casino with marketing and data analytics capabilities and assist teams to deliver greater entertainment to the players.

Frequently Asked Questions (FAQ):

How big is the global casino management systems market?

What is growth rate of the casino management systems market?

What are the key trends affecting the global casino management systems market?

Who are the key players in casino management systems market?

What is the casino management systems market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 CASINO MANAGEMENT SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS AND SERVICES OF CASINO MANAGEMENT SYSTEMS VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF CASINO MANAGEMENT SYSTEMS VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, ILLUSTRATION OF COMPANY REVENUE ESTIMATION

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 4, TOP DOWN (DEMAND SIDE): SHARE OF CASINO MANAGEMENT SYSTEMS IN THE OVERALL INFORMATION TECHNOLOGY MARKET

2.4 IMPLICATION OF COVID-19 ON THE CASINO MANAGEMENT SYSTEMS MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19, CASINO MANAGEMENT SYSTEMS MARKET

2.4.1 IMPACT OF THE COVID-19 PANDEMIC:

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 COMPETITIVE EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPETITIVE EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 14 GLOBAL CASINO MANAGEMENT SYSTEMS MARKET AND Y-O-Y GROWTH RATE

FIGURE 15 GLOBAL CASINO MANAGEMENT SYSTEMS MARKET TO WITNESS A DECLINE IN GROWTH DURING THE FORECAST PERIOD

FIGURE 16 SEGMENTS WITH HIGH GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 17 CASINO MANAGEMENT SYSTEMS MARKET: REGIONAL SNAPSHOT

FIGURE 18 GEOGRAPHIC DISTRIBUTION OF THE CASINO MANAGEMENT SYSTEMS MARKET

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CASINO MANAGEMENT SYSTEMS MARKET

FIGURE 19 DEMAND FOR BETTER MANAGEMENT OF SECURITY AND SURVEILLANCE OPERATIONS IN CASINOS TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2020 VS. 2025

FIGURE 20 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY SERVICE, 2020 VS. 2025

FIGURE 21 DEPLOYMENT AND INTEGRATION SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY APPLICATION, 2020 VS. 2025

FIGURE 22 HOTEL AND HOSPITALITY MANAGEMENT SEGMENT TO LEAD THE CASINO MANAGEMENT SYSTEMS MARKET IN 2020

4.5 MARKET, BY END USER, 2018 VS. 2025

FIGURE 23 LARGE CASINOS TO LEAD THE MARKET DURING 2018–2025

4.6 MARKET INVESTMENT SCENARIO

FIGURE 24 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 MARKET DYNAMICS

FIGURE 25 CASINO MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Demand for better management of security and surveillance operations in casinos

FIGURE 26 TIMELINE FOR SECURITY SYSTEM UPGRADATION IN THE HOSPITALITY INDUSTRY

5.1.1.2 Significant cost savings enabled by the adoption of casino management solutions

5.1.1.3 Growing concerns over cyber threats in the hospitality and gaming industry

FIGURE 27 DATA BREACH ATTACKS IN THE HOSPITALITY INDUSTRY, 2019

5.1.2 RESTRAINTS

5.1.2.1 Growing popularity of online casinos/gambling

FIGURE 28 GLOBAL INTERNET PENETRATION SHARE AS PERCENTAGE OF POPULATION, 2020

5.1.2.2 Unfavorable regulatory landscape for gambling

5.1.3 OPPORTUNITIES

5.1.3.1 Use of advanced analytical technologies for improving the solution capabilities

5.1.3.2 Growth of the hospitality industry in emerging countries

5.1.3.3 Integration with complementary solutions to enhance solution utility

5.1.4 CHALLENGES

5.1.4.1 Steep decline in casino revenues and operations due to the COVID-19 pandemic

5.1.4.2 Lack of skilled IT professionals

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

FIGURE 29 CASINO MANAGEMENT MARKET: CUMULATIVE GROWTH FROM DRIVERS

FIGURE 30 CASINO MANAGEMENT MARKET: CUMULATIVE GROWTH FROM OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

FIGURE 31 CASINO MANAGEMENT MARKET: CUMULATIVE DECLINE DUE TO RESTRAINTS AND CHALLENGES

5.2.3 CUMULATIVE GROWTH ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 32 VALUE CHAIN ANALYSIS: CASINO MANAGEMENT MARKET

