Access Control Reader Market by Reader Type (Card-based Readers, Biometric Readers, and Multi-technology Readers), Smart Card Technology Type (iCLASS, MIFARE, DESFire, Advant), Vertical, and Geography - Global Forecast to 2024-2036

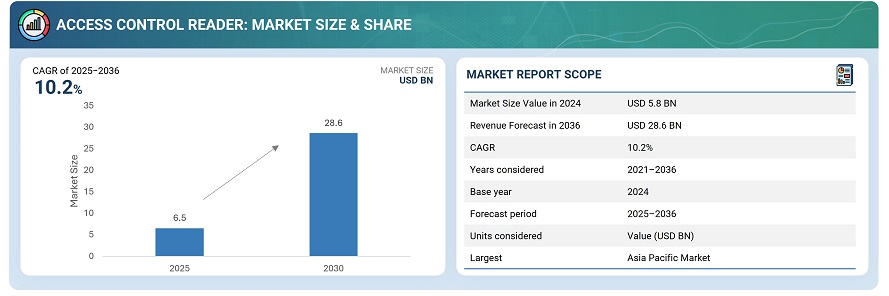

The global access control reader market was valued at USD 6.5 billion in 2024 and is estimated to reach USD 28.6 billion by 2036, at a CAGR of 10.2% between 2025 and 2036.

The growth of this market is mainly driven by the high demand for enhanced security; contactless interfaces to boost adoption of smart cards; and increased convenience, enhanced security identity management, and improved human resource management. Increasing urbanization in emerging economics provides major opportunities for the growth of the access control reader market.

Advanced technologies are reshaping the access control reader market, led by the rapid adoption of facial recognition, mobile credentials, and biometric authentication systems. The growing emphasis on contactless and hygienic access solutions is fueling demand across various industries. The integration of artificial intelligence (AI) is significantly enhancing system intelligence, enabling faster and more accurate user identification, as well as adaptive threat detection. Furthermore, the convergence of physical and cybersecurity frameworks is accelerating the shift toward integrated access control ecosystems, offering organizations a unified and robust security infrastructure.

Market by Reader

Card-based readers

The card-based reader segment holds the largest share of the global access control reader market, owing to its widespread adoption, cost-effectiveness, and proven reliability across commercial and industrial environments. Growing adoption of smart cards and encrypted communication protocols for improved security performance. The increasing demand for smart and proximity cards to monitor and record employee activities is one of the major drivers for the growth of card-based readers. Smartcards are proven to be more reliable than magnetic stripes and proximity cards. The increasing demand for smart and proximity cards to monitor and record employee activities acts as a driver for the growth of smart card readers.

Biometric Reader

Biometric technologies are used to measure different physiological parameters for identification and authentication purposes in access control systems. Biometrics is one of the fastest-growing technologies used to secure perimeters. Biometrics enables identifying a person's physical characteristics to provide controlled physical access to infrastructure. This technology is being increasingly adopted in government facilities, manufacturing units, power stations, defense establishments, and enterprises. The key players in the biometric reader market include NEC Corporation (Japan), Gemalto N.V. (Netherlands), Johnson Controls International pic (Ireland), NAPCO Security Technologies, Inc. (US), IDEMIA (France), and Suprema HQ Inc. (South Korea).

Market by Vertical

Commercial

The commercial vertical is the largest adopter of access control readers. In this vertical, commercial premises such as enterprises and data centers, banks and financial centers, hotels, and retail stores and malls are considered. The demand for access control readers is increasing since they reduce the need for manned security significantly, thereby reducing the expenditure on security. These factors are encouraging commercial and service organizations to adopt access control readers to protect people and property. Major players that provide access control readers for the commercial vertical include Bosch Security Systems Inc. (Germany), Allegion plc (Ireland), HID Global (US), IDEMIA (France), and dormakaba Holding AG (Switzerland).

Residential

In residential vertical, the implementation of access control and video surveillance security systems is increasing to prevent property invasion and burglary, and to authenticate access. The market for home security solutions has been growing at a rapid pace over the last few years as a result of the growing home automation trend. The key factors contributing to the growth of this market include the rise in crime rates, ongoing technological advancements, and the demand for authentication by homeowners. The leading players in this market are Honeywell International Inc. (US), Siemens AG (Germany), THE ASSA ABLOY GROUP (Sweden), Bosch Security Systems (US).

