Carbon Credit Trading Platform Market by Type (Voluntary, Regulated), System Type (Cap and Trade, Baseline and Credit), End Use (Industrial, Utilities, Energy, Petrochemical, Aviation) and Region - Global Forecast to 2027

[184 Pages Report] The carbon credit trading platform market is expected to grow from an estimated USD 106 million in 2022 to USD 317 million by 2027, at a CAGR of 24.4% during the forecast period. The increasing demand for carbon credit trading platforms is due to the strong eagerness of industries and businesses to act on climate change and reduce global warming. Also, the demand is driven by the rising investments in carbon capture technologies as well as renewable energy adoption.

To know about the assumptions considered for the study, Request for Free Sample Report

Carbon Credit Trading Platform Market Dynamics

Driver: Rising number of markets permitting the partial use of carbon credits

The world is working towards achieving the net zero goals. Climate change entails a whole economic transition. Navigating consequent risks and opportunities require a mix of innovative tools including carbon credits. The increasing demand for carbon credits in the upcoming years is a driving factor for the carbon trading platforms. The carbon credit is treated as a financial tool to reduce (not increase) carbon emissions by storing carbons for future or later use. Many businesses are now adopting this technique of partially using carbon credits which is benefitting them a lot. They use as much as they want according to the limit set for a project and if they have few left, it is then used later for another project. This not only helps them to save a lot of money but also invest in more such credits in the future when required. Hence, these permissions help in driving the market for carbon credit

Restraints: Transparency and Traceability issues in the market

The increasing price of carbon credits may act as a market restraint in the forecast period. There is a fluctuation in prices and hence the rising prices and demand is leading to high transaction volumes.

Opportunities: Growing regulatory (compliance) and industry association requirements

Though carbon offset credits used to be common in the Voluntary Carbon Market (VCM), it is observed that there is a rising trend of their inclusion in the compliance markets. The China Emissions Trading System (ETS) is one example given. Other examples are the case of Singapore and California. The EU ETS is the largest ETS in the world and has a strong presence and aims to ban the use of carbon offsets and credits in its low-carbon transition. The regulatory/compliance markets covers sectors that are working actively towards achieving the net zero goals. There is a high reliability on carbon offsets and trading of carbon credits, to achieve the net zero commitments.

Challenges: Trading Platforms involve fraudulent activities because of a lack of cyber security

Fraudulent activities hamper the growth of the Carbon Credit Trading Platform market. The European Union Emission Trading System (EU ETS) has experienced the fraudulent traders in the past years. The activity has resulted in losses of approximately 5 billion euros for several national tax revenues. The preventive measures for these fraudulent activities have been adopted by countries, that is changing the taxation rules on the transactions. The lack of cybersecurity can cause huge loss and can destabilize the trust of consumers and businesses to engage in the digital trade.

To know about the assumptions considered for the study, download the pdf brochure

The cap and trade segment by system type expected to hold the largest market share from 2022 to 2027

Based on the system type, cap and trade is estimated to be the largest market from 2020 to 2027. The cap and trade system allows the market to determine a carbon price, and that price drives investment decisions and market innovation. Thus, it boosts the demand for the carbon credit trading platform. The cap and trade system creates an exchange value for emissions. Companies with emissions credits can sell them to gain profits, creating a new earning source for industries. Hence, this segment is expected to witness a higher growth rate during the forecast period.

Utilities followed by the industrial segment is projected to emerge as the largest segment, by end use, in the carbon credit trading platform market

Based on the end use, utilities is projected to hold the highest market share during the forecast period. Power companies are now focusing on ecology and pursuing innovative approaches and global best practices for reducing carbon emissions significantly. The use of higher efficiency conventional fuel technologies and lesser emission-intensive fuels, evaluation and implementation of new and renewable energy facets demonstrate companies’ environmental commitment. Carbon emissions from the power sector and electrical companies are increasing rapidly; therefore, there is an urgent need for decarbonization in these sectors, which eventually propels the demand for carbon credits. The market for the industrial segment is growing owing to the increased emissions over the years due to heavy manufacturing and industrial activities. Heavy industries are creating maximum environmental impact as their daily operations emit greenhouse gases, leading to global warming. These industries are focused on executing decarbonization initiatives to tackle climate change, driving the demand for carbon credit trading platforms. The need for carbon trading and demand for carbon credits play a crucial role.

Asia Pacific is expected to be the fastest growing market during the forecast period.

In Asia Pacific, the leading national emission trading system (ETS) is in the Republic of Korea. China is seeking an emission trading system (ETS) that fits with its context, offers flexibility, is without major faults, and can improve operations. This seeks to identify practical solutions for the successful design and implementation of national emissions trading systems in Asia, increase their consistency and harmonization and encourage connectivity at a regional and international level. Hence, the demand for carbon credits to control carbon emissions will rise substantially, further driving the growth of the carbon credit trading platform market in this region.