5.4 ECOSYSTEM

FIGURE 33 CASINO MANAGEMENT MARKET: ECOSYSTEM

5.5 AVERAGE SELLING PRICE TREND

5.5.1 CASINO MANAGEMENT SYSTEMS PRICE TREND

TABLE 3 CASINO MANAGEMENT SYSTEMS: AVERAGE PRICE TREND

5.6 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 34 CASINO MANAGEMENT SYSTEMS MARKET: PORTER'S FIVE FORCE ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 YC-YCC SHIFT

FIGURE 35 YC-YCC SHIFT FOR THE CASINO MANAGEMENT SYSTEMS MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.8.2 ONLINE GAMING AND GAMBLING

5.8.3 AUGMENTED REALITY AND VIRTUAL REALITY

5.8.4 BLOCKCHAIN

5.8.5 CYBERSECURITY

5.9 CYBERSECURITY AND DATA REGULATORY IMPLICATIONS

5.9.1 GENERAL DATA PROTECTION REGULATION

5.9.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.9.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.9.4 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.9.5 GRAMM-LEACH-BLILEY ACT

5.9.6 SARBANES-OXLEY ACT

5.9.7 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.10 USE CASES

5.10.1 BAO SON INTERNATIONAL HOTEL VERSACE’S CLUB DEPLOYS IGT ADVANTAGE TO HANDLE A RAGE OF ESSENTIAL FUNCTIONS

5.10.2 GRAND SIERRA RESORT DEPLOYED KONAMI’S SYNKORS AS THE EXCLUSIVE CASINO MANAGEMENT PLATFORM

5.10.3 KATE SYSTEMS AND ACCESS-IS COLLABORATED ON THE CASINO MANAGEMENT SYSTEMS TO COMPLY WITH LEGAL MANDATES IN BELGIUM

5.10.4 TABLE TRAC HELPED THE RUNNING CREEK CASINO TO UPGRADE ITS CASINO MANAGEMENT SYSTEMS

5.10.5 IGT ACQUIRES MAJORITY OF THE CLASS III GAME FLOOR AT THE EMERALD QUEEN I-5 CASINO

5.11 PATENT ANALYSIS

5.11.1 CASINO MANAGEMENT SYSTEMS PATENTS

TABLE 4 CASINO MANAGEMENT SYSTEMS PATENTS

5.12 ADJACENT MARKETS

6 MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

FIGURE 36 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 COMPONENT: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 6 COMPONENT: MARKET SIZE, 2020–2025 (USD MILLION)

TABLE 7 COMPONENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 8 COMPONENT: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 SERVICES

FIGURE 37 DEPLOYMENT AND INTEGRATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 11 COMPONENT: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 12 COMPONENT: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 14 SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.1 CONSULTING

6.3.1.1 Consulting: Casino management systems market drivers

6.3.1.2 Consulting: COVID-19 impact

TABLE 15 CONSULTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 16 CONSULTING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.2 DEPLOYMENT AND INTEGRATION

6.3.2.1 Deployment and integration: casino management systems market drivers

6.3.2.2 Deployment and integration: COVID-19 impact

TABLE 17 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 18 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3.3 SUPPORT AND MAINTENANCE

6.3.3.1 Support and maintenance: Casino management systems market drivers

6.3.3.2 Support and maintenance: COVID-19 impact

TABLE 19 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 CASINO MANAGEMENT SYSTEMS MARKET, BY END USER (Page No. - 93)

7.1 INTRODUCTION

FIGURE 38 SMALL AND MEDIUM CASINOS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 END USER: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 22 END USER: MARKET SIZE, 2020–2025 (USD MILLION)