Market by Geography

Geographically, the access control reader market is experiencing widespread adoption across North America, Europe, Asia Pacific, and RoW. Asia Pacific leads the market, due to rapid urbanization and infrastructure development in countries like China, India, and Southeast Asia, fueling demand for advanced security systems. Government initiatives for smart cities and digital transformation accelerate adoption, rising concerns about safety and security increase demand for biometric and multi-technology readers, and rising integration of cloud, AI, and mobile technologies further boost market expansion, positioning Asia-Pacific as the fastest-growing region in the access control reader market.

Market Dynamics

Driver: Increasing Cyber And Malware Attacks

The access control reader market is witnessing strong growth driven by rising security concerns, fraud incidents, and the need for connected identity management systems across critical infrastructures such as data centers, banks, enterprises, and public facilities. The proliferation of smart homes has further accelerated demand for remotely accessible wired and wireless access control systems. As fraud, cyber threats, and regulatory identification requirements grow more complex, organizations are prioritizing secure, cost-efficient, and intelligent authentication solutions. The market is further propelled by the adoption of IoT-enabled and wireless security architectures, offering seamless integration, enhanced user authentication, and contactless operation.

Restraint: High Initial Setup and Maintenance Costs

A major challenge for the access control reader market is the high initial investment and ongoing maintenance costs involved with deploying advanced systems. Implementing biometric, mobile-based, and cloud-connected access control solutions requires substantial spending on hardware, software, and system integration, which can discourage small and medium-sized enterprises (SMEs) from adopting these technologies. Additionally, ongoing costs such as maintenance, software updates, and technical support increase the total cost of ownership, creating financial hurdles, especially in cost-sensitive regions.

Opportunity: Increasing adoption of mobile-based and cloud-integrated access control solutions

The adoption of mobile-based and cloud-integrated access control solutions presents a significant growth opportunity for the access control reader market as organizations shift toward digitally connected security infrastructures. Furthermore, integration with cloud and mobile ecosystems supports multi-factor authentication, encrypted communication, and remote control, improving protection against credential theft or unauthorized access.

Challenge: Risk of Data Breach and Privacy Issues

The growing use of biometric authentication in access control systems introduces heightened security and privacy challenges. With rapidly evolving fraud techniques and the rise of AI-driven spoofing methods, including deep neural networks capable of replicating or generating facial features, the risk of unauthorized access and data breaches is becoming a key concern for market stakeholders. These vulnerabilities are expected to act as potential restraints to market expansion in the coming years.

Future Outlook

Between 2025 and 2036, the access control reader market is expected to grow rapidly as due to the increasing adoption of biometric authentication technologies such as facial and fingerprint recognition. The integration of IoT and AI is transforming security infrastructure—enabling intelligent, data-driven, and adaptive access systems. Growing investments in smart building ecosystems and the push for seamless, user-centric access experiences across high-security environments are further fueling adoption.

Key Market Players

Top Access control reader companies are ASSA ABLOY ABv (Sweden), Dormokaba Holding AG (Switzerland), Allegion plcv (Ireland), Identiv, Inc. (US), and IDEMIA (france).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Markets Covered

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Key Driving Factors Pertaining to Access Control Reader Market

4.2 Smart Card Reader Market, By Technology

4.3 Market in Europe, Card-Based Reader Type and Country

4.4 Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Enhanced Security

5.2.1.2 Contactless Interfaces to Boost Adoption of Smart Cards

5.2.1.3 Increased Convenience, Enhanced Secure Identity Management, and Improved Human Resource Management

5.2.2 Restraints

5.2.2.1 Limited Awareness About Advanced Security Solutions Among Users

5.2.3 Opportunities

5.2.3.1 Increasing Urbanization in Emerging Economies

5.2.4 Challenges

5.2.4.1 Security Concerns Related to Unauthorized Access and Data Breach

5.3 Value Chain Analysis

6 Access Control Reader Market, By Reader Type (Page No. - 40)

6.1 Introduction

6.2 Card-Based Readers

6.2.1 Magnetic Stripe Readers

6.2.1.1 Magnetic Stripe Readers Accounted for Smallest Share of Card-Based Reader Market, in Terms of Value and Volume, in 2018