Key Players

Intercontinental Exchange, Inc. (US), Nasdaq, Inc. (US), CME Group (US), AirCarbon Exchange (ACX) (Singapore), Carbon Trade Exchange (CTX) (UK), Xpansiv (US), Carbonplace (England), Planetly (Germany), Likvidi (UK), Toucan (Germany), BetaCarbon (Australia), ClimateTrade (US), Carbon Credit Capital (US), Flowcarbon (US), Carbonex (UK)

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$106 million |

|

Estimated Value by 2027 |

$317 million |

|

Growth Rate |

Poised to grow at a CAGR of 24.4% |

|

Largest Share Segments |

|

|

Market Report Segmentation |

type, system type, end-use, and region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies covered |

Nasdaq Inc. (US), EEX Group (Germany), AirCarbon Exchange (Singapore), Carbon Trade Exchange (UK), Xpansiv (US), CME Group (US), Climate Impact X (Singapore), Carbonplace (England), Planetly (Germany), Likvidi (UK), Toucan (Germany), BetaCarbon (Australia), MOSS.Earth (Brazil), ClimateTrade (US), Carbon Credit Capital (US), Flowcarbon (US), Carbonex (UK), PathZero (Australia), South Pole (Switzerland), Public Investment Fund (Saudi Arabia) |

This research report categorizes the carbon credit trading platform market based on type, system type, end-use, and region.

Based on type:

- Voluntary Carbon Market

- Regulated Carbon Market

Based on system type:

- Cap and Trade

- Baseline and Credit

Based on end use:

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

Based on the region:

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In July 2022, Aircarbon exchange (ACX), signed a collaboration agreement with the Nairobi international financial center (NIFC) and the Nairobi Securities Exchange (NSE) to develop a Kenya carbon exchange during the official launch of the Nairobi international financial center (NIFC). The partnership will establish a carbon ecosystem in Kenya connected to ACX’s international client order book, allowing buyers and sellers, international and domestic, to transact efficiently and transparently.

- In March 2022, CarbonX, a carbon asset developer, has signed a memorandum of understanding (MOU) with the AirCarbon exchange (ACX) to develop a carbon marketplace in Indonesia jointly. The partnership will provide Indonesian carbon project developers with a domestic carbon market linked to ACX's international client order book. Also, the carbon marketplace will allow the growing Indonesian carbon market to rapidly scale up.

- In September 2021, CTX & IBAC –Partnership to support Business Aviation Voluntary Commitments on Climate Change. The International Business Aviation Council (IBAC) represents over 18,000 operators worldwide on Aviation emissions reductions.

Frequently Asked Questions (FAQ):

What is the current size of the carbon credit trading platform market?

The current market size of the global carbon credit trading platform market is estimated to be USD 106 million in 2022.

What is the major drivers for the carbon credit trading platform market?

The effects of climate change have raised awareness all over the world for the need to reduce carbon emissions, especially from heavy energy sources. Climate change entails a whole economic transition. Navigating consequent risks and opportunities require a mix of innovative tools, including carbon credits. Demand for carbon credits will grow significantly in the coming decades. The carbon credit is treated as a financial tool to reduce (not increase) carbon emissions by storing carbons for future or later use. The demand for quality carbon credit trading platforms is at an all-time high due to the strong eagerness of industries and businesses to act on climate change and reduce global warming.

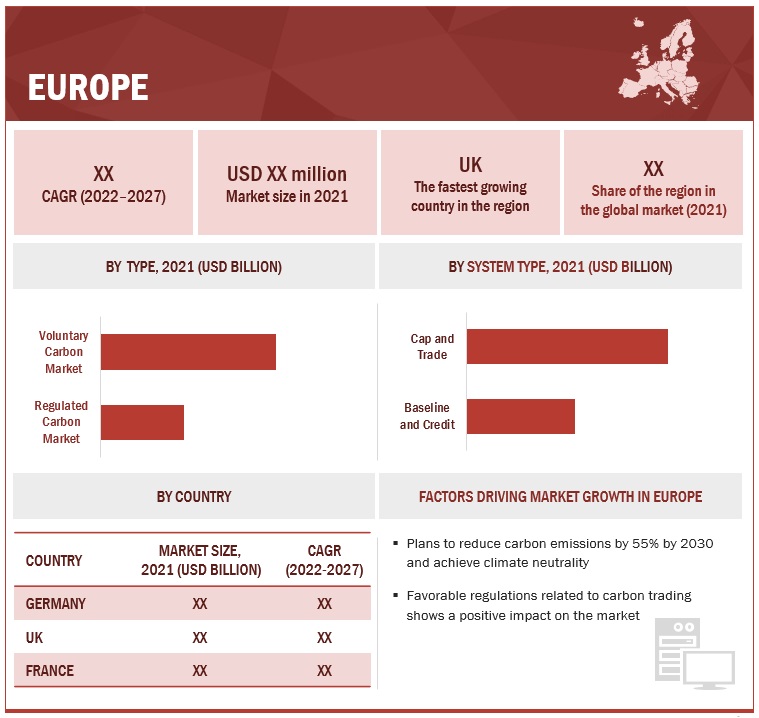

Which is the largest region during the forecasted period in the carbon credit trading platform market?