TABLE 23 END USER: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 24 END USER: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.2 LARGE CASINOS

7.2.1 LARGE CASINOS: MARKET DRIVERS

7.2.2 LARGE CASINOS: COVID-19 IMPACT

TABLE 25 LARGE CASINOS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 LARGE CASINOS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 SMALL AND MEDIUM CASINOS

7.3.1 SMALL AND MEDIUM CASINOS: MARKET DRIVERS

7.3.2 SMALL AND MEDIUM CASINOS: COVID-19 IMPACT

TABLE 27 SMALL AND MEDIUM CASINOS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 28 SMALL AND MEDIUM CASINOS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 MARKET, BY APPLICATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 39 SECURITY AND SURVEILLANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 29 APPLICATION: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 30 APPLICATION: MARKET SIZE, 2020–2025 (USD MILLION)

TABLE 31 APPLICATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 APPLICATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.2 ACCOUNTING

8.2.1 ACCOUNTING: MARKET DRIVERS

8.2.2 ACCOUNTING: COVID-19 IMPACT

TABLE 33 ACCOUNTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 ACCOUNTING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 SECURITY AND SURVEILLANCE

8.3.1 SECURITY AND SURVEILLANCE: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

8.3.2 SECURITY AND SURVEILLANCE: COVID-19 IMPACT

TABLE 35 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 36 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 HOTEL AND HOSPITALITY MANAGEMENT

8.4.1 HOTEL AND HOSPITALITY MANAGEMENT: MARKET DRIVERS

8.4.2 HOTEL AND HOSPITALITY MANAGEMENT: COVID-19 IMPACT

TABLE 37 HOTEL AND HOSPITALITY MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 38 HOTEL AND HOSPITALITY MANAGEMENT: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.5 ANALYTICS

8.5.1 ANALYTICS: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

8.5.2 ANALYTICS: COVID-19 IMPACT

TABLE 39 ANALYTICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 40 ANALYTICS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.6 PLAYER TRACKING

8.6.1 PLAYER TRACKING: MARKET DRIVERS

8.6.2 PLAYER TRACKING: COVID-19 IMPACT

TABLE 41 PLAYER TRACKING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 42 PLAYER TRACKING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.7 DIGITAL CONTENT MANAGEMENT

8.7.1 DIGITAL CONTENT MANAGEMENT: MARKET DRIVERS

8.7.2 DIGITAL CONTENT MANAGEMENT: COVID-19 IMPACT

TABLE 43 DIGITAL CONTENT MANAGEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 DIGITAL CONTENT MANAGEMENT: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 CASINO MANAGEMENT SYSTEMS MARKET, BY REGION (Page No. - 110)

9.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 41 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 42 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 43 ASIA PACIFIC TO BE THE HOTSPOT FOR INVESTORS DURING THE FORECAST PERIOD

TABLE 45 CASINO MANAGEMENT SYSTEMS MARKET SIZE, BY REGION, 2014–2019(USD MILLION)

TABLE 46 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 45 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN NORTH AMERICA

TABLE 47 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

FIGURE 46 NORTH AMERICA: COUNTRY-WISE ANALYSIS

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.2.4 UNITED STATES

9.2.4.1 United States: Casino management systems market drivers

9.2.4.2 United States: COVID-19 impact

TABLE 57 UNITED STATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 58 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 59 UNITED STATES: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 60 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 61 UNITED STATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.2.5 CANADA

9.2.5.1 Canada: Casino management systems market drivers

9.2.5.2 Canada: COVID-19 impact

TABLE 65 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 66 CANADA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATORY LANDSCAPE

FIGURE 47 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN EUROPE

TABLE 73 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

FIGURE 48 EUROPE: COUNTRY-WISE ANALYSIS

TABLE 81 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.4.1 United Kingdom: Casino management systems market drivers