6.2.2 Proximity Card Readers (125 Khz)

6.2.2.1 Proximity Card Readers are Expected to Hold Significant Size of Card-Based Reader Market, in Terms of Value and Volume, During Forecast Period

6.2.3 Smart Card Readers (13.56 Mhz)

6.2.3.1 Smartcard Readers Expected to Witness Highest CAGR in Card-Based Reader Market During Forecast Period

6.2.3.1.1 Contact-Based

6.2.3.1.2 Contactless

6.3 Biometric Readers

6.3.1 Fingerprint

6.3.1.1 Fingerprint Held Largest Size of Biometric Reader Market, in Terms of Value and Volume, in 2018

6.3.2 Palm Recognition

6.3.2.1 Palm Recognition Readers are Used in Access Control Systems for Security Purpose

6.3.3 IRIS Recognition

6.3.3.1 IRIS Recognition Readers Provide High Accuracy for Authentication

6.3.4 Face Recognition

6.3.4.1 Face Recognition Readers to Exhibit Highest CAGR in Biometric Reader Market During Forecast Period

6.3.5 Vein Recognition

6.3.5.1 Vein Recognition Readers Gaining Visibility in Upcoming Years for Biometric Readers

6.3.6 Voice Recognition

6.3.6.1 Voice Recognition Readers' Usability for Restricting Unauthorized Access

6.4 Multi-Technology Readers

6.4.1 Multi-Technology Readers to Account for Significant Size of Access Control Reader Market During Forecast Period

7 Smart Card Reader Market, By Technology Type (Page No. - 54)

7.1 Introduction

7.2 iCLASS

7.2.1 iCLASS Technology to have Significant Demand for Smartcard Readers

7.3 MIFARE

7.3.1 MIFARE Technology Expected to Witness at Highest Growth Rate During Forecast Period

7.4 DESFire

7.4.1 DESFire Technology—Advanced Version of MIFARE Family

7.5 LEGIC Advant

7.5.1 Small Market Share of Advant Due to Limited Access

7.6 Others

8 Access Control Reader Market, By Vertical (Page No. - 60)

8.1 Introduction

8.2 Commercial

8.2.1 Access Control Readers Witness High Adoption in Enterprises and Data Centers for Security Purposes

8.2.1.1 Enterprises and Data Centers

8.2.1.2 Banks and Financial Centers

8.2.1.3 Hotels, Stadiums, and Amusement Parks

8.2.1.4 Retail Stores and Malls

8.3 Government

8.3.1 Government Vertical Expected to Grow at Significant Rate of During Forecast Period

8.4 Residential

8.4.1 Residential Vertical Expected to Grow at Highest CAGR During Forecast Period

9 Geographic Analysis (Page No. - 66)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.1.1 US Expected to Continue to Account for Largest Share of Access Control Reader Market in the Americas During 2019–2024

9.2.2 Canada

9.2.2.1 Adoption of High-Security Solutions in Canada Resulted in A Significant Share of Market in Country

9.2.3 Mexico

9.2.3.1 Growth Opportunities for Home Automation and Security Applications to Make Access Control Reader Market Lucrative in Mexico

9.2.4 South America

9.2.4.1 Growing Security Concerns and Increasing Use of Identification Solutions Would Lead the Market in South America

9.3 Europe

9.3.1 UK and Ireland

9.3.1.1 Market in the UK Expected to Grow at A Significant Rate During Forecast Period

9.3.2 Dach Countries

9.3.2.1 Dach Countries Likely to Continue to Account for Largest Size of Market During 2019–2024

9.3.3 France

9.3.3.1 Growing Number of Terrorist Attacks Drive French Market

9.3.4 Italy

9.3.4.1 Italy Expected to Deploy Security Solutions to Overcome Challenges Such as Increased Crime Rate, Homeland Security Breaches, and Illegal Immigration

9.3.5 Scandinavia

9.3.5.1 Scandinavia Expected to Witness Highest CAGR in Access Control Market During Forecast Period

9.3.6 Benelux

9.3.6.1 Growing Need for Identification and Security Solutions Would Boost Demand for Access Control Readers in These Countries