Europe is expected to be the largest region during the forecasted period in the carbon credit trading platform market. The pledges such as carbon-free-world in countries such as Norway, Iceland, Ireland, Switzerland, Sweden, and Denmark act as driving forces for the European carbon credit trading platform market. The industrial sector is strong in these countries and is expected to grow further, leading to high demand for industrial carbon credit trading platforms from industrial facilities.

Which is the fastest-growing segment, by current during the forecasted period in the carbon credit trading platform market?

The voluntary carbon market segment is expected to register a higher growth rate owing to its flexibility and helping sectors/industries focus on technologies and projects that are likely to become cost-competitive. Asia Pacific, South America, and the Middle East are expected to show high growth in the voluntary carbon market owing to the increasing demand for voluntary carbon credits from manufacturing industries in countries such as India, China, Brazil, Saudi Arabia, and Argentina. With the rising focus on decarbonizing the global economy in the coming years, the demand for voluntary carbon credits is likely to increase.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

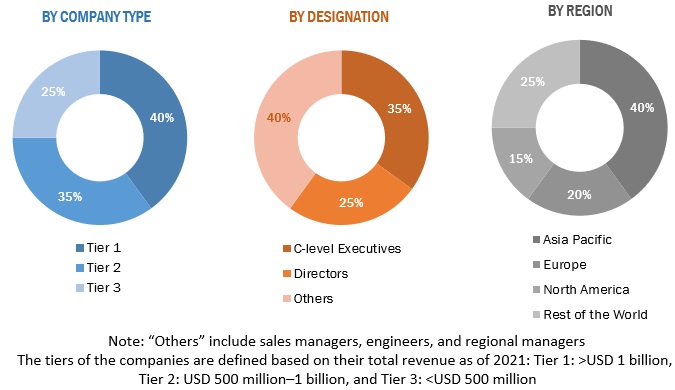

This study involved major activities in estimating the current size of the carbon credit trading platform market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was the validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global carbon credit trading platform market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

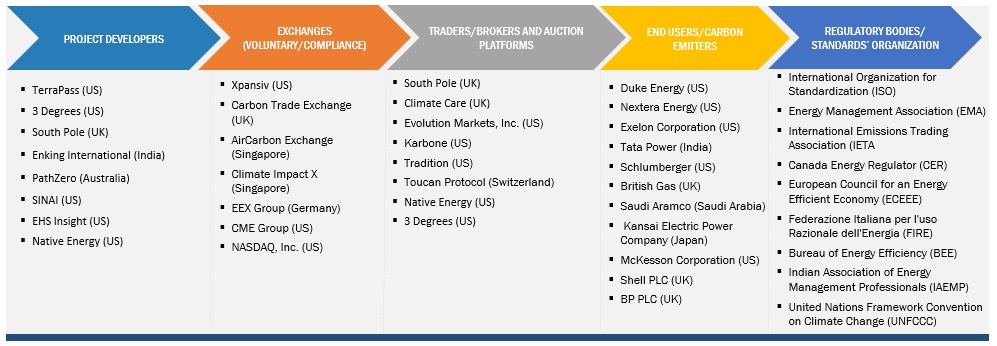

The carbon credit trading platform market comprises several stakeholders, such as project developers, exchanges, traders/brokers and auction platforms, and end users/carbon emitters in the supply chain. The demand-side of this market is characterized by end-users. Moreover, the demand is also fueled by the growing demand of industrial and utilities. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

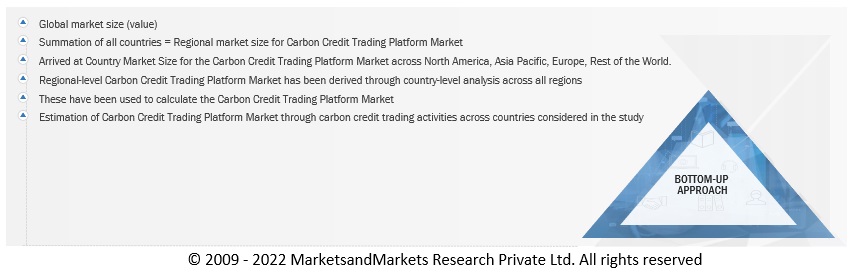

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the carbon credit trading platform market.

- In this approach, the carbon credit trading platform transaction fee statistics for each type have been considered at regional level and carbon credit trading platform revenues and statistics at country level

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of carbon credit trading platform.

- Several primary interviews have been conducted with key opinion leaders related to carbon credit trading platform system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Carbon Credit Trading Platform Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by the splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the carbon credit trading platform market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the carbon credit trading platform market by type, system type, and end use, in terms of value

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, and Rest of the World, along with their key countries, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the switchgear market

- This report covers the carbon credit trading platform market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Carbon Credit Trading Platform Market