9.3.4.2 United Kingdom: COVID-19 impact

TABLE 83 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 84 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 90 UNITED KINGDOM:

MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.3.5 GERMANY

9.3.5.1 Germany: Casino management systems market drivers

9.3.5.2 Germany: COVID-19 impact

TABLE 91 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 92 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 93 GERMANY: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 95 GERMANY: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 GERMANY: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.3.6 FRANCE

9.3.6.1 France: Casino management systems market drivers

9.3.6.2 France: COVID-19 impact

TABLE 99 FRANCE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 100 FRANCE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 101 FRANCE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 105 FRANCE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 106 FRANCE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.3.7 REST OF EUROPE

TABLE 107 REST OF EUROPE: CASINO MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 50 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN ASIA PACIFIC

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

FIGURE 51 ASIA PACIFIC: COUNTRY-WISE ANALYSIS

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.4.4 AUSTRALIA AND NEW ZEALAND

9.4.4.1 Australia and New Zealand: Casino management systems market drivers

9.4.4.2 Australia and New Zealand: COVID-19 impact

TABLE 125 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 126 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 127 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 128 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 129 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 130 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 131 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 132 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.4.5 CHINA

9.4.5.1 China: Casino management systems market drivers

9.4.5.2 China: COVID-19 impact

TABLE 133 CHINA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 135 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 136 CHINA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 137 CHINA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 138 CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 139 CHINA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.4.6 JAPAN

9.4.6.1 Japan: Casino management systems market drivers

9.4.6.2 Japan: COVID-19 impact

TABLE 141 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 143 JAPAN: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 144 JAPAN: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 145 JAPAN: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 146 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 147 JAPAN: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 148 JAPAN: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.4.7 SINGAPORE

9.4.7.1 Singapore: Casino management systems market drivers

9.4.7.2 Singapore: COVID-19 impact

TABLE 149 SINGAPORE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 150 SINGAPORE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 151 SINGAPORE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 152 SINGAPORE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 153 SINGAPORE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 154 SINGAPORE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 155 SINGAPORE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 156 SINGAPORE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.4.8 REST OF ASIA PACIFIC

TABLE 157 REST OF ASIA PACIFIC: CASINO MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

FIGURE 52 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN MIDDLE EAST AND AFRICA

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2014–2019 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUB REGION, 2020–2025 (USD MILLION)

9.5.4 MIDDLE EAST

9.5.4.1 Middle East: Casino management systems market drivers

9.5.4.2 Middle East: COVID-19 impact

TABLE 175 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 176 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 177 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 178 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 179 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 180 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 181 MIDDLE EAST: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 182 MIDDLE EAST: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.5.5 AFRICA

9.5.5.1 Africa: Casino management systems market drivers

9.5.5.2 Africa: COVID-19 impact

TABLE 183 AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 184 AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 185 AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 186 AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 187 AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 188 AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 189 AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 190 AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: CASINO MANAGEMENT SYSTEMS MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

FIGURE 53 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN LATIN AMERICA

TABLE 191 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.4 BRAZIL

9.6.4.1 Brazil: Casino management systems market drivers

9.6.4.2 Brazil: COVID-19 impact

TABLE 201 BRAZIL: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 202 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 203 BRAZIL: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 204 BRAZIL: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 205 BRAZIL: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 206 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 207 BRAZIL: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 208 BRAZIL: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.6.5 MEXICO

9.6.5.1 Mexico: Casino management systems market drivers

9.6.5.2 Mexico: COVID-19 impact

TABLE 209 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 210 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 211 MEXICO: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 212 MEXICO: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 213 MEXICO: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 214 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 215 MEXICO: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 216 MEXICO: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

9.6.6 REST OF LATIN AMERICA

TABLE 217 REST OF LATIN AMERICA: CASINO MANAGEMENT SYSTEMS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 218 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 219 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 220 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 221 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 222 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 223 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 224 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