9.3.7 Iberia

9.3.7.1 Market in Iberia Expected to Grow at Moderate Rate

9.4 APAC

9.4.1 China

9.4.1.1 China Likely to Continue to Hold Largest Share of Access Control Reader Market in APAC During Forecast Period

9.4.2 Japan

9.4.2.1 With the Growing Economy and Rising Demand for Advance Security Solutions, Japan is Likely to Continue to Be Second-Largest Market in APAC for Access Control Readers in Next Few Years

9.4.3 India

9.4.3.1 Growing Security Threat and Increasing Urbanization Boost Indian Market Growth

9.4.4 South Korea

9.4.4.1 Increasing Need to Improve Security for Small- and Medium-Sized Businesses Compels South Korean Companies to Adopt Access Control Solutions

9.4.5 Australia and New Zealand

9.4.5.1 Need to Manage Visitor Movements and Behavior Boosts Demand for Access Control Readers in Australia and New Zealand

9.4.6 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.1.1 Growing Security Initiatives By Governments Drive the Middle Eastern Access Control Reader Market

9.5.2 Africa

9.5.2.1 Growing Industrialization in Africa Expected to Increase Demand for Access Control Readers

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.2 Market Player Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (25 Companies)

10.4.2 Business Strategy Excellence (25 Companies)

10.5 Competitive Scenario

10.6 Competitive Situations & Trends

10.6.1 Product Launches/Developments

10.6.2 Acquisitions

10.6.3 Collaborations/Contracts/Agreements/Partnerships

10.6.4 Expansions

11 Company Profiles (Page No. - 118)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 Introduction

11.2 Key Players

11.2.1 ASSA ABLOY AB

11.2.2 Dormakaba Holding AG

11.2.3 Allegion PLC

11.2.4 Identiv, Inc.

11.2.5 IDEMIA

11.2.6 Nedap N.V.

11.2.7 Suprema Hq Inc.

11.2.8 Gemalto N.V. (Thales Group)

11.2.9 NAPCO Security Technologies, Inc.

11.2.10 Avigilon Corporation (MotoRoLA Solutions, Inc.)

11.3 Other Companies

11.3.1 Peter Hengstler GmbH+Co. (PHG)

11.3.2 Paxton Access Ltd.

11.3.3 Castles Technology

11.3.4 DUALi Inc.

11.3.5 AMAG Technology, Inc.

11.3.6 AXIS Communications AB

11.3.7 PAX Technology Limited

11.3.8 Advanced Card Systems Limited

11.3.9 Gallagher Group Limited

11.3.10 Brivo, Inc.

11.3.11 Salto Systems S.L.

11.3.12 Vanderbilt Industries

11.3.13 Watchdata

11.3.14 Arabit Systems Inc.

11.3.15 Idteck Co., Ltd.

11.3.16 Union Community Co., Ltd.

11.3.17 Nortech Control Systems Limited

11.3.18 Stanley Convergent Security Solutions, Inc.

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view *Details on might not be captured in case of unlisted companies.)*

12 Appendix (Page No. - 163)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Author Details

List of Tables (69 Tables)

Table 1 Top 10 Countries With Highest Number of Terror Attacks and Fatalities, 2016

Table 2 Access Control Reader Market, By Reader Type, 2016–2024 (USD Million)

Table 3 Market for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 4 Market for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 5 Market for Card-Based Readers, By Region, 2016–2024 (USD Million)

Table 6 Access Control Reader Market for Proximity Card Readers, By Region, 2016–2024 (USD Million)

Table 7 Market for Smartcard Readers, By Region, 2016–2024 (USD Million)

Table 8 Market for Smart Card Readers, By Type, 2016–2024 (USD Million)

Table 9 Market for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 10 Market for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 11 Market for Biometric Readers, By Region, 2016–2024 (USD Million)

Table 12 Market for Fingerprint Readers, By Region, 2016–2024 (USD Million)

Table 13 Market for PLAM Readers, By Region, 2016–2024 (USD Million)

Table 14 Market for IRIS Readers, By Region, 2016–2024 (USD Million)

Table 15 Market for Face Recognition Readers, By Region, 2016–2024 (USD Million)

Table 16 Market for Vein Recognition Readers, By Region, 2016–2024 (USD Million)

Table 17 Market for Voice Recognition Readers, By Region, 2016–2024 (USD Thousand)

Table 18 Access Control Reader Market for Multi-Technology Readers, By Region, 2016–2024 (USD Million)

Table 19 Smart Card Reader Market, By Technology Type, 2016–2024 (USD Million)

Table 20 Market for iCLASS Based Readers, By Region, 2016–2024 (USD Million)

Table 21 Market for MIFARE-Based Readers, By Region, 2016–2024 (USD Million)

Table 22 Market for DESFire-Based Readers, By Region, 2016–2024 (USD Million)

Table 23 Market for Advant Based Readers, By Region, 2016–2024 (USD Thousand)

Table 24 Market for Other Technology-Based Readers, By Region, 2016–2024 (USD Million)

Table 25 Market, By Vertical, 2016–2024 (USD Million)

Table 26 Market for Commercial Vertical, By Region, 2016–2024 (USD Million)

Table 27 Market for Government Vertical, By Region, 2016–2024 (USD Million)

Table 28 Market for Residential Vertical, By Region, 2016–2024 (USD Million)

Table 29 Access Control Reader Market, By Region, 2016–2024 (USD Million)

Table 30 Market in Americas, By Reader Type, 2016–2024 (USD Million)

Table 31 Market in Americas for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 32 Market in Americas for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 33 Market in Americas for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 34 Market in Americas for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 35 Market in Americas for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 36 Smart Card Reader Market in Americas, By Technology, 2016–2024 (USD Million)

Table 37 Market in Americas, By Vertical, 2016–2024 (USD Million)

Table 38 Market in Americas, By Geography, 2016–2024 (USD Million)

Table 39 Access Control Reader Market in Europe, By Reader Type, 2016–2024 (USD Million)

Table 40 Market in Europe for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 41 Market in Europe for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 42 Market in Europe for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 43 Market in Europe for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 44 Market in Europe for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 45 Smart Card Reader Market in Europe, By Technology, 2016–2024 (USD Million)

Table 46 Market in Europe, By Vertical, 2016–2024 (USD Million)

Table 47 Market in Europe, By Geography, 2016–2024 (USD Million)

Table 48 Access Control Reader Market in APAC, By Reader Type, 2016–2024 (USD Million)

Table 49 Market in APAC for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 50 Market in APAC for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 51 Market in APAC for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 52 Market in APAC for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 53 Market in APAC for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 54 Smart Card Reader Market in APAC, By Technology, 2016–2024 (USD Million)

Table 55 Market in APAC, By Vertical, 2016–2024 (USD Million)

Table 56 Market in APAC, By Country, 2016–2024 (USD Million)

Table 57 Access Control Reader Market in RoW, By Reader Type, 2016–2024 (USD Million)

Table 58 Market in RoW for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 59 Market in RoW for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 60 Market in RoW for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 61 Market in RoW for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 62 Market in RoW for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 63 Smart Card Reader Market in RoW, By Technology, 2016–2024 (USD Million)

Table 64 Market in RoW, By Vertical, 2016–2024 (USD Million)

Table 65 Access Control Reader Market in RoW, By Region, 2016–2024 (USD Million)

Table 66 Product Launches/Developments (2016–2019)

Table 67 Mergers and Acquisitions (2016–2019)

Table 68 Collaborations/Contracts/Agreements/Partnerships (2016–2019)

Table 69 Expansions (2016–2019)

List of Figures (41 Figures)

Figure 1 Access Control Reader Market: Segmentation

Figure 2 Smart Card Reader Market Segmentation

Figure 3 Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Access Control Reader Market, 2016–2024 (USD Billion)

Figure 9 Market, By Reader Type (2019 vs 2024)

Figure 10 Smart Card Readers Held Largest Share of Card-Based Market in 2018

Figure 11 Access Control Reader Market for Residential Vertical Expected to Grow at Highest CAGR From 2019 to 2024