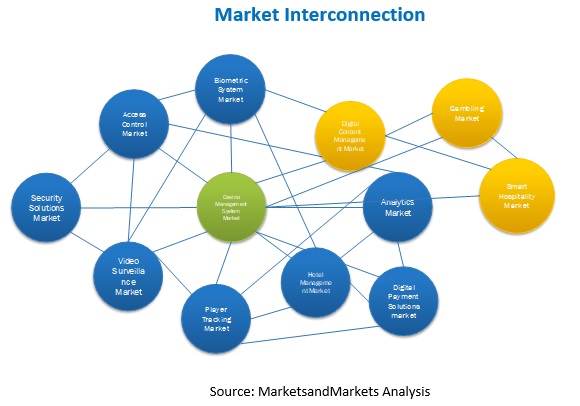

10 ADJACENT MARKETS (Page No. - 188)

10.1 INTRODUCTION

10.2 LIMITATIONS

10.3 VIDEO SURVEILLANCE MARKET

10.3.1 BY OFFERING

FIGURE 54 HARDWARE SEGMENT EXPECTED TO HOLD LARGEST SIZE OF VIDEO SURVEILLANCE MARKET BY 2025

TABLE 225 GLOBAL VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD BILLION)

10.3.2 BY VERTICAL

FIGURE 55 VIDEO SURVEILLANCE MARKET FOR INFRASTRUCTURE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 226 VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

10.3.3 BY REGION

FIGURE 56 APAC TO DOMINATE VIDEO SURVEILLANCE MARKET DURING FORECAST PERIOD

TABLE 227 VIDEO SURVEILLANCE MARKET, BY REGION, 2017–2025 (USD MILLION)

10.4 PUBLIC SAFETY AND SECURITY MARKET

10.4.1 BY SOLUTION

FIGURE 57 EMERGENCY AND DISASTER MANAGEMENT SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 228 SOLUTION: PUBLIC SAFETY AND SECURITY MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 229 SOLUTION: PUBLIC SAFETY AND SECURITY MARKET SIZE, 2020–2025 (USD MILLION)

10.4.2 BY SERVICE

FIGURE 58 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 230 SERVICES: PUBLIC SAFETY AND SECURITY MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 231 SERVICES: PUBLIC SAFETY AND SECURITY MARKET SIZE, 2020–2025 (USD MILLION)

10.4.3 BY REGION

FIGURE 59 NORTH AMERICA ESTIMATED TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 232 PUBLIC SAFETY AND SECURITY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 233 PUBLIC SAFETY AND SECURITY MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 197)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 60 MARKET EVALUATION FRAMEWORK

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CASINO MANAGEMENT SYSTEMS VENDORS

11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 61 REVENUE SHARE ANALYSIS OF MARKET IN 2020

11.5 HISTORIC REVENUE ANALYSIS

FIGURE 62 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING CASINO MANAGEMENT SYSTEMS PROVIDERS

11.6 COMPETITIVE EVALUATION MATRIX, 2020

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 63 CASINO MANAGEMENT SYSTEMS MARKET (GLOBAL), COMPETITIVE EVALUATION MATRIX, 2020

11.7 STRENGTH OF PRODUCT PORTFOLIO ANALYSIS OF CMS PLAYERS

FIGURE 64 PRODUCT FOOTPRINT ANALYSIS OF PLAYERS IN THE MARKET

11.8 BUSINESS STRATEGY EXCELLENCE ANALYSIS OF CMS PLAYERS

FIGURE 65 BUSINESS STRATEGY EXCELLENCE ANALYSIS PLAYERS IN THE MARKET

11.9 STARTUP/SME EVALUATION MATRIX, 2020

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 66 MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

11.10 RANKING OF KEY PLAYERS IN CASINO MANAGEMENT SYSTEMS MARKET, 2020

FIGURE 67 RANKING OF TOP 5 CMS PLAYERS, 2020

12 COMPANY PROFILES (Page No. - 208)

12.1 INTRODUCTION

(Business overview, Products and Solutions offered, Recent developments & MnM View)*