Figure 12 APAC to Exhibit Highest CAGR in Market During Forecast Period

Figure 13 Growing Worldwide Demand for Security Solutions to Boost Market During Forecast Period

Figure 14 MIFARE Technology-Based Smart Card Leaders Expected to Account for Largest Market Size By 2024

Figure 15 Fingerprint Readers to Lead Smart Card Reader Market During 2019–2024

Figure 16 Smartcard Readers and Dach Countries Accounted for Largest Share of Market in Europe in 2018

Figure 17 India to Witness Highest CAGR in Global Market From 2019 to 2024

Figure 18 High Adoption of Access Control Solutions Owing to Enhanced Security Drives Growth of Market

Figure 19 Major Value Added By Original Equipment Manufacturers and Security and Management Software Providers

Figure 20 Card-Based Readers Expected to Dominate Market During 2019–2024

Figure 21 APAC is Expected to Lead Biometric Reader Market During Forecast Period

Figure 22 MIFARE Technology-Based Smart Cards Expected to Account for Largest Market Share By 2024

Figure 23 Access Control Reader Market for Residential Vertical Expected to Grow at the Highest CAGR From 2019 to 2024

Figure 24 Market for Residential Vertical in APAC to Grow at Highest CAGR From 2019 to 2024

Figure 25 APAC to Dominate Access Control Reader Market During Forecast Period

Figure 26 Snapshot of Market in Americas

Figure 27 Snapshot of Market in Europe

Figure 28 Snapshot of Market in APAC

Figure 29 Companies Adopted Product Launches/Developments as Key Growth Strategies During 2016–2019

Figure 30 ASSA ABLOY AB (Sweden) Led Market in 2018

Figure 31 Market (Global) Competitive Leadership Mapping, 2018

Figure 32 Evaluation Framework: Access Control Reader Market

Figure 33 ASSA ABLOY AB: Company Snapshot

Figure 34 Dormakaba Holding AG: Company Snapshot

Figure 35 Allegion PLC: Company Snapshot

Figure 36 Identiv, Inc.: Company Snapshot

Figure 37 Nedap N.V.: Company Snapshot

Figure 38 Suprema Hq Inc.: Company Snapshot

Figure 39 Gemalto N.V.: Company Snapshot

Figure 40 NAPCO Security Technologies, Inc.: Company Snapshot

Figure 41 Avigilon Corporation: Company Snapshot

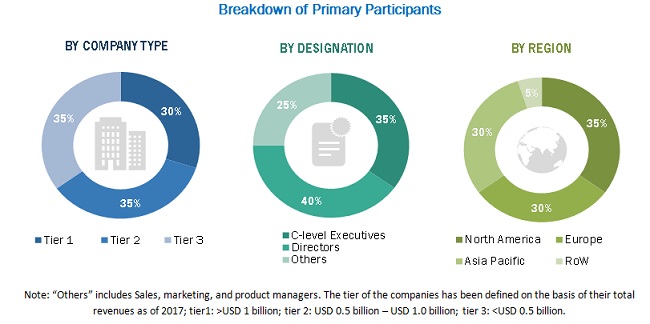

The study involved 4 major activities in estimating the current size of the access control reader market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts from across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the access control reader market begins with capturing data on revenues of key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology includes studying annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The access control reader market’s supply chain comprises several stakeholders, such as suppliers of standard components, original equipment manufacturers (OEMs), software providers, solutions providers, and system integrators. The supply side is characterized by advancements in access control reader types and their applications in diverse verticals. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the access control reader market and various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides of card-based readers, biometric readers, and multi-technology readers.

Research Objective

- To describe and forecast the access control reader market by reader type, vertical, and geography, in terms of value

- To describe and forecast the market by reader type, in terms of volume

- To describe and forecast the smart card market, by technology

- To describe and forecast the market size for various segments with regard to the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide a detailed overview of the value chain of the market

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To profile key players and comprehensively analyze their market rankings and core competencies2 and detail the competitive landscape for market leaders

- To analyze growth strategies such as contracts, mergers and acquisitions, product launches and developments, and R&D in the overall market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions

- What will be the new verticals in which access control readers be used?

- Who are the key players in the market and how intense is the competition?

Growth opportunities and latent adjacency in Access Control Reader Market