12.2 NOVOMATIC

FIGURE 68 NOVOMATIC: COMPANY SNAPSHOT

12.3 SCIENTIFIC GAMES

FIGURE 69 SCIENTIFIC GAMES: COMPANY SNAPSHOT

12.4 KONAMI GAMING

FIGURE 70 KONAMI GAMING: COMPANY SNAPSHOT

12.5 PANASONIC

FIGURE 71 PANASONIC: COMPANY SNAPSHOT

12.6 ORACLE

FIGURE 72 ORACLE: COMPANY SNAPSHOT

12.7 AGILYSYS

FIGURE 73 AGILYSYS: COMPANY SNAPSHOT

12.8 WINSYSTEMS

12.9 AMATIC INDUSTRIES

12.10 ENSICO GAMING

12.11 HONEYWELL

12.12 APEX PRO GAMING

12.13 HCL

12.14 DALLMEIER

12.15 PLAYTECH

12.16 LODGING AND GAMING SYSTEMS

12.17 CYRUN

12.18 INTERNATIONAL GAME TECHNOLOGY

12.19 WAVESTORE

12.20 TANGAM SYSTEMS

12.21 ADVANSYS

12.22 AVIGILON

12.23 CASINFO SYSTEMS

12.24 STARTUP COMPANIES

12.24.1 RNGPLAY

12.24.2 FUNFAIR

12.24.3 GAMING ANALYTICS

12.24.4 DELTA CASINO SYSTEMS

12.24.5 DAOBET

12.24.6 CASINOFLEX SYSTEMS

12.24.7 OMNIGO

12.24.8 NTECHLAB

12.24.9 NELYSIS

12.24.10 BATELEUR SYSTEMS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.25 RIGHT TO WIN

TABLE 234 RIGHT TO WIN

13 APPENDIX (Page No. - 254)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

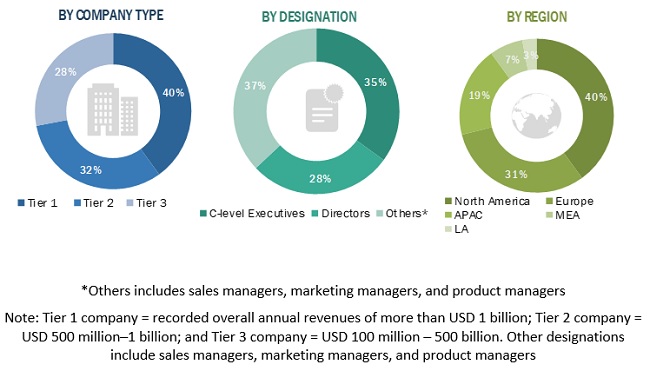

The study involved four major activities to estimate the current size of the casino management systems market. An exhaustive secondary research was done to collect information on the casinos management system market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various sources were used to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from The SANS Institute, Information Systems Security Association (ISSA), American Gaming Association, European Casino Association (ECA), National Indian Gaming Association, International Association of Gaming Regulators (IAGR), and others. The ICT investment and spending of various countries was extracted from their respective technology associations and government bodies, such as the U.S. digital services and European DG CONNECT. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players according to their offerings; industry trends related to technology, application, and region; and key developments from both market- and technology-oriented perspectives.

Primary Research

The casino management systems market comprises several stakeholders, casinos management system specialists, casinos management system and service providers, business analysts, business intelligence tools, enterprise users, telecommunication providers, technology consultants, and System Integrators (SIs). The demand side of the market consists of security and surveillance, hotels and resorts, gaming systems, online gambling services, and others. The supply side includes casinos management system and service providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Casino Management Systems Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the casino management systems market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global casino management systems market by component, by application, by end user, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), MEA and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall casino management systems market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the casino management systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the additional countries

- Further breakdown of the application markets for listed countries

Company Information

- Additional profiling of companies in the casino management systems market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Casino Management Systems